Professional Documents

Culture Documents

Form 16: Wipro Limited

Uploaded by

Prantik PramanikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16: Wipro Limited

Uploaded by

Prantik PramanikCopyright:

Available Formats

WIPRO LIMITED

Form 16 Digitally Signed

Form16 Details:

Employee Name: PRANTIK PRAMANIK

Employee PAN: CNAPP8766M

Employee Serial Number: 673061

Employee Designation: Senior Associate

Form16 Control Number: 673061/2015-16

Assessment Year: 2016-17 2016-17

Certificate Number:

E-file your Income-tax Return:

You can click the link below, to electronically file your Income -tax return.The link would transfer your Form Data to the

e-filing website of Skorydov (www.myITreturn.com).On the website you can enter additional details of your Income and

file your return electronically as per the provisions of the Income-Tax Department.

Click here to prepare your Income-tax Return

If you cannot open the link above then please visit www.myITreturn.com and follow the instructions mentioned therein.

Signature Details:

This form has been signed and certified using a Digital Signature Certificate as specified under section 119 of

the Income-tax Act, 1961.

The Digital Signature of the signatory has been affixed in the box provided below.To see the details and validate

the signature,you should click on the box.

Digitally Signed by : KRISHNAMURTHY BALASUBRAMANIAN

KRISHNAMURTHY BALASUBRAMANIAN

Digital Signature Certificate issued by : (N)CODE SOLUTIONS CA 2014 2016.05.31 10:29:44

Signer:

Serial Number of DSC : 1106395

CN=KRISHNAMURTHY BALASUBRAMANIAN

C=IN

Number of pages : 5 (including this page)

O=Personal , CID - 4275687

2.5.4.20=9b1be8a42be24cefd49e6ed3014274025fef3015b13c3f498d65e543547d8c86

Public key:

RSA/2048 bits

myITreturn.com PRANTIK PRAMANIK-673061

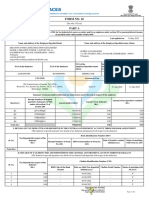

FORM NO.16

2016-17

PART A

Certificate under section 203 of the income-tax Act, 1961 for tax deducted at source on Salary

Certificate No.: Last Updated on:

Name and address of the Employer Name and address of the Employee

WIPRO LIMITED PRANTIK PRAMANIK

Senior Associate

# 76P & 80P,, SARJAPUR ROAD,, DODDAKANELLI,, BENGALURU, 673061

KARNATAKA, 560035

PAN of the Deductor TAN of the Deductor PAN of the Employee Employee Reference No. provided

by the Employer (if available)

AAACW0387R BLRW00126A CNAPP8766M 673061

CIT (TDS) Assessment Year Period

From To

2016-17

21/04/2015 31/03/2016

Summary of amount paid / credited and tax deducted at source theron in respect of the employee

Quarter(s) Receipt Numbers of original statements of Amount paid /credited Amount of tax deducted Amount of tax

TDS under sub-section (3) of section 200 deposited/remitted

(Rs.) (Rs.) (Rs.)

Quarter 1 0.00 0.00 0.00

Quarter 2 0.00 0.00 0.00

Quarter 3 0.00 0.00 0.00

Quarter 4 0.00 0.00 0.00

Total 0.00 0.00 0.00

II. DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sr. Tax Deposited in Respect of the Employee Challan Identification Number (CIN)

No (Rs.) BSR Code of the Date on which Tax Challan Serial Status of matching

Bank Branch Deposited (dd/MM/yyyy) number with OLTAS*

1

Verification

I, KRISHNAMURTHY BALASUBRAMANIAN son / daughter of KRISHNAMURTHY, working in the capacity of VICE PRESIDENT (designation) do hereby certify that a sum

of Rs. 0.00 [(RUPEES ZERO ONLY) (in words)] has been deducted and deposited to the credit of the Central Government. I further certify that the information given above

is true, complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

For WIPRO LIMITED

Place : BENGALURU Signature of the person responsible for deduction of tax

Date : 31-May-2016 This form is signed using Digital Signature. Please see page 1.

