Professional Documents

Culture Documents

IMECS2008 pp462-467

Uploaded by

Christian Rajiv CoongheOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IMECS2008 pp462-467

Uploaded by

Christian Rajiv CoongheCopyright:

Available Formats

Proceedings of the International MultiConference of Engineers and Computer Scientists 2008 Vol I

IMECS 2008, 19-21 March, 2008, Hong Kong

Gaining Insights to the Tea Industry of Sri Lanka

using Data Mining

H.C. Fernando, W. M. R Tissera, and R. I. Athauda

(SLTB) [4], Central Bank of Sri Lanka [1], [3], Sri Lanka

Abstract—This paper describes an application of data mining Customs [23] and Department of Census and Statistics [6].

techniques to study certain aspects of tea industry in Sri Lanka The data of this study was provided by SLTB. We hope that

using different types of data available. This study showed that the identified patterns in this study would help to make policy

exports and production continuously increase with time. It

further revealed how production vary with the three elevations

decisions in improving tea production and exports, which

they are grown, namely, High, Low and Mid. Time series contributes significantly to the national economy of Sri

analysis produced ART(p) models for production and price. Lanka.

The study resulted in significant insights and knowledge about

the tea industry which contributes significantly to the Sri

Lankan economy. II. METHODOLOGY

Index Terms—Data mining, cluster analysis, time series

analysis The initial exploration started with preparing data to be

comparable with respect to currency. The currency of the

auction prices is recorded in Sri Lanka Rupee (LKR). Due to

I. INTRODUCTION the fluctuations of the exchange rates and currency

Data mining (DM) is a powerful new technology to depreciation, comparable price in USD was calculated as

analyze information in large databases and extract hidden follows:

predictive information from them. There is a growing interest

to use this new technology to convert large passive databases Actual _ monthly _ average _ auction _ price _ in _ LKR _ per _ kg

into useful actionable information. The advantage of data Monthly _ average _ exchange _ rate _ in _ USD

mining techniques is that they can be used to explore massive

volumes of data automatically unlike queries posed by a Monthly average exchange rates [2] were used to perform

human analyst. this transformation. As there were only a few variables,

The process of data mining consists of three stages: (i) the reduction of the dimension of the data was not necessary. It

initial exploration, (ii) model building or pattern was essential to select data for the same period of time for a

identification and (iii) deployment [8]. The initial exploration given variable. Preliminary analysis was carried out as the

usually starts with data preparation which may involve next step of initial exploration using SPSS [20].

cleaning data, data transformations, selecting subsets of Microsoft SQL Sever [19], [21], [26] is a powerful

records and - in case of data sets with large numbers of Database Management Systems (DBMS) that offers different

variables - performing some preliminary feature selection DM algorithms and techniques and is user friendly.

operations to bring the number of variables to a manageable Therefore, we selected Microsoft SQL Server 2005 due to its

range. Data Mining lends techniques from many different DBMS capabilities and DM algorithms [19], [26].

disciplines such as databases ([9], [13], [15], [16], [18], [24],

A. Clustering

and others), statistics [12], Machine Learning/Pattern

Recognition [5], and Visualization [14]. Cluster analysis is a branch of statistics that has been

The aim of this study is to investigate how data mining successfully applied to many applications. Its main goal is to

techniques can be used to find relationships among factors identify clusters present in the data. There are two main

such as production, export and auction price of tea. It is approaches to clustering, namely, hierarchical clustering and

possible to obtain comparatively large sets of data on tea partitioning clustering. The Microsoft clustering algorithm,

exports from different sources, namely, Sri Lanka Tea Board k-means [10], is a partitioning algorithm which creates

partitions of a database of N objects into a set of k clusters. It

Manuscript received December 30, 2007 minimizes total intra-cluster variance, or, the squared error

H. C. Fernando (corresponding author to provide phone: function (V)

+94-11-230-1904; fax: +94-11-230-1906; e-mail: chandrika.f@sliit.lk)., and k 2

W. M. R Tissera are with the Sri Lanka Institute of Information Technology, V =∑ ∑x j − μi

Level #16, BOC Merchant Tower, St. Micheals Road, Colombo 03. Sri i =1 x j ∈S i

Lanka.. (e-mail: menik.t@sliit.lk)

R. I. Athauda is with the Faculty of Science and Information Technology, where, there are k clusters Si , i = 1,2,..., k and µi is the

School of Design, Communication and Information Technology, The

University of Newcastle, NSW 2308. Australia. (e-mail: centroid or mean point of all the points xi ∈ S i .

