Professional Documents

Culture Documents

Format of Reporting For Registration Ofvaluerunder Section 34 Ab of Thewealth Tax Act

Uploaded by

Manoj KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Format of Reporting For Registration Ofvaluerunder Section 34 Ab of Thewealth Tax Act

Uploaded by

Manoj KumarCopyright:

Available Formats

FORMAT OF REPORTING FOR REGISTRATION OFVALUERUNDER SECTION 34 AB OF THEWEALTH TAX ACT,1957

SI.NO Particulars Details

(a) Whether theapplicant satisfies thecondition laid down in Rule

8A(2)(i)&(ii) of the W.T. Act,1957

(b) Whether the applicant satisfies the condition laid down in Rule8A(2)

of the W.T. Act,1957,

(i) (i) Period of association of the business of valuation of Immovable

property;

(ii)

(iii) (ii) Assocaition in this business in the capacity of valuation of

Immovable property;

(iv)

(v) (iii)Average turnover of the firm/ association for last three years;

(vi)

(iv) Profit earned for the last three years by the firm;

(c) Whether the applicant is disqualified in terms of 1. Rule 8A(12) of the

W.T. Rules

(i) Whether working with Government or other employer

(ii) Whether valuer of work of Art

2. Rule 8(13) W.T. Rules;

(i) Whether dismissed/removed from Govt./ other service

(ii) Whether convicted of any offence connected with any

proceeding under IT/WT/GT Act.

(iii) Whether any penalty imposed under under IT/WT/GT Act.

(iv) Whether undercharged insolvent.

(v) Whether convicted of any offence and sentenced to

imprisonment.

(d) Whether the applicant is Co-operative in the matter of payment of

tax

(e) In case, the applicant was in service either with Government or any

private firm/ company/instituion etc. if yes, details of his

service,gross salasry received by him and exact period of service may

be given

(f) Details of year wise gross professional receipt of the firm and also his

share of imcome as per Deed of partnership, if any, of the firm, in

case the applicant is a partner in a firm or architect/ valuer etc. if so,

whether he is claiming standard deduction u/s 16(i) of the I.T Act,

amount of salary may also be furnished.

(g) Please give your comments on the professional qualification of the

applicant.

Enclo: Court Affidavit & Annexure-A

(Bidhan Purkayastha)

Income-tax Officer

Ward-2(2), Dibrugarh

You might also like

- 18K00293-Lumbatan-Binidayan Section PDFDocument125 pages18K00293-Lumbatan-Binidayan Section PDFVincent PorrazzoNo ratings yet

- Bidding Documents 19K00330Document126 pagesBidding Documents 19K00330Vinzsoy Daypal MalagarNo ratings yet

- Spoken EnglishDocument225 pagesSpoken EnglishKumuda Srinath100% (2)

- Conscience: Subjective Norm of MoralityDocument24 pagesConscience: Subjective Norm of MoralityNate RiverNo ratings yet

- A Teacher's Guide to Understanding Mark Twain's The Prince and the PauperDocument30 pagesA Teacher's Guide to Understanding Mark Twain's The Prince and the PauperFarha Ahmed50% (2)

- GST Section ListDocument7 pagesGST Section ListRahul ThapaNo ratings yet

- Bidding Documents RX ClusterBDocument135 pagesBidding Documents RX ClusterBfhdNo ratings yet

- CDI 2 Guide Covers Interview and Interrogation TechniquesDocument23 pagesCDI 2 Guide Covers Interview and Interrogation TechniquesRaymund Mendoza Bulosan84% (19)

- Jeffrey DahmerDocument3 pagesJeffrey DahmerJoren SantosNo ratings yet

- Supreme Court Rules on Power of President to Suspend Elected Local OfficialsDocument2 pagesSupreme Court Rules on Power of President to Suspend Elected Local OfficialsNyx PerezNo ratings yet

- People V BeltranDocument18 pagesPeople V BeltranCattleyaNo ratings yet

- Corazon Nevada Vs Atty Rodolfo Casuga Case DigestDocument2 pagesCorazon Nevada Vs Atty Rodolfo Casuga Case DigestJeters VillaruelNo ratings yet

- Echegaray V Sec. of JusticeDocument4 pagesEchegaray V Sec. of JusticeValentine MoralesNo ratings yet

