Professional Documents

Culture Documents

4 PDF

Uploaded by

Jocelyn CelynOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 PDF

Uploaded by

Jocelyn CelynCopyright:

Available Formats

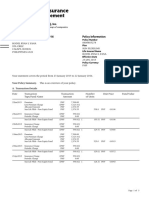

Proposed Insured:

Ms. ALIYAH KAYE MANILHIG BESAS

Age 2, Female, Non-smoker

Policyowner or Payor:

Mrs. JOCELYN MANILHIG BESAS

Age 31, Female

Dear JOCELYN,

Thank you for your interest in AXA products. Life BasiX is a regular-pay variable life insurance product that addresses life's essential

needs for basic protection with opportunities for long-term investment. But unlike most investments, it provides multiple benefits as

follows:

KEY BENEFITS:

1. Guaranteed Death Benefit equivalent to at least 500% of the annual premium if no withdrawal is made.

2. Potential upsides from the portion of the premium placed in bonds, equities and/or money market instruments, depending on your

risk appetite.

3. Guaranteed loyalty bonus as a reward for keeping your investments with AXA.

4. Supplement benefits from riders that provide other forms of protection.

• CARE guarantees daily hospitalization benefit of PHP 800/day or PHP 1,600/day if under intensive care.

• PAYOR’S CLAUSE waives all future premiums if the payor becomes totally and permanently disabled before age 60.

For a premium of PHP 36,068.72 annually, you get to enjoy the following benefits:

BENEFITS

For You For Your Loved Ones

(Living Benefits) (Death Benefits)

When insured reaches age 65 Upon death of the Insured

Based on (PHP) Based on 8% annual rate (PHP)

4% annual rate of return, Account Value 7,878,878 Age 50 14,096,317

Or 8% annual rate of return, Account Value 45,580,756 Age 60 30,894,320

Age 70 67,159,948

Or 10%annual rate of return, Account Value 115,777,989

Notes:

1. The values above are based on the projected performance of your chosen fund/s. Since the fund performance may vary, the values of your

units are not guaranteed and will depend on the actual investment performance at that given period. The illustrated returns on investments

are based on assumed annual rates of 4%, 8%, and 10%. These rates are for illustration purposes only and do not represent maximum or

minimum return on your fund.

2. If after purchasing the variable life insurance contract, you realize that it does not fit your financial needs, you may return the

contract to AXA Philippines within 15 days from the time you receive it. AXA Philippines will return to you the account value, the

bid-offer spread, and all initial charges.

3. Any withdrawal from the Living Benefit will correspondingly reduce the Death Benefit payable.

This is not a deposit product. Earnings are not assured and principal amount invested is exposed to risk

of loss. This product cannot be sold to you unless its benefits and risks have been thoroughly explained.

If you do not fully understand this product, do not purchase or invest in it.

Page 1 of 9 of Proposal No. 18.2.072216.1003312

Printed on: 7/22/2016 7:19:51 PM Created on: 7/22/2016 7:19:38 PM Expiry Date: 10/22/2016

Version Number: 2016.18.2 - 01 Date for Next Insurance Age: 1/4/2017

Plan Code: BAX/ Rider Code: MEB2, WPDD21

Philippine Peso

for: Ms. ALIYAH KAYE MANILHIG BESAS, 2, Female, Non-smoker

SPECIAL FEATURES

Top-up Subject to the rules set by AXA Philippines from time to time, you have the option to increase the

benefits of your Policy by paying additional premiums on top of your regular premium which will

be used to buy more units on your chosen investment fund(s).

Premium Holiday Premiums are paid throughout the life of your Policy, but you have the option to suspend payment

anytime as long as the Account Value is sufficient to cover these.

Loyalty Bonus As long as your Policy remains in force, a 5% Loyalty Bonus will be paid on the 15th and 25th year

to increase your Account Value. The Bonus will be equal to 5% of the average of the month-end

Account Values for the last 120 months.

Inflation Link You have the option to increase your insurance protection, with no further proof of insurability, at

a minimal cost of insurance deduction on each anniversary of your Policy, before age 60 with the

Inflation Index Endorsement (IIE). This also does not require that you provide further proof if

insurability. The amount by which you can increase your coverage is based on the current

Consumer Price Index subject to a minimum that AXA Philippines may determine from time to

time.

The succeeding pages of this proposal provide more details on the benefits and features of Life BasiX.

Again, thank you for your interest in AXA products. If you have questions, please call me at the number specified below, or call the AXA

Philippines Customer Care Hotline at Tel Nos: (02)5815-292 or (02)3231-292.

TALO, NOVELYN VEGA

91804

027097

639269952123

Page 2 of 9 of Proposal No. 18.2.072216.1003312

Printed on: 7/22/2016 07:19:51 PM Created on: 7/22/2016 7:19:38 PM Expiry Date: 10/22/2016

Version Number: 2016.18.2 - 01 Date for Next Insurance Age: 1/4/2017

Plan Code: BAX/ Rider Code: MEB2, WPDD21

Philippine Peso

for: Ms. ALIYAH KAYE MANILHIG BESAS, 2, Female, Non-smoker

Life BasiX is a regular-pay variable life insurance product where a portion of the premiums, net of the company’s charges, is invested

into your choice of funds. Subject to the rules set by AXA Philippines from time to time, you can increase your investment anytime by

paying top-up premiums, but the value of the funds (and your policy benefits) may go up or down depending on market conditions. The

death benefit option you have elected is Level. The minimum Death Benefit in this proposal is PHP 112,6441.