Rukshan.Athauda@newcastle.edu.au)

Monthly data was available for production and prices but

ISBN: 978-988-98671-8-8 IMECS 2008

Proceedings of the International MultiConference of Engineers and Computer Scientists 2008 Vol I

IMECS 2008, 19-21 March, 2008, Hong Kong

not for exports in our data set. Therefore, cluster analysis was the least throughout the year (see Fig. 5).

possible only for the three variables: time, price and

production for the three types of tea.

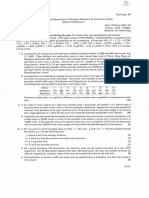

Production v s Y e ar

350000

B. Time series analysis

The trends of the variables with time (monthly or yearly) 300000

Tea Production (MT)

were analyzed using time series analysis. SQL Server 250000

provides the facility to perform time series analysis using

200000

Autoregressive tree model (ART) [17]. An ART is a

piecewise linear autoregressive model in which the 150000

boundaries are defined by a decision tree and leaves of the 100000

decision tree contain linear autoregressive models. An

1900 1920 1940 1960 1980 2000 2020

ART(p) model is an ART model in which each leaf of the Ye a r

decision tree contains AR(p) model, and the split variables

for the decision tree are chosen from among the previous p Figure 1. Production by year

variables in the time series. ART(p) models are more

powerful than AR models because they can model non-linear

relationships in time series data [25]. ART models are

particularly suitable for data mining because of the

Exports vs Year

computationally efficient methods available for learning 350000

from data. Also, the resulting models yield accurate forecasts

300000

and are easily interpretable.

Tea Exports (MT)

250000

ART (p) model is given by:

p Φi 200000

L L

f ( y t y t − p ,..., y t −1 , θ ) = ∏ f i ( y t y t − p ,..., y t −1 , θ i ) Φ i = ∏ N (mi + ∑ bij y t − j , σ i2 )

i =1 i =1 j =1 150000

where L is the number of leaves, θ = (θ1 ,...,θ L ) , and 100000

θ i = (mi , bi1 ,..., bip , σ i2 ) , are the model parameters for the linear

1900 1920 1940 1960 1980 2000 2020

regression at leaf l i , i = 1,..., L .

Year

Figure 2. Exports by year

The experiment is carried out for three different data sets.

Data set I: Annual export and production of tea from 1911

to 2006.

105

Data set II. Monthly production according to the elevation %

from 1986 to 2006. 100

95

Data set III Monthly auction prices according to the

90

elevation from 1986 to 2006.

85

80

III. RESULTS 75

1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005

Data set I contains annual figures of export and production Year

of tea (in metric tons) of any elevation. Fig. 1 shows a

continuous progress in production with time. The same Figure 3. Export as a percentage of production by year

relationship was found for exports and time too (see Fig. 2). It

is important to observe that we have exported more than the

production in some instances (see Fig. 3). This was possible

because tea was imported to blend with Ceylon tea, thereby

adding more tea to the production of Sri Lanka (e.g. In 2006, 29%

Low grown tea

export as a percentage of production was 102%). We have 51% Mid grown tea

High grown tea

been able to export any amount we produced so far (see Fig.

20%

6).

