Professional Documents

Culture Documents

Labor Cost Worksheet 2012

Uploaded by

Elmar PacpacoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Labor Cost Worksheet 2012

Uploaded by

Elmar PacpacoCopyright:

Available Formats

Basic Instructions for use of the Labor Worksheet

Please notice that there are three tabs at the bottom of your screen labeled; Instructions for use, Completed example,

and Labor worksheet. You can access these tabs by simply clicking on the tab you want to open.

The yellow cells within the spreadsheet templates are meant to be used by you to enter the data required to calculate

the total burdened labor cost for one employee. You can also modify or add descriptions in the descriptions column.

This worksheet is protected so you can only enter or change information inside the yellow cells or the description cells.

This is done to help avoid making the mistake of entering data into a cell that contains formulas. If you need to modify

any formulas or add additional rows or columns; go to the review toolbar at the top of your screen, then un-protect the

sheet. (Be sure to protect the worksheet again to prevent unintended changes) NOTE: The red triangle in the upper

right corner of the yellow cells indicates that there is a comment about how to use or enter information relative to that

cell. To see the comment; pass your cursor over the cell. Use of this spreadsheet is at the total liability of the

user. Be careful with the formulas. Confirm that you have not missed any expenses specific to your company

that may not be listed on this worksheet.

Please send any comments or suggestions to Shawn McCadden at: shawn@shawnmccadden.com

BURDENED COST OF LABOR WORKSHEET

TEMPLATE

Yellow cells are meant for data entry. All other cells, except description cells, are locked to protect formulas or the function of the

spreadsheet.

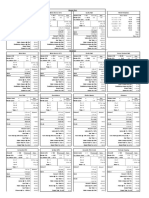

Employee: Bill Ding

Date of worksheet: Employee Compensation & Benefits

$2,800

Workweeks this year 52

Workdays each week 5 $3,300

Workhours each day 8

Actual hours to be paid 2080

Actual hours to be worked 1940

NON-PRODUCTIVE TIME Days Total Hours Cost/Year $38,800

Paid Holidays 5 40 $1,190.11

Paid Vacation days 5 40 $1,190.11

0 $0.00

Office meeting hours/year 50 $1,487.64 Income for hours worked

Hours to attend education 10 $297.53 Income for non-productive hours

$0.00 Employer paid benefits

Total 140 $4,165.38

EXPENSE RATE Capped at Cost/Year Cost/hour worked TOTALS

Basic hourly Wage: $20.00 $41,600.00 $21.44

Social Security 6.20% $106,800.00 $2,579.20 $1.33

Medicare 1.45% $603.20 $0.31

State Unemployment tax 1.50% $10,800.00 $162.00 $0.08

Federal Unemployment tax 0.80% $7,000.00 $56.00 $0.03

Workers Compensation 9.39% $3,906.24 $2.01

Liability Insurance 2.10% $873.60 $0.45

Total $49,780.24 $25.66 $25.66

BENEFITS Cost/Year Cost/hour worked

Medical Benefits/Insurance $3,000.00 $1.55

Education fees $300.00 $0.15

$0.00

Total $3,300.00 $1.70 $1.70

RELATED EXPENSES Cost/Year Cost/hour worked

Truck Payments or depreciation $2,000.00 $1.03

Truck Insurance $500.00 $0.26

Gas and Oil $1,200.00 $0.62

Cell Phone $740.00 $0.38

$0.00

Vehicle Maintenance $200.00 $0.10

Total $4,640.00 $2.39 $2.39

TOTAL HARD COST OF LABOR PER HOUR: $29.75

TOTAL BURDENED COST OF LABOR TO EMPLOYER THIS YEAR: $57,720.24

Based on hours to be paid

YEARLY INCOME OF EMPLOYEE FOR HOURS ACTUALLY WORKED: Income fo $38,800.00

Based on hours actually worked

YEARLY INCOME OF EMPLOYEE FOR NON-PRODUCTIVE HOURS: Income for $2,800.00

Based on hours paid to employee for time not producing income

TOTAL YEARLY INCOME OF EMPLOYEE: $41,600.00

Based on total hours to be paid

VALUE OF EMPLOYEE BENEFITS THIS YEAR: Employer p $3,300.00

Based on employer paid benefits

TOTAL EMPLOYEE COMPENSATION AND BENEFITS THIS YEAR: $44,900.00

Based on total yearly income paid by employer plus cost of benefits paid by employer

