Professional Documents

Culture Documents

Scan 0001

Uploaded by

El-Sayed MohammedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scan 0001

Uploaded by

El-Sayed MohammedCopyright:

Available Formats

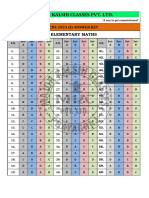

MODULE 21 PROFESSIONAL RESPONSIBILITIES

8 MULTIPLE-CHOICE ANSWERS*

2

I. c - - 1 a - - 3 d - - 4 d - - 6 d -

2. d - - 6.

17. ,d - - I.

32. a - - 6.

47. a - - I. b

62. -

-

b -

3. - - 18. b - - 33. b - - 48. d - - 63. c

- -

4. c - - 19. d - - 34. a - - 49. b - - 64. b

- -

5. c - - 20. c - - 35. c - - 50. c - - 65. c - -

6. a - - 2I. a - - 36. b - - SI. b - - 66. c

- -

7. d - - 22. d - - -37. a - - 52. d - -

8. c - - 23. d - - 38. a - - 53. c - -

9. b - - 24. c - - 39. b - - 54. d - -

,

10. a 25. a 40. c 55. d

- - - - - - - -

lI. a - - 26. Cl - - 4I. c - - 56. a - -

12. a - - 27. c - - 42. c - - 57. a - -

13. b - - 28. c - - 43. b - - 58. b - -

14. b - - 29. a - - 44. d - - 59. c - - 1st: _/66= %

c -

15. - - 30. c - - 45. c - - 60. a - - 2nd: ~66= %

-

MULTIPLE-CHOICE ANSWER EXPLANATIONS

A.2. Code of Professional Conduct-Principles statements. This is a key position as defined by the

Interpretation of Rule 10 1.

1. Cc) The requirement is to identify the statement that 6. (a) According to Rule 102 of the Code of Profes-

best describes the meaning of generally accepted auditing sional Conduct, in performing any professional service, a

standards. Answer Cc) is correct because generally accepted member shall maintain objectivity and integrity, avoid con-

auditing standards deal with measures of the quality of the flicts of interest, and not knowingly misrepresent facts. An-

performance of audit procedures CAU 150). Answer (d) is swer (a) is correct as. this would be knowingly misrepre-

incorrect because procedures relate to acts to be performed,

senting the facts. Answers (b) and (d) are incorrect as these

not directly to the standards. Answer (b) is incorrect be-

cause generally accepted auditing standards have been is- are not intentional misstatements. Answer (c) is incorrect

sued by predecessor groups, as well as by the Auditing because while one must remain objective" while performing

Standards Board. Answer (a) is incorrect because there may consulting services, independence is not required unless the

or may not be universal compliance with the standards. CP A also performs attest services for that client.

2. (d) All of these can result in the automatic expul-

sion of the member from the AICPA. Answer (a) is incor- 7. (d) The requirement is to determine which act is

rect because although the conviction of a felony can result in generally prohibited. Answer (d) is correct because "If an

automatic expulsion, likewise can the other two. An- engagement is terminated prior to completion, the member is

swers (b) and Cc) are incorrect because all three can result in required to return only client records" (ET 501). Answer (a)

automatic expulsion from the AICPA. is incorrect because issuing a modified report explaining a

A.3. Code of Professional Conduct-Rules, Interpreta- failure to follow a governmental regulatory agency's stan-

dards when conducting an attest service is not prohibited.

tions, and Rulings

Answer (c) is incorrect because accepting a contingent fee is

3. (b) Answer (b) is correct because an effective , allowable when representing a elient in an examination by a

corporate governance structure is a control that can be revenue agent of the client's federal or state income tax re-

implemented by a client that increases independence of the turn (ET 302). Answer (b) is incorrect because revealing

attest team. Answer (a) is incorrect because it is a safeguard confidential client information during a quality review of a

that is implemented by regulation or the CP A firm. Answer professional practice by a team from the state CP A society is