Below are important details of the proposal along with how your investment will be allocated between the available funds. You may

change this allocation anytime depending on your investment goals and/or risk appetite.

Basic Plan and Supplements Cover up to Age Sum Insured (PHP) Annual Premium (PHP)

Basic

Life BasiX 100 900,000 32,184.00

Supplements

CARE (REGULAR) 71 2,079.20

PAYOR'S CLAUSE UPON DEATH & DISABILITY 21 32,184 1,805.52

Total² 36,068.72

You may also pay your premium in the following modes:

Modes of Payment Modal Premium Fund Name ³ Fund Allocation

(PHP)

Semi-Annual 18,034.36 Opportunity Fund 50%

Quarterly 9,017.18 Chinese Tycoon Fund 50%

Monthly 3,005.75

Notes:

1. This is the minimum Death Benefit at policy inception. The minimum Death Benefit for any policy year is equal to 500% of the annual regular Life Basix premium, plus

125% of each paid top-up premium, if any, less 125% of each partial withdrawal, if any.

2. Premiums for all products are payable up to termination age. For the premium term of the supplement/s, if any, please refer to the supplement definition indicated in

the "Summary of the Riders Attached to this Proposal".

3. See Product Notes for description of the funds.

Page 3 of 9 of Proposal No. 18.2.072216.1003312

Printed on: 7/22/2016 07:19:51 PM Created on: 7/22/2016 7:19:38 PM Expiry Date: 10/22/2016

Version Number: 2016.18.2 - 01 Date for Next Insurance Age: 1/4/2017

Plan Code: BAX/ Rider Code: MEB2, WPDD21

Philippine Peso

for: Ms. ALIYAH KAYE MANILHIG BESAS, 2, Female, Non-smoker

ILLUSTRATION OF BENEFITS

The illustrated benefits of your policy (subject to actual market performance) are shown below.

Total Cumulative ILLUSTRATION OF BENEFITS

End of Regular Basic 4.00 % Rate of Return 8.00 % Rate of Return 10.00 % Rate of Return

Policy Premium, Rider

Year Premiums and Top- Living Benefit Death Benefit Living Benefit Death Benefit Living Benefit Death Benefit

up, if any, Paid

1 32,184 18,613 630,000 19,366 630,000 19,743 630,000

2 64,368 37,989 720,000 40,302 720,000 41,482 720,000

3 96,552 58,160 810,000 62,935 810,000 65,418 810,000

4 128,736 79,159 900,000 87,403 900,000 91,773 900,000

5 160,920 101,011 900,000 113,846 900,000 120,785 900,000

10 321,840 284,931 900,000 349,930 900,000 388,336 900,000

15 482,760 524,324 900,000 716,803 900,000 841,945 900,000

20 643,680 802,160 900,000 1,239,819 1,239,819 1,554,076 1,554,076

25 804,600 1,181,339 1,181,339 2,070,478 2,070,478 2,779,460 2,779,460

30 965,520 1,603,299 1,603,299 3,229,075 3,229,075 4,674,473 4,674,473

35 1,126,440 2,116,678 2,116,678 4,931,434 4,931,434 7,726,412 7,726,412

40 1,287,360 2,741,282 2,741,282 7,432,759 7,432,759 12,641,590 12,641,590

45 1,448,280 3,501,207 3,501,207 11,108,025 11,108,025 20,557,533 20,557,533

50 1,609,200 4,425,773 4,425,773 16,508,197 16,508,197 33,306,238 33,306,238

55 1,770,120 5,550,649 5,550,649 24,442,821 24,442,821 53,838,155 53,838,155

60 1,931,040 6,919,232 6,919,232 36,101,387 36,101,387 86,905,012 86,905,012

Age60 1,866,672 6,339,407 6,339,407 30,894,320 30,894,320 71,766,002 71,766,002

Age65 2,027,592 7,878,878 7,878,878 45,580,756 45,580,756 115,777,989 115,777,989

Age70 2,188,512 9,751,878 9,751,878 67,159,948 67,159,948 186,659,735 186,659,735

The rates of return shown above are for illustration purposes and are not based on past performance nor guarantee future performance. The actual return may

differ. The illustrated values are net of premium charges of 35%/35%/35%/35%/35% of the basic premium for the 1st to 5th policy years; all top-ups shall be subject to a

premium charge of 2%; Cost of Insurance has been deducted monthly from the illustrated values as well as Administration Charge amounting to Php1,200 p.a. The Annual

Premiums for any attached Supplement shall be deducted monthly from the illustrated values if the Policy is under Premium Holiday. An Asset Management Charge of 2% p.a.

for Philippine Wealth Bond, Philippine Wealth Balanced and Philippine Wealth Equity Funds and 2.5% p.a. for Opportunity, Chinese Tycoon and Spanish

American Legacy Funds have already been deducted from the illustrated values. The illustrated values are still subject to a surrender charge for withdrawals (partial or full)

transacted up to the 5th policy year. The surrender charge is equal to the amount withdrawn multiplied by a surrender factor of 100%/100%/25%/10%/5% for the 1st to 5th

years respectively.

This illustration shall form part of the insurance contract once the Policy is issued.

