Professional Documents

Culture Documents

Art 1838-1839 (Partnership)

Uploaded by

Mosarah AltCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Art 1838-1839 (Partnership)

Uploaded by

Mosarah AltCopyright:

Available Formats

Article 1838 liquidating partnership property (turning

(The provision speaks of the right of the partner to it into cash)

rescind contract of partnership.) paying outstanding debts

collecting outstanding receivables

The contract of partnership is voidable or distributing the proceeds, and

annullable if one is induced by fraud or any other actions required to bring

misrepresentation to become a partner.1 partnership business to close.

The “fraud or misrepresentation” here vitiates

the consent whereby the contract of Until the partnership accounts are determined, it

partnership had been entered into, hence, it is cannot be determined how much any of the

really “dolo causante.”2 partners is entitled, if at all.

Thus “where a partnership contract is Article 1839 sets forth a priority system for the

rescinded on the ground of the fraud or distribution of partnership property (see Art.

misrepresentation of one of the parties 1810.) and individual property when a

thereto, the party entitled to rescind is, partnership is dissolved to those entitled thereto.

without prejudice to any other right, entitled:”

(1) The assets of the partnership are:

a. right of LIEN or RETENTION (a) partnership property (including

“To a lien on, or right of retention of, the surplus goodwill); and

of the partnership property after satisfying the (b) The contributions of the partners

partnership liabilities to third persons for any necessary for the payment of all the

sum of money paid by him for the purchase of liabilities in accordance with Article

an interest in the partnership and for any 1797.

capital or advances contributed by him”

(2) Order of application the assets:

b. right of SUBROGATION (a) First, those owing to partnership

“To stand, after all liabilities to third persons creditors;

have been satisfied, in the place of the creditors (b) Second, those owing to partners other

of the partnership for any payments made by than for capital and profits (such as

him in respect of the partnership liabilities” loans given by the partners or

advances for business expenses);

c. right of INDEMNIFICATION (c) Third, those owing for the return of

” To be indemnified by the person guilty of the the capital contributed by the

fraud or making the representation against all partners;

debts and liabilities of the partnership.” (d) Finally, if any partnership assets

remain, they are distributed as profits

It is to be noted, however, that the rights of the to the partners in the proportion in

partner entitled to rescind (to annul) “are which profits to the partners in the

without prejudice to any other rights” under proportion in which profits are to be

other provisions of law. shared

(3) The assets shall be applied in the order of

their declaration in No. 1 of this article to the

Article 1839 satisfaction of the liabilities.

(This article enunciates of the methods of settling

the accounts of the partnership—liquidation and (4) The partners shall contribute, as provided by

distribution of assets of dissolved partnership) article 1797, the amount necessary to satisfy

the liabilities.

Where the business of dissolved partnership is not

continued, the process of winding up consists:

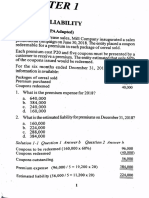

(5) An assignee for the benefit of creditors or any total sum of P300,000.00, thereby leaving a balance of

P60,000.00;

person appointed by the court shall have the (d) The balance of P60,000.00 constitutes the profit which

right to enforce the contributions specified in shall be divided among A, B, and C (unless there is an

the preceding number. agreement to the contrary [Art. 1839, 1st par.] which,

however, cannot prejudice the rights of third persons)

in proportion to their capital contributions. Therefore,

(6) Any partner or his legal representative shall A is entitled to 3/6 or P30,000.00, B, 2/6 or P20,000.00

have the right to enforce the contributions and C, 1/6 or P10,000.00.

specified in No. 4, to the extent of the amount

(3) Suppose, in the same example, the liabilities of the

which he has paid in excess of his share of the partnership amount to P560,000.00. The partnership assets,

liability. then shall be exhausted to satisfy these liabilities thereby

leaving an unpaid balance of P60,000.00. The partners shall

then contribute to the loss, in the absence of an agreement

(7) The individual property of a deceased partner to the contrary, in accordance with their capital

shall be liable for the contributions specified contributions. Consequently, A is liable out of his separate

in No. 4. property in the amount of P30,000.00, B, P20,000.00, and C,

P10,000.00.

(8) When partnership property and the individual These contributions which are necessary to pay the

properties of the partners are in possession of liabilities of the partnership are considered partnership

a court for distribution, partnership creditors assets (No. 1[b].) and any assignee for the benefit of

creditors and any person appointed by the court may

shall have priority on partnership property enforce the contributions.

and separate creditors on individual property,

saving the rights of lien or secured creditors. In case C paid the whole amount of P60,000.00, then, he has

a right to recover the amount which he has paid in excess of

his share of the liability from A, P30,000.00 and from B,

(9) Where a partner has become insolvent or his P20,000.00.

estate is insolvent, the claims against his

separate property shall rank in the following (4) If B is already dead, his estate is still liable for the

contributions needed to pay off the partnership obligations

order: provided they were incurred while he was still a partner.

