Professional Documents

Culture Documents

Venkys

Uploaded by

gopi11789Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Venkys

Uploaded by

gopi11789Copyright:

Available Formats

EQUITY STRATEGISTS

B 231 C, Greater Kailash - I

VENKY’S New Delhi-110048

Website : www.equitystrategists.com

(INDIA) LTD E-mail : contactus@ equitystrategists.com

- SILENT BREEDER - Analyst : D Prasad (9810018028)

P D Gupta (011-25269790)

5th January, 2004

Industry : Food Products Present Price : Rs 83

Category : Strong Growth Projected Price : Rs. 150

NSE/ BSE Code : VENKEYS/523261 Holding Period : 12 Months

MARKET DATA EXECUTIVE SUMMARY

√ Venky’s (India) Ltd (VIL), promoted by Dr. B.V. Rao, a

Current Equity : Rs. 9.39 cr. visionary in poultry sector, is the only listed stock of the Rs.

Face Value : Rs 10 1200 crore Venkateshwara Hatcheries (VH) group. VIL is a

Book Value : Rs. 78.55 fully integrated company with impressive portfolio which

includes animal health products, pellet feeds, processed

Market Cap. : Rs. 77.93 cr. chicken products, solvent oil extraction, and SPF Eggs.

Free Float : 46.44 % √ VIL enjoys most prominent position in the broiler and layer

High / Low : Rs 99/37 breeds market. It supplies one day old chicks to poultry farmers.

Listing : BSE / NSE BV-300 enjoys 85% share in the layer market while Vencobb

BSE Code : 523261/ VENKEYS enjoys 65% share in the broiler market. VIL sells its processed

chicken under the Venky’s brand name. Venky’s is the first

national brand in the processed chicken segment. VIL is a

SHAREHOLDING PATTERN (%) preferred supplier to the Indian outlets of McDonalds, KFC,

Pizza Hut, and Domino’s.

√ VIL, new ventures in regular succession, besides adding

significant value, gave it an edge in technology and high returns

Corp.

on investment. VIL has technical collaboration with SPAFAS

Bodies Inc. USA to manufacture Specific Pathogen Free Eggs.Its unit

3% is among four such units in the world and the only one of its

Public kind in the developing world.VIL has a technical tie up with

38% Promote Specialty Enzymes and Biochemicals,US to produce high value

rs enzyme-based products for poultry,human & cattle segments.

FII 53% √ VIL has tied up with Australian Food Rite Pty and Natures

2%

Gift Pty to further enhance its manufacturing range for pet foods.

√

MF/UTI

Liberalisation of trade barriers by European Union as per WTO

4%

agreements, would provide huge market for poultry products

as the prices in EU are 4-5 times of the prices ruling in India.

PRICE CHART √ The fall in maize prices and rise in prices of poultry products

would put VIL back on growth path which was affected by

poor monsoon, rising maize prices and falling realizations from

poultry products in FY03.

√ VIL was ranked 67th by Forbes among the 100 best global

small companies in the year 1999-2000. VIL is regularly paying

dividends/ bonus to provide decent returns to investors. VIL

bought back 8.75 lac equity shares to further enhance share

holder’s value.

√ VIL, a fully integrated, market leader in poultry industry, future

FMCG company in fast growing food market at CMP of Rs 83

is available at a low P/E 6 and 5 on FY04 & FY05 expected

earnings offers immense growth potential for bargain hunters.

VENKY’S INDIA LTD EQS RESEARCH

BUSINESS PROFILE

Venky’s (India) Limited (VIL) formerly known as Western Hatcheries Limited was established in

1976,mainly to produce day-old layer and broiler chicks for the dense poultry markets of North

India. Venky’s impressive portfolio includes animal health products, pellet feeds, processed, and

further processed chicken products, solvent oil extraction, SPF eggs, nutritional health products

for humans, and pet food & health care products. It has primarily three divisions namely poultry, animal

health products, feed and feed ingradients.

