Professional Documents

Culture Documents

The Stanton Brief Equity 5.29.19!2!2

Uploaded by

hannahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Stanton Brief Equity 5.29.19!2!2

Uploaded by

hannahCopyright:

Available Formats

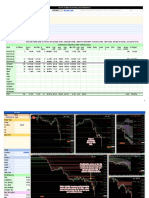

Stanton Analytics

The Stanton Brief For Trading On:

Equity Futures Wednesday, May 29, 2019

3 Day Cycle Study 1

Instrument ES NQ YM RTY

Cycle Day Neutral Neutral Neutral Neutral

Targets 2

ES NQ YM RTY

Upper Target 3 2,897.08 7,497.83 26,245 1,553.0

Upper Target 2 2,856.33 7,406.33 25,858 1,531.9

Upper Target 1 2,830.67 7,349.42 25,613 1,518.7

Moneyline 2,815.58 7,314.83 25,471 1,510.8

Lower Target 1 2,789.92 7,257.92 25,226 1,497.6

Lower Target 2 2,774.83 7,223.33 25,084 1,489.7

Lower Target 3 2,734.08 7,131.83 24,697 1,468.6

3 Day Rally Target (Last 20 Cycles) 3 2,838.29 7,400.58 25,666 1,527.0

3 Day Rally Target (All Cycles 10 Years) 3 2,828.47 7,348.92 25,575 1,524.4

Ranges and Rallys

ES NQ YM RTY

Average 3 Day Rally (Last 20 Cycles) 37.79 120.33 336 24.2

Average 3 Day Rally (All Cycles 10 Years) 27.97 68.67 245 21.6

Todays Max Range (Last 20 Cycles) 28.78 99.68 262 21.2

Todays Max Range (All Cycles 10 Years) 23.99 57.24 209 18.4

Odds of intraday Rallys or Declines of: >> Rally > 10 Rally > 20 Rally > 100 Rally > 10

85% 87% 76% 78%

Odds of intraday Rallys or Declines of: >> Rally > 20 Rally > 25 Rally > 150 Rally > 15

49% 81% 56% 54%

Notes

1.) The 3 Day Cycle consists of a BUY DAY, a NEUTRAL DAY and a SELL SHORT DAY, always in that order. On a BUY DAY, new buyers are

looking for value (lower prices) to initiate long positions; therefore the anticipated move is down to our targets or ranges. On a NEUTRAL

DAY, the expected move is sideways to up, with the BUY DAY low being the key level. Any move below and then back above the BUY DAY

low signals a long trade. On a SELL SHORT DAY the expected move is up, with prices exhausting at upper targets or range projections. At

any point in the CYCLE in which price exceeds the Average 3 Day Rally long positions are no longer advisable.

2.) Above Upper Target 3, long trades are no longer advisable. Below Lower Target 3, short trades are no longer advisable. Upper and

Lower Targets 1 and 2 are levels at which positions with multiple lots can consider scaling out of positions and locking in profits.

3.) A zero (0.0) will appear in the row "3 Day Rally Target" only on BUY DAYS in the CYCLE. The calculation requires knowing the price of the

BUY DAY low which is not known until after the day is complete.

Confidential. This document may not be reproduced or redistributed without the expressed written consent of Stanton Analytics.

You might also like

- Case 2Document5 pagesCase 2api-351143215No ratings yet

- I. Investment Objectives: Stocks ExpectationDocument3 pagesI. Investment Objectives: Stocks ExpectationThu ThuNo ratings yet

- Daily Market Update: June 07, 2023 June 07, 2023Document4 pagesDaily Market Update: June 07, 2023 June 07, 2023Shrayan DuariNo ratings yet

- Solutions Assignment 2Document5 pagesSolutions Assignment 2sirine zaltniNo ratings yet

- Daily Market Update: June 13, 2023 June 13, 2023Document4 pagesDaily Market Update: June 13, 2023 June 13, 2023Shrayan DuariNo ratings yet

- Stasticalfns CWDocument6 pagesStasticalfns CWArpit KurlNo ratings yet

- Top 3 Profitable Option Buying StrategiesDocument24 pagesTop 3 Profitable Option Buying StrategiesAbdul KaderNo ratings yet

- AllRounder AlgoReportDocument2 pagesAllRounder AlgoReportSabah SaleemNo ratings yet

- CSE Market Report Nov 26Document14 pagesCSE Market Report Nov 26Don Nuwan DanushkaNo ratings yet

- Coral Reef - SummaryDocument3 pagesCoral Reef - SummaryHikal GmailNo ratings yet

- Strategy Test ReportDocument2 pagesStrategy Test ReportHadiyatno HalibNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelSeroja NTT 2021No ratings yet

- Anand Kumar GourDocument8 pagesAnand Kumar GourMayank ChoukseyNo ratings yet

- Metabical Pricing Strategy - FarahqoonitaDocument10 pagesMetabical Pricing Strategy - FarahqoonitaFarah QoonitaNo ratings yet