Designation : VICE PRESIDENT Full Name : KRISHNAMURTHY BALASUBRAMANIAN

myITreturn.com PRANTIK PRAMANIK-673061

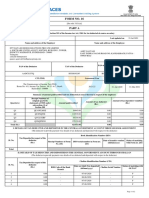

Part B (Annexure)

Details of Salary paid and any other Income and tax deducted Rs. Rs. Rs.

1. GROSS SALARY

(a) Salary as per provisions contained in section 17(1) 205,729.00

(b) Value of perquisites under section 17(2) 0.00

(as per Form No:12BA,wherever applicable)

(c) Profits in lieu of salary under section 17(3) 0.00

(as per Form No: 12BA,wherever applicable)

Total 205,729.00

2. Less : Allowance to the extent exempt u/s 10 12,045.00

Sl No. Allowance Rs.

1 Conveyance Exemption 12,045.00

3. Balance (1-2) 193,684.00

4. DEDUCTIONS :

(a) Entertainment Allowance 0.00

(b) Tax on Employment 1,410.00

5. Aggregate of 4 (a) and (b) 1,410.00

6. INCOME CHARGEABLE UNDER THE HEAD 'SALARIES' ( 3-5 ) 192,274.00

7. Add : Any other income reported by the employee

(a) Income under the Head 'Income from House Property' 0.00

0.00

8. GROSS TOTAL INCOME ( 6+7 ) 192,274.00

9. DEDUCTIONS UNDER CHAPTER VI-A

(A) Sections 80C, 80CCC & 80CCD

(a) Section 80C Gross Amount Deductible Amount

Employee Provident Fund 7,429.00 7,429.00

(b) Section 80CCC 0.00 0.00

(c) Section 80CCD(1) 0.00 0.00

(d) Section 80CCD(1B) 0.00 0.00

(e) Section 80CCD(2) 0.00 0.00

Total of (a) + (b) + (c) + (d) + (e) 7,429.00

Note: Aggregate amount deductible under sections, i.e., 80C, 80CCC and 80CCD(1) shall not

exceed one lakh fifty thousand rupees.

myITreturn.com PRANTIK PRAMANIK-673061

(B) Other Sections(e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A Gross Amount Qualifying Amount Deductible Amount

(a) 80 CCG Rajiv Gandhi Equity Scheme 0.00 0.00 0.00

(b) 80 D Medical Claim 450.00 450.00 450.00

(c) 80 DD Handicapped Dependents 0.00 0.00 0.00

(d) 80 DDB Medical Expenses, Chronic Diseases 0.00 0.00 0.00

(e) 80 E Interest on Loan taken for Higher Education 0.00 0.00 0.00

(f) 80 EE Interest on Loan for House Property 0.00 0.00 0.00

(g) 80 U Permanent Physical disability 0.00 0.00 0.00

(h) 80 G Donation 0.00 0.00 0.00

(i) 80 GG Rent paid(HRA not received) 0.00 0.00 0.00

(j) 80 TTA Deduction on Interest on Saving Account 0.00 0.00 0.00

450.00

10. Aggregate of deductible amounts under chapter VI-A 7,879.00

11. Total income (8-10 ) 184,395.00

12. Tax on total income 0.00

13. Rebate u/s 87A (for income upto Rs 5,00,000/-) 0.00

14. Tax Payable after rebate u/s 87A 0.00

15. Surcharge (@ 12% on tax at S. No. 14) 0.00

16. Education Cess @ 3% (on tax computed at S.No. 14+15) 0.00

17. Tax Payable (14+15+16) 0.00

18. Relief under section 89 0.00

19. Tax Payable (17-18 ) 0.00

20. Less : (a) Tax Deducted at source u/s 192 (1) 0.00

(b) Tax paid by the employer on behalf of the employee 0.00

u/s 192 (1A) on perquisites u/s 17(2)

0.00

21. Tax payable / refundable (19-20 ) 0.00

Verification

Income tax deducted in case of individual employee forms a part of total amount of monthly deposits.

I, KRISHNAMURTHY BALASUBRAMANIAN son / daughter of KRISHNAMURTHY, working in the capacity of VICE PRESIDENT (designation), do hereby certify that the information given above is true,

complete and correct and is based on the books of account, documents, TDS statements, and other available records.