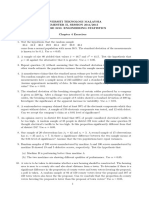

Data set II contains how the average production of a

particular month for a period of 20 years is distributed (see Figure 4. Average tea production by elevation

Fig. 4 and Fig. 5) among the three elevations they are grown,

namely, High, Low and Mid [23]. Low grown tea is produced

at 1500-1800 feet. Mid-grown tea is from heights between

1800-3500 feet. High grown tea is produced at the height of

3500 to 7500 feet. Low grown tea contributes to almost half

of the production (see Fig. 4). Mid grown tea production is

ISBN: 978-988-98671-8-8 IMECS 2008

Proceedings of the International MultiConference of Engineers and Computer Scientists 2008 Vol I

IMECS 2008, 19-21 March, 2008, Hong Kong

Comparable Avg. Tea

2.00

14.00 1.50

L

Prices

12.00

1.00 M

10.00

L-aver age

H

8.00 0.50

M-aver age

6.00 H-aver age 0.00

4.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2.00 Month

0.00

Figure 7. Average price distribution by elevation

M o nt h

Figure 5. Average tea production by elevation B. Cluster analysis for production and price

This section presents the results of cluster analysis using

A. Regression of exports on production

K-means algorithm [19], [26] available in Microsoft SQL

Data set I consists of yearly exports and production of tea Server 2005. This analysis was performed only for monthly

from 1911 (see Fig. 1 and Fig. 2). Fig. 1 shows a continuous production and prices. Since, monthly data was not available

progress in exports with time. The same relationship was for exports, it was excluded from cluster analysis. We were

found for production and time too. This indicates that exports able to obtain seven clusters as presented in Fig. 8 and Table

and production follows the same pattern with time. It is I. It is important to note that low grown tea forms two distinct

shown that the more tea is produced, more can be exported clusters: cluster 5 and 7. The constitution of cluster 7, which

(see Fig. 3). Since the scatter plot showed a strong linear gives the highest average production, is 100% low grown tea.

correlation (r =0.993) between these two variables, a simple The other cluster, which consists of 100% low grown tea,

linear regression was fitted (export = 6625 + namely, cluster 5, gives second highest average production.

0.914*production; R2=0.98). Fig. 6 shows how well the The third highest average production is found in cluster 6,

regression line fits the data. It shows a positive trend, which which consists of 88.5% of low grown tea, and the balance is

amounts to an increase of 914,000 kg per year for exports of high grown tea. It can be concluded that low grown tea is the

tea, further justifying our earlier comments. main contributor to the production. The pattern in clustering

of price is the same as of production. That is, the highest

average price is found in cluster 7, followed by cluster 5 and

Exports vs production

350000

cluster 6. Therefore, the most significant contributor to the

price of tea is low grown tea.

300000

Table I . Distribution of Mean and Standard Deviation by cluster

250000

Exports (MT)

Category Participation Price Production

200000

Clust Low Mediu High

150000 er % m% % Mean SD Mean SD

1 1.8 85.9 12.3 1.45 ± 0.27 3.89 ± 0.58

100000

2 32.6 7.3 60.1 1.51 ± 0.28 5.55 ± 0.48

100000 150000 200000 250000 300000 350000

3 30.8 _ 69.2 1.56 ± 0.03 7.19 ± 0.51

production (MT) 4 64.2 _ 35.8 1.53 ± 0.25 9.01 ± 0.45

5 100 _ _ 1.89 ± 0.25 13.31 ± 0.73

Figure 6. Regression graph between exports and production of tea 6 88.5 _ 11.5 1.73 ± 0.31 10.77 ± 0.63

7 100 _ _ 1.9 ± 0.16 16.08 ± 1.10

Data set III contains monthly auction prices according to

the elevation of tea (see Fig. 7). On average, the price of low

grown tea stands above that of the other types. However,

prices of all three types decrease in the period of June-July. It

is important to note that the price is not governed by mere

production. The simple linear regressions explain almost

nothing of the variation in price in all three types of tea (Low:

R-Sq = 7.8%, Mid: R-Sq = 1.8% and High: R-Sq = 0.2%).

This indicates that the auction price is independent of the

amount of production.

