Professional Documents

Culture Documents

US Internal Revenue Service: Irb05-48

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: Irb05-48

Uploaded by

IRSCopyright:

Available Formats

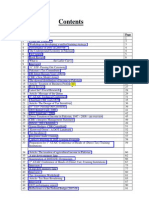

Bulletin No.

2005-48

November 28, 2005

HIGHLIGHTS

OF THIS ISSUE

These synopses are intended only as aids to the reader in

identifying the subject matter covered. They may not be

relied upon as authoritative interpretations.

INCOME TAX Announcement 2005–84, page 1064.

This announcement is to advise fiscal year pass-through enti-

ties of two new act sections of the Katrina Emergency Tax Relief

Rev. Rul. 2005–73, page 1050. Act (KETRA) of 2005 (these act sections will not be codified).

LIFO; price indexes; department stores. The September Act section 301 concerns the temporary suspension of limi-

2005 Bureau of Labor Statistics price indexes are accepted tations of charitable contributions for individuals. Act section

for use by department stores employing the retail inventory 305 concerns the donation of “apparently wholesome food” by

and last-in, first-out inventory methods for valuing inventories individuals, corporations, and partnerships.

for tax years ended on, or with reference to, September 30,

2005.

T.D. 9229, page 1051. EXEMPT ORGANIZATIONS

REG–144898–04, page 1062.

Final, temporary, and proposed regulations under section 6081 Announcement 2005–85, page 1065.

of the Code relate to the simplification of procedures for obtain- A list is provided of organizations now classified as private foun-

ing automatic extensions of time to file certain returns. The dations.

temporary regulations allow individual income taxpayers and

certain other taxpayers to obtain an automatic six-month exten- Announcement 2005–86, page 1069.

sion of time to file certain returns by filing a single request. For The Adelphi Foundation, Inc., of Adelphi, MD; Anaheim Cinco

these returns, the regulations also remove the requirements De Mayo Festivals, Inc., of Los Angeles, CA; Metro Housing

for a signature and an explanation of the need for an extension Partnership, Inc., of Arlington, TX; and Summerside, Inc., of

of time to file. Vallejo, CA, no longer qualify as organizations to which contri-

butions are deductible under section 170 of the Code.

Notice 2005–88, page 1060.

This notice provides procedures for corporations, electing

small business corporations, and organizations required to

file returns under section 6033 to seek a waiver of the re-

quirement to electronically file Form 1120, U.S. Corporation

Income Tax Return; Form 1120S, U.S. Income Tax Return for

an S Corporation; Form 990, Return of Organization Exempt

From Income Tax; and Form 990–PF, Return of Private Founda-

tion or Section 4947(a)(1) Nonexempt Charitable Trust Treated

as a Private Foundation.

(Continued on the next page)

Finding Lists begin on page ii.

Index for July through November begins on page vi.

ADMINISTRATIVE

T.D. 9229, page 1051.

REG–144898–04, page 1062.

Final, temporary, and proposed regulations under section 6081

of the Code relate to the simplification of procedures for obtain-

ing automatic extensions of time to file certain returns. The

temporary regulations allow individual income taxpayers and

certain other taxpayers to obtain an automatic six-month exten-

sion of time to file certain returns by filing a single request. For

these returns, the regulations also remove the requirements

for a signature and an explanation of the need for an extension

of time to file.

Notice 2005–88, page 1060.

This notice provides procedures for corporations, electing

small business corporations, and organizations required to

file returns under section 6033 to seek a waiver of the re-

quirement to electronically file Form 1120, U.S. Corporation

Income Tax Return; Form 1120S, U.S. Income Tax Return for

an S Corporation; Form 990, Return of Organization Exempt

From Income Tax; and Form 990–PF, Return of Private Founda-

tion or Section 4947(a)(1) Nonexempt Charitable Trust Treated

as a Private Foundation.

November 28, 2005 2005–48 I.R.B.

The IRS Mission

Provide America’s taxpayers top quality service by helping applying the tax law with integrity and fairness to all.

them understand and meet their tax responsibilities and by

Introduction

The Internal Revenue Bulletin is the authoritative instrument of court decisions, rulings, and procedures must be considered,

the Commissioner of Internal Revenue for announcing official and Service personnel and others concerned are cautioned

rulings and procedures of the Internal Revenue Service and for against reaching the same conclusions in other cases unless

publishing Treasury Decisions, Executive Orders, Tax Conven- the facts and circumstances are substantially the same.

tions, legislation, court decisions, and other items of general

interest. It is published weekly and may be obtained from the

The Bulletin is divided into four parts as follows:

Superintendent of Documents on a subscription basis. Bulletin

contents are compiled semiannually into Cumulative Bulletins,

which are sold on a single-copy basis. Part I.—1986 Code.

This part includes rulings and decisions based on provisions of

It is the policy of the Service to publish in the Bulletin all sub- the Internal Revenue Code of 1986.

stantive rulings necessary to promote a uniform application of

the tax laws, including all rulings that supersede, revoke, mod- Part II.—Treaties and Tax Legislation.

ify, or amend any of those previously published in the Bulletin. This part is divided into two subparts as follows: Subpart A,

All published rulings apply retroactively unless otherwise indi- Tax Conventions and Other Related Items, and Subpart B, Leg-

cated. Procedures relating solely to matters of internal man- islation and Related Committee Reports.

agement are not published; however, statements of internal

practices and procedures that affect the rights and duties of

taxpayers are published. Part III.—Administrative, Procedural, and Miscellaneous.

To the extent practicable, pertinent cross references to these

subjects are contained in the other Parts and Subparts. Also

Revenue rulings represent the conclusions of the Service on the included in this part are Bank Secrecy Act Administrative Rul-

application of the law to the pivotal facts stated in the revenue ings. Bank Secrecy Act Administrative Rulings are issued by

ruling. In those based on positions taken in rulings to taxpayers the Department of the Treasury’s Office of the Assistant Sec-

or technical advice to Service field offices, identifying details retary (Enforcement).

and information of a confidential nature are deleted to prevent

unwarranted invasions of privacy and to comply with statutory

requirements. Part IV.—Items of General Interest.

This part includes notices of proposed rulemakings, disbar-

ment and suspension lists, and announcements.

Rulings and procedures reported in the Bulletin do not have the

force and effect of Treasury Department Regulations, but they

may be used as precedents. Unpublished rulings will not be The last Bulletin for each month includes a cumulative index

relied on, used, or cited as precedents by Service personnel in for the matters published during the preceding months. These

the disposition of other cases. In applying published rulings and monthly indexes are cumulated on a semiannual basis, and are

procedures, the effect of subsequent legislation, regulations, published in the last Bulletin of each semiannual period.

The contents of this publication are not copyrighted and may be reprinted freely. A citation of the Internal Revenue Bulletin as the source would be appropriate.

For sale by the Superintendent of Documents, U.S. Government Printing Office, Washington, DC 20402.

2005–48 I.R.B. November 28, 2005

Part I. Rulings and Decisions Under the Internal Revenue Code

of 1986

Section 472.—Last-in, Rev. Rul. 2005–73 ventory methods for tax years ended on,

First-out Inventories or with reference to, September 30, 2005.

The following Department Store In- The Department Store Inventory Price

26 CFR 1.472–1: Last-in, first-out inventories. ventory Price Indexes for September Indexes are prepared on a national basis

2005 were issued by the Bureau of La- and include (a) 23 major groups of depart-

LIFO; price indexes; department

bor Statistics. The indexes are accepted ments, (b) three special combinations of

stores. The September 2005 Bureau of

by the Internal Revenue Service, under the major groups — soft goods, durable

Labor Statistics price indexes are accepted

§ 1.472–1(k) of the Income Tax Regula- goods, and miscellaneous goods, and (c) a

for use by department stores employing

tions and Rev. Proc. 86–46, 1986–2 C.B. store total, which covers all departments,

the retail inventory and last-in, first-out

739, for appropriate application to inven- including some not listed separately, ex-

inventory methods for valuing inventories

tories of department stores employing the cept for the following: candy, food, liquor,

for tax years ended on, or with reference

retail inventory and last-in, first-out in- tobacco, and contract departments.

to, September 30, 2005.