Page 4 of 9 of Proposal No. 18.2.072216.1003312

Printed on: 7/22/2016 07:19:52 PM Created on: 7/22/2016 7:19:38 PM Expiry Date: 10/22/2016

Version Number: 2016.18.2 - 01 Date for Next Insurance Age: 1/4/2017

Plan Code: BAX/ Rider Code: MEB2, WPDD21

Philippine Peso

for: Ms. ALIYAH KAYE MANILHIG BESAS, 2, Female, Non-smoker

ILLUSTRATION OF BENEFITS (with Premium Holiday on Year 10)

You can choose to suspend payment for regular premium and top-ups as long as the Account Value of your Policy is sufficient to cover the

charges and pay for the premium of any supplement. This feature is called a Premium Holiday which you can apply for. Note that under

this feature, there is a possibility that your Account Value may be depleted and may result to your policy being terminated.

The following table is an example of the impact of a premium holiday at year 10 and/or withdrawals from the fund assuming different

rates of return. However, note that the rates of return are for illustration purposes only. They are not based on past performance nor

guarantee future returns.

Total Cumulative ILLUSTRATION OF BENEFITS (with Premium Holiday on Year 10)

End of Regular Basic 4.00 % Rate of Return 8.00 % Rate of Return 10.00 % Rate of Return

Policy Premium, Rider

Year Premiums and Top Living Benefit Death Benefit Living Benefit Death Benefit Living Benefit Death Benefit

-up, if any, Paid

1 32,184 18,613 630,000 19,366 630,000 19,743 630,000

2 64,368 37,989 720,000 40,302 720,000 41,482 720,000

3 96,552 58,160 810,000 62,935 810,000 65,418 810,000

4 128,736 79,159 900,000 87,403 900,000 91,773 900,000

5 160,920 101,011 900,000 113,846 900,000 120,785 900,000

10 321,840 284,931 900,000 349,930 900,000 388,336 900,000

15 321,840 337,245 900,000 506,697 900,000 619,409 900,000

20 321,840 387,587 900,000 721,638 900,000 975,121 975,121

25 321,840 462,813 900,000 1,070,330 1,070,330 1,593,001 1,593,001

30 321,840 531,874 900,000 1,543,199 1,543,199 2,534,637 2,534,637

35 321,840 612,556 900,000 2,233,434 2,233,434 4,046,290 4,046,290

40 321,840 709,534 900,000 3,245,406 3,245,406 6,478,533 6,478,533

45 321,840 823,785 900,000 4,727,390 4,727,390 10,390,487 10,390,487

50 321,840 963,029 963,029 6,903,301 6,903,301 16,689,012 16,689,012

55 321,840 1,132,216 1,132,216 10,099,607 10,099,607 26,831,992 26,831,992

60 321,840 1,333,886 1,333,886 14,791,545 14,791,545 43,162,714 43,162,714

Age60 321,840 1,249,489 1,249,489 12,697,028 12,697,028 35,687,057 35,687,057

Age65 321,840 1,469,922 1,469,922 18,600,751 18,600,751 57,416,301 57,416,301

Age70 321,840 1,704,877 1,704,877 27,239,200 27,239,200 92,373,912 92,373,912

The rates of return shown above are for illustration purposes and are not based on past performance nor guarantee future performance. The actual return may

differ. The illustrated values are net of premium charges of 35%/35%/35%/35%/35% of the basic premium for the 1st to 5th policy years; all top-ups shall be subject to a

premium charge of 2%; Cost of Insurance has been deducted monthly from the illustrated values as well as Administration Charge amounting to Php1,200 p.a. The Annual

Premiums for any attached Supplement shall be deducted monthly from the illustrated values if the Policy is under Premium Holiday. An Asset Management Charge of 2% p.a.

for Philippine Wealth Bond, Philippine Wealth Balanced and Philippine Wealth Equity Funds and 2.5% p.a. for Opportunity, Chinese Tycoon and Spanish

American Legacy Funds have already been deducted from the illustrated values. The illustrated values are still subject to a surrender charge for withdrawals (partial or full)

transacted up to the 5th policy year. The surrender charge is equal to the amount withdrawn multiplied by a surrender factor of 100%/100%/25%/10%/5% for the 1st to 5th

years respectively.

The contract term is specified in the illustration of benefits in this proposal. Please refer to the assumptions below used in the above

example.

Other Assumptions:

1. This example assumes that all premiums shown in the above table are paid in full when due and as planned with no premium holiday in the first

10 policy years. It assumes the current scale of charges remains unchanged.

2. A loyalty bonus estimated to be 5% of the average Account Value from 6th to 15th policy years on the 15th year, 5% of the average Account

Value from the 16th to 25th policy years on the 25th year is included in this illustration. The bonus will be equal to 5% of the average of the

month-end Account Values over the last 120 months.

3. The proposed policy charges used in this illustration summary are based on the standard risk class without taking into account your own

circumstances (e.g. occupation and health condition, etc). Risk class will be determined according to our underwriting guidelines. The

investment gains/risks associated with this plan are solely to your account.