NOTE: All costs specified above assume employee will work every assigned workday, except paid holidays and vacation days

www.shawnmccadden.com

426675297.xlsx - Completed example Page 2 of 3 Copyright 2002 RDBI, LLP

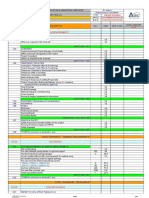

BURDENED COST OF LABOR WORKSHEET

TEMPLATE

Yellow cells are meant for data entry. All other cells, except description cells, are locked to protect formulas or the function of the

spreadsheet.

Employee:

Date of worksheet: Employee Compensation & Benefits

Workweeks this year 52

Workdays each week 5

Workhours each day

Actual hours to be paid 0

Actual hours to be worked 0

NON-PRODUCTIVE TIME Days Total Hours Cost/Year

Paid Holidays 0 #DIV/0!

Paid Vacation days 0 #DIV/0!

0 #DIV/0!

Office meeting hours/year #DIV/0! Income for hours worked

Hours to attend education #DIV/0! Income for non-productive hours

#DIV/0! Employer paid benefits

Total 0 #DIV/0!

EXPENSE RATE Capped at Cost/Year Cost/hour worked TOTALS

Basic hourly Wage: $12.00 $0.00 #DIV/0!

Social Security $0.00 #DIV/0!

Medicare $0.00 #DIV/0!

State Unemployment tax $0.00 #DIV/0!

Federal Unemployment tax $0.00 #DIV/0!

Workers Compensation $0.00 #DIV/0!

Liability Insurance $0.00 #DIV/0!

Total $0.00 #DIV/0! #DIV/0!

BENEFITS Cost/Year Cost/hour worked

Medical Benefits/Insurance #DIV/0!

Education fees #DIV/0!

#DIV/0!

Total $0.00 #DIV/0! #DIV/0!

RELATED EXPENSES Cost/Year Cost/hour worked

Truck Payments or depreciation #DIV/0!

Truck Insurance #DIV/0!

Gas and Oil #DIV/0!

Cell Phone #DIV/0!

#DIV/0!

Vehicle Maintenance #DIV/0!

Total $0.00 #DIV/0! #DIV/0!

TOTAL HARD COST OF LABOR PER HOUR: #DIV/0!

TOTAL BURDENED COST OF LABOR TO EMPLOYER THIS YEAR: $0.00

Based on hours to be paid

YEARLY INCOME OF EMPLOYEE FOR HOURS ACTUALLY WORKED: Income fo $0.00

Based on hours actually worked

YEARLY INCOME OF EMPLOYEE FOR NON-PRODUCTIVE HOURS: Income for $0.00

Based on hours paid to employee for time not producing income

TOTAL YEARLY INCOME OF EMPLOYEE: $0.00

Based on total hours to be paid

VALUE OF EMPLOYEE BENEFITS THIS YEAR: Employer p $0.00

Based on employer paid benefits

TOTAL EMPLOYEE COMPENSATION AND BENEFITS THIS YEAR: $0.00

Based on total yearly income paid by employer plus cost of benefits paid by employer

NOTE: All costs specified above assume employee will work every assigned workday, except paid holidays and vacation days

www.shawnmccadden.com

426675297.xlsx - Labor Worksheet Page 3 of 3 Copyright 2002 RDBI, LLP

You might also like

- Estimating & CostingDocument9 pagesEstimating & CostingArui RegarNo ratings yet

- Updated Status As On 31.12.2018 B PDFDocument33 pagesUpdated Status As On 31.12.2018 B PDFNitesh Jangir100% (1)

- Project Initiation: Radian Z. Hosen September 2012Document17 pagesProject Initiation: Radian Z. Hosen September 2012Untung PitoyoNo ratings yet

- Metal Sheet Rev2Document5 pagesMetal Sheet Rev2Mohammad SyeduzzamanNo ratings yet

