Professional Documents

Culture Documents

Beauty Salon

Uploaded by

sharatchandOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Beauty Salon

Uploaded by

sharatchandCopyright:

Available Formats

BACKGROUND NOTE ON THE BEAUTY SALON INDUSTRY

(JANUARY 2004)

This note contains summary data based on research conducted by ValueNotes Database

Pvt. Ltd. (ValueNotes). Care has been taken to ensure that the information and views

contained in this report are reliable, but no responsibility is accepted for errors of fact or

opinion. Reproduction in whole or in part without written permission is prohibited.

A. Market Size

The beauty salon market in India has been growing steadily over the past few years. As

of end FY03, there were an estimated 61,000 beauty salons in towns with over 1 million

population.

For the purpose of analysing the beauty salon industry, Value Notes has used the

following classification of the beauty salon market in India –

Category No. of Typical Characteristics

Employees

Large >6 Large parlours providing a varied range of services and/or

specialization, premium price range

Medium 3–5 Medium parlours, medium price range

Small 1–2 Small parlours, limited service range

Home 1 Individuals operating from home/giving home service

Note: This is not an exact classification. Some exceptions may prevail due to the

heterogeneous nature of this business.

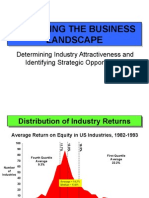

Exhibit 1: Population-wise estimate of parlours by category (FY 2003)

18000

16000

14000

12000

10000 Metro

8000 Mini-metro

6000 Small towns

4000

2000

0

Large Medium Small Home

Source : Valuenotes Research

Copyright, ValueNotes Database Pvt. Ltd, 2004. Page 1 of 6

Some observations:

• Interestingly, half of these parlours are in the ‘home’ category. The large salons (with

more than 6 employees, providing a wider range of services) constitute only 4% of

the total number of beauty salons in the country. The medium size salons (with 3-5

employees, medium price range) are less than 10 percent.

• More than half of the beauty salons are in the major metros - Mumbai, Delhi and

Kolkata (population more than 10 million). The others are balanced almost equally

between the mini-metros (population size 3 to 10 million) and the smaller towns

(population between 1 and 3 million).

• Also, there are a high number of small and home based beauty salons in the metros.

B. Turnover Estimates

We estimate the total turnover of the beauty salon market to be between Rs. 1493

crores and Rs. 1805 crores (FY03) in cities with more than 1 million population.

Exhibit 2: Turnover Estimates (FY 2003)

Source :Valuenotes Research

100%

15% 16%

90% 24%

80%

21%

70% 29%

Home

60%

42% Small

50% 25%

21%

Medium

40%

Large

30%

16%

20% 39% 42%

10% 19%

0%

Metro Mini-metro Small town

Across the town classes, the large beauty salons took up 27% of the revenue inspite of

being substantially lower in numbers as compared to the other categories. Also, of the

total, the metros account for about 60% of the total turnover.

Interestingly, it is the small beauty salons (1-2 employees, offering limited services) that

take up about 42% of the revenues in the metros. Adding the home category (those who

work out of homes/garages etc.), the total revenue generated is over 65% of the total.

In other towns of 1 million + also, they take up a sizeable portion of the revenue.

The home segment, on the other hand, despite being the largest in numbers, takes up

between 15-24% of the total revenue estimated in this market.

Copyright, ValueNotes Database Pvt. Ltd, 2004. Page 2 of 6

q So what services are the money grossers for this industry?

Across the categories of beauty salons, haircuts are the most revenue generating

service, accounting for between 25-30% of the total revenues. Hair styling (hair

colouring, perming, streaking etc.) contribute to about 18% of the revenues for the

larger salons, but are very insignificant revenue earners for the other categories. This is

especially true of high-end speciality parlours.

In the medium size parlours, hairstyles lose out as the revenue generators since the skill

sets are generally perceived to be lower in this category. However, facials, being

comparatively price inelastic, make up for 31% of the revenue generation in this

category. This trend also follows to the smaller and home parlours as this is a function

of price rather than volumes.

