Professional Documents

Culture Documents

PF Assignment

Uploaded by

KhanozaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PF Assignment

Uploaded by

KhanozaiCopyright:

Available Formats

In s t it u t e o f M a n a g e m e

U n i v e r s i t y o f B a l o c h i s t a n , Q

ASSIGNMENT # 2

Compare the Balochistan provincial budgets and criticize

SUBMITTED BY NAJEEBULLAH

SUBMITTED TO Mr. Adeel Anjum

PROGRAM MPA

ENROLMETN # P15

SESSION 2008-2010

SUBJECT PUBLIC FINANCE

DATE OF SUBMISSION 6/07/2010

Budget definition:

Budget is a careful instrument of public policy depicting appropriate

utilization of resources for proper policy Implementation in the light of

the political mandate of the Government.

The budget of a government is a summary or plan of the intended

revenues and expenditures of that government.

Budget presents the whole problem of financing the Government and

attracts legislative and public attention on the total expenditure

compared to the total revenue receipts.

Budgeting Process

Budgeting is the formal procedure of preparing budgets. It involves the

following basic steps:

• Identifying expenses

• Determining different sources of income

• Preparing the budget

• Establishing the budget period

• Laying down the budget procedure

• Allocating income for expenses

• Monitoring the efficiency of the budget

Re-assessing the budget

National Budget

National budgets are legal documents, which are provided by

legislatures before being passed by the executive head of the nation,

such as the president, prime minister or other chief official of a nation.

The budgeting process of a nation involves:

• Classifying expenses: The expenses allocated in a government

budget include consumption and investment expenditure on

infrastructure development and research and development. It

also includes transfer payments, such as social security and

unemployment benefits.

• Revenue determination: The primary source of revenue

generation for a government budget is taxes.

• Preparing budgets: A government budget may be for a quarter, a

year, five years or ten years. The period of the budget and the

procedure of revenue allocation are exclusively mentioned by

the government.

Examples of specific country budgeting processes, such as those in US,

Canada, UK, Germany, Australia, New Zealand, Japan, Pakistan, India

and Brazil.

Budget contains the following things:

• Expenditure

o Revenue Expenditure

o Capital Expenditure

o Development Expenditure

• Revenue

o Revenue Receipts

o Capital Receipts

BALOCHISTAN BUDGETS OF FISCAL YEAR 2009-2010

AND 2010-2011 COMPARISON

2010-2011

Rs. in billion

A REVENUE RECEIPTS 115.527

Divisible Pool 83.000

Straight transfer 16.398

Grants 12.000

i Arrears (Well head price) 2.000

ii. Arrears GDS 10.000

Provincial Own Receipt 4.130

B CAPITAL RECEIPTS 29.390

Recoveries (Loans and Advances) 0.107

State Trading 10.134

Floating Debt (W&M Limit/Adv.) 9.021

Repayment of Blocked Account-I

By Federal Government 5.400

Resources for Development 4.727

Foreign Project Assistance Loan 3.916

Cash Assistance (Japanese Grants) 0.012

Counter Value Fund (Japan)

(For Pasni Fish Harbor

Authority) 0.800side PSDP/Public Rep. Prig. -

SUMMARY

Total Revenue Receipts (A) 115.527

Total Capital Receipts (B) 29.390

Total Receipts (A+B) 144.917

C REVENUE EXPENDITURE 83.444

Current Revenue Expenditure 83.444

General Public Service 18.565

Public Order Safety Affairs 12.505

Economic Affairs 9.107

Housing and Community Amenities 6.680

Health Affairs & Services 7.443

Recreation, Culture and Religion 2.226

Education Affairs and Services 17.328

Social Protection 0.782

Subsidies 0.418

Grant for Local Governments 4.000

Debt Servicing (Interest) 4.391

Net surplus/deficit (A-C) 32.084

D CAPITAL EXPENDITURE 41.819

Repayment of Central Loans (Principal) 2.973

Loans and Advances 0.600

Investment 12.000

Repayment of Block A/C -I by Fed. Govt.3.600

(Principal

Repayment of Block A/C -II by Prov. Govt2.200

. (Principal)

Repayment of CDL 1.710

State Trading 9.716

Public Debt to be discharged 9.021

Net surplus/deficit (B-D) (12.430)

E DEVELOPMENT EXPENDITURE 26.754

PSDP 22.026

Foreign Project Assistance Loan 3.916

Cash Assistance (Japanese Grants) 0.012

Counter Value Fund (Japan) (For Pasni

Fish Harbor Authority) 0.800

SUMMARY

Total Current Expenditure (C+D) 125.263

Total Development Expenditure (E) 26.754

Total Expenditure (C+D+E) 152.017

OVER ALL POSITION (7.100) (deficit)

