Professional Documents

Culture Documents

Financial Statement Analysis: Understanding the Key Financial Statements

Uploaded by

thakurvinod0 ratings0% found this document useful (0 votes)

65 views9 pagesThis document discusses key concepts in financial statement analysis including the balance sheet, income statement, and statement of cash flows. It asks questions about valuing a firm's assets, liabilities, equity, and growth opportunities. It also discusses modifications that can be made to financial statements such as capitalizing operating leases and research & development expenses to provide a more accurate picture of a company's operating performance and value.

Original Description:

Original Title

Aswath Damodaran 1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses key concepts in financial statement analysis including the balance sheet, income statement, and statement of cash flows. It asks questions about valuing a firm's assets, liabilities, equity, and growth opportunities. It also discusses modifications that can be made to financial statements such as capitalizing operating leases and research & development expenses to provide a more accurate picture of a company's operating performance and value.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

65 views9 pagesFinancial Statement Analysis: Understanding the Key Financial Statements

Uploaded by

thakurvinodThis document discusses key concepts in financial statement analysis including the balance sheet, income statement, and statement of cash flows. It asks questions about valuing a firm's assets, liabilities, equity, and growth opportunities. It also discusses modifications that can be made to financial statements such as capitalizing operating leases and research & development expenses to provide a more accurate picture of a company's operating performance and value.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 9

Aswath Damodaran 1

Financial Statement Analysis

Aswath Damodaran 2

Questions we would like answered…

Assets Liabilities

Assets in Place Debt

Equity

What is the value of the debt?

How risky is the debt?

What is the value of the equity?

How risky is the equity?

Growth Assets

What are the assets in place?

How valuable are these assets?

How risky are these assets?

What are the growth assets?

How valuable are these assets?

Aswath Damodaran 3

Basic Financial Statements

The balance sheet, which summarizes what a firm owns

and owes at a

point in time.

The income statement, which reports on how much a

firm earned in

the period of analysis

The statement of cash flows, which reports on cash

inflows and

outflows to the firm during the period of analysis

Aswath Damodaran 4

The Balance Sheet

Assets Liabilities

Fixed Assets

Debt

Equity

Short-term liabilities of the firm

Intangible Assets

Long Lived Real Assets

Assets which are not physical,

like patents & trademarks

Current Assets

Investments in securities & Financial Investments

assets of other firms

Short-lived Assets

Equity investment in firm

Debt obligations of firm

Current

Liabilties

Other

Liabilities Other long-term obligations

Figure 4.1: The Balance Sheet

Aswath Damodaran 5

A Financial Balance Sheet

Assets Liabilities

Assets in Place Debt

Equity

Fixed Claim on cash flows

Little or No role in management

Fixed Maturity

Tax Deductible

Residual Claim on cash flows

Significant Role in management

Perpetual Lives

Growth Assets

Existing Investments

Generate cashflows today

Includes long lived (fixed) and

short-lived(working

capital) assets

Expected Value that will be

created by future investments

Aswath Damodaran 6

The Income Statement

Figure 4.2: Income Statement

Revenues

Gross revenues from sale

of products or services

- Operating Expenses

Expenses associates with

generating revenues

Operating income for the = Operating Income

period

Expenses associated with - Financial Expenses

borrowing and other financing

Taxes due on taxable income - Taxes

= Net Income before extraordinary items

Earnings to Common &

Preferred Equity for

Current Period

Profits and Losses not - (+) Extraordinary Losses (Profits)

associated with operations

Profits or losses associated - Income Changes Associated with Accounting Changes

with changes in accounting

rules

Dividends paid to preferred - Preferred Dividends

stockholders

= Net Income to Common Stockholders

Aswath Damodaran 7

Modifications to Income Statement

There are a few expenses that consistently are

miscategorized in

financial statements.In particular,

• Operating leases are considered as operating expenses by

accountants but

they are really financial expenses

• R &D expenses are considered as operating expenses by

accountants but

they are really capital expenses.

The degree of discretion granted to firms on revenue

recognition and

extraordinary items is used to manage earnings and

provide misleading

pictures of profitability.

Aswath Damodaran 8

Dealing with Operating Lease

Expenses

Debt Value of Operating Leases = PV of Operating

Lease Expenses at

the pre-tax cost of debt

This now creates an asset - the value of which is equal

to the debt

value of operating leases. This asset now has to be

depreciated over

time.