BUREAU OF LABOR STATISTICS, DEPARTMENT STORE

INVENTORY PRICE INDEXES BY DEPARTMENT GROUPS

(January 1941 = 100, unless otherwise noted)

Percent Change

from Sep. 2004

Groups Sep. 2004 Sep. 2005 to Sep. 20051

1. Piece Goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 488.9 497.3 1.7

2. Domestics and Draperies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 526.6 514.7 -2.3

3. Women’s and Children’s Shoes . . . . . . . . . . . . . . . . . . . . . . . . . . . . 657.4 700.4 6.5

4. Men’s Shoes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 842.8 890.9 5.7

5. Infants’ Wear . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 582.8 569.6 -2.3

6. Women’s Underwear. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 509.6 541.1 6.2

7. Women’s Hosiery . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 336.6 338.6 0.6

8. Women’s and Girls’ Accessories . . . . . . . . . . . . . . . . . . . . . . . . . . . 576.2 572.2 -0.7

9. Women’s Outerwear and Girls’ Wear . . . . . . . . . . . . . . . . . . . . . . . 371.0 364.0 -1.9

10. Men’s Clothing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 531.2 532.9 0.3

11. Men’s Furnishings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 567.1 561.0 -1.1

12. Boys’ Clothing and Furnishings . . . . . . . . . . . . . . . . . . . . . . . . . . . . 425.7 393.1 -7.7

13. Jewelry. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 886.2 882.6 -0.4

14. Notions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 797.8 807.4 1.2

15. Toilet Articles and Drugs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 993.2 996.4 0.3

16. Furniture and Bedding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 608.0 596.0 -2.0

17. Floor Coverings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 584.0 606.7 3.9

18. Housewares. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 711.7 703.4 -1.2

19. Major Appliances. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 197.4 204.4 3.5

20. Radio and Television. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41.1 38.6 -6.1

21. Recreation and Education2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79.9 77.4 -3.1

22. Home Improvements2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 128.9 136.4 5.8

23. Automotive Accessories2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 113.0 116.3 2.9

Groups 1–15: Soft Goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 559.8 559.6 0.0

Groups 16–20: Durable Goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 379.8 377.0 -0.7

Groups 21–23: Misc. Goods2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93.0 92.8 -0.2

Store Total3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 495.4 494.5 -0.2

1

Absence of a minus sign before the percentage change in this column signifies a price increase.

2

Indexes on a January 1986 = 100 base.

3The store total index covers all departments, including some not listed separately, except for the following: candy, food, liquor,

tobacco, and contract departments.

2005–48 I.R.B. 1050 November 28, 2005

DRAFTING INFORMATION DATES: Effective Date: These regulations a second form to request a three-month dis-

are effective November 7, 2005. cretionary extension. Requiring these tax-

The principal author of this revenue Applicability Dates: For dates payers to file two different forms to ob-

ruling is Michael Burkom of the Office of applicability of these regulations, tain the full six-month extension creates an

of Associate Chief Counsel (Income Tax see §§1.6081–2T(i), 1.6081–3T(e)(2), unnecessary burden on taxpayers and the

and Accounting). For further informa- 1.6081–4T(f), 1.6081–5T(g), 1.6081– IRS, and it can cause unnecessary confu-

tion regarding this revenue ruling, contact 6T(g), 1.6081–7T(g), 1.6081–10T(f), sion.

Mr. Burkom at (202) 622–7924 (not a 1.6081–11T(e), 25.6081–1T(f), 26.6081– To reduce the complexity of the current

toll-free call). 1T(f), 53.6081–1T(f), 55.6081–1T(f), extension process, and to provide cost sav-

156.6081–1T(f), 157.6081–1T(f), and ings and other benefits to taxpayers and the

301.6081–2T(e). IRS, these temporary regulations simplify

Section 6081.—Extension the extension process by allowing certain

of Time for Filing Returns FOR FURTHER INFORMATION taxpayers to file a single request for an

CONTACT: Allen D. Madison, (202) automatic six-month extension of time to

26 CFR 1.6081–2T: Automatic extension of time to 622–4940 (not a toll-free number). file certain returns. Because the extension

file certain returns filed by partnerships (temporary).

is automatic, these taxpayers do not need

SUPPLEMENTARY INFORMATION:

to sign the extension request or provide

T.D. 9229 an explanation of the reasons for request-

Background

ing an extension. Simplifying, consoli-

DEPARTMENT OF This document contains amendments to dating, and standardizing extension forms

THE TREASURY 26 CFR parts 1, 25, 26, 53, 55, 156, 157, will reduce taxpayer burden and will also

Internal Revenue Service and 301 under section 6081 of the Inter- reduce taxpayer confusion and error in fil-

26 CFR Parts 1, 25, 26, 53, nal Revenue Code. Section 6081(a) pro- ing the correct form. In addition, taxpayers

vides that the Secretary may grant a rea- will save considerable time and expense

55, 156, 157, 301 by not having to complete and file a sec-

sonable extension of time for filing any re-

turn, declaration, statement, or other doc- ond request to obtain the full six-month

Extension of Time for Filing extension. This simplification will also

ument required by Title 26 or by regula-

Returns tions. Except in the case of taxpayers who lower processing costs and facilitate in-

are abroad, no such extension shall be for creased efficiency for the IRS. Accord-

AGENCY: Internal Revenue Service ing to IRS research, simplification of the

more than six months. The regulations un-

(IRS), Treasury. extension process will save taxpayers be-

der section 6081 provide specific rules tax-

payers must follow to request an extension tween $73–94 million annually and will

ACTION: Final and temporary regula- save the IRS $4.6 million annually.

of time to file Federal tax returns. A tax-

tions.

payer must generally submit a written ap-

plication for the extension on or before the Individual Income Taxpayers

SUMMARY: This document contains final

and temporary regulations relating to the due date of the return. An extension of Currently, individual income taxpayers

simplification of procedures for obtaining time for filing a return does not extend the submit Form 4868 “Application for Auto-

automatic extensions of time to file cer- time for payment of tax. matic Extension of Time To File a U.S. In-

tain returns. The portions of this docu- dividual Income Tax Return,” for an ini-

Explanation of Provisions

ment that are final regulations provide nec- tial four-month extension of time to file an

essary cross-references to the temporary Rationale for Change individual income tax return. The Form

regulations. The temporary regulations al- 4868 must be filed by the original due date

low individual income taxpayers and cer- Currently, most taxpayers other than of the return. Taxpayers do not have to

tain other taxpayers to obtain an automatic corporations can receive a full six-month sign or give a reason for the extension re-

six-month extension of time to file certain extension of time to file their income tax quest. Taxpayers must, however, provide

returns by filing a single request. For these returns, but to obtain the full six-month ex- a proper estimate of their tax liability.

returns, the temporary regulations also re- tension they must file one application for Form 4868 does not extend the time for

move the requirements for a signature and an initial extension of time and then file payment of tax. Although no payment of

an explanation of the need for an extension a second application to obtain an exten- tax is necessary in order to receive the ex-

of time to file. The temporary regulations sion for the balance of the six months. For tension, penalties and interest may apply

affect taxpayers who are required to file example, individual income taxpayers re- on any amounts that are not paid as of

certain returns and need an extension of quest an initial four-month automatic ex- the original due date of the return. Indi-

time to file. The text of the temporary reg- tension on one form and then use a second vidual income taxpayers can seek an ad-

ulations also serves as the text of the pro- form to request a two-month discretionary ditional two-month extension of time to

posed regulations (REG–144898–04) set extension. Similarly, trusts and partner- file on Form 2688, “Application for Addi-

forth in the notice of proposed rulemaking ships request an initial three-month auto- tional Extension of Time To File U.S. Indi-

on this subject in this issue of the Bulletin. matic extension on one form and then use vidual Income Tax Return,” which requires

