Professional Documents

Culture Documents

SMU - MCA NEW FALL 2010 - Financial Management and Accounting (MC0065) - SEM - 1 - ASSIGNMENTS - Set1

Uploaded by

killer1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SMU - MCA NEW FALL 2010 - Financial Management and Accounting (MC0065) - SEM - 1 - ASSIGNMENTS - Set1

Uploaded by

killer1Copyright:

Available Formats

August 2010

ASSIGNMENT - MCA semester 1

MC0065 –Financial Management and Accounting – 4 Credits

(Book ID: B0724)

Assignment Set- 1 (60 Marks)

Note: Each question carries 10 Marks. Answer all the questions

1) What is financial statement? Explain purpose and objectives of financial statement.

2) What is a Funds Flow Statement? Discuss the importance and objectives of Funds flow

statement?

3) What are the important Revenue statement ratios or income statement ratios? Explain them

breifly.

4) What do you mean by Trial Balance? Mention the kinds of errors

a) Disclosed by Trial Balance

b) Not Disclosed by Trial Balance

5) The following is the revenue statement of Hind Traders Limited for the year ended 31st

March, 2000:

Rs

Sales 5, 00,000

Less: Cost of Goods sold 3,00,000

-------------

Gross Profit 2,00,000

Less: Operating Expenses 1,20,000

-------------

Operating Profit 80,000

Add: Non-Operating Income 12,000

-------------

92,000

Less: Non-Operating Expenses 4,000

-------------

Net Profit 88,000

Less: Tax 50% 44,000

-------------

Net Profit after Tax 44,000

-------------

Calculate (i) Gross Profit Ratio (ii) Operating Ratio (iii) Operating Profit Ratio

(iv) Net Profit Ratio.

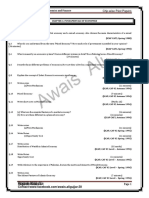

6) The following are the balance sheet of paliwal exports ltd. For the year 2000 and 2001

2000 2001 Assets 2000 2001

Liabilities Rs Rs Rs Rs

Share capital 5,50,000 6,20,000 Current Assets:

Stock 2,00,000 2,70,000

Creditors for goods 1,60,000 2,50,000 Sundry Debtors 2,25,000 2,45,000

Cash 40,000 65,000

Creditors for exp 10,000 12,000 Prepaid Expenses: 25,000 22,000

B/P 1,00,000 1,10,000 Non current Assets:

Securities premium 50,000 80,000 Plant & Machinery 7,00,000 8,80,000

Profit&loss A/c 1,00,000 2,00,000 Goodwill 1,00,000 70,000

Debentures 3,00,000 2,00,000 Investments 1,80,000 1,80,000

General reserve 2,00,000 2,60,000

14,70,000 17,32,00 14,70,000 17,32,000

0

-

You are required to prepare funds flow statement

August 2010

Master of Computer Application- MCA Semester 1

MC0065 – Financial Management & Accounting - 4 Credits

(Book ID: B0724)

Assignment Set- 2 (60 Marks)

Note: Each question carries 10 Marks. Answer all the questions.

1 Define a cash flow statement .What are the uses and limitations of preparing a Cash Flow

Statement?

2 Define ‘Marginal Cost’ and ‘Marginal costing’. Discuss the advantages and limitations of

marginal costing.

3 What do you understand by budgetary control? What are the essentials of good budget and

Explain types of budgets?

4 What is standard costing? Point out clearly the distinction between standard cost and other

cost systems?

5. Your company has a production capacity of 2, 00,000 units year. Normal capacity utilization is

reckoned as 90%.Standard variable production costs are rs.11 per unit. The fixed costs are

rs.360000 per year. Variable selling costs are rs.3 per unit and fixed selling costs are rs.2,

70,000 per year. The unit selling price is rs.20.In the year just ended on 30th June, 1998, the

production was 1, 60,000 units and sales were 1, 50,000 units. The closing inventory on 30-6-

1998 was 20,000 units. The actual variable production costs for the year were rs.35, 000 higher

than the standard.

(i)Calculate the profit for the year by using Marginal costing method

6) The standard material required to manufacture one unit of product X is 10 kg and the

standard price per kg of material is Rs.2.50.The cost accountant records, however, reveals that

11,500 kg of materials costing Rs.27, 600 were used for Manufacturing 1,000 units of product X.

Calculate the material variances.

