Professional Documents

Culture Documents

Banking Theory PPT2

Uploaded by

Shaqif Hasan Sajib0 ratings0% found this document useful (0 votes)

2 views12 pagesBanking Theory PPT2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBanking Theory PPT2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views12 pagesBanking Theory PPT2

Uploaded by

Shaqif Hasan SajibBanking Theory PPT2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 12

Major departments or Administrative

Units of Bangladesh Bank:

Accounts & Budgeting Depariment

Agricultural Credit Department

. Anti-Money Laundering Department

+ Bangladesh Bank Training Academy

Banking Regulation and Policy Department

Central Bank Strengthening Project Cell

Common Services Department

Credit Information Bureau

+ Debt Management Department

Department of Banking Inspection 1

+ Department of Banking Inspection 2

Department of Currency Management and Payment System

+ Department of Financial institutions and Markets

Department of Off-Site Supervision

+ Department of Printing and Publications

Equity and Entrepreneurship Fund Unit

Expenditure Management Department

Major departments or Administrative

Units of Bangladesh Ban!

Foreian Exchange Inspection & Vcilance Department

Foreign Exchange Investment Deparment

Foren Exchange Operation Department

Foreign Excnange Poicy Department

Forex Reserve & Treasury Management Department

Governors Secretar!

Human Resout stent

formation Systems Development Department

{ngernal Aust Deparment

lnvestment Promotion & Financing Facity Project Cal

{T Operation & Communication Department

‘aw Department

Monetary Policy Deparment

Policy Analysis Unt

Research Department

Secutty Management Department

es Department

Slalistics Department

08-03-20

08-03-2017

Objectives and importance of Bank:

= The objectives and importance of Bank can

be viewed from three different

perspectives namely from the view point

of owners, government and customers.

Objectives of Bank from owner's

viewpoint:

Earning profit: Profit motive of the owners of the Bank acts as a

driving force in engaging themselves in the business of|

banking like all other business.

Rendering Services: Bank renders various services to the|

society 25 a part of thelr social commitment and this is 2

prime objective for engaging in banking business. Bankers are

ot only to make profit but also to do some good to the

society,

Investment of fund: The owners of the bank treat the bank as

"2 sultable sector to invest their accumulated saved money.

The owners of bank take bank as a way of|

ill by enhancing the periphery of their banking

Earning good

earning good

business.

Raising efficiency: The owners sharpen their managerial skill

‘and efficiency by ensuring smooth operation of their banking

business.

Objectives of Bank from

Government viewpoint:

Issuance of currency notes: Goverment issues currency notes as @

‘medium of exchange through banks.

Formation of capital in society: Government always encourages

Yormation of capital in society through households and bank act as 2

catalyzing force in formation of capital In different sectors of the

Society.

‘of ideal money. through its. various asset. products and expedites

industalization. Eventually this nelps the growth of GDP, alleviating

poverty and ensures equal distribution of wealth,

introl over money market: Bank by its various products helps in

‘controling money._market (supply of money in the market) and

‘Quards against the economy to be inflated

Creation _of employment opportunities: Bank to fulfil its human

“Sresource requirements and create a substantial employment

opportunities

‘ounseling in, financial matters: Banks sometimes put up effective

08-03-2017

Investment of capital and Industrialization: Bank helps investment L— | y¢/™

isuggestons to. Gove Th Tmarclal matters from thelr part

Objectives of Bank from Customer's

viewpoint:

Safe custodian of public money: Bank acts as a safe

custodian of public money. By depositing own money

into a Bank account people get rid of worries like theft,

burglary and snatching

Advice_and counseling: Sometimes bank acts as a

financial advisers to its customers in various aspects.

Representative or trustee: Bank sometimes performs

the role of a representative or trustee on behalf of its

customers.

