Professional Documents

Culture Documents

Gasoline Prices

Uploaded by

Energy TomorrowCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gasoline Prices

Uploaded by

Energy TomorrowCopyright:

Available Formats

Gasoline PricesIn Brief

Rising Gasoline Prices

Why are Gasoline Prices Rising?

More expensive crude oil is driving up gasoline prices.

Historically, as crude prices have increased, so have gasoline prices. The reverse is also true.

At $94 per barrel of crude oil (2011 Jan.-Mar. average), refiners spend over $2.20 for the amount of oil needed to make

one gallon of gasoline. That $2.20 represents the largest component (more than two-thirds) of the pump price. Taxes

add an average of another 48 cents a gallon to the price. Refining the crude oil, storage, delivery and retailing further

add to the cost of producing gasoline.

Global economic recovery is increasing demand for oil as unrest in Mideast puts supplies at risk.

The price of crude oil is set by supply and demand in the global marketplace.

Rising crude oil prices are an indication that a recovering world economy is increasing demand for more energy around

the globe.

While growth is concentrated in Asia and the Middle East, U.S. demand for gasoline is also growing, increasing an

average of 4.1 percent from January to March 2011 (API estimates).

With the worldwide economic recovery underway, demand is on the rise again as unrest in the Mideast has put supplies

at risk. This combination of rising demand and reduced supply is helping to push prices higher.

U.S. refiners are producing at or near record levels.

This year U.S. refiners produced record amounts of gasoline and distillate fuel oils for March and for the first quarter

(Jan.-Mar. 2011, API estimates) while domestic crude production slipped by 0.2 percent in the first quarter of 2011

compared with 2010.

U.S. producers are pumping less oil.

U.S. crude oil producers are pumping less oil this year than last year. The Energy Information Administration (EIA)

says expected delays in near-term projects increase uncertainty about future investment in offshore production and

lowers estimates of future production.

These delays are attributed in large part to the drilling moratoria and the changes in expected lease sales off the Pacific

and Atlantic coasts.

Address the problem with more supply and greater efficiency.

Increased oil production tends to decrease crude oil prices, thus reducing the cost of producing gasoline, diesel,

aviation fuel and other crude oil products.

While we cannot control overseas crude oil production, we can develop our own ample oil and natural gas resources—

but only if the government cooperates.

More U.S. oil and natural gas development would create hundreds of thousands of new jobs, generate billions in more

government revenues and cut the trade deficit.

Government should grant access to more public lands on a timelier basis because developing oil fields takes time.

Waiting until the economic recovery kicks in and energy demand rises puts consumers at risk.

Greater efficiency–more vehicle miles per gallon–is also part of the solution.

Taxing the industry more won’t help; earnings are reasonable.

Over the last five years, industry earnings have been in line with U.S. manufacturing industries, averaging just 7 cents

for every dollar of sales.

Oil and natural gas companies pay an effective tax rate of 41.1 percent, compared to 26.5 percent for all other S&P

Industrial companies.

More taxes would deter domestic investment and thus reduce potential production.

Increased production would produce higher government revenue than would higher taxes.

A new study from Wood Mackenzie found that from 2011 to 2025, negative economic consequences of higher taxes

will, in the long run, more than offset any short-term gains in tax revenue.

More important, the study shows that increased access and development of domestic oil and natural gas resources

would create an additional half million jobs by 2025.

May 2011

You might also like

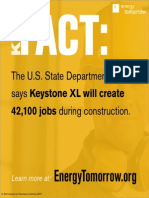

- Know The Facts On Keystone XL?Document3 pagesKnow The Facts On Keystone XL?Energy TomorrowNo ratings yet

- Investing in New JobsDocument1 pageInvesting in New JobsEnergy TomorrowNo ratings yet

- U.S. Liquefied Natural Gas Exports: America's Opportunity and AdvantageDocument38 pagesU.S. Liquefied Natural Gas Exports: America's Opportunity and AdvantageEnergy TomorrowNo ratings yet

- America SpokeDocument1 pageAmerica SpokeEnergy TomorrowNo ratings yet

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- Investing in Quality JobsDocument1 pageInvesting in Quality JobsEnergy TomorrowNo ratings yet

- Energy Solutions PrimerDocument13 pagesEnergy Solutions PrimerAaron MonkNo ratings yet

- Pipelines, Investing in SafetyDocument1 pagePipelines, Investing in SafetyEnergy TomorrowNo ratings yet

- Investing in CommunitiesDocument1 pageInvesting in CommunitiesEnergy TomorrowNo ratings yet

- Investing in The Promise of AmericaDocument1 pageInvesting in The Promise of AmericaEnergy TomorrowNo ratings yet

- API Comments On DOE LNG Export StudyDocument24 pagesAPI Comments On DOE LNG Export StudyEnergy TomorrowNo ratings yet

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- API Blogger Conference Call On Gas Prices - 03.26.12Document10 pagesAPI Blogger Conference Call On Gas Prices - 03.26.12Energy TomorrowNo ratings yet

