Professional Documents

Culture Documents

For Ate Maricar - Resignation Letter

Uploaded by

Rashanne Mallo Apellido0 ratings0% found this document useful (0 votes)

6 views2 pagesLetter

Original Title

For Ate Maricar_Resignation Letter

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLetter

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesFor Ate Maricar - Resignation Letter

Uploaded by

Rashanne Mallo ApellidoLetter

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

TOPIC: Bank Reconciliation

INTRODUCTION

Good afternoon, class.

Based on our last week’s discussion, we have learned that cash is

classified under the “current assets” section. Moreover, we have learned

that cash is the most liquid among them. Hence, it is prone to theft or

embezzlement and misappropriation. The good news is there is what you

called “cash management” when effective, may protect the company’s

money from loss through theft or fraud.

One of the characteristics of a system of cash control is periodic

reconciliation of bank statement balance and cash balance in the

company’s accounting records. Regular reconciliation of bank balance

and book balance for cash uncovers immediately any error or

irregularities in recording cash transactions. Any error or irregularity is,

therefore, rectified immediately.

Disclaimer! This measure may not totally eliminate the possibilities of

misappropriation or errors, but can significantly reduce the chances of

theft, loss, or inadvertent errors in the management of cash.

What is a bank reconciliation?

Bank Reconciliation - a statement which brings into agreement the cash

balance per book and cash balance per bank. It is usually prepared

monthly because the bank provides the depositor company its bank

statement at the end of every month. (Show a printed example and

define bank statement)

How does it work?

1. First, we need to observe and examine the bank statement. We

should look at the beginning cash balance, the credit and debit

memos, errors, if any, and the ending cash balance for the month

ended.

2. Second, we need to compare the beginning and ending cash

balances per books with the bank statement. These two accounts

should be equal because they are reciprocal accounts. Meaning,

when one account is debited, the other account is credited or vice

versa. Hence, in absence of errors committed by either in the bank

or book balances, these reciprocal accounts should be the same.

However, more frequent than not, these accounts differ due to

timing.

3. Third, we should identify and define the book and bank reconciling

items. (Use Robles book for the definitions)

Book - CMs, DMs, errors

Bank - DIT, OC, errors

4. Fourth, we apply the formula using the single - date bank

reconciliation. (Explain why single - date reconciliation) (Write the

pro forma Bank Recon Statement using the adjusted balance

method, Reference - Valix book)

(Solve the sample problem in Robles book)

5. Fifth, we prepare the adjusting entries.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- TSR 1054 Hollow World Campaign Setting PDFDocument264 pagesTSR 1054 Hollow World Campaign Setting PDFJohn Sweeney92% (12)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- INGLES Verbos Regulares e IrregularesDocument5 pagesINGLES Verbos Regulares e IrregularesDilia Romero FernandezNo ratings yet

- Implementing Rules for USJ-R JPIA's Mr. and Ms. Ambassadors PageantDocument16 pagesImplementing Rules for USJ-R JPIA's Mr. and Ms. Ambassadors PageantJacinto Doctolero Barruga III0% (1)

- The Robbery at Gotham National Bank - BatmanDocument2 pagesThe Robbery at Gotham National Bank - BatmanAna Lilia0% (1)

- Unit 9 Present Simple Passive y Past Simple PassiveDocument4 pagesUnit 9 Present Simple Passive y Past Simple PassiveJean Pierre Valladares HidalgoNo ratings yet

- Rex BarksDocument95 pagesRex BarksYorka Olavarria100% (5)

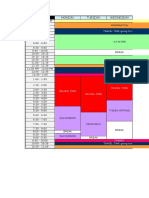

- Schedule: Monday Tuesday WednesdayDocument2 pagesSchedule: Monday Tuesday WednesdayRashanne Mallo ApellidoNo ratings yet

- Tax AssignmentDocument1 pageTax AssignmentRashanne Mallo ApellidoNo ratings yet

