Professional Documents

Culture Documents

Mua Sa Lun

Uploaded by

JuanHanzelLimboOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mua Sa Lun

Uploaded by

JuanHanzelLimboCopyright:

Available Formats

MEMORANDUM OF AGREEMENT FOR LIVELIHOOD LOAN FACILITY

(For Government Agencies/Corporations)

KNOW ALL MEN BY THESE PRESENTS:

This Memorandum of Agreement (the “Agreement”) made and entered by and

between:

LAND BANK OF THE PHILIPPINES, a government financial institution

created and existing under and by virtue of the provision of Republic Act

No. 3844, as amended, with principal office at LANDBANK Plaza, 1598

M. H. del Pilar cor. Dr. J. Quintos Street, Malate, Manila, Philippines,

represented by this by its President and Chief Executive Office, CECILLA

C. BORROMEO through her duly authorized representative, Department

Manager Catanauan Branch, MERCEDITA M. DE RAMA hereinafter

referred to as “LANDBANK”,

-and-

LOCAL GOVERNMENT UNIT OF CATANAUAN, a government agency

created and existing under and by virtue of Philippine law, with principal

office address at Barangay Poblacion 9, Catanauan, Quezon,

Philippines, represented herein by its Mayor and Chief Executive, ATTY.

ALMIRA A. ORFANEL hereinafter referred to as “LOCAL GOVERNMENT

UNIT OF CATANAUAN”.

WITNESSETH: That

WHEREAS, the LOCAL GOVERNMENT UNIT OF CATANAUAN requested

LANDBANK to extend its Livelihood Loan Facility (the “Facility”) to its qualified

employees:

WHEREAS, LANDBANK has agreed to the LOCAL GOVERNMENT UNIT OF

CATANAUAN request subject to such terms and conditions as may be mutually

agreed upon:

NOW, THEREFORE, for and in consideration of the foregoing premises and of

mutual covenants and stipulations hereafter set forth, the parties hereby mutually

agree as follows:

I. The grant of a livelihood loan under the Facility to the employees of

LOCAL GOVERNMENT UNIT OF CATANAUAN are subject to the

following terms and conditions.

II. Loan Amount

A. Borrower’s Eligibility Criteria

1. Except for appointive officials and their co-terminus

appointees, the borrower must be a regular/permanent

employee of the LOCAL GOVERNMENT UNIT OF

CATANAUAN and has been in the service for at least one

(1) year;

2. Must have no pending administrative/criminal case;

3. Must be eighteen (18) to sixty four (64) years of age at the

time of loan application; The Head of Agency whose age is

above the maximum requirement maybe accommodated,

provided:

3.1 The co-maker requirements are satisfied; and

3.2 Special insurance coverage thru Landbank

Insurance Brokerage, Inc. is approved / facilitated

and the special insurance premium coverage for the

whole term is paid.

4. Must have no pending application for retirement or not due

for retirement within the term of the loan;

5. Must be up-to-date in the payment of his/her existing loans

with LANDBANK, if any;

6. Must have a monthly net take-home pay (MNTHP) of Five

Thousand Pesos (P5,000.00) or such amounts as may be

prescribed by the General Appropriations Act which is in

effect at the time of loan application.

For avoidance of doubt, MNTHP is the resulting amount

after considering all deductions and amortizations of all

existing loans, including the livelihood loan applied for.

7. Must have a co-maker who is employed in the same

office/agency even if assigned to a different office/branch of

the agency within the same region. With at least equal rank

or salary grade and at least MNTHP as the borrower and is

not a co-maker of another employee-borrower under this

loan facility.

8. Must have an existing LANDBANK ATM Payroll Account

with the Servicing Branch where proceeds of loan shall be

credited and/or loan payments shall be debited, as may be

applicable.

1. Non – Elected

- Qualified rank and file (SG 17 & below) employees may avail

of a loan equivalent to up to eight (8) months of their Gross

Pay but not to exceed Two Hundred Twenty Thousand

Pesos (P220,000.00).

- Qualified officers (SG 18 & up) may avail of a loan equivalent

to up to eight (8) months of their Gross Pay but not to

exceed Four Hundred Fifty Thousand Pesos (P450,000.00).

2. Elected

- Elected Officials and Co-terminus appointees may avail of a

loan equivalent to up to eight (8) months of their Gross Pay

but not to exceed P500,000.00.

For avoidance of doubt, Gross Pay shall include Basic Pay and

RATA/ACA/PERA, meal allowance and other fixed allowances

of the same nature.