November 28, 2005 1051 2005–48 I.R.B.

taxpayers to provide an explanation of the certain excise, income, information, and The Treasury Department and the IRS rec-

need for an extension and must be signed other returns by submitting Form 2758, ognize that because the six-month auto-

under penalties of perjury. “Application for Extension of Time To File matic extension is available for returns of

To reduce burden on taxpayers and the Certain Excise, Income, Information, and pass-through entities, some taxpayers may

IRS, the temporary regulations provide an Other Returns,” may request an automatic not receive information returns from the

automatic six-month extension to taxpay- six-month extension of time to file by fil- pass-through entities that they need in or-

ers who must file an individual income tax ing the new Form 7004, “Application for der to complete their own income tax re-

return if they submit a timely, completed Automatic 6-Month Extension of Time To turns before those returns are due. For ex-

application for extension on Form 4868. File Certain Business Income Tax, Infor- ample, an individual income taxpayer with

Taxpayers do not have to sign the request mation, and Other Returns.” Previously, a six-month extension of time to October

or explain why an extension is needed in these taxpayers filed Form 2758 in order 15 to file the Form 1040 may not receive a

order to receive the automatic six-month to obtain a 90-day extension. To obtain Schedule K–1 from a partnership in which

extension of time to file. An automatic the extension, these taxpayers had to sign the taxpayer holds an interest until after the

extension under the temporary regulations the form and provide an explanation of the partnership files its Form 1065 on its ex-

does not extend the time for payment of need for the extension. To obtain addi- tended due date of October 15. Similarly,

tax. Accordingly, taxpayers must make a tional time beyond the 90-day period, these a C-corporation with a six-month exten-

proper estimate of any tax due. While no taxpayers had to file Form 2758 a second sion to September 15 to file its Form 1120

payment of tax is required in order to ob- time, once again signing the request and may not receive a Schedule K–1 from a

tain the extension, failure to pay any tax as providing an explanation why the initial calendar year partnership in which it holds

of the original due date of the return may extension was not sufficient. The total ex- an interest until 30 days after its return is

subject the taxpayer to penalties and inter- tension was capped at the statutory maxi- due if the partnership files its Form 1065

est. mum of six months. The Form 2758 has and sends out the Schedule K–1s on its

been obsoleted by these regulations. extended due date of October 15. This

Corporate Income Taxpayers filing anomaly existed under prior regu-

Partnership, REMIC, and Certain Trust lations when the pass-through entity re-

These temporary regulations do not

Taxpayers ceived an extension of time to file to a date

change the rules regarding filing exten-

on or after the extended due date for the

sions for corporate income tax returns.

Prior regulations required partnerships, pass-through interest holder, but the auto-

Currently, corporations may obtain an au-

real estate mortgage investment conduits matic six-month extension in these regula-

tomatic six-month extension of time to

(REMICs) and certain trusts to request tions may cause this to happen with more

file their income tax returns by submitting

three-month automatic extensions of time frequency.

Form 7004, “Application for Automatic

to file by submitting Form 8736, “Appli- Because of this filing anomaly, the

Extension of Time To File Corporation

cation for Automatic Extension of Time availability of a six-month extension of

Income Tax Return.” Corporations do not

To File U.S. Return for a Partnership, time to file for pass-through entities may

have to sign the extension request or give

REMIC, or for Certain Trusts.” These result in taxpayers filing an increased

a reason for their request. The Form 7004

entities could then file a second request number of amended income tax returns.

does not extend the time for payment of

for an additional three-month extension of Therefore, it may be appropriate for

tax. Accordingly, corporations filing Form

time to file on Form 8800, “Application pass-through entities to have a shorter

7004 must compute the total amount of

for Additional Extension of Time to File extension period than their partners or

their tentative tax and make a remittance

U.S. Return for a Partnership, REMIC, or shareholders. The Treasury Department

of any balance due. Although these regu-

for Certain Trusts.” In order to promote and the IRS request comments on whether

lations do not change the rules regarding

simplified extension procedures, the tem- a shorter extension of time to file for

filing extensions for corporations, they do

porary regulations allow these taxpayers pass-through entities might reduce overall

change the title to and appearance of Form

to file an automatic six-month extension taxpayer burden. Please follow the in-

7004. Taxpayers filing certain other types

of time to file on one application, the new structions in the “Comments and Public

of returns will now also use Form 7004 to

Form 7004, “Application for Automatic Hearing” section in the notice of pro-

request an automatic six-month extension

6-Month Extension of Time To File Cer- posed rulemaking accompanying these

of time to file. The new Form 7004 will be

tain Business Income Tax, Information, temporary regulations in this issue of the

titled “Application for Automatic 6-Month

and Other Returns.” These taxpayers do Bulletin.

Extension of Time To File Certain Busi-

not have to sign the Form 7004 or provide In order to minimize the burden that

ness Income Tax, Information, and Other

an explanation for their request in order to might be imposed as a result of this filing

Returns” and will apply to a larger number

receive the automatic six-month extension anomaly, the Treasury Department and the

of returns than the prior form.

of time to file. Forms 8736 and 8800 have IRS encourage pass-through entities that

Taxpayers Previously Filing Form 2758 to been obsoleted by these regulations. request an extension of time to file to min-

Request an Extension of Time The six-month automatic extension of imize the impact that such extension might

time to file set forth in these temporary reg- have on their partners’ or members’ ability

Under these regulations, taxpayers that ulations applies to returns of pass-through to timely file (with an extension) their own

previously requested additional time to file entities, e.g., Form 1065 for partnerships. tax returns.

2005–48 I.R.B. 1052 November 28, 2005

Transition Rule for the extension of time to file or a signa- Section 1.6081–11T also issued under

ture. 26 U.S.C. 6081. * * *

These temporary regulations are ef-

fective for applications for an automatic Special Analyses §1.6081–2 [Removed]

extension of time to file certain returns

filed after December 31, 2005. There- It has been determined that this Trea- Par. 2. Section 1.6081–2 is removed.

fore, the temporary regulations apply to sury decision is not a significant regula- Par. 3. Section 1.6081–2T is added to

applications for extension of time to file tory action as defined in Executive Order read as follows:

tax year 2005 returns. In addition, these 12866. Therefore, a regulatory assessment

is not required. It also has been deter- §1.6081–2T Automatic extension of time

temporary regulations also apply to appli-

mined that section 553(b) of the Admin- to file certain returns filed by partnerships

cations for extension of time to file some

istrative Procedure Act (5 U.S.C. chapter (temporary).

tax year 2004 returns for certain fiscal year

taxpayers because these returns are due 5) does not apply to these regulations. For (a) In general. A partnership required

after December 31, 2005. Although these the applicability of the Regulatory Flexi- to file Form 1065, “U.S. Return of Part-

fiscal year taxpayers should continue to bility Act (5 U.S.C. chapter 6), refer to the nership Income,” or Form 8804, “Annual

use the tax year 2004 extension forms, the Special Analyses section of the preamble Return for Partnership Withholding Tax,”

IRS will grant a six-month extension of to the cross-reference notice of proposed for any taxable year will be allowed an

time to file if an extension request made rulemaking published in this issue of the automatic 6-month extension of time to

on one of these forms would otherwise Bulletin. Pursuant to section 7805(f) of file the return after the date prescribed for

qualify under these temporary regulations, the Internal Revenue Code, these tempo- filing the return if the partnership files an

except for use of the specified form. rary regulations will be submitted to the application under this section in accor-

Chief Counsel for Advocacy of the Small dance with paragraph (b) of this section.