- For Ate Maricar - Resignation LetterDocument1 pageFor Ate Maricar - Resignation LetterRashanne Mallo ApellidoNo ratings yet

- 11981Document11 pages11981JanMikhailPanerioNo ratings yet

- For Ate Maricar - Resignation LetterDocument1 pageFor Ate Maricar - Resignation LetterRashanne Mallo ApellidoNo ratings yet

- How to Write an Effective Claim LetterDocument3 pagesHow to Write an Effective Claim LetterRashanne Mallo Apellido100% (1)

- Beezy ScheduleDocument1 pageBeezy Schedulerash_anne01No ratings yet

- Tenses Worksheet GR 11Document2 pagesTenses Worksheet GR 11ZahraNo ratings yet

- Muet Speaking Past Year QuestionsDocument13 pagesMuet Speaking Past Year QuestionsSteven Tan67% (3)

- App 9 20 24Document42 pagesApp 9 20 24Asbury Park PressNo ratings yet

- 1997 Herman Goldstein Award For Excellence in Problem-Oriented Policing A Nomination Submitted by The Indiana State Police DepartmentDocument17 pages1997 Herman Goldstein Award For Excellence in Problem-Oriented Policing A Nomination Submitted by The Indiana State Police DepartmentlosangelesNo ratings yet

- Northern Mythology, Comprising The Principal Popular Traditions and Superstitions of Scandinavia, North Germany, and The Netherlands3 PDFDocument378 pagesNorthern Mythology, Comprising The Principal Popular Traditions and Superstitions of Scandinavia, North Germany, and The Netherlands3 PDFSoulless_Demon100% (2)

- 06 Chapter2Document17 pages06 Chapter2meymeymeyNo ratings yet

- 7 Tips For Preventing Identity TheftDocument1 page7 Tips For Preventing Identity Theftnewsusa_01No ratings yet

- RobinhoodDocument30 pagesRobinhoodBinesh JoseNo ratings yet

- Times Leader 09-21-2011Document42 pagesTimes Leader 09-21-2011The Times LeaderNo ratings yet

- Peoria County Jail Booking Sheet For Sept. 2, 2016Document7 pagesPeoria County Jail Booking Sheet For Sept. 2, 2016Journal Star police documentsNo ratings yet

- Script TV Drama 1Document16 pagesScript TV Drama 1api-569784573No ratings yet

- Mip 02 AttachmentcguidelinesonassociaterelationsDocument2 pagesMip 02 AttachmentcguidelinesonassociaterelationsHanna MarzuuqohNo ratings yet

- LCSO Booking Report 9-12-2020Document2 pagesLCSO Booking Report 9-12-2020WCTV Digital TeamNo ratings yet

- Humor and Indian ParliamentDocument183 pagesHumor and Indian ParliamentRohit MishraNo ratings yet

- GP Crime and PunishmentDocument4 pagesGP Crime and PunishmentTan Kang SoonNo ratings yet

- Confirmation 1068409Document3 pagesConfirmation 1068409ankiosaNo ratings yet

- Accounting Information System EthicsDocument5 pagesAccounting Information System EthicsgailmissionNo ratings yet

- Oblicon Cases 1Document27 pagesOblicon Cases 1Rm GalvezNo ratings yet

- JD Restaurant Manager PDFDocument3 pagesJD Restaurant Manager PDFMukti UtamaNo ratings yet

- Shuford's Smokehouse Red Bank PD ReportDocument3 pagesShuford's Smokehouse Red Bank PD ReportNewsChannel 9 StaffNo ratings yet

- Reported SpeechDocument9 pagesReported SpeechFC DuqueRios MadridNo ratings yet

- Criminal Law 1 TranscriptDocument52 pagesCriminal Law 1 TranscriptErika TorrefielNo ratings yet

- California Prison ReformDocument29 pagesCalifornia Prison ReformPaul ColbertNo ratings yet

- Business English Vocabulary: Word MeaningDocument39 pagesBusiness English Vocabulary: Word MeaningJonathasNo ratings yet