- Project Costs: Project Task Labor Hours Labor Cost ($) Material Cost ($) Travel Cost ($) Other Cost ($) Total Per TaskDocument1 pageProject Costs: Project Task Labor Hours Labor Cost ($) Material Cost ($) Travel Cost ($) Other Cost ($) Total Per TaskKaruppasamy Gurusamy100% (1)

- Approved Budget Cost: I. Stage 1Document66 pagesApproved Budget Cost: I. Stage 1Joel King AzaresNo ratings yet

- Exhibit D Construction Budget TemplateDocument10 pagesExhibit D Construction Budget Templateivona009100% (1)

- Material Delivery ScheduleDocument20 pagesMaterial Delivery ScheduleBarnabas UdehNo ratings yet

- Cost CodesDocument5 pagesCost CodesMichael PadreJuanNo ratings yet

- Cost Code Breakdown: 03-001 NW Food WarehouseDocument2 pagesCost Code Breakdown: 03-001 NW Food WarehouseAnonymous szDONqNo ratings yet

- Contract No.: 2017eod0001Document11 pagesContract No.: 2017eod0001Jhundel PajarillagaNo ratings yet

- BOQ FormatExcelDocument2 pagesBOQ FormatExcelHomeSolutions Iloilo100% (2)

- Estimating Direct Costs of Welding EquationsDocument2 pagesEstimating Direct Costs of Welding EquationsGerson Suarez CastellonNo ratings yet

- Cost Estimate TemplateDocument61 pagesCost Estimate TemplateCorbyFrielNo ratings yet

- Construction of Covered Court QuimmarderoDocument1 pageConstruction of Covered Court QuimmarderoErwin Macapinlac MabutiNo ratings yet

- Template Estimation WBS v0.1Document11 pagesTemplate Estimation WBS v0.1FGW HN Trương Văn Đạt100% (1)

- How To Make A PERT-CPM Chart and SWOT AnalysisDocument8 pagesHow To Make A PERT-CPM Chart and SWOT Analysis'Ronnel Cris ⎝⏠⏝⏠⎠ Consul'0% (1)

- Cashflow Print - As Per Schedule G - 30!12!2018Document42 pagesCashflow Print - As Per Schedule G - 30!12!2018abhishekNo ratings yet

- Estimating & Budgeting Worksheet SampleDocument16 pagesEstimating & Budgeting Worksheet SamplejeesNo ratings yet

- Quotation of Tower Crane 40ftDocument2 pagesQuotation of Tower Crane 40ftBeni UtomoNo ratings yet

- BoQ - Structure Steel Request CostingDocument12 pagesBoQ - Structure Steel Request CostingRanu JanuarNo ratings yet

- Pipeline Unit Cost Estimator May-08 PDFDocument1 pagePipeline Unit Cost Estimator May-08 PDFGeorge DeriNo ratings yet

- Pag Asa Steel - ReinforcementDocument2 pagesPag Asa Steel - Reinforcementjremptymak100% (1)

- K7 PROJECT COST ESTIMATES 011822 11amDocument49 pagesK7 PROJECT COST ESTIMATES 011822 11amfrancis sebastian lagamayoNo ratings yet

- Site Work Estimating TipsDocument30 pagesSite Work Estimating TipsAguirre De Joya RonaldoNo ratings yet

- Detailed Unit Price Analysis (Dupa) : Designation No. of Person No. of Hours Hourly Rate Amount ADocument3 pagesDetailed Unit Price Analysis (Dupa) : Designation No. of Person No. of Hours Hourly Rate Amount AJigo AlianganNo ratings yet

- Steel manufacturing and industrial services project B.O.QDocument11 pagesSteel manufacturing and industrial services project B.O.QJettSorianoNo ratings yet

- TOTAL PC FLOWTEC INDIA ORGANIZATION CHARTDocument51 pagesTOTAL PC FLOWTEC INDIA ORGANIZATION CHARTHarshanand KalgeNo ratings yet

- Lead Estimator for Oil & Gas Operator in DubaiDocument2 pagesLead Estimator for Oil & Gas Operator in DubaiManoj SinghNo ratings yet