Poultry Division

The Company is a franchisee of Vencobb and BV-300 breeds and has farms and hatcheries in the states of Maharashtra,

Gujarat and North Indian states of UP, Punjab, Haryana,Jammu Kashmir, Delhi and Bihar. It supplies one day old

chicks (broilers and layers) to poultry farmers of these states. BV-300 enjoys 85% share in the layer market while

Vencobb has 65% share in the broiler market. The product range, catered to retail as well as institutional markets,

includes Fresh Chilled Chicken, Frozen Chicken and several Economy products. Venky’s Mintomein, an array of

ready-to-cook products have created a market space for themselves among homemakers. VIL, state of art, fully

automated set-up equipped with a dressing facility imported from the Dutch company Stork processing plant situated

at Kamshet. VIL has technical collaboration with SPAFAS Inc. USA to manufacture Specific Pathogen Free Eggs, its

unit is among four such units in the world and the only one of its kind in the developing world.

Animal Health Products

The wide range of products includes Antibiotics, Feed Supplements, Growth Promoters, Anticoccidials, Electrolytes

and Disinfections. To enter in fast growing pet food market, VIL has set up Royal Pet as a division of Venky’s (India)

Limited. Royal Pet, with its strong sense of customer service and expertise in scientific formulations and technology

utilization, is strategically placed to live up to its customer’s expectation by creating high quality products through

extensive research, an innovative spirit, and state-of-the-art manufacturing facilities by investing Rs. 8 crore. The pet

food business possess huge growth potential from present level of Rs. 150 crore. VIL has tied up with Australian Food

Rite Pty and Natures Gift Pty to further enhance its manufacturing range for pet foods. VIL is also planning to venture

later in medicaments for the segment under the Venky’s Pet brand to drive margins in coming years.

Feed and Feed Ingredients

Feed and its ingredients constitute more than 50 % of cost for poultry industry, VIL, in order to have better cost control

has its own De-oiled Soya Cake (DOC) and Edible Oil Refinery. It supplies feed to farmers and also markets edible

soya oil in bulk. The acid oil, which is converted from a by-product of the oil refinery, is supplied to local soap

manufacturers.

Nutritional Health Products

Egg based protein is considered as among the best for human bodies. VIL introduced products for the nutritional well

being of humans in 1998 to meet the growing demand from the increased health consciousness among urban societies

of India. VIL products include several compositions for conditions like pregnancies, diabetes, and good health for

growing children. Recently it has also launched OTC products for sportsmen, athletes, and bodybuilders. Many of

VIL’s Nutritional Health Products are being prescribed and recommended by various doctors.

OPPORTUNITIES IN INDIAN POULTRY INDUSTRY

The Poultry Industry has excellent potential in India in the years to come. A n earlier study of Indian Food Industry by

CII and McKinsey & Co. projected a very bright future for the Indian Poultry Industry.

“The poultry sector in India has a potential to grow at over 20% a year over the next 10 years. This

will enable it to at least quadruple in size, growing from the present Rs. 75 billions to approx. Rs.

300 billions (in real terms) by 2005.”

The statement though maade in 1997 reflects the unrealised potentail of poultry industry in India. A fully integrated

modern plant of VIL is now fully geared to exploit this untapped potential. It offers tremendous oppurtunities for

growth in the rapidly expanding poultry industry. The per capita poultry consumption in India is just 0.44 Kg per year,

which is very much lower as compared to developing countries like Pakistan (2.3 Kgs), China(4 Kgs), Thailand (9 Kgs)

USA (44 Kgs). Awreness program for use of eggs as a major protein input to growing children would also drive the

growth of poultry industry.

VENKY’S INDIA LTD EQS RESEARCH

FINANCIAL HIGHLIGHTS

FINANCIAL PERFORMANCE

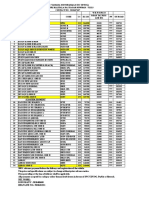

Particulars FY03 H1FY04 H1FY03 % Change FY04P FY05P The projections for FY04 do

not include Rs 4.16 cr. benefit

Net Sales 298.09 138.00 149.03 -7.40 323.00 377.00

Other income 2.67 1.88 1.60 17.50 3.05 2.44

arising out from sale of invest-

Total Income 300.76 139.88 150.63 -7.14 326.05 379.44 ment in wholly owned subsid-

Total Expenditure 281.31 129.96 138.41 -6.11 297.94 347.65 iary VMSL. The earnings

Operating Profit 19.45 9.92 12.22 -18.82 28.11 31.79 growth would come from rise in