For WIPRO LIMITED

Place : BENGALURU Signature of the person responsible for deduction of tax

Date : 31-May-2016 This form is signed using Digital Signature. Please see page 1.

Designation : VICE PRESIDENT Full Name : KRISHNAMURTHY BALASUBRAMANIAN

* Status of matching with OLTAS

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details mentioned in the TDS / TCS

F Final statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government account have been verified by Pay & Accounts Officer (PAO)

O Overbooked Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the amount is over claimed in the

statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or makes new payment for excess amount claimed in the statement

P Provisional Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on verification of payment details

submitted by Pay and Accounts Officer (PAO)

U Unmatched Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment details in bank match with details of

deposit in TDS / TCS statement

myITreturn.com PRANTIK PRAMANIK-673061

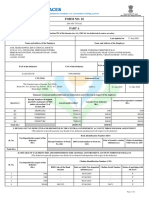

FORM NO. 12BA

{See Rule 26A(2)(B)}

Statement showing particulars of perquisites, other fringe benefits or

amenities and profits in lieu of salary with value thereof

1. Name and Address of the Employer : WIPRO LIMITED

# 76P & 80P,, SARJAPUR ROAD,, DODDAKANELLI,,

BENGALURU, KARNATAKA, 560035

2. TAN : BLRW00126A

3. TDS Assessment Range of the Employer :

4. Name of Employee : PRANTIK PRAMANIK

Designation : Senior Associate

PAN : CNAPP8766M

5. Is the Employee a Director or a person with substantial

interest in the company (Where the employer is a company) : NO

6. Income under the Head "Salaries" of the Employee : 205,729.00

(Other than from perquisites)

7. Financial Year : 2015-16 2015-16

8. Valuation of perquisites

Sl. Nature of perquisite Value of perquisite Amount, if any, recovered Amount of Taxable

No as per rules(Rs.) from employee(Rs.) perquisite(Rs.)

(1) Company Leased Accomadation 0.00 0.00 0.00

(2) Cars/Other Automotive 0.00 0.00 0.00

(3) Perq. on Driver Salary 0.00 0.00 0.00

(4) Perq. on Pension Contribution 0.00 0.00 0.00

(5) Interest free or concessional loans 0.00 0.00 0.00

(6) Perq. Long service Award 0.00 0.00 0.00

(7) Perq. on Transfer of Asset (CAR) 0.00 0.00 0.00

(8) Free Meals (Food Coupons Taxable) 0.00 0.00 0.00

(9) Free Education 0.00 0.00 0.00

(10) Gifts,vouchers,etc. 0.00 0.00 0.00

(11) Credit card expenses 0.00 0.00 0.00

(12) Club expenses 0.00 0.00 0.00

(13) Use of movable assets by employees 0.00 0.00 0.00

(14) Transfer of assets to employees 0.00 0.00 0.00

(15) Value of any other benefit/amenity/service/previlege 0.00 0.00 0.00

(16) Stock Options (ESOS Perquisites) 0.00 0.00 0.00

(17) Perq. On Medical Reimbursement 0.00 0.00 0.00

(18) Total Value of Perquisites 0.00 0.00 0.00

(19) Value of profits for in lieu of salary as per section 17(3) 0.00 0.00 0.00

* "Other benefits or amenties" includes medical reimbursement exceeding Rs. 15,000/-.

9. Details of Tax

a) Tax Deducted from Salary of Employee u/s 192(1) : 0.00

b) Tax Paid by Employer on behalf of Employee u/s 192(1A) : 0.00

c) Total Tax Paid : 0.00

d) Date of Payment into Government Treasury : As per Form-16

DECLARATION BY EMPLOYER

I, KRISHNAMURTHY BALASUBRAMANIAN son of KRISHNAMURTHY working as VICE PRESIDENT do hereby declare on behalf of WIPRO LIMITED that the

information given above is based on the books of account, documents and other relevant records or information available with us and the details of value of each such

perquisite are in accordance with section 17 and rules framed thereunder and that such information is true and correct.