Figure 8. Cluster Profile

ISBN: 978-988-98671-8-8 IMECS 2008

Proceedings of the International MultiConference of Engineers and Computer Scientists 2008 Vol I

IMECS 2008, 19-21 March, 2008, Hong Kong

C. Time series analysis for export and production Table III. ART model for production

It is important to know the trend for production and export Region ART model

so that the recent future can be predicted. One of the data Year >= 1993 Production = 73215.369 + 0.166 * Production(-3) + 0.232 *

Production(-2) + 0.379 * Production(-1)

mining techniques, time series [25] was used to identify the

trend of exports and production. For this analysis time frame

Year < 1993 Production = 99579.595 + 0.629 * Production(-3) + 0.049 *

was fixed from 1977, in which year open economy was Production(-1) -0.149 * Production(-2)

introduced to the country. After introducing the open

economy the exports have increased considerably.

In order to investigate how the exports and production

In order to fit a time series model for the trend found in predicted to vary by the two time series model, Fig. 11 was

exports the following ART model was calculated (Table II).

constructed. This graph uses the data calculated by the two

The decision tree produces two distinct nodes. One node

time series models. The gap between export and production is

represents period before mid 1992 and the other node

predicted to exist in future too. This shows that the

represents period after mid 1992 (see Fig. 9).

production doesn’t meet the continuous increase in the export

adequately (see Fig. 11).

340000

Quantity (MT)

330000

320000 Exports

310000 Production

Figure 9. Decision Tree of ART model of annual exports

300000

290000

The two time series model for the two periods mentioned

07

10

13

16

19

22

above is given in Table II. They both show that the export

20

20

20

20

20

20

figure for a given month only depends on export figures of Year

the previous two months. Also, exports are continuously

increasing with time. The time series model predicts a Figure 11. Prediction using ART model

continuous growth in exports (i.e. coefficients are positive)

(see Table II). D. Time series analysis for Prices

Table II. ART model for annual exports This analysis was carried out separately for the three types

Region ART model

of tea. As low-grown tea is the highest contributor, we started

this analysis with low grown tea. The decision tree for this

Year >= 1992.500 Exports = 49164.421 + 0.254 *

Exports(-2) + 0.600 * Exports(-1) model had only the root node, hence one leaf (see Fig. 12).

Therefore, the linear autoregressive model needs to be

Year < 1992.500 Exports = 93197.567 + 0.279 * calculated only for one region and is presented in Table IV.

Exports(-2) + 0.244 * Exports(-1) This model shows a positive trend in price of low grown tea,

which only depends on the price of the previous month

In order to fit a time series model for the trend found in

production, the following ART model was calculated (see

Table III). The decision tree produces two distinct nodes (see

Fig. 11).

Figure 12. Decision Tree of ART model for prices of

Low-grown tea

Table IV. ART model for price of low grown tea

Figure 10. Decision Tree of ART model of annual production Region AR model

All Low Grown Price = 0.078 +

0.956 * Low Grown Price(-1)

One node represents period before 1993 and the other node

represents period after 1993 (see Fig. 10).

The two time series models for the two regions show that The decision tree for mid-grown tree also has only the root

the production figure for a given month only depends on node, hence one leaf (see Fig. 13). Therefore, the linear

production figures of the previous three months (see Table autoregressive model needs to be calculated only for one

III). Also, production is continuously increasing with time. region and is presented in Table V. This model shows a

The time series model predicts a continuous growth in positive trend in price of mid grown tea, which only depends

production but slow. on the price of the previous two months.

ISBN: 978-988-98671-8-8 IMECS 2008

Proceedings of the International MultiConference of Engineers and Computer Scientists 2008 Vol I

IMECS 2008, 19-21 March, 2008, Hong Kong

Considering monthly data, it is important to note that in

February, March, September and October, the production is

comparatively low (see Fig. 5 and Fig. 7). In 1994, 1998 and

2003, there had been marked differences in prices for all

three types of tea. When considering the auction prices for

different categories of tea from 1986 to 2006, the highest

prices for different categories of tea have been reported in the

Figure 13. Decision Tree of price of mid- grown tea period 1996-1997. One of the significant events took place in

1996 was wining the “World Cup” in cricket. The marketing

Table V. ART model for comparable price fluctuations of Mid campaign and the publicity obtained by the country may have

grown tea

helped to improve the prices of tea. If the correlation

Region AR model between marketing and prices of tea can be established then

All Mid Grown Price = 0.132 + 1.093 * Mid Grown Price(-1) considering different strategies to market tea can result in

-0.183 * Mid Grown Price(-2)

higher auction price for tea. This correlation (although

possible) remains to be shown by future research.

