Professional Documents

Culture Documents

Commodities During Jan 2008 Crisis

Uploaded by

ysisodiaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commodities During Jan 2008 Crisis

Uploaded by

ysisodiaCopyright:

Available Formats

From the SelectedWorks of Yogendra Sisodia

November 2009

Commodities during Jan 2008 Crisis

Contact Start Your Own Notify Me

Author SelectedWorks of New Work

Available at: http://works.bepress.com/ysisodia/5

Correlation between Nifty 50 and MCX Comdex during Jan 08 crisis

Here we are finding how the commodity prices (using MCX Comdex commodity index as a commodity proxy)

affects the Nifty spot market. We have taken 3 months data (Dec2007 to Feb 2008) because during Jan 2008 the

trend of Nifty reversed significantly causing Nifty spot and Nifty Futures to crash.

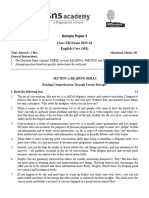

Fig1: Nifty Turnaround in Jan 2008

0.08

0.06

0.04

0.02

0

-0.02 0 10 20 30 40 50

-0.04

-0.06

Comdex Return

-0.08

Nifty Return

-0.1

Fig2: Nifty Return v/s Comdex returns

Nifty (Y Axis) and Comdex (X Axis)

0.1

0.05

0

-0.02 -0.01 0 0.01 0.02 0.03

-0.05

-0.1

Fig3: Scatter Plot of Nifty and Comdex

The descriptive analysis shows that standard deviation of Comdex returns is low i.e. commodities fluctuates less

than equity. Also mean return is positive for MCX Comdex compared to the Nifty 50.

Yogendra Sisodia (SMP-1033)

Comdex Return Nifty Return

Mean 0.001723325 Mean -0.003230381

Standard Error 0.001466788 Standard Error 0.004254433

Median 0.002860557 Median 0.000764733

Mode #N/A Mode #N/A

Standard

Standard Deviation 0.009392029 Deviation 0.027241666

Sample Variance 8.82102E-05 Sample Variance 0.000742108

Kurtosis -0.303345671 Kurtosis 3.13840337

Skewness -0.240914287 Skewness -0.428712633

Range 0.037566885 Range 0.158251288

Minimum -0.017312281 Minimum -0.091046064

Maximum 0.020254604 Maximum 0.067205223

Sum 0.07065632 Sum -0.132445635

Count 41 Count 41

As we know the Regression analysis performs linear regression analysis by using the "least squares" method to

fit a line through a set of observations. We can analyze how a single dependent variable (here Nifty) is affected

by the values of independent variable (MCX Comdex).Some findings are correlation coefficient of 0.5322 which

shows not significant relation between the two asset classes for this volatile duration. Similarly R-Square of .283

tells us that Commodity prices not significant drives the equity market.

Detailed findings of regression analysis are given in annexure A. Annexure B have all data used for calculation.

Conclusion

Commodities don’t have the huge volatility compared to equity.

Investors must seriously consider commodities as excellent asset class.

Limitations

As of March 2010 Commodity Indices Futures can’t be purchased in India (Forwards Contract

Regulation Act).

Historically Gold and Oil definitively have negative correlation with Equity market.

Annexure A

SUMMARY OUTPUT

Regression Statistics

0.53223

Multiple R 2641

0.28327

R Square 1584

Adjusted R 0.26489

Square 3933

Standard 0.02335

Error 6549

Observatio

ns 41

ANOVA

Significan

df SS MS F ce F

0.008408 0.008408 15.41391 0.000341

Regression 1 729 729 627 39

0.021275 0.000545

Residual 39 606 528

0.029684

Total 40 335

Coefficie Standard Lower Upper Lower Upper

nts Error t Stat P-value 95% 95% 95.0% 95.0%

Yogendra Sisodia (SMP-1033)