Interest 4.37 1.96 2.38 -17.65 3.68 2.92 demand of poultry products in

Gross Profit 15.08 7.96 9.84 -19.11 24.43 28.87

Depreciation 5.75 3.13 2.79 12.19 6.45 6.75

rural market due to enhanced

PBT 9.33 4.83 7.05 -31.49 17.98 22.12 purchasing power as a result of

Tax 1.65 1.05 1.41 -25.53 5.05 6.77 good monsoon. The prices of

Net Profit 7.68 3.78 5.64 -32.98 12.93 15.35 key raw amterial Maize are also

Equity 9.75 9.39 10.27 9.37 9.39 9.39 indownward trend thereby

EPS 7.88 4.03 5.49 -26.70 13.77 16.35

CPS 13.77 7.36 8.21 -10.35 20.64 23.54

boosting margins of the

Dividend 30 40 50 comapny. We expect these fac-

OPM % 6.47 7.09 8.11 8.62 8.38 tors coupled with interest sav-

PBDT % 5.01 5.69 6.53 7.49 7.61 ing will propel the EPS to Rs.

NPM % 2.55 2.70 3.74 3.97 4.05 13.77 in FY04 and further to

Rs 16 plus in FY05.

KEY GROWTH FACTORS FOR VIL

⇒ Market Leader, a pioneer in Poultry Industry with fully integrated and world class

facilities

⇒ Converting itself into a FMCG company with a large array of branded products

⇒ Huge outsourcing potential remains to be untapped as stores like Walmart, etc,

are looking toward India for its various shelf products including Ready to Eat Chicken

products. Venky is ideally placed to capitalise this opportunity.

⇒ Poultry industry has tremendous growth potential with low consumption of eggs

and poultry meat when compared to world standards.

⇒ WTO agreements may force EU to cut subsidies thereby offer huge export potential

⇒ Early entrant in high margin pet food business

⇒ Proximity to Middle East market with its own brand

VENKY’S INDIA LTD EQS RESEARCH

TECHNICAL ANALYSIS

INVESTMENT STRATEGY

VIL, a fully integrated, market leader in poultry industry, future FMCG company in fast

growing food market at CMP of Rs 83 is available at a low P/E 6 and 5 on FY04 &

FY05 expected earnings offers immense growth potential for bargain hunters.

BUYING IS RECOMMENDED STRONGLY

EQUITY STRATEGISTS

Product A Product B

TECHNO FUNDA newsletter BUY/SELL ADVICE THROUGH SMS

catering to all market participants DURING MARKET HOURS

through various columns.

BENEFITS- FEATURES - Momentum based trades

√ A trader/investor can choose with a low holding period ( 1-7 days)

strategy suiting his risk profile,

investment attitude and desired We recommend only when we have

holding period. conviction in advices.Therefore we

√ Returns are commensurate may not send even single advice in

with strategy. a day at times and 4-6 advicces in a

day. On an average one can expect

Occasionally we add columns like

INFORMED GOSSIP - activities of 50 advices in a month.

market operators,FIIs,Mutual funds.

BENEFITS

√ Focussed short term trading

MARKET COMMENTARY COLUMN

√ Optimum returns

- a must read column captures index

outlook, sector in flavour and strategy √ Logical Stop losses.

to be adopted.

COLUMN HOLDING PERIOD APPRX RETURN RISK PROFILE

INTRADAY TRADES ONE DAY 3-5 % HIGH RISK/LOW RETURNS

DERIVATIVE PICK 1-2 Weeks 5-10% MEDIUM RISK/MEDIUM RETURNS

STOCK WATCH 2-5 Weeks 15-20 % LOW RISK/ HIGH RETURNS

INVESTMENT PICK 3-6 Months 35-40% LOW RISK/HIGH RETURNS

FUNDAMENTAL PICK 6-12 MONTHS 50-60% LOW RISK/SUPER RETURNS

OUR EARLIER RECOMMENDATIONS APPRECIATED BY : Jindal Steel & Power (450%), Jindal Strips (450%), Matrix Labs (

500%), Mphasis BFL ( 200%), JPIND ( 200%), MoserBaer ( 300%), Hexaware ( 200%),Lupin(250%), Shasun Chem(200%),

Polyplex(200%), Bharat Forge ( 200 %), Aurobindo Pharma (300%), Sterlite (350%), Bong Ref (400%) etc.,

For Further Information and subscription enquiries kindly contact :

