Professional Documents

Culture Documents

IRR of RA 11203 or The Rice Liberalization Act (RLA) - Signed

Uploaded by

SunStar Philippine News0 ratings0% found this document useful (0 votes)

208 views31 pagesImplementing rules and regulations of Republic Act 11203 or the Rice Liberalization Act (RLA)

Original Title

IRR of RA 11203 or the Rice Liberalization Act (RLA)_signed

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentImplementing rules and regulations of Republic Act 11203 or the Rice Liberalization Act (RLA)

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

208 views31 pagesIRR of RA 11203 or The Rice Liberalization Act (RLA) - Signed

Uploaded by

SunStar Philippine NewsImplementing rules and regulations of Republic Act 11203 or the Rice Liberalization Act (RLA)

Copyright:

© All Rights Reserved

You are on page 1of 31

e

NATIONAL ECONOMIC AND DEVELOPMENT AUTHORITY

DEPARTMENT OF BUDGET AND MANAGEMENT

Joint Memorandum Circular No. _©/-7B1/9

Series of 2019

Subject: The Implementing Rules and Regulations of Republic Act No.

11203, “An Act Liberalizing the Importation, Exportation and

Trading of Rice, Lifting for the Purpose the Quantitative Import

Restriction on Rice, and for Other Purposes.”

Introduction. This Joint Memorandum Circular implements the provisions of Republic

Act No. 11203, “An Act Liberalizing the Importation, Exportation and Trading of Rice,

Lifting for the Purpose the Quantitative Import Restriction on Rice, and for Other

Purposes” pursuant to Section 17 thereof.

ARTICLE|

DECLARATION OF POLICY

SECTION 1. Section 2 of Republic Act (R. A.) No. 8178, as amended, is hereby further

_amended to read as follows:

“SEC. 2. Declaration of Policy. — It is the policy of the State to ensure food security

and to make the country's agricultural sector viable, efficient and globally competitive.

The State adopts the use of tariffs in lieu of non-tariff import restrictions to protect local

producers of agricultural products.

XXX"

U ARTICLE II

DEFINITION OF TERMS

SEC. 2. Section 3 of R. A. No. 8178, as amended is hereby further amended to read

as follows:

“SEC. 3. Definition of Terms. - The following definitions apply to the terms used in

a this Act:

“(a) “Agricultural products” shall refer to specific commodities classified under

Chapters 1-24 of the Harmonized Commodity Description and Coding System (HS)

1

adopted and used in Section 1611 of R. A. NO. 10863, otherwise known as the “Customs

Modernization and Tariff Act” (CMTA);

XK

“(c) "ATIGA Rate” refers to tariff rate commitments under the ASEAN Trade in

Goods Agreement (ATIGA) applicable to importations originating from Association of

Southeast Asian Nations (ASEAN) member States;

“(d) “Bound rate” refers to the agreed maximum tariffs on products committed by

the Philippines to the World Trade Organization (WTO) under the Uruguay Round

Final Act, and under the ATIGA, in accordance with its tariff schedule (Annex 2: Tariffs,

under the ASEAN Trade in Goods Agreement (ATIGA)- PHILIPPINES);

“(e) “Buffer Stock” refers to the optimal level of rice inventory that shall be

maintained at any given time to be used for emergency situations and to sustain the

disaster relief programs of the government during natural or man-made calamities;

“(f) “In-Quota Tariff Rate” refers to the tariff rates for minimum access volumes

committed by the Philippines to the WTO under the Uruguay Round Final Act;

“(g) ‘Out-Quota Tariff Rate” refers to the higher rate of customs duty that is levied

on the quantities of an imported agricultural product in excess of its minimum access

volume (MAV);

“(h) “Minimum Access Volume” refers to the volume of a specific agricultural

product that is allowed to be imported with a lower tariff as committed by the

Philippines to the WTO under the Uruguay Round Final Act;

“()) “Most Favoured Nation (MFN) Rate” refers to Philippine tariff rates that are

applicable to imports from all sources as prescribed in the CMTA;