- Key Performance Indicators (Kpi) Tracker Worksheet Template: Company NameDocument2 pagesKey Performance Indicators (Kpi) Tracker Worksheet Template: Company NameTawfiq4444No ratings yet

- Caimbang 4thqtrFINALDocument131 pagesCaimbang 4thqtrFINALChesella Kaye Lungay100% (1)

- Cut & Fill Build Up Rates 2012Document18 pagesCut & Fill Build Up Rates 2012Tuan HafizuddinNo ratings yet

- Real Estate vs Shares Investment ComparisonDocument19 pagesReal Estate vs Shares Investment Comparisonamit1234No ratings yet

- Organization Chart TemplateDocument1 pageOrganization Chart TemplateVikas TiwariNo ratings yet

- Project Management Quick Reference GuideDocument5 pagesProject Management Quick Reference GuidejcpolicarpiNo ratings yet

- APO Productivity Database 2017v1Document1,109 pagesAPO Productivity Database 2017v1rahul nagareNo ratings yet

- Successful Project Management - Applying Best PracticesDocument7 pagesSuccessful Project Management - Applying Best PracticesIsabelle NyamgerohNo ratings yet

- Project Management Quick Reference Guide For Project 2007Document7 pagesProject Management Quick Reference Guide For Project 2007Anonymous MVbaaUBSZTNo ratings yet

- Project Proposal SOWDocument4 pagesProject Proposal SOWmetroroadNo ratings yet

- Bridge Construction Boq Item Cost AnalysisDocument405 pagesBridge Construction Boq Item Cost Analysis朱叶凡No ratings yet

- Schedule Bar Chart FormatDocument109 pagesSchedule Bar Chart FormatCristian RepolNo ratings yet

- Project Management at The GSTMDocument15 pagesProject Management at The GSTMkhwezitoniNo ratings yet

- Ref Cost Database 2019Document22 pagesRef Cost Database 2019N.a. M. TandayagNo ratings yet

- BOQ Housing - MyCitiHomesDocument4 pagesBOQ Housing - MyCitiHomesAnjo BalucasNo ratings yet

- Bar ChartDocument2 pagesBar ChartJacqueline MarcosNo ratings yet

- Proposed 1 Storey Residential House Construction ScheduleDocument1 pageProposed 1 Storey Residential House Construction ScheduleVan Gioffri BalisalisaNo ratings yet

- Estimate Summary: Change Order Cont. Sales TaxDocument2 pagesEstimate Summary: Change Order Cont. Sales TaxM.N Huda Construction LtdNo ratings yet

- Productivity Rate (Piping Works)Document21 pagesProductivity Rate (Piping Works)Ahmed Essam TimonNo ratings yet

- Productivity Output For PreliminariesDocument2 pagesProductivity Output For PreliminariesAmalina YaniNo ratings yet

- Daily Construction Inspection Report TemplateDocument2 pagesDaily Construction Inspection Report TemplateAbigail100% (1)

- National Water Supply Project UpdateDocument31 pagesNational Water Supply Project UpdateGamitha LakshanNo ratings yet

- Pueblo Verde Expansion Column Cutting ListDocument20 pagesPueblo Verde Expansion Column Cutting ListAilyn O. DungogNo ratings yet

- Material and Labor CostDocument9 pagesMaterial and Labor CostKamen RiderNo ratings yet

- Project Cost Estimating Manual: Third Edition December 2007Document83 pagesProject Cost Estimating Manual: Third Edition December 2007Osama El-ShafieyNo ratings yet

- WPR SR1285477 COCS Clean Up Minas 7C-77 (Site Prep) Cut Off 29 Nop 2019Document47 pagesWPR SR1285477 COCS Clean Up Minas 7C-77 (Site Prep) Cut Off 29 Nop 2019Erick SavrinaldoNo ratings yet

- Thomas Frank's Budget Modeler Template!Document9 pagesThomas Frank's Budget Modeler Template!Norman LefortNo ratings yet

- Pay Stub E0dc3c9c 5a29 4c3f B0ab Dc7aca25b2e9Document1 pagePay Stub E0dc3c9c 5a29 4c3f B0ab Dc7aca25b2e9Ngeleka kalalaNo ratings yet