- ITC Provisions and Rules in GSTDocument8 pagesITC Provisions and Rules in GSTAnonymous ikQZphNo ratings yet

- 00evangelista Vs SistozaDocument2 pages00evangelista Vs SistozaMary Flor ChuaNo ratings yet

- Form No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Document2 pagesForm No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Anonymous 2evaoXKKdNo ratings yet

- Form CHG-1-16032017 Signe Cfil CDocument6 pagesForm CHG-1-16032017 Signe Cfil CsunjuNo ratings yet

- Annexure To Income Tax CircularDocument6 pagesAnnexure To Income Tax CircularDipti BhanjaNo ratings yet

- Addendum Corrigendum 01Document21 pagesAddendum Corrigendum 01billing cbi housingNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

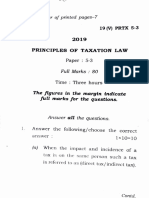

- Principles of Taxation Law Paper 5.3Document22 pagesPrinciples of Taxation Law Paper 5.3mg9433822No ratings yet

- Key Highlights of The Proposed GST Changes in Union Budget 2023 24 For Easy DigestDocument23 pagesKey Highlights of The Proposed GST Changes in Union Budget 2023 24 For Easy DigestshwetaNo ratings yet

- Input Tax Credit: Cma Bibhudatta SarangiDocument3 pagesInput Tax Credit: Cma Bibhudatta SarangihanumanthaiahgowdaNo ratings yet

- Goods and Service Tax Rules, 2017: List of Registration FormsDocument71 pagesGoods and Service Tax Rules, 2017: List of Registration FormsArul PrakashNo ratings yet

- Igst Itc 11112022Document18 pagesIgst Itc 11112022hrtclients1No ratings yet

- Section - 24 GST REGDocument1 pageSection - 24 GST REGraj pandeyNo ratings yet

- Instructions ITR 7 AY 2019-20Document52 pagesInstructions ITR 7 AY 2019-20Anonymous CSvZH6No ratings yet

- Form PDF 453493910110820Document7 pagesForm PDF 453493910110820deepkaryan1988No ratings yet

- Form No. Chg-1: English Hindi Form LanguageDocument7 pagesForm No. Chg-1: English Hindi Form LanguageKunal ObhraiNo ratings yet

- Form No 3CEDocument3 pagesForm No 3CE123vidyaNo ratings yet

- Module 3 Dec 20Document132 pagesModule 3 Dec 20Dinesh GadkariNo ratings yet

- Form-No.12bb 2020-21Document1 pageForm-No.12bb 2020-21Sk SerafatNo ratings yet

- Paper-2 International Tax Practice-NOV 20Document22 pagesPaper-2 International Tax Practice-NOV 20dhawaljaniNo ratings yet

- Article On Composition Scheme With Case StudyDocument12 pagesArticle On Composition Scheme With Case StudySejal GuptaNo ratings yet

- MakeMyTripLtd 6KDocument293 pagesMakeMyTripLtd 6KMrunalR.DhavaleNo ratings yet

- Changes Made in Income Tax Act 2058Document10 pagesChanges Made in Income Tax Act 2058shankarNo ratings yet

- Cicil Registration AnnexuresDocument27 pagesCicil Registration AnnexuresS UDAY KUMARNo ratings yet

- Technical 2007Document27 pagesTechnical 2007Mohammed IkramaliNo ratings yet

- XPeng Inc - Form 20-F (Apr-16-2021)Document271 pagesXPeng Inc - Form 20-F (Apr-16-2021)Peng WuNo ratings yet

- Test Series: October, 2019 Mock Test Paper 1 Final (New) Course Group Ii Paper 8: Indirect Tax Laws Maximum Marks: 100 Marks Time Allowed: 3 HoursDocument10 pagesTest Series: October, 2019 Mock Test Paper 1 Final (New) Course Group Ii Paper 8: Indirect Tax Laws Maximum Marks: 100 Marks Time Allowed: 3 HoursANIL JARWALNo ratings yet

- GSTDocument13 pagesGSTpriyababu4701No ratings yet

- Aar 1082 Endemol India PVT LTDDocument7 pagesAar 1082 Endemol India PVT LTDMukesh RathodNo ratings yet