(a) Those owing to separate creditors;

(b) Those owing to partnership creditors; (5) Suppose now that under Nos. 1 and 2 above, C owes F

P40,000.00. Following the rule that partnership creditors

(c) Those owing to partners by way of have preference regarding partnership property, only the

contribution. share of C in the amount of P10,000.00 can be used to pay

his debt to F and the unpaid balance of P30,000.00 must be

EXAMPLES: taken from the individual property, if any, of C.

(1) A, B, and C, are partners. A contributed P150,000.00, B

P100,000.00, and C, P50,000.00. On dissolution, the assets of (6) Suppose again, that the partnership debts amount to

the partnership amounted to P500,000.00. The partnership P560,000.00 as in No. 3. So, C is still liable out of his

owes D the amount of P70,000.00, E, P50,000.00, and A, separate property to partnership creditors in the amount of

P20,000.00. P10,000.00. His separate property amounts to P45,000.00.

In this case, his assets shall first be applied to pay his debt of

(2) The accounts of the partnership shall be settled as follows: P40,000.00 to F and the balance of P5,000.00 to pay part of

(a) D and E, who are partnership creditors, shall be paid his debt of P10,000.00 still owing to partnership creditors in

first the total sum of P120,000.00, leaving a balance of accordance with the rule that regarding individual

P380,000.00; properties, individual creditors are preferred.

(b) Then, A, who is also a creditor, will be paid his credit of

P20,000.00, leaving a balance of P360,000.00;

(c) Afterwards, the contributions of A, B, and C to the

partnership capital shall be returned to them in the

You might also like

- THE SOVEREIGN CITIZEN By: Judge Dale, RetiredDocument3 pagesTHE SOVEREIGN CITIZEN By: Judge Dale, RetiredAnonymous nYwWYS3ntV100% (12)

- Philippine Legal Forms 2015Document394 pagesPhilippine Legal Forms 2015Joseph Rinoza Plazo0% (1)

- Mock Trial ScriptDocument25 pagesMock Trial ScriptRonilo Subaan94% (18)

- Consequential Damages Allowable For Breach of Implied Warranty of Habitability Cases SheetDocument17 pagesConsequential Damages Allowable For Breach of Implied Warranty of Habitability Cases SheetRich100% (1)

- Answer Unlawful Detainer SampleDocument4 pagesAnswer Unlawful Detainer SampleMarvin Vallarta0% (1)

- Civil Law Compilation Bar Q&a 1990-2017 PDFDocument380 pagesCivil Law Compilation Bar Q&a 1990-2017 PDFReynaldo Yu100% (10)

- LAW On PARTNERSHIPS & PRIVATE CORPORATIONS - ReviewerDocument18 pagesLAW On PARTNERSHIPS & PRIVATE CORPORATIONS - ReviewerOne DozenNo ratings yet

- Rights of The AccusedDocument13 pagesRights of The AccusedLorebeth EspañaNo ratings yet

- 1 Liabpdf PDF FreeDocument25 pages1 Liabpdf PDF FreekianamarieNo ratings yet

- Obligations of The PrincipalDocument15 pagesObligations of The Principaljhienell100% (1)

- Spec Com BQsDocument15 pagesSpec Com BQsMosarah AltNo ratings yet

- Law of TortsDocument28 pagesLaw of TortsSam KariukiNo ratings yet

- Insu. Casedigests Ust PDFDocument192 pagesInsu. Casedigests Ust PDFAnonymous ifiHUmx100% (2)

- Law On Partnership - General Provisions... Art. 1767-1775Document5 pagesLaw On Partnership - General Provisions... Art. 1767-1775Joe P PokaranNo ratings yet

- Equitable PCI Vs TanDocument2 pagesEquitable PCI Vs TanMosarah AltNo ratings yet

- Equitable PCI Vs TanDocument2 pagesEquitable PCI Vs TanMosarah AltNo ratings yet

- Article 1819Document9 pagesArticle 1819Melvar DaydayNo ratings yet

- Law Quiz PracticeDocument72 pagesLaw Quiz PracticeJyNo ratings yet

- Article 1831-1833Document4 pagesArticle 1831-1833Jessica Acosta0% (1)

- (Regulatory Framework For Business Transactions) : PartnershipDocument10 pages(Regulatory Framework For Business Transactions) : PartnershipAnonymous YtNo ratings yet

