Professional Documents

Culture Documents

TOAMOD2 Financial Statement Presentation

Uploaded by

CukeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TOAMOD2 Financial Statement Presentation

Uploaded by

CukeeCopyright:

Available Formats

THEORY OF ACCOUNTS

Module 2 Financial Statement Presentation

2.1. IAS 1 Presentation of Financial Statements ....................................................... 1

2.2. IAS 7 Statement of Cash Flows ................................................................................ 6

2.3. IAS 8 Accounting Policies, Changes in Accounting

Estimates and Errors ................................................................................................... 8

2.4. IAS 10 Events After the Reporting Period .......................................................11

2.5. IAS 24 Related Party Disclosures .........................................................................13

2.6. IFRS 5 Noncurrent Assets Held for Sale and

Discontinued Operations .........................................................................................16

TOAMOD2.1 IAS 1 PRESENTATION OF FINANCIAL STATEMENTS

Effective date Periods beginning on or after 1 January 2005

Scope IAS 1 applies to all general purpose financial statements that are prepared and

presented in accordance with International Financial Reporting Standards (IFRSs).

Objective The objective of IAS 1 is to prescribe the basis for presentation of general purpose

financial statements, to ensure comparability both with the entity's financial statements

of previous periods and with the financial statements of other entities. IAS 1 sets out the

overall requirements for the presentation of financial statements, guidelines for their

structure and minimum requirements for their content. Standards for recognizing,

measuring, and disclosing specific transactions are addressed in other Standards and

Interpretations.

OVERALL CONSIDERATIONS

1. Fair presentation and compliance with IFRS

Financial statements are required to be presented fairly as set out in the framework and in accordance

with IFRS and are required to comply with all requirements of IFRSs.

a. IAS 1 requires an entity to make an explicit and unreserved statement of compliance in the notes.

b. Inappropriate accounting policies are not rectified either by disclosure of the accounting policies

used or by notes or explanatory material.

c. IAS 1 acknowledges that in extremely rare circumstances, management may conclude that

compliance with an IFRS requirement would be so misleading that it would conflict with the

objective of financial statements set out in the Conceptual Framework. In such a case, the entity

may be permitted to depart from the requirement of an IFRS if the relevant regulatory framework

requires, or otherwise does not prohibit, such a departure. Shall disclose the following:

• that management has concluded that the financial statements present fairly the entity’s

financial position, financial performance and cash flows

• that it has complied with applicable IFRSs, except that it has departed from a particular

requirement to achieve a fair presentation

• the title of the IFRS from which the entity has departed, the nature of the departure,

including the treatment that the IFRS would require, the reason why that treatment would be

so misleading in the circumstances

• for each period presented, the financial effect of the departure on each item in the financial

statements that would have been reported in complying with the requirement

2. Going concern

Financial statements are required to be prepared on a going concern basis (unless entity is in liquidation or

has ceased trading or there is an indication that the entity is not a going concern). If management has

significant concerns about the entity’s ability to continue as a going concern, the uncertainties must be

disclosed.

3. Accrual basis of accounting

Entities are required to use accrual basis of accounting except for cash flow information.

4. Presentation consistency

An entity is required to retain presentation and classification from one period to the next unless:

• it is apparent that another presentation or classification would be more appropriate following a

significant change in the nature of the entity’s operations or a review of its financial statements

• an IFRS requires a change in presentation

If comparative amounts are changed or reclassified, an entity is required to disclose the following:

• the nature of the reclassification

• the amount of each item or class of items that is reclassified

• the reason for the reclassification

5. Materiality and aggregation

Each material class of similar assets and items of dissimilar nature or function is to be presented

separately. The Standards do not provide a quantitative or qualitative threshold in determining

materiality, it is a matter of professional judgment.

6. Offsetting

Offsetting of assets and liabilities or income and expenses is not permitted unless required by other IFRSs.

7. Comparative information

At least 1 year of comparative information (unless impractical). Listed entities in the Philippines are

required to disclose as a minimum three (3) of each statements of comprehensive income, statements of

changes in equity, and statements of cash flows.

When an entity changes the end of its reporting period and presents financial statements for a period

longer or shorter than one (1) year, it shall disclose the following:

• the period covered by the financial statements

• the reason for using a longer or shorter period

• the fact that amounts presented are not entirely comparable

TOAMOD2 FINANCIAL STATEMENT PRESENTATION 1

COMPLETE SET OF FINANCIAL STATEMENTS

A complete set of financial statements includes:

a statement of financial position (balance sheet) at the end of the period

a statement of profit or loss and other comprehensive income for the period (presented as a single

statement, or by presenting the profit or loss section in a separate statement of profit or loss,

immediately followed by a statement presenting comprehensive income beginning with profit or

loss)

a statement of changes in equity for the period

a statement of cash flows for the period

notes, comprising a summary of significant accounting policies and other explanatory notes

comparative information prescribed by the standard.

An entity may use titles for the statements other than those stated above. All financial statements are

required to be presented with equal prominence.

When an entity applies an accounting policy retrospectively or makes a retrospective restatement of items

in its financial statements, or when it reclassifies items in its financial statements, it must also present a

statement of financial position as at the beginning of the earliest comparative period.

Reports that are presented outside of the financial statements – including financial reviews by

management, environmental reports, and value added statements – are outside the scope of IFRSs.

STRUCTURE AND CONTENT

1. Identification of the financial statements

Financial statements must be clearly identified and distinguished from other information in the same

published document, and must identify:

Name of the reporting entity

Whether the financial statements cover the individual entity or a group of entities

The statement of financial position date (or the period covered)

The presentation currency (as defined by IAS 21 The Effects of Changes in Foreign Exchange Rates)

The level of rounding used (e.g. thousands, millions)

2. Reporting period

There is a presumption that financial statements will be prepared at least annually.

If the annual reporting period changes and financial statements are prepared for a different period, the

entity must disclose the reason for the change and state that amounts are not entirely comparable.

3. Statement of financial position

Present current and non-current items separately; or Present items in order of liquidity

Current assets Current liabilities

a. Expected to be realized in, or is intended for sale a. Expected to be settled in the entity’s normal

or consumption in the entity’s normal operating operating cycle

cycle b. Held primarily for trading

b. Held primarily for trading c. Due to be settled within 12 months

c. Expected to be realized within 12 months d. The entity does not have an unconditional right to

d. Cash or cash equivalents. defer settlement of the liability for at least 12

months.

All other assets are required to be classified as non-

current. All other liabilities are required to be classified as

non-current.

Line items Further information

The line items to be included on the face of the statement of financial Regarding issued share capital

position are: and reserves, the following

a. property, plant and equipment disclosures are required:

b. investment property numbers of shares

c. intangible assets authorized, issued and fully

d. financial assets (excluding amounts shown under (e), (h), and (i)) paid, and issued but not fully

e. investments accounted for using the equity method paid

f. biological assets par value (or that shares do

g. inventories not have a par value)

h. trade and other receivables a reconciliation of the number

i. cash and cash equivalents of shares outstanding at the

j. assets held for sale beginning and the end of the

k. trade and other payables period

l. provisions description of rights,

m. financial liabilities (excluding amounts shown under (k) and (l)) preferences, and restrictions

n. current tax liabilities and current tax assets, as defined in IAS 12

2 TOAMOD2 FINANCIAL STATEMENT PRESENTATION

o. deferred tax liabilities and deferred tax assets, as defined in IAS 12 treasury shares, including

p. liabilities included in disposal groups shares held by subsidiaries

q. non-controlling interests, presented within equity and associates

r. issued capital and reserves attributable to owners of the parent. shares reserved for issuance

under options and contracts

Additional line items, headings and subtotals may be needed to fairly a description of the nature

present the entity's financial position. and purpose of each reserve

within equity.

