Professional Documents

Culture Documents

BroadMoney M2

Uploaded by

Mudassir YounusOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BroadMoney M2

Uploaded by

Mudassir YounusCopyright:

Available Formats

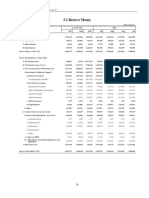

th

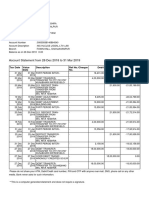

Provisional Data on Monetary Aggregates as on October 8 , 2010

1) Broad Money (M2)

(Million Rupees)

Stocks at Yearly Flows Monetary Impact Since

COMPONENTS End-June P

1st July to

P FY 09 FY 10

2010 8-Oct-10 P 10-Oct-09

A Currency in Circulation 1,295,385 169,847 143,212 145,932 111,707

B Other Deposits with SBP 6,663 401 2,000 1,489 257

C Total Demand & Time Deposits incl. RFCDs 1/ 4,475,183 277,827 494,799 -111,237 -106,856

of which Residents Foreign Currency Deposits (RFCDs) 345,438 16,934 65,074 11,459 20,559

Broad Money (M2) 5,777,231 448,076 640,012 36,184 5,108

Growth 9.56% 12.46% 0.63% 0.10%

Factors Affecting Broad Money (M2)

A Net Foreign Assets of the Banking System 2/ 545,454 -171,657 49,600 44,223 7,509

B Net Domestic Assets of the Banking System (1+2+3) 5,231,777 619,732 590,413 -8,039 -2,401

Growth 15.41% 12.72% -0.15% -0.05%

1 Net Government Sector Borrowings (a+b+c) 2,440,941 525,763 406,636 174,120 76,546

a 3/ 2,011,459 316,418 330,437 196,857 78,019

Borrowings for Budgetary Support

(i) From SBP of which 1,208,651 130,932 44,005 184,501 -36,431

a) Central Government 1,141,750 44,258 30,138 212,642 -56,636

b) Provincial Government 67,002 88,402 12,757 -27,244 18,664

Balochistan Government 19,886 6,161 -4,475 -9,096 -1,612

Khyber Pakhtunkhwa Government -4,834 7,947 -4,139 -11,626 -4

Punjab Government 56,503 62,350 5,482 -729 23,446

Sindh Government -4,554 11,945 15,889 -5,793 -3,166

c) AJK Government -100 -1,728 1,110 -896 1,542

(ii) From Scheduled banks 802,808 185,487 286,433 12,356 114,451

a) Central Government 1,047,004 227,780 309,514 7,421 115,784

b) Provincial Government -244,196 -42,293 -23,081 4,935 -1,334

b Commodity Operations 413,191 210,778 76,989 -23,994 83

c Others 16,291 -1,434 -790 1,257 -1,557

2 Credit to Non-Government Sector (a+b+c+d) 3,388,800 170,070 198,806 -97,940 -13,790

a Credit to Private Sector 3,019,822 17,082 112,926 -72,125 -81,037

b Credit to Public Sectors Enterprises (PSEs) 375,033 152,723 85,028 -26,177 68,093

c PSEs Special Account-Debt Repayment with SBP -23,683 -86 0 0 0

d Other Financial Institutions (SBP credit to NBFIs) 17,628 351 852 363 -846

3 Other Items (net) -597,964 -76,100 -15,030 -84,219 -65,157

Broad Money (M2) 5,777,231 448,075 640,013 36,184 5,108

Growth 9.56% 12.46% 0.63% 0.10%

P: Provisional

Memorandum Items

Accrued profit on SBP holdings of MRTBs 37,206 16,932 2,075 6,667 114

Outstanding amout of MTBs (realized value in auctuions) 1,063,045 202,498 323,570 7,052 134,027

Net Government Budgetary Borrowings for Budgetry Support (Estimated

on cash basis as done in government budget)

From Banking System 1,934,554 304,620 304,563 192,430 85,942

From SBP 1,171,445 114,000 41,930 177,835 -36,545

From Scheduled Banks 763,108 190,620 262,633 14,595 122,487

1/ Excluding inter-bank deposits, deposits of governments and foreign constituents.

2/ The treatment of SDR allocation changed from Equity to SBP foreign liability w.e.f. 30-06-2009 and onwards.

3/ Government’s borrowing mechanisms from the banking system are as follows:-

(a) Borrowings from scheduled banks is mainly through fortnightly auctioning of Market Treasury Bills (MTBs) of 3, 6 and 12-month

maturities. Government of Pakistan also borrows long-term by quarterly auctioning of Pakistan Investment Bonds (PIBs) of 3, 5, 10, 15, 20

and 30 years maturities.