- MRC JuliDocument2 pagesMRC Julisandro tobingNo ratings yet

- Daily Stocks Exploration for 13 August 2018Document1 pageDaily Stocks Exploration for 13 August 2018wahidNo ratings yet

- TexoilDocument2 pagesTexoilRaphael NdemNo ratings yet

- PSX Quote 31-08-2022Document42 pagesPSX Quote 31-08-2022wasayrazaNo ratings yet

- Pembahasan Kuis ALK 3 Kasus 2020Document11 pagesPembahasan Kuis ALK 3 Kasus 2020ihza srNo ratings yet

- Written Assignment Solution Unit 6Document6 pagesWritten Assignment Solution Unit 6Emmanuel Gift Bernard100% (1)

- Return On Equity Calculations: Yellow Cells Are User Inputs. Please Do Not Change Any Other CellDocument4 pagesReturn On Equity Calculations: Yellow Cells Are User Inputs. Please Do Not Change Any Other CellMohammad YaqoobNo ratings yet

- Daily Nifty 50 technical levels reportDocument6 pagesDaily Nifty 50 technical levels reportTejvinder SondhiNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- KimlolDocument9 pagesKimlolMorello SiméonNo ratings yet

- 3.8L Agarbatti MakingDocument9 pages3.8L Agarbatti MakingVedant AssociatesNo ratings yet

- Stock Analysis of Power Finance CorporationDocument5 pagesStock Analysis of Power Finance CorporationDeepak YadavNo ratings yet

- Jack Schwager's Complete Guide To Designing and Testing Trading SystemsDocument15 pagesJack Schwager's Complete Guide To Designing and Testing Trading SystemskosurugNo ratings yet

- JM Daily - 23 Aug - DebtDocument373 pagesJM Daily - 23 Aug - DebtPravin SinghNo ratings yet

- Bonds - October 25 2021Document3 pagesBonds - October 25 2021Lisle Daverin BlythNo ratings yet

- Bonds - October 26 2021Document3 pagesBonds - October 26 2021Lisle Daverin BlythNo ratings yet

- Perhitungan Working Hours DiggerDocument120 pagesPerhitungan Working Hours Diggerosmaini sutraNo ratings yet

- Manzana Insurance - Operations ManagementDocument9 pagesManzana Insurance - Operations ManagementRaghavanNo ratings yet

- Daftar Penerimaan Dana Kapitasi Puskesmas Mapane Bulan Februari 2015Document8 pagesDaftar Penerimaan Dana Kapitasi Puskesmas Mapane Bulan Februari 2015Hermansyah SuariNo ratings yet

- Σdemand ∈Previous Η Periods Η: Rosalijos, Reyman M. Bet-Mt2Document5 pagesΣdemand ∈Previous Η Periods Η: Rosalijos, Reyman M. Bet-Mt2reyman rosalijosNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Bonds - May 30 2021Document3 pagesBonds - May 30 2021Lisle Daverin BlythNo ratings yet

- Book 1Document4 pagesBook 1yajoxo7707No ratings yet

- BGD 01-02Document6 pagesBGD 01-02muthum44499335No ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsiteDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsitewahidNo ratings yet

- BootstrappingMath by RMDocument10 pagesBootstrappingMath by RMRudy Martin Bada AlayoNo ratings yet

- VERTEX TRADING BELL 03 FEB 2022 -Document3 pagesVERTEX TRADING BELL 03 FEB 2022 -dinilaNo ratings yet

- Aqu Vol21 IssueIDocument2 pagesAqu Vol21 IssueIkirthanaNo ratings yet

- FIS 2020-21 End Term AnswerDocument6 pagesFIS 2020-21 End Term AnswerAaryan SarupriaNo ratings yet

- 166 Nidhi ShettyDocument5 pages166 Nidhi ShettyAaboli KambliNo ratings yet

- Risk and Portfolio Management Spring 2011: Statistical ArbitrageDocument66 pagesRisk and Portfolio Management Spring 2011: Statistical ArbitrageSwapan ChakrabortyNo ratings yet

- ATS - Daily Trading PlanDocument1 pageATS - Daily Trading PlanRonAlNo ratings yet

- Hasil SPSSDocument28 pagesHasil SPSSFebri ZuanNo ratings yet

- Week 11 Test Template: Summary StatsDocument6 pagesWeek 11 Test Template: Summary StatsjeremyrulesNo ratings yet

- Bandhan Bank Ltd financial analysisDocument10 pagesBandhan Bank Ltd financial analysischandrajit ghoshNo ratings yet

- 79.80 MaghDocument68 pages79.80 MaghPrashant ThapaNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Price Loan Amount Term Rate Handling Fees: EFY APYDocument12 pagesPrice Loan Amount Term Rate Handling Fees: EFY APYJames KevinNo ratings yet