Further sub-classifications of line items presented are made in the

statement or in the notes, for example: NOTE: Additional disclosures

a. classes of property, plant and equipment are required in respect of

b. disaggregation of receivables entities without share capital

c. disaggregation of inventories in accordance with IAS 2 Inventories and where an entity has

d. disaggregation of provisions into employee benefits and other reclassified puttable financial

items instruments.

e. classes of equity and reserves.

4. Statement of profit or loss and other comprehensive income

Concepts of profit or loss and comprehensive income Components of OCI

Profit or loss – the total of income less expenses, excluding A. OCI that will be reclassified subsequently

the components of other comprehensive income. to profit or loss

G/L from translating financial

Other comprehensive income – items of income and expense statements of a foreign

(including reclassification adjustments) that are not operation

recognized in profit or loss as required or permitted by Unrealized G/L on derivative

other IFRSs. contracts designated as cash flow

hedge

Total comprehensive income – the change in equity during a Unrealized G/L on debt

period resulting from transactions and other events, other investment measured at FVOCI

than those changes resulting from transactions with owners

in their capacity as owners. B. OCI that will not be reclassified

subsequently to profit or loss

NOTE: All items of income and expense recognized in a Unrealized G/L on equity

period must be included in profit or loss unless a Standard investment measured at FVOCI

or an Interpretation requires otherwise (i.e. instead to be Change in revaluation surplus

included in other comprehensive income). Remeasurements of defined

benefit plan

Change in FV attributable to credit

risk of financial liability designated

at FVPL

Choice in presentation Basic requirements

An entity presents all items of income and expense The statement(s) must present:

recognized in a period, either: a. profit or loss

a. In a single statement of comprehensive b. total other comprehensive income

income c. comprehensive income for the period

b. In two statements: a statement displaying d. an allocation of profit or loss and

components of profit or loss (separate income comprehensive income for the period between

statement) and a second statement of other non-controlling interests and owners of the

comprehensive income parent.

Line items

Profit or loss section or statement NOTE: Expenses recognized in

The following minimum line items must be presented in the profit profit or loss should be analyzed

or loss section (or separate statement of profit or loss, if presented): either by nature (raw materials,

a. revenue staffing costs, depreciation, etc.) or

b. gains and losses from the derecognition of financial assets by function (cost of sales, selling,

measured at amortized cost administrative, etc.)

c. finance costs

d. share of the profit or loss of associates and joint ventures

accounted for using the equity method

e. certain gains or losses associated with the reclassification of

financial assets

f. tax expense

g. a single amount for the total of discontinued items

Other comprehensive income section NOTE: Line items within other

The other comprehensive income section is required to present line comprehensive income are required

items which are

TOAMOD2 FINANCIAL STATEMENT PRESENTATION 3

classified by their nature, and to be categorized into two

grouped between those items that will or will not be categories:

reclassified to profit and loss in subsequent periods. Those that could subsequently

be reclassified to profit or loss

An entity shall disclose reclassification adjustments relating to Those that cannot be

components of other comprehensive income. reclassified to profit or loss.

Other requirements

a. Additional line items may be needed to fairly present the entity's results of operations.

b. Items cannot be presented as 'extraordinary items' in the financial statements or in the notes.

c. Certain items must be disclosed separately either in the statement of comprehensive income or in

the notes, if material, including:

write-downs of inventories to net realizable value or of property, plant and equipment to

recoverable amount, as well as reversals of such write-downs

restructurings of the activities of an entity and reversals of any provisions for the costs of

restructuring

disposals of items of property, plant and equipment

disposals of investments

discontinuing operations

litigation settlements

other reversals of provisions

5. Statement of cash flows

Refer to TOAMOD2.2 IAS 7 Statement of Cash Flows for an in-depth discussion.

6. Statement of changes in equity

Information required to be presented:

a. On the face of the statement:

total comprehensive income for the period, showing separately amounts attributable to owners of

the parent and to non-controlling interests

the effects of any retrospective application of accounting policies or restatements made in

accordance with IAS 8, separately for each component of other comprehensive income

reconciliations between the carrying amounts at the beginning and the end of the period for each

component of equity, separately disclosing:

a. profit or loss

b. other comprehensive income (an analysis of other comprehensive income by item is required

to be presented either in the statement or in the notes)

c. transactions with owners, showing separately contributions by and distributions to owners

and changes in ownership interests in subsidiaries that do not result in a loss of control

b. Either on the face of the statement or in the notes:

amount of dividends recognized as distributions

the related amount per share

7. Notes to the financial statements

The notes must:

present information about the basis of preparation of the financial statements and the specific

accounting policies used

disclose any information required by IFRSs that is not presented elsewhere in the financial

statements and

provide additional information that is not presented elsewhere in the financial statements but

is relevant to an understanding of any of them

Notes are presented in a systematic manner and cross-referenced from the face of the financial

statements to the relevant note.

Other disclosures

a. Judgments and key assumptions – judgments management has made in the process of applying the

entity's accounting policies that have the most significant effect on the amounts recognized in the financial

statements and key assumptions concerning the future, and other key sources of estimation uncertainty

at the end of the reporting period, that have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next financial year.

b. Dividends – the amount of dividends proposed or declared before the financial statements were

authorized for issue but which were not recognized as a distribution to owners during the period, and the

related amount per share, and the amount of any cumulative preference dividends not recognized.

c. Capital disclosures – information about its objectives, policies and processes for managing capital.

• qualitative information about the entity's objectives, policies and processes for managing capital,

including

4 TOAMOD2 FINANCIAL STATEMENT PRESENTATION

o description of capital it manages

o nature of external capital requirements, if any

o how it is meeting its objectives

quantitative data about what the entity regards as capital

changes from one period to another

whether the entity has complied with any external capital requirements and

if it has not complied, the consequences of such non-compliance.

d. Puttable financial instruments –

summary quantitative data about the amount classified as equity

the entity's objectives, policies and processes for managing its obligation to repurchase or redeem

the instruments when required to do so by the instrument holders, including any changes from the

previous period

the expected cash outflow on redemption or repurchase of that class of financial instruments

information about how the expected cash outflow on redemption or repurchase was determined.

e. Other information –

domicile and legal form of the entity

country of incorporation

address of registered office or principal place of business

description of the entity's operations and principal activities

if it is part of a group, the name of its parent and the ultimate parent of the group

if it is a limited life entity, information regarding the length of the life.

8. Third Statement of Financial Position

The improvement clarifies in regard to a third statement of financial position required when an entity

changes accounting policies, or makes retrospective restatements or reclassifications:

Opening statement is only required if impact is material

Opening statement is presented as at the beginning of the immediately preceding comparative

period required by IAS 1 (e.g. if an entity has a reporting date of 31 December 2012 statement of

financial position, this will be as at 1 January 2011)

Only include notes for the third period relating to the change.

TOAMOD2 FINANCIAL STATEMENT PRESENTATION 5

TOAMOD2.2 IAS 7 STATEMENT OF CASH FLOWS

Effective date Periods beginning on or after 1 January 1994

Scope All entities that prepare financial statements in conformity with IFRSs are required to

present a statement of cash flows.

Objective The objective of IAS 7 is to require the presentation of information about the

historical changes in cash and cash equivalents of an entity by means of a statement

of cash flows, which classifies cash flows during the period according to operating,

investing, and financing activities.

Fundamental principle in IAS 7

• The statement of cash flows analyses changes in cash and cash equivalents during a period.

• Cash and cash equivalents comprise:

a. cash on hand

b. demand deposits

c. short-term, highly liquid investments that are readily convertible to a known amount of cash and

that are subject to an insignificant risk of changes in value.

• Guidance notes indicate that an investment normally meets the definition of a cash equivalent when it

has a maturity of three months or less from the date of acquisition.