Finally, the operating earnings has to be adjusted to

reflect these

changes:

• Adjusted Operating Earnings = Operating Earnings +

Operating Lease

Expense - Depreciation on the leased asset

• If we assume that depreciation = principal payment on the debt

value of

operating leases, we can use a short cut:

Adjusted Operating Earnings = Operating Earnings + Debt value

of

Operating leases * Cost of debt

Aswath Damodaran 9

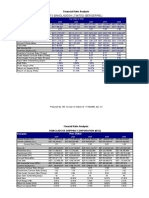

Examples: Operating Leases at

Boeing and

The Home Depot in 1998

Boeing Home Depot

Year Operating Lease Expense Present Value at

5.5%

Operating

Lease Expense

Present Value

at 5.8%

1 $ 205 $ 194.31 $ 294 $ 277.88

2 $ 167 $ 150.04 $ 291 $ 259.97

3 $ 120 $ 102.19 $ 264 $ 222.92

4 $ 86 $ 69.42 $ 245 $ 195.53

5 $ 61 $ 46.67 $ 236 $ 178.03

Yr 6 -15 $ - $ - $ 270 $ 1,513.37

PV of Operating Lease Expenses $ 562.64 $ 2,647.70

Aswath Damodaran 10

Imputed Interest Expenses on

Operating

Leases

Boeing The Home Depot

PV of Operating Leases $ 562.64 $ 2647.70

Interest rate on Debt 5.50% 5.80%

Imputed interest expense on PV of operating leases $ 30.95 $ 153.57

Aswath Damodaran 11

The Effects of _Capitalizing

Operating Leases

Debt : will increase, leading to an increase in debt ratios

used in the

cost of capital and levered beta calculation

Operating income: will increase, since operating leases

will now be

before the imputed interest on the operating lease expense

Net income: will be unaffected since it is after both

operating and

financial expenses anyway

Return on Capital will generally decrease since the

increase in

operating income will be proportionately lower than the

increase in

book capital invested

Aswath Damodaran 12

R&D Expenses: Operating or Capital

Expenses

Accounting standards require us to consider R&D as an

operating

expense even though it is designed to generate future

growth. It is

more logical to treat it as capital expenditures.

To capitalize R&D,

• Specify an amortizable life for R&D (2 - 10 years)

• Collect past R&D expenses for as long as the amortizable life

• Sum up the unamortized R&D over the period. (Thus, if the

amortizable

life is 5 years, the research asset can be obtained by adding up

1/5th of the

R&D expense from five years ago, 2/5th of the R&D expense

from four

years ago...:

Aswath Damodaran 13

Example: Capitalizing R&D

Expenses: Boeing

Year R&D Unamort ized

Port ion

Value

198 9 $75 4 0.10 $75

199 0 $82 7 0.20 $16 5

199 1 $1,41 7 0.30 $42 5

199 2 $1,84 6 0.40 $73 8

199 3 $1,66 1 0.50 $83 1

199 4 $1,70 4 0.60 $1,02 2

199 5 $1,30 0 0.70 $91 0

199 6 $1,63 3 0.80 $1,30 6

199 7 $1,92 4 0.90 $1,73 2

199 8 $1,89 5 1.00 $1,89 5

Capitalized Value of R& D Expenses = $9,10 0

Aswath Damodaran 14

Boeing’s Corrected Operating

Income

Boeing

Operating Income $1,720

+ Research and Development Expenses $1,895

- Amortization of Research Asset $1,382

+ Imputed Interest Expense on Operating

Leases

$ 31

= Adjusted Operating Income $2,264

Aswath Damodaran 15

The Effect of Capitalizing R&D

OperatingIncome will generally increase, though it

depends upon

whether R&D is growing or not. If it is flat, there will be

no effect

since the amortization will offset the R&D added back.

The faster

R&D is growing the more operating income will be

affected.

Net income will increase proportionately, depending

again upon how

fast R&D is growing

Book value of equity (and capital) will increase by the

capitalized

Research asset

Capital expenditures will increase by the amount of

R&D;

Depreciation will increase by the amortization of the

research asset;

For all firms, the net cap ex will increase by the same

amount as the

after-tax operating income.

Aswath Damodaran 16

The Statement of Cash Flows

Cash Flows From Operations

+ Cash Flows From Investing

+ Cash Flows from Financing

Net cash flow from operations,

after taxes and interest expenses

Includes divestiture and acquisition

of real assets (capital expenditures)

and disposal and purchase of

financial assets. Also includes

acquisitions of other firms.