Cc) is incorrect because it is a safeguard that is required by not prohibited (ET 301).

regulation or the CPA firm. Answer (d) is incorrect because

8. (c) According to Rule 203 of the Code of Profes- '

it represents a threat rather than a safeguard.

sional Conduct, CP As are allowed to depart from a GASB

4. (c) Answer (c) is correct because the team member Statement only when results of the Standard would be \

would be reviewing his or her own work. Answer (a) is misleading. Examples of possible circumstances justifying

incorrect because this is an example of a familiarity threat. departure are new legislation and a new form of business

Answer (b) is incorrect because this is an example of a transaction.

safeguard to threats to independence. Answer (d) is

incorrect because this represents a financial self-interest 9. (b) The requirement is to determine whether aCPA

threat to independence. may hire a non-CPA systems analyst and, if so, under what

conditions. Answer (b) is correct because ET 291 allows

5. (c) According to the Code of Professional Conduct, such a situation when the CP A is qualified to supervise and

Rule 101 regarding independence, a spouse may be evaluate the work of the specialist. Answer (a) is incorrect

employed by a client if s/he does not exert significant because the CP A need not be qualified to perform the spe-

influence over the contents of the client's financial cialist's tasks. Answer (c) is incorrect because non-CPA

professionals are permitted to be associated with CP A firms

* Explanation of how to use this performance record appears on page 12.

You might also like

- MCQ PRDocument1 pageMCQ PREl-Sayed MohammedNo ratings yet

- Module 21 Professional Responsibilities Multiple Choice AnswersDocument1 pageModule 21 Professional Responsibilities Multiple Choice AnswersHazem El SayedNo ratings yet

- MCQ PRDocument1 pageMCQ PREl-Sayed MohammedNo ratings yet

- MO ULE Taxes: Partne Ships: Multiple Choice AnswersDocument3 pagesMO ULE Taxes: Partne Ships: Multiple Choice AnswersZeyad El-sayedNo ratings yet

- Contracts Module Multiple Choice AnswersDocument3 pagesContracts Module Multiple Choice AnswersHazem El SayedNo ratings yet

- Tax rules for gifts and estatesDocument3 pagesTax rules for gifts and estatesZeyad El-sayedNo ratings yet

- Module 36 Taxes Corporat: Multipl - HOI E RSDocument2 pagesModule 36 Taxes Corporat: Multipl - HOI E RSAnonymous JqimV1ENo ratings yet

- Analyzing Sales Contracts Under the UCCDocument1 pageAnalyzing Sales Contracts Under the UCCEl-Sayed MohammedNo ratings yet

- Scan 0018Document1 pageScan 0018Zeyad El-sayedNo ratings yet

- Isro Ans Key 2017 IIDocument1 pageIsro Ans Key 2017 IIjithinaravind007No ratings yet

- Answer SheetDocument2 pagesAnswer Sheetvima.acostaNo ratings yet

- MOD LE Taxes: Transactions in Propert: Ltip E-Choi W RDocument1 pageMOD LE Taxes: Transactions in Propert: Ltip E-Choi W REl Sayed AbdelgawwadNo ratings yet

- Answers To Paper 3 SbaDocument2 pagesAnswers To Paper 3 Sbatolo toloNo ratings yet

- F9659599GATE Answers - CS - 4Document1 pageF9659599GATE Answers - CS - 4Ashish RatheeNo ratings yet

- Test-1 GC Leong AnswerKey 1706012920346Document1 pageTest-1 GC Leong AnswerKey 1706012920346ishugautam777No ratings yet

- Auditing Theory Salosagcol Answer Key 2021Document2 pagesAuditing Theory Salosagcol Answer Key 2021Berna Mortejo100% (4)

- Gate-2011 Answers - Electronics: Abcd Abcd Abcd AbcdDocument1 pageGate-2011 Answers - Electronics: Abcd Abcd Abcd AbcdSaurabh KumarNo ratings yet

