Professional Documents

Culture Documents

Aadhar

Uploaded by

petercoolguyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aadhar

Uploaded by

petercoolguyCopyright:

Available Formats

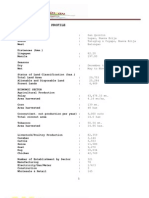

Aadhar to create bank accounts electronically for poor people

Mumbai, Feb 10, DH News Service:

To popularise banking services, Aadhar would electronically create accounts for poor individuals at partner banks, said the agency chairman Nandan Nilekani on Wednesday.

His statement addresses the concerns of many bankers who had feared that they did not have the infrastructure to creating bank accounts for millions of Aadhar number holders. The authorities of the Aadhar project, which is working to give a unique number to all Indian residents, see spread of banking as a major outcome of their effort. Eighty per cent of the two million individuals, who have been enrolled for the unique Aadhar number so far, have requeste d for bank accounts, said Nilekani while addressing the Nasscom Leadership Forum 2011. The poor individuals find it difficult to open bank accounts as they are unable to meet the Know Your Customer (KYC) norms of the banks. Under KYC norms, banks are requi red to verify documents, which authenticate the identity of individuals, to prevent the misuse of bank accounts for money laundering, terrorism and other illegal activities. The Finance ministry and RBI have recently notified that banks could open no -frill accounts for poor individuals with only Aadhar number, Nilekani noted. But he also said that of the estimated 70,000 bank branches in the country only 6 per cent were in villages, thus making banking services elusive even for the villagers with accounts. To overcome this constraint, RBI had issued guidelines to enroll business correspondents, under which a variety of private businesses from petrol pumps to local kirana shops, could start acting as micro ATMs. A bank account holder could approach a kira na shop to draw a small sum, say Rs 300, and the money would be dispensed from the shops cash box after authenticating the identity of the individual online. The application would also deduct the money from the individual and credit it to the kiranas account, Nilekani said. In Jharkhand, three banks were conducting a pilot project across several districts to disburse NREGA funds through micro ATMs, he informed. If the idea worked the government could disburse up to Rs 100,000 crores it spends on developmental programmes such as NREGA through Aadhar-enabled Micro ATMs, he informed.

BANKING

NPCL rolls out Aadhar -enabled payment system

4 Mar, 2011, 0719 hrs IST, ET Bureau

MUMBAI: The National Payment Corporation, or NPCL, has rolled out its Aadharenabled payment system (AEPS) project to make banking easier for those at the bottom of the pyramid by involving business correspondents . NPCL has partnered with three banks for the project. It is also planning to rope in Nabard for involving rur al account holders into the core banking fold. AEPS will promote financial inclusion and help customers having no frills accounts to access banking services from business correspondents from across banks. Through this facility , customers need not go to the bank with which s/he holds an account. NPCL defines it as a bank -led model, enabling online financial inclusion transaction at PoS or point of sale, or the MicroATM, through Business Correspondent (BC) of one bank for customers of another using Aadhar Authentication . The pilot project being run in districts of Jharkhand (where the first unique identity authority, or UID numbers, have been provided) in association with three banks ICICI bank, Union bank of India and Bank of India. Under AEPS, customers would be able to check their balance enquiries, withdraw and deposit cash and transfer funds from one UID number to the other from any of the business correspondents. Business correspondents act on behalf of bank branches in the absence of brick and mortar branch and provide banking services. They have been important agents of financial inclusion .

(See pictures on next page)

Civil Society News New Delhi

Across the road from the Oberoi and the Aman , two of Delhi's most expensive hotels, people are checking into a night shelter called Apna Ghar. They turn up in a dribble, picking their way through the surrounding slum and climbing a dingy staircase to a large stark hall on the first floor. Night shelters are dreary places and this one is no exception. It is an extension of the mean world of the streets. There is little to look forward to. But these days there is a buzz at Apna Ghar. It is about Aadhar, a system of personal identification which invo lves a unique number and a card with photograph. Some 250 people at Apna Ghar and living in nearby shanties and parks have been given Aadhar numbers and cards. Another 200 will get their numbers soon. Thanks to this identity, many of them now also have zero -balance bank accounts with the Corporation Bank branch at Lajpat Nagar. For these homeless people, the number, card and bank account are emblems of a status they never imagined could have been their s. Long accustomed to being pushed around and harassed by the police, the Aadhar identity now serves as the government's acceptance of their existence. Aadhar has been made possible by the Unique Identification Authority of India whose chairman is Nandan Nilekani. He is one of the founders of the information technology company, Infosys, and was its managing director before he shifted to government to take up this project. The Aadhar number involves taking images of the fingerprints and the iris of a person. The name, age and address are also recorded. In the case of the homeless

