Professional Documents

Culture Documents

Fact Salary

Uploaded by

msadithianOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fact Salary

Uploaded by

msadithianCopyright:

Available Formats

10.

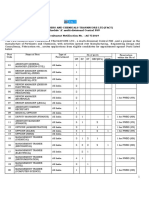

Statement of monthly remuneration of employees and workmen including system of

compensation.

For Executives

Remuneration to the Executives is governed by the directives of the Department of Public

Enterprises. The monthly pay structure for Executives indicating the minimum and maximum of

the pay scales are as under:

Below Board Level

Salary Basic Basic

DA Pattern

Grade Minimum Maximum

E-0 12600 32500

E-1 16400 40500

E-2 20600 46500

E-3 24900 50500 DA linked to AICPI

2001=100 which is 126.33 as

E-4 29100 54500 on 01.01.2007.

E-5 32900 58000

E-6 36600 62000

E-7 43200 66000

E-8 51300 73000

Board Level Executives

Director 65000 75000

As mentioned above.

CMD 75000 90000

In addition to the Basic within the above ranges indicated, Executives are entitled for DA linked

to AICPI 126.33 as on 01.01.2007, House Rent Allowance, Family Planning Allowance,

Allowance for Acquiring Higher Qualification, PF, Gratuity, Leave Encashment, Superannuation

Pension, Post Retirement Medical Benefit and Performance Related Pay as applicable to them.

Besides the above Executives are paid perks and allowance as admissible under A.I. No. 970

dated 16.02.2010 and 987 dated 11.10.2010.

For Workmen

The workmen compensation is through negotiations with the recognized unions. The

monthly pay structure for workmen, indicating the minimum and maximum of the pay

scales are as under:

Workmen

Salary Basic Basic

DA Pattern

Grade Minimum Maximum

W-1 8340 23470

W-2 8440 23750

w-3 8550 24060

w-4 8670 24400

w-5 8800 24770 DA linked to AICPI 1960=100

which is 3150 as on 01.07.2008.

w-6 8940 25160

w-7 9090 25580

w-8 9250 26030

w-9 9420 28968

w-10 9600 29525

In addition to the Basic within the above ranges indicated, Workmen are entitled for DA linked to

AICPI 1960=100 which is 3150 as on 01.07.2008, House Rent Allowance, Family Planning

Indian Rare Earths Ltd

Allowance, Allowance for Acquiring Higher Qualification, PF, Gratuity, Leave Encashment, Post

Retirement Medical Benefit and New Pension Scheme as applicable to them. Besides the above

Workmen are paid perks and allowance as admissible under the relevant long term wage

settlement as applicable.

You might also like

- ECIL Recruitment for 70 Technical Officer PositionsDocument4 pagesECIL Recruitment for 70 Technical Officer Positionsrajendra reddyNo ratings yet

- 98 2020Document4 pages98 2020msadithianNo ratings yet

- LAST DATE: 21/10/2020: CATEGORY NO: 103/2020 Part 1 (General Category)Document5 pagesLAST DATE: 21/10/2020: CATEGORY NO: 103/2020 Part 1 (General Category)msadithianNo ratings yet

- Product Supplier ListDocument46 pagesProduct Supplier ListmsadithianNo ratings yet

- Kamco AE SyllubusDocument3 pagesKamco AE SyllubusAmalTSathyan100% (1)

- Advt 01 2020 Final.Document38 pagesAdvt 01 2020 Final.msadithianNo ratings yet

- Request For Proposal in Two Bid System: Wncgoamo-Navy@nic - inDocument18 pagesRequest For Proposal in Two Bid System: Wncgoamo-Navy@nic - inmsadithianNo ratings yet

- Recruitment of Junior Executive On Fixed Tenure Contract BasisDocument3 pagesRecruitment of Junior Executive On Fixed Tenure Contract BasisSantosh KumarNo ratings yet