- Maths - Answer Key Test Topic: UP T.G.T 2021: C A B D B C A A D DDocument1 pageMaths - Answer Key Test Topic: UP T.G.T 2021: C A B D B C A A D DShailendra YadavNo ratings yet

- Maths - Answer Key Test Topic: UP T.G.T 2021: C A B D B C A A D DDocument1 pageMaths - Answer Key Test Topic: UP T.G.T 2021: C A B D B C A A D DShailendra YadavNo ratings yet

- Maths - Answer Key Test Topic: UP T.G.T 2021: C A B D B C A A D DDocument1 pageMaths - Answer Key Test Topic: UP T.G.T 2021: C A B D B C A A D DShailendra YadavNo ratings yet

- VPM Classes - Ugc Net - June 12 - CS - Ans Key - Paper-Ii & IiiDocument1 pageVPM Classes - Ugc Net - June 12 - CS - Ans Key - Paper-Ii & IiiRAJESHNo ratings yet

- Bank of Maharashtra Officers' Mock Test Answers 2016Document1 pageBank of Maharashtra Officers' Mock Test Answers 2016sanjeevNo ratings yet

- Fiitjee: JEE (Main) - 2018Document12 pagesFiitjee: JEE (Main) - 2018Biswajit MaityNo ratings yet

- For Students of Classes 5th To 10th National Standard Examination in Junior Science (NSEJS) Stage - I Code: JS 530 Answer Key, 20 Nov. 2016Document1 pageFor Students of Classes 5th To 10th National Standard Examination in Junior Science (NSEJS) Stage - I Code: JS 530 Answer Key, 20 Nov. 2016Rakshit YadavNo ratings yet

- Answer Key: B e A B B B A A B B A B e e A B A e B A A B B e A e B e e A e A A e e B e e A A B B C B e e e A A A A A e eDocument2 pagesAnswer Key: B e A B B B A A B B A B e e A B A e B A A B B e A e B e e A e A A e e B e e A A B B C B e e e A A A A A e eTimShefNo ratings yet

- Gupta and Gupta (Correct Ans Key )Document13 pagesGupta and Gupta (Correct Ans Key )aebsdNo ratings yet

- Lembar Jawaban UAS BP2Document1 pageLembar Jawaban UAS BP2Apriyani DikaNo ratings yet

- Kunci JAwabanDocument2 pagesKunci JAwabansdn 4kabatNo ratings yet

- 2nd Shift Answer Key Series A ExportDocument1 page2nd Shift Answer Key Series A ExportGhjNo ratings yet

- 3rd Shift Answer Key Series ADocument97 pages3rd Shift Answer Key Series AKeshav MeenaNo ratings yet

- File 1681717666770Document2 pagesFile 1681717666770harshssharma786No ratings yet

- 4th Shift Answer Key Series ADocument97 pages4th Shift Answer Key Series AMurari lal yadavNo ratings yet

- JEE Main 2018 FT-II PCM AnswersDocument12 pagesJEE Main 2018 FT-II PCM AnswersBB Ki VinesNo ratings yet

- M ULE Taxes Individual: Multiple CHO Ce Answers'Document3 pagesM ULE Taxes Individual: Multiple CHO Ce Answers'El-Sayed MohammedNo ratings yet

- Individual Tax Module MCQsDocument3 pagesIndividual Tax Module MCQsAnonymous JqimV1ENo ratings yet

- M ULE Taxes Individual: Multiple CHO Ce Answers'Document3 pagesM ULE Taxes Individual: Multiple CHO Ce Answers'El-Sayed MohammedNo ratings yet

- PB Exam - AnswersDocument1 pagePB Exam - AnswersJazehl ValdezNo ratings yet

- Answer Sheet For Placement TestDocument2 pagesAnswer Sheet For Placement Testkunthea hak100% (2)

- 04 - ETS NEET New Pattern (Solution) Physics 11-08-2021 SKR SirDocument2 pages04 - ETS NEET New Pattern (Solution) Physics 11-08-2021 SKR SirRishabh DwivediNo ratings yet