2009-2010

Rs. in billion

A - TOTAL REVENUE RECEIPTS 59.054101

(I) Federal Receipts 55.408436

Shared Taxes 29.204937

Subvention 13.9755

Surcharge on Gas 5.6329

Excise Duty on Gas 1.3710

Royalty on Gas 4.4437

GST (Provincial) 0.7803

(II) Provincial Receipts 53.0812

Tax Receipts 1.1327

Non-Tax Receipts 2.51299

B - CURRENT REVENUE EXP 53.08127

General Administration 10.1321

Law & Order 5.5582

Community Services 1.791855

Social Services 5.1736

Economic Services 5.6828

Subsidy (Wheat) 1.000

Debt Servicing 1.7425

Provincial Allocable/GST 2.5% 22.000

C - Revenue Surplus (A-B) 5.9728

D - CAPITAL RECEIPTS 1.6854

Recoveries (Loans & Advances) 0.0813

Unfunded Debt 1.6040

E - CURRENT CAPITAL EXPENDITURE 2.6289

Repayment of Central Loans 2.32890

Loans & Advances 0.3000

F- Net Capital Receipt (D-E) 0.9435

REVENUE SURPLUS (C-F) (5.0293)

RESOURCES FOR DEV. OUTLAY 10.2038

Resources for Development 5.0293

Foreign Project Assistance Loan 5163 0

Cash Assistance (Japanese Grant) 0.0115

DEVELOPMENT OUTLAY 18536.322

PSDP 10.4291

Public Representative Program 3.0000

Foreign Project Assistance Loan 5.0957

Cash Assistance (Japanese Grant) 0.0115

TOTAL DEFICIT (8.3324)

ANALYSIS

When we compare the budget of 2009-2010 with the 2010-2011 then

we find that this year budget is as double as previous year. The budget

of 2009-2010 was also a record budget as compare with 2008-2009.

But we didn’t find any major development project for the province

Because of lack of implementation of the policy.

The positive point is that in the current year budget a very good

amount is invested in development sector. The increase in the budget

of development sector is a good sign. The budget deficit has also

decreased as compared with previous. The 100% increase in salaries

of police, levies is also a positive step of finishing corruption in police

as compare with the previous budget only 15% increase in the salaries

of the government employees. And in the budget of 2010-2011 the

salaries and pension has also increased by 50%, which is a good sign

towards the progress of the province. But a very less amount is

estimated for the education in the province. The education system is

going worse day by day. No any single point is mentioned in the

current and previous budget. No any single point is mentioned in both

budgets about the shortage of electricity. Another negative point of

the budget of 2010-2011 is that the subsidy has decreased

significantly, which is not a good sign.

You might also like

- Basic Logo CommandsDocument2 pagesBasic Logo CommandsKhanozaiNo ratings yet

- Alphabet Cards Back To BackDocument10 pagesAlphabet Cards Back To BackKhanozaiNo ratings yet

- National Testing Service Pakistan: (Building Standards in Educational & Professional Testing)Document5 pagesNational Testing Service Pakistan: (Building Standards in Educational & Professional Testing)farrukhsaleem_01No ratings yet

- Computer HardwareDocument11 pagesComputer HardwareKhanozaiNo ratings yet

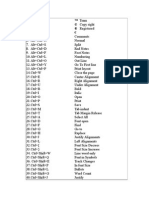

- Shots Cut KeysDocument3 pagesShots Cut KeysKhanozaiNo ratings yet

- Investment Analysis 9Document17 pagesInvestment Analysis 9KhanozaiNo ratings yet

- Investment Analysis 9Document17 pagesInvestment Analysis 9KhanozaiNo ratings yet

- Conflict Management in The WorkplaceDocument22 pagesConflict Management in The Workplacesyedazra98% (41)

- Geologic Maps Show The Distribution of Different Types of Structures and RockDocument1 pageGeologic Maps Show The Distribution of Different Types of Structures and RockKhanozaiNo ratings yet

- MONETARY Policy of Pakistan AnalysisDocument24 pagesMONETARY Policy of Pakistan Analysisxaxif50% (2)

- ENTREPRENEURSHIPDocument10 pagesENTREPRENEURSHIPKhanozaiNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Schedules of Alphanumeric Tax CodesDocument5 pagesSchedules of Alphanumeric Tax CodesKatherine YuNo ratings yet