- Ticf Kwøm/ Aõy Hni-K/ S U-Td-J N) VXW (A-Õ-Y-S - Uv) : Aw-¡Msv) N.H, XNCP-H-/ - ) PCWDocument5 pagesTicf Kwøm/ Aõy Hni-K/ S U-Td-J N) VXW (A-Õ-Y-S - Uv) : Aw-¡Msv) N.H, XNCP-H-/ - ) PCWmsadithianNo ratings yet

- CHSL 2017 Schedule KeralaDocument5,941 pagesCHSL 2017 Schedule KeralamsadithianNo ratings yet

- Central Institute of Plastics Engineering & Technology (Cipet) (An Autonomous Body Under Ministry of Chemicals & Fertilizers, Govt of India)Document8 pagesCentral Institute of Plastics Engineering & Technology (Cipet) (An Autonomous Body Under Ministry of Chemicals & Fertilizers, Govt of India)Nagamani RajeshNo ratings yet

- A Government of India Undertaking) Administrative Building, Chembur, Mumbai-400 074Document45 pagesA Government of India Undertaking) Administrative Building, Chembur, Mumbai-400 074Nitin KeshavNo ratings yet

- AFCAT 2 Download Official Notification PDFDocument50 pagesAFCAT 2 Download Official Notification PDFmsadithianNo ratings yet

- Corri57 58Document2 pagesCorri57 58msadithianNo ratings yet

- Detailed Advt CRP Clerks IXDocument50 pagesDetailed Advt CRP Clerks IXSabeeha SayedNo ratings yet

- Final Seniority List of Joint DirectorsDocument2 pagesFinal Seniority List of Joint DirectorsmsadithianNo ratings yet

- Detailed Advt CRP Clerks IXDocument50 pagesDetailed Advt CRP Clerks IXSabeeha SayedNo ratings yet

- Cochin Shipyard Graduate Apprentice 2019Document11 pagesCochin Shipyard Graduate Apprentice 2019msadithianNo ratings yet

- Not 0062019 0872019Document6 pagesNot 0062019 0872019msadithianNo ratings yet

- Signature Not Verified: Digitally Signed by Reninath S N Date: 2018.12.07 17:18:57 Ist Location: EprocureDocument1 pageSignature Not Verified: Digitally Signed by Reninath S N Date: 2018.12.07 17:18:57 Ist Location: EprocuremsadithianNo ratings yet

- 07 2009 FACT Notification - 2may019Document17 pages07 2009 FACT Notification - 2may019rohit sinhaNo ratings yet

- 7th CPC Advisory and Option FormDocument2 pages7th CPC Advisory and Option FormmsadithianNo ratings yet

- Detailed Advertisement For The Recruitment of 312 Administrative Officers (Generalists and Specialists) (Scale I) 2018Document26 pagesDetailed Advertisement For The Recruitment of 312 Administrative Officers (Generalists and Specialists) (Scale I) 2018msadithianNo ratings yet

- Sl. Items Deno QTY EMD Rs 4,25,000Document2 pagesSl. Items Deno QTY EMD Rs 4,25,000msadithianNo ratings yet

- Notification AAICLAS Security Screener Posts PDFDocument15 pagesNotification AAICLAS Security Screener Posts PDFPraveen laxkarNo ratings yet

- Tendernotice 1Document35 pagesTendernotice 1msadithianNo ratings yet

- AFCAT 01-2019 NotificationDocument29 pagesAFCAT 01-2019 NotificationAyush Kumar SinghNo ratings yet

- AFCAT 01-2019 NotificationDocument29 pagesAFCAT 01-2019 NotificationAyush Kumar SinghNo ratings yet

- Sports File 15.11.18 Revised FINALDocument8 pagesSports File 15.11.18 Revised FINALmsadithianNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sunway Berhad (F) Part 2 (Page 97-189)Document93 pagesSunway Berhad (F) Part 2 (Page 97-189)qeylazatiey93_598514100% (1)

- Cambridge International General Certificate of Secondary EducationDocument6 pagesCambridge International General Certificate of Secondary EducationGurpreet GabaNo ratings yet