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- It's Cold OutsideDocument1 pageIt's Cold OutsideEnergy Tomorrow0% (1)

- The Keys To Energy SecurityDocument2 pagesThe Keys To Energy SecurityEnergy TomorrowNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Reflection Paper Elective 3Document2 pagesReflection Paper Elective 3ChaskieNo ratings yet

- المواصفاتDocument14 pagesالمواصفاتMohamed ElzabalawyNo ratings yet

- Caspian Oil and Gas Potential and Export ChallengesDocument285 pagesCaspian Oil and Gas Potential and Export ChallengespauldmeNo ratings yet

- Low Carbon Industries and Climate Change For Myanmar: Present by Thet Htar Su HlaingDocument26 pagesLow Carbon Industries and Climate Change For Myanmar: Present by Thet Htar Su HlaingTin Aung KyiNo ratings yet

- ERC Refinery ProjectDocument16 pagesERC Refinery ProjectSameh El-Sabbagh100% (3)

- Delayed Coking: Chapter 5Document39 pagesDelayed Coking: Chapter 5Mani MozhiNo ratings yet

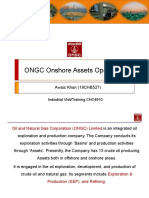

- Presentation On Summer Internship/ Training in Ongc LTDDocument18 pagesPresentation On Summer Internship/ Training in Ongc LTDlokesh_bhatiyaNo ratings yet

- Índice Global de InnovaciónDocument430 pagesÍndice Global de InnovaciónAnonymous F21kWX2sNo ratings yet

- 2023.01.11 Daily NewsDocument6 pages2023.01.11 Daily NewsMOHAMMAD BILAL NURAZIZNo ratings yet

- Lubricant SubstitutionDocument2 pagesLubricant SubstitutionU Thaung Myint87% (23)

- 2002 IEA Russian Energy SurveyDocument281 pages2002 IEA Russian Energy SurveyFelipe CostaNo ratings yet

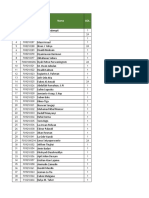

- No NIK Nama GOL DocumentDocument54 pagesNo NIK Nama GOL Documentahmad fatikhul udinNo ratings yet

- Title of Your Presentation: A Free Presentation TemplateDocument6 pagesTitle of Your Presentation: A Free Presentation TemplateAkash GuptaNo ratings yet

- Overview: Philippine Downstream Oil Industry and Pricing: Hideliza V. LudoviceDocument26 pagesOverview: Philippine Downstream Oil Industry and Pricing: Hideliza V. LudoviceJhun PaaNo ratings yet

- Chapter 2 Quiz - 231214 - 195227Document3 pagesChapter 2 Quiz - 231214 - 195227Munir IbrahimNo ratings yet

- Map of Concession AreasDocument1 pageMap of Concession Areascjeski100% (1)

- Construction of Oil Collecting Station (OCS) at Barekuri/ AssamDocument1 pageConstruction of Oil Collecting Station (OCS) at Barekuri/ Assamshakuntla5bankerNo ratings yet

- Multiple Choice Questions On Oil Gas and Petrochemicals PDFDocument327 pagesMultiple Choice Questions On Oil Gas and Petrochemicals PDFShakerMahmood100% (2)

- Major Thermal Power Plants in India (100 MW and GreaterDocument14 pagesMajor Thermal Power Plants in India (100 MW and Greaterrenkutla19710% (1)

- IEA - IEA Oil Information 2018-IEA (2018) PDFDocument758 pagesIEA - IEA Oil Information 2018-IEA (2018) PDFivanushk417No ratings yet

- 2016-PET Group of Companies - 72PPI - UpdatedDocument1 page2016-PET Group of Companies - 72PPI - Updatedjane2127No ratings yet

- Towing and rig handling experience logDocument4 pagesTowing and rig handling experience logachmad mulyana100% (1)

- NTPC - Case StudyDocument10 pagesNTPC - Case StudyZaheen EkhlasNo ratings yet

- Oil & Gas Processing Facilities (Onshore & Offshore) and Petroleum RefineryDocument37 pagesOil & Gas Processing Facilities (Onshore & Offshore) and Petroleum RefineryRicky Rizki Rifo OktaviandraNo ratings yet

- 1 IOCL Annual Report 2016 17Document364 pages1 IOCL Annual Report 2016 17janpath3834No ratings yet

- ReportDocument95 pagesReportKavisha singhNo ratings yet

- ONGC OverviewDocument15 pagesONGC OverviewAwaiz KhanNo ratings yet

- ONGC- MAKING TOMORROW BRIGHTERDocument2 pagesONGC- MAKING TOMORROW BRIGHTERRohan ChandnaNo ratings yet

- Geothermal Energy Here and Now: Sustainable, Clean, FlexibleDocument52 pagesGeothermal Energy Here and Now: Sustainable, Clean, FlexibleChit Citra Aulian ChalikNo ratings yet

- Company Overview: Initial Report May 6th, 2008Document24 pagesCompany Overview: Initial Report May 6th, 2008beacon-docsNo ratings yet