the address of the NGO running the night shelter is given. This information is stored electronically on computers and made available universally through the Internet. There are some 30,000 homeless people identified in Delhi who will be given the Aadhar number. But the problem of identification relates to millions of people who may not technically be homeless but don't have papers to prove their identities. Across India more than 500 million people are not part of the banking system because of problems related to identity. Aadhar, with its use of information technology, is regarded by the government as a quick and efficient way of establishing identities on such a large scale. It is seen as a tool for inclusion, particularly for bringing more people into the formal banking system. Serious concerns: However, several serious concerns have been raised about Aadhar. Several leaders in the social sector feel it is too intrusive. There are fears that it will be misused and lead to civil rights violations. Others find it too costly as a nationwide initiative. There is criticism that the Manmohan Singh government has not been transparent and needed to have public debate before launching A adhar. The choice of Nilekani is also questioned. For many the jury is still out on whether the system will work at all. There are doubts whether it is feasible to store hundreds of millions of identities in a technologically foolproof way. Homeless feel empowered: But at Apna Ghar on the floor of the night shelter, homeless people are happy to show their identification cards with their Aadhar numbers. They are also excited about having bank accounts. The Aadhar number has made it possible. Earlier they didn't have the identification papers the bank would ask for. It is just weeks since the accounts were opened. So, there is some hesitation in going to the nearby Lajpat Nagar branch of the Corporation Bank. But people are already dreaming o f what they can do. Many of them have decided that what they need are ATM cards so that, being homeless and footloose, they can access their money as and when they need it. The shelter is run by the Society for the Promotion of Youth and Masses (SPYM). But before this NGO took charge it was run by the Municipal Corporation of Delhi (MCD). On 2 October, on the eve of the Commonwealth Games, Chief Minister Sheila Dikshit presided over a ceremony at the Apna Ghar night shelter to give away 40 Aadhar numbers.

Since then the demand for the number has kept growing. An Aadhar counter opened at the shelter makes it simple to register. Young computer operators in yellow sweat shirts with the Aadhar logo work in shifts, collecting personal data and transferring it online. The process takes about 20 minutes. (See pictures on next page)

Aadhar Leading To Surge In Bank Accounts

By venu achalla December 10, 2010

0

The main force behind Aadhaar is to provide residents with a means to easily and effectively establish their identity to any agency without having the need to produce multiple identity documents. Aadhaar would thus be critical to the Government in achieving its goals of Social and Financial inclusion. Well, according to Nandan Nilekani, chairman of Unique Identification Authority of India (UIDAI), Aadhaar is well-on-track to achieve this. In an event organized by Indian Institute of Banking and Finance, he said that there is a massive explosion for bank accounts among people enrolling for Aadhaar or the unique IDs. In fact, if the current pace of enrolments is continued, then there is a real possibility that the number of bank accounts issued in the next four years will exceed the number of accounts banks have issued since Indias independence.

He also expressed his optimism about receiving Finance Ministrys consent on his proposal to make the unique identity number equal to KYC (know-your-customer) norms for the village accounts. KYC norms at present act as the biggest entry barrier for urban and rural poor. If KYC regulation is updated to include Aadhaar authentication, it could turn out to be a blessing for financial service providers. This will enable UIDAI to electronically pass the residents consent along with the demographic information to banks for opening the bank account. This can greatly ease the account opening process with no need for physical documentation. This would not only reduce the customer acquisition cost but would also fasten up the process, while still ensuring strict check on customers identity due to the biometric authentication done through UIDAI.

Aadhaar project is already being implemented as a pilot at Sindhudurg in Maharashtra, where about 2 lakh people have been issued with UID numbers. The pilot project also works as a micro-ATM card, wherein a villager can approach a banking correspondent, who in turn dispenses the cash to the third party on successful verification of Aadhaar records. The financial services is getting disaggregated with newer specialized participants constantly entering the value chain. Still there are many obstacles that the banks face in offering financial services to the poor, especially in the rural and remotest parts of the country. The Aadhaar initiative started by the Government is one of the highly ambitious projects undertaken to remove such obstacles. The scale of the initiative is unprecedented and it will involve active participation of Central and State Governments as well as public and private sector agencies across the country. UIDAI maintains that the pilot project has been a success and that it has reached a tipping point with the launch of the project. Lets hope that same is the case with national implementation as well. What are your views on the Aadhaar initiative?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Discuss The Processes of The Following PlantsDocument1 pageDiscuss The Processes of The Following PlantsEric John CruzNo ratings yet