Certain Employee Plan Returns Business Administration for comment on In the case of a partnership described in

their impact on small businesses. §1.6081–5(a)(1), the automatic exten-

These temporary regulations also allow

administrators and sponsors of employee sion of time to file allowed under this

Drafting Information

benefit plans subject to Employee Re- section runs concurrently with an exten-

tirement Income Security Act of 1974 The principal author of these regula- sion of time to file granted pursuant to

(ERISA) to report information concerning tions is Tracey B. Leibowitz of the Office §1.6081–5(a).

the plans and direct filing entities to use of the Associate Chief Counsel (Procedure (b) Requirements. To satisfy this para-

a new version of Form 5558, “Applica- and Administration), Administrative Pro- graph (b), the partnership must—

tion for Extension of Time To File Certain visions and Judicial Practice Division. (1) Submit a complete application on

Employee Plan Returns,” for an automatic Form 7004, “Application for Automatic

***** 6-Month Extension of Time To File Cer-

two and one-half-month extension of time

to file. Under these regulations, the Form tain Business Income Tax, Information,

Amendments to the Regulations

5558 no longer requires taxpayers to pro- and Other Returns,” or in any other man-

vide an explanation of the need for the Accordingly, 26 CFR parts 1, 25, 26, ner prescribed by the Commissioner;

extension of time to file or a signature. 53, 55, 156, 157, and 301 are amended as (2) File the application on or before the

follows: later of—

Gift Tax Returns (i) The date prescribed for filing the re-

PART 1—INCOME TAXES turn of the partnership; or

Under section 6075(b)(2), individuals (ii) The expiration of any extension of

who make a transfer by gift and who re- Paragraph 1. The authority citation for time to file granted under §1.6081–5(a);

quest an automatic extension of time to part 1 is amended by removing the entries and

file the individual’s income tax return are for §1.6081–2, §1.6081–4, §1.6081–6, and (3) File the application with the Internal

deemed to have an extension of time to file §1.6081–7 and adding entries in numerical Revenue Service office designated in the

the return required by section 6019. The order to read, in part, as follows: application’s instructions.

temporary regulations also allow donors Authority: 26 U.S.C. 7805 * * * (c) Payment of section 7519 amount.

who do not request an extension of time to Section 1.6081–2T also issued under 26 An automatic extension of time for fil-

file an income tax return to request an au- U.S.C. 6081. ing a partnership return of income granted

tomatic six-month extension of time to file Section 1.6081–4T also issued under 26 under paragraph (a) of this section does

Form 709, “United States Gift (and Gen- U.S.C. 6081. not extend the time for payment of any

eration-Skipping Transfer) Tax Return” by Section 1.6081–6T also issued under 26 amount due under section 7519, relating to

filing a new version of Form 8892, “Pay- U.S.C. 6081. required payments for entities electing not

ment of Gift/GST Tax and/or Application Section 1.6081–7T also issued under 26 to have a required taxable year.

for Extension of Time To File Form 709.” U.S.C. 6081. (d) Section 444 election. An automatic

Under these regulations, the Form 8892 no Section 1.6081–10T also issued under extension of time for filing a partnership

longer requires an explanation of the need 26 U.S.C. 6081. return of income will run concurrently

November 28, 2005 1053 2005–48 I.R.B.

with any extension of time for filing a 6-Month Extension of Time To File Cer- (4) Show on the application the full

return allowed because of section 444, tain Business Income Tax, Information, amount properly estimated as tax for the

relating to the election of a taxable year and Other Returns,” or in any other man- taxable year.

other than a required taxable year. ner prescribed by the Commissioner. (c) No extension of time for the payment

(e) Effect of extension on partner. An (a)(2) through (d) [Reserved]. For of tax. An automatic extension of time for

automatic extension of time for filing a further guidance, see §1.6081–3(a)(2) filing a return granted under paragraph (a)

partnership return of income under this through (d). of this section will not extend the time for

section does not extend the time for filing a (e) Effective dates. (1) Except as pro- payment of any tax due on such return.

partner’s income tax return or the time for vided in paragraph (e)(2) of this section, (d) Termination of automatic extension.

the payment of any tax due on a partner’s this section applies to requests for exten- The Commissioner may terminate an au-

income tax return. sions of time to file corporation income tax tomatic extension at any time by mailing

(f) Termination of automatic extension. returns due after December 7, 2004. to the individual a notice of termination at

The Commissioner may terminate an au- (2) Paragraph (a)(1) of this section ap- least 10 days prior to the termination date

tomatic extension at any time by mailing plies to applications for an automatic ex- designated in such notice. The Commis-

to the partnership a notice of termination tension of time to file corporation income sioner must mail the notice of termination

at least 10 days prior to the termination tax returns filed after December 31, 2005. to the address shown on the Form 4868 or

date designated in such notice. The Com- The applicability of this section expires on to the individual’s last known address. For

missioner must mail the notice of termi- November 4, 2008. further guidance regarding the definition

nation to the address shown on the Form of last known address, see §301.6212–2 of

7004 or to the partnership’s last known §1.6081–4 [Removed] this chapter.

address. For further guidance regarding (e) Penalties. See section 6651 for fail-

Par. 6. Section 1.6081–4 is removed.

the definition of last known address, see ure to file an individual income tax re-

Par. 7. Section 1.6081–4T is added to

§301.6212–2 of this chapter. turn or failure to pay the amount shown

read as follows:

(g) Penalties. See section 6698 for fail- as tax on the return. In particular, see

ure to file a partnership return. §1.6081–4T Automatic extension of time §301.6651–1(c)(3) of this chapter (relat-

(h) Effective dates. This section is ap- for filing individual income tax return ing to a presumption of reasonable cause

plicable for applications for an automatic (temporary). in certain circumstances involving an au-

extension of time to file the partnership re- tomatic extension of time for filing an in-

turns listed in paragraph (a) of this section (a) In general. An individual who is re- dividual income tax return).

filed after December 31, 2005. The appli- quired to file an individual income tax re- (f) Effective dates. This section is ap-

cability of this section expires on Novem- turn will be allowed an automatic 6-month plicable for applications for an automatic

ber 4, 2008. extension of time to file the return after the extension of time to file an individual in-

Par. 4. Section 1.6081–3 is amended by date prescribed for filing the return if the come tax return filed after December 31,

revising paragraphs (a)(1) and (e). individual files an application under this 2005. The applicability of this section ex-

section in accordance with paragraph (b) pires on November 4, 2008.

§1.6081–3 Automatic extension of time of this section. In the case of an individ- Par. 8. Section 1.6081–5 is amended by

for filing corporation income tax returns. ual described in §1.6081–5(a)(5) or (6), the revising paragraph (b) to read as follows:

automatic 6-month extension will run con-

(a) * * * §1.6081–5 Extensions of time in the case

currently with the extension of time to file

(1) [Reserved]. For guidance on the of certain partnerships, corporations, and

granted pursuant to §1.6081–5.

form to file to request a 6-month exten- U.S. citizens and residents.

(b) Requirements. To satisfy this para-

sion of time to file corporation income

graph (b), an individual must—

tax returns after December 31, 2005, see *****

(1) Submit a complete application on

§1.6081–3T. (b) [Reserved]. For guidance on how a

Form 4868, “Application for Automatic

***** person should demonstrate that the person

Extension of Time To File U.S Individual

(e) For guidance on the applicability qualified for the extension in paragraph (a)

Income Tax Return,” or in any other man-

date of this section, see §1.6081–3T. of this section after December 31, 2005,

ner prescribed by the Commissioner;

Par. 5. Section 1.6081–3T is added to see §1.6081–5T.

(2) File the application on or before the

read as follows: later of— *****

(i) The date prescribed for filing the re- Par. 9. Section 1.6081–5T is added to

§1.6081–3T Automatic extension of time read as follows:

turn; or

for filing corporation income tax returns

(ii) The expiration of any extension of

(temporary). §1.6081–5T Extensions of time in the case

time to file granted pursuant to §1.6081–5;

of certain partnerships, corporations, and

(a) [Reserved]. For further guidance, (3) File the application with the Internal

U.S. citizens and residents (temporary).

see §1.6081–3(a). Revenue Service office designated in the

(1) An application must be submitted application’s instructions; and (a) [Reserved]. For further guidance,

on Form 7004, “Application for Automatic see §1.6081–5(a).