- Dissolution QuizDocument8 pagesDissolution QuizronaldNo ratings yet

- Oblicon First Exam (With Answers)Document10 pagesOblicon First Exam (With Answers)Bernice Joana L. Piñol100% (1)

- 9Document2 pages9Johnny Johnny Yes Papa SinsNo ratings yet

- Tax Case Digests CompilationDocument207 pagesTax Case Digests CompilationFrancis Ray Arbon Filipinas83% (24)

- Tax Case Digests CompilationDocument207 pagesTax Case Digests CompilationFrancis Ray Arbon Filipinas83% (24)

- Metropolitan Bank Vs Wilfred ChiokDocument1 pageMetropolitan Bank Vs Wilfred ChiokMosarah AltNo ratings yet

- Banking and AMLADocument26 pagesBanking and AMLAMosarah AltNo ratings yet

- PartnershipDocument7 pagesPartnershipami50% (2)

- Nakpil Vs CADocument1 pageNakpil Vs CAAziel Marie C. GuzmanNo ratings yet

- C. Property Rights of A PartnerDocument5 pagesC. Property Rights of A PartnerClyde Tan0% (2)

- 1848-1852 General Rules and ExceptionDocument7 pages1848-1852 General Rules and ExceptionJulo R. Taleon100% (1)

- CHAPTER 1 - Partnership Quizzer With AnswersDocument5 pagesCHAPTER 1 - Partnership Quizzer With AnswersJust ForNo ratings yet

- Art 1848-1852Document4 pagesArt 1848-1852Rea Jane B. MalcampoNo ratings yet

- Subic Bay Metropolitan Authority vs. Commission On Elections, 262 SCRA 492, G.R. No. 125416 September 26, 1996 PDFDocument24 pagesSubic Bay Metropolitan Authority vs. Commission On Elections, 262 SCRA 492, G.R. No. 125416 September 26, 1996 PDFMarl Dela ROsaNo ratings yet

- Article 1860-1867 PartnershipDocument2 pagesArticle 1860-1867 PartnershipAron Panturilla100% (1)

- Activity 3 Key PDFDocument5 pagesActivity 3 Key PDFKervin Rey JacksonNo ratings yet

- Law On Partnership NOTES PDFDocument16 pagesLaw On Partnership NOTES PDFJinky Jorgio100% (4)

- People V WagasDocument1 pagePeople V WagasMosarah AltNo ratings yet

- Art 1772-1774Document3 pagesArt 1772-1774CML100% (1)

- Article 1771Document1 pageArticle 1771karl doceoNo ratings yet

- Salazar Vs JY BrothersDocument4 pagesSalazar Vs JY BrothersMosarah AltNo ratings yet

- Article 1793Document2 pagesArticle 1793JudyNo ratings yet

- Chapter 3 Dissolution and Winding UpDocument10 pagesChapter 3 Dissolution and Winding UpNoel Diamos Allanaraiz100% (1)

- Civil Procedure - July 14 2018 (Q Only)Document14 pagesCivil Procedure - July 14 2018 (Q Only)Riza Mutia100% (1)

- Ting Ting Pua V Sps TiongDocument2 pagesTing Ting Pua V Sps TiongeieipayadNo ratings yet

- Chapter 1 - General ProvisionsDocument8 pagesChapter 1 - General ProvisionsCharmaine AlipayoNo ratings yet

- ARTICLE 1857 One of The Characteristics of Limited PartnershipsDocument6 pagesARTICLE 1857 One of The Characteristics of Limited PartnershipsJovelyn OrdoniaNo ratings yet

- Law On PartnershipDocument26 pagesLaw On PartnershipAngelita Dela cruzNo ratings yet

- Ocampo vs. Tirona Case Digest: FactsDocument2 pagesOcampo vs. Tirona Case Digest: FactsdaybarbaNo ratings yet

- Abad Vs PhilcomsatDocument2 pagesAbad Vs PhilcomsatFiels GamboaNo ratings yet

- Article 1822-1824Document15 pagesArticle 1822-1824jalilah gunti50% (2)

- General Principles: Criterion To Determine Whether Corporation Is Public or PrivateDocument3 pagesGeneral Principles: Criterion To Determine Whether Corporation Is Public or PrivateHemsley Battikin Gup-ayNo ratings yet

- Article 1792 To 1997Document12 pagesArticle 1792 To 1997Sukh Gill100% (1)

- Article 1840. Creditors of The Old Partnership Are Still Creditors of The New Partnership WhenDocument9 pagesArticle 1840. Creditors of The Old Partnership Are Still Creditors of The New Partnership WhenJhean NaresNo ratings yet