- Tbf-531Bodyfat Monitor/Scale: Instruction ManualDocument13 pagesTbf-531Bodyfat Monitor/Scale: Instruction ManualJose JimenoNo ratings yet

- Q1. Read The Passage Given Below and Answer The Questions That FollowDocument2 pagesQ1. Read The Passage Given Below and Answer The Questions That FollowUdikshaNo ratings yet

- Postpartum Health TeachingDocument8 pagesPostpartum Health TeachingMsOrange96% (24)

- Alex AspDocument11 pagesAlex AspAceNo ratings yet

- Nres1dm-Chapter I and IIDocument35 pagesNres1dm-Chapter I and IImlmmandapNo ratings yet

- Behavioral Economics Applications GuideDocument12 pagesBehavioral Economics Applications GuideJosé Luis BalbontínNo ratings yet

- Bio-Oil® Product ManualDocument60 pagesBio-Oil® Product ManualguitarristaclasicosdnNo ratings yet

- Behavorial Methods IIDocument18 pagesBehavorial Methods IImehak727No ratings yet

- Curing Stage 4 Cancer and Terminal Liver Disease with Alpha Lipoic AcidDocument14 pagesCuring Stage 4 Cancer and Terminal Liver Disease with Alpha Lipoic Acidguy777No ratings yet

- Rabia PDFDocument22 pagesRabia PDFLadybirdNo ratings yet

- Digestive System PowerpointDocument33 pagesDigestive System PowerpointThomas41767% (6)

- Symbols On PackegingDocument3 pagesSymbols On PackegingsakibarsNo ratings yet

- Lesson 1 Local Government's Historical BackgroundDocument16 pagesLesson 1 Local Government's Historical BackgroundLorienelNo ratings yet

- Prepared By: Ulfat Amin MSC Pediatric NursingDocument25 pagesPrepared By: Ulfat Amin MSC Pediatric NursingAngelic khanNo ratings yet

- ASP ProductsDocument33 pagesASP ProductsSerghei Barba100% (1)

- Storage Tanks Selection and Sizing: Richardhaw@sympatico - CaDocument50 pagesStorage Tanks Selection and Sizing: Richardhaw@sympatico - CamanojjuvaliNo ratings yet

- Biology 3rd ESO Full DossierDocument54 pagesBiology 3rd ESO Full DossierNinaNo ratings yet

- NCP - Acute Pain - FractureDocument1 pageNCP - Acute Pain - Fracturemawel73% (22)

- The NBCP Referral Code SubDocument4 pagesThe NBCP Referral Code SubArcon Solite BarbanidaNo ratings yet

- Syringe CompatibilityDocument1 pageSyringe CompatibilityRaju NiraulaNo ratings yet

- Endocrine DisruptorsDocument50 pagesEndocrine DisruptorsSnowangeleyes AngelNo ratings yet

- GENETIC DISORDERS AND CYTOGENETICSDocument7 pagesGENETIC DISORDERS AND CYTOGENETICSsmilechance8No ratings yet

- Methodology Tapping Methodology of WaterlineDocument15 pagesMethodology Tapping Methodology of WaterlineBryNo ratings yet

- OPINION ESSAY AbortionDocument2 pagesOPINION ESSAY AbortionLuisa Patiño100% (1)

- Emotional Dysregulation in Adult ADHD What Is The Empirical EvidenceDocument12 pagesEmotional Dysregulation in Adult ADHD What Is The Empirical EvidenceVo PeaceNo ratings yet

- Needs - Human Needs Are The Basic Demands and Include Food, ClothingDocument3 pagesNeeds - Human Needs Are The Basic Demands and Include Food, ClothingChandi BalasooriyaNo ratings yet

- Understanding Uterine FibroidsDocument52 pagesUnderstanding Uterine FibroidsDoctor JitNo ratings yet

- Intro To Wastewater Collection and PumpingDocument84 pagesIntro To Wastewater Collection and PumpingMoh'd KhadNo ratings yet

- Oet Reading Part A Additional - GlucomaDocument8 pagesOet Reading Part A Additional - Glucomaafacean25% (8)