Professional Documents

Culture Documents

IF7 Syllabus 2008

Uploaded by

TelehealthOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IF7 Syllabus 2008

Uploaded by

TelehealthCopyright:

Available Formats

THE CHARTERED

INSURANCE INSTITUTE

IF7

Healthcare insurance products

Objective: To provide knowledge and understanding of the fundamental principles and

practices relating to healthcare insurance.

Summary of learning outcomes

1. Healthcare product types;

2. Structure of the UK healthcare insurance market;

3. Healthcare provision in the UK and overseas;

4. Legal and regulatory considerations;

5. Risk assessment, rating and underwriting;

6. Claims.

Important notes

• Method of assessment: 100 multiple choice questions (MCQs). 2 hours are allowed for

this examination.

• This syllabus will be examined from 1 January 2008 until 31 December 2008.

• Candidates will be examined on the basis of English law and practice unless otherwise

stated.

• Candidates should refer to the CII update website www.cii.co.uk/updates for the latest

information on changes to law and practice and when they will be examined.

Published October 2007 1 of 3

© The Chartered Insurance Institute 2007

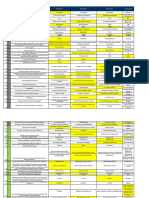

1. Healthcare product types 4. Legal and regulatory considerations

On completion, candidates should On completion, candidates should

1.1 understand the main features of the following 4.1 know the main features of the Financial Services Authority

core products: regulation and dispute resolution relating to healthcare

– private medical insurance; insurance;

– health cash plans; 4.2 know the main features of ABI and industry-agreed codes of

practice and non-statutory regulation relating to healthcare;

– dental insurance;

4.3 understand the effect on healthcare insurance of the:

1.2 know the main features of the following related products

and services: – Access to Medical Reports Act 1988;

– cover for major medical expenses; – Access to Health Records Act 1990;

– sickness and accident policies, including payment – Disability Discrimination Act 1995;

protection insurance and mortgage payment protection – Data Protection Act 1998;

insurance; 4.4 know the personal taxation implications for holders of

– international medical insurance for expatriates; healthcare insurance;

– overseas medical expenses; 4.5 be able to apply the principles defined in learning

– travel insurance; outcome 4 to a given set of circumstances.

– dental capitation plans;

– employee assistance programmes; 5. Risk assessment, rating and

– treatment advice services; underwriting

– health screening;

On completion, candidates should

– private GP services;

5.1 understand the main risk considerations and general

1.3 understand the main features of the following long-term underwriting principles of private medical insurance with

protection products: specific reference to:

– long-term care insurance; – general exclusions and exceptions;

– income protection insurance (PHI); – medical conditions and procedures;

– critical illness insurance; – acute and chronic conditions;

1.4 understand the circumstances in which each of the – hospital banding, postcode rating and restricted

above products would be appropriate. hospital networks;

– excesses and co-payments;

2. Structure of the UK healthcare 5.2 understand the following styles of underwriting

insurance market medical history:

– moratorium;

On completion, candidates should – full medical underwriting;

2.1 know the organisation and function of: – continued personal medical exclusions (CPME);

– provident insurers; – medical history disregarded (MHD);

– commercial insurers; – premium ratings;

– third party administrators; 5.3 know the rating and underwriting considerations for the

– other providers of healthcare insurance; core healthcare products specific to:

– health and dental cash funds; – corporate schemes;

– reassurers and reinsurers of healthcare products; – Small and Medium Enterprises schemes (SMEs);

2.2 understand the basic function and operation of – voluntary schemes;

employee healthcare trusts; – individual plans;

2.3 understand the main distribution channels for 5.4 understand the use of customer loyalty mechanisms that

healthcare insurance. operate in the healthcare market;

5.5 be able to apply the principles defined in learning

3. Healthcare provision in the UK and outcome 5 to a given set of circumstances.

overseas

6. Claims

On completion, candidates should

3.1 know the key features of National Health Service and On completion, candidates should

private healthcare services provision in the UK; 6.1 know the principles of claims assessment applied to core

3.2 know the key features of the systems of healthcare healthcare insurance products;

provision in mainland Europe and the USA. 6.2 know the processes involved in a claim under:

– private medical insurance policies;

– other core product policies;

6.3 understand the elements of and the factors that contribute

to healthcare claims costs;

6.4 know the main methods by which claims costs may

be controlled;

6.5 be able to apply the principles defined in learning

outcome 6 to a given set of circumstances.