Exhibit 3 : Revenue from various services across categories

Share of revenue by service (FY03)

Segment Large Medium Small &

Home

Haircut 23% 26% 30%

Hairstyle 18% 8% 1%

Wax 17% 19% 16%

Manicure 7% 7% 5%

Pedicure 9% 8% 5%

Facial 20% 31% 35%

Others 7% 1% 7%

100% 100% 100%

Therefore, it is easy to say that haircut is the most popular as well as the most revenue

earning service in this business. Interestingly, for the medium and small beauty salons,

facials form about 30-35% of the earnings.

Price:

Quite obviously, the price differences are highly significant between the town classes,

with prices in the metros being considerably higher than the smaller towns, the

difference being upto Rs. 500 for haircuts. Price differences are the highest in haircuts

and facials, followed by hairstyles. Among the other services, the price differences do not

appear to be so dramatic.

The main drivers for price variations are quality of the services offered and the retention

of good employees. These are also important factors which drive customer loyalty. Also

the locality in which the parlour is located drives the price. In case of large parlours, a

certain niche or speciality determines the price points for the services offered.

Product Sales:

Product sales constitute a very low part of the revenues. In fact, it is only the large

parlours that engaged in product sales. But this too contributed to only about 7% of the

revenues.

Copyright, ValueNotes Database Pvt. Ltd, 2004. Page 3 of 6

Only L’Oreal appears to have has managed to successfully push its product line,

especially the hair treatment products through the beauty salons. Some of the reasons

for this being – exclusive sales of L’Oreal products in the salons, regular training for the

salon staff and sale of certain L’Oreal products not available at any other outlets.

C. Growth Estimates

According to Value Notes, the overall estimated growth rate for this industry (in FY

2003-04) in terms of number of parlours would be between 20-25%, but revenue growth

would be only about 4-5%. We also estimate that the growth rate would be higher

among the metros and the smaller towns.

Also, growth rates would be better among the large parlours rather than the medium

and small parlours. This is because the smaller players are being threatened by the

burgeoning home segment.

Growth Drivers:

• An overall increased awareness of beauty

• Improvement of technical skills, a growing demand for something new

• Veering of beauty salons towards ‘treatment’ and ‘therapy’

• Aggressive efforts by companies like L’Oreal for their products

Inhibitors to growth are mainly the stiff competition due to the establishment of small

and home size parlours. This is also due to the emergence of a lot of training institutes

offering inexpensive short duration courses.

Also, problems faced by the parlour owners include the service tax, felt by mostly the

large beauty salon owners. Undercutting by smaller parlour owners was also another

problem faced by this industry.

Some highlights:

• The size of the beauty salon industry is estimated at between Rs. 1493 and Rs. 1805

crores. This is attributed to the advent of foreign TV channels, changing lifestyles,

higher purchasing power and greater awareness and need for ‘beauty’.

• However, the growth rates in number and revenue are contrasting. While the

increase in numbers is dramatic, the revenue growth is pegged at only 4-5%.

• The barriers to entry in this business are low and therefore it makes the business

very competitive. This is more significant in the smaller and home based parlour

segment

• The higher end market is growing at a considerably slower rate, but is grossing the

highest revenues. This is evident from the fact that a number of major national and

international names in the beauty and personal care segment are making forays into

this industry.

• Typically, the speciality skills and branding, therefore appear to make the customer

loyal, especially in terms of the high-end large parlours.

Copyright, ValueNotes Database Pvt. Ltd, 2004. Page 4 of 6

• Specialised services and niche products are the buzzwords. This is quite evident for

greater demand for aromatherapy, herbal treatments etc. Creating a niche seems to

the demand of the hour rather than a ‘jack of all’ business.

• ‘Health’ and ‘beauty’ are being converged. This also proves to be good news for the

industry as a wider range of services could be included in their offerings to

customers.