Net cash flow from the issue and

repurchase of equity, from the

issue and repayment of debt and after

dividend payments

= Net Change in Cash Balance

Figure 4.3: Statement of Cash Flows

Aswath Damodaran 17

The Financial perspective on cash

flows

Infinancial analysis, we are much more concerned

about

• Cash flows to the firm or operating cash flows, which are

before cash

flows to debt and equity)

• Cash flows to equity, which are after cash flows to debt but

prior to cash

flows to equity

You might also like

- Damodaran On Valuation PDFDocument102 pagesDamodaran On Valuation PDFmanishpawar11No ratings yet

- Financial Statement AnalysisDocument17 pagesFinancial Statement AnalysisRaijo PhilipNo ratings yet

- Cash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationDocument32 pagesCash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationHanh Mai TranNo ratings yet

- Summary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingFrom EverandSummary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingNo ratings yet

- Investment Banking, Equity Research, Valuation Interview Handpicked Questions and AnswerDocument17 pagesInvestment Banking, Equity Research, Valuation Interview Handpicked Questions and AnswerStudy FreakNo ratings yet

- Quiz1 PDFDocument45 pagesQuiz1 PDFShami Khan Shami KhanNo ratings yet

- Weeks 1 To 4 Fundamental AnalysisDocument166 pagesWeeks 1 To 4 Fundamental Analysismuller1234No ratings yet

- Tesla Mar 2014 ValuaionDocument59 pagesTesla Mar 2014 ValuaionVangelis KondratievNo ratings yet

- Value Enhancement - DCF, EVA, CFROI PDFDocument99 pagesValue Enhancement - DCF, EVA, CFROI PDFRoyLadiasanNo ratings yet

- VP Manufacturing Supply Chain in Denver CO Resume Reynold GobrisDocument2 pagesVP Manufacturing Supply Chain in Denver CO Resume Reynold GobrisReynold GobrisNo ratings yet

- TRIAL Fitness Center Financial Model v.1.0Document97 pagesTRIAL Fitness Center Financial Model v.1.0Uzumaki SoenartoNo ratings yet

- Discounted Cash Flow Valuation The Inputs: K.ViswanathanDocument47 pagesDiscounted Cash Flow Valuation The Inputs: K.ViswanathanHardik VibhakarNo ratings yet

- 7905AFE Corporate Finance Learning Case Study Exemplar #1 PDFDocument29 pages7905AFE Corporate Finance Learning Case Study Exemplar #1 PDFDheeraj JainNo ratings yet

- Valuation - CocacolaDocument14 pagesValuation - CocacolaLegends MomentsNo ratings yet

- DCFDocument37 pagesDCFPiyush SharmaNo ratings yet

- Case29trx 130826040031 Phpapp02Document14 pagesCase29trx 130826040031 Phpapp02Vikash GoelNo ratings yet

- Orange County Case ReportDocument8 pagesOrange County Case ReportOguz AslayNo ratings yet

- RC Equity Research Report Essentials CFA InstituteDocument3 pagesRC Equity Research Report Essentials CFA InstitutetheakjNo ratings yet

- William CV - BlackRockDocument2 pagesWilliam CV - BlackRockWilliam GameNo ratings yet

- Reverse Discounted Cash FlowDocument11 pagesReverse Discounted Cash FlowSiddharthaNo ratings yet

- Eco ProjectDocument29 pagesEco ProjectAditya SharmaNo ratings yet

- VALUATION METHODS: KEY CONCEPTS AND APPROACHESDocument39 pagesVALUATION METHODS: KEY CONCEPTS AND APPROACHESMark LesterNo ratings yet

- Choosing The Right Valuation ModelDocument7 pagesChoosing The Right Valuation Modelbma0215No ratings yet

- Annual Report Analysis Highlights Infosys' Growth DriversDocument9 pagesAnnual Report Analysis Highlights Infosys' Growth DriversAbhishek PaulNo ratings yet

- WACC ModuleDocument10 pagesWACC ModuleJay Aubrey PinedaNo ratings yet

- The Value of Control: Stern School of BusinessDocument38 pagesThe Value of Control: Stern School of Businessavinashtiwari201745No ratings yet

- Investing in HealthDocument2 pagesInvesting in HealthViola KostusyevaNo ratings yet

- Discounted Cash Flow (DCF) ModellingDocument43 pagesDiscounted Cash Flow (DCF) Modellingjasonccheng25No ratings yet

- Case Study About TaiwanDocument28 pagesCase Study About TaiwanHazel HizoleNo ratings yet