- 2009 Form 990 For Harvard Management CompanyDocument55 pages2009 Form 990 For Harvard Management CompanyresponsibleharvardNo ratings yet

- Rent ReceiptDocument1 pageRent Receiptsaurav mazumdarNo ratings yet

- Name: Alief Muh M A BintangDocument4 pagesName: Alief Muh M A BintangAlifNo ratings yet

- Leases Income Taxes Employee Benefits: Rsoriano/JmaglinaoDocument3 pagesLeases Income Taxes Employee Benefits: Rsoriano/JmaglinaoMerliza JusayanNo ratings yet

- Cfibg TBD 2021 03Document4 pagesCfibg TBD 2021 03Muzammil KaziNo ratings yet

- PIN Certificate: This Is To Certify That Taxpayer Shown Herein Has Been Registered With Kenya Revenue AuthorityDocument1 pagePIN Certificate: This Is To Certify That Taxpayer Shown Herein Has Been Registered With Kenya Revenue AuthorityFelix BrianNo ratings yet

- Henderson V CollectorDocument3 pagesHenderson V CollectorViolet ParkerNo ratings yet

- Gasbill 4800349743 202403 20240315011615Document1 pageGasbill 4800349743 202403 20240315011615uzairabbasi96098No ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument3 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountA&P ConsultancyNo ratings yet

- Taxes To Be Subsumed Under GSTDocument3 pagesTaxes To Be Subsumed Under GSTShreyaNo ratings yet

- Simple GST Invoice Format in Excel PDFDocument1 pageSimple GST Invoice Format in Excel PDFJugaadi Bahman100% (1)

- Vietnam Fuji Electric Vietnam Co., LTD BilingDocument2 pagesVietnam Fuji Electric Vietnam Co., LTD BilingdongmingNo ratings yet

- Form of Return of Income Under Income-Tax Ordinance, 1984 (Ord. XXXVI of 1984)Document1 pageForm of Return of Income Under Income-Tax Ordinance, 1984 (Ord. XXXVI of 1984)Kulfi BarfiNo ratings yet

- U0001 7201772518204120177251820482Document4 pagesU0001 7201772518204120177251820482gajendra ankolekarNo ratings yet

- Capital Gains Statement: Nippon India Credit Risk Fund - Growth Plan Growth Option (Inf204K01Fq3)Document3 pagesCapital Gains Statement: Nippon India Credit Risk Fund - Growth Plan Growth Option (Inf204K01Fq3)kulwinder singhNo ratings yet

- Rohm Apollo v. CIRDocument3 pagesRohm Apollo v. CIRGelaine MarananNo ratings yet

- 01 Chap 14 RosenDocument64 pages01 Chap 14 RosenSagar ChowdhuryNo ratings yet

- Weekly Tax Table 2016 17Document9 pagesWeekly Tax Table 2016 17busydogNo ratings yet

- Theory and Precatice of GSTDocument3 pagesTheory and Precatice of GSTakking0146No ratings yet

- Latar Belakang GST Di MalaysiaDocument49 pagesLatar Belakang GST Di MalaysiaBenny WeeNo ratings yet

- Tax Lec 2Document14 pagesTax Lec 2Yousef Waleed100% (1)

- Value Added Tax (Vat) .PPT FinalDocument57 pagesValue Added Tax (Vat) .PPT FinalNick254No ratings yet

- Obillos, Jr. vs. Commissioner of Internal Revenue, No. L-68118 - Case Digest (Co-Ownership Nor Sharing in Gross Returns Not Itself Partnership)Document1 pageObillos, Jr. vs. Commissioner of Internal Revenue, No. L-68118 - Case Digest (Co-Ownership Nor Sharing in Gross Returns Not Itself Partnership)Alena Icao-AnotadoNo ratings yet

- Effect of Tax Avoidance and Tax EvasionDocument13 pagesEffect of Tax Avoidance and Tax EvasionChe DivineNo ratings yet

- Water Tax ReceiptDocument1 pageWater Tax ReceiptVijayanand ENo ratings yet

- ACCTG 26 Income Taxation: Lyceum-Northwestern UniversityDocument5 pagesACCTG 26 Income Taxation: Lyceum-Northwestern UniversityAmie Jane Miranda100% (1)

- (Solution) Take Home Assignment 3 (2023S)Document3 pages(Solution) Take Home Assignment 3 (2023S)何健珩No ratings yet

- Tax InvoiceDocument1 pageTax InvoicePankaj SinghNo ratings yet

- 12 PDFDocument2 pages12 PDFNarayana rao dubaNo ratings yet