Providing credit facility: Bank provides credit facility to

its~customers~and-makes opportunities to invest in

profitable sector and by the process create income

‘opportunities for customers.

mone Lanndeg

9

You might also like

- TAFJ DistributionDocument11 pagesTAFJ DistributionShaqif Hasan SajibNo ratings yet

- Pacs Analysis Corrections Tsr-195396 v1.0Document6 pagesPacs Analysis Corrections Tsr-195396 v1.0Shaqif Hasan SajibNo ratings yet

- LO1 - PROJ 606 - Intro To Project Mangt. Plan & Sub PlansDocument27 pagesLO1 - PROJ 606 - Intro To Project Mangt. Plan & Sub PlansShaqif Hasan SajibNo ratings yet

- Pacs Analysis Corrections Tsr-195396 v1.0Document6 pagesPacs Analysis Corrections Tsr-195396 v1.0Shaqif Hasan SajibNo ratings yet

- TAFJ-AS WebLogicInstallDocument72 pagesTAFJ-AS WebLogicInstallShaqif Hasan SajibNo ratings yet

- TAFJ-AS Online TransactionDocument16 pagesTAFJ-AS Online TransactionShaqif Hasan SajibNo ratings yet

- TAFJ-AS WebSPhereInstallDocument65 pagesTAFJ-AS WebSPhereInstallDevinda De ZoysaNo ratings yet

- JBC SonarQube PluginDocument27 pagesJBC SonarQube PluginZakaria AlmamariNo ratings yet

- How To Deploy Axis2 War File N JBossDocument4 pagesHow To Deploy Axis2 War File N JBossEzy AkpanNo ratings yet

- TAFJ-Application Test FrameworkDocument13 pagesTAFJ-Application Test FrameworkShaqif Hasan SajibNo ratings yet

- Code Coverage ReceiverDocument20 pagesCode Coverage ReceiverOns DhaouadiNo ratings yet

- TAFJ - JBC Precompiler RulesDocument47 pagesTAFJ - JBC Precompiler RulesShaqif Hasan SajibNo ratings yet

- TAFJ-AS JBossInstall v7 EAP PDFDocument36 pagesTAFJ-AS JBossInstall v7 EAP PDFAbishek CoolNo ratings yet

- TAFJ JBC Remote DebuggerDocument10 pagesTAFJ JBC Remote DebuggerShaqif Hasan SajibNo ratings yet

- TAFJ DSPackageInstallerDocument41 pagesTAFJ DSPackageInstallerZakaria AlmamariNo ratings yet

- TAFJ-ChangeSet InstallationDocument13 pagesTAFJ-ChangeSet InstallationShaqif Hasan SajibNo ratings yet

- TAFJ EclipseDocument88 pagesTAFJ EclipseGopi RamalingamNo ratings yet

- Tafj CalljeeDocument9 pagesTafj CalljeeShaqif Hasan SajibNo ratings yet

- TAFJ DeprecationMechanimDocument11 pagesTAFJ DeprecationMechanimShaqif Hasan SajibNo ratings yet

- MBL - UXP - Import DevelopmentsDocument63 pagesMBL - UXP - Import DevelopmentsShaqif Hasan SajibNo ratings yet

- Code Coverage ReceiverDocument20 pagesCode Coverage ReceiverOns DhaouadiNo ratings yet

- TAFJ-DB PerformanceDocument19 pagesTAFJ-DB PerformanceShaqif Hasan SajibNo ratings yet

- Tafj-As Jbossinstall v6.4 EapDocument33 pagesTafj-As Jbossinstall v6.4 EapShaqif Hasan SajibNo ratings yet

- NI Instrument and Cheque Crossing, EndorsementDocument51 pagesNI Instrument and Cheque Crossing, EndorsementShaqif Hasan SajibNo ratings yet

- Objectives and Importance of BankDocument42 pagesObjectives and Importance of BankShaqif Hasan SajibNo ratings yet

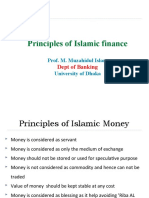

- Principles of Islamic FinanceDocument8 pagesPrinciples of Islamic Financeshourav_10682631No ratings yet

- Chapter 3 Impact of RibaDocument22 pagesChapter 3 Impact of RibaShaqif Hasan SajibNo ratings yet

- Negotiable Instruments NI Act. 1881 Came Into Force On 1: /conversion/tmp/scratch/438498291.doc - 1Document29 pagesNegotiable Instruments NI Act. 1881 Came Into Force On 1: /conversion/tmp/scratch/438498291.doc - 1Shaqif Hasan SajibNo ratings yet

- Objectives and Importance of BankDocument42 pagesObjectives and Importance of BankShaqif Hasan Sajib0% (1)

- NI Instrument and Cheque Crossing, EndorsementDocument51 pagesNI Instrument and Cheque Crossing, EndorsementShaqif Hasan SajibNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)