- @dtaxmcq Income Tax Amendment sheetDocument50 pages@dtaxmcq Income Tax Amendment sheetmshivam617No ratings yet

- Judicial Rulings BY ABHAY DESAIDocument27 pagesJudicial Rulings BY ABHAY DESAIPiyush PatelNo ratings yet

- eNIT36 1Document5 pageseNIT36 1ravitejaNo ratings yet

- Comparisn Section 19AAAA Section 19AAAAA Section 19BBBBB Section 82BB PDFDocument6 pagesComparisn Section 19AAAA Section 19AAAAA Section 19BBBBB Section 82BB PDFPopy AkterNo ratings yet

- Cma RTP Dec 18Document34 pagesCma RTP Dec 18amit jangraNo ratings yet

- GST - Input Tax Credit - Edition 5Document17 pagesGST - Input Tax Credit - Edition 5Vineet PandeyNo ratings yet

- ITR-1 Acknowledgement for Salaried IndividualDocument8 pagesITR-1 Acknowledgement for Salaried Individualsuhail amirNo ratings yet

- KPMG - Change in Tax Audit ReportDocument5 pagesKPMG - Change in Tax Audit ReportDhananjay KulkarniNo ratings yet

- Department of Public Works & Highways: Regional Office XDocument120 pagesDepartment of Public Works & Highways: Regional Office XMANNY CARAJAYNo ratings yet

- Mcq-Pgbp-Ito Exam-2020Document9 pagesMcq-Pgbp-Ito Exam-2020Durgadevi BaskaranNo ratings yet

- MCQs of GST Book 1Document136 pagesMCQs of GST Book 1AnjuRoseNo ratings yet

- 17BD0054-MPB (Completion) Bayabat, AmulungDocument106 pages17BD0054-MPB (Completion) Bayabat, AmulungChristian HindangNo ratings yet

- List of Important Sections - GST May 2023 by CA Kishan KumarDocument5 pagesList of Important Sections - GST May 2023 by CA Kishan KumarNarayan choudharyNo ratings yet

- MCQ On TDS, TCS & Advance TaxDocument15 pagesMCQ On TDS, TCS & Advance TaxPrakhar GuptaNo ratings yet

- Section - IiiDocument5 pagesSection - Iiishuruaat2003No ratings yet

- Requirements U/S 195: By: Ca Sanjay K. AgarwalDocument71 pagesRequirements U/S 195: By: Ca Sanjay K. AgarwalHemanthKumarNo ratings yet

- Virtual Certificate Course On GST: GST & Indirect Taxes Committee of Icai, New DelhiDocument41 pagesVirtual Certificate Course On GST: GST & Indirect Taxes Committee of Icai, New DelhiNikhil JainNo ratings yet

- Form s3Document18 pagesForm s3kirill.evseev2016No ratings yet

- Tax Audit ReportDocument18 pagesTax Audit ReportNeha DenglaNo ratings yet

- 6399 Supplemental Statement 20200730 7Document13 pages6399 Supplemental Statement 20200730 7Newsbomb AlbaniaNo ratings yet

- Pre-Week Batch 90 (TAX)Document12 pagesPre-Week Batch 90 (TAX)Elaine Joyce GarciaNo ratings yet

- CPAR Taxation PreweekDocument38 pagesCPAR Taxation PreweekAndrei Nicole RiveraNo ratings yet

- Dipn 02Document38 pagesDipn 02Difanny KooNo ratings yet

- Tds On Dividend 24062022Document6 pagesTds On Dividend 24062022thimothiNo ratings yet

- Limited Liability Partnership Act 2000Document20 pagesLimited Liability Partnership Act 2000irfan subairNo ratings yet

- Uganda Passes Income Tax Amendment Act 2020Document10 pagesUganda Passes Income Tax Amendment Act 2020TonyNo ratings yet

- Form PDF 139026350310819Document6 pagesForm PDF 139026350310819Density GamingNo ratings yet

- (Updated Syllabus) Bihar Public Service Commission - Preliminary & Mains Examination 2017Document100 pages(Updated Syllabus) Bihar Public Service Commission - Preliminary & Mains Examination 2017vivek kumar singhNo ratings yet