For WIPRO LIMITED

Signature of the person responsible for deduction of tax

This form is signed using Digital Signature. Please see page 1.

Place: BENGALURU Full Name : KRISHNAMURTHY BALASUBRAMANIAN

Date : 31-May-2016 Designation : VICE PRESIDENT

myITreturn.com PRANTIK PRAMANIK-673061

You might also like

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedsaisindhuNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedpadduNo ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022BHARATH MPNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedRishabh PareekNo ratings yet

- Rajan Barot Mumbai Offer LetterDocument6 pagesRajan Barot Mumbai Offer LetterRajan BarotNo ratings yet

- E85888 RelievingLetterDocument1 pageE85888 RelievingLettervamsiwasiNo ratings yet

- Relieving - Service Certificate-M1050360Document1 pageRelieving - Service Certificate-M1050360SUNDARNo ratings yet

- Abrpb4480f Partb 2020-21Document3 pagesAbrpb4480f Partb 2020-21Subray N BanaulikarNo ratings yet

- Kansupriya@Deloitte - Com f162022 2023Document10 pagesKansupriya@Deloitte - Com f162022 2023Supriya KandukuriNo ratings yet

- Salaryslip 201770022 1 2018 Copy FebDocument1 pageSalaryslip 201770022 1 2018 Copy FebNazeera ShaikNo ratings yet

- Cyient Ltd..................Document1 pageCyient Ltd..................SyamkumarDuggiralaNo ratings yet

- Pay Slip March 2017Document4 pagesPay Slip March 2017Anonymous AsVoWD04c0% (1)

- A-Radha@dxc - Com F16Document9 pagesA-Radha@dxc - Com F16Radha PraveenNo ratings yet

- Aeries Technology Group Private Limited: Full and Final Settlement - December 2018Document3 pagesAeries Technology Group Private Limited: Full and Final Settlement - December 2018तेजस्विनी रंजनNo ratings yet

- Gmail - Letter of Intent - NAVEENA K - Ref. No. - 9263041 PDFDocument2 pagesGmail - Letter of Intent - NAVEENA K - Ref. No. - 9263041 PDFsivakumarNo ratings yet

- Relieving LetterDocument1 pageRelieving LetterJagadeesh SuraNo ratings yet

- Acctstmt FDocument3 pagesAcctstmt FAbhay SinghNo ratings yet

- TO Whomsoever It May Concern: Ltd. From 2 June, 2017 To 31 July, 2017Document1 pageTO Whomsoever It May Concern: Ltd. From 2 June, 2017 To 31 July, 2017Neeraj DwivediNo ratings yet

- 14th October, 2016 Confidential: To Whom So Ever It May ConcernDocument1 page14th October, 2016 Confidential: To Whom So Ever It May ConcernKunal LegacyNo ratings yet

- Manas PDFDocument3 pagesManas PDFSantosh Kumar RautNo ratings yet

- Form 16 - FY 20 - 21 - FY 2020 - 2021Document9 pagesForm 16 - FY 20 - 21 - FY 2020 - 2021Amit GautamNo ratings yet

- 1 1000 Form16Document5 pages1 1000 Form16Rakshit SharmaNo ratings yet

- Aofpc1472d 2020-21Document2 pagesAofpc1472d 2020-21uday digumarthiNo ratings yet

- Symbiotic Automation Systems (P) Ltd. Bangalore Pay Slip For The Month of March - 2017Document1 pageSymbiotic Automation Systems (P) Ltd. Bangalore Pay Slip For The Month of March - 2017Anindya BasuNo ratings yet

- Relieving LetterDocument1 pageRelieving LetterShivam GoyalNo ratings yet

- Reliving LatterDocument2 pagesReliving LatterRageshNo ratings yet

- Contractual Offer Letter - Chaturanan ChoudharyDocument1 pageContractual Offer Letter - Chaturanan ChoudharyAryan ChoudharyNo ratings yet

- Udaan Evf L2Document12 pagesUdaan Evf L2mayank.dce123No ratings yet

- 2019 20 PDFDocument7 pages2019 20 PDFSanjeet SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Process and Guidelines For ID Card SubmissionDocument2 pagesProcess and Guidelines For ID Card SubmissionSunil Yadav0% (1)