(b) Federal Government may also borrow directly from SBP either through Ways and Means Advance or purchase (by SBP) of Market Related

Treasury Bills (MRTBs). The Ways and Means Advance is extended for Government borrowings up to Rs.100 million at an interest rate of

4 percent per annum whereas higher amounts are borrowed through SBP purchase of 6-month MTBs at the weighted average yield of

6-month MTB determined in the most recent fortnightly auction of treasury bills. The weighted average yield on 6-month MTB was 13.07

percent as a result of the auction conducted on 6th October 2010.

(c) Provincial Governments and the Government of Azad Jammu & Kashmir may also borrow directly from SBP through raising of their

debtor balances (over drafts) within limits defined for them. An interest rate is charged on the borrowings which is weighted average of the

weighted average yields of 6-month MTBs over the preceding three months. In case, the Provincial Governments or the Government of Azad

Jammu & Kashmir borrow over and above the over draft limit, they are penalized by charging an incremental rate of 4 percent per annum.

Source: Based on weekly returns of scheduled banks for the week ending Friday.

Contact Person: Mr. Muhammad Atif Hamza (Sr. Joint Director), Monetary & Financial Statistics Division, Phone: 92 21 32453668

For Feedback: http://www.sbp.org.pk/stats/survey/index.asp

You might also like

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Bank Teller Job Interview Questions and AnswersDocument7 pagesBank Teller Job Interview Questions and AnswersTarik Ahmed100% (1)

- Trade Finance: GuideDocument36 pagesTrade Finance: Guidesujitranair100% (1)

- Blmscul3542895 PDFDocument1 pageBlmscul3542895 PDFEric Jara0% (1)

- Air WaybillDocument1 pageAir WaybillRizal BachtiarNo ratings yet

- PNB ScamDocument13 pagesPNB ScamPrachi ChhedaNo ratings yet

- Importance of CASA DepositsDocument2 pagesImportance of CASA Depositsvinodkulkarni100% (1)

- FI End User Manual 151005Document129 pagesFI End User Manual 151005kush2477No ratings yet

- Sawadjaan-v-CA-DIGESTDocument3 pagesSawadjaan-v-CA-DIGESTRobby DelgadoNo ratings yet

- 2256XXXXXXXXX624120 06 2019 PDFDocument4 pages2256XXXXXXXXX624120 06 2019 PDFLakshman RaiNo ratings yet

- Central Bank of The Philippines v. Citytrust Banking Corporation, G.R. No. 141835Document1 pageCentral Bank of The Philippines v. Citytrust Banking Corporation, G.R. No. 141835xxxaaxxxNo ratings yet

- Assignment of Digital BankingDocument18 pagesAssignment of Digital BankingZakaria Sakib50% (2)

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument16 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignaturemohitNo ratings yet

- Factors Affecting Broad Money (M2)Document18 pagesFactors Affecting Broad Money (M2)Khizar Khan JiskaniNo ratings yet

- Factors Affecting Reserve Money (RM) : GrowthDocument35 pagesFactors Affecting Reserve Money (RM) : GrowthKhizar Khan JiskaniNo ratings yet

- Chapter 5Document20 pagesChapter 5bilalNo ratings yet

- MS08092022Document3 pagesMS08092022Hoàng Minh ChuNo ratings yet

- TABLE 5.1 Components of Monetary AssetsDocument9 pagesTABLE 5.1 Components of Monetary AssetsfaysalNo ratings yet

- 5-Money and CreditDocument8 pages5-Money and CreditAhsan Ali MemonNo ratings yet

- Credit/Loans Classified by BorrowersDocument5 pagesCredit/Loans Classified by Borrowerssm_1234567No ratings yet

- Chapter IVDocument6 pagesChapter IVmohsin.usafzai932No ratings yet

- Ess 2022 Chapter 5 eDocument9 pagesEss 2022 Chapter 5 eDahamNo ratings yet

- 10.1 Consolidated Fiscal Operations (Federal & Provincial) : FY14 FY15 FY16 FY17 FY18 FY19Document4 pages10.1 Consolidated Fiscal Operations (Federal & Provincial) : FY14 FY15 FY16 FY17 FY18 FY19MeeroButtNo ratings yet

- 4-Fiscal DevelopmentDocument5 pages4-Fiscal DevelopmentAhsan Ali MemonNo ratings yet

- Financial Statement For The FY 2023 2024 BudgetDocument5 pagesFinancial Statement For The FY 2023 2024 BudgetkarthanzewNo ratings yet