- Ce Plans and Estimates (Cetech2) : Instructor: Engr. Peter Adrian T. Ngo, RceDocument22 pagesCe Plans and Estimates (Cetech2) : Instructor: Engr. Peter Adrian T. Ngo, RcePeter Adrian NgoNo ratings yet

- Toeic Answer SheetDocument2 pagesToeic Answer SheetMai ThanhNo ratings yet

- DSR013847 1 Guest Pro Forma PDFDocument2 pagesDSR013847 1 Guest Pro Forma PDFEstherNo ratings yet

- Letter WritingDocument23 pagesLetter WritingZingalala huuuNo ratings yet

- CSE2004 SyllabusDocument2 pagesCSE2004 SyllabusABHAY POTLURI 20BCI0017No ratings yet

- SGM700 Series Manual PDFDocument108 pagesSGM700 Series Manual PDFRohit SainiNo ratings yet

- wALKIE TALKIE COMMUNICATIONDocument16 pageswALKIE TALKIE COMMUNICATIONAashu VermaNo ratings yet

- Gearless Drives For Medium-Power Belt Conveyors: MotionDocument6 pagesGearless Drives For Medium-Power Belt Conveyors: MotionchalogdNo ratings yet

- SDWP 046Document47 pagesSDWP 046Marius AngaraNo ratings yet

- F5 BIGIP ASM PresentationDocument182 pagesF5 BIGIP ASM PresentationAnandapriya MohantaNo ratings yet

- Geoffrey BawaDocument10 pagesGeoffrey BawaIwan GunawanNo ratings yet

- Philippine Perspective of Digitizing Printed Heritage Materials (Part1)Document35 pagesPhilippine Perspective of Digitizing Printed Heritage Materials (Part1)Fe Angela VerzosaNo ratings yet

- C551a Multi-Mode Manual Transaxle PDFDocument615 pagesC551a Multi-Mode Manual Transaxle PDFdaodinhtam100% (5)

- Particle Swarm Optimization: Technique, System and ChallengesDocument9 pagesParticle Swarm Optimization: Technique, System and ChallengesMary MorseNo ratings yet

- PMP - TemplateDocument24 pagesPMP - TemplateUsama AbuelattaNo ratings yet

- Municipal Profile of Umingan, PangasinanDocument51 pagesMunicipal Profile of Umingan, PangasinanGina Lee Mingrajal Santos100% (1)

- Bela I Crvene Tigrova MastDocument5 pagesBela I Crvene Tigrova MastNadrljanskiDusanNo ratings yet

- WPQ Ejcom Nr476Document13 pagesWPQ Ejcom Nr476Touil HoussemNo ratings yet

- Lubricants Rev6 (Broch14160813) Web PDFDocument44 pagesLubricants Rev6 (Broch14160813) Web PDFJan HendriksNo ratings yet

- Nearmiss Trending AnalysisDocument40 pagesNearmiss Trending AnalysisTayyab MayoNo ratings yet

- Chapter 6Document8 pagesChapter 6Coci KhouryNo ratings yet

- D7sys Funktion BDocument530 pagesD7sys Funktion BpandhuNo ratings yet

- MasterRheobuild® 716Document3 pagesMasterRheobuild® 716Jagan Mohana Rao ChinnalaNo ratings yet

- Kane 450 Operating ManualDocument30 pagesKane 450 Operating ManualMarioara FeraruNo ratings yet

- TeSys D contactor data sheet for 9A AC-3 440V coilDocument8 pagesTeSys D contactor data sheet for 9A AC-3 440V coilbatuhanizmirli2No ratings yet

- Folleto de ProductoDocument5 pagesFolleto de ProductoJhon SuarezNo ratings yet

- Graphical Method Linear ProgramDocument5 pagesGraphical Method Linear ProgramDaleyThomasNo ratings yet

- What Every Engineer Should Know About Software Engineering, 2nd Edition (Phillip A. Laplante, Mohamad Kassab)Document395 pagesWhat Every Engineer Should Know About Software Engineering, 2nd Edition (Phillip A. Laplante, Mohamad Kassab)ML GoreNo ratings yet

- General Index and Applications Guide for CV Joints, Drive Shafts and Vehicle ModelsDocument692 pagesGeneral Index and Applications Guide for CV Joints, Drive Shafts and Vehicle ModelsМарияКрутскихNo ratings yet