- AprilDocument1 pageAprilabhinavbartarNo ratings yet

- PDF ContentDocument9 pagesPDF Contentsuresh sivadasanNo ratings yet

- Experience LetterDocument1 pageExperience LetterSharathPundamalliNo ratings yet

- Pay Slip SeptemberDocument1 pagePay Slip SeptemberboomiNo ratings yet

- To Whomsoever It May Concern: Wipro LogoDocument1 pageTo Whomsoever It May Concern: Wipro LogoParvishMarmatNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- Roshan Sample ResumeDocument4 pagesRoshan Sample ResumeAbhijeetKushwaha100% (1)

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- Putul Mathur Vice President - Human ResourcesDocument1 pagePutul Mathur Vice President - Human ResourcesAnkita Nijhawan MalikNo ratings yet

- Virchow Petrochemical Private Limited: (C.Subbareddy) General ManagerDocument5 pagesVirchow Petrochemical Private Limited: (C.Subbareddy) General ManagerraajiNo ratings yet

- Worldwide SolutionsDocument1 pageWorldwide SolutionsKamlesh NandanwarNo ratings yet

- Vinay Kapoor & AssociatesDocument5 pagesVinay Kapoor & AssociatesHarbrinder GurmNo ratings yet

- Img 20190406 0001 PDFDocument5 pagesImg 20190406 0001 PDFsaravanan ramkumarNo ratings yet

- Form 16 20-21Document2 pagesForm 16 20-21Mohammad AliNo ratings yet

- Emp Temp Code: 1421519603 Kartikey Sharma Date: September 17, 2022Document4 pagesEmp Temp Code: 1421519603 Kartikey Sharma Date: September 17, 2022Arvind SinghaniyaNo ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- ConsolidatedMarksheet R210823018492Document1 pageConsolidatedMarksheet R210823018492Ritik VermaNo ratings yet

- Pi00358 - Relieving - Experience Letter-Amit Chandulal DesaiDocument1 pagePi00358 - Relieving - Experience Letter-Amit Chandulal Desaiamitdesai92No ratings yet

- April Salary SlipDocument1 pageApril Salary SlipTushar kumarNo ratings yet

- ZHR RVPN 111500Document69 pagesZHR RVPN 111500vinodk33506No ratings yet

- 17p31a1232 Vineetha Infosys PDFDocument9 pages17p31a1232 Vineetha Infosys PDFGisadoNo ratings yet

- T1152 - Gaurav Kumar Singh - Relieving LetterDocument1 pageT1152 - Gaurav Kumar Singh - Relieving LetterGaurav SinghNo ratings yet

- Relieving LetterDocument1 pageRelieving Lettereluri77manoj100% (1)

- Part B PDFDocument3 pagesPart B PDFDebesh KuanrNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- Accenture Solutions PVT LTDDocument1 pageAccenture Solutions PVT LTDVaraprasad ReddyNo ratings yet

- Appraisal Letter 2Document1 pageAppraisal Letter 2csreddyatsapbiNo ratings yet

- Form 16: Wipro LimitedDocument6 pagesForm 16: Wipro Limitedbharath50% (2)

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedIbrahim MohammadNo ratings yet

- Car No. Driver Name Month Date Login Hours BookingsDocument6 pagesCar No. Driver Name Month Date Login Hours BookingsPrantik PramanikNo ratings yet

- Account Interest CertificateDocument1 pageAccount Interest CertificatePrantik PramanikNo ratings yet

- Vishnu Solutions PVT LimitedDocument1 pageVishnu Solutions PVT LimitedPrantik PramanikNo ratings yet

- West Bengal Primary Teachers Manual PDFDocument139 pagesWest Bengal Primary Teachers Manual PDFPrantik Pramanik100% (1)

- LP:) (. LPT../,.R.: Ill: ! ./ R,,.li..r, I/i.,rDocument3 pagesLP:) (. LPT../,.R.: Ill: ! ./ R,,.li..r, I/i.,rPrantik PramanikNo ratings yet