Published October 2007 2 of 3

© The Chartered Insurance Institute 2007

Reading list

The following list provides details of various publications which

may assist with your studies. The primary text for this syllabus

is shown in bold type. Periodicals and publications listed as

additional reading will be of value in ensuring candidates keep

up to date with developments and in providing a wider coverage

of syllabus topics. Any reference materials cited are authoritative,

detailed works which should be used selectively as and when

required.

Note: The examination will test the syllabus alone. The reading

list is provided for guidance only and is not in itself the subject

of the examination.

CII/Personal Finance Society members can borrow most of these

additional study materials from CII Knowledge Services and may

be able to purchase some at a special discount. For further

information on lending and discounts go to

www.cii.co.uk/knowledge

Primary text

Healthcare insurance products. London: The CII. Coursebook IF7.

Additional reading

Critical illness insurance. Andy Couchman. London: CII

Knowledge Services. Updated as necessary. Available online

(CII/Personal Finance Society members only)

at www.cii.co.uk/knowledge/factfiles

Long-term care insurance. Andy Couchman. London: CII

Knowledge Services. Updated as necessary. Available online

(CII/Personal Finance Society members only)

at www.cii.co.uk/knowledge/factfiles

Reference works

Dictionary of insurance. C Bennett. 2nd ed. London: Pearson

Education, 2004. Also available online (CII/Personal Finance

Society members only) at www.cii.co.uk/knowledge/dictionaries

The Protection Review. Cheltenham, Gloucestershire: Bank

House Communications. Annual.

Periodicals

The Journal. London: The CII. Six issues a year. Also available

online (CII/Personal Finance Society members only)

at www.cii.co.uk/knowledge/journal

Post Magazine. London: Incisive Financial Publishing. Weekly.

Examination guides

You are strongly advised to study these before the examination.

Please visit www.cii.co.uk to buy online or contact CII Customer

Service for further information on +44 (0)20 8989 8464.

Exam technique/study skills

There are many modestly priced guides available in bookshops.

You should choose one which suits your requirements.

You will also find advice at www.cii.co.uk/knowledge/careersupport

(CII/Personal Finance Society members only).

For a more interactive approach, you should consider:

Winning the brain game. London: The CII, 2006. CD-ROM.

Published October 2007 3 of 3

© The Chartered Insurance Institute 2007

You might also like

- If1 Syllabus 2016 20160107 115441Document5 pagesIf1 Syllabus 2016 20160107 115441Mohamed ArafaNo ratings yet

- New Syllabus PDFDocument77 pagesNew Syllabus PDFPrashantNo ratings yet

- A Cat Bond Premium Puzzle?: Financial Institutions CenterDocument36 pagesA Cat Bond Premium Puzzle?: Financial Institutions CenterchanduNo ratings yet

- 02 - LLMIT CH 2 Feb 08Document24 pages02 - LLMIT CH 2 Feb 08Pradyut TiwariNo ratings yet

- Insurance ManagementDocument76 pagesInsurance ManagementDurga Prasad DashNo ratings yet

- Risks and Rewards For The Insurance Sector: The Big Issues, and How To Tackle ThemDocument26 pagesRisks and Rewards For The Insurance Sector: The Big Issues, and How To Tackle ThemPie DiverNo ratings yet

- Certificate in Insurance: Unit 1 - Insurance, Legal and RegulatoryDocument29 pagesCertificate in Insurance: Unit 1 - Insurance, Legal and RegulatorytamzNo ratings yet