• Also, a lot of parlours (especially in the large metro segment) appear to be attracting

men as clientele. There seems to be a movement from traditional barber shops to

speciality salons for men offering a whole range of services.

Copyright, ValueNotes Database Pvt. Ltd, 2004. Page 5 of 6

About ValueNotes

ValueNotes Database is a leading provider of business intelligence and research, with expertise across selected

domains and types of customer needs. We work with clients across the globe, both within and outside the

financial community.

• Outsourcing (BPO) • sector/industry reports

• IT and IT services • company profiles

• Financial services • equity research

• Professional services • investment appraisals

• Telecommunications • competitive analysis

• Media • market segmentation and sizing

• real Estate • partner selection and due diligence

ValueNotes also runs the popular web site www.valuenotes.com:

• The largest aggregator of information on Indian business and finance

• One of the few independent research platforms in India, the site offers a variety of research products on

India's financial markets and corporate sector

• A common platform/distribution channel for quality publishers of research, which has made it the preferred

vehicle for India's best-known equity analysts, technical analysts and research houses

• ValueNotes does not offer financial services such as broking, fund management, merchant banking, etc.,

which allows them to take an "unbiased" stand

For further information, please contact:

• Name • Telephone • e-mail

Meena Vaidyanathan 020- 438 9401 / 4388633 meena@valuenotes.com

Mob: 98-226-51451

Arun Jethmalani 020 - 589 9590 jetu@valuenotes.com

Jui Narendran 020 - 589 9590 jui@valuenotes.com

…from data to decisions

Copyright, ValueNotes Database Pvt. Ltd, 2004. Page 6 of 6

You might also like

- OceanLink Partners Q1 2019 LetterDocument14 pagesOceanLink Partners Q1 2019 LetterKan ZhouNo ratings yet

- Maintenance Manual: Models 8300, 8400, and 8500 Pallet Trucks and Model 8600 Tow TractorDocument291 pagesMaintenance Manual: Models 8300, 8400, and 8500 Pallet Trucks and Model 8600 Tow TractorJosé Luis Ang Soto92% (13)

- 3-4 Cutting RoomDocument17 pages3-4 Cutting Roomtotol99100% (1)

- Pareto's Principle: Expand your business with the 80/20 ruleFrom EverandPareto's Principle: Expand your business with the 80/20 ruleRating: 5 out of 5 stars5/5 (1)

- TM1600 ManualDocument28 pagesTM1600 ManualedgarcooNo ratings yet

- Group-1 PPT Royal EnfieldDocument8 pagesGroup-1 PPT Royal EnfieldPuneet AgarwalNo ratings yet

- Airbus A300-600/A310 Landing Gear SystemsDocument190 pagesAirbus A300-600/A310 Landing Gear SystemsRaph 1123No ratings yet

- Aligning HR Interventions With Business StrategiesDocument14 pagesAligning HR Interventions With Business StrategiesSunielNo ratings yet

- Buisiness Marketing Project On: Avery DennisonDocument21 pagesBuisiness Marketing Project On: Avery DennisonGaurav Kumar100% (1)

- Amy RollinsonDocument51 pagesAmy RollinsonfrankyNo ratings yet

- Service Reboot: The New Science of Selling, Marketing, and Managing ServicesFrom EverandService Reboot: The New Science of Selling, Marketing, and Managing ServicesNo ratings yet

- GGGGGDocument35 pagesGGGGGMuhammad FaheemNo ratings yet

- Benchmarking AnalysisDocument9 pagesBenchmarking AnalysisMounaim 123 Hourmat AllahNo ratings yet

- HMT: Relaunch Strategy by Rohan ChackoDocument35 pagesHMT: Relaunch Strategy by Rohan Chackorohanchacko67% (3)

- Gandhinagar MarketDocument27 pagesGandhinagar Marketkrunal vaishnavNo ratings yet

