Professional Documents

Culture Documents

Satish Project Capital Structure

Uploaded by

Ashwin KumaraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Satish Project Capital Structure

Uploaded by

Ashwin KumaraCopyright:

Available Formats

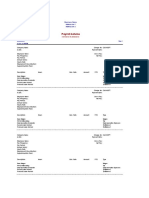

01272215/CEUPP7360A PRAGADEESS Govindaswamy SHANKAR

PART B (Annexure)

Details of Salary paid and any other income and tax deducted INR INR INR

1. Gross Salary

(a) Salary as per provisions contained in sec.17(1) 272997.00

(b) Value of perquisites u/s 17(2)

(as per Form No.12BA, wherever applicable) 0.00

(c) Profits in lieu of salary under section 17(3)

(as per Form No.12BA, wherever applicable) 0.00

(d) Total 272997.00

2. Less: Allowance to the extent exempt u/s 10 9600.00

Conveyance Exemption 9600.00

3. Balance(1-2) 263397.00

4. Deductions :

(a) Entertainment allowance 0.00

(b) Tax on employment 2190.00

5. Aggregate of 4(a) and (b) 2190.00

6. Income chargeable under the head 'salaries' (3-5) 261207.00

7. Add: Any other income reported by the employee 0.00

8. Gross total income (6+7) 261207.00

9. Deductions under chapter VI-A Gross amount Deductible amount

(A) sections 80C, 80CCC and 80CCD

(a) section 80C

i) Employee Provident Fund 9420.00 9420.00

(b) section 80CCC 0.00 0.00

(c) section 80CCD(2) 0.00 0.00

Note: 1. Aggregate amount deductible under sections 80C, 80CCC and

80CCD(1) shall not exceed two lakh rupees.

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A. Gross amount Qualifying amount Deductible amount

(a) 80D(03) 8022.00 8022.00 8022.00

10. Aggregate of deductible amount under Chapter VIA 17442.00

11. Total Income (8-10) 243770.00

12. Tax on total income 0.00

13. Education cess @ 3 % ( on tax computed at S.No.12 ) 0.00

14. Tax Payable (12+13) 0.00

15. Less: Relief under section 89 (attach details) 0.00

16. Tax payable (14-15) 0.00

Verification

I, CAWASI B JOKHI, son/daughter of BAHADUR JOKHI working in the capacity of SENIOR MANAGER (designation) do hereby certify

that the information given above is true, complete and correct and is based on the books of account, documents, TDS statements, and other

available records.

Place MUMBAI

Date 10.05.2018 (Signature of person responsible for deduction of tax)

Designation: SENIOR MANAGER Full Name: CAWASI B JOKHI

Annexure to Form No.16

Name: PRAGADEESS Govindaswamy SHANKAR Emp No.: 01272215

Particulars Amount(Rs.)

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Emoluments paid

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Basic Salary 78492.00

Conveyance Allowance 9600.00

House Rent Allowance 27468.00

Leave Travel Allowance 6540.00

Medical Allowance 3000.00

Arrears from previous yr/s -400.00

Food Coupons 20400.00

Night Shift Allowance 32600.00

Personal Allowance 65892.00

Variable Allowance 26400.00

City Allowance 3000.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Perks

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Gross emoluments 272997.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Income from other sources

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Total income from other sources 0.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Exemptions u/s 10

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Conveyance Exemption 9600.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Total Exemption 9600.00

Digitally Signed By CAWASI BAHADUR JOKHI

(TATA CONSULTANCY SERVICES LIMITED)

Date : 14-May-2018

Date: 10.05.2018 Full Name: CAWASI B JOKHI

Place: MUMBAI Designation: SENIOR MANAGER

01272215/CEUPP7360A PRAGADEESS Govindaswamy SHANKAR

FORM No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisites, other fringe

benefits or amenities and profits in lieu of salary with value thereof

1) Name and address of employer :

TATA CONSULTANCY SERVICES LTD. , 8th Flr, Nirmal Bldg, Nariman Point Mumbai - 400021 , Maharashtra

2) TAN: MUMT11446B

3) TDS Assesment Range of the employer :

,,,,

4) Name, designation and PAN of employee :

Mr/Ms: PRAGADEESS Govindaswamy SHANKAR , Desig.: Process Associate , Emp #: 01272215 , PAN: CEUPP7360A

5) Is the employee a director or a person with substantial interest in

the company (where the employer is a company):

6) Income under the head "Salaries" of the employee : 261207.00

(other than from perquisites)

7) Financial year : 2017-2018

8) Valuation of Perquisites

S.No Nature of perquisites Value of perquisite Amount, if any, recovered Amount of perquisite

(see rule 3) as per rules ( INR ) from the employee (INR) chargeable to tax( INR)

(1) (2) (3) (4) Col(3)-Col(4) (5)

1 Accommodation 0.00 0.00 0.00

2 Cars/Other automotive 0.00 0.00 0.00

3 Sweeper, gardener, watchman or 0.00 0.00 0.00

personal attendant

4 Gas, electricity, water 0.00 0.00 0.00

5 Interest free or concessional loans 0.00 0.00 0.00

6 Holiday expenses 0.00 0.00 0.00

7 Free or concessional travel 0.00 0.00 0.00

8 Free meals 0.00 0.00 0.00

9 Free Education 0.00 0.00 0.00

10 Gifts, vouchers, etc. 0.00 0.00 0.00

11 Credit card expenses 0.00 0.00 0.00

12 Club expenses 0.00 0.00 0.00

13 Use of movable assets by employees 0.00 0.00 0.00

14 Transfer of assets to employees 0.00 0.00 0.00

15 Value of any other benefit 0.00 0.00 0.00

/amenity/service/privilege

16 Stock options ( non-qualified options ) 0.00 0.00 0.00

17 Other benefits or amenities 0.00 0.00 0.00

18 Total value of perquisites 0.00 0.00 0.00

19 Total value of profits in lieu of salary 0.00 0.00 0.00

as per section 17 (3)