2005–48 I.R.B. 1054 November 28, 2005

(b) In order to qualify for the extension (2) File the application on or before the Conduit (REMIC) Income Tax Return,”

under this section— date prescribed for filing the return with or Form 8831, “Excise Taxes on Excess

(1) A statement must be attached to the the Internal Revenue Service office desig- Inclusions of REMIC Residual Interests,”

return showing that the person for whom nated in the application’s instructions; and for any taxable year will be allowed an

the return is made is a person described in (3) Show on the application the amount automatic 6-month extension of time to

paragraph (a) of this section; or properly estimated as tax for the estate or file the return after the date prescribed for

(2) If a person described in paragraph trust for the taxable year. filing the return if the REMIC files an ap-

(a) of this section requests additional time (c) No extension of time for the payment plication under this section in accordance

to file, the person must request the exten- of tax. An automatic extension of time for with paragraph (b) of this section.

sion on or before the fifteenth day of the filing a return granted under paragraph (a) (b) Requirements. To satisfy this para-

sixth month following the close of the tax- of this section will not extend the time for graph (b), a REMIC must—

able year and check the appropriate box payment of any tax due on such return. (1) Submit a complete application on

on Form 4868, “Application for Automatic (d) Effect of extension on beneficiary. Form 7004, “Application for Automatic

Extension of Time To File a U.S. Individ- An automatic extension of time to file an 6-Month Extension of Time To File Cer-

ual Income Tax Return,” or Form 7004, estate or trust income tax return under this tain Business Income Tax, Information,

“Application for Automatic 6-Month Ex- section will not extend the time for filing and Other Returns,” or in any other man-

tension of Time To File Certain Business the income tax return of a beneficiary of ner prescribed by the Commissioner;

Income Tax, Information, and Other Re- the estate or trust or the time for the pay- (2) File the application on or before the

turns,” whichever is applicable, or in any ment of any tax due on the beneficiary’s date prescribed for filing the return with

other manner prescribed by the Commis- income tax return. the Internal Revenue Service office desig-

sioner. (e) Termination of automatic extension. nated in the application’s instructions; and

(c) through (f) [Reserved]. For further The Commissioner may terminate an au- (3) Show on the application the full

guidance, see §1.6081–5(c) through (f). tomatic extension at any time by mailing amount properly estimated as tax for the

(g) Effective date. This section is ap- to the estate or trust a notice of termina- REMIC for the taxable year.

plicable for applications for an automatic tion at least 10 days prior to the termina- (c) No extension of time for the payment

extension of time to file returns of income tion date designated in such notice. The of tax. An automatic extension of time for

for taxpayers listed in paragraph (a) of Commissioner must mail the notice of ter- filing a return granted under paragraph (a)

this section filed after December 31, 2005. mination to the address shown on the Form of this section will not extend the time for

The applicability of this section expires on 7004 or to the estate or trust’s last known payment of any tax due on such return.

November 4, 2008. address. For further guidance regarding (d) Effect of extension on residual or

the definition of last known address, see regular interest holders. An automatic ex-

§1.6081–6 [Removed] §301.6212–2 of this chapter. tension of time to file a REMIC income

(f) Penalties. See section 6651 for fail- tax return under this section will not extend

Par. 10. Section 1.6081–6 is removed.

ure to file an estate or trust income tax re- the time for filing the income tax return of

Par. 11. Section 1.6081–6T is added to

turn or failure to pay the amount shown as a residual or regular interest holder of the

read as follows:

tax on the return. REMIC or the time for the payment of any

§1.6081–6T Automatic extension of time (g) Effective dates. This section is ap- tax due on the residual or regular interest

to file estate or trust income tax return plicable for applications for an automatic holder’s income tax return. An automatic

(temporary). extension of time to file an estate or trust extension will also not extend the time for

income tax return filed after December 31, payment of any excise tax on excess inclu-

(a) In general. An estate or trust re- 2005. The applicability of this section ex- sions of REMIC residual interests.

quired to file an income tax return on Form pires on November 4, 2008. (e) Termination of automatic extension.

1041, “U.S. Income Tax Return for Estates The Commissioner may terminate an au-

and Trusts,” will be allowed an automatic §1.6081–7 [Removed] tomatic extension at any time by mailing

6-month extension of time to file the re- to the REMIC a notice of termination at

Par. 12. Section 1.6081–7 is removed.

turn after the date prescribed for filing the least 10 days prior to the termination date

Par. 13. Section 1.6081–7T is added to

return if the estate or trust files an applica- designated in such notice. The Commis-

read as follows:

tion under this section in accordance with sioner must mail the notice of termination

paragraph (b) of this section. §1.6081–7T Automatic extension of time to the address shown on the Form 7004 or

(b) Requirements. To satisfy this para- to file Real Estate Mortgage Investment to the REMIC’s last known address. For

graph (b), an estate or trust must— Conduit (REMIC) income tax return further guidance regarding the definition

(1) Submit a complete application on (temporary). of last known address, see §301.6212–2 of

Form 7004, “Application for Automatic this chapter.

6-Month Extension of Time To File Cer- (a) In general. A Real Estate Mortgage (f) Penalties. See sections 6698 and

tain Business Income Tax, Information, Investment Conduit (REMIC) required to 6651 for failure to file a REMIC income

and Other Returns,” or in any other man- file an income tax return on Form 1066, tax return or failure to pay an amount

ner prescribed by the Commissioner; “U.S. Real Estate Mortgage Investment shown as tax on the return.

November 28, 2005 1055 2005–48 I.R.B.

(g) Effective dates. This section is ap- the definition of last known address, see curity Act of 1974 for penalties for failure

plicable for applications for an automatic §301.6212–2 of this chapter. to file a timely and complete Form 5500.

extension of time to file REMIC income (e) Penalties. See section 6651 for fail- (e) Effective dates. This section is ap-

and excise tax returns listed in paragraph ure to file a return or failure to pay an plicable for applications for an automatic

(a) of this section filed after December 31, amount shown as tax on the return. extension of time to file Forms 5500 filed

2005. The applicability of this section ex- (f) Effective dates. This section is ap- after December 31, 2005. The applicabil-

pires on November 4, 2008. plicable for applications for an automatic ity of this section expires on November 4,

Par. 14. Section 1.6081–10T is added extension of time to file the withholding 2008.

to read as follows: tax return for U.S. source income of for-

eign persons return filed after December PART 25—GIFT TAX; GIFTS MADE

§1.6081–10T Automatic extension of 31, 2005. The applicability of this section AFTER DECEMBER 31, 1954

time to file withholding tax return for expires on November 4, 2008.

U.S. source income of foreign persons Par. 16. The authority citation for part

Par. 15. Section 1.6081–11T is added

(temporary). 25 is amended by adding an entry in nu-

to read as follows:

merical order to read, in part, as follows:

(a) In general. A withholding agent §1.6081–11T Automatic extension of time Authority: 26 U.S.C. 7805 * * *

or intermediary required to file a return for filing certain employee plan returns Section 25.6081–1T also issued under

on Form 1042, “Annual Withholding Tax (temporary). the authority of 26 U.S.C. 6081(a). * * *

Return for U.S. Source Income of Foreign

Persons,” for any taxable year will be al- (a) In general. An administrator or §25.6081–1 [Removed]

lowed an automatic 6-month extension of sponsor of an employee benefit plan re-

Par. 17. Section 25.6081–1 is removed.

time to file the return after the date pre- quired to file a return under the provisions

Par. 18. Section 25.6081–1T is added

scribed for filing the return if the withhold- of chapter 61 or the regulations there-

to read as follows:

ing agent or intermediary files an applica- under on Form 5500 (series), “Annual

tion under this section in accordance with Return/Report of Employee Benefit Plan,” §25.6081–1T Automatic extension of time

paragraph (b) of this section. will be allowed an automatic 21/2-month for filing gift tax returns (temporary).

