Professional Documents

Culture Documents

Putnam Perspective: Lifetime Income Scores

Uploaded by

Putnam InvestmentsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Putnam Perspective: Lifetime Income Scores

Uploaded by

Putnam InvestmentsCopyright:

Available Formats

June or bond funds?

Bonds2011Perspectives

Why a bond fund might be the better choice Lifetime for most clients Income Scores to assess and

Opportunity of a lifetime: using

improve retirement preparedness

W. Van Harlow, Ph.D., CFA Director, Investment Retirement Solutions

Key takeaways

Working Americans are on

track to replace roughly 64% of their working income in retirement, a figure that falls to 30% without Social Security

The onus of ensuring adequate financial resources in retirement has gradually shifted from employers and the government to employees. The result is that Americans will need to begin measuring their progress toward seeking a financially secure retirement much earlier in their careers. This notion of measurement is relatively new for most Americans, and only recently have tools been developed that can help households evaluate where they stand in their efforts to save for retirement. One such metric is the Lifetime Income Score , developed by Putnam Investments in partnership with Brightwork Partners. The Lifetime Income Score was designed to estimate the level of income that U.S. households are currently on track to replace in retirement. Scores incorporate numerous variables related to earnings through employment, as well as financial behavior and confidence in financial decision-making.

SM

The best-prepared

households contribute 10% or more to a defined contribution plan, while the least-prepared have no access to an employerbased plan

The average income for the

best- and least-prepared households is the same

To calculate Lifetime Income Scores, 3,290 working adults between the ages of 18 and 65 were surveyed, with segments weighted in accordance with U.S. Census parameters for all working adults. Overall, the median Lifetime Income Score was 64%, indicating that the median U.S. household can currently expect to replace 64% of its income in retirement. While this figure provides a general assessment of overall retirement preparedness in America, it does not reflect which factors lead to higher or lower scores, nor does it offer any prescriptive advice to help employees improve their savings efforts. Therefore, to help households better assess their own retirement preparedness we analyzed Lifetime Income Scores by individual factors to determine which have the most predictive value in determining retirement preparedness. We also calculated scores exclusive of Social Security income to ascertain the level of dependence different population segments have on Social Security income.

Putnam Investm ents |putnam.com

J u n e 2011| Opportunity of a lifetime: using Lifetime Income Scores to assess and improve retirement preparedness

Lifetime Income Score

Demographics Demographics play an important role in determining retirement preparedness and in the calculation of Lifetime Income Scores. Among the demographic factors that have been shown to impact retirement preparedness are age, gender, education level, income, and employment industry. Age is one of the most influential determinants, with Lifetime Income Scores declining as age increases, from 73% for the 18 to 34 segment to 60% for those age 50 to 65. This relationship is likely the result of two primary conditions: Younger workers have longer time horizons until retirement and lower current incomes (and greater earning potential), and the oldest respondents (age 50 to 65) have fewer working years remaining and have likely maximized their earning potential. It is also worth noting that Social Security plays a much larger part in the retirement security of the oldest workers compared with their younger counterparts, with those age 65 only on track to replace 12% of their income without Social Security.

Exhibit 1: Older Americans are less secure

With SSI 75% Without SSI

60%

45%

30%

15%

0%

1834

3549 Age segment

5065

Years to retirement also had a relationship to retirement preparedness; however, unlike with age, those with the fewest years to retirement produced the highest scores (83%). Though this group consists primarily of older workers, the difference is that this subset has near-term retirement plans that are contingent upon their financial preparedness, whereas others have approached retirement age without the expectation of or the means for retirement. Gender was also a determining factor, with males notably more prepared for retirement than females, and significantly less reliant on Social Security income. This disparity is likely due to what is referred to as the gender gap. Although the gap has narrowed considerably over the past 20 years, in 2008 women still earned $0.77 to the dollar of their male counterparts according to the latest census.1

Laura Fitzpatrick, Why Do Women Still Earn Less Than Men? Time, April 20, 2010, http://www.time.com/time/nation/ article/0,8599,1983185,00.html.

Without Social Security, Americans between the ages of 50 and 65 and still working can expect to replace only 28% of their working income.