Page 5 of 9 of Proposal No. 18.2.072216.1003312

Printed on: 7/22/2016 07:19:52 PM Created on: 7/22/2016 7:19:38 PM Expiry Date: 10/22/2016

Version Number: 2016.18.2 - 01 Date for Next Insurance Age: 1/4/2017

Plan Code: BAX/ Rider Code: MEB2, WPDD21

Philippine Peso

for: Ms. ALIYAH KAYE MANILHIG BESAS, 2, Female, Non-smoker

Notes on the illustration of Benefits

1. All payments and benefits shown are in Philippine pesos. Payments are acceptable in policy currency only.

2. AXA Philippines reserves the right to adjust the Basic and Supplement premiums, and any charges in this plan.

3. The quoted values are illustrations only of the key features, benefits and assumptions of the chosen insurance plans. If your application is

accepted, you will receive a policy contract, which will include detailed terms, conditions, and exclusions. A new Illustration of Benefits will be

provided in the contract, which may differ from this proposed illustration.

4. The benefits and premiums of the Index-linked Increase Endorsement, if any, are not included in the summary in the previous page.

5. The benefits are based on the projected performance of your chosen fund/s. Since fund performance may vary, the values of your units are not

guaranteed and will depend on the actual investment performance at that given period. The illustrated returns on investments are based on

assumed annual rates of 4.00%, 8.00%, and 10.00%. These rates are for illustration purposes only and do not represent maximum or

minimum return on your fund value.

6. A bid-offer spread, which is the difference between the bid price and the offer price units, may be determined by AXA Philippines from time to

time. The above illustration is based on a bid-offer spread of 5%.

7. This illustration summary relates to your Life BasiX only, and excludes any Supplements in this proposal. It assumes that all premiums are paid

in full when due and as planned with no premium holiday and the current scale of charges remains unchanged. Any deviation from this will

change the illustrated values accordingly.

8. A loyalty bonus, credited on the 15th and 25th policy years, is included in the illustration. The bonus is estimated to be 5% of the average of

the month-end Account Values over the last 120 months.

9. The proposed policy charges used in this illustration summary are based on the standard risk class without taking into account your own

circumstances (e.g. occupation and health condition, etc). Risk class will be determined according to our underwriting guidelines. The

investment gains/risks associated with this plan are solely to your account.

10. Juvenile Lien.

The Juvenile Lien is applied to the Minimum Death Benefit and the illustration of Death Benefits for policy years when Insured is below five (5)

years old. The Death Benefit illustrated is based on the following schedule:

Age (nearest birthday) at Death Death Benefit Payable

6 months 50% of the Death Benefit, or the Account Value, whichever is higher

1 year 60% of the Death Benefit, or the Account Value, whichever is higher

2 years 70% of the Death Benefit, or the Account Value, whichever is higher

3 years 80% of the Death Benefit, or the Account Value, whichever is higher

4 years 90% of the Death Benefit, or the Account Value, whichever is higher

Product Notes

1. Life Basix is a regular-pay variable life insurance plan. Only the minimum Death Benefit is guaranteed while the Policy is in-force. The rest of

the benefits, namely the partial and full withdrawal values and the actual Death Benefit at time of death, all depend on the investment

experience of separate account(s) linked to the Policy.

Under the INCREASING DEATH BENEFIT OPTION, your beneficiaries will receive the Policy Sum Insured plus the Account Value at time of death.

While under the LEVEL DEATH BENEFIT option, your beneficiaries will receive the Policy Sum Insured less the partial withdrawals made for the

past twelve (12) months, or the Account Value at time of death, whichever is higher.

2. The living benefits shown in the illustration summary are equal to the Account Value of the Policy.

3. The client may choose from the following funds. If client chooses to invest in more than one fund, a minimum allocation of 10% on one fund is

required. The total allocation should always be 100%.

a. Philippine Wealth Bond Fund - This Bond Fund is an actively managed fixed income fund that seeks to capitalize on capital and

income growth through investments in interest-bearing securities issued by the Philippine Government and money market

instruments issued by banks.

b. Philippine Wealth Balanced Fund - This Balanced Fund is designed to achieve long-term growth through both interest income

and capital gains with an emphasis on providing a modest level of risk. It seeks to manage risk by diversifying asset classes and

industry groups through investment in bonds issued by the Philippine government and equities issued by Philippine corporations

comprising the Philippine Stock Exchange Index.

c. Philippine Wealth Equity Fund - This Equity Fund seeks to achieve long-term growth of capital by investing mainly in equities of

Philippine corporations comprising the Philippine Stock Exchange Index. The fund aims to provide access to a diversified portfolio of

equities from different industries.

d. Opportunity Fund - This equity fund aims to achieve long term growth through capital gains and dividends by investing in equities

of Philippine corporations that will provide access to a diversified portfolio of equities from different industries.

e. Chinese Tycoon Fund - This equity fund aims to achieve medium to long term growth through capital gains and dividends by

investing in equities that will provide access to a management themed-portfolio reflective of the Chinese-Filipino entrepreneurial

spirit through strategic investments in Philippine companies from different industries.

f. Spanish American Legacy Fund - This equity fund aims to achieve medium to long term growth through capital gains and

Page 6 of 9 of Proposal No. 18.2.072216.1003312

Printed on: 7/22/2016 07:19:52 PM Created on: 7/22/2016 7:19:38 PM Expiry Date: 10/22/2016

Version Number: 2016.18.2 - 01 Date for Next Insurance Age: 1/4/2017

Plan Code: BAX/ Rider Code: MEB2, WPDD21

Philippine Peso

for: Ms. ALIYAH KAYE MANILHIG BESAS, 2, Female, Non-smoker

dividends by investing in equities that will provide access to a management themed-portfolio through strategic investments in

Philippine companies from different industries with Spanish/American heritage.