• Equity investments are normally excluded, unless they are in substance a cash equivalent (e.g. preferred

shares acquired within three months of their specified redemption date).

• Bank overdrafts which are repayable on demand and which form an integral part of an entity's cash

management are also included as a component of cash and cash equivalents.

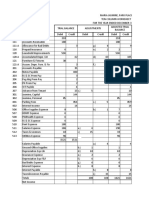

Components of a Statement of Cash Flows

The statement of cash flows shall report cash flows during the period classified by operating activities,

investing activities and financing activities.

Operating activities Investing activities Financing activities

Main revenue producing Activities that relate to the Activities that cause changes to

activities of the entity and other acquisition and disposal of long- contributed equity and

activities that are not investing or term assets and other borrowings of an entity.

financing activities (including investments that are not included

taxes paid/received, unless in cash equivalents.

clearly attributable to investing

or financing activities).

Affects non-current liabilities

Affects profit or loss Affects non-current assets and equity

Other classification considerations:

1. Interest and dividends received and paid may be classified as operating, investing, or financing cash

flows, provided that they are classified consistently from period to period.

Cash flows from/for Option 1 Option 2

Interest income received Operating Investing

Interest expense paid Operating Financing

Dividend income received Operating Investing

Dividend paid to owners Financing Operating

NOTE: Financial institutions shall apply Option 1 in classifying interests and dividends. Option 2 does not

normally apply to financial institutions as per industry practice.

2. Cash flows arising from taxes on income are normally classified as operating, unless they can be

specifically identified with financing or investing activities.

Example: taxes paid that are capitalized as part of the cost of an item of property, plant and equipment

are presented in investing activities

3. The exchange rate used for translation of transactions denominated in a foreign currency should be the

rate in effect at the date of the cash flows (i.e. spot rate at the time of the transaction)

Reporting Cash Flows from Operating Activities

Cash flows from operating activities may be presented using either direct method or indirect method.

Both methods are acceptable by IAS 7, however, direct method is encouraged under IAS 7.

Direct method Indirect method

Shows each major class of gross cash receipts and Adjusts accrual basis net profit or loss for the effects

gross cash payments. of non-cash transactions.

Cash receipts from customers • Changes during the period in inventories and

Cash paid to suppliers operating receivables and payables

Cash paid to employees • Non-cash items such as depreciation,

Cash paid for other operating expenses provisions, deferred taxes, unrealized foreign

Interest paid currency gains and losses, and undistributed

Income taxes paid profits of associates

Net cash from operating activities

6 TOAMOD2 FINANCIAL STATEMENT PRESENTATION

• All other items for which the cash effects are

investing or financing cash flows.

Other considerations to note:

1. Non cash investing and financing activities must be disclosed separately.

2. Cash flows must be reported gross. Set-off is only permitted in very limited cases and additional

disclosures are required (refer to IAS 7.24 for examples relating to term deposits and loans).

3. Foreign exchange transactions should be recorded at the rate at the date of the cash flow.

4. Acquisition and disposal of subsidiaries are investment activities and specific additional disclosures

are required.

5. Where the equity method is used for joint ventures and associates, the statement of cash flows should

only show cash flows between the investor and investee.

6. Where a joint venture is proportionately consolidated, the venturer should only include its

proportionate share of the cash flows of the joint venture.

7. Disclose cash not available for use by the group.

8. Assets and liabilities denominated in a foreign currency generally include an element of unrealized

exchange difference at the reporting date.

9. Disclose the components of cash and cash equivalents and provide a reconciliation back to the

statement of financial position amount if required.

10. Non-cash investing and financing transactions are not to be disclosed in the statement of cash flows.

TOAMOD2 FINANCIAL STATEMENT PRESENTATION 7

TOAMOD2.3 IAS 8 ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES

AND ERRORS

Effective date Periods beginning on or after 1 January 2005

Scope IAS 8 shall be applied in selecting and applying accounting policies, and accounting for

changes in accounting policies, changes in accounting estimates and corrections of prior

period errors.

Objective The objective of IAS 8 is to prescribe the criteria for selecting and changing

accounting policies, together with the accounting treatment and disclosure of changes

in accounting policies, changes in accounting estimates and corrections of errors. The

Standard is intended to enhance the relevance and reliability of an entity’s financial

statements, and the comparability of those financial statements over time and with the

financial statements of other entities.

Accounting policies

specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting

financial statements.

Selection and application of accounting Changes in accounting policies

policies An entity shall change an accounting policy only if the

a. When an IFRS specifically applies to a change:

transaction, other event or condition, the a. is required by an IFRS; or

accounting policy or policies applied to b. results in the financial statements providing reliable

that item shall be determined by applying and more relevant information about the effects of

the IFRS. transactions, other events or conditions on the entity’s

b. In the absence of an IFRS that specifically financial position, financial performance or cash flows.

applies to a transaction, other event or

condition, management shall use its Examples of Change in Accounting Policy

judgment. The following sources should a. Change in the method of inventory pricing from the

be referred to, to make the judgment: FIFO to weighted average method.

Requirements and guidance in other b. Change in the method of accounting for long term

standards/interpretations dealing with construction contract.

similar issues c. The initial adoption of policy to carry assets at

Definitions, recognition criteria and revalued amount.

measurement concepts in the d. Change from cost model to fair value model in

framework measuring investment property and property, plant

May use other GAAP that use a similar and equipment.

conceptual framework and/or may e. Change to a new policy resulting from the

consult other industry requirement of a new PFRS.

practice/accounting literature that is not

in conflict with standards or The following are not changes in accounting policies:

interpretations a. the application of an accounting policy for transactions,

Consistency of accounting policies other events or conditions that differ in substance

An entity shall select and apply its from those previously occurring; and

accounting policies consistently for b. the application of a new accounting policy for

similar transactions, other events and transactions, other events or conditions that did not

conditions, unless an IFRS specifically occur previously or were immaterial.

requires or permits categorization of items

for which different policies may be Principle:

appropriate. If an IFRS requires or permits If change is due to new standard/interpretation, apply

such categorization, an appropriate transitional provisions.

accounting policy shall be selected and If no transitional provisions, apply retrospectively.

applied consistently to each category.

Retrospective application - applying a new accounting

policy to transactions, other events and conditions as if

that policy had always been applied.

However, if it is impracticable to determine either the

period-specific effects or the cumulative effect of the

change for one or more prior periods presented, the

entity shall apply the new accounting policy to the

carrying amounts of assets and liabilities as at the

beginning of the earliest period for which retrospective

application is practicable, which may be the current

period, and shall make a corresponding adjustment to

the opening balance of each affected component of

equity for that period.

8 TOAMOD2 FINANCIAL STATEMENT PRESENTATION

Also, if it is impracticable to determine the cumulative

effect, at the beginning of the current period, of

applying a new accounting policy to all prior periods,

the entity shall adjust the comparative information to

apply the new accounting policy prospectively from the

earliest date practicable.

Disclosures relating to changes in accounting policies

1. Initial application of IFRS:

a. the title of the IFRS

b. when applicable, that the change in accounting policy is made in accordance with its transitional

provisions

c. the nature of the change in accounting policy

d. when applicable, a description of the transitional provisions

e. when applicable, the transitional provisions that might have an effect on future periods

f. for the current period and each prior period presented, to the extent practicable, the amount of the

adjustment:

i. for each financial statement line item affected; and

ii. if IAS 33 Earnings per Share applies to the entity, for basic and diluted earnings per share

g. the amount of the adjustment relating to periods before those presented, to the extent practicable

h. if retrospective application is impracticable for a particular prior period, or for periods before those

presented, the circumstances that led to the existence of that condition and a description of how and

from when the change in accounting policy has been applied.