The decision tree for high-grown tree produced three The authors believe that further research in data analysis

regions (see Fig. 14). The piecewise linear autoregressive with respect to the tea industry can result in significant

model was calculated for three regions and is presented in insights and knowledge, which can be utilized for better

Table VI. This model revealed that the price of high grown alignment and growth in the sector contributing to the Sri

tea is constant at present. Lankan economy.

This paper demonstrates the possibility of applying

techniques such as data mining to gain useful insights in

sectors such as tea industry. In future, we plan to further

investigate this area of research in close collaboration with

domain experts from the tea sector.

Figure 14. Decision Tree of price of High- grown tea

ACKNOWLEDGMENT

This research was inspired and necessary data were

provided by Sri Lanka Tea Board (SLTB). We would like to

Table VI. ART model for price of High grown tea

acknowledge Mr. Palitha Sarukkali, Statistician, SLTB, for

Region AR model his valuable guidance and support.

High Grown Price-3 >= 1.957 High Grown Price = 1.651

High Grown Price-3 >= 1.957 High Grown Price = 1.651

and Month >= 5/19/1999 REFERENCES

High Grown Price-3 >= 1.957 High Grown Price = 0.744 -0.472 * High

and Month < 5/19/1999 Grown Price(-3) + 0.121 * High Grown [1] Annual report, 2005, Central Bank of Sri Lanka.

Price(-2) + 0.433 * High Grown Price(-1) [2] Average monthly exchange rates , [cited Aug. 2007] [online], available

+ 0.715 * High Grown Price(-96) from World Wide Web [http://www.cbsl.gov.lk/info/ _cei/er/e_1 .asp].

[3] Central bank of Sri Lanka: Official web page for Central bank of Sri

Lanka [cited Aug 2007] [online], available from

[http://www.cbsl.gov.lk/].

IV. CONCLUSION [4] Ceylon tea board: Official web site for Ceylon tea board [online], [cited

Aug 03 2007], available from World Wide Web

This section discusses a study carried out with some data [http://www.pureceylontea.com].

related to the Sri Lankan tea industry. Sri Lanka considers [5] Crone S.F., Lessmann S. and Stahlbock R., “Utility based data mining

export of tea as a lucrative business. Understanding the for time series analysis: cost-sensitive learning for neural network

predictors,” Chicago, pp. 59 – 68, 2005.

different parameters such as production, costs, prices, and [6] Department of Census and Statistics of Sri Lanka: Official web page

others can assist in growth, development and higher for Census and Statistics Department of Sri Lanka [cited Aug 2007]

profitability in this sector. [online], available from [http://www.statistics.gov.lk/].

[7] Department of Commerce: Official web page for Department of

As discussed, the strong correlation between production Commerce [cited Aug 2007] [online], available from

and exports makes us to believe that the tea production is the [http://www.doc.gov.lk/].

only aspect governing tea exports. Ninety eight per cent of [8] Dunham M.H., “Data Mining Introductory and Advanced Topics,”

Pearson, 2005.

the variation in exports is explained by production. This is [9] Ester. M., Kriegal. H., and Schubert M., “Web Site Mining: A new way

further proven by the fact that the auction price has little/no to spot Competitors, Customers and suppliers in the World Wide Web,”

correlation over exports of all types of tea. Proceedings of SIGKDD-2002, 2002.