B-231C, Greater Kailash-I, New Delhi-110048

D PRASAD - 9810018028, JATIINDER SHARRMA - 9899252034

E-Mail: contactus@equitystrategists.com Website : www.equitystrategists.com

VENKY’S INDIA LTD EQS RESEARCH

You might also like

- 7 Steps To Building Your Personal BrandDocument5 pages7 Steps To Building Your Personal BrandGladz C CadaguitNo ratings yet

- Poultry diseases: Causes, symptoms and treatment, with notes on post-mortem examinationsFrom EverandPoultry diseases: Causes, symptoms and treatment, with notes on post-mortem examinationsNo ratings yet

- Venkateshwara Hatcheries Private LimitedDocument28 pagesVenkateshwara Hatcheries Private LimitedArjun Pradeep100% (1)

- Beef Feedlot Management Guide: Inma Agribusiness Program - USAID/IraqDocument38 pagesBeef Feedlot Management Guide: Inma Agribusiness Program - USAID/IraqJhon Oleg RamosNo ratings yet

- 8.business Plan of Srinagar Agro FarmDocument9 pages8.business Plan of Srinagar Agro FarmSantosh BhandariNo ratings yet

- Poultry Production and Marketing Project Kitui, KenyaDocument11 pagesPoultry Production and Marketing Project Kitui, KenyaPramod Kumar Chaudhary100% (1)

- Hatchery Sme Gov ProjectDocument10 pagesHatchery Sme Gov ProjectanandbittuNo ratings yet

- Vaccination Schedule PoultryDocument3 pagesVaccination Schedule PoultrykumarNo ratings yet

- Mini Dairy Plant at Dairy FarmsDocument6 pagesMini Dairy Plant at Dairy Farmssurya277No ratings yet

- Renewal Forms of Hotel MembershipDocument13 pagesRenewal Forms of Hotel MembershipDheeraj PareekNo ratings yet

- 4000 BroilerDocument10 pages4000 BroilerDanish JavedNo ratings yet

- Poultry ManagementDocument114 pagesPoultry Managementadavid74100% (3)

- Milk Production in Dry Zone - Sunil GamageDocument8 pagesMilk Production in Dry Zone - Sunil GamageSunil GamageNo ratings yet

- Poultry Industry: //iiffDocument60 pagesPoultry Industry: //iiffBehera RakeshNo ratings yet

- Entry Strategy For Foreign Player in India Yogurt MarketDocument17 pagesEntry Strategy For Foreign Player in India Yogurt MarketSamarth DarganNo ratings yet

- FINAL - Layer Poultry Estate-OrissaDocument14 pagesFINAL - Layer Poultry Estate-OrissaSrinivas RaoNo ratings yet

- Indian Feed Industry-Revitalizing Nutritional Security - Jun 2015 PDFDocument52 pagesIndian Feed Industry-Revitalizing Nutritional Security - Jun 2015 PDFRAJESH JIINNA100% (1)

- Answer: Expenditure Cycle - Payroll SubsystemDocument4 pagesAnswer: Expenditure Cycle - Payroll SubsystemAngeilyn Segador Roda - TambuliNo ratings yet

- Poultry Feed Industry of Pakistan - DR Ramzee v2009Document5 pagesPoultry Feed Industry of Pakistan - DR Ramzee v2009bangash260% (1)

- Rural Poultry Projects in KeralaDocument109 pagesRural Poultry Projects in KeralaDeepa Menon0% (1)

- Business Partners: Shadab Akhtar Ashwani Pande Khyber KhishkiDocument6 pagesBusiness Partners: Shadab Akhtar Ashwani Pande Khyber KhishkiAshwani PandeNo ratings yet

- Project Report For Animal Feed PlantDocument6 pagesProject Report For Animal Feed Plantsamars05No ratings yet

- Egg Farming 20000Document14 pagesEgg Farming 20000Tripurari KumarNo ratings yet

- Sampel For CAT 2022Document15 pagesSampel For CAT 2022Vidhi ChoithaniNo ratings yet

- Quail Farming Mastery: Expert Insights and Solutions to Common ChallengesFrom EverandQuail Farming Mastery: Expert Insights and Solutions to Common ChallengesNo ratings yet

- Introduction To Direct MarketingDocument14 pagesIntroduction To Direct Marketingvishal_shekhar2416No ratings yet