4. The Bid Price of an Investment Fund is the price for cancelling a Unit of the Investment Fund as determined in accordance with the Valuation

provision.

5. The Offer Price of an Investment Fund is the price for creating a Unit of the Investment Fund as determined in accordance with the Valuation

provision.

Page 7 of 9 of Proposal No. 18.2.072216.1003312

Printed on: 7/22/2016 07:19:52 PM Created on: 7/22/2016 7:19:38 PM Expiry Date: 10/22/2016

Version Number: 2016.18.2 - 01 Date for Next Insurance Age: 1/4/2017

Plan Code: BAX/ Rider Code: MEB2, WPDD21

Philippine Peso

for: Ms. ALIYAH KAYE MANILHIG BESAS, 2, Female, Non-smoker

Attached Supplements

Summary of the Riders Attached to this Proposal

1. CARE pays a specific amount to defray the cost of hospital confinement/admission due to sickness or injury, based on the

following schedule:

CONFINEMENT/ADMISSION BENEFITS

ECONOMY REGULAR SUPERIOR PREMIER

General Admission (up to 1,000 days) P300/day P800/day P1,200/day P2,000/day

Intensive Care (up to 120 days) P600/day P1,600/day P2,400/day P4,000/day

Regular, Superior and Premier plans are entitled to "No Claim" discount equivalent to 15% of the previous year's annual premium if the benefit is

not availed of within the first three(3) consecutive years immediately preceding the current policy year.

CARE Premiums are payable up to termination age and are renewable annually. The premium rate will depend on the attained

age of the Insured at renewal date. Below is a sample premium schedule for your reference:

Age Nearest Annual Premium Age Nearest Annual Premium

Birthday Birthday

2 2,079.20 50 5,819.04

3 2,079.20 55 5,989.20

4 2,079.20 60 6,963.60

5 2,042.40 65 10,219.60

6 2,042.40 70 20,940.00

7 2,042.40

8 2,042.40

9 2,042.40

10 2,042.40

11 2,042.40

2. PAYOR’S CLAUSE is recommended in cases where a minor is the insured. With this supplement and in the event you pass away

or are suddenly unable to pay because of a disability, AXA ensures that your policy is kept alive and your child’s benefits continue

as if premiums are regularly and continuously paid.

3. The Index-linked Increase Endorsement (IIE) allows you to increase your insurance benefits at the rate of inflation with no

additional medical or processing requirements so you can be sure the value of your benefits cope with future costs.

NOTES:

1. The rates shown, if any, are those currently in effect. The rates applicable upon renewal of the Supplement will be those in effect at the date of

renewal.

2. For a detailed description of the Supplements, including exclusions and other provisions, please refer to the policy contract.

Page 8 of 9 of Proposal No. 18.2.072216.1003312

Printed on: 7/22/2016 07:19:52 PM Created on: 7/22/2016 7:19:38 PM Expiry Date: 10/22/2016

Version Number: 2016.18.2 - 01 Date for Next Insurance Age: 1/4/2017

Plan Code: BAX/ Rider Code: MEB2, WPDD21

Philippine Peso

for: Ms. ALIYAH KAYE MANILHIG BESAS, 2, Female, Non-smoker

DECLARATIONS AND ACKNOWLEDGMENTS

DECLARATIONS

1. It is my understanding that the total premium I am going to pay when I purchase this plan shall consist of the Life BasiX premium, regular

top-up premium, and Supplement premiums shown above, if any. I was also made aware that only the Life BasiX premium and top-up

premiums will be allocated to purchase units of the investment fund/s I will choose.

2. I confirm having read and understood the information in this proposal. My Financial Advisor/Financial Executive fully explained to me the

features and charges that will be made on my plan, and that the actual variable plan benefits will reflect the actual investment experience of

the separate account into which my fund is invested. I also confirm that I will fully assume all investment gains / risks associated with the

purchase of this plan.

Acknowledgment of Variability

Variable Life Insurance Plan

I acknowledge that:

I have applied with AXA Philippines for a Variable Life Policy, and have reviewed the illustration(s) that shows how a variable life insurance

policy performs using AXA Philippines’ assumptions and based on Insurance Commission’s guidelines on interest rates.

I understand that since fund performance may vary, the values of my units are not guaranteed and will depend on the actual performance at

that given period and that the value of my Policy could be less than the capital invested. The unit values of my Variable Life Insurance are

periodically published.

I understand that the investment risks under the Policy are to be borne solely by me, as the policyholder.

Product Transparency Declaration

By signing off on the items listed below, I acknowledge that the same have been discussed with and thoroughly explained to me.

· I understand that I am buying an investment-linked insurance product.

· I understand that the principal and earnings are not guaranteed and that the value of my unit investment (NAVPU) may go up or down depending on

the performance of the separate funds.

· I understand that the funds will be invested in Equities and/or Bonds or a combination thereof, and will be subject to changes in market conditions.

· The available funds and the risks that they bear have been thoroughly discussed with me, and I have made my Fund Allocation decision based on my

own judgment of and tolerance for these risks.

· I understand that this product is appropriate for a long-term investment horizon.

· I understand that I will have zero (0) withdrawal value during the first two (2) years of the policy because the amount withdrawn will be subject to

100% surrender charge on the first two (2) years.