- Multiple Choice Questions 1Document5 pagesMultiple Choice Questions 1Minh Hòa100% (1)

- 6a Department Order No 136 14 Guidelines For The Implementation of GHS PDFDocument30 pages6a Department Order No 136 14 Guidelines For The Implementation of GHS PDFAviects Avie JaroNo ratings yet

- Exam PrepDocument6 pagesExam PrepStarLink1No ratings yet

- Back Years Six Epfo Paper Apfc Ao EoDocument190 pagesBack Years Six Epfo Paper Apfc Ao EoshanuNo ratings yet

- Birla Institute OF Technology: BIT NoidaDocument21 pagesBirla Institute OF Technology: BIT NoidaAlankar BansalNo ratings yet

- New Features of Oracle Fusion Release 12Document136 pagesNew Features of Oracle Fusion Release 12kullayappa786No ratings yet

- Guide To Managing Workplace ConflictsDocument8 pagesGuide To Managing Workplace Conflictsblueraider007No ratings yet

- Defining Business Ethics: Afterwork AssessmentDocument12 pagesDefining Business Ethics: Afterwork AssessmentPamela Rose CasenioNo ratings yet

- Bruce George Elton Mayo 2013Document22 pagesBruce George Elton Mayo 2013epchotNo ratings yet

- Labor Relations Digest Atty CDocument2 pagesLabor Relations Digest Atty Ccedric vanguardNo ratings yet

- Running Head: ANALYZING A LEADER 1Document9 pagesRunning Head: ANALYZING A LEADER 1api-253788190No ratings yet

- WE Winter 2013Document44 pagesWE Winter 2013Venture PublishingNo ratings yet

- Impact of Unethical Behavior at Workplace PPT - FinalDocument11 pagesImpact of Unethical Behavior at Workplace PPT - Finalrahila ak0% (1)

- Tancinco v. GSIS. G.R. No. 132916. November 16, 2001 FactsDocument2 pagesTancinco v. GSIS. G.R. No. 132916. November 16, 2001 FactsJoshuaMaulaNo ratings yet

- LORA 1. Organizational Psychology - Definition, Scope, Importance, ApplicationDocument3 pagesLORA 1. Organizational Psychology - Definition, Scope, Importance, ApplicationLolsi Santurdzhiyan0% (1)

- Guide To Risk AssessmentDocument16 pagesGuide To Risk AssessmentArun IyerNo ratings yet

- SPM AssignmentDocument8 pagesSPM AssignmentKelvin MasekoNo ratings yet

- Agrawal Assignment 2Document8 pagesAgrawal Assignment 2Kritika AgrawalNo ratings yet

- Research ProposalDocument8 pagesResearch Proposalaeinekipla100% (1)

- Sample ResumeDocument2 pagesSample ResumeMom-c PSNo ratings yet

- Art. 106 109 ORAL RECITATIONDocument4 pagesArt. 106 109 ORAL RECITATIONGian Paula MonghitNo ratings yet

- Standard Operating Procedure For Health and SafetyDocument5 pagesStandard Operating Procedure For Health and SafetyEntoori Deepak ChandNo ratings yet

- TWENDEDocument8 pagesTWENDEwasswa isaac jeffNo ratings yet

- Challenges and Opportunities Affecting The Future of HRMDocument14 pagesChallenges and Opportunities Affecting The Future of HRMmehedee129No ratings yet

- MPNP Policy Guidelines PublicDocument13 pagesMPNP Policy Guidelines PublicfooNo ratings yet

- Greetings For The Day,: Hi ProfessionalsDocument3 pagesGreetings For The Day,: Hi Professionalssundeep kumar1No ratings yet

- IEEC - Batching and Crushing Plant ChecklistDocument15 pagesIEEC - Batching and Crushing Plant ChecklistgabinuangNo ratings yet

- Tourism Advantages and DisadvantagesDocument1 pageTourism Advantages and DisadvantagesAlif MahmudNo ratings yet

- SAG - Domestic Work NC IIDocument6 pagesSAG - Domestic Work NC IIMhel Demabogte100% (1)