NOTE: Financial statements of subsequent periods need not repeat these disclosures.

2. Voluntary change in accounting policy:

a. the nature of the change in accounting policy

b. the reasons why applying the new accounting policy provides reliable and more relevant

information

c. for the current period and each prior period presented, to the extent practicable, the amount of the

adjustment:

i. for each financial statement line item affected; and

ii. if IAS 33 applies to the entity, for basic and diluted earnings per share

d. the amount of the adjustment relating to periods before those presented, to the extent practicable

e. if retrospective application is impracticable for a particular prior period, or for periods before those

presented, the circumstances that led to the existence of that condition and a description of how and

from when the change in accounting policy has been applied.

NOTE: Financial statements of subsequent periods need not repeat these disclosures.

3. Application of a new IFRS issued but not yet effective:

a. the title of the new IFRS

b. the nature of the impending change or changes in accounting policy

c. the date by which application of the IFRS is required

d. the date as at which it plans to apply the IFRS initially

e. either: (i) a discussion of the impact that initial application of the IFRS is expected to have on the

entity’s financial statements; or (ii) if that impact is not known or reasonably estimable, a statement

to that effect.

Changes in accounting estimates

an adjustment of the carrying amount of an asset or a liability, or the amount of the periodic consumption

of an asset, that results from the assessment of the present status of, and expected future benefits and

obligations associated with, assets and liabilities. Changes in accounting estimates result from new

information or new developments and, accordingly, are not corrections of errors.

Principles: Disclosures:

Recognize the change prospectively in a. Nature and amount of change that has an effect in the

profit or loss in: current period (or expected to have in future)

a. the period of the change, if the change b. Fact that the effect of future periods is not disclosed

affects that period only; or because of impracticality

b. the period of the change and future c. Subsequent periods need not repeat these disclosures

periods, if the change affects both

Examples of accounting estimates:

a. Bad debts

b. Inventory obsolescence

c. Useful life, residual value, and expected pattern of consumption of benefit of depreciable asset

d. Warranty cost

e. Fair value of financial assets and financial liabilities

TOAMOD2 FINANCIAL STATEMENT PRESENTATION 9

Prior period errors

omissions from, and misstatements in, the entity’s financial statements for one or more prior periods

arising from a failure to use, or misuse of, reliable information that:

a. was available when financial statements for those periods were authorized for issue

b. could reasonably be expected to have been obtained and taken into account in the preparation and

presentation of those financial statements

Such errors include the effects of mathematical mistakes, mistakes in applying accounting policies,

oversights or misinterpretations of facts, and fraud.

Principle: Disclosures:

Correct material prior period errors retrospectively in the first a. the nature of the prior period

set of financial statements authorized for issue after their error

discovery by: b. for each prior period presented,

a. restating the comparative amounts for the prior period(s) to the extent practicable, the

presented in which the error occurred; or amount of the correction:

b. if the error occurred before the earliest prior period i. for each financial statement

presented, restating the opening balances of assets, line item affected

liabilities and equity for the earliest prior period presented. ii. if IAS 33 applies to the entity,

for basic and diluted

A prior period error shall be corrected by retrospective earnings per share

restatement except to the extent that it is impracticable to c. the amount of the correction at

determine either the period-specific effects or the cumulative the beginning of the earliest

effect of the error. prior period presented

a. When it is impracticable to determine the period-specific d. if retrospective restatement is

effects of an error on comparative information for one or impracticable for a particular

more prior periods presented, the entity shall restate the prior period, the circumstances

opening balances of assets, liabilities and equity for the that led to the existence of that

earliest period for which retrospective restatement is condition and a description of

practicable (which may be the current period). how and from when the error

b. When it is impracticable to determine the cumulative effect, has been corrected

at the beginning of the current period, of an error on all prior e. Subsequent periods need not

periods, the entity shall restate the comparative information repeat these disclosures

to correct the error prospectively from the earliest date

practicable.

10 TOAMOD2 FINANCIAL STATEMENT PRESENTATION

TOAMOD2.4 IAS 10 EVENTS AFTER THE REPORTING PERIOD

Effective date Periods beginning on or after 1 January 2005

Scope IAS 10 shall be applied in the accounting for, and disclosure of, events after the

reporting period.

Objective The objective of IAS 10 is to prescribe: (a) when an entity should adjust its financial

statements for events after the reporting period; and (b) the disclosures that an entity

should give about the date when the financial statements were authorized for issue and

about events after the reporting period. The Standard also requires that an entity

should not prepare its financial statements on a going concern basis if events after the

reporting period indicate that the going concern assumption is not appropriate.

Events after the reporting period

those events, favorable and unfavorable, that occur between the end of the reporting period and the date

when the financial statements are authorized for issue.

Adjusting events after the reporting period Non-adjusting events after the reporting period

those that provide evidence of conditions that those that are indicative of conditions that arose

existed at the end of the reporting period after the reporting period

An entity shall adjust the amounts recognized in An entity shall not adjust the amounts

its financial statements to reflect adjusting events recognized in its financial statements to reflect

after the reporting period. non-adjusting events after the reporting period.

Examples: Examples:

a. the settlement after the reporting period of a a. decline in fair value of investments between

court case that confirms that the entity had a the end of the reporting period and the date

present obligation at the end of the reporting when the financial statements are authorized for

period. issue.

b. the receipt of information after the reporting b. a major business combination after the

period indicating that an asset was impaired reporting period or disposing of a major

at the end of the reporting period, or that the subsidiary

amount of a previously recognized impairment c. announcing a plan to discontinue an

loss for that asset needs to be adjusted. For operation

example: d. major purchases of assets, classification of

i. the bankruptcy of a customer that occurs assets as held for sale in accordance with

after the reporting period usually confirms IFRS 5, other disposals of assets, or

that the customer was credit-impaired at the expropriation of major assets by government

end of the reporting period; e. the destruction of a major production plant

ii. the sale of inventories after the reporting by a fire after the reporting period

period may give evidence about their net f. announcing, or commencing the implementation

realizable value at the end of the reporting of, a major restructuring (see IAS 37)

period. g. major ordinary share transactions and

c. the determination after the reporting period of potential ordinary share transactions after

the cost of assets purchased, or the proceeds the reporting period

from assets sold, before the end of the reporting h. abnormally large changes after the reporting

period. period in asset prices or foreign exchange

d. the determination after the reporting period of rates

the amount of profit-sharing or bonus i. changes in tax rates or tax laws enacted or

payments, if the entity had a present legal or announced after the reporting period that have

constructive obligation at the end of the a significant effect on current and deferred tax

reporting period to make such payments as a assets and liabilities

result of events before that date j. entering into significant commitments or

e. the discovery of fraud or errors that show that contingent liabilities, for example, by issuing

the financial statements are incorrect. significant guarantees

k. commencing major litigation arising solely out

of events that occurred after the reporting

period.

Disclosures:

1. The date when the financial statements were authorized for issue and who gave that

authorization. If the entity’s owners or others have the power to amend the financial statements after

issue, the entity shall disclose that fact.

2. If an entity receives information after the reporting period about conditions that existed at the end of

the reporting period (adjusting events), it shall update disclosures that relate to those conditions, in

the light of the new information.

3. If non-adjusting events after the reporting period are material, non-disclosure could influence the

economic decisions that users make on the basis of the financial statements. Accordingly, an entity shall

disclose the following for each material category of non-adjusting event after the reporting period:

TOAMOD2 FINANCIAL STATEMENT PRESENTATION 11

a. the nature of the event; and

b. an estimate of its financial effect, or a statement that such an estimate cannot be made.

Other considerations:

1. Going concern:

An entity shall not prepare its financial statements on a going concern basis if management determines

after the reporting period either that it intends to liquidate the entity or to cease trading, or that it has

no realistic alternative but to do so.