- ATS - Daily Trading Plan 4april2019Document1 pageATS - Daily Trading Plan 4april2019KPH BaliNo ratings yet

- Kim'S Trade Summary and Statistics: Link Jingjang TraderDocument4 pagesKim'S Trade Summary and Statistics: Link Jingjang TraderMorello SiméonNo ratings yet

- الواجب المنزليDocument9 pagesالواجب المنزليمحمد الحسنNo ratings yet

- Bonds - October 30 2018Document3 pagesBonds - October 30 2018Tiso Blackstar GroupNo ratings yet

- Bonds - October 31 2018Document3 pagesBonds - October 31 2018Tiso Blackstar GroupNo ratings yet

- Articles of Incorporation - Real EstateDocument6 pagesArticles of Incorporation - Real EstateRj Arevado100% (1)

- Chapter 05 - Statement of Financial Position and Statement of Cash FlowsDocument86 pagesChapter 05 - Statement of Financial Position and Statement of Cash FlowsRachel Mae Fajardo100% (2)

- BORN TO TRADE Ultimate Forex GuideDocument75 pagesBORN TO TRADE Ultimate Forex GuideOntiretse NgwakoNo ratings yet

- 2010-2015 FRM Practice ExamsDocument540 pages2010-2015 FRM Practice Examsmveytsman100% (13)

- HKDA Case WrittenDocument2 pagesHKDA Case WrittenMrDorakon0% (1)

- Ibbotson Classic Yearbook. Numerous Examples Are PresentedDocument15 pagesIbbotson Classic Yearbook. Numerous Examples Are PresentedWahyuniiNo ratings yet

- Wall Street Verdicts Settlements 1Document193 pagesWall Street Verdicts Settlements 1locopr1No ratings yet

- Project ForexDocument63 pagesProject ForexRitesh koliNo ratings yet

- DSFI Annual-Report 2015Document143 pagesDSFI Annual-Report 2015Yudhi MahendraNo ratings yet

- 6 Simple Strategies For Trading Forex PDFDocument89 pages6 Simple Strategies For Trading Forex PDFAgus Rian75% (4)

- Demo - Nism 8 - Equity Derivatives ModuleDocument7 pagesDemo - Nism 8 - Equity Derivatives ModuleBhupat1270% (1)

- FOREXDocument8 pagesFOREXIvy NisorradaNo ratings yet

- Ultra Fast ProfitDocument15 pagesUltra Fast ProfitPrima Arif Maulana100% (1)

- FINAL EXAM TITLEDocument6 pagesFINAL EXAM TITLEPsyche Rizsavi Fontanilla-MamadraNo ratings yet

- DA4399 CFA Level II Quick Sheet PDFDocument10 pagesDA4399 CFA Level II Quick Sheet PDFNikhil BhatiaNo ratings yet

- Export-Import DocumentationDocument31 pagesExport-Import DocumentationpakhtunNo ratings yet

- Barclays POINT BrochureDocument6 pagesBarclays POINT BrochureQilong ZhangNo ratings yet

- Voluntary Petition For Non-Individuals Filing For BankruptcyDocument89 pagesVoluntary Petition For Non-Individuals Filing For BankruptcyAnonymous lTRXIIVnyNo ratings yet

- Premier Cement 16Document177 pagesPremier Cement 16Leanna R. Braxton100% (1)

- Sametra Billiot, AC550 Wk7 HomeworkDocument4 pagesSametra Billiot, AC550 Wk7 HomeworkSametra BilliotNo ratings yet

- Et Wealth 23-29 Sep 2019Document27 pagesEt Wealth 23-29 Sep 2019shad ali sabriNo ratings yet

- 2008 Hanbook IAPS 1006Document90 pages2008 Hanbook IAPS 1006Vivienne BeverNo ratings yet

- Baltic Guide 2011-ViewingDocument41 pagesBaltic Guide 2011-ViewingPaul JärvetNo ratings yet

- Cordova v. Reyes Daway Lim Bernardo Lindo Rosales Law Offices (2007Document2 pagesCordova v. Reyes Daway Lim Bernardo Lindo Rosales Law Offices (2007Cherlene TanNo ratings yet

- F9D2Document30 pagesF9D2mysticsoulNo ratings yet

- ABBA - Annual Report - 2015 - Revisi PDFDocument271 pagesABBA - Annual Report - 2015 - Revisi PDFmei-257402No ratings yet

- Zero Management Fee MemoDocument13 pagesZero Management Fee MemomaxNo ratings yet

- Trade Like A Pirate - 67 Golden - Debra Hague PDFDocument632 pagesTrade Like A Pirate - 67 Golden - Debra Hague PDFniranjannlg100% (1)

- Foreign Market Entry StrategiesDocument33 pagesForeign Market Entry StrategiesSoumendra RoyNo ratings yet

- Monetary Theory: An IntroductionDocument30 pagesMonetary Theory: An IntroductionMina SkyNo ratings yet