You might also like

- MC0066Document64 pagesMC0066killer1No ratings yet

- mc0080 Set 2 July 2011Document10 pagesmc0080 Set 2 July 2011killer1No ratings yet

- MC0080-Analysis and Design of AlgorithmsDocument12 pagesMC0080-Analysis and Design of AlgorithmsdenzilR88No ratings yet

- mc0079 Set 2 July 2011Document10 pagesmc0079 Set 2 July 2011killer1No ratings yet

- mc0076 Set 2 July 2011Document14 pagesmc0076 Set 2 July 2011killer1No ratings yet

- MC0076 Fall Drive Assignment 2011Document2 pagesMC0076 Fall Drive Assignment 2011shailendubey17No ratings yet

- MC0061-Computer Programming C Language-Fall-10Document3 pagesMC0061-Computer Programming C Language-Fall-10Sunil KooriyattilNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Starting A New Dental Practice Checklist PDFDocument4 pagesStarting A New Dental Practice Checklist PDFAbdelrahman GalalNo ratings yet

- Mcom ProjectDocument61 pagesMcom Projectsonali wadate100% (1)

- Chapter 1 Class 11 AccountancyDocument7 pagesChapter 1 Class 11 AccountancySunil Gupta0% (1)

- Financial Benchmark - Auto Parts Manufacturers - Vertical IQDocument1 pageFinancial Benchmark - Auto Parts Manufacturers - Vertical IQfisehaNo ratings yet

- Uccc&Spbcba&Sdhgcbca&It Sybcom Sem-Iv Accountancy & Taxation-Iv MCQ Question BankDocument22 pagesUccc&Spbcba&Sdhgcbca&It Sybcom Sem-Iv Accountancy & Taxation-Iv MCQ Question BankI-51 GAURAV RANALKARNo ratings yet

- GCC 2019Document117 pagesGCC 2019Srinivas MantryNo ratings yet

- Motorcycle Insurance ReceiptDocument1 pageMotorcycle Insurance ReceiptWan RidhwanNo ratings yet

- DAFODocument4 pagesDAFOLidiacfNo ratings yet

- HOBADocument20 pagesHOBAJaira ClavoNo ratings yet

- CAF 02 CHP Wise Past PaperDocument45 pagesCAF 02 CHP Wise Past PaperaliNo ratings yet

- Structure of The Examination PaperDocument12 pagesStructure of The Examination PaperRaffa MukoonNo ratings yet

- ENTERPRISE, Forms of Business OwnershipDocument10 pagesENTERPRISE, Forms of Business OwnershipKristy JenacNo ratings yet

- Investment Office ANRS: Project Profile On The Establishment of Bicycle Assembling PlantDocument27 pagesInvestment Office ANRS: Project Profile On The Establishment of Bicycle Assembling Plantbig john100% (1)

- Factors Affecting Buying Behavior of Consumers Towards Life Insurance ProductsDocument62 pagesFactors Affecting Buying Behavior of Consumers Towards Life Insurance ProductsRohit BurmanNo ratings yet

- Pakistan International Airlines 1 S KDocument27 pagesPakistan International Airlines 1 S KShoukat KhanNo ratings yet

- 17 x11 FinMan E Quantitative MethodsDocument10 pages17 x11 FinMan E Quantitative MethodsJericho PedragosaNo ratings yet

- Chapter 2Document32 pagesChapter 2Nur SyahidahNo ratings yet

- Cash Flow StatementDocument12 pagesCash Flow StatementChikwason Sarcozy MwanzaNo ratings yet

- Form16 SignedDocument7 pagesForm16 SignedrajNo ratings yet

- Homework Chapter 6Document10 pagesHomework Chapter 6Le Nguyen Thu UyenNo ratings yet

- The Investment Setting: Answers To QuestionsDocument11 pagesThe Investment Setting: Answers To Questions12jd100% (1)

- Autotext - BackupDocument85 pagesAutotext - Backuppravita4658No ratings yet

- The Craig Proctor Ultimate Real Estate Success Super ConferenceDocument12 pagesThe Craig Proctor Ultimate Real Estate Success Super ConferenceMike Le0% (1)

- Name: Shamal Vivek Singh ID: s11172656: Af314 AssignmentDocument8 pagesName: Shamal Vivek Singh ID: s11172656: Af314 AssignmentShamal SinghNo ratings yet

- K-W-L Chart: (Financial Accounts) Bba - Semester 1Document9 pagesK-W-L Chart: (Financial Accounts) Bba - Semester 1Rabeeka SiddiquiNo ratings yet

- CAPSTONE PROJECT 2015-2017: "A Management Research Project On Mergers and Acquisitions in Indian Banking Sector"Document41 pagesCAPSTONE PROJECT 2015-2017: "A Management Research Project On Mergers and Acquisitions in Indian Banking Sector"Gulshan KumarNo ratings yet

- Management Control SystemDocument159 pagesManagement Control SystemRishi Johnny Raina100% (2)

- Resume: S. SaravanavelDocument2 pagesResume: S. SaravanavelRupali BiswalNo ratings yet

- Goods and Financial Markets: The IS-LM Model: Prepared By: Fernando Quijano and Yvonn QuijanoDocument35 pagesGoods and Financial Markets: The IS-LM Model: Prepared By: Fernando Quijano and Yvonn QuijanoKumarGauravNo ratings yet

- NewmewDocument178 pagesNewmewsarojNo ratings yet