- AN-301 Poultry Nutrition and Feed Technology 2 (1-2)Document2 pagesAN-301 Poultry Nutrition and Feed Technology 2 (1-2)Faizan AhmadNo ratings yet

- PDCM Report On VenkyDocument19 pagesPDCM Report On VenkymeghnakhandelwalNo ratings yet

- Pakistan Poultry IndustryDocument50 pagesPakistan Poultry IndustryMichael LambNo ratings yet

- Suguna Group - HRDocument26 pagesSuguna Group - HRsri lakshmiNo ratings yet

- Venkys ChickenDocument20 pagesVenkys ChickenNilesh AhujaNo ratings yet

- Venkys ChickenDocument20 pagesVenkys ChickenMehervaan Kohli0% (1)

- Bovans White Cs Cage Product Guide L7150-2 PDFDocument48 pagesBovans White Cs Cage Product Guide L7150-2 PDFNarayan YadavNo ratings yet

- Economic Study of Poultry Development in India ReviemDocument18 pagesEconomic Study of Poultry Development in India ReviemVikram RathoreNo ratings yet

- VKS Farms Project ReportDocument35 pagesVKS Farms Project ReportSuganyaMohanNo ratings yet

- Poultry Industry in IndiaDocument8 pagesPoultry Industry in IndiaDivya SasiNo ratings yet

- Poultry and Its Future ProspectsDocument4 pagesPoultry and Its Future ProspectsNasimNo ratings yet

- Suguna Case StudyDocument13 pagesSuguna Case StudyRaj KumarNo ratings yet

- Bovans White CS Cage English GuideDocument16 pagesBovans White CS Cage English Guidearadhya bhatiyaNo ratings yet

- Interview Suguna PoultryDocument6 pagesInterview Suguna Poultryramen4uNo ratings yet

- Poultry FarmingDocument5 pagesPoultry FarmingAakash AgrawalNo ratings yet

- Venky Financial ReportDocument9 pagesVenky Financial ReportPrabhjeet KalsiNo ratings yet

- Goat - Value - Chain - Study - Heifer - 2012Document57 pagesGoat - Value - Chain - Study - Heifer - 2012Arpan ParajuliNo ratings yet

- Model D PR For Poultry FarmingDocument35 pagesModel D PR For Poultry FarmingDinesh ChouguleNo ratings yet

- Vaccination Schedule Commercial LayerDocument3 pagesVaccination Schedule Commercial LayerBINAY KUMAR YADAVNo ratings yet

- Poultry Diseases and Their TreatmentDocument2 pagesPoultry Diseases and Their TreatmentAmrit chutiaNo ratings yet

- A Project Report On Poultry Trade at New DelhiDocument69 pagesA Project Report On Poultry Trade at New Delhinawaljain100% (2)

- Business DescriptionDocument6 pagesBusiness DescriptionTahir MumtazNo ratings yet

- Zydus Feed Additive PDFDocument1 pageZydus Feed Additive PDFimran_99251No ratings yet

- Poultry 1Document2 pagesPoultry 1Fahad MahadiNo ratings yet

- Poultry Feed Supplements & AdditivesDocument14 pagesPoultry Feed Supplements & AdditivesanfomedpoonamNo ratings yet

- BV300Document39 pagesBV300rajeevunnao100% (1)

- Management Thesis SugunaDocument53 pagesManagement Thesis SugunashobhadasNo ratings yet

- Gut Health in Poultry, 2013 PDFDocument42 pagesGut Health in Poultry, 2013 PDFvetbcas100% (1)

- Poultry Farming Project Process Profit and Guide 2018Document3 pagesPoultry Farming Project Process Profit and Guide 2018Ganesh BodakeNo ratings yet

- Cattle Breeds in Pakistan - 1st ClassDocument8 pagesCattle Breeds in Pakistan - 1st ClassKaleem Sandhu100% (1)

- The Role of Vaccination & Lab Monitoring in The Control of Poultry Diseases.Document35 pagesThe Role of Vaccination & Lab Monitoring in The Control of Poultry Diseases.Shah NawazNo ratings yet

- BroilerDocument16 pagesBroilerGurinder Singh SandhuNo ratings yet

- Project Report For 9000Document10 pagesProject Report For 9000GOLLAVILLI GANESH100% (1)