2. Dividends:

If an entity declares dividends to holders of equity instruments after the reporting period, the entity

shall not recognize those dividends as a liability at the end of the reporting period.

Disclosures in the notes about going concern and dividends declaration shall be in accordance with IAS 1.

12 TOAMOD2 FINANCIAL STATEMENT PRESENTATION

TOAMOD2.5 IAS 24 RELATED PARTY DISCLOSURES

Effective date Periods beginning on or after 1 January 2011

Scope IAS 24 shall be applied in:

a. identifying related party relationships and transactions;

b. identifying outstanding balances, including commitments, between an entity and its

related parties;

c. identifying the circumstances in which disclosure of the items in (a) and (b) is

required; and

d. determining the disclosures to be made about those items.

IAS 24 requires disclosure of:

Related party relationships

Related party transactions

Outstanding balances with related parties

Commitments to related parties

The disclosures have to be made in the related consolidated and separate financial

statements of:

A parent

Investors with joint control of an investee

Investor with significant influence over an investee.

Objective The objective of this IAS 24 is to ensure that an entity’s financial statements contain the

disclosures necessary to draw attention to the possibility that its financial position and

profit or loss may have been affected by the existence of related parties and by

transactions and outstanding balances, including commitments, with such parties.

Definitions

1. Related party - a person or entity that is related to the entity that is preparing its financial statements

(in this Standard referred to as the ‘reporting entity’)

a. A person or a close member of that person’s family is related to a reporting entity if that person:

i. has control or joint control of the reporting entity

ii. has significant influence over the reporting entity

iii. is a member of the key management personnel of the reporting entity or of a parent of the

reporting entity

b. An entity is related to a reporting entity if any of the following conditions applies:

i. The entity and the reporting entity are members of the same group (which means that each

parent, subsidiary and fellow subsidiary is related to the others).

ii. One entity is an associate or joint venture of the other entity (or an associate or joint venture of a

member of a group of which the other entity is a member).

iii. Both entities are joint ventures of the same third party.

iv. One entity is a joint venture of a third entity and the other entity is an associate of the third

entity.

v. The entity is a post-employment benefit plan for the benefit of employees of either the reporting

entity or an entity related to the reporting entity. If the reporting entity is itself such a plan, the

sponsoring employers are also related to the reporting entity.

vi. The entity is controlled or jointly controlled by a person identified in (a).

vii. A person identified in (a)(i) has significant influence over the entity or is a member of the key

management personnel of the entity (or of a parent of the entity).

viii. The entity, or any member of a group of which it is a part, provides key management personnel

services to the reporting entity or to the parent of the reporting entity.

2. Related party transaction - a transfer of resources, services or obligations between a reporting entity

and a related party, regardless of whether a price is charged

3. Close members of the family of a person - those family members who may be expected to influence,

or be influenced by, that person in their dealings with the entity and include:

a. that person’s children and spouse or domestic partner;

b. children of that person’s spouse or domestic partner; and

c. dependents of that person or that person’s spouse or domestic partner

4. Compensation - includes all employee benefits (as defined in IAS 19 Employee Benefits) including

employee benefits to which IFRS 2 Share-based Payment applies.

5. Key management personnel - those persons having authority and responsibility for planning,

directing and controlling the activities of the entity, directly or indirectly, including any director

(whether executive or otherwise) of that entity.

6. Government - refers to government, government agencies and similar bodies whether local, national or

international.

TOAMOD2 FINANCIAL STATEMENT PRESENTATION 13

7. Government-related entity - an entity that is controlled, jointly controlled or significantly influenced

by a government.

Disclosures

1. Relationships between a parent and its subsidiaries

Disclose irrespective of whether there have been transactions between them, shall disclose the name

of its parent and, if different, the ultimate controlling party. If neither the entity’s parent nor the

ultimate controlling party produces consolidated financial statements available for public use, the

name of the next most senior parent that does so shall also be disclosed.

2. Key management personnel compensation

Disclose in total and for each of the following categories:

a. short-term employee benefits

b. post-employment benefits

c. other long-term benefits

d. termination benefits

e. share-based payment

3. Management entities

If an entity obtains key management personnel services from a management entity, the requirements

in (2) to analyze compensation into short term, post- employment, other long term and termination

benefits, and share-based payments, do not have to be applied to the compensation paid by the

management entity to the management entity’s employees or directors.

Instead, the entity has to disclose the amount incurred for the service fee paid to the management

entity.

4. Related party transactions

Only if there have been transactions, disclose:

a. The nature of related party relationship

b. Information about transactions

c. Information about outstanding balances, including commitments, to understand the potential

effect of the relationship on the financial statements

d. Information about impairment or bad debts with related parties.

The above disclosures shall be presented separately for each of the following categories:

a. The parent

b. Entities with joint control of, or significant influence over, the entity

c. Subsidiaries

d. Associates

e. Joint ventures in which the entity is a joint venturer

f. Key management personnel of the entity or its parent

g. Other related parties

5. Government-related entities

A reporting entity is exempt from the disclosure requirements in (4) in relation to related party

transactions and outstanding balances, including commitments, with:

a. a government that has control or joint control of, or significant influence over, the reporting entity;

b. another entity that is a related party because the same government has control or joint control of,

or significant influence over, both the reporting entity and the other entity

Shall disclose the following about the transactions and related outstanding balances:

a. the name of the government and the nature of its relationship with the reporting entity (ie control,

joint control or significant influence);

b. the following information in sufficient detail to enable users of the entity’s financial statements to

understand the effect of related party transactions on its financial statements:

i. the nature and amount of each individually significant transaction; and

ii. for other transactions that are collectively, but not individually, significant, a qualitative or

quantitative indication of their extent.

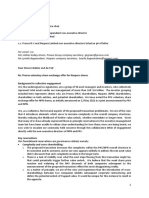

Sample Diagram Showing Related Parties

14 TOAMOD2 FINANCIAL STATEMENT PRESENTATION

Entity A

Person Y -Controls RE Person U

-Has (ultimate) control of RE -KMP of A

-Has joint control of RE

Entity A1 Entity U1

-Subsidiary of A -Controlled by U

-Joint venture of A -Jointly

Entity Y1 Entity Y2 - Associate of A controlled by U

-Controlled by Y -Y is KMP

-Jointly controlled by Y

-Significant influence

held by Y Entity Y3 Person V

-Controlled by Y2 -Close family

member of U

Person Z

-Close family member of Y Entity V1

-Controlled by V

-Jointly

controlled by V

Entity Z1 Entity Z2

-Controlled by Z -Z is KMP

-Jointly controlled by Z Entity B

-Significant influence -Jointly

held by Z Entity Z3 controls RE

-Controlled by Z2

Entity B1

-Joint venture of B

Person X Person W -Associate of B

-Close family -KMP of RE

member of W -Significant influence

over RE Entity C

-Significant

influence over

Entity X1 RE

-Controlled by X Entity W1

-Jointly -Controlled by W REPORTING ENTITY

controlled by X -Jointly controlled by W Entity C1

-Joint venture of C

Entity RE1 -Associate of C

-Subsidiary of RE

-Joint venture of RE

-Associate of RE

TOAMOD2 FINANCIAL STATEMENT PRESENTATION 15

TOAMOD2.6 IFRS 5 NONCURRENT ASSETS HELD FOR SALE AND

DISCONTINUED OPERATIONS

Effective date Periods beginning on or after 1 January 2005

Scope IFRS 5 applies to all recognized non-current assets and disposal groups of an entity

that are:

held for sale; or

held for distribution to owners.

Assets classified as non-current in accordance with IAS 1 shall not be reclassified as

current assets until they meet the criteria of IFRS 5.

