Professional Documents

Culture Documents

Xavier 2016

Uploaded by

al_crespo0 ratings0% found this document useful (0 votes)

56 views2 pagesXavier 2016

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentXavier 2016

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

56 views2 pagesXavier 2016

Uploaded by

al_crespoXavier 2016

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

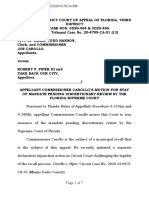

FULL AND PUBLIC DISCLOSURE

OF FINANCIAL INTERESTS

FOR OFFICE USE ONLY:

FLORIDA

COMMISSION ON ETHICS

WAY 31 2016

RECEIVED

Xaver taus Suet” SCANNED

County Commissioner District 7

PRo-

Sch ROtESg rocoae —MINIMIMINNIN

oe ED |

Ma 38128-1908 ID No. 241635

det ata ge LULL PL

(CHECK IF THIS IS AFILING BYACANDIDATE CQ)

PART A~ NET WORTH

Please enter the value of your net worth as of December 31, 2015 or a more current date. [Note: Net worth is not cal-

culated by subtracting your reported liabilities from your reported assets, so please see the instructions on page 3.]

My net worth as of May 24 ,2016 _was$ S02 ao CésT

PART B-- ASSETS

Conf. Code

Suarez , Xavier Louis

HOUSEHOLD GOODS AND PERSONAL EFFECTS:

Household goods and personal affects may be reported in a lump sum if ther aggregate value exceeds $1,000. This category includes any of the

following, i rot neld for investment purpeses: jewelry; collections of stamps, guns, and numismatie tems; art objects; household equipment and

fumishings; clothing: other household items; and vehicles for personal use, whether owned of leased

“The aggregate value of my household goods and personal effects (described above) is $_ <5 CO), °*

ASSETS INDIVIDUALLY VALUED AT OVER $1,000

DESCRIPTION OF ASSET (specific description is required - se instructions p4) VALUE OF ASSET

') [Kesidence @ ls SE QS Read FUNG2 Mian Fr 39 127 Psag ove est

2)1Gndo 4 2645 Callian fue Ug 3 Mani Binh, A 33IYO ldsse,oce_ Est

2552000. G4

7 SO. est

PART C— LIABILITIES

LIABILITIES IN EXCESS OF $1,000 (See instructions on page 4):

NAME AND ADDRESS OF CREDITOR AMOUNT OF LIABILITY

Mieve AMM Wattpne Leeiwille KY") Qeulen (aval Sires ZL $2egcco ft

above, Yoko Areice alias 130! U5, Gatcy 6h, Coral Oo bua | CBSE Eo

above. Nata Sh Dallas Hx, 'S peciel sey’ Sanices , Littleton, CO ayer Shs efi

KMEX vevaluing, credit oe fot

JOINT AND SEVERAL LIABILIVIES NOT REPORTED ABOVE”

NAME AND ADORESS OF CREDITOR AMOUNT OF LIABILITY

GEFORN 6 Etecve levy 120 (Carnet ovo ae) FRGET

Freep by reerencein is 90221), FAC

PART D ~ INCOME

Idontiy each separate source and amount of income which exceeded $1,000 during the year, including secondary sources of income. Or attach a compel

copy of your 2015 federal income tax relutn, including ail W2s, schedules, and atachments, Please redact ary socal secunly or account numbers before

fatlaching your felums, as the law requires these documents b¢ posted to the Commission's website

Clete a copy of my 2015 federa income tx rei and al V8, schedules, and tschments

{i you chock fs ox and tach a Copy of yur 2075 tax ror, you mood not complete tho romalndar of Part

PRIMARY SOURCES OF INCOME (See instructions on page 5):

NAME OF SOURCE OF INCOME EXCEEDING $1,000 ADDRESS OF SOURCE OF INCOME

lew Offi. KONS Luar eh [4S 5625 Rb #Na2 Mame’ 77127

SECONDARY SOURCES OF INCOME [Major customers, cllons, et. of businesses owed by reporting person~see instructions on page &):

NAME OF NAME OF MAJOR SOURCES: ADDRESS, PRINCIPAL BUSINESS

BUSINESS ENTITY ‘OF BUSINESS INCOME. OF SOURCE AGTIVITY GF SOURCE

Nimes Dade Courty | Ommssi¢ney Uo 54 Paden 2902 fable Serta.

San

Ws Savul Sena ; ee

PART E — INTERESTS IN SPECIFIED BUSINESSES [latructions on page 6

SUSNESS ENTITY BUSINESS ENTITY #2 BUSINESS ENT #3

TAME OF,

BUSINESS ENTITY

"ADDRESS OF

BUSINESS ENTITY

PRINCIPAL BUSINESS

AGTVITY

POSITION HELD

(WITH ENTITY,

TOWN MORE THAN A 5%

INTEREST IN THE BUSINESS

NATURE OF MY

OWNERSHIP INTEREST

PART F- TRAINING

For officers required to complete annual ethics traning pursuant to section 112.3142, FS.

()_ICERTIFY THAT | HAVE COMPLETED THE REQUIRED TRAINING.