- 30 Poultry Diseases Online Course Module 1 of 3Document9 pages30 Poultry Diseases Online Course Module 1 of 3daniel mundawaroNo ratings yet

- Suguna Project Pons Last ReloadedDocument51 pagesSuguna Project Pons Last ReloadedPerumal Kumar100% (1)

- Poltry FormingDocument7 pagesPoltry FormingAzhar Abbas KulaChINo ratings yet

- Recent Advances in Animal Nutrition– 1978: Studies in the Agricultural and Food SciencesFrom EverandRecent Advances in Animal Nutrition– 1978: Studies in the Agricultural and Food SciencesNo ratings yet

- Beak Trimming Handbook for Egg Producers: Best Practice for Minimising Cannibalism in PoultryFrom EverandBeak Trimming Handbook for Egg Producers: Best Practice for Minimising Cannibalism in PoultryRating: 5 out of 5 stars5/5 (1)

- DownloadDocument2 pagesDownloadJOCKEY 2908No ratings yet

- Client Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactDocument3 pagesClient Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactRupert GilliandNo ratings yet

- UntitledDocument1 pageUntitledReplacement AccountNo ratings yet

- AP Invoice Approval Workflow Setup and UsageDocument9 pagesAP Invoice Approval Workflow Setup and UsageMuhammad FaysalNo ratings yet

- Cap. 1 Hospitality Industry AccountingDocument25 pagesCap. 1 Hospitality Industry Accountingdianelys alejandroNo ratings yet

- ECO 210 - MacroeconomicsDocument5 pagesECO 210 - MacroeconomicsRahul raj SahNo ratings yet

- Bihar TouristDocument5 pagesBihar TouristAditya SharmaNo ratings yet

- SP LawsuitDocument54 pagesSP Lawsuitdhlivingston100% (2)

- Baroda e GatewayDocument7 pagesBaroda e GatewayRajkot academyNo ratings yet

- Staff-Car-Rules-1980-amended-October, 2020Document19 pagesStaff-Car-Rules-1980-amended-October, 2020Waqar AhmadNo ratings yet

- Comprehensive Bike Insurance PolicyDocument2 pagesComprehensive Bike Insurance PolicyGodwin LoboNo ratings yet

- 4xiaomi - WikipediaDocument1 page4xiaomi - Wikipediaamitsinghdaredevil12No ratings yet

- BSBSTR602 Project PortfolioDocument16 pagesBSBSTR602 Project Portfoliocruzfabricio0No ratings yet

- Skripsi Full Tanpa Bab PemabahasanDocument80 pagesSkripsi Full Tanpa Bab Pemabahasanwahyu rizkiNo ratings yet

- April 202 FdA Business Environment Assignment 2 L4 AmendedDocument5 pagesApril 202 FdA Business Environment Assignment 2 L4 AmendedHussein MubasshirNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part A)Document2 pages(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part A)John Carlos DoringoNo ratings yet

- Meghmani Organics Limited Annual Report 2019 PDFDocument254 pagesMeghmani Organics Limited Annual Report 2019 PDFmredul sardaNo ratings yet

- Tunnel Advertising Business ProposalDocument28 pagesTunnel Advertising Business ProposalNavpreetthettiNo ratings yet

- Management AccountingDocument2 pagesManagement AccountingVampire0% (1)

- Project Report On Dabur India Limited (Marketing)Document86 pagesProject Report On Dabur India Limited (Marketing)Avanikant VidyarthyNo ratings yet

- Social Studies Grade 9 PDFDocument9 pagesSocial Studies Grade 9 PDFJudith BandaNo ratings yet

- Ana Anida, Arief Daryanto, Dan Dudi S. HendrawanDocument12 pagesAna Anida, Arief Daryanto, Dan Dudi S. Hendrawanalfitra mahendraNo ratings yet

- University of Delhi: Semester Examination TERM I MARCH 2023 Statement of Marks / GradesDocument2 pagesUniversity of Delhi: Semester Examination TERM I MARCH 2023 Statement of Marks / GradesDev ChauhanNo ratings yet

- Charter PartyDocument16 pagesCharter PartyChinnadurai SenguttuvanNo ratings yet

- Sir AnsleyDocument2 pagesSir Ansleyqf2008802No ratings yet