If an entity disposes of a group of assets, possibly with directly associated liabilities (i.e.

an entire cash-generating unit), together in a single transaction, if a non-current asset in

the group meets the measurement requirements in IFRS 5, then IFRS 5 applies to the

group as a whole. The entire group is measured at the lower of its carrying amount and

fair value less costs to sell.

Non-current assets to be abandoned cannot be classified as held for sale.

Exclusions to measurement requirements of IFRS 5. Disclosure requirements still to be

complied with:

Deferred tax assets (IAS 12 Income Taxes)

Assets arising from employee benefits (IAS 19 Employee Benefits)

Financial assets in the scope of IAS 39 Financial Instruments: Recognition and

Measurement / IFRS 9 Financial Instruments

Non-current assets that are accounted for in accordance with the fair value

model (IAS 40 Investment Property)

Non-current assets that are measured at fair value less estimated point of sale

costs (IAS 41 Biological Assets)

Contractual rights under insurance contracts (IFRS 4 Insurance Contracts)

Objective The objective of IFRS 5 is to specify the accounting for assets held for sale, and the

presentation and disclosure of discontinued operations.

In particular, the IFRS requires: (a) assets that meet the criteria to be classified as held

for sale to be measured at the lower of carrying amount and fair value less costs to sell,

and depreciation on such assets to cease; and (b) assets that meet the criteria to be

classified as held for sale to be presented separately in the statement of financial

position and the results of discontinued operations to be presented separately in the

statement of comprehensive income.

Definitions

1. Cash-generating unit – the smallest identifiable group of assets that generates cash inflows that are

largely independent of the cash inflows from other assets or groups of assets.

2. Discontinued operations – a component of an entity that either has been disposed of or is classified as

held for sale and:

a. represents a separate major line of business or geographical area of operations,

b. is part of a single coordinated plan to dispose of a separate major line of business or

geographical area of operations or

c. is a subsidiary acquired exclusively with a view to resale

3. Disposal group – a group of assets to be disposed of, by sale or otherwise, together as a group in a

single transaction, and liabilities directly associated with those assets that will be transferred in the

transaction.

4. Fair value – the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date.

Classification

1. An entity shall classify a non-current asset (or disposal group) as held for sale if its carrying amount will

be recovered principally through a sale transaction rather than through continuing use. The following

criteria must be met:

a. The asset (or disposal group) is available for immediate sale.

b. The terms of asset sale must be usual and customary for sales of such assets

c. The sale must be highly probable

Management is committed to a plan to sell the asset

An active programme to locate a buyer and complete the plan must have been initiated

Asset must be actively marketed for a sale at a reasonable price in relation to its current fair

value

16 TOAMOD2 FINANCIAL STATEMENT PRESENTATION

d. Sale should be completed within one year from classification date (except if delay is caused by

events or circumstances beyond the entity’s control and the entity remains committed to its plan to

sell the asset or disposal group)

2. Sale transactions include exchanges of non-current assets for other non-current assets when the

exchange has commercial substance in accordance with IAS 16 Property, Plant and Equipment.

3. When an entity acquires a non-current asset exclusively with a view to its subsequent disposal, it shall

classify the non-current asset as held for sale at the acquisition date only if the one-year requirement is

met.

Measurement

1. An entity shall measure a non-current asset (or disposal group) classified as held for sale at the lower of

its carrying amount and fair value less costs to sell.

2. An entity shall measure a non-current asset (or disposal group) classified as held for distribution to

owners at the lower of its carrying amount and fair value less costs to distribute.

3. Immediately before the initial classification of the asset (or disposal group) as held for sale, the carrying

amounts of the asset (or all the assets and liabilities in the group) shall be measured in accordance with

applicable IFRSs.

4. On subsequent remeasurement of a disposal group, the carrying amounts of any assets and liabilities

that are not within the scope of the measurement requirements of this IFRS, but are included in a

disposal group classified as held for sale, shall be remeasured in accordance with applicable IFRSs

before the fair value less costs to sell of the disposal group is remeasured.

Recognition of impairment losses and reversals

1. An entity shall recognize an impairment loss for any initial or subsequent write-down of the asset (or

disposal group) to fair value less costs to sell, to the extent that it has not been recognized.

2. An entity shall recognize a gain for any subsequent increase in fair value less costs to sell of an asset, but

not in excess of the cumulative impairment loss that has been recognized either in accordance with

this IFRS or previously in accordance with IAS 36.

3. The impairment loss (or any subsequent gain) recognized for a disposal group shall reduce (or

increase) the carrying amount of the non-current assets in the group that are within the scope of the

measurement requirements of this IFRS.

4. A gain or loss not previously recognized by the date of the sale of a non-current asset (or disposal

group) shall be recognized at the date of derecognition.

5. An entity shall not depreciate (or amortize) a non-current asset while it is classified as held for sale or

while it is part of a disposal group classified as held for sale.

6. Interest and other expenses attributable to the liabilities of a disposal group classified as held for

sale shall continue to be recognized.

Changes to a plan of sale or to a plan of distribution to owners

1. If an entity has classified an asset (or disposal group) as held for sale or as held for distribution to

owners, but the criteria are no longer met, the entity shall cease to classify the asset (or disposal group)

as held for sale or held for distribution to owners.

NOTE: The classification criteria also apply to non-current assets (or disposal groups) held for distribution

to owners. A reclassification from held for sale to held for distribution to owners is not a change to a plan

and therefore not a new plan.

2. Shall be measured at the lower of:

a. its carrying amount before the asset (or disposal group) was classified as held for sale or as

held for distribution to owners, adjusted for any depreciation, amortization or revaluations

that would have been recognized had the asset (or disposal group) not been classified as held for sale

or as held for distribution to owners, and

b. its recoverable amount at the date of the subsequent decision not to sell or distribute.

Presentation and disclosure

An entity shall present and disclose information that enables users of the financial statements to evaluate

the financial effects of discontinued operations and disposals of non-current assets (or disposal groups).

a. Presenting discontinued operations

Classification as a discontinued operation depends on when the operation also meets the

requirements to be classified as held for sale.

A single amount in the statement of comprehensive income comprising the total of:

i. the post-tax profit or loss of discontinued operations and

ii. the post-tax gain or loss recognized on the measurement to fair value less costs to sell or on the

disposal of the assets or disposal group(s) constituting the discontinued operation.

An analysis of the single amount (either in the notes or in the statement of comprehensive income):

i. the revenue, expenses and pre-tax profit or loss of discontinued operations;

ii. the related income tax expense as required by IAS 12.

iii. the gain or loss recognized on the measurement to fair value less costs to sell or on the disposal of

the assets or disposal group(s) constituting the discontinued operation; and

iv. the related income tax expense as required by IAS 12.

Cash flow disclosure is required – either in the notes or statement of cash flows.

TOAMOD2 FINANCIAL STATEMENT PRESENTATION 17

Amount of income attributable to owners of the parent – either in the notes or statement of

comprehensive income.

Comparatives are restated.

b. Gains or losses related to continuing operations

Any gain or loss on the remeasurement of a non-current asset (or disposal group) classified as held

for sale that does not meet the definition of a discontinued operation shall be included in profit or

loss from continuing operations.

c. Presentation of a noncurrent asset or disposal group classified as held for sale

An entity shall present a non-current asset classified as held for sale and the assets of a disposal group

classified as held for sale separately from other assets in the statement of financial position.

The liabilities of a disposal group classified as held for sale shall be presented separately from other

liabilities in the statement of financial position.

Those assets and liabilities shall not be offset and presented as a single amount.

The major classes of assets and liabilities classified as held for sale shall be separately disclosed

either in the statement of financial position or in the notes, except if the disposal group is a newly

acquired subsidiary.

An entity shall present separately any cumulative income or expense recognized in other

comprehensive income relating to a non-current asset (or disposal group) classified as held for sale.