- 01 - LLMIT CH 1 Feb 08Document18 pages01 - LLMIT CH 1 Feb 08Pradyut TiwariNo ratings yet

- HDFC LifeDocument66 pagesHDFC LifeChetan PahwaNo ratings yet

- Module 3 Yr. 2017Document89 pagesModule 3 Yr. 2017Xaky ODNo ratings yet

- 05 - LLMIT CH 5 Feb 08 PDFDocument22 pages05 - LLMIT CH 5 Feb 08 PDFPradyut TiwariNo ratings yet

- Insurance SectorDocument45 pagesInsurance Sectorverma786786100% (1)

- Principles of Insurance and Risk Management: Md. Shamsul Alam, Senior Lecturer, ASAUBDocument97 pagesPrinciples of Insurance and Risk Management: Md. Shamsul Alam, Senior Lecturer, ASAUBMatel ArisNo ratings yet

- IC-24 - Legal Aspects of Life AssuranceDocument1 pageIC-24 - Legal Aspects of Life Assuranceaman vermaNo ratings yet

- Claim Settlement of GICDocument51 pagesClaim Settlement of GICSusilPandaNo ratings yet

- Lloyds Solvency II Tutorial - and - CertificateDocument9 pagesLloyds Solvency II Tutorial - and - Certificatescribd4anoop100% (1)

- Module 5 Yr. 2017Document85 pagesModule 5 Yr. 2017Xaky ODNo ratings yet

- Legal Framework in InsuranceDocument36 pagesLegal Framework in InsuranceHarshit Srivastava 18MBA0050No ratings yet

- Pub Standstill Covers enDocument22 pagesPub Standstill Covers enXitish MohantyNo ratings yet

- 88 - IC-Marketing-and-Public-RelationsDocument1 page88 - IC-Marketing-and-Public-RelationsVINAY S N33% (3)

- Reinsurance Principle and Practice CPCUDocument9 pagesReinsurance Principle and Practice CPCUNguyen Quoc HuyNo ratings yet

- Classification of InsuranceDocument5 pagesClassification of InsuranceRajendranath BeheraNo ratings yet

- Chartered Insurance Institute of Nigeria - Exemption GuidelinesDocument2 pagesChartered Insurance Institute of Nigeria - Exemption Guidelinesejogheneta100% (1)

- CPCUScholarship CorporateCustomersDocument2 pagesCPCUScholarship CorporateCustomersShanmuganathan RamanathanNo ratings yet

- Motor Insurance Study Material FinalDocument67 pagesMotor Insurance Study Material FinalsekkilarjiNo ratings yet

- Intro2Insurance IndustryDocument94 pagesIntro2Insurance IndustryRajMrRajNo ratings yet

- Basic of Reinsurance 03 June 21 Munch ReDocument24 pagesBasic of Reinsurance 03 June 21 Munch ReFernand DagoudoNo ratings yet

- Pce.a.chapter1 8Document73 pagesPce.a.chapter1 8Ela DerarajNo ratings yet

- Table No 133Document2 pagesTable No 133ssfinservNo ratings yet

- MAX BUPA Health Insurance Company LTD: Claims ManualDocument13 pagesMAX BUPA Health Insurance Company LTD: Claims Manualjkhan_724384No ratings yet

- Ic33 Print Out 660 English PDFDocument54 pagesIc33 Print Out 660 English PDFumesh100% (1)

- Ciin SyllabusDocument61 pagesCiin SyllabusejoghenetaNo ratings yet

- LOMA 281 Module 2 Lesson 2 Cash Value Life Insurance Summary of Key PointsDocument1 pageLOMA 281 Module 2 Lesson 2 Cash Value Life Insurance Summary of Key PointslehunglhNo ratings yet

- III AssociateDocument2 pagesIII Associateagupta_118177No ratings yet

- Cpcu 520 TocDocument2 pagesCpcu 520 Tocshanmuga89No ratings yet

- General Insurance Business: ObjectiveDocument4 pagesGeneral Insurance Business: ObjectiveJeremy JarvisNo ratings yet