- Quiz - Fintech, FMCG, ECommerceDocument341 pagesQuiz - Fintech, FMCG, ECommerceShomyo RoyNo ratings yet

- FMCGDocument59 pagesFMCGakshay yadavNo ratings yet

- FY22 Salary Increments Benchmarking StudyDocument17 pagesFY22 Salary Increments Benchmarking StudyAbhijith PrabhakarNo ratings yet

- Cottle Taylor Case AnalysisDocument18 pagesCottle Taylor Case AnalysisHEM BANSALNo ratings yet

- Summer Tranning Report ArunDocument13 pagesSummer Tranning Report ArunArun SolankiNo ratings yet

- TSMG Tata Review-June 2006Document5 pagesTSMG Tata Review-June 2006dipangshu12No ratings yet

- Bhavesh PPT SipDocument14 pagesBhavesh PPT Sipyatin rajputNo ratings yet

- FASHION MM9 (Ultimate Version)Document17 pagesFASHION MM9 (Ultimate Version)PiyushNo ratings yet

- Di Combination Graphs IDocument3 pagesDi Combination Graphs IXYZ0% (3)

- Cottle Taylor Case AnalysisDocument18 pagesCottle Taylor Case AnalysisRALLAPALLI VISHAL VIJAYNo ratings yet

- Beauty Salon Business Overview & Trends, 2012Document4 pagesBeauty Salon Business Overview & Trends, 2012dprosenjitNo ratings yet

- Market Survey of Hero Honda and Their MarketingDocument21 pagesMarket Survey of Hero Honda and Their MarketingSwastikBasuNo ratings yet

- ilide.info-chapter-6-pr_8cb6ea0de29f105dceb44e446a0410c8 (1)Document11 pagesilide.info-chapter-6-pr_8cb6ea0de29f105dceb44e446a0410c8 (1)ANH NGUYỄN LÊ NGỌCNo ratings yet

- EN - Presentation SSG 24.05Document44 pagesEN - Presentation SSG 24.05K HARIKRISHNANo ratings yet

- MSP Benchmark Survey ReportDocument19 pagesMSP Benchmark Survey Reportchrisban35No ratings yet

- 3.2 Analysis From RetailersDocument13 pages3.2 Analysis From Retailerssgsachin4No ratings yet

- ANCEBMM Auto-Care Center - Vol. III - A Survey ReportDocument61 pagesANCEBMM Auto-Care Center - Vol. III - A Survey ReportAria RosarioNo ratings yet

- Mecklai FX Risk Management Survey findingsDocument8 pagesMecklai FX Risk Management Survey findingsanandkumarnsNo ratings yet

- Research Insight: 1: A Research Report of Telecom Sector ON Bharti Airtel LimitedDocument16 pagesResearch Insight: 1: A Research Report of Telecom Sector ON Bharti Airtel LimitedTanu SinghNo ratings yet

- An Analysis of Micro, Small and Medium Enterprises in India.Document33 pagesAn Analysis of Micro, Small and Medium Enterprises in India.Abdul MoizzNo ratings yet

- The Rise of Indian Luxury MarketDocument31 pagesThe Rise of Indian Luxury Marketabhiabhijain3012No ratings yet

- Watch Explainer: Errors & Omissions Liability (E&O) : You Exec Makes NoDocument13 pagesWatch Explainer: Errors & Omissions Liability (E&O) : You Exec Makes NoYahya AulyaNo ratings yet

- Netherlands - SBA Fact Sheet 2019Document18 pagesNetherlands - SBA Fact Sheet 2019warda arshadNo ratings yet

- Zuriac Franchise PlanDocument17 pagesZuriac Franchise PlanManmeet SinghNo ratings yet

- TATA Hexa Case Study: Go Getters Agnimitra Banerjee (1702010) Himanshu Gupta (1702070) Himanshu Kapoor (1702071)Document13 pagesTATA Hexa Case Study: Go Getters Agnimitra Banerjee (1702010) Himanshu Gupta (1702070) Himanshu Kapoor (1702071)Himanshu GuptaNo ratings yet