Prior year balances in the statement of financial positions are not reclassified as held for sale.

d. Additional disclosures

An entity shall disclose the following information in the notes in the period in which a non-current

asset (or disposal group) has been either classified as held for sale or sold:

i. a description of the non-current asset (or disposal group)

ii. a description of the facts and circumstances of the sale, or leading to the expected disposal, and the

expected manner and timing of that disposal

iii. the gain or loss recognized (impairment) and, if not separately presented in the statement of

comprehensive income, the caption in the statement of comprehensive income that includes that

gain or loss

iv. if applicable, the reportable segment in which the non-current asset (or disposal group) is

presented (IFRS 8 Operating Segments)

An entity shall disclose, in the period of the decision to change the plan to sell the non-current asset

(or disposal group), a description of the facts and circumstances leading to the decision and the effect

of the decision on the results of operations for the period and any prior periods presented.

18 TOAMOD2 FINANCIAL STATEMENT PRESENTATION

You might also like

- Financial Statement Presentation. Theory of Accounts GuideDocument20 pagesFinancial Statement Presentation. Theory of Accounts GuideCykee Hanna Quizo LumongsodNo ratings yet

- Theory of Accounts: Module 2 Financial Statement PresentationDocument33 pagesTheory of Accounts: Module 2 Financial Statement PresentationRHEA CYBELE OSARIONo ratings yet

- Chapter 14 Financial StatementsDocument12 pagesChapter 14 Financial Statementsmaria isabella100% (1)

- NFRS IiiDocument105 pagesNFRS Iiikaran shahiNo ratings yet

- CFAS Unit 1 Module 2Document25 pagesCFAS Unit 1 Module 2KC PaulinoNo ratings yet

- PAS 1 Financial Statement PresentationDocument6 pagesPAS 1 Financial Statement Presentationjoubert andres100% (1)

- What It Does:: With PfrssDocument7 pagesWhat It Does:: With PfrssOlive Jean TiuNo ratings yet

- Philippine Accounting Standard No. 1: Presentation of Financial StatementsDocument58 pagesPhilippine Accounting Standard No. 1: Presentation of Financial StatementsDark PrincessNo ratings yet

- GAM Financial StatementsDocument12 pagesGAM Financial StatementsNabelah OdalNo ratings yet

- Financial Statements Presentation PAS 1Document72 pagesFinancial Statements Presentation PAS 1not funny didn't laughNo ratings yet

- AS-01 Financial Statement StandardsDocument9 pagesAS-01 Financial Statement StandardsAtaulNo ratings yet

- Toa Pas 1 Financial StatementsDocument14 pagesToa Pas 1 Financial StatementsreinaNo ratings yet

- IAS:1 - Presentation of Financial StatementsDocument44 pagesIAS:1 - Presentation of Financial StatementsAbu Bakkar SiddiqueNo ratings yet

- PAS 1: Financial Statement Presentation BasicsDocument52 pagesPAS 1: Financial Statement Presentation BasicsJustine VeralloNo ratings yet

- IAS:1 - Presentation of Financial StatementsDocument47 pagesIAS:1 - Presentation of Financial StatementsLucy AnnNo ratings yet

- Pas 1 - Presentation of Financial StatementsDocument27 pagesPas 1 - Presentation of Financial StatementsJomel Serra BrionesNo ratings yet

- Ind AS 1 Financial Statement OverviewDocument11 pagesInd AS 1 Financial Statement OverviewPavan KocherlakotaNo ratings yet

- Sri Lanka Accounting StandardDocument6 pagesSri Lanka Accounting StandardYoosuf Mohamed IrsathNo ratings yet

- NEW Schedule VIDocument22 pagesNEW Schedule VISanjay BhatterNo ratings yet

- ACC205 Seminar 2 StudentDocument35 pagesACC205 Seminar 2 StudentDa Na ChngNo ratings yet

- Pas 1Document58 pagesPas 1Reggie Pernites Dela CernaNo ratings yet

- Presentation of Financial Statements (Copy) (Copy) - TaskadeDocument5 pagesPresentation of Financial Statements (Copy) (Copy) - Taskadebebanco.maryzarianna.olaveNo ratings yet

- Objective of IAS 1Document8 pagesObjective of IAS 1mahekshahNo ratings yet

- FAR-4201 (Financial Statements)Document8 pagesFAR-4201 (Financial Statements)Gwyneth CartallaNo ratings yet

- Ifrs Indian GAPP Cost V/s Fair Value: Components of Financial StatementsDocument8 pagesIfrs Indian GAPP Cost V/s Fair Value: Components of Financial Statementsnagendra2007No ratings yet

- Saint Columban College Refreshment Course Financial Statement NotesDocument9 pagesSaint Columban College Refreshment Course Financial Statement Notesۦۦۦۦۦ ۦۦ ۦۦۦNo ratings yet

- THEORIES PAS 1 and PAS 8Document28 pagesTHEORIES PAS 1 and PAS 8PatrickMendozaNo ratings yet

- 08_Handout_1(CFAS)Document12 pages08_Handout_1(CFAS)laurencedechosa907No ratings yet

- Ias 34Document4 pagesIas 34OLANIYI DANIELNo ratings yet

- Chapter 2 Presentation of Financial StatementsDocument5 pagesChapter 2 Presentation of Financial StatementsBLESSINGS KACHILIKANo ratings yet

- Financial Statement Presentation RequirementsDocument6 pagesFinancial Statement Presentation RequirementsAlaine DobleNo ratings yet

- Unit - 1joint Stock Companies (Ind As) ThoryDocument5 pagesUnit - 1joint Stock Companies (Ind As) ThoryTtttNo ratings yet

- Government Accounting: Accounting For Non-Profit OrganizationsDocument39 pagesGovernment Accounting: Accounting For Non-Profit OrganizationsmoNo ratings yet

- FULLIFRS Vs IFRSforSMES BAGSITDocument220 pagesFULLIFRS Vs IFRSforSMES BAGSITVidgezxc LoriaNo ratings yet

- 2022-2023 INTACC3 PAS 1 HandoutsDocument9 pages2022-2023 INTACC3 PAS 1 HandoutsJefferson AlingasaNo ratings yet

- IPSAS 1 Financial statement present including cash)Document34 pagesIPSAS 1 Financial statement present including cash)zelalemNo ratings yet

- IAS 1 Financial Statement RequirementsDocument6 pagesIAS 1 Financial Statement RequirementsmulualemNo ratings yet

- Cfas Presentation of FSDocument27 pagesCfas Presentation of FSRogelio F Geronimo Jr.No ratings yet

- INTACC 3.1LN Presentation of Financial StatementsDocument9 pagesINTACC 3.1LN Presentation of Financial StatementsAlvin BaternaNo ratings yet

- #3 Pas 1Document6 pages#3 Pas 1Shara Joy B. ParaynoNo ratings yet

- Chapter 3 - IAS 1Document10 pagesChapter 3 - IAS 1Bahader AliNo ratings yet

- Pas 1Document5 pagesPas 1Christy CaneteNo ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial ReportingNhel AlvaroNo ratings yet

- Fa 534Document11 pagesFa 534Sonia MakwanaNo ratings yet

- Ias 1 Presentation of Financial Statements-2Document7 pagesIas 1 Presentation of Financial Statements-2Pia ChanNo ratings yet

- Ind As 1, 7,8,10, 34Document40 pagesInd As 1, 7,8,10, 34Dr. Meghna DangiNo ratings yet

- NAS 1: Presentation of Financial Statements: Prepared By: CA Anish GyawaliDocument22 pagesNAS 1: Presentation of Financial Statements: Prepared By: CA Anish GyawaliSujit DasNo ratings yet