CONFORME: These declarations and acknowledgments are made with the knowledge of

the AXA representative whose signature appears below:

_____________________________ ____________________ _____________________________________ ________________________

Applicant/Policy Owner Date Financial Advisor/Financial Executive Date

Signature over Printed Name Signature over Printed Name

TO BE FILLED UP BY AXA PHILIPPINES

_________________________ _________________________

These declarations and acknowledgments are valid for _________________________ _________________________

the following policy/ies with policy number/s: _________________________ _________________________

Disclosure of Conflict of Interest

The Company adopts a Conflict of Interest Policy and undertakes to disclose any material information which gives rise to actual or potential conflict of interest to

our customers. Company likewise takes all reasonable steps to ensure fair dealings with our customers.

General Disclaimer

All information and opinions provided are of a general nature and for information purposes only. The information and any opinions herein are based upon

sources believed to be reliable. AXA Philippines, its officers and directors make no representations or warranty, expressed or implied, with respect to the

correctness, completeness of the information and opinions in this document. Investment or participation in the Fund(s) is subject to risk and possible loss of

principal. Please carefully read the policy and endorsements and consider the investment objectives, risks, charges and expenses before investing. You should

seek professional advice from your financial, tax, accounting or legal consultant before making an investment. Past performance is not indicative of future

performance.

THIS FINANCIAL PRODUCT OF AXA PHILIPPINES IS NOT INSURED BY THE PHILIPPINE DEPOSIT

INSURANCE CORPORATION (PDIC) AND IS NOT GUARANTEED BY METROBANK OR PS BANK.

Page 9 of 9 of Proposal No. 18.2.072216.1003312

Printed on: 7/22/2016 07:19:52 PM Created on: 7/22/2016 7:19:38 PM Expiry Date: 10/22/2016

Version Number: 2016.18.2 - 01 Date for Next Insurance Age: 1/4/2017

Plan Code: BAX/ Rider Code: MEB2, WPDD21

You might also like

- Document Code Revision / Version ID Rev. 00 Date Created / Updated May. 2019Document4 pagesDocument Code Revision / Version ID Rev. 00 Date Created / Updated May. 2019fordmayNo ratings yet

- Reflection Movie2Document3 pagesReflection Movie2api-238840335No ratings yet

- College of Arts and Sciences Effective First Semester: A.Y. 2018-2019Document9 pagesCollege of Arts and Sciences Effective First Semester: A.Y. 2018-2019ged rocamoraNo ratings yet

- Historical Development of The Philippine Educational SystemDocument2 pagesHistorical Development of The Philippine Educational SystemAnjo San Juan100% (1)

- Module1 Learner Centered PrinciplesDocument13 pagesModule1 Learner Centered PrinciplesAllysa AvelinoNo ratings yet

- Organization and Management of Special SchoolDocument14 pagesOrganization and Management of Special SchoolLaiqueShahNo ratings yet

- Building & Enhancing Final ExamDocument7 pagesBuilding & Enhancing Final ExamGeisha Leigh Coruna CabiloganNo ratings yet

- Children LiteratureDocument50 pagesChildren LiteratureCherelyn De LunaNo ratings yet

- ExaminationDocument6 pagesExaminationGlen Jhon Meregildo OrquinNo ratings yet

- Educ 3 Education in Emergencies ReportDocument13 pagesEduc 3 Education in Emergencies ReportApril Gen GupanaNo ratings yet

- The Nature of Teaching and LearningDocument12 pagesThe Nature of Teaching and LearningApolonia Molina100% (1)

- Ikhlas Value Term TakafulDocument5 pagesIkhlas Value Term TakafulNazim SalehNo ratings yet

- ProfEd 9 (The Teaching Profession)Document10 pagesProfEd 9 (The Teaching Profession)Mary Jane Dar EstiponaNo ratings yet

- 01 Using ICT in Developing 21st Century Skills ICT in The 21st Century SkillsDocument24 pages01 Using ICT in Developing 21st Century Skills ICT in The 21st Century SkillsShunyne MoralesNo ratings yet

- Syllabus in Facilitating LearningDocument4 pagesSyllabus in Facilitating LearningMichael Figueroa100% (1)

- Bus 203 - Principles and Methods of TeachingDocument5 pagesBus 203 - Principles and Methods of TeachingMa. Cecilia BudionganNo ratings yet

- Chapter 1 (Latest) - The Concept of Educational SociologyDocument25 pagesChapter 1 (Latest) - The Concept of Educational SociologyNur Khairunnisa Nezam II0% (1)

- Sample Curricula Bachelor of Secondary EducationDocument28 pagesSample Curricula Bachelor of Secondary Educationjosefalarka100% (1)

- Syllabus-Foundation of Special and Inclusive EducationDocument19 pagesSyllabus-Foundation of Special and Inclusive EducationHoney AntiguaNo ratings yet

- COURSE TITLE Foundations of Special and Inclusive EducationDocument1 pageCOURSE TITLE Foundations of Special and Inclusive EducationMariella Alexes Rombaoa EspirituNo ratings yet

- Prof Ed 6 Foundations of Spec and Incl EducDocument2 pagesProf Ed 6 Foundations of Spec and Incl EducIvy Gingane100% (2)

- Merrill's First Principles of InstructionDocument28 pagesMerrill's First Principles of InstructionSeleno ThalassoNo ratings yet

- MAED Foundations of Special Education SyllabusDocument6 pagesMAED Foundations of Special Education SyllabusBernadette Sambrano Embien100% (1)