- It's English That Kills YouDocument63 pagesIt's English That Kills YouSujeet DongarjalNo ratings yet

- Chapter 2: Fundamentals of InsuranceDocument16 pagesChapter 2: Fundamentals of InsuranceFaye Nandini SalinsNo ratings yet

- NTUC Wealth SolitaireDocument36 pagesNTUC Wealth SolitaireGaryNo ratings yet

- Guide For Marketing & Public Relations: Key For Fellowship ExaminationDocument14 pagesGuide For Marketing & Public Relations: Key For Fellowship ExaminationRakesh KumarNo ratings yet

- Academy of Life Underwriting - ALU 101 - Basic Life Insurance Underwriting - Textbook For 2022 Exam Cycle (2021)Document359 pagesAcademy of Life Underwriting - ALU 101 - Basic Life Insurance Underwriting - Textbook For 2022 Exam Cycle (2021)KALPESH SHAHNo ratings yet

- "ULIP As An Investment AvenueDocument60 pages"ULIP As An Investment AvenueMahesh ThallapelliNo ratings yet

- Underwriting Risk Process Under Life InsuranceDocument12 pagesUnderwriting Risk Process Under Life InsuranceSATNAAM89100% (1)

- Role of Acturies in InsuranceDocument12 pagesRole of Acturies in InsurancePrajakta Kadam67% (3)

- Insurance and Economic DevelopmentDocument9 pagesInsurance and Economic DevelopmentHarmeet KaurNo ratings yet

- Insurance Qualifications FrameworkDocument1 pageInsurance Qualifications FrameworkWill SackettNo ratings yet

- Reinsurance Glossary 3Document68 pagesReinsurance Glossary 3أبو أنس - اليمنNo ratings yet

- Literature Review On Insurance Management SystemDocument5 pagesLiterature Review On Insurance Management SystemAncy KalungaNo ratings yet

- How To Prepare For Institute Exams HandbookDocument36 pagesHow To Prepare For Institute Exams Handbookbanu_mageswariNo ratings yet

- 3) Fire Insurance DetailDocument62 pages3) Fire Insurance DetailVaibhav PrajapatiNo ratings yet

- CA Loss PaperDocument52 pagesCA Loss Paperalias shaariNo ratings yet

- Malaysian Takaful DynamicsDocument28 pagesMalaysian Takaful DynamicsOsama0% (1)

- Principles of Life InsuranceDocument63 pagesPrinciples of Life InsuranceKanishk GuptaNo ratings yet

- Ic 72Document1 pageIc 72Sandeep NehraNo ratings yet

- Facultative Reinsurance PDFDocument2 pagesFacultative Reinsurance PDFLindsay0% (1)

- An Insurer's Perspective of Safety: A SarkarDocument26 pagesAn Insurer's Perspective of Safety: A SarkartharakaNo ratings yet

- Business Interruption: Coverage, Claims, and Recovery, 2nd EditionFrom EverandBusiness Interruption: Coverage, Claims, and Recovery, 2nd EditionNo ratings yet

- 42ld340h Commercial Mode Setup Guide PDFDocument59 pages42ld340h Commercial Mode Setup Guide PDFGanesh BabuNo ratings yet

- Math - Snowflake With ProtractorsDocument4 pagesMath - Snowflake With Protractorsapi-347625375No ratings yet

- Qualification of Class Y Flip Chip Cga Package Technology For SpaceDocument8 pagesQualification of Class Y Flip Chip Cga Package Technology For SpacePepe ChorizoNo ratings yet

- MJDF Mcqs - Mixed - PDFDocument19 pagesMJDF Mcqs - Mixed - PDFAyesha Awan0% (3)

- NHD Process PaperDocument2 pagesNHD Process Paperapi-122116050No ratings yet

- Submitted By: S.M. Tajuddin Group:245Document18 pagesSubmitted By: S.M. Tajuddin Group:245KhurshidbuyamayumNo ratings yet