OATH coumvor * WMiae Dade

|, the person whose name appears at the ‘Sworn to (or affrmed) and subsribed before me this_2S day of

beginning of his form do depose on otha atrmaton . Ry ee

ad say that tho information dciosed on tis fom

and any attachments hereto ise, acura,

aed compl

a7

a oe Personally Raown "OR Produced Identification

Lg :

SIGNATURE OF REPORTING OFFICIAL OR CANDIDATE Type of Identifcaion Produced

Ifa certiied public accountant licensed under Chapter 473, or attorney in good stancing with the Forida Bar prepared this form for you, he or

she must complete the following statement:

1 . prepared the CE Form 6 in accordance with At. I, Se. 8, Florida Constitution,

Section 112.3144, Florida Statutes, and the instructions fo the form. Upon my reasonable knowledge and belie, the disclosure herein is tue

‘and correct.

Signature Date

Preparation of this form by a CPA or attorney does not relieve the filer of the responsibility to sign the form under oath.

‘GE FORM 6 Efociv vray, 12016 PROEZ

sept telarnce nue 9 002), FAC.

You might also like

- Don't Like The ChiefDocument3 pagesDon't Like The Chiefal_crespoNo ratings yet

- Captain Ortiz ReprimandDocument5 pagesCaptain Ortiz Reprimandal_crespo100% (1)

- Miami Shores Village PD Comprehensive Report of Racism, Malfeasance and Criminal ViolationsDocument54 pagesMiami Shores Village PD Comprehensive Report of Racism, Malfeasance and Criminal Violationsal_crespo100% (1)

- Code Compliance Officers Sues Miami Commissioner Alex Diaz de La PortillaDocument8 pagesCode Compliance Officers Sues Miami Commissioner Alex Diaz de La PortillaPolitical CortaditoNo ratings yet

- Petition To Stop Park in The RoadsDocument13 pagesPetition To Stop Park in The Roadsal_crespoNo ratings yet

- Suarez, Francis X. - Form 1Document3 pagesSuarez, Francis X. - Form 1al_crespoNo ratings yet

- Suarez, Francis X. - Public Disclosure of Financial InterestsDocument2 pagesSuarez, Francis X. - Public Disclosure of Financial Interestsal_crespoNo ratings yet

- County Silver Bluff AppealDocument37 pagesCounty Silver Bluff Appealal_crespoNo ratings yet

- R-20-0203 - Zero Tolerance For Vandalism or Destruction of City or Private PropertyDocument2 pagesR-20-0203 - Zero Tolerance For Vandalism or Destruction of City or Private Propertyal_crespoNo ratings yet

- Grant Stern LawsuitDocument19 pagesGrant Stern Lawsuital_crespoNo ratings yet

- Advantage ContractDocument12 pagesAdvantage Contractal_crespoNo ratings yet

- DLP Statement of OrganizationDocument3 pagesDLP Statement of Organizational_crespoNo ratings yet

- Lystad ContractDocument4 pagesLystad Contractal_crespoNo ratings yet

- Outside Employment FormsDocument3 pagesOutside Employment Formsal_crespoNo ratings yet

- MD CRA Grand Jury ReportDocument44 pagesMD CRA Grand Jury Reportal_crespoNo ratings yet

- Letter On Miami 21 Task Force Violating Florida Code of EthicsDocument18 pagesLetter On Miami 21 Task Force Violating Florida Code of Ethicsal_crespoNo ratings yet

- Pension OrdinanceDocument4 pagesPension Ordinanceal_crespoNo ratings yet

- 2020-06-11 City Commission - Public Agenda-2350Document73 pages2020-06-11 City Commission - Public Agenda-2350al_crespoNo ratings yet

- Carollo Motion To StayDocument7 pagesCarollo Motion To Stayal_crespoNo ratings yet

- Alex LetterDocument3 pagesAlex Letteral_crespoNo ratings yet

- 2017-10-12 City Commission - Full Minutes-1620Document91 pages2017-10-12 City Commission - Full Minutes-1620al_crespoNo ratings yet

- CampaignDocument 2 PDFDocument2 pagesCampaignDocument 2 PDFal_crespoNo ratings yet

- Winker Motion On CarolloDocument3 pagesWinker Motion On Carolloal_crespoNo ratings yet

- Portilla Compliant PDFDocument30 pagesPortilla Compliant PDFal_crespoNo ratings yet

- Reiner LetterDocument2 pagesReiner Letteral_crespoNo ratings yet

- Mayor Pocket - CIPDocument2 pagesMayor Pocket - CIPal_crespoNo ratings yet

- 09-10-2019: Damaso Letter To ColinaDocument3 pages09-10-2019: Damaso Letter To Colinaal_crespoNo ratings yet

- CIO: 09-03-2019 Response 09-26-2019Document4 pagesCIO: 09-03-2019 Response 09-26-2019al_crespoNo ratings yet

- Memo Projections - June Meeting - Based On May Data With ReportsDocument16 pagesMemo Projections - June Meeting - Based On May Data With Reportsal_crespoNo ratings yet

- Grace Sdolares ArgumentDocument6 pagesGrace Sdolares Argumental_crespoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)