- Answer Sheet Test ScoreDocument1 pageAnswer Sheet Test ScoreVlad VizcondeNo ratings yet

- Cds - (I) 2019 Answer Key Math: "A Way To Get Commissioned"Document2 pagesCds - (I) 2019 Answer Key Math: "A Way To Get Commissioned"sagar kumarNo ratings yet

- Hoja de Respuesta Mbti Nombre: EdadDocument1 pageHoja de Respuesta Mbti Nombre: EdadAlf Contreras LobosNo ratings yet

- PRTC Batch 1022 - AFAR Final Preboard AnswersDocument52 pagesPRTC Batch 1022 - AFAR Final Preboard AnswersLouie RobitshekNo ratings yet

- Expert Professional Academy Pvt. Ltd. - Ca-Foundation: DD-264 by Ca Vinod ReddyDocument3 pagesExpert Professional Academy Pvt. Ltd. - Ca-Foundation: DD-264 by Ca Vinod ReddyKIRAN JAGTAPNo ratings yet

- Aits 1718 CRT II Jeem SolDocument20 pagesAits 1718 CRT II Jeem SolDivyansh JainNo ratings yet

- Scan 0068Document1 pageScan 0068Zeyad El-sayedNo ratings yet

- MCQs For & SDH - New WBCS - 12th SM - 12th Class - GK (Ans)Document1 pageMCQs For & SDH - New WBCS - 12th SM - 12th Class - GK (Ans)akash709121No ratings yet

- Math 9 Practice Final ExamDocument17 pagesMath 9 Practice Final ExamJessica Sarches NiñaNo ratings yet

- Multiple Choice Bubble Sheet Template Customize This WordDocument3 pagesMultiple Choice Bubble Sheet Template Customize This WordAl Bin0% (1)

- Aits 1718 FT IV Jeem SolDocument20 pagesAits 1718 FT IV Jeem Solsoumengoswami10No ratings yet

- E 1 PDFDocument17 pagesE 1 PDFJaytee TiryadNo ratings yet

- Document PDF 286 PDFDocument4 pagesDocument PDF 286 PDFSathya PrabhaNo ratings yet

- Name: Ave de Guzman Codename: PeriwinkleDocument1 pageName: Ave de Guzman Codename: PeriwinkleAve de GuzmanNo ratings yet

- XI N.M. Minor Test - 12 Code - A Ans. & Sol. (06!03!2023)Document20 pagesXI N.M. Minor Test - 12 Code - A Ans. & Sol. (06!03!2023)myyt747No ratings yet

- Gs AnskeyDocument2 pagesGs Anskeyasati1687No ratings yet

- Nsejs 2017 JS532 Answer Key by ResonanceDocument1 pageNsejs 2017 JS532 Answer Key by ResonanceThe ChampionNo ratings yet

- Komiljonov Mirsaid Shuhratjon O G LiDocument1 pageKomiljonov Mirsaid Shuhratjon O G LimRSh mRShNo ratings yet

- NSEB Code B221 PDFDocument1 pageNSEB Code B221 PDFAkhilesh JayachandranNo ratings yet

- Eq o o o o Eq: ND RDDocument8 pagesEq o o o o Eq: ND RDEl-Sayed MohammedNo ratings yet

- VGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGDocument1 pageVGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGEl-Sayed MohammedNo ratings yet

- Module 21 Professional ResponsibilitiesDocument2 pagesModule 21 Professional ResponsibilitiesEl-Sayed MohammedNo ratings yet

- Alex Act 2 Sc1 Site 2Document5 pagesAlex Act 2 Sc1 Site 2El-Sayed MohammedNo ratings yet

- Module 36 Taxes: CorporateDocument1 pageModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- Module 36 Taxes: CorporateDocument1 pageModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- Ca LD Limi A I N or He R An Ind Dual T Xpaye R: o T o T Yea IVI A 'SDocument1 pageCa LD Limi A I N or He R An Ind Dual T Xpaye R: o T o T Yea IVI A 'SZeyad El-sayedNo ratings yet