[10] Faber V., “Clustering and the Continuous k-Means Algorithm,” Los

As shown in Fig. 5, mid and high grown tea production is

Alamos Science, Number 22, 1994.

considerably lower than that of low grown tea. The auction [11] Grabmeier J., and Rudolph A., “Techniques of Cluster Algorithms in

prices for tea start rising by end of July. From August to Data Mining,” Data Mining and Knowledge Discovery, Springer

March prices remain comparatively high. Also, low grown Netherlands Vol. 6, No 4 , pp 303-360,2002.

[12] Hosking R. M. J.,. Edwin P. D and Sudan M., “A statistical perspective

tea seems to fetch an average higher price when compared to on data mining,” Future Generation Computing Systems, special issue

others. It would be interesting to find out the profitability of on Data Mining, 1997.

each type of tea (high, mid and low) considering the cost of [13] Julisch. K., and Dacier. M., “Mining Intrusion Detection Alarms for

Actionable Knowledge,” Proceedings of KDD-2002, 2002.

production.

ISBN: 978-988-98671-8-8 IMECS 2008

Proceedings of the International MultiConference of Engineers and Computer Scientists 2008 Vol I

IMECS 2008, 19-21 March, 2008, Hong Kong

[14] Keim. D.A, “Information visualization and visual data mining,”

Proceedings of IEEE Transactions on Visualization and Computer

Graphics, Vol. 8, pp 1-8, 2002.

[15] Kitts. B., Freed. D., and Kommers. J, “Cross –sell: A Fast Promotion –

Turntable Customer item Recommendation Method Based on

Conditionally Independent Probabilities.,” Proceedings of KDD-2000,

2000.

[16] Ma Y., Liu B., Wong C. K., Yu P.S., Lee S. M., “Targeting the Right

Student Using Data Mining,” Proceedings of KDD 2000,Boston, MA

USA,2000.

[17] Meek C., Chickering D.M, and Heckerman D., “Autoregressive Tree

Models for Time-Series Analysis,” 2002.

[18] Roset. S., Murad U., Neumann. E., Idan.Y., and Pinkas.G., “Discovery

of Fraud Rules for Telecommunications – Challenges and Solutions.,”

Proceedings of KDD-99, 1999.

[19] SQL Server 2005 Data Mining information: [cited Aug 2007] [online],

available from World Wide Web

[http://www.sqlserverdatamining.com].

[20] SPSS: Official web page for SPSS: [cited Jan 2008] [online], available

from [http://www.spss.com/spss/]

[21] SQL Server 2005: Official web page for SQL Server 2005 [cited Aug

2007] [online], available from

[http://www.microsoft.com/sql/default.mspx].

[22] Sri Lanka Customs: Official web page for Department of Commerce

[cited Aug 2007] [online], available from

[http://www.customs.gov.lk/].

[23] The story of the Ceylon tea [cited Aug. 2007] [online], available from

World Wide Web [http://www.angelfire.com/wi/SriLanka/

ceyl_tea.htm].

[24] Tissera. W.M.R., Athauda. R. I., and Fernando H.C., “Discovery of

Strongly Related Subjects in the Undergraduate Syllabi using Data

Mining,” Proceeding of ICIA 2006,2006.

[25] Tong H., “Threshold models in Nonlinear Time Series Analysis,”

Springer-Verlag, New York,1983.

[26] Zhao H. T. and Maclennan J., “Data Mining with SQL Server 2005”,

Wiley Publishing Inc. USA., 2005.