(b) Requirements. To satisfy this para- extension of time to file the return after

graph (b), a withholding agent or interme- the date prescribed for filing the return if (a) In general. Under section

diary must— the administrator or sponsor files an ap- 6075(b)(2), an automatic six-month ex-

(1) Submit a complete application on plication under this section in accordance tension of time granted to a donor to

Form 7004, “Application for Automatic with paragraph (b) of this section. file the donor’s return of income under

6-Month Extension of Time To File Cer- (b) Requirements. To satisfy this para- §1.6081–4T shall be deemed to also be

tain Business Income Tax, Information, graph (b), an administrator or sponsor a six-month extension of time granted to

and Other Returns,” or in any other man- must— file a return on Form 709, “United States

ner prescribed by the Commissioner; (1) Submit a complete application on Gift (and Generation-Skipping Transfer)

(2) File the application on or before the Form 5558, “Application for Extension of Tax Return.” If a donor does not obtain an

date prescribed for filing the return with Time To File Certain Employee Plan Re- extension of time to file the donor’s return

the Internal Revenue Service office desig- turns,” or in any other manner as may be of income under §1.6081–4T, the donor

nated in the application’s instructions; and prescribed by the Commissioner; and will be allowed an automatic 6-month

(3) Remit the amount of the properly (2) File the application with the Internal extension of time to file Form 709 after

estimated unpaid tax liability on or before Revenue Service office designated in the the date prescribed for filing if the donor

the date prescribed for payment. application’s instructions on or before the files an application under this section in

(c) No extension of time for the payment date prescribed for filing the information accordance with paragraph (b) of this sec-

of tax. An automatic extension of time for return. tion. In the case of an individual described

filing a return granted under paragraph (a) (c) Termination of automatic extension. in §1.6081–5(a)(5) or (6), the automatic

of this section will not extend the time for The Commissioner may terminate an auto- 6-month extension of time to file Form

payment of any tax due on such return. matic extension at any time by mailing to 709 will run concurrently with the exten-

(d) Termination of automatic extension. the administrator or sponsor a notice of ter- sion of time to file granted pursuant to

The Commissioner may terminate an au- mination at least 10 days prior to the termi- §1.6081–5.

tomatic extension at any time by mailing nation date designated in such notice. The (b) Requirements. To satisfy this para-

to the withholding agent or intermediary Commissioner must mail the notice of ter- graph (b), a donor must—

a notice of termination at least 10 days mination to the address shown on the Form (1) Submit a complete application on

prior to the termination date designated in 5558 or to the administrator or sponsor’s Form 8892, “Payment of Gift/GST Tax

such notice. The Commissioner must mail last known address. For further guidance and/or Application for Extension of Time

the notice of termination to the address regarding the definition of last known ad- To File Form 709,” or in any other manner

shown on the Form 7004 or to the with- dress, see §301.6212–2 of this chapter. prescribed by the Commissioner;

holding agent or intermediary’s last known (d) Penalties. See sections 6652, 6692, (2) File the application on or before the

address. For further guidance regarding and the Employee Retirement Income Se- later of—

2005–48 I.R.B. 1056 November 28, 2005

(i) The date prescribed for filing the re- of time to file the return after the date Section 53.6081–1T also issued under

turn; or prescribed for filing if the skip person 26 U.S.C. 6081(a).

(ii) The expiration of any extension of distributee or trustee files an application

time to file granted pursuant to §1.6081–5; under this section in accordance with para- §53.6081–1 [Removed]

and graph (b) of this section.

Par. 22. Section 53.6081–1 is removed.

(3) File the application with the Internal (b) Requirements. To satisfy this para-

Par. 23. Section 53.6081–1T is added

Revenue Service office designated in the graph (b), a skip person distributee or

to read as follows:

application’s instructions. trustee must—

(c) No extension of time for the payment (1) Submit a complete application on §53.6081–1T Automatic extension of

of tax. An automatic extension of time for Form 7004, “Application for Automatic time for filing the return to report taxes

filing a return granted under paragraph (a) 6-Month Extension of Time To File Cer- due under section 4951 for self-dealing

of this section will not extend the time for tain Business Income Tax, Information, with a nuclear decommissioning fund

payment of any tax due on such return. and Other Returns,” or in any other man- (temporary).

(d) Termination of automatic extension. ner prescribed by the Commissioner;

The Commissioner may terminate an ex- (2) File the application on or before the (a) In general. A disqualified person

tension at any time by mailing to the donor date prescribed for filing the return with for purposes of section 4951(e)(4) who

a notice of termination at least 10 days the Internal Revenue Service office desig- engaged in self-dealing with a Nuclear

prior to the termination date designated in nated in the application’s instructions; and Decommissioning Fund, and must re-

such notice. The Commissioner must mail (3) Remit the amount of the properly port tax due under section 4951 on Form

the notice of termination to the address estimated unpaid tax liability on or before 1120-ND, “Return for Nuclear Decom-

shown on the Form 8892, or to the donor’s the date prescribed for payment. missioning Funds and Certain Related

last known address. For further guidance (c) No extension of time for the payment Persons,” will be allowed an automatic

regarding the definition of last known ad- of tax. An automatic extension of time for 6-month extension of time to file the re-

dress, see §301.6212–2 of this chapter. filing a return granted under paragraph (a) turn after the date prescribed for filing the

(e) Penalties. See section 6651 for fail- of this section will not extend the time for return if the disqualified person files an ap-

ure to file a gift tax return or failure to pay payment of any tax due on such return. plication under this section in accordance

the amount shown as tax on the return. (d) Termination of automatic extension. with paragraph (b) of this section. For

(f) Effective dates. This section is appli- The Commissioner may terminate an au- guidance on requesting an extension of

cable for applications for an extension of tomatic extension at any time by mailing time to file Form 1120-ND for purposes of

time to file Form 709 filed after December to the skip person distributee or trustee reporting contributions received, income

31, 2005. The applicability of this section a notice of termination at least 10 days earned, administrative expenses of operat-

expires on November 4, 2008. prior to the termination date designated in ing the fund, and the tax on modified gross

such notice. The Commissioner must mail income, see §1.6081–3 of this chapter.

PART 26—GENERATION-SKIPPING the notice of termination to the address (b) Requirements. To satisfy this para-

TRANSFER TAX REGULATIONS shown on the Form 7004 or to the skip graph (b), a disqualified person must—

UNDER THE TAX REFORM ACT OF person distributee or trustee’s last known (1) Submit a complete application on

1986 address. For further guidance regarding Form 7004, “Application for Automatic

the definition of last known address, see 6-Month Extension of Time To File Cer-

Par. 19. The authority citation for part

§301.6212–2 of this chapter. tain Business Income Tax, Information,

26 is amended by adding an entry in nu-

(e) Penalties. See section 6651 for fail- and Other Returns,” or in any other man-

merical order to read, in part, as follows:

ure to file a generation-skipping transfer ner prescribed by the Commissioner;

Authority: 26 U.S.C. 7805 * * *

tax return or failure to pay the amount (2) File the application on or before the

Section 26.6081–1T also issued under

shown as tax on the return. date prescribed for filing the return with

the authority of 26 U.S.C. 6081(a).

(f) Effective dates. This section is effec- the Internal Revenue Service office desig-

Par. 20. Section 26.6081–1T is added

tive for applications for an automatic ex- nated in the application’s instructions; and

to read as follows:

tension of time to file a generation-skip- (3) Remit the amount of the properly

§26.6081–1T Automatic extension of time ping transfer tax return filed after Decem- estimated unpaid tax liability on or before

for filing generation-skipping transfer tax ber 31, 2005. The applicability of this sec- the date prescribed for payment.

returns (temporary). tion expires on November 4, 2008. (c) No extension of time for the payment

of tax. An automatic extension of time for

(a) In general. A skip person dis- PART 53—FOUNDATION AND filing a return granted under paragraph (a)

tributee required to file a return on Form SIMILAR EXCISE TAXES of this section will not extend the time for

706-GS(D), “Generation-Skipping Trans- payment of any tax due on such return.

Par. 21. The authority citation for part

fer Tax Return For Distributions,” or a (d) Termination of automatic extension.