- VbgerettttttttttttttttttttttttttttttttttttttttttttttfdsssssssssssssssssssgDocument1 pageVbgerettttttttttttttttttttttttttttttttttttttttttttttfdsssssssssssssssssssgEl-Sayed MohammedNo ratings yet

- Egyptian language school worksheet on tensesDocument1 pageEgyptian language school worksheet on tensesEl-Sayed Mohammed100% (1)

- M ULE E: OD D Btor-Creditor RelationshipsDocument2 pagesM ULE E: OD D Btor-Creditor RelationshipsZeyad El-sayedNo ratings yet

- IMP BooksDocument13 pagesIMP BooksEl-Sayed MohammedNo ratings yet

- Taxes: Gift and EstateDocument3 pagesTaxes: Gift and EstateZeyad El-sayedNo ratings yet

- M ULE Taxes Individual: Multiple CHO Ce Answers'Document3 pagesM ULE Taxes Individual: Multiple CHO Ce Answers'El-Sayed MohammedNo ratings yet

- Scan 0089Document2 pagesScan 0089Anonymous JqimV1ENo ratings yet

- Scan 0093Document3 pagesScan 0093Zeyad El-sayedNo ratings yet

- Agency MC answers explainedDocument2 pagesAgency MC answers explainedZeyad El-sayedNo ratings yet

- Module 21 P Fessional Responsi I ES: RO B LitiDocument2 pagesModule 21 P Fessional Responsi I ES: RO B LitiHazem El SayedNo ratings yet

- M ULE Taxes Individual: Multiple CHO Ce Answers'Document3 pagesM ULE Taxes Individual: Multiple CHO Ce Answers'El-Sayed MohammedNo ratings yet

- Mjds ALKDSFDEQWEWFDEQWEWEQWEFEQWEFDocument2 pagesMjds ALKDSFDEQWEWFDEQWEWEQWEFEQWEFEl-Sayed MohammedNo ratings yet

- Tax Planning and Strategic ManagDocument2 pagesTax Planning and Strategic ManagEl-Sayed MohammedNo ratings yet

- DDSFDFGHJKLJHKLKJHGJKHGKHGJKDocument1 pageDDSFDFGHJKLJHKLKJHGJKHGKHGJKEl-Sayed MohammedNo ratings yet

- Ghewrefgafewekqpergkafklefdbf Fdfbdsamsldfbmfdel Elrwetkgio3P (Regfb Efdgfbfndfskwl Erfgfbgjrewkl 3Retgero3EwrpgfbDocument1 pageGhewrefgafewekqpergkafklefdbf Fdfbdsamsldfbmfdel Elrwetkgio3P (Regfb Efdgfbfndfskwl Erfgfbgjrewkl 3Retgero3EwrpgfbEl-Sayed MohammedNo ratings yet

- Taxes: Gift and EstateDocument3 pagesTaxes: Gift and EstateZeyad El-sayedNo ratings yet

- Oxs CASDWE213Document1 pageOxs CASDWE213El-Sayed MohammedNo ratings yet

- Professional Responsibilities: Requ RedDocument2 pagesProfessional Responsibilities: Requ RedEl-Sayed MohammedNo ratings yet

- Taxes: Gift and EstateDocument3 pagesTaxes: Gift and EstateZeyad El-sayedNo ratings yet

- Scan 0090Document2 pagesScan 0090Anonymous JqimV1ENo ratings yet

- The City - Populus' As A Self-Governing CorporationDocument24 pagesThe City - Populus' As A Self-Governing Corporation马寅秋No ratings yet

- Modelling of Induction Motor PDFDocument42 pagesModelling of Induction Motor PDFsureshNo ratings yet

