Professional Documents

Culture Documents

Four Pillars Finance January 2011

Uploaded by

FourPillarsFinanceCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Four Pillars Finance January 2011

Uploaded by

FourPillarsFinanceCopyright:

Available Formats

Four Pillars Finance Newsletter

Issue #110 (20 January 2011)

Hello everybody.

Today we take a look at the medium term perspectives for the markets we cover.

Some interesting situations are arising.

We have been mostly in one-way markets since last summer, but it is not going to stay like that.

It would make life too easy.

Here is the FPF prediction chart for the Nasdaq in 2011.

(Predictive chart made with FPF 1.1 software, available at http://www.fourpillars.net/finance/fpf.php)

Nasdaq

Current level: 2725

The Nasdaq is now very close to the price levels we pictured as an ideal selling area in our previous newsletter (Dec.13)

As you can see in the FPF prediction chart for Nasdaq, a top is likely in January or early February, but then we will enter

more dangerous waters.

Metal months are coming up for February-March, which means increased odds for a market decline or at least some serious

consolidation.

Also May-June does not look too good in our cycles.

So, take some profits, buy some protection for your portfolio, or just stay out...

Possible downside targets: 2400, then 2100

Here is our updated prediction chart for Nasdaq

Also notice the massive divergence that my momentum indicator is currently showing.

This usually signals a change of trend is about to start:

Gold

Current level for XAU index: 205

Gold stocks are down almost 10% since our last newsletter.

We have been warning for weakness in this market (for which I got some angry letters), but really the gold stocks are doing

rather poorly given that gold and silver prices are at or near record highs.

The XAU index is now back to where it was in early 2008 (see chart)

We are still in Earth months, typically a bottom period for gold stocks, so we stick to our downside target of 190 for this

market. If we drop below that, then watch for 170, next 150.

Here is the updated chart:

US 20 Year Treasury Bond Fund (TLT)

Current level for TLT etf: 92

Bonds have continued to be rather weak (= interest rates going up).

We are close to major support level near 89 on the TLT (see chart), so I think there is room for some upward bounce here.

Also my momentum indicator is showing a large positive divergence.

I would cover short positions in bonds, and wait for a bounce back up to 100-105 (TLT) in the next couple of months.

Here is the chart:

Euro – US dollar

Current level for Euro-US$: 1.34

The Euro is now recovering some of its recent losses.

Our cycles suggest that we will get another leg down into the April-May expected bottom period for Euro.

So I would look for an opportunity to sell Euro around 1.38

Here is the updated chart:

Happy trading, Danny

Blog site

Feel welcome to visit the Four Pillars Finance blog, where you can give comments or ask questions:

http://fourpillarsfinance.wordpress.com

LunaticTrader

For more short term stock market direction based on moon cycles, visit our Lunatic Trader site and blog.

There we offer our weekly comments.

http://lunatictrader.wordpress.com

http://lunatictrader.com

Four Pillars Finance software - Free trial download

For more detailed daily prediction charts you are welcome to download the Four Pillars Finance 1.1

software on our site : http://www.fourpillars.net/finance/fpf.php

The program calculates the Chinese cycles and shows you in advance the best days , months or

years to buy or sell stocks, gold, bonds, currencies, commodities...

No experience in Chinese astrology is needed in order to use this program.

****

If you want to receive our next monthly outlook in your mailbox, please subscribe to the free

Newsletter on our site: http://www.fourpillars.net/finance/newsl.php

You are welcome to forward this free newsletter to anyone who is interested.

*****

Copyright © 2011 Fourpillars.net

Contact us : http://www.fourpillars.net/finance/contact.php

Disclaimer: Investing in stocks, commodities or currencies is risky. No guarantee can be given that the above prediction will be correct.

Fourpillars.net cannot in any way be responsible for eventual losses you may incur if you trade based on the information

given in this article.

Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record,

simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may

have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated

trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No

representation is being made that any account will or is likely to achieve profits or losses similar to those shown. This

information should not be considered as a recommendation to engage in the purchase and/or sale of any futures contract

and/or options. Trade at your own risk.

You might also like

- Four Pillars Finance Forecasts For 2014Document75 pagesFour Pillars Finance Forecasts For 2014FourPillarsFinanceNo ratings yet

- Four Pillars Finance August 2012Document6 pagesFour Pillars Finance August 2012FourPillarsFinanceNo ratings yet

- Four Pillars Finance June 2013Document6 pagesFour Pillars Finance June 2013FourPillarsFinanceNo ratings yet

- Four Pillars Finance March 2013Document6 pagesFour Pillars Finance March 2013FourPillarsFinanceNo ratings yet

- Four Pillars Finance August 2011Document6 pagesFour Pillars Finance August 2011FourPillarsFinanceNo ratings yet

- Solar Cycles and The Stock MarketDocument7 pagesSolar Cycles and The Stock MarketFourPillarsFinance0% (1)

- Four Pillars Finance Forecasts For 2013Document64 pagesFour Pillars Finance Forecasts For 2013FourPillarsFinanceNo ratings yet