- Payment of Bonus Form A B C and DDocument13 pagesPayment of Bonus Form A B C and DAmarjeet singhNo ratings yet

- 1940 Doreal Brotherhood PublicationsDocument35 pages1940 Doreal Brotherhood Publicationsfrancisco89% (9)

- Investment Decision RulesDocument113 pagesInvestment Decision RulesHuy PanhaNo ratings yet

- Fortianalyzer v6.2.8 Upgrade GuideDocument23 pagesFortianalyzer v6.2.8 Upgrade Guidelee zwagerNo ratings yet

- Medford Airport History (TX)Document33 pagesMedford Airport History (TX)CAP History LibraryNo ratings yet

- IFB Microwave Oven Customer Care in HyderabadDocument8 pagesIFB Microwave Oven Customer Care in HyderabadanilkumarNo ratings yet

- Pradeep Kumar SinghDocument9 pagesPradeep Kumar SinghHarsh TiwariNo ratings yet

- How a Dwarf Archers' Cunning Saved the KingdomDocument3 pagesHow a Dwarf Archers' Cunning Saved the KingdomKamlakar DhulekarNo ratings yet

- Business and Transfer Taxation Chapter 11 Discussion Questions AnswerDocument3 pagesBusiness and Transfer Taxation Chapter 11 Discussion Questions AnswerKarla Faye LagangNo ratings yet

- Cardinal Numbers From 1 To 500Document9 pagesCardinal Numbers From 1 To 500Victor Tovar100% (1)

- The Art of War: Chapter Overview - Give A Brief Summary of The ChapterDocument3 pagesThe Art of War: Chapter Overview - Give A Brief Summary of The ChapterBienne JaldoNo ratings yet

- Summary of Kamban's RamayanaDocument4 pagesSummary of Kamban's RamayanaRaj VenugopalNo ratings yet

- National Dairy Authority BrochureDocument62 pagesNational Dairy Authority BrochureRIKKA JELLEANNA SUMAGANG PALASANNo ratings yet

- Engineering Economy 2ed Edition: January 2018Document12 pagesEngineering Economy 2ed Edition: January 2018anup chauhanNo ratings yet

- Important PIC'sDocument1 pageImportant PIC'sAbhijit SahaNo ratings yet

- Vista Print TaxInvoiceDocument2 pagesVista Print TaxInvoicebhageshlNo ratings yet

- MKT201 Term PaperDocument8 pagesMKT201 Term PaperSumaiyaNoorNo ratings yet

- Purpose and Types of Construction EstimatesDocument10 pagesPurpose and Types of Construction EstimatesAisha MalikNo ratings yet

- Final Exam 2012 EntryDocument2 pagesFinal Exam 2012 EntryYonatanNo ratings yet

- URP - Questionnaire SampleDocument8 pagesURP - Questionnaire SampleFardinNo ratings yet

- George Orwell (Pseudonym of Eric Arthur Blair) (1903-1950)Document10 pagesGeorge Orwell (Pseudonym of Eric Arthur Blair) (1903-1950)Isha TrakruNo ratings yet

- Human Resource Management in HealthDocument7 pagesHuman Resource Management in HealthMark MadridanoNo ratings yet

- An Analysis of Gram Nyayalaya Act, 2008 FDRDocument15 pagesAn Analysis of Gram Nyayalaya Act, 2008 FDRPrakash Kumar0% (1)

- Russian Revolution History Grade 9 NotesDocument6 pagesRussian Revolution History Grade 9 NotesYesha ShahNo ratings yet

- Fta Checklist Group NV 7-6-09Document7 pagesFta Checklist Group NV 7-6-09initiative1972No ratings yet

- FinTech BoguraDocument22 pagesFinTech BoguraMeraj TalukderNo ratings yet

- Quiz 2Document2 pagesQuiz 2claire juarezNo ratings yet

- Exam Notes PDFDocument17 pagesExam Notes PDFmmeiring1234No ratings yet