C. Manner of Release

The loan proceeds shall be net of Credit Life Insurance (CLI)

premium, penalty (if applicable) and other charges. The same shall be

credited to borrower’s existing LANDBANK deposit account (ATM or

Savings Account) maintained with the Servicing Branch.

D. Repayment Terms

1. The Loan shall have a minimum term of twelve (12) months

and maximum of thirty six (36) months with monthly term

divisor. For elected officials, the term should not exceed

three (3) months prior to remaining term of office of the

Borrower/LGU Officials.

2. The loan shall be paid in equal monthly amortization thru:

Option 1: Debit from by LANDBANK from employee-

borrower’s LANDBANK ATM Payroll Account

(thru DMVAL Facility) on the scheduled

remittance date.

Option 2: Salary/Payroll deduction from employee-

borrower by LOCAL GOVERNMENT UNIT OF

CATANAUAN and remitted to LANDBANK over

the counter (OTC) not later than five (5) banking

days after the scheduled remittance date.

3. The loan repayment shall commence on the payroll date

immediately succeeding the month the loan was released.

E. Loan Renewal

Loan renewal shall only be allowed on or after the anniversary date

of the loan provided that (a) LANDBANK has received payments

equivalent to at least twelve (12) monthly amortizations, and (b) the

co-maker/surety shall continue as co-maker/surety of the loan or

the borrower/employee has a new co-maker/surety who is qualified

under Section A.7 hereto.

F. Interest Rates and Other Charges

1. The interest rate on the loan under the Facility shall be

fixed at 12% per annum.

2. Interest for the whole term shall be payable in arrears and

shall be computed annually based on outstanding loan

balance.

3. The borrower shall be required to obtain a Credit Life

Insurance (CLI) for the entire term of the loan. Accordingly,

payment for premiums thereon that may be charged within

the term of the loan shall be deducted by LANDBANK from

the loan proceeds.

4. In case of loan renewal, unexpired insurance premium shall

be applied / deducted from the computed CLI premium due

of the loan or to be added to the loan proceeds.

5. Documentary Stamp taxes as may be imposed under

existing tax laws and regulations shall be for the account of

the employee-borrower.

6. All fees and other charges that may be due under the loan

may be adjusted at any time during the term of the loan, on

account of a regulation of the Monetary Board of the

Bangko Sentral ng Pilipimas, an increase in LANDBANK’s

cost of funding and/or maintaining the loan or other factors

including, but not limited to, any special reserve

requirements, exchange rate fluctuations and changes in

the financial market. LANDBANK shall notify the LOCAL

GOVERNMENT UNIT OF CATANAUAN and the Borrower

of such adjustment, which shall take effect on the next

succeeding amortization period following such notice.

G. Collaterals/Securities

The livelihood loan shall be secured by the borrower’s assignment

of his salaries, allowances, bonuses, retirement benefits,

separation/gratuity pay, monetary value of accumulated leave

credits and other monetary receivables from the LOCAL

GOVERNMENT UNIT OF CATANAUAN and ATM Payroll account

in favor of LANDBANK.

H. Past Due Account

1. An account shall be considered technical past due if the

borrower fails to pay his/her amortization on due date, and

such failure to pay is not remedied within five (5) banking

days from due date thereof;

2. A penalty fee equivalent to three percent (3%) per month

shall be imposed on the past due principal amount from the

day after due date of the loan up to the date of actual

payment.

3. The granting of loan to the employees of LOCAL

GOVERNMENT UNIT OF CATANAUAN shall be

temporarily suspended whenever:

a. Technical past due rate (PDR) reaches 10%; or

Actual PDR reaches 10%; or

b.

Combined Technical and Actual PDR reaches 10%.

c. The loan release shall resume when the LOCAL

GOVERNMENT UNIT OF CATANAUAN technical

and actual PDR are reduced below 10%.

I. Reciprocal Business Requirement

The granting of this Livelihood Loan Facility to qualified employees

and officials of LOCAL GOVERNMENT UNIT OF CATANAUAN

shall continue provided it maintains reciprocal business with

LANDBANK that warrants availment of the Facility.

II. Covenants of the Parties

A. The LOCAL GOVERNMENT UNIT OF CATANAUAN shall:

1. Have an existing agreement on ATM Payroll Facility with

LANDBANK, as may be applicable.

Maintain the following reciprocal business with LANDBANK

to warrant availment of the Livelihood Loan Facility:

a. Maintain Peso or Dollar Deposit (Current, Savings or

Time)

b. Maintain MDS Accounts

c, ATM Payroll Tie-up

d. Availment of Loan Products

e. Other identified reciprocal business

3. Certify through its Personnel Department that the borrower

and his co-borrower/surety are qualified to avail of the loan.