- Particulars: Financial Statements Scope ObjectiveDocument40 pagesParticulars: Financial Statements Scope ObjectiveKm Brly FanoNo ratings yet

- IAS 1 Financial Reporting RequirementsDocument7 pagesIAS 1 Financial Reporting RequirementshemantbaidNo ratings yet

- LkasDocument24 pagesLkasRommel CruzNo ratings yet

- FARAP-4516Document10 pagesFARAP-4516Accounting StuffNo ratings yet

- Module 03 - Presentation of Financial StatementsDocument19 pagesModule 03 - Presentation of Financial Statementspaula manaloNo ratings yet

- Pas 1 Presentation of Financial StatementsDocument16 pagesPas 1 Presentation of Financial StatementsJustine VeralloNo ratings yet

- Financial Reporting Guide for BeginnersDocument12 pagesFinancial Reporting Guide for Beginnersフ卂尺乇ᗪNo ratings yet

- Accounting Standard DiscosuresDocument24 pagesAccounting Standard DiscosuresplmahalakshmiNo ratings yet

- Chapter 14 Financial StatementsDocument12 pagesChapter 14 Financial StatementsAngelica Joy ManaoisNo ratings yet

- Pas 1 Presentation of Financial StatementsDocument8 pagesPas 1 Presentation of Financial StatementsR.A.100% (1)

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument21 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- Code of Ethics For Teachers PDFDocument10 pagesCode of Ethics For Teachers PDFMevelle Laranjo AsuncionNo ratings yet

- The Teaching Profession Knowledge of Subject Matte PDFDocument5 pagesThe Teaching Profession Knowledge of Subject Matte PDFCatherine tevesNo ratings yet

- Aqua Pure Water Refilling Station Financial StatementsDocument22 pagesAqua Pure Water Refilling Station Financial StatementsCukeeNo ratings yet

- MAS-Preparationand Presentationof The ReportDocument1 pageMAS-Preparationand Presentationof The ReportCukeeNo ratings yet

- Assignment Legal BasesDocument10 pagesAssignment Legal BasesCukeeNo ratings yet

- Aqua Pure Water Refilling Station Financial StatementsDocument22 pagesAqua Pure Water Refilling Station Financial StatementsCukeeNo ratings yet

- Auditing Theory and Other Assurance ServicesDocument8 pagesAuditing Theory and Other Assurance ServicesCukeeNo ratings yet

- MAS DIFFERENTIAL COST ANALYSIS Practice and NotesDocument9 pagesMAS DIFFERENTIAL COST ANALYSIS Practice and NotesCukee100% (1)

- Assignment Legal BasesDocument10 pagesAssignment Legal BasesCukeeNo ratings yet

- Gross EstateDocument6 pagesGross EstateCukeeNo ratings yet

- IFRS 5 Non-Current Assets Held for Sale and Discontinued OperationsDocument3 pagesIFRS 5 Non-Current Assets Held for Sale and Discontinued OperationsCukeeNo ratings yet

- Optimal Capital Structure AnalysisDocument6 pagesOptimal Capital Structure AnalysisIsfundiyerTaungaNo ratings yet

- Part1 Topic 4 Reconstitution of PartnershipDocument21 pagesPart1 Topic 4 Reconstitution of PartnershipShivani ChoudhariNo ratings yet

- Different Approaches To ValuationDocument11 pagesDifferent Approaches To ValuationSumit SahniNo ratings yet

- 6-4B SolutionDocument3 pages6-4B SolutionAnish AdhikariNo ratings yet

- Instructional Module: Republic of The Philippines NUEVA Vizcaya State University Bayombong, Nueva VizcayaDocument4 pagesInstructional Module: Republic of The Philippines NUEVA Vizcaya State University Bayombong, Nueva VizcayaJarold MatiasNo ratings yet

- Safal Niveshak Interview of Basant Maheshwari Sept. 2014 PDFDocument59 pagesSafal Niveshak Interview of Basant Maheshwari Sept. 2014 PDFVenkatesha RamaiahNo ratings yet

- Q1 WK 7 Las Fabm 2 Ma. Cristina R. JamonDocument8 pagesQ1 WK 7 Las Fabm 2 Ma. Cristina R. JamonFunji BuhatNo ratings yet

- Contingent Consideration AccountingDocument25 pagesContingent Consideration AccountingAEDRIAN LEE DERECHONo ratings yet

- Financial Accounting Problems and SolutionsDocument10 pagesFinancial Accounting Problems and SolutionsThe ShiningNo ratings yet

- Believe Are Doing The " Right Thing" in Terms of Consumer Protection, Human Rights and TheDocument48 pagesBelieve Are Doing The " Right Thing" in Terms of Consumer Protection, Human Rights and TheSofia SantosNo ratings yet

- Ar01022 P PDFDocument78 pagesAr01022 P PDFvirat swaroopNo ratings yet

- K1. Using The Adjusted Trial Balance Prepared in P...Document6 pagesK1. Using The Adjusted Trial Balance Prepared in P...M Younis ShujraNo ratings yet

- Management Accounting Ratios ExplainedDocument30 pagesManagement Accounting Ratios ExplainedT S Kumar KumarNo ratings yet

- Tutorial 4 Answer Mfrs123 Borrowing CostsDocument5 pagesTutorial 4 Answer Mfrs123 Borrowing CostsannabelleNo ratings yet

- CHAPTER 7 INVENTORIES QUIZDocument4 pagesCHAPTER 7 INVENTORIES QUIZanna maria100% (1)

- Pakistan Stock Exchange - Wikipedia PDFDocument4 pagesPakistan Stock Exchange - Wikipedia PDFanon_154643438No ratings yet

- Microsoft Word - Form 22Document7 pagesMicrosoft Word - Form 22Ganesh RakaleNo ratings yet

- AttachmentDocument8 pagesAttachmentRessa LiniNo ratings yet

- p176 Maria JasmineDocument9 pagesp176 Maria JasmineIsaiah Valencia100% (1)

- Philippine Financial Reporting Standards 16 Leases (PFRS 16)Document3 pagesPhilippine Financial Reporting Standards 16 Leases (PFRS 16)Queen ValleNo ratings yet

- Written Assignment Unit 4Document9 pagesWritten Assignment Unit 4Mike StevenNo ratings yet

- ADCORP1Document10 pagesADCORP1rtchuidjangnanaNo ratings yet

- Sambal Company comparative balance sheet and cash flow analysisDocument2 pagesSambal Company comparative balance sheet and cash flow analysisconequip philippines100% (1)

- Do Global Stocks Outperform US Treasury Bills? Hendrik Bessembinder Et Al July 5, 2019Document85 pagesDo Global Stocks Outperform US Treasury Bills? Hendrik Bessembinder Et Al July 5, 2019Abdullah18No ratings yet

- Internship ReportDocument49 pagesInternship ReportKarina Permata Sari0% (1)

- Palantir Stock-Based Compensation Update Provides InsightDocument18 pagesPalantir Stock-Based Compensation Update Provides InsightRyan LamNo ratings yet

- Grace Corporati On: Financial Statements For The Year Ended December 31, 2017Document3 pagesGrace Corporati On: Financial Statements For The Year Ended December 31, 2017Nesuui MontejoNo ratings yet

- ABC Chapter 5 Accounting For Business Combinations by Millan 2020Document25 pagesABC Chapter 5 Accounting For Business Combinations by Millan 2020Nayoung LeeNo ratings yet

- Slide AKT 202 Akuntansi Keuangan Menengah Presentasi 12Document44 pagesSlide AKT 202 Akuntansi Keuangan Menengah Presentasi 12Alan KurniawanNo ratings yet

- PRX - NPN - Collaborative Investor Letter To Boards - 09062021Document4 pagesPRX - NPN - Collaborative Investor Letter To Boards - 09062021Krash KingNo ratings yet