- PR1649ST10012024 RMDocument1 pagePR1649ST10012024 RMkushal srivastavaNo ratings yet

- Research Report On Public FinanceDocument4 pagesResearch Report On Public Financemaryamshah63neduetNo ratings yet

- PFO-July June 2022 23Document10 pagesPFO-July June 2022 23Murtaza HashimNo ratings yet

- 10.1 Consolidated Fiscal Operations (Federal & Provincial)Document4 pages10.1 Consolidated Fiscal Operations (Federal & Provincial)MeeroButtNo ratings yet

- Trade and PaymentsDocument17 pagesTrade and PaymentsmazamniaziNo ratings yet

- Nepal Macroeconomic Situation First Nine Months Data of 2009-10Document20 pagesNepal Macroeconomic Situation First Nine Months Data of 2009-10Chandan SapkotaNo ratings yet

- Money CreditDocument14 pagesMoney CreditAdil IshaqueNo ratings yet

- Balance of PaymentsDocument12 pagesBalance of PaymentsVipulNo ratings yet

- Statement of Government Operations: O/w Exceptional Contribution From Bank of Mauritius 33,000Document2 pagesStatement of Government Operations: O/w Exceptional Contribution From Bank of Mauritius 33,000Yashas SridatNo ratings yet

- Appendix Table 8: India'S Overall Balance of PaymentsDocument1 pageAppendix Table 8: India'S Overall Balance of PaymentsPandu PrasadNo ratings yet

- Analysis of State Budget Finances 2023Document9 pagesAnalysis of State Budget Finances 2023Manasee RatnakarNo ratings yet

- Bop PDFDocument1 pageBop PDFLoknadh ReddyNo ratings yet

- Audited Amc 09-10Document14 pagesAudited Amc 09-10kamalkantshuklaNo ratings yet

- Iepr2513270515 MSDocument1 pageIepr2513270515 MSBhavsar HarshNo ratings yet

- Budget Statistics 2006 - 2012: Ministry of Finance Republic of IndonesiaDocument15 pagesBudget Statistics 2006 - 2012: Ministry of Finance Republic of IndonesiaanwarNo ratings yet

- No. 42: India's Overall Balance of Payments: Current StatisticsDocument6 pagesNo. 42: India's Overall Balance of Payments: Current StatisticsReuben RichardNo ratings yet

- Balance de Payement GabonDocument35 pagesBalance de Payement GabonabondoengandzasteveneNo ratings yet

- 02 EnglishDocument7 pages02 EnglishMalaz.A.S MohamedNo ratings yet

- Table 1 Pakistan: Summary of Consolidated Federal and Provincial Budgetry Operations, 2013-14 ProvisionalDocument10 pagesTable 1 Pakistan: Summary of Consolidated Federal and Provincial Budgetry Operations, 2013-14 Provisionalhamza tariqNo ratings yet

- Pakistan Balance of PaymentsDocument94 pagesPakistan Balance of PaymentsHamzaNo ratings yet

- Ringkasan APBN 2011-2015Document3 pagesRingkasan APBN 2011-2015GlorithoNo ratings yet

- Page 1 of 4: (Rs. in Million)Document4 pagesPage 1 of 4: (Rs. in Million)Qammar U DinNo ratings yet

- Current Macroeconomic Situation: (Based On First Four Months' Data of 2007/08)Document25 pagesCurrent Macroeconomic Situation: (Based On First Four Months' Data of 2007/08)Monkey.D. LuffyNo ratings yet

- NPI TW IV 2017Document20 pagesNPI TW IV 2017Hayyin Nur AdisaNo ratings yet

- PortfoiloDocument1 pagePortfoiloHemant ChaudhariNo ratings yet

- 80028Document2 pages80028jeetNo ratings yet

- Balance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob GeorgeDocument16 pagesBalance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob Georgeatulpal112No ratings yet

- Stanbic Bank Q3 2023 Financial ResultsDocument1 pageStanbic Bank Q3 2023 Financial Resultskaranjamike565No ratings yet

- EBL 2016 - L&A Note (7.b.10)Document1 pageEBL 2016 - L&A Note (7.b.10)Anindita SahaNo ratings yet

- Takaful Companies - Overall: ItemsDocument6 pagesTakaful Companies - Overall: ItemsZubair ArshadNo ratings yet