4. If applicable, require the employee/borrower and co-maker

to authorize LANDBANK to collect or cause the collection of

the installments/amortizations due on his/her loan through

automatic debit against borrower’s ATM Payroll account

using the DMVAL Facility until full settlement of the loan.

5. If applicable, collect or cause the collection of the

installments/amortizations due on the loans of its employee-

borrower through automatic salary deductions and remit to

LANDBANK not later than 5 banking days after the

scheduled remittance date until full settlement of the loan.

6. In case of transfer/reassignment of employee-borrower to

another unit/department with LOCAL GOVERNMENT UNIT

OF CATANAUAN reassignment of a borrower to another

government agency; termination/ separation from the

service of a borrower, the loan shall become due and

demandable. For this reason, the LOCAL GOVERNMENT

UNIT OF CATANAUAN shall require the employee-borrower

to secure prior clearance from LANDBANK to ensure

settlement of his/her obligation

7. Ensure adherence of its employees-borrowers/co-makers in

the Livelihood Loan Program guidelines.

Submit its Certification (for government agency) and

Secretary’s Certificate and/or Board Resolution (for

corporation) authorizing the execution of this Agreement and

designating its authorized signatory/ies hereto:

B. LANDBANK shall:

1. Provide livelihood loans to the qualified employees of

LOCAL GOVERNMENT UNIT OF CATANAUAN subject to

LANDBANK’s guidelines;

2. If applicable, provide the LOCAL GOVERNMENT UNIT OF

CATANAUAN a copy of the documents signed by the

employee/borrower authorizing LANDBANK to deduct from

his/her ATM Payroll account the monthly amortizations;

3. Provide the Personnel Department of LOCAL

GOVERNMENT UNIT OF CATANAUAN the list of approved

loan applications under the Facility, including the loan

amount, date of release and amortization schedule.

III. Other Conditions

A. Annual Review. The Facility shall be subject to annual review by

LANDBANK and all availments and drawdowns under this credit

program shall be subject to availability of funds.

B. Determination of Eligibility. Anything in this Agreement to the

contrary notwithstanding, the determination of the eligibility of

Entities/Agencies and/or Borrowers/Co-makers under this Facility

shall be the sole prerogative of LANDBANK.

C. Supplements and Amendments. The parties hereto, may, in

writing, amend the provisions, hereof.

You might also like

- Something SomethingDocument2 pagesSomething SomethingJuanHanzelLimboNo ratings yet

- Land Bank Cash Count SheetDocument1 pageLand Bank Cash Count SheetJuanHanzelLimboNo ratings yet

- Citi Mercury Jan 2016Document4 pagesCiti Mercury Jan 2016JuanHanzelLimboNo ratings yet

- Citi Rewards Visa document breakdownDocument6 pagesCiti Rewards Visa document breakdownJuanHanzelLimboNo ratings yet

- Citi Rewards Dec 2015Document6 pagesCiti Rewards Dec 2015JuanHanzelLimboNo ratings yet

- Mercury Drug Citi Card Statement BreakdownDocument6 pagesMercury Drug Citi Card Statement BreakdownJuanHanzelLimboNo ratings yet

- Online MANAGER’S CHECK (MC) REGISTER and PROCESSING SYSTEM (OMMCPSDocument19 pagesOnline MANAGER’S CHECK (MC) REGISTER and PROCESSING SYSTEM (OMMCPSJuanHanzelLimboNo ratings yet

- Violin Level 1Document39 pagesViolin Level 1Christian Noel50% (2)

- UITF Weekly UpdateDocument2 pagesUITF Weekly UpdateJuanHanzelLimboNo ratings yet

- Managerial AccountingDocument16 pagesManagerial AccountingJuanHanzelLimboNo ratings yet

- LANDBANK Remittance System Provides Real-Time Services for OFWsDocument87 pagesLANDBANK Remittance System Provides Real-Time Services for OFWsJuanHanzelLimboNo ratings yet

- Gubg Ho'Document1 pageGubg Ho'JuanHanzelLimboNo ratings yet

- Hbo Case JEWELDocument25 pagesHbo Case JEWELJuanHanzelLimboNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Maharashtra State Electricity Distribution Co. LTDDocument2 pagesMaharashtra State Electricity Distribution Co. LTDMrityunjay PathakNo ratings yet

- Viva On Plastic MoneyDocument13 pagesViva On Plastic MoneySmita GuptaNo ratings yet