- - - -

0.00589 0.003710 1.587768 0.120414 0.013395 0.001613 0.013395 0.001613

Intercept 0757 086 173 253 114 601 114 601

X Variable 1.54374 0.393205 3.926056 0.000341 0.748413 2.339078 0.748413 2.339078

Comdex 5688 206 07 39 094 281 094 281

Annexure B

Date Comdex Close Nifty Close Comdex Return Nifty Return

12-03-2007 2281.31 5865

12-04-2007 2278.89 5858.35 -0.001061357 -0.001134488

12-05-2007 2288.1 5940 0.004033297 0.013841139

12-06-2007 2250.65 5954.7 -0.016502715 0.00247169

12-07-2007 2275.96 5974.3 0.011182878 0.003286112

12-10-2007 2286.48 5960.6 0.004611576 -0.002295789

12-11-2007 2290.01 6097.25 0.001542667 0.022666703

12-12-2007 2303.8 6159.3 0.006003749 0.010125285

12/13/2007 2331.27 6058.1 0.01185325 -0.016566915

12/14/2007 2294.19 6047.7 -0.016033343 -0.001718185

12/17/2007 2268.92 5777 -0.011075893 -0.045793518

12/18/2007 2301.63 5742.3 0.01431362 -0.00602469

12/19/2007 2290.3 5751.15 -0.004934754 0.001540008

12/20/2007 2299.44 5766.5 0.003982802 0.002665476

12/24/2007 2344.43 5985.1 0.019376687 0.037207737

12/26/2007 2355.11 6070.75 0.004545134 0.014209109

12/27/2007 2377.43 6081.5 0.009432637 0.00176922

12/28/2007 2386.73 6079.7 0.003904156 -0.000296023

12/31/2007 2380.36 6138.6 -0.002672492 0.00964135

01-01-2008 2379.35 6144.35 -0.000424396 0.000936257

01-02-2008 2410.43 6179.4 0.012977814 0.005688219

01-03-2008 2432.37 6178.55 0.009060936 -0.000137563

01-04-2008 2455.3 6274.3 0.009382863 0.015378309

01-07-2008 2444.96 6279.1 -0.00422019 0.000764733

01-08-2008 2442.03 6287.85 -0.001199102 0.001392542

01-09-2008 2462.06 6272 0.008168737 -0.002523917

01-10-2008 2432.5 6156.95 -0.012078863 -0.018513758

01-11-2008 2444.51 6200.1 0.004925159 0.006983896

01/14/2008 2458.35 6206.8 0.005645699 0.001080044

01/15/2008 2461.65 6074.25 0.001341464 -0.02158694

01/16/2008 2419.4 5935.75 -0.017312281 -0.023065136

01/17/2008 2421.69 5913.2 0.000946068 -0.003806249

01/18/2008 2404.43 5705.3 -0.007152774 -0.035791573

01/21/2008 2399.69 5208.8 -0.001973307 -0.091046064

01/22/2008 2367.52 4899.3 -0.013496569 -0.061257165

01/23/2008 2385.81 5203.4 0.007695696 0.06021992

01/24/2008 2381.59 5033.45 -0.001770357 -0.033206624

01/25/2008 2430.32 5383.35 0.020254604 0.067205223

01/28/2008 2419 5274.1 -0.004668704 -0.020502808

01/29/2008 2454.05 5280.8 0.014385489 0.001269553

01/30/2008 2461.08 5167.6 0.002860557 -0.021669237

01/31/2008 2448.33 5137.45 -0.005194119 -0.005851517

Yogendra Sisodia (SMP-1033)

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Physics EssayDocument5 pagesPhysics Essayapi-423656794No ratings yet

- Theories of Outdoor & Adventure EducationDocument8 pagesTheories of Outdoor & Adventure EducationMohd Zaidi Abd LatifNo ratings yet

- Syllabus HRM, Jan-May 2012Document12 pagesSyllabus HRM, Jan-May 2012alejandro_garcia_240No ratings yet