- Ashwin 2070Document2 pagesAshwin 2070nayanghimireNo ratings yet

- Vii.4. Produk Domestik Bruto Menurut Penggunaan Atas Dasar Harga Konstan 2000 (Miliar RP)Document2 pagesVii.4. Produk Domestik Bruto Menurut Penggunaan Atas Dasar Harga Konstan 2000 (Miliar RP)Izzuddin AbdurrahmanNo ratings yet

- PR1790S30012019 MSDocument1 pagePR1790S30012019 MSRahul NikamNo ratings yet

- Money SupplyDocument1 pageMoney SupplyRahul NikamNo ratings yet

- RBI Money SupplyDocument1 pageRBI Money SupplyNinandha PranavNo ratings yet

- Growth and Stabilization: : at Average Exchange Rate P: ProvisionalDocument17 pagesGrowth and Stabilization: : at Average Exchange Rate P: ProvisionalWaqas TayyabNo ratings yet

- 8-Trade and PaymentDocument16 pages8-Trade and PaymentAhsan Ali MemonNo ratings yet

- Chapter - 1 THE BUDGET 2020-21 Salient Features: Entered On 11/06/2020 23:59Document36 pagesChapter - 1 THE BUDGET 2020-21 Salient Features: Entered On 11/06/2020 23:59M Farooq ArbyNo ratings yet

- Reporting of Government Deficits and Debt LevelsDocument12 pagesReporting of Government Deficits and Debt LevelsthestorydotieNo ratings yet

- Financial Data Year 2019-20Document9 pagesFinancial Data Year 2019-20Sabarna ChakrabortyNo ratings yet

- SummaryDocument1 pageSummaryPicoNo ratings yet

- FRBM Fiscal Policy Statement 2022 23Document20 pagesFRBM Fiscal Policy Statement 2022 23ramesh.bNo ratings yet

- Annual Budget StatementDocument22 pagesAnnual Budget StatementFunkaarNo ratings yet

- Economic IndicatorsDocument2 pagesEconomic IndicatorsmkpatidarNo ratings yet

- Balancepayment BPM6-sep19Document2 pagesBalancepayment BPM6-sep19javedNo ratings yet

- Domestic External DebtDocument9 pagesDomestic External Debtshab291No ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- The Origin of Financial Crises by George CooperDocument6 pagesThe Origin of Financial Crises by George CooperSoner Atakan Ertürk0% (1)

- Arushi ProjectDocument77 pagesArushi ProjectshagunNo ratings yet

- Northern Cpa Review Center: Auditing ProblemsDocument12 pagesNorthern Cpa Review Center: Auditing ProblemsKim Cristian MaañoNo ratings yet

- Lecture 10 Audit FinalisationDocument21 pagesLecture 10 Audit FinalisationShibin Jayaprasad100% (1)

- University of Vermont Branding and Marketing RFPDocument14 pagesUniversity of Vermont Branding and Marketing RFPSeven Days VermontNo ratings yet

- HDFC Life Sanchay Plus Retail Brochure Final CTCDocument16 pagesHDFC Life Sanchay Plus Retail Brochure Final CTCdhaval2011No ratings yet

- Basic Reconciliation StatementsDocument41 pagesBasic Reconciliation StatementsBeverly EroyNo ratings yet

- Front Page (2 Files Merged)Document64 pagesFront Page (2 Files Merged)Md KhaledNo ratings yet

- Labuan DFS - Exposure Draft On Guidelines On Regulatory RequirementsDocument13 pagesLabuan DFS - Exposure Draft On Guidelines On Regulatory RequirementsPraveen KumarNo ratings yet

- QP 1Document7 pagesQP 1Shankar ReddyNo ratings yet

- 1567408107395rej1z59pM0TrJ6Ni PDFDocument2 pages1567408107395rej1z59pM0TrJ6Ni PDFBrajesh PandayNo ratings yet

- Dealing With DebtDocument36 pagesDealing With DebtJanezNo ratings yet

- IntrerShip Report On SME Banking PDFDocument81 pagesIntrerShip Report On SME Banking PDFBhavika MadaanNo ratings yet

- Deep Dive For Project ManagementDocument4 pagesDeep Dive For Project ManagementlaxmangkNo ratings yet

- Harshad MehtaDocument27 pagesHarshad MehtaaasthamathurNo ratings yet

- Identifying Signals For Card Members in OPEN Cards Business CategoryDocument14 pagesIdentifying Signals For Card Members in OPEN Cards Business CategoryNitish Kumar GuptaNo ratings yet

- Insurance Manual Ver 1Document82 pagesInsurance Manual Ver 1api-3743824No ratings yet

- Booking.comDocument16 pagesBooking.comSnezhana PadeshkaNo ratings yet