- Our Marketing Team Has Carried Out Market Research To Collect Primary Data Before Launching Our Product XXXDocument6 pagesOur Marketing Team Has Carried Out Market Research To Collect Primary Data Before Launching Our Product XXXayushsoodye01No ratings yet

- L'Oreal Nederland B.V. Product: Case PresentationDocument34 pagesL'Oreal Nederland B.V. Product: Case PresentationFaizan Ul HaqNo ratings yet

- A Study On Customer Satisfaction Towards Ruler Pipes PVT LTD, AndrapradeshDocument7 pagesA Study On Customer Satisfaction Towards Ruler Pipes PVT LTD, Andrapradeshsumanth shettyNo ratings yet

- Analyzing The Business Landscape: Determining Industry Attractiveness and Identifying Strategic OpportunitiesDocument18 pagesAnalyzing The Business Landscape: Determining Industry Attractiveness and Identifying Strategic Opportunitiesgirish8911No ratings yet

- DMART Investment Thesis - RKDocument54 pagesDMART Investment Thesis - RKRohit KadamNo ratings yet

- Problem Set - Answer KeyDocument6 pagesProblem Set - Answer KeyAlly TrizNo ratings yet

- Ashley's copy_191_Jan June WeChat Luxury IndexDocument47 pagesAshley's copy_191_Jan June WeChat Luxury IndexEric HoNo ratings yet

- CDI ASEAN-Retail May2015-EN PDFDocument4 pagesCDI ASEAN-Retail May2015-EN PDFMohd Farid Mohd NorNo ratings yet

- 2011 Economic Snapshot of The Salon IndustryDocument8 pages2011 Economic Snapshot of The Salon IndustryprobeautyassociationNo ratings yet

- Group 05 (Ad Compaign of Cola)Document9 pagesGroup 05 (Ad Compaign of Cola)vivek0020No ratings yet

- H MartDocument10 pagesH MartArya EdifyNo ratings yet

- COVID 19 Effects On MSMEs IraqDocument3 pagesCOVID 19 Effects On MSMEs IraqThanasis DimasNo ratings yet

- Business PlanDocument16 pagesBusiness PlanJewel RatillaNo ratings yet

- 763 (90) - Customer Relationship Management Pantaloons)Document96 pages763 (90) - Customer Relationship Management Pantaloons)Anagogic SapientNo ratings yet

- Assignment (BS Software Engineering) : Section Submitted To Project NameDocument9 pagesAssignment (BS Software Engineering) : Section Submitted To Project NameNajam Ul SaqibNo ratings yet

- The Rural Urban DivideDocument8 pagesThe Rural Urban DivideKomal JalanNo ratings yet

- Dealers Stock Share (0-10%) Total Number of Dealers:-106Document6 pagesDealers Stock Share (0-10%) Total Number of Dealers:-106Karan TrivediNo ratings yet

- Spain - SBA Fact Sheet 2019Document17 pagesSpain - SBA Fact Sheet 2019PNo ratings yet

- Beauty IndustryDocument10 pagesBeauty IndustryMehvish MukaddamNo ratings yet

- Final Project Report On LakmeDocument66 pagesFinal Project Report On LakmeJagdish SachdevaNo ratings yet

- Analyzing The Business LandscapeDocument18 pagesAnalyzing The Business Landscapedanic13No ratings yet

- Changing India:: A Consumer & Retail PerspectiveDocument50 pagesChanging India:: A Consumer & Retail PerspectivedhanmaliNo ratings yet

- Vibrant Gujarat: Micro Small and Medium Micro, Small and Medium Enterprises: Engine ofDocument45 pagesVibrant Gujarat: Micro Small and Medium Micro, Small and Medium Enterprises: Engine ofVandita KhudiaNo ratings yet

- Connect quality people through meaningful meetingsDocument24 pagesConnect quality people through meaningful meetingsharrysmith123No ratings yet