- Introduction to Managing Information with ITDocument64 pagesIntroduction to Managing Information with ITSean Thomas BurkeNo ratings yet

- Enginering Industrial Training Final ReportDocument2 pagesEnginering Industrial Training Final Reportmohd_azaruddinNo ratings yet

- Project 619815 Epp 1 2020 1 It Eppka1 JMD MobDocument2 pagesProject 619815 Epp 1 2020 1 It Eppka1 JMD MobSania AkhtarNo ratings yet

- The Codex: Jason DsouzaDocument874 pagesThe Codex: Jason DsouzaMattNo ratings yet

- Quantitative research on solutions to mendicancyDocument2 pagesQuantitative research on solutions to mendicancyHassan Montong80% (5)

- Bracket Panel Insert Missing 8dDocument14 pagesBracket Panel Insert Missing 8dabinayaNo ratings yet

- Meth Confronting The ProblemDocument1 pageMeth Confronting The ProblemamychowNo ratings yet

- CE 27 11617 Practice Problems For Second LEDocument2 pagesCE 27 11617 Practice Problems For Second LECJNo ratings yet

- Harvard Bim-Intro 1996Document2 pagesHarvard Bim-Intro 1996Rui GavinaNo ratings yet

- Princeton Science School - Home of Young Achievers Pre-Test in Math 7ADocument2 pagesPrinceton Science School - Home of Young Achievers Pre-Test in Math 7AAngelu Marienne SamsonNo ratings yet

- SS ZG513Document10 pagesSS ZG513tuxaanandNo ratings yet

- Lean LogisticsDocument10 pagesLean LogisticsSérgio BragaNo ratings yet

- DTCWTDocument60 pagesDTCWTRoot TempNo ratings yet

- RPMS Part 2Document4 pagesRPMS Part 2Rei Diaz ApallaNo ratings yet

- Englishvi4thgrading 150612020842 Lva1 App6892Document44 pagesEnglishvi4thgrading 150612020842 Lva1 App6892xylaxander100% (1)

- Latihan Soal SNMPTN 2011 B. Inggris 336Document6 pagesLatihan Soal SNMPTN 2011 B. Inggris 336Asriadi AzisNo ratings yet

- SQP Eng 3Document12 pagesSQP Eng 3tasmitha98No ratings yet

- 4 Simple RTL (VHDL) Project With VivadoDocument6 pages4 Simple RTL (VHDL) Project With VivadoNarendra BholeNo ratings yet

- Instabilities, Chaos, and Turbulence - Manneville PDFDocument406 pagesInstabilities, Chaos, and Turbulence - Manneville PDFFinalDanishNo ratings yet

- Niversidad de Amboanga: School of Engineering, Information and Communicatons TechnologyDocument11 pagesNiversidad de Amboanga: School of Engineering, Information and Communicatons TechnologyYasinNo ratings yet

- Vpci PMC NCR 0026 PDFDocument51 pagesVpci PMC NCR 0026 PDFDarrel Espino AranasNo ratings yet

- Deeper Inside Pagerank: Amy N. Langville and Carl D. MeyerDocument46 pagesDeeper Inside Pagerank: Amy N. Langville and Carl D. MeyerZulemaNo ratings yet

- Lesson Plan Statistics and Probability COT 3Document5 pagesLesson Plan Statistics and Probability COT 3Nimrod Ladiana100% (1)

- MIS Process Modeling: Requirements Determination TechniquesDocument67 pagesMIS Process Modeling: Requirements Determination TechniquesSAURABH KUMARNo ratings yet

- Human Relations & YouDocument27 pagesHuman Relations & YouDhea Rizky Amelia SatoNo ratings yet

- Virtualbox Star VMDocument10 pagesVirtualbox Star VMcoolporroNo ratings yet

- C Programming Lab Manual by Om Prakash MahatoDocument7 pagesC Programming Lab Manual by Om Prakash MahatoAnonymous 4iFUXUTNo ratings yet