- TRX IPO CaseDocument12 pagesTRX IPO Casebiggestyolo0% (1)

- Comparable Company Analysis GuideDocument11 pagesComparable Company Analysis GuideRamesh Chandra DasNo ratings yet

- Option Valuation - DamodaranDocument82 pagesOption Valuation - DamodaranIA M.No ratings yet

- Estimating A Firm's Cost of Capital: Chapter 4 OutlineDocument17 pagesEstimating A Firm's Cost of Capital: Chapter 4 OutlineMohit KediaNo ratings yet

- DCF PPTDocument16 pagesDCF PPTgagan8189No ratings yet

- Chap 04 - DDM and DCFDocument33 pagesChap 04 - DDM and DCFhelloNo ratings yet

- ME Cycle 8 Session 10Document76 pagesME Cycle 8 Session 10OttilieNo ratings yet

- Case Study BDODocument2 pagesCase Study BDOSaumya GoelNo ratings yet

- Chapter 9 Project Cash FlowsDocument28 pagesChapter 9 Project Cash FlowsGovinda AgrawalNo ratings yet

- Appraoches To Valuation 1Document67 pagesAppraoches To Valuation 1tj00007No ratings yet

- BM410-16 Equity Valuation 2 - Intrinsic Value 19oct05Document35 pagesBM410-16 Equity Valuation 2 - Intrinsic Value 19oct05muhammadanasmustafaNo ratings yet

- Tesla valuation report with key metricsDocument60 pagesTesla valuation report with key metricsHarshVardhan Sachdev100% (1)

- cdf58sm Mod 3.1Document68 pagescdf58sm Mod 3.1vibhuti goelNo ratings yet

- Measuring Value for M&ADocument18 pagesMeasuring Value for M&Arishit_93No ratings yet

- Turnaround Strategy: DR Amit RangnekarDocument46 pagesTurnaround Strategy: DR Amit RangnekarDr Amit RangnekarNo ratings yet

- Primary and Secondary MarketDocument57 pagesPrimary and Secondary MarketRahul Shakya100% (1)

- Impact of Fundamentals on IPO ValuationDocument21 pagesImpact of Fundamentals on IPO ValuationManish ParmarNo ratings yet

- ITT - Group Assignment - 3DDocument5 pagesITT - Group Assignment - 3DRitvik DineshNo ratings yet

- Equity Research Report ExpediaDocument18 pagesEquity Research Report ExpediaMichelangelo BortolinNo ratings yet

- Exercises on FRA’s and SWAPS valuationDocument5 pagesExercises on FRA’s and SWAPS valuationrandomcuriNo ratings yet

- Val PacketDocument157 pagesVal PacketKumar PrashantNo ratings yet

- Investment DecisionDocument26 pagesInvestment DecisionToyin Gabriel AyelemiNo ratings yet

- IFRS Functional Currency CaseDocument23 pagesIFRS Functional Currency CaseDan SimpsonNo ratings yet

- 11.2019-Huang&Crotts-Hofstede's Cultural Dimensions and Tourist SatisfactionDocument10 pages11.2019-Huang&Crotts-Hofstede's Cultural Dimensions and Tourist SatisfactionRegita HelmianiNo ratings yet

- Interviews Financial ModelingDocument7 pagesInterviews Financial ModelingsavuthuNo ratings yet

- Bixby Casebank For COBE Faculty2Document40 pagesBixby Casebank For COBE Faculty2Akshay Goel0% (1)

- KKR - Consolidated Research ReportsDocument60 pagesKKR - Consolidated Research Reportscs.ankur7010No ratings yet

- International Financial Management AssignmentDocument12 pagesInternational Financial Management AssignmentMasara OwenNo ratings yet

- Financial Statement Analysis: The Raw Data for InvestingDocument18 pagesFinancial Statement Analysis: The Raw Data for Investingshamapant7955100% (2)

- Valuation: Aswath DamodaranDocument100 pagesValuation: Aswath DamodaranAsif IqbalNo ratings yet

- Valuation: Aswath DamodaranDocument100 pagesValuation: Aswath DamodaranhsurampudiNo ratings yet

- Module 4 Financial Projections and BudgetsDocument11 pagesModule 4 Financial Projections and BudgetsJanin Aizel GallanaNo ratings yet

- Community Center Business Plan ExampleDocument31 pagesCommunity Center Business Plan ExampleJoseph QuillNo ratings yet

- Vishal Mega MartDocument56 pagesVishal Mega MartTarun100% (1)