- Zero-Gapped: HOW TO RAISE YOUR BARBERSHOP PERFORMANCE USING TRIED AND TESTED GROWTH HACKING STRATEGIESFrom EverandZero-Gapped: HOW TO RAISE YOUR BARBERSHOP PERFORMANCE USING TRIED AND TESTED GROWTH HACKING STRATEGIESNo ratings yet

- Data Book: Automotive TechnicalDocument1 pageData Book: Automotive Technicallucian07No ratings yet

- Semiconductor Devices Are Electronic Components That Exploit The Electronic Properties of Semiconductor MaterialsDocument3 pagesSemiconductor Devices Are Electronic Components That Exploit The Electronic Properties of Semiconductor MaterialsNuwan SameeraNo ratings yet

- Machine Design ME 314 Shaft DesignDocument14 pagesMachine Design ME 314 Shaft DesignMohammed AlryaniNo ratings yet

- C - TurretDocument25 pagesC - TurretNathan BukoskiNo ratings yet

- Powercell PDX Brochure enDocument8 pagesPowercell PDX Brochure enFate Laskhar VhinrankNo ratings yet

- Training Estimator by VladarDocument10 pagesTraining Estimator by VladarMohamad SyukhairiNo ratings yet

- Srinivas ReportDocument20 pagesSrinivas ReportSrinivas B VNo ratings yet

- Tm3 Transm Receiver GuideDocument66 pagesTm3 Transm Receiver GuideAl ZanoagaNo ratings yet

- EI GAS - CompressedDocument2 pagesEI GAS - Compressedtony0% (1)

- 1800 Series Inverted Bucket Steam TrapsDocument2 pages1800 Series Inverted Bucket Steam TrapsIoana PopescuNo ratings yet

- PCBA MachineDocument62 pagesPCBA MachineSahara MalabananNo ratings yet

- DiMaggio Et Al 2001 Social Implication of The InternetDocument30 pagesDiMaggio Et Al 2001 Social Implication of The InternetDon CorneliousNo ratings yet

- Sony MP3 NWZ B143F ManualDocument82 pagesSony MP3 NWZ B143F ManualdummihaiNo ratings yet

- ExcelDocument258 pagesExcelsusi herawatiNo ratings yet

- Gpover Ip FormatDocument61 pagesGpover Ip FormatGaurav SethiNo ratings yet

- Dune Supreme/ Dune Vector: WWW - Armstrong-Ceilings - Co.Uk WWW - Armstrong-Ceilings - IeDocument2 pagesDune Supreme/ Dune Vector: WWW - Armstrong-Ceilings - Co.Uk WWW - Armstrong-Ceilings - IeMuneer KonajeNo ratings yet

- 107-b00 - Manual OperacionDocument12 pages107-b00 - Manual OperacionJuan David Triana SalazarNo ratings yet

- Cylinder Head Valve Guide and Seat Inspection and RepairDocument1 pageCylinder Head Valve Guide and Seat Inspection and Repairnetifig352No ratings yet

- H Value1Document12 pagesH Value1Sahyog KumarNo ratings yet

- 02 - MDS System and ControlDocument55 pages02 - MDS System and Controlchinith100% (1)

- TSB 18-114Document6 pagesTSB 18-114hoesy1No ratings yet

- Pundit Transducers - Operating Instructions - English - HighDocument8 pagesPundit Transducers - Operating Instructions - English - HighAayush JoshiNo ratings yet

- Analyzing Kernel Crash On Red HatDocument9 pagesAnalyzing Kernel Crash On Red Hatalexms10No ratings yet

- Portfolio - Lesson - Thinking HatsDocument2 pagesPortfolio - Lesson - Thinking Hatsapi-231993252No ratings yet

- Atheros Valkyrie BT Soc BriefDocument2 pagesAtheros Valkyrie BT Soc BriefZimmy ZizakeNo ratings yet