- Article 1771 - Classification of PartnershipsDocument7 pagesArticle 1771 - Classification of PartnershipsMhico MateoNo ratings yet

- 4 Michael Guy Vs GacottDocument2 pages4 Michael Guy Vs GacottNova Marasigan100% (1)

- Obligations of The Partners With Regard To Third PersonsDocument61 pagesObligations of The Partners With Regard To Third PersonsNathaniel Skies100% (4)

- Article 1830-1835Document32 pagesArticle 1830-1835Nathaniel SkiesNo ratings yet

- Illustrative CaseDocument11 pagesIllustrative CaseCristine CaringalNo ratings yet

- Business Law ReviewerDocument5 pagesBusiness Law Reviewerkenneth coronelNo ratings yet

- CHAPTER 3 Dissolution and Winding Up CODALDocument5 pagesCHAPTER 3 Dissolution and Winding Up CODALfermo ii ramosNo ratings yet

- Article 1788Document3 pagesArticle 1788enliven morenoNo ratings yet

- Law 1Document3 pagesLaw 1Amethyst Jordan60% (5)

- Accounting 132Document2 pagesAccounting 132Anne Marieline BuenaventuraNo ratings yet

- Finals - Financial AccountingDocument6 pagesFinals - Financial AccountingAlyssa QuiambaoNo ratings yet

- Chapter 6 To 9 ObliconDocument8 pagesChapter 6 To 9 ObliconAnne DerramasNo ratings yet

- Article 1815Document1 pageArticle 1815Alexandria Evangelista100% (1)

- Article 1828-1867Document5 pagesArticle 1828-1867ChaNo ratings yet

- 02 Handout 1Document9 pages02 Handout 1PopoyNo ratings yet

- TaxDocument4 pagesTaxGia Serilla100% (1)

- Obligations of PartnersDocument3 pagesObligations of PartnersKat AntonioNo ratings yet

- Article 1787-1796Document23 pagesArticle 1787-1796Baylon RachelNo ratings yet

- False. Article 1468. If The Consideration of The Contract Consists Partly in Money, and Partly inDocument8 pagesFalse. Article 1468. If The Consideration of The Contract Consists Partly in Money, and Partly inIrish AnnNo ratings yet

- Law Article 1485-1488Document1 pageLaw Article 1485-1488John Lexter MacalberNo ratings yet

- CASTILLO, Erica Miles C. - LAWS ON OBLIGATION AND CONTRACT ACTIVITY#1Document3 pagesCASTILLO, Erica Miles C. - LAWS ON OBLIGATION AND CONTRACT ACTIVITY#1Miles CastilloNo ratings yet

- Law and Joint Obligations ModifiedDocument34 pagesLaw and Joint Obligations ModifiedAllanah AncotNo ratings yet

- Art 1767-1770Document4 pagesArt 1767-1770Mark Andrei TalastasNo ratings yet

- COBLAW2 2ndterm20192020 Topic21Jan2020Document9 pagesCOBLAW2 2ndterm20192020 Topic21Jan2020Rina TugadeNo ratings yet

- AlagangWency - Partnersip Dissolution Short QuizDocument1 pageAlagangWency - Partnersip Dissolution Short QuizKristian Paolo De LunaNo ratings yet

- Acompre DatedDocument1 pageAcompre DatedAnonymous t1lbUug0A50% (4)

- DocxDocument67 pagesDocxGet BurnNo ratings yet

- Pfrs 14: Regulatory Deferral AccountsDocument2 pagesPfrs 14: Regulatory Deferral AccountsElla MaeNo ratings yet

- BL223 - Chapter 1 Summary. Part 1Document10 pagesBL223 - Chapter 1 Summary. Part 1Gerry Sajol100% (1)

- Quiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFDocument3 pagesQuiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFSamuel BandibasNo ratings yet

- Agency ReportDocument9 pagesAgency ReportErica NocheNo ratings yet

- Article 1767 Par 2Document2 pagesArticle 1767 Par 2Jeny Princess FrondaNo ratings yet

- 2021 Schedule of Preweek LecturesDocument1 page2021 Schedule of Preweek LecturesMarcky MarionNo ratings yet

- Pretrial Process FlowDocument1 pagePretrial Process FlowMosarah AltNo ratings yet

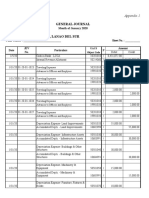

- General Journal: Appendix 1Document5 pagesGeneral Journal: Appendix 1Mosarah AltNo ratings yet