- Mathematics of Finance Canadian 8Th Edition Brown Solutions Manual Full Chapter PDFDocument54 pagesMathematics of Finance Canadian 8Th Edition Brown Solutions Manual Full Chapter PDFretailnyas.rjah100% (8)

- Tutorial Topic 4Document4 pagesTutorial Topic 4Aiyoo JessyNo ratings yet

- Get Loan Agreement PDFDocument9 pagesGet Loan Agreement PDFRicardo RodriguezNo ratings yet

- PI For Ayu 50kgDocument1 pagePI For Ayu 50kgNikitiw UtariNo ratings yet

- Ahrefs Invoice AzqJJYTY53mgM1lGODocument2 pagesAhrefs Invoice AzqJJYTY53mgM1lGOlalatendu ParidaNo ratings yet

- Oblicon Case DigestsDocument10 pagesOblicon Case DigestsMikkaEllaAnclaNo ratings yet

- Clix REPAYMENT - SCHEDULE - REPORT AC2019091353787Document1 pageClix REPAYMENT - SCHEDULE - REPORT AC2019091353787Manohar ChaudharyNo ratings yet

- Econ 101E (Module 3) Hand-Out Money-Time Relationship 1st Sem 2020-2021Document5 pagesEcon 101E (Module 3) Hand-Out Money-Time Relationship 1st Sem 2020-2021May May MagluyanNo ratings yet

- A Study On Customers Preference and Satisfaction of Four Basic Banking Services in Coimbatore and ErodeDocument12 pagesA Study On Customers Preference and Satisfaction of Four Basic Banking Services in Coimbatore and Erodesankar_anand247034No ratings yet

- Town Savings and Loan Bank vs. CADocument2 pagesTown Savings and Loan Bank vs. CANoo NooooNo ratings yet

- Government of Canada Cheques: Security FeaturesDocument14 pagesGovernment of Canada Cheques: Security FeatureslindaNo ratings yet

- T8-R44-P2-Hull-RMFI-Ch24-v3 - Study NotesDocument22 pagesT8-R44-P2-Hull-RMFI-Ch24-v3 - Study Notesshantanu bhargavaNo ratings yet

- Growth Strategy of ICICI BankDocument2 pagesGrowth Strategy of ICICI Banksonu1aNo ratings yet

- Corporate Restructuring & Valuation: Bank of Rajasthan MergerDocument5 pagesCorporate Restructuring & Valuation: Bank of Rajasthan MergerDevanshee KothariNo ratings yet

- NWB2594 - 1014 - 90513889 2Document5 pagesNWB2594 - 1014 - 90513889 2Nick VoulgarisNo ratings yet

- Holding a Commercial Partnership at Maandeeq Poultry FarmDocument3 pagesHolding a Commercial Partnership at Maandeeq Poultry FarmWandaNo ratings yet

- Role of Central Bank With Reference To Indian ScenarioDocument19 pagesRole of Central Bank With Reference To Indian ScenarioImran Shaikh88% (16)

- Males Major Culprits For Infringing On Rights of Women and ChildrenDocument2 pagesMales Major Culprits For Infringing On Rights of Women and ChildrenserenityNo ratings yet

- Getachew TadesseDocument75 pagesGetachew TadesseBobasa S AhmedNo ratings yet

- BSP Published Circulars 2017Document2 pagesBSP Published Circulars 2017Remson OrasNo ratings yet

- Monetary Authority of Singapore - Interest Rates of Banks and Finance CompaniesDocument4 pagesMonetary Authority of Singapore - Interest Rates of Banks and Finance CompaniesMunif MuhammadNo ratings yet

- Banking Awareness Multiple Choice QuestionsDocument7 pagesBanking Awareness Multiple Choice QuestionsPriyanshuNo ratings yet

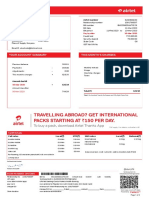

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesBASHARAT KHANNo ratings yet

- Monthly Banking/ Financial/ Economic Awareness SagaDocument48 pagesMonthly Banking/ Financial/ Economic Awareness SagaSunday MondayNo ratings yet

- Loans and AdvanceDocument8 pagesLoans and AdvanceDjay SlyNo ratings yet

- Republic BankDocument4 pagesRepublic BankNguyenNo ratings yet

- Ceramic Manufacture Case Study: (Project B - Failure To Perfect The Manufacturing Process)Document7 pagesCeramic Manufacture Case Study: (Project B - Failure To Perfect The Manufacturing Process)Mhira AlmeroNo ratings yet

- Commercial Invoice Gas Sale MozambiqueDocument1 pageCommercial Invoice Gas Sale Mozambiquealsone07No ratings yet