- Chapter 7 - Finanacial Project ApprisalDocument46 pagesChapter 7 - Finanacial Project ApprisalDomach Keak RomNo ratings yet

- AF5102 Accounting Theory Introduction & Accounting Under Ideal ConditionsDocument15 pagesAF5102 Accounting Theory Introduction & Accounting Under Ideal ConditionsXinwei GuoNo ratings yet

- O1 - Fundamentals of Financial Accounting (Study Text)Document391 pagesO1 - Fundamentals of Financial Accounting (Study Text)Ali Raza Chowdry100% (1)

- Montee Company Income Statement For The Month Ended July 31, 2017 Debit Credit Revenue $ 6,150 Expenses $ 2,600 950 600 400 150 4,700 $1,450Document3 pagesMontee Company Income Statement For The Month Ended July 31, 2017 Debit Credit Revenue $ 6,150 Expenses $ 2,600 950 600 400 150 4,700 $1,450Gerald DiazNo ratings yet

- Accountancy QP 3 (A) 2023Document5 pagesAccountancy QP 3 (A) 2023mohammedsubhan6651No ratings yet

- Total P 1,200,000: Refer PDF Problem 1Document2 pagesTotal P 1,200,000: Refer PDF Problem 1Joanna Rose DeciarNo ratings yet

- Harvard Financial Accounting Final Exam 2Document12 pagesHarvard Financial Accounting Final Exam 2Bharathi RajuNo ratings yet

- Understanding Financial Statements 11th Edition Fraser Test BankDocument38 pagesUnderstanding Financial Statements 11th Edition Fraser Test Bankandrotomyboationv7fsf100% (10)

- Consolidated Financial Statements - 5. CFS (Subsidiaries)Document56 pagesConsolidated Financial Statements - 5. CFS (Subsidiaries)shubhamNo ratings yet

- Renault India Private Limited: Detailed ReportDocument13 pagesRenault India Private Limited: Detailed Reportb0gm3n0tNo ratings yet

- Quiz - Single EntryDocument2 pagesQuiz - Single EntryGloria BeltranNo ratings yet

- KPMG 2018 Banks IfsDocument221 pagesKPMG 2018 Banks Ifschakas100% (1)

- Wiley P2 Sec-A FlashcardDocument29 pagesWiley P2 Sec-A FlashcardnaxahejNo ratings yet

- Valuation Method 1Document7 pagesValuation Method 1alliahnahNo ratings yet

- Hapter: Investments in Noncurrent Operating Assets-Utilization and RetirementDocument43 pagesHapter: Investments in Noncurrent Operating Assets-Utilization and RetirementMaskter TwinsetsNo ratings yet

- Sample Q & A Chapter: Leverage & Capital Restructuring: Before Restructuring After RestructuringDocument3 pagesSample Q & A Chapter: Leverage & Capital Restructuring: Before Restructuring After Restructuringnur fatinNo ratings yet

- (123doc) Question Financial Statement AnalysisDocument9 pages(123doc) Question Financial Statement AnalysisUyển's MyNo ratings yet

- FABM-2 LAS Quarter 3Document84 pagesFABM-2 LAS Quarter 3Rudelyn AlcantaraNo ratings yet

- Financial Ratios AnalysisDocument22 pagesFinancial Ratios AnalysisSheikh Muhammad HannanNo ratings yet

- Assignment ACC705 T2 2017Document5 pagesAssignment ACC705 T2 2017babar zuberiNo ratings yet

- Corporate Liquidation ExercisesDocument3 pagesCorporate Liquidation ExercisesArlene Diane OrozcoNo ratings yet

- Berger Paints Bangladesh Ltmited (Bergerpbl) : ElementsDocument4 pagesBerger Paints Bangladesh Ltmited (Bergerpbl) : Elementskowsar088No ratings yet

- Double Entry Accounting 2014Document84 pagesDouble Entry Accounting 2014Study Group100% (3)

- Divine Aura Final Project 12Document20 pagesDivine Aura Final Project 12Usva SaleemNo ratings yet

- Topic 1 Property Plant and Equipment Part 2 A222Document44 pagesTopic 1 Property Plant and Equipment Part 2 A222Amirah AdlinaNo ratings yet

- Doupnik ch04Document43 pagesDoupnik ch04Catalina Oriani100% (1)

- Fsap 8e - Pepsico 2012Document46 pagesFsap 8e - Pepsico 2012Allan Ahmad Sarip100% (1)