ISBN: 978-988-98671-8-8 IMECS 2008

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Thapar Institute of Engineering & Technology (Deemed To Be University), PatialaDocument2 pagesThapar Institute of Engineering & Technology (Deemed To Be University), PatialaSwapnilNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Ebook Elementary Statistics 3Rd Edition Navidi Solutions Manual Full Chapter PDFDocument52 pagesEbook Elementary Statistics 3Rd Edition Navidi Solutions Manual Full Chapter PDFDouglasRileycnji100% (11)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- (Griselda Deelstra, Guillaume Plantin (Auth.) ) RisDocument85 pages(Griselda Deelstra, Guillaume Plantin (Auth.) ) RiscakraNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- GRADE 12 Mathematics NAT Review MaterialsDocument12 pagesGRADE 12 Mathematics NAT Review MaterialsIrene MacapalaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Chapter 30 - Revised Draft-7-05-2005Document153 pagesChapter 30 - Revised Draft-7-05-2005Tere Mota DondéNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Information Paper: Northern Territory Skilled Occupation Priority ListDocument10 pagesInformation Paper: Northern Territory Skilled Occupation Priority ListHarjit Singh MangatNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Mind Map or Summary For Chapter 2Document3 pagesMind Map or Summary For Chapter 2Amirah AzlanNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Riskope The Factor of Safety and Probability of Failure Relationship 1Document12 pagesRiskope The Factor of Safety and Probability of Failure Relationship 1jaguilarn1960No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Eng ISM Chapter 7 Probability by Mandenhall SolutionDocument28 pagesEng ISM Chapter 7 Probability by Mandenhall SolutionUzair Khan100% (1)

- PMP Exam QuestionsDocument31 pagesPMP Exam QuestionsAsuelimen tito100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- A Cognitive-Affective System Theory of Personality - ZZZDocument23 pagesA Cognitive-Affective System Theory of Personality - ZZZCristina DiaconuNo ratings yet

- Projet - COLD STORAGEDocument21 pagesProjet - COLD STORAGESanket GokhaleNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 2010 CMA Part 2 Section B: Corporate FinanceDocument326 pages2010 CMA Part 2 Section B: Corporate FinanceAhmed Magdi0% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Process Capability AnalysisDocument20 pagesProcess Capability AnalysisTaufik NurkalihNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- UTM STATISTICS CHAPTER 4 EXERCISESDocument3 pagesUTM STATISTICS CHAPTER 4 EXERCISESAbdullah BelasegakNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Qa QCDocument62 pagesQa QCHaroldRafaelNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Suinn, 2001Document4 pagesSuinn, 2001Mahbub SarkarNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Chapter 1 Briefing IntroductionDocument101 pagesChapter 1 Briefing IntroductionAhmed AsnagNo ratings yet

- Think Stats: Probability and Statistics For ProgrammersDocument142 pagesThink Stats: Probability and Statistics For ProgrammersSalvador RamirezNo ratings yet

- Final Exam Sample 1 NOsolutions1Document14 pagesFinal Exam Sample 1 NOsolutions1alexandre.stalensNo ratings yet

- Final SB BTDocument85 pagesFinal SB BTNgan Tran Nguyen ThuyNo ratings yet

- Effect of Aerobic Exercise On Peripheral Nerve Functions of Population With Diabetic Peripheral Neuropathy in Type 2 Diabetes: A Single Blind, Parallel Group Randomized Controlled TrialDocument8 pagesEffect of Aerobic Exercise On Peripheral Nerve Functions of Population With Diabetic Peripheral Neuropathy in Type 2 Diabetes: A Single Blind, Parallel Group Randomized Controlled TrialHadsabsaNo ratings yet

- Chapter 06-Statistical Methods in Quality Management: True/FalseDocument20 pagesChapter 06-Statistical Methods in Quality Management: True/False132345usdfghjNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Astm D 6084Document4 pagesAstm D 6084AbelClarosNo ratings yet

- Adobe Scan 15-Jan-2024Document6 pagesAdobe Scan 15-Jan-2024Moksh GoyalNo ratings yet

- CH - 4 Risk, Return and Portfolio TheoryDocument44 pagesCH - 4 Risk, Return and Portfolio TheoryBerhanu ShankoNo ratings yet

- CH 06Document9 pagesCH 06Bairah KamilNo ratings yet

- Tutorial Letter 101 (Both) For RSC2601 2020Document55 pagesTutorial Letter 101 (Both) For RSC2601 2020SleepingPhantoms100% (2)

- Worksheet I: Statistics and Probability - Grade 11Document2 pagesWorksheet I: Statistics and Probability - Grade 11Tin CabosNo ratings yet

- Course Materials: TextDocument32 pagesCourse Materials: TextErin WalkerNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)