53 is amended by adding an entry in nu-

trustee required to file a return on Form The Commissioner may terminate an au-

merical order to read, in part, as follows:

706-GS(T), “Generation-Skipping Trans- tomatic extension at any time by mailing

Authority: 26 U.S.C. 7805 * * *

fer Tax Return For Terminations,” will be to the disqualified person a notice of ter-

allowed an automatic 6-month extension mination at least 10 days prior to the ter-

November 28, 2005 1057 2005–48 I.R.B.

mination date designated in such notice. (b) Requirements. To satisfy this para- Par. 29. Section 156.6081–1T is added

The Commissioner must mail the notice of graph (b), a REIT or RIC must— to read as follows:

termination to the address shown on the (1) Submit a complete application on

Form 7004 or to the disqualified person’s Form 7004, “Application for Automatic §156.6081–1T Automatic extension of

last known address. For further guidance 6-Month Extension of Time To File Cer- time for filing a return due under chapter

regarding the definition of last known ad- tain Business Income Tax, Information, 54 (temporary).

dress, see §301.6212–2 of this chapter. and Other Returns,” or in any other man-

(e) Penalties. See section 6651 for fail- ner prescribed by the Commissioner; (a) In general. A taxpayer required to

ure to file or failure to pay the amount (2) File the application on or before the file a return on Form 8725, “Excise Tax on

shown as tax on the return. date prescribed for filing the return with Greenmail,” will be allowed an automatic

(f) Effective dates. This section is ap- the Internal Revenue Service office desig- 6-month extension of time to file the re-

plicable for applications for an automatic nated in the application’s instructions; and turn after the date prescribed for filing the

extension of time to file a return to report (3) Remit the amount of the properly return if the taxpayer files an application

taxes due under section 4951 for self-deal- estimated unpaid tax liability on or before under this section in accordance with para-

ing with a Nuclear Decommissioning Fund the date prescribed for payment. graph (b) of this section.

filed after December 31, 2005. The appli- (c) No extension of time for the payment (b) Requirements. To satisfy this para-

cability of this section expires on Novem- of tax. An automatic extension of time for graph (b), a taxpayer must—

ber 4, 2008. filing a return granted under paragraph (a) (1) Submit a complete application on

of this section will not extend the time for Form 7004, “Application for Automatic

PART 55—EXCISE TAX ON REAL payment of any tax due on such return. 6-Month Extension of Time To File Cer-

ESTATE INVESTMENT TRUSTS (d) Termination of automatic extension. tain Business Income Tax, Information,

AND REGULATED INVESTMENT The Commissioner may terminate an au- and Other Returns,” or in any other man-

COMPANIES tomatic extension at any time by mailing ner prescribed by the Commissioner;

to the REIT or RIC a notice of termina- (2) File the application on or before the

Par. 24. The authority citation is tion at least 10 days prior to the termina- date prescribed for filing the return with

amended by adding an entry in numerical tion date designated in such notice. The the Internal Revenue Service office desig-

order to read, in part, as follows: Commissioner must mail the notice of ter- nated in the application’s instructions; and

Authority: 26 U.S.C. 6001, 6011, 6071, mination to the address shown on the Form (3) Remit the amount of the properly

6091, and 7805 * * * 7004 or to the REIT or RIC’s last known estimated unpaid tax liability on or before

Section 55.6081–1T also issued under address. For further guidance regarding the date prescribed for payment.

26 U.S.C. 6081(a). * * * the definition of last known address, see (c) No extension of time for the payment

§301.6212–2 of this chapter. of tax. An automatic extension of time for

§55.6081–1 [Removed] (e) Penalties. See section 6651 for fail- filing a return granted under paragraph (a)

ure to file or failure to pay the amount of this section will not extend the time for

Par. 25. Section 55.6081–1 is removed. shown as tax on the return. payment of any tax due on such return.

Par. 26. Section 55.6081–1T is added (f) Effective dates. This section is ap- (d) Termination of automatic extension.

to read as follows: plicable for applications for an automatic The Commissioner may terminate an au-

extension of time to file a return due under tomatic extension at any time by mailing

§55.6081–1T Automatic extension of time chapter 44, filed after December 31, 2005. to the taxpayer a notice of termination at

for filing a return due under Chapter 44 The applicability of this section expires on least 10 days prior to the termination date

(temporary). November 4, 2008. designated in such notice. The Commis-

sioner must mail the notice of termination

(a) In general. A Real Estate Invest- PART 156—EXCISE TAX ON to the address shown on the Form 7004 or

ment Trust (REIT) required to file a return GREENMAIL to the taxpayer’s last known address. For

on Form 8612, “Return of Excise Tax on further guidance regarding the definition

Par. 27. The authority citation is

Undistributed Income of Real Estate In- of last known address, see §301.6212–2 of

amended by adding an entry in numerical

vestment Trusts,” or a Regulated Invest- this chapter.

order to read, in part, as follows:

ment Company (RIC) required to file a re- (e) Penalties. See section 6651 for fail-

Authority: 26 U.S.C. 6001, 6011, 6061,

turn on Form 8613, “Return of Excise Tax ure to file or failure to pay the amount

6071, 6091, 6161, and 7805 * * *

on Undistributed Income of Regulated In- shown as tax on the return.

Section 156.6081–1T also issued under

vestment Companies,” will be allowed an (f) Effective dates. This section is ap-

26 U.S.C. 6081(a). * * *

automatic 6-month extension of time to plicable for applications for an automatic

file the return after the date prescribed for §156.6081–1 [Removed] extension of time to file a return due under

filing the return if the REIT or RIC files chapter 54, filed after December 31, 2005.

an application under this section in accor- Par. 28. Section 156.6081–1 is re- The applicability of this section expires on

dance with paragraph (b) of this section. moved. November 4, 2008.

2005–48 I.R.B. 1058 November 28, 2005

PART 157—EXCISE TAX ON (d) Termination of automatic extension. (1) Submit a complete application on

STRUCTURED SETTLEMENT The Commissioner may terminate an au- Form 7004, “Application for Automatic

FACTORING TRANSACTIONS tomatic extension at any time by mailing 6-Month Extension of Time To File Cer-

to the taxpayer a notice of termination at tain Business Income Tax, Information,

Par. 30. The authority citation is least 10 days prior to the termination date and Other Returns,” or in any other man-

amended by adding an entry in numerical designated in such notice. The Commis- ner prescribed by the Commissioner; and

order to read, in part, as follows: sioner must mail the notice of termination (2) File the application on or before the

Authority: 26 U.S.C. 7805 * * * to the address shown on the Form 7004 or date prescribed for filing the return with

Section 157.6081–1T also issued under to the taxpayer’s last known address. For the Internal Revenue Service office desig-

26 U.S.C. 6081(a). * * * further guidance regarding the definition nated in the application’s instructions.

of last known address, see §301.6212–2 of (c) Termination of automatic extension.

§157.6081–1 [Removed]

this chapter. The Commissioner may terminate an au-

Par. 31. Section 157.6081–1 is re- (e) Penalties. See section 6651 for fail- tomatic extension at any time by mailing

moved. ure to file or failure to pay the amount to the trust a notice of termination at least

Par. 32. Section 157.6081–1T is added shown as tax on the return. 10 days prior to the termination date des-

to read as follows: (f) Effective dates. This section is ap- ignated in such notice. The Commissioner

plicable for applications for an automatic must mail the notice of termination to the

§157.6081–1T Automatic extension of extension of time to file a return due under address shown on the Form 7004 or to

time for filing a return due under chapter chapter 55, filed after December 31, 2005. the trust’s last known address. For further

55 (temporary). The applicability of this section expires on guidance regarding the definition of last

November 4, 2008. known address, see §301.6212–2 of this

(a) In general. A taxpayer required chapter.

to file a return on Form 8876, “Excise PART 301—PROCEDURE AND (d) Penalties. See section 6677 for fail-

Tax on Structured Settlement Factoring ADMINISTRATION ure to file information returns with respect

Transactions,” will be allowed an auto- to certain foreign trusts.

matic 6-month extension of time to file the Par. 33. The authority citation is (e) Effective dates. This section is ef-

return after the date prescribed for filing amended by adding an entry in numerical fective for applications for an automatic

the return if the taxpayer files an applica- order to read, in part, as follows: extension of time to file an information re-

tion under this section in accordance with Authority: 26 U.S.C. 7805 * * * turn with respect to certain foreign trusts

paragraph (b) of this section. Section 301.6081–2T also issued under listed in paragraph (a) of this section filed

(b) Requirements. To satisfy this para- 26 U.S.C. 6081(a). * * * after December 31, 2005. The applicabil-

graph (b), the taxpayer must— Par. 34. Section 301.6081–2T is added ity of this section expires on November 4,

(1) Submit a complete application on to read as follows: 2008.