- Tax DigestsDocument13 pagesTax DigestsMosarah AltNo ratings yet

- LectureDocument25 pagesLectureMarieNo ratings yet

- Politicsl LawDocument91 pagesPoliticsl LawMosarah AltNo ratings yet

- PNB Vs BalmacedaDocument2 pagesPNB Vs BalmacedaMosarah AltNo ratings yet

- Cayanan Vs North StarDocument2 pagesCayanan Vs North StarMosarah AltNo ratings yet

- San Miguel Corp Vs PuzonDocument2 pagesSan Miguel Corp Vs PuzonMosarah AltNo ratings yet

- Equitable Banking Vs Special SteelDocument1 pageEquitable Banking Vs Special SteelMosarah AltNo ratings yet

- Sps Ros Vs PNB 2011 PDFDocument8 pagesSps Ros Vs PNB 2011 PDFMosarah AltNo ratings yet

- Sps Uy Vs CA 2000Document7 pagesSps Uy Vs CA 2000Mosarah AltNo ratings yet

- Tax ReviewerDocument45 pagesTax ReviewerMosarah AltNo ratings yet

- Politicsl LawDocument91 pagesPoliticsl LawMosarah AltNo ratings yet

- Siochi Vs CA 2010 PDFDocument9 pagesSiochi Vs CA 2010 PDFMosarah AltNo ratings yet

- Ching Vs CA 1990Document6 pagesChing Vs CA 1990Mosarah AltNo ratings yet

- Army Insititute of Law, MohaliDocument11 pagesArmy Insititute of Law, MohaliAdvitya SambyalNo ratings yet

- Nippon Yusen Case SummaryDocument1 pageNippon Yusen Case SummaryArif Zulhilmi Abd Rahman100% (1)

- Apocada Vs NLRCDocument2 pagesApocada Vs NLRCJunelyn T. EllaNo ratings yet

- Lupangco vs. Court of AppealsDocument17 pagesLupangco vs. Court of AppealsKfMaeAseronNo ratings yet

- Remembering Equity and Its Role in Property RelationshipsDocument61 pagesRemembering Equity and Its Role in Property RelationshipsKamugisha JshNo ratings yet

- Calicdan vs. CendañaDocument6 pagesCalicdan vs. CendañaSALMAN JOHAYRNo ratings yet

- Sem VI Jurisprudence IIDocument2 pagesSem VI Jurisprudence IIArhum KhanNo ratings yet

- Del Rosario Vs Manila ElectricDocument2 pagesDel Rosario Vs Manila ElectricMaribel Nicole LopezNo ratings yet

- Letter Request For Publication (Rule 8.1120), Brost v. City of Santa Barbara, No. B246153 (Apr. 1, 2015)Document4 pagesLetter Request For Publication (Rule 8.1120), Brost v. City of Santa Barbara, No. B246153 (Apr. 1, 2015)RHTNo ratings yet

- PEARL ISLAND COMMERCIAL CORPORATION, Plaintiff-Appellee, LIM TAN TONG and MANILA SURETY & FIDELITY CO., INC., Defendants-AppellantsDocument2 pagesPEARL ISLAND COMMERCIAL CORPORATION, Plaintiff-Appellee, LIM TAN TONG and MANILA SURETY & FIDELITY CO., INC., Defendants-AppellantsJoseph MacalintalNo ratings yet

- Assignment On: Arbitration Proceedings in Indian Oil CorporationDocument12 pagesAssignment On: Arbitration Proceedings in Indian Oil CorporationNevedita SinghNo ratings yet

- Company Law and Secretarial Practice Chapter 1Document11 pagesCompany Law and Secretarial Practice Chapter 1Vipin Mandyam Kadubi100% (1)

- Pre-Qualification Exam in LawDocument4 pagesPre-Qualification Exam in LawSam MieNo ratings yet

- Sea Lion Fishing Corp Vs PeopleDocument10 pagesSea Lion Fishing Corp Vs PeopleAldous AbayonNo ratings yet

- Solivio v. CA, G.R. No. 83484, Feb 12, 1990Document11 pagesSolivio v. CA, G.R. No. 83484, Feb 12, 1990Dara CompuestoNo ratings yet

- SALTING vs. VELEZ (Premiliminary Injunction)Document2 pagesSALTING vs. VELEZ (Premiliminary Injunction)MuhammadIshahaqBinBenjamin100% (1)

- Two Types of Causation: Re: Polemis (1921) CADocument13 pagesTwo Types of Causation: Re: Polemis (1921) CAsaidatuladaniNo ratings yet

- Business Law: Prof. Mohana RajeDocument39 pagesBusiness Law: Prof. Mohana Rajeblind_readerNo ratings yet