“() “Quantitative Import Restrictions” refer to non-tariff restrictions used to limit the.

amount of imported commodities, including, but not limited to, discretionary import

licensing and import quotas, whether qualified or absolute;

“(k) “Rice” refers to all products classified under the Harmonized Commodity

Description and Coding System (HS) heading 10.06;

“()) “Rice Shortage" is a situation where the quantity available or the supply of the

commodity in a market falls short of the quantity demanded or required at a given

time;

“(m) “Tariff’ refers to a tax levied on a commodity imported from another country

It earns revenues for the government and regarded as instruments to promote local

industries by taxing their competitors. The benefit is accorded to the local producers

by the maintenance of a domestic price at a level equal to the world price plus the

tariff;

“(n) ‘Tariff Equivalent’ refers to the rate of tariff that provides comparable protection

under existing quantitative import restrictions, reflected by the average price gap

between domestic prices and world prices; and

“(0) “Tariffication” refers to the lifting of all existing quantitative restrictions such as

import quotas or prohibitions, imposed on agricultural products, and replacing these

restrictions with tariffs.”

Rule 2.1. Other terms used in this Implementing Rules and Regulations (IRR)

are defined as follows:

Rule 2.1 (a). “Optimal Level” is the level of rice inventory that shall be

strategically positioned and maintained by the National Food Authority

(NFA) at any given time which includes the following:

i. Level of stocks to be used for emergency situations; and

ii. Level of stocks needed to sustain disaster relief operations of the

government

Rule 2.1 (b). “Emergency Situations” refer to situations which are

unforeseen or sudden occurrence, especially danger, demanding

immediate action.

Rule 2.1 (c). “Disaster Relief Programs” refer to programs of the

government that help the community or persons at risk from pre or post

disasters such as but not limited to earthquakes, tornadoes, massive fire,

severe drought, civil disaster, war or armed conflict, tsunami, storm

surge, and the like. Disaster relief programs also include:

i. Disaster Preparedness;

ii, Disaster Prevention; and

iii, Disaster Response as provided in Republic Act No. 10121 or the

Philippine Disaster Risk Reduction and Management Act of 2010.

Rule 2.1 (d). ‘Natural calamities” refer to major adverse events or

incident resulting from the natural processes of the environment

cluding, but not limited to typhoons, flooding, fire, catastrophic weather

events and other fortuitous events which cannot be prevented and cause

damage to life and property.

—

Rule 2.1 (e). “Man-made calamities" refer to critical and disaster

situations which are caused by human decisions and activities and may

include, but not be limited to, economic sabotage, war, rebellion, or any

similar situation.

Rule 2.1 (f). The “Act” refers to Republic Act No. 11203 or An Act

Liberalizing the Importation, Exportation and Trading of Rice, Lifting for

x the Purpose the Quantitative Import Restriction on Rice, and for Other

Purposes,

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Judicial Affidavit Complaint Vs Paul FarolDocument23 pagesJudicial Affidavit Complaint Vs Paul FarolSunStar Philippine News100% (8)

- Judicial Affidavit Complaint Vs Paul FarolDocument23 pagesJudicial Affidavit Complaint Vs Paul FarolSunStar Philippine News100% (8)

- DOH Circular On Price Cap For Covid-19 Rapid Antigen TestingDocument3 pagesDOH Circular On Price Cap For Covid-19 Rapid Antigen TestingSunStar Philippine NewsNo ratings yet

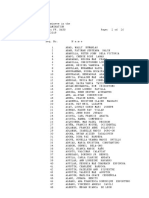

- Unofficial List of Bar PassersDocument68 pagesUnofficial List of Bar PassersTheSummitExpress100% (2)

- Notice of The Davao Doctors Hospital's Annual Stockholders Meeting 2020Document1 pageNotice of The Davao Doctors Hospital's Annual Stockholders Meeting 2020SunStar Philippine NewsNo ratings yet

- DILG Good Financial Housekeeping ReportDocument5 pagesDILG Good Financial Housekeeping ReportSunStar Philippine NewsNo ratings yet