- Four Pillars Finance June 2012Document6 pagesFour Pillars Finance June 2012FourPillarsFinanceNo ratings yet

- Four Pillars Finance March 2011Document6 pagesFour Pillars Finance March 2011FourPillarsFinanceNo ratings yet

- Four Pillars Finance December 2010Document6 pagesFour Pillars Finance December 2010FourPillarsFinanceNo ratings yet

- Four Pillars Finance Year 2011Document4 pagesFour Pillars Finance Year 2011FourPillarsFinanceNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Contoh Dan Soal Cash FlowDocument9 pagesContoh Dan Soal Cash FlowAltaf HauzanNo ratings yet

- SECURITY ANALYSIS COURSE AT COLUMBIADocument14 pagesSECURITY ANALYSIS COURSE AT COLUMBIAdarwin12100% (1)

- Module 1 - Foundations in Financial Planning StandardsDocument13 pagesModule 1 - Foundations in Financial Planning Standardsraman927No ratings yet

- NCFM Model Test PaperDocument8 pagesNCFM Model Test PapersplfriendsNo ratings yet

- Real Estate Investment in India:: Analysing The Near FutureDocument15 pagesReal Estate Investment in India:: Analysing The Near FutureVipin SNo ratings yet

- Roche Case Study PDFDocument10 pagesRoche Case Study PDFAbu TaherNo ratings yet

- Revenue Based Financing 101Document6 pagesRevenue Based Financing 101Mansi aggarwal 171050No ratings yet

- Tom Hougaard The Trading Manual SinglesDocument183 pagesTom Hougaard The Trading Manual SinglesYuthpati Rathi100% (6)

- Reves v. Ernst & Young, 494 U.S. 56 (1990)Document21 pagesReves v. Ernst & Young, 494 U.S. 56 (1990)Scribd Government DocsNo ratings yet

- Ijsrp p6022Document7 pagesIjsrp p6022Gaurav PandeyNo ratings yet

- Cost of Capital AnalysisDocument4 pagesCost of Capital AnalysisSouliman MuhammadNo ratings yet

- FIN619 FinalDocument95 pagesFIN619 Finalqundeel.com80% (5)

- Financial ServicesDocument4 pagesFinancial ServicesadhuNo ratings yet

- Ioqm DPP-4Document1 pageIoqm DPP-4tanishk goyalNo ratings yet

- MCB Bank LTDDocument30 pagesMCB Bank LTDanam tariqNo ratings yet

- Chapter - 3Document38 pagesChapter - 3martha clarNo ratings yet

- Disclosure Report On BAHTNET Self-Assessment Against The Principles For Financial Market InfrastructuresDocument31 pagesDisclosure Report On BAHTNET Self-Assessment Against The Principles For Financial Market InfrastructuresViwat JulkittiphanNo ratings yet

- Investment Risk: Grade 12Document10 pagesInvestment Risk: Grade 12Leonila Oca50% (2)

- Intermediate Accounting: Long-Term Financial LiabilitiesDocument68 pagesIntermediate Accounting: Long-Term Financial LiabilitiesShuo LuNo ratings yet

- The Wise Investor PDFDocument19 pagesThe Wise Investor PDFKatrina0% (1)

- V Sharan Chapter 4Document17 pagesV Sharan Chapter 4jazzy123No ratings yet

- Role of Multinational Corporations (MNCS) in Globalising Indian Economy-A Case Study of Hindustan Lever Limited (HLL)Document445 pagesRole of Multinational Corporations (MNCS) in Globalising Indian Economy-A Case Study of Hindustan Lever Limited (HLL)Arka DasNo ratings yet

- Assignment 3 Lessons From Derivatives MishapsDocument3 pagesAssignment 3 Lessons From Derivatives MishapsSandip Chovatiya100% (2)

- Ken Fisher InterviewDocument9 pagesKen Fisher Interviewkirit0No ratings yet

- Problem 1: 1.1Document7 pagesProblem 1: 1.1Janna Mari FriasNo ratings yet

- What Is An Investment PhilosophyDocument10 pagesWhat Is An Investment PhilosophyArafat DreamtheterNo ratings yet

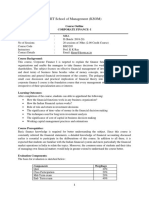

- KSOM Corporate Finance Course OutlineDocument3 pagesKSOM Corporate Finance Course OutlineAkankshya PanigrahiNo ratings yet

- Syllabus: Financial Structure and Strategies Prof. Jyoti Gupta ESCP-EAP, European School of ManagementDocument2 pagesSyllabus: Financial Structure and Strategies Prof. Jyoti Gupta ESCP-EAP, European School of ManagementViet TrinhNo ratings yet

- Matang BHD IPODocument377 pagesMatang BHD IPOUNsangkarableNo ratings yet

- 0036 - Accounting For Business - EditedDocument4 pages0036 - Accounting For Business - EditedAwais AhmedNo ratings yet