- Code of Ethics For Professional Teachers: Reported By: Tetchie D. GonzalesDocument18 pagesCode of Ethics For Professional Teachers: Reported By: Tetchie D. GonzalesTetchie GonzalesNo ratings yet

- Section 8 Strategic Management: E838 Effective Leadership and Management in EducationDocument10 pagesSection 8 Strategic Management: E838 Effective Leadership and Management in EducationJeremiah Miko LepasanaNo ratings yet

- REVISED Final Syllabus PED 100Document18 pagesREVISED Final Syllabus PED 100Perine Dela Cruz PangilinanNo ratings yet

- RPMS Tool For Teacher I-IIIDocument21 pagesRPMS Tool For Teacher I-IIIMary Jane Mangune0% (1)

- What Is Technological Pedagogical Content Knowledge?: Instructor: Pedro P. Raymunde JR., LPT, MAEDDocument17 pagesWhat Is Technological Pedagogical Content Knowledge?: Instructor: Pedro P. Raymunde JR., LPT, MAEDJoyce Crystal D. CagadasNo ratings yet

- Syllabus For TECH6102Document9 pagesSyllabus For TECH6102api-342200066No ratings yet

- Child and Adolescent Learning - Module 1Document10 pagesChild and Adolescent Learning - Module 1LU NA BieNo ratings yet

- How DepEd Prepares For The K To 12 ProgramDocument6 pagesHow DepEd Prepares For The K To 12 ProgramMarnelyn LajotNo ratings yet

- DPE 105 - Educational TechnologyDocument8 pagesDPE 105 - Educational TechnologymeltdownxNo ratings yet

- The Enhance Basic Education Act of 2013Document8 pagesThe Enhance Basic Education Act of 2013Geebe Latriel ValdezNo ratings yet

- Sto. Rosario Elementary School: Annual Implementation PlanDocument31 pagesSto. Rosario Elementary School: Annual Implementation PlanDianneGarciaNo ratings yet

- The Teaching Profession FinalsDocument1 pageThe Teaching Profession FinalsAntonette TagadiadNo ratings yet

- Code of Ethics For Professional TeachersDocument33 pagesCode of Ethics For Professional Teachersemmalyn tamayoNo ratings yet

- Domains of LearningDocument41 pagesDomains of LearningTakipsilim PhotographyNo ratings yet

- DELM 116 Strategic Planning and ManagementDocument3 pagesDELM 116 Strategic Planning and Managementarmand resquir jr100% (1)

- Ece 103 Introduction To Early Childhood EducationDocument2 pagesEce 103 Introduction To Early Childhood Educationapi-269538243No ratings yet

- Davao Oriental State College of Science and Technology: SyllabusDocument10 pagesDavao Oriental State College of Science and Technology: SyllabusElla KiayNo ratings yet

- Course: Ge 2-Readings in The Philippine History Topic: Content and Contextual Analysis of Selected Primary SourcesDocument17 pagesCourse: Ge 2-Readings in The Philippine History Topic: Content and Contextual Analysis of Selected Primary SourcesRay Mark BanzueloNo ratings yet

- St. Louis College of Bulanao: Purok 6, Bulanao, Tabuk City, Kalinga 3800Document9 pagesSt. Louis College of Bulanao: Purok 6, Bulanao, Tabuk City, Kalinga 3800Cath TacisNo ratings yet

- Traditional vs. 21st Century ClassroomDocument2 pagesTraditional vs. 21st Century ClassroomNancy Arias CastilloNo ratings yet

- Approaches To School CurriculumDocument21 pagesApproaches To School CurriculumJason Orolfo Salvadora HL100% (1)

- 02 Understanding Adult Learning ProcessDocument7 pages02 Understanding Adult Learning ProcessMak ShawonNo ratings yet

- Lesson Exemplar English Grade 11 SampleDocument5 pagesLesson Exemplar English Grade 11 SampleLiezel AntonioNo ratings yet

- Special EducationDocument24 pagesSpecial EducationRejill May LlanosNo ratings yet

- Learner Centered Psychological PrinciplesDocument17 pagesLearner Centered Psychological PrinciplesMark James VinegasNo ratings yet

- Fry SlidesManiaDocument12 pagesFry SlidesManiaRosie-Lyn OgalaipNo ratings yet

- On Becoming A Glocal Teacher MACUGAY EVA BDocument14 pagesOn Becoming A Glocal Teacher MACUGAY EVA Bcatalino parotcha0% (1)

- MIDTERM Test - Building and Enhancing New Literacies Across Curriculum - QuizletDocument10 pagesMIDTERM Test - Building and Enhancing New Literacies Across Curriculum - QuizletSherwin Buenavente SulitNo ratings yet

- A Presentation in Foundations of EducationDocument44 pagesA Presentation in Foundations of EducationJordan LlegoNo ratings yet

- Sc-Ve Values EducationDocument17 pagesSc-Ve Values EducationKimberly Joyce ArdaisNo ratings yet

- Part I. Socio-Demographic Profile: Interview ScheduleDocument4 pagesPart I. Socio-Demographic Profile: Interview ScheduleLaurence Brian HagutinNo ratings yet

- Form - (Instructions) CHED IAS Form 15Document3 pagesForm - (Instructions) CHED IAS Form 15AngzNo ratings yet

- Implication Teacher's DevelopmentDocument13 pagesImplication Teacher's DevelopmentCapix ShinobuNo ratings yet

- Technology For Teaching and Learning 2 PDFDocument30 pagesTechnology For Teaching and Learning 2 PDFchristine jhenn villalobos100% (1)