- 2019 Bar Exam ResultsDocument39 pages2019 Bar Exam ResultsSunStar Philippine NewsNo ratings yet

- List of Nominees For Mindanao LEG (In No Particular Order)Document5 pagesList of Nominees For Mindanao LEG (In No Particular Order)SunStar Philippine NewsNo ratings yet

- Office of The Governor: JL (Epuhlit of Tqe Jqilippines Jro&ince of C!IehuDocument1 pageOffice of The Governor: JL (Epuhlit of Tqe Jqilippines Jro&ince of C!IehuSunStar Philippine NewsNo ratings yet

- Tentative List of Aspirants For National Posts in The 2022 ElectionsDocument15 pagesTentative List of Aspirants For National Posts in The 2022 ElectionsRappler100% (1)

- Office of The Governor: JL (Epuhlit of Tqe Jqilippines Jro&ince of C!IehuDocument1 pageOffice of The Governor: JL (Epuhlit of Tqe Jqilippines Jro&ince of C!IehuSunStar Philippine NewsNo ratings yet

- 2019 SALN Table Summary Senate WebsiteDocument2 pages2019 SALN Table Summary Senate WebsiteSunStar Philippine NewsNo ratings yet

- Letter To SunStar CebuDocument2 pagesLetter To SunStar CebuSunStar Philippine NewsNo ratings yet

- Speech On A Question of Personal and Collective Privilege by Cebu Rep. Raul V. Del MarDocument5 pagesSpeech On A Question of Personal and Collective Privilege by Cebu Rep. Raul V. Del MarSunStar Philippine NewsNo ratings yet

- Res 1125 2021 Ord. No. 2021 04Document9 pagesRes 1125 2021 Ord. No. 2021 04SunStar Philippine NewsNo ratings yet

- LIST OF NOMINEES FOR VISAYAS LEG (In No Particular Order)Document8 pagesLIST OF NOMINEES FOR VISAYAS LEG (In No Particular Order)SunStar Philippine NewsNo ratings yet

- SunStar Paywall User GuideDocument9 pagesSunStar Paywall User GuideSunStar Philippine NewsNo ratings yet

- Notice of The Davao Doctors Hospital's Annual Stockholders Meeting 2020Document1 pageNotice of The Davao Doctors Hospital's Annual Stockholders Meeting 2020SunStar Philippine NewsNo ratings yet

- Copernicus Programme Fact SheetDocument2 pagesCopernicus Programme Fact SheetSunStar Philippine NewsNo ratings yet

- Projects For Implementation in Cebu City North District in 2020Document7 pagesProjects For Implementation in Cebu City North District in 2020SunStar Philippine NewsNo ratings yet

- Election HotspotsDocument27 pagesElection HotspotsSunStar Philippine NewsNo ratings yet

- PHYS0319 AlphaDocument25 pagesPHYS0319 AlphaRappler100% (1)

- Central Visayas Center For Health Development: Osmeña Boulevard, Sambag II, Cebu City, 6000 PhilippinesDocument2 pagesCentral Visayas Center For Health Development: Osmeña Boulevard, Sambag II, Cebu City, 6000 PhilippinesSunStar Philippine NewsNo ratings yet

- Republic Act 11458Document2 pagesRepublic Act 11458SunStar Philippine NewsNo ratings yet

- March 2019 Pharmacist Licensure Examination ResultsDocument42 pagesMarch 2019 Pharmacist Licensure Examination ResultsRappler100% (1)

- Official Time Results of All-Women Ultra Marathon 2019 On March 9-10, 2019 in CebuDocument6 pagesOfficial Time Results of All-Women Ultra Marathon 2019 On March 9-10, 2019 in CebuSunStar Philippine NewsNo ratings yet

- Official Time Results of All-Women Ultra Marathon 2019Document5 pagesOfficial Time Results of All-Women Ultra Marathon 2019SunStar Philippine NewsNo ratings yet

- Mid1118 AlphaDocument24 pagesMid1118 AlphaRapplerNo ratings yet

- Chem1118 AlphaDocument15 pagesChem1118 AlphaRapplerNo ratings yet