Professional Documents

Culture Documents

IT Declaration-1555459035665

Uploaded by

Pooja ParabOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IT Declaration-1555459035665

Uploaded by

Pooja ParabCopyright:

Available Formats

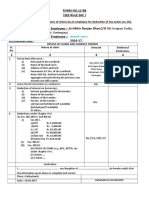

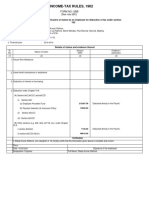

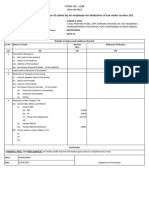

FORM NO.

12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1.Name and address of the employee : Aditya Ajit Torde

2.Permanent Account Number of the employee : AMTPT5768R

3.Financial year : 2019-20

Details of claims and evidence thereof

Sl. Nature of claim Amount Evidence / particulars

No. (Rs.)

(1) (2) (3) (4)

1. House Rent Allowance:

(i) Rent paid to the landlord 108,000.00

(ii) Name of the landlord SANTOSH KADAM

(iii) Address of the landlord 31/614, NEW MBPT COLONY, NADKARNI

PARK,WADALA EAST ANTOP HILL,MUMBAI

400037-

(iv) Permanent Account Number of the landlord AGIPK2796H

Note: Permanent Account Number shall be furnished if the aggregate rent paid during the

previous year exceeds one lakh rupees

2. Leave travel concessions or assistance

3. Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

(ii)Name of the lender

iii) Address of the lender

(iv) Permanent Account Number of the lender

(a) Financial Institutions(if available)

(b) Employer(if available)

(c) Others

4. Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

Children Tuition Fees 104,000.00

(ii) Section 80CCC

(iii) Section 80CCD

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A.

80D - Medical Bills - Very Senior Citizen 20,000.00

5. Deduction under Section 24

Verification

I, Aditya Ajit Torde son/daughter of Ajit Chhabu Torde do hereby certify that the information given above is complete and correct.

Place:

Date: 10-Apr-2019 (Signature of the employee)

Designation: Area Business Manager Full Name: Aditya Ajit Torde

You might also like

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAshokdheena 619No ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192mayurNo ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBDedyTo'tedongNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBWater SpecNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFSahil KumarNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBPrAbHaS DarLiNgNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFRudolph Antony ThomasNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMuhammed RiyazNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMeghana JoshiNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Fabdd PDFDocument3 pagesFabdd PDFSahil KumarNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Tax DeclarationDocument2 pagesTax DeclarationVISHAKHA SHARMANo ratings yet

- ONGC Road, Patharkandi. Dist. Karimganj.: Form No.12 BB (See Rule 26C)Document1 pageONGC Road, Patharkandi. Dist. Karimganj.: Form No.12 BB (See Rule 26C)Mriganko DharNo ratings yet

- FormDocument2 pagesFormdileepNo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- Form 12BBDocument2 pagesForm 12BBsumitgp87No ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- Form - 12BBDocument2 pagesForm - 12BBmudassir mNo ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- Income Tax Savings Declaration Form EngDocument2 pagesIncome Tax Savings Declaration Form EngDedyTo'tedongNo ratings yet

- Img 0006Document3 pagesImg 0006Puneet GuptaNo ratings yet

- Form 12BDocument2 pagesForm 12BNageswar MakalaNo ratings yet

- FORM12BBDocument1 pageFORM12BBBotla RajaNo ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Form12bb 5663202Document2 pagesForm12bb 5663202uttamraochopade52No ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportAnkit RajNo ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument4 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence Thereofvijay sharmaNo ratings yet

- Barclays Bank Statement 3Document3 pagesBarclays Bank Statement 3zainab100% (1)

- Business Finance Module 5Document10 pagesBusiness Finance Module 5CESTINA, KIM LIANNE, B.No ratings yet

- Introduction To Bankruptcy Law 6Th Edition Frey Test Bank Full Chapter PDFDocument31 pagesIntroduction To Bankruptcy Law 6Th Edition Frey Test Bank Full Chapter PDFchastescurf7btc100% (10)

- Acknowledge ReceiptDocument4 pagesAcknowledge ReceiptdimenmarkNo ratings yet

- Suggestions Support: (/Merchantportal/Index - Jsf?Javax - Faces.Token 1512344759688)Document3 pagesSuggestions Support: (/Merchantportal/Index - Jsf?Javax - Faces.Token 1512344759688)Surinder ChughNo ratings yet

- ACT1104 Assignment 4Document5 pagesACT1104 Assignment 4cjorillosa2004No ratings yet

- Bima Gold by Lic of India - 9811896425Document3 pagesBima Gold by Lic of India - 9811896425Harish ChandNo ratings yet

- Financial Markets and Institutions: Assignment-4Document4 pagesFinancial Markets and Institutions: Assignment-4diveshNo ratings yet

- 49m DR - Gabriel - 29may2020 EffendyDocument5 pages49m DR - Gabriel - 29may2020 EffendyFaith Wave driveNo ratings yet

- SWAYAM SchemeDocument8 pagesSWAYAM Schemekashif raja khanNo ratings yet

- Heirs of Zoilo Espiritu v. Sps. LandritoDocument3 pagesHeirs of Zoilo Espiritu v. Sps. LandritoGrace Ann TamboonNo ratings yet

- SR 2023 MT101Document55 pagesSR 2023 MT101Masoud DastgerdiNo ratings yet

- Epayslip 2023-07-27 31173270Document1 pageEpayslip 2023-07-27 31173270ryan robert mercadoNo ratings yet

- September AthenaDocument1 pageSeptember AthenaSathyavathi PyNo ratings yet

- 空调维修已付款凭证Document3 pages空调维修已付款凭证william6703No ratings yet

- How To Build Business Credit 060518Document20 pagesHow To Build Business Credit 060518James ClaireNo ratings yet

- Originators Guide Rules v2.3 Nov 06Document171 pagesOriginators Guide Rules v2.3 Nov 06BobNo ratings yet

- HTFDRecent SalesDocument11 pagesHTFDRecent Salespostbox7310% (1)

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- Literature Review of Retail Banking in IndiaDocument5 pagesLiterature Review of Retail Banking in Indiac5qfb5v5100% (1)

- HRMM GuidenceDocument6 pagesHRMM GuidencenadliesaNo ratings yet

- Part III Money Market (Revised For 2e)Document31 pagesPart III Money Market (Revised For 2e)Harun MusaNo ratings yet

- 02 Handout 120Document5 pages02 Handout 120John michael ServianoNo ratings yet

- Gratuity Calculation For Municipality) EmployeesDocument4 pagesGratuity Calculation For Municipality) EmployeesPranab BanerjeeNo ratings yet

- JTHS Business Partner DirectorDocument10 pagesJTHS Business Partner DirectorGabriel AlvesNo ratings yet

- UMANG - One App, Many Government ServicesDocument1 pageUMANG - One App, Many Government Servicessuraj.sNo ratings yet

- Ashok KumarDocument2 pagesAshok Kumarapexlofi93421No ratings yet

- Loan Calculator WorksheetDocument1 pageLoan Calculator WorksheetFrancis Vijay Kumar Batta100% (1)

- Genmath Compound InterestDocument23 pagesGenmath Compound InterestAndrei Lee0% (1)

- Internship Report: Page - I ©daffodil International UniversityDocument30 pagesInternship Report: Page - I ©daffodil International UniversityMazharul IslamNo ratings yet