- AXA Sample ProposalDocument10 pagesAXA Sample Proposalneilmijares23No ratings yet

- Adap - LifebasixDocument13 pagesAdap - LifebasixKat EspanoNo ratings yet

- Proposed Insured: Mr. Renzi Javier de Castro Age 33, Male, Non-Smoker Policyowner or Payor: Mr. Renzi Javier de Castro Age 33, Male Dear RenziDocument12 pagesProposed Insured: Mr. Renzi Javier de Castro Age 33, Male, Non-Smoker Policyowner or Payor: Mr. Renzi Javier de Castro Age 33, Male Dear RenziMarc Darrel OmbaoNo ratings yet

- LIT NotesDocument737 pagesLIT NotesMegat AlifNo ratings yet

- BST 1 - Variable Life Insurance v1.0Document42 pagesBST 1 - Variable Life Insurance v1.0Donna Mae Palabay MalasigNo ratings yet

- NC Life Insurance Practice Exam QuestionsDocument42 pagesNC Life Insurance Practice Exam QuestionsFabian NonesNo ratings yet

- Insurance Commision Variable Insurance ContractsDocument11 pagesInsurance Commision Variable Insurance ContractsPetRe Biong PamaNo ratings yet

- Life Insurance Products & Terms PDFDocument16 pagesLife Insurance Products & Terms PDFSuman SinhaNo ratings yet

- 2,5kMR ERROL SOLIDARIOS PAA Plus Quotation PDFDocument8 pages2,5kMR ERROL SOLIDARIOS PAA Plus Quotation PDFErrol Rabe SolidariosNo ratings yet

- Anniversary Statement 25 January 2016Document3 pagesAnniversary Statement 25 January 2016Rodel Ryan YanaNo ratings yet

- TemplateDocument36 pagesTemplateSubhan Imran100% (1)

- 2011 Tot PDFDocument86 pages2011 Tot PDFAssur AnceNo ratings yet

- Shriram Life InsuranceDocument31 pagesShriram Life Insurancebhagyashree mohantyNo ratings yet

- Foreign Trusts: Their Distinguishing Features and The Consequences of Their Use-An UpdateDocument15 pagesForeign Trusts: Their Distinguishing Features and The Consequences of Their Use-An UpdateChristopher S. Armstrong100% (2)

- 10 YEARS OLD - YEAR - OLD - Exact - 10LP - QuotationDocument12 pages10 YEARS OLD - YEAR - OLD - Exact - 10LP - QuotationAntoniette Samantha NacionNo ratings yet

- Swati 2022Document84 pagesSwati 2022Anil kadamNo ratings yet

- IC 38 IRDA Exam Question Bank PDF For Life Insurance - Ambitious BabaDocument30 pagesIC 38 IRDA Exam Question Bank PDF For Life Insurance - Ambitious BabaPrince DipuNo ratings yet

- Variable - Online Mock ExamDocument11 pagesVariable - Online Mock ExamMitziRawrrNo ratings yet

- Life Insurance Is A Contract Between The Policy Owner and TheDocument27 pagesLife Insurance Is A Contract Between The Policy Owner and TheRicha JainNo ratings yet

- U01 Apps SGSunSMART SGSunSMARTFiles OPENILLUSTRATIONPDF 800954O150420211227375178095Document11 pagesU01 Apps SGSunSMART SGSunSMARTFiles OPENILLUSTRATIONPDF 800954O150420211227375178095Marilou AgustinNo ratings yet

- LLQP Final Exam Ques PDFDocument57 pagesLLQP Final Exam Ques PDFRitesh Laller17% (6)

- DLD InsCom VUL ReviewerDocument12 pagesDLD InsCom VUL ReviewerMaria Joselda VillanuevaNo ratings yet

- Classification of InsuranceDocument10 pagesClassification of InsuranceKhalid MehmoodNo ratings yet

- IC Exam ReviewerDocument14 pagesIC Exam Reviewerfrancis75% (8)

- STD Insurance Commission VUL REVIEWER Answer Key 1.2Document12 pagesSTD Insurance Commission VUL REVIEWER Answer Key 1.2Shenna PalajeNo ratings yet

- VIVENCIA PRIME All RidersDocument12 pagesVIVENCIA PRIME All RidersRalph RUzzelNo ratings yet

- IC 38 Short Notes (2) 125Document1 pageIC 38 Short Notes (2) 125Anil KumarNo ratings yet

- Variable Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerDocument14 pagesVariable Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerKenneth QuiranteNo ratings yet

- Set For Life 10pay Sales Illustration: Celebrate LivingDocument11 pagesSet For Life 10pay Sales Illustration: Celebrate LivingJane NavarezNo ratings yet

- Ic38 Q&a-2Document29 pagesIc38 Q&a-2Anonymous O82vX350% (2)

- LyndonBasc 0894220504221237Document7 pagesLyndonBasc 0894220504221237LyndonNo ratings yet

- Supplemental Background Material: Life and Health Insurance FundamentalsDocument48 pagesSupplemental Background Material: Life and Health Insurance FundamentalsCarolNo ratings yet

- Notice: Investment Company Act of 1940: Cohen & Steers VIF Realty Fund, Inc., Et Al.Document7 pagesNotice: Investment Company Act of 1940: Cohen & Steers VIF Realty Fund, Inc., Et Al.Justia.comNo ratings yet