- IRJ November 2021Document44 pagesIRJ November 2021sigma gaya100% (1)

- Higher Vapor Pressure Lower Vapor PressureDocument10 pagesHigher Vapor Pressure Lower Vapor PressureCatalina PerryNo ratings yet

- Malaybalay CityDocument28 pagesMalaybalay CityCalvin Wong, Jr.No ratings yet

- 3 HVDC Converter Control PDFDocument78 pages3 HVDC Converter Control PDFJanaki BonigalaNo ratings yet

- Cultural AnthropologyDocument12 pagesCultural AnthropologyTRISH BOCANo ratings yet

- Duties and Responsibilities - Filipino DepartmentDocument2 pagesDuties and Responsibilities - Filipino DepartmentEder Aguirre Capangpangan100% (2)

- Ethics FinalsDocument22 pagesEthics FinalsEll VNo ratings yet

- Determination of Hydroxymethylfurfural (HMF) in Honey Using The LAMBDA SpectrophotometerDocument3 pagesDetermination of Hydroxymethylfurfural (HMF) in Honey Using The LAMBDA SpectrophotometerVeronica DrgNo ratings yet

- INDUSTRIAL PHD POSITION - Sensor Fusion Enabled Indoor PositioningDocument8 pagesINDUSTRIAL PHD POSITION - Sensor Fusion Enabled Indoor Positioningzeeshan ahmedNo ratings yet

- Awo, Part I by Awo Fa'lokun FatunmbiDocument7 pagesAwo, Part I by Awo Fa'lokun FatunmbiodeNo ratings yet

- GSM Based Prepaid Electricity System With Theft Detection Using Arduino For The Domestic UserDocument13 pagesGSM Based Prepaid Electricity System With Theft Detection Using Arduino For The Domestic UserSanatana RoutNo ratings yet

- Module 17 Building and Enhancing New Literacies Across The Curriculum BADARANDocument10 pagesModule 17 Building and Enhancing New Literacies Across The Curriculum BADARANLance AustriaNo ratings yet

- Sip Poblacion 2019 2021 Revised Latest UpdatedDocument17 pagesSip Poblacion 2019 2021 Revised Latest UpdatedANNALLENE MARIELLE FARISCALNo ratings yet

- ASTM D 4437-99 Standard Practice For Determining The Integrity of Fiel Seams Used in Joining Flexible Polymeric Sheet GeomembranesDocument3 pagesASTM D 4437-99 Standard Practice For Determining The Integrity of Fiel Seams Used in Joining Flexible Polymeric Sheet GeomembranesPablo Antonio Valcárcel Vargas100% (2)

- Mars Atlas MOM 8 13Document6 pagesMars Atlas MOM 8 13aldert_pathNo ratings yet

- Water Flow Meter TypesDocument2 pagesWater Flow Meter TypesMohamad AsrulNo ratings yet

- Quadratic SDocument20 pagesQuadratic SAnubastNo ratings yet

- Know Your TcsDocument8 pagesKnow Your TcsRocky SinghNo ratings yet

- Corporate Members List Iei Mysore Local CentreDocument296 pagesCorporate Members List Iei Mysore Local CentreNagarjun GowdaNo ratings yet

- Glory in The Cross - Holy Thursday - Schutte PDFDocument1 pageGlory in The Cross - Holy Thursday - Schutte PDFsharon0murphyNo ratings yet

- Self-Efficacy and Academic Stressors in University StudentsDocument9 pagesSelf-Efficacy and Academic Stressors in University StudentskskkakleirNo ratings yet

- As I Lay Writing How To Write Law Review ArticleDocument23 pagesAs I Lay Writing How To Write Law Review ArticleWalter Perez NiñoNo ratings yet

- Fractional Differential Equations: Bangti JinDocument377 pagesFractional Differential Equations: Bangti JinOmar GuzmanNo ratings yet

- The Story of An Hour QuestionpoolDocument5 pagesThe Story of An Hour QuestionpoolAKM pro player 2019No ratings yet