- (Updated Syllabus) Bihar Public Service Commission - Preliminary & Mains Examination 2017Document100 pages(Updated Syllabus) Bihar Public Service Commission - Preliminary & Mains Examination 2017vivek kumar singhNo ratings yet

- G.A.R Travel AllowanceDocument5 pagesG.A.R Travel AllowanceManoj KumarNo ratings yet

- Income-Tax Department: 1. Whether Resident/Resident But NotDocument2 pagesIncome-Tax Department: 1. Whether Resident/Resident But NotManoj KumarNo ratings yet

- Income-Tax Department: 1. Whether Resident/Resident But NotDocument2 pagesIncome-Tax Department: 1. Whether Resident/Resident But NotManoj KumarNo ratings yet

- Income-Tax Department: 1. Whether Resident/Resident But NotDocument2 pagesIncome-Tax Department: 1. Whether Resident/Resident But NotManoj KumarNo ratings yet

- Poena - Logia: Activity 1. Reaction PaperDocument2 pagesPoena - Logia: Activity 1. Reaction PaperJustine TabNo ratings yet

- Solving Crimes in the PastDocument21 pagesSolving Crimes in the PastMATEO BALAGUER BENNÁSARNo ratings yet

- Wrongful Restraint and ConfinementDocument5 pagesWrongful Restraint and ConfinementRaaghav SapraNo ratings yet

- Twelfth Greater Sin of Falsely Accusing Others of Adultery or HomosexualityDocument7 pagesTwelfth Greater Sin of Falsely Accusing Others of Adultery or HomosexualityfarzanahrosliNo ratings yet

- Vocabulary 3Document5 pagesVocabulary 3Huyền ThuNo ratings yet

- Imm5621 032017 2-P9TW901 PDFDocument5 pagesImm5621 032017 2-P9TW901 PDFJASMAN GILLNo ratings yet

- 025 DIGESTED El Pueblo de Filipinas Vs Pablo San Juan y Monterosa - No. L-46896Document4 pages025 DIGESTED El Pueblo de Filipinas Vs Pablo San Juan y Monterosa - No. L-46896Paul ToguayNo ratings yet

- Ra 10707Document5 pagesRa 10707Gretchen Alunday SuarezNo ratings yet

- Gender-Based Crimes Against Women in Himachal Pradesh: An AnalysisDocument46 pagesGender-Based Crimes Against Women in Himachal Pradesh: An AnalysisPranshu GaurNo ratings yet

- People vs. DioDocument4 pagesPeople vs. DioMJ BautistaNo ratings yet

- Shakespeare's Presentation of Women in Much Ado About Nothing Act 4 Scene 1Document3 pagesShakespeare's Presentation of Women in Much Ado About Nothing Act 4 Scene 1bluebeary12350% (2)

- Criminal Law Book 2 of Revised Penal Code, Title-SixDocument24 pagesCriminal Law Book 2 of Revised Penal Code, Title-SixEzzeden GualNo ratings yet

- Federal Capital Offenses: An Overview of Substantive and Procedural LawDocument43 pagesFederal Capital Offenses: An Overview of Substantive and Procedural LawisaacNo ratings yet

- The Corrections SystemDocument16 pagesThe Corrections SystemNek PuriNo ratings yet

- Amber Booth - The Power To PardonDocument2 pagesAmber Booth - The Power To Pardonapi-552631852No ratings yet

- Dependency Claims and Bereavement Damages Under Section 7 of the CLA 1956Document31 pagesDependency Claims and Bereavement Damages Under Section 7 of the CLA 1956Syahirah ArifNo ratings yet

- Aman Kabra Law of CrimesDocument8 pagesAman Kabra Law of CrimesPRATEEK RAJPUTNo ratings yet

- Daughed Abused by Father Emily OreillyDocument3 pagesDaughed Abused by Father Emily Oreillyapi-240718682No ratings yet

- Karnataka Shops and Commercial Establishments ActDocument11 pagesKarnataka Shops and Commercial Establishments ActArchit SonikaNo ratings yet

- NCR AddressDocument14 pagesNCR AddressAnonymous dX4PqXDNo ratings yet

- Jacob Kingston Plea AgreementDocument22 pagesJacob Kingston Plea AgreementLarryDCurtis100% (1)