- Soal Paket 1Document10 pagesSoal Paket 1Nurul HayatiNo ratings yet

- Intrinsic Resistance and Unusual Phenotypes Tables v3.2 20200225Document12 pagesIntrinsic Resistance and Unusual Phenotypes Tables v3.2 20200225Roy MontoyaNo ratings yet

- 4th Singapore Open Pencak Silat Championship 2018-1Document20 pages4th Singapore Open Pencak Silat Championship 2018-1kandi ari zonaNo ratings yet

- German composer known for political worksDocument4 pagesGerman composer known for political worksGeorge PikNo ratings yet

- Marwar Steel Tubes Pipes StudyDocument39 pagesMarwar Steel Tubes Pipes Studydeepak kumarNo ratings yet

- Cash Flow StatementDocument57 pagesCash Flow StatementSurabhi GuptaNo ratings yet

- DRR Module 4 Detailed Lesson PlanDocument8 pagesDRR Module 4 Detailed Lesson PlanFe Annalie Sacal100% (2)

- Prophetic Prayer Declarations - September, 2021Document5 pagesProphetic Prayer Declarations - September, 2021Jelo RichNo ratings yet

- Prayer BuddyDocument42 pagesPrayer BuddyJoribelle AranteNo ratings yet

- PallavaDocument24 pagesPallavaAzeez FathulNo ratings yet

- ASSIGNMENTDocument5 pagesASSIGNMENTPanchdev KumarNo ratings yet

- Neoclassicism: Romanticism Realism ImpressionismDocument16 pagesNeoclassicism: Romanticism Realism ImpressionismErika EludoNo ratings yet

- Test Unit 3Document2 pagesTest Unit 3RAMONA SECUNo ratings yet

- IFRS 17 Risk Adjustment For Non-Financial Risk For Life and Health Insurance ContractsDocument34 pagesIFRS 17 Risk Adjustment For Non-Financial Risk For Life and Health Insurance ContractsaljdummyNo ratings yet

- Chap 4 eDocument22 pagesChap 4 eHira AmeenNo ratings yet

- Primer To Using Stampplot® Pro Standard User LicensedDocument21 pagesPrimer To Using Stampplot® Pro Standard User LicensedSandy Rachman AdrianNo ratings yet

- I Will Call Upon The Lord - ACYM - NewestDocument1 pageI Will Call Upon The Lord - ACYM - NewestGerd SteveNo ratings yet

- Adina CFD FsiDocument481 pagesAdina CFD FsiDaniel GasparinNo ratings yet

- Introduction To Vitamin C, (Chemistry STPM)Document2 pagesIntroduction To Vitamin C, (Chemistry STPM)NarmeenNirmaNo ratings yet

- Philhis Handouts Week 1Document5 pagesPhilhis Handouts Week 1Jeen JeenNo ratings yet

- Sexual Self PDFDocument23 pagesSexual Self PDFEden Faith Aggalao100% (1)

- Summary Basis For Regulatory Action TemplateDocument23 pagesSummary Basis For Regulatory Action TemplateAviseka AcharyaNo ratings yet

- Comic Conversations – Lesson Plan & TemplatesDocument15 pagesComic Conversations – Lesson Plan & TemplatesShengdee OteroNo ratings yet

- Role of TaxationDocument5 pagesRole of TaxationCarlo Francis Palma100% (1)

- Intro To Flight (Modelling) PDFDocument62 pagesIntro To Flight (Modelling) PDFVinoth NagarajNo ratings yet

- Distance Learning 2016 Telecom AcademyDocument17 pagesDistance Learning 2016 Telecom AcademyDyego FelixNo ratings yet

- WORKSHOP ON ACCOUNTING OF IJARAHDocument12 pagesWORKSHOP ON ACCOUNTING OF IJARAHAkif ShaikhNo ratings yet

- OEO105020 LTE ERAN2.2 Connection Management Feature ISSUE 1.00Document52 pagesOEO105020 LTE ERAN2.2 Connection Management Feature ISSUE 1.00Daniel YulistianNo ratings yet