9. Details of tax, -

(a) Tax deducted from salary of the employee under section 192(1) 0.00

(b) Tax paid by employer on behalf of the employee under section192(1A) 0.00

(c) Total tax paid 0.00

(d) Date of payment into Government treasury

DECLARATION BY EMPLOYER

I, CAWASI B JOKHI son/daughter of BAHADUR JOKHI working as SENIOR MANAGER (designation ) do hereby declare on behalf of

TATA CONSULTANCY SERVICES LTD. ( name of the employer ) that the information given above is based on the books of account,

documents and other relevant records or information available with us and the details of value of each such perquisite are in accordance with

section 17 and rules framed thereunder and that such information is true and correct.

Signature of the person responsible

for deduction of tax

Place: MUMBAI Full Name : CAWASI B JOKHI

Date : 10.05.2018 Designation : SENIOR MANAGER

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Amazon As An Employer: Section 4:-Group 6Document5 pagesAmazon As An Employer: Section 4:-Group 6Aarti VilasNo ratings yet

- Surplus Rules 2002Document33 pagesSurplus Rules 2002adhityaNo ratings yet

- Director Manager Benefits in NYC Resume Cris GansmanDocument3 pagesDirector Manager Benefits in NYC Resume Cris GansmanCrisGansmanNo ratings yet

- Chapter 1 Introduction To Human Resource ManagementDocument18 pagesChapter 1 Introduction To Human Resource ManagementBaron919No ratings yet

- Jasmine F Slaughter - Day&Zimmerman - Fall2011Document22 pagesJasmine F Slaughter - Day&Zimmerman - Fall2011studentATtempleNo ratings yet

- MBA PROJECT Reliance Energe Employee EngagementDocument85 pagesMBA PROJECT Reliance Energe Employee EngagementAakash Pareek100% (2)

- Importance of Effective Orientation and On BoardingDocument12 pagesImportance of Effective Orientation and On BoardingRobin Hull100% (1)

- 20 Roles and Responsibilities of HR ManagerDocument6 pages20 Roles and Responsibilities of HR ManagerAyushi Dhingra100% (2)

- HRM Payroll SummaryDocument4 pagesHRM Payroll SummarywhattheeNo ratings yet

- Guidelines On Administrative Matters IN APDocument16 pagesGuidelines On Administrative Matters IN APT.Raja Srinivasa ReddyNo ratings yet

- Incentives and Fringe BenefitsDocument4 pagesIncentives and Fringe BenefitsPankaj2cNo ratings yet

- 11Document2 pages11Anna CiciNo ratings yet

- Filas 2 ReviseDocument15 pagesFilas 2 ReviseLoretha Henry YanNo ratings yet

- Example Formal Report Methods For Motivating EmployeesDocument15 pagesExample Formal Report Methods For Motivating EmployeesnrljnnhNo ratings yet

- Executive Attrition: at NTPCDocument9 pagesExecutive Attrition: at NTPCSamNo ratings yet

- Myob Payslip TemplateDocument1 pageMyob Payslip Templateapi-384163101No ratings yet

- PKSDocument11 pagesPKSPankaj SharmaNo ratings yet

- Employee VoiceDocument19 pagesEmployee Voiceateeqabid100% (1)

- PRMS FAQsDocument3 pagesPRMS FAQsfriendbceNo ratings yet

- Chart Showing Computation of 'Salary' IncomeDocument3 pagesChart Showing Computation of 'Salary' IncomeRocky RkNo ratings yet

- Chicago Food and Beverage PresentationDocument30 pagesChicago Food and Beverage PresentationGulnara SharifullinaNo ratings yet

- Proof of Travel Not Required For Claiming LTADocument3 pagesProof of Travel Not Required For Claiming LTAyagayNo ratings yet

- Fringe Benefits 1Document13 pagesFringe Benefits 1Jessa Mae ZamudioNo ratings yet

- RemunerationDocument15 pagesRemunerationJoel HeathNo ratings yet

- Why Corporate Mentoring?: Five Benefits of A Workplace Mentoring ProgramDocument8 pagesWhy Corporate Mentoring?: Five Benefits of A Workplace Mentoring ProgramVP88No ratings yet

- Exit Interview Form Sample 2Document4 pagesExit Interview Form Sample 2iuliahaNo ratings yet

- Retirement Policy ResearchesDocument4 pagesRetirement Policy ResearchesGrace NudaloNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 336, Docket 94-7120Document13 pagesUnited States Court of Appeals, Second Circuit.: No. 336, Docket 94-7120Scribd Government DocsNo ratings yet

- Bata FinalDocument44 pagesBata FinalmrzeettsNo ratings yet

- A Project On Employee Motivation by Shahid KV ChavakkadDocument44 pagesA Project On Employee Motivation by Shahid KV ChavakkadsmillysamNo ratings yet