Form 7004, “Application for Automatic

6-Month Extension of Time To File Cer- §301.6081–2T Automatic extension of Mark E. Matthews,

tain Business Income Tax, Information, time for filing an information return Deputy Commissioner for

and Other Returns,” or in any other man- with respect to certain foreign trusts Services and Enforcement.

ner prescribed by the Commissioner; (temporary).

(2) File the application on or before the Approved October 26, 2005.

date prescribed for filing the return with (a) In general. A trust required to file a

Eric Solomon,

the Internal Revenue Service office desig- return on Form 3520-A, “Annual Informa-

Acting Deputy Assistant Secretary

nated in the application’s instructions; and tion Return of Foreign Trust With a U.S.

(for Tax Policy).

(3) Remit the amount of the properly Owner,” will be allowed an automatic

estimated unpaid tax liability on or before 6-month extension of time to file the re- (Filed by the Office of the Federal Register on November 4,

2005, 8:45 a.m., and published in the issue of the Federal

the date prescribed for payment. turn after the date prescribed for filing the Register for November 7, 2005, 70 F.R. 67356)

(c) No extension of time for the payment return if the trust files an application under

of tax. An automatic extension of time for this section in accordance with paragraph

filing a return granted under paragraph (a) (b) of this section.

of this section will not extend the time for (b) Requirements. To satisfy this para-

payment of any tax due on such return. graph (b), a trust must—

November 28, 2005 1059 2005–48 I.R.B.

Part III. Administrative, Procedural, and Miscellaneous

Form 1120, Form 1120S, lion for taxable years ending on or after on or after December 31, 2005, the Service

Form 990, and Form 990–PF December 31, 2006. will allow the taxpayer 20 calendar days

Electronic Filing Waiver The temporary regulations further from the date of first transmission to per-

require private foundations or section fect the return for electronic resubmission.

Request Procedures 4947(a)(1) trusts (regardless of asset size) If the electronic return cannot be ac-

that are required to file returns under sec- cepted for processing electronically, the

Notice 2005–88 tion 6033 and that meet the 250 return taxpayer must file a paper return with the

threshold, to file their Form 990–PF elec- Service Center where it would normally be

Background tronically for taxable years ending on or filed. In order for the paper return to be

after December 31, 2006. considered timely, it must be filed by the

This Notice provides procedures for

later of the due date, or 5 calendar days

corporations, electing small business cor- Exclusions from the e-File Requirement after the date the Service last gives noti-

porations, and organizations required to

fication to the taxpayer that the return has

file returns under section 6033 (taxpayers) Temporary regulations sections been rejected, as long as the first transmis-

to request a waiver of the requirement 301.6011–5T, 301.6033–4T, and sion was made on or before the due date

to electronically file Form 1120, U.S. 301.6037–2T and IRS publications pro- of the return (including extensions). The

Corporation Income Tax Return; Form vide for exceptions and hardship waivers paper return should include an explanation

1120S, U.S. Income Tax Return for an from the electronic filing requirement for of why the return is being filed after the

S Corporation; Form 990, Return of Or- corporations, organizations required to file due date and include a copy of the Ser-

ganization Exempt From Income Tax; and returns under section 6033, and electing vice’s final rejection notification. A paper

Form 990–PF, Return of Private Foun- small business corporations. IRS Publica- return filed in accordance with this para-

dation or Section 4947(a)(1) Nonexempt tion 4163, Modernized e-File (MeF) Infor- graph will be considered timely filed and

Charitable Trust Treated as a Private mation for Authorized IRS e-file Providers any elections attached to the return will be

Foundation. This notice also includes of Forms 1120/1120S, and IRS Publica- considered valid. A waiver request does

guidance on the timely filing of a return tion 4206, Information for Authorized IRS not have to be filed by the taxpayer under

required to be electronically filed that is e-file Providers of Exempt Organization the perfection procedures described in this

rejected. Filings, contain instructions for filing paragraph.

On January 12, 2005, the Treasury De- corporate and tax exempt organization

partment and the Internal Revenue Service returns electronically, and exclude certain Requests for Waiver of Electronic Filing

(Service) issued temporary regulations types of returns from the electronic filing Requirement

that, beginning in 2006, require certain requirement. For example, for tax year

large corporations, electing small business 2005, the Service has excluded amended When certain taxpayers required to file

corporations and organizations required returns from the electronic filing require- over 250 returns fail to file electronically

to file returns under section 6033 to elec- ment. The Service, however, will accept as required, those taxpayers may be liable

tronically file their income tax or annual amended returns through the Modernized for failure to file penalties under I.R.C.

information returns. T.D. 9175, 2005–10 e-File (MeF) program effective January §§ 6651 or 6652, unless the taxpayer can

I.R.B. 665 [70 F.R. 2012]. 2007. For a complete and up to date list of establish that the failure to file the return

Section 6011(e)(2) provides that the the exclusions or for further information electronically was due to reasonable cause

Service may not require an entity to file on electronic filing, refer to Publication and not due to willful neglect. The tem-

returns on electronic media unless the en- 4163, Publication 4206, and the IRS.gov porary regulations permit the Service to

tity is required to file at least 250 returns Internet site. The Service will post an- waive the electronic filing requirement if

during the calendar year. Under the tem- swers to frequently-asked questions on the taxpayer demonstrates that undue hard-

porary regulations, corporations that meet this site. ship would result if it were required to file

this threshold and that have assets of $50 its return electronically. The regulations

million or more must file their Form 1120 Timely Filing of Rejected e-Filed Returns require that taxpayers seeking a waiver

or Form 1120S returns electronically for should request that waiver in the man-

taxable years ending on or after December If the portion of a return required to ner prescribed in applicable revenue pro-

31, 2005. The temporary regulations also be filed electronically is transmitted on or cedures or publications.

require that tax exempt organizations with before the due date (including extensions) The Service will approve or deny re-

assets of $100 million or more that are and is ultimately rejected, but the elec- quests for a waiver of the electronic filing

required to file returns under section 6033 tronic return originator and the taxpayer requirement based on each taxpayer’s

and that meet the 250 return threshold file comply with the following requirements particular facts and circumstances. In de-

their Form 990 electronically for taxable for timely submission of the return, the re- termining whether to approve or deny a

years ending on or after December 31, turn will be considered timely filed and waiver request, the Service will consider

2005. The $50 million and $100 million any elections attached to the return will be the taxpayer’s ability to timely file its

asset thresholds will decrease to $10 mil- considered valid. For taxable years ending return electronically without incurring an

2005–48 I.R.B. 1060 November 28, 2005

undue economic hardship. The Service b) why the steps were unsuccessful, quest with the Ogden Submission Process-

will generally grant waivers for filing re- c) the undue hardship that would re- ing Center.

turns electronically where the taxpayer sult by complying with the electronic fil- Use the following address if using the

can demonstrate the undue hardship that ing requirement, including any incremen- U.S. Postal Service:

would result by complying with the elec- tal costs to the taxpayer of complying with

tronic filing requirement, including any the electronic filing requirements. Incre- Internal Revenue Service

incremental costs to the filer. Mindful of mental costs are those costs that are above Ogden Submission Processing Center

the software and technological issues in and beyond the costs to file on paper. The Attn: Forms 1120 and 990 e-file Waiver