Putnam Investm ents |putnam.com

Exhibit 2: The gender gap persists

Lifetime Income Score With SSI Without SSI

Exhibit 3: An argument for higher education

75% With SSI Without SSI

60% Female Lifetime Income Score

45%

30%

Male

15%

0% 0% 10% 20% 30% 40% 50% 60% 70% 80%

Graduate school

4-year college

Some college

High school diploma or less

Level of education

Lifetime Income Scores increased along with education level, rising from 59% for those with a high school diploma or less to 72% for those with a graduate school degree. The range was even wider when Social Security income was excluded: 17% to 46%. These findings concur with data showing that education has a direct impact on earning potential and the ability to maintain continuous employment. According to the Bureau of Labor Statistics Current Population Survey, in 2009 those with a masters degree earned twice as much on a weekly basis as those with a high school diploma, and the unemployment rate among individuals with a masters degree was 3.9%, compared with 9.7% for those with only a high school diploma.2

Obviously, income directly affects retirement preparedness, with Lifetime Income Scores rising along with income level; however, median scores were relatively low (< 65%) for household incomes below $100,000, which constitute the majority of U.S. households. The most recently released data from the U.S. Census Bureau shows that in 2009 the real median household income was $49,777, and only 20.1% of households earned incomes above $100,000.3 However, counting Social Security, the difference in scores between the lowest income earners and the top income earners is surprisingly small (61% versus 80%), suggesting that saving can play a significant role in retirement preparedness, regardless of income.4

2 Education pays Bureau of Labor Statistics Current Population Survey, 2011, http://www.bls.gov/emp/ep_chart_001.htm.

3 Income, Poverty, and Health Insurance Coverage in the United States: 2009 U.S. Census Bureau, Sept. 2010, http://www.census.gov/prod/2010pubs/p60-238.pdf. 4 Richard W. Johnson, Barbara A. Butrica, and Corina Mommaerts, Work and Retirement Patterns for the G.I. Generation, Silent Generation, and Early Boomers: Thirty Years of Change Center for Retirement Research at Boston College, July 2010, http://crr.bc.edu/images/stories/Working_Papers/wp_2010-8.pdf.

J u n e 2011| Opportunity of a lifetime: using Lifetime Income Scores to assess and improve retirement preparedness

Exhibit 4: The level of income mattered less than one would think

Lifetime Income Score With SSI Annual household income level $175K+ Without SSI

Exhibit 5: Scores dropped sharply for households without access to retirement plans

With SSI Without SSI

75% Lifetime Income Score 60% 45% 30% 15% < $50K 0% 10% 20% 30% 40% 50% 60% 70% 80% 0% Eligible and active in DC plan Eligible, but not active in DC plan Employer plan status Ineligible for employer plan

$100K < $175K

$50K < $100K

The difference in preparedness between the lowest income earners and the top income earners is surprisingly small (61% versus 80%), suggesting that saving can play a significant role in retirement preparedness, regardless of income.

Financial behavior Even more important than demographics in the determination of retirement preparedness is financial behavior, including defined contribution plan participation, the use of an advisor, and a general propensity to save. The most important determinant of Lifetime Income Scores was employer plan eligibility, with those eligible for participation achieving scores that were nearly twice as high as those without plan access. This finding has profound implications for the future of retirement in the United States, as, according to 2010 research from the U.S. Bureau of Labor Statistics, more than 40% of workers employed in private industry do not have access to a defined contribution plan.5

5 Program Perspectives, Vol. 2 Issue 6, U.S. Bureau of Labor Statistics, Nov. 2010, http://www.bls.gov/opub/perspectives/ program_perspectives_vol2_issue6.pdf.

Interestingly, the scores of those households that were eligible to participate in a defined contribution plan, but that were inactive, fell between those who were ineligible and those who were eligible and active. This suggests that access is the key, and that those who have access, but are not currently participating, have a relatively high probability of doing so at some point in the future by either electing to contribute or through automatic enrollment, which is becoming a more common practice. According to a recent survey by Hewitt Associates, 59% of large employers offer automatic enrollment, and an additional 12% said they were likely to do so.6 Among those participating in a defined contribution plan, the deferral rate had a significant influence on Lifetime Income Scores, increasing dramatically for households contributing 10% or more. In fact, those choosing a deferral rate of 10% or more were on track to replace 124% of their income in retirement including Social Security, and 93% excluding it. Higher scores were also associated with higher defined contribution plan balances. The survey indicates that households maintaining balances of $100,000 or greater are on target to achieve an income replacement rate of 104%.

6 Hot Topics in Retirement 2010, Hewitt Associates, 2011, http://www.aon.com/attachments/thought-leadership/ Hewitt_HotTopicsRet_Survey_2010_Findings.pdf.

Putnam Investm ents |putnam.com

Households deferring 10% or more to an employer retirement plan are on track to replace 124% of their income, even without Social Security, according to the survey.

Exhibit 6: The best-prepared households saved more

Lifetime Income Score With SSI Without SSI 75% 10%+ DC plan deferral rate 60% 4% < 10% Lifetime Income Score

Exhibit 7: Savers who use financial advisors were better prepared

With SSI Without SSI

45%

0.01% < 4%

30%

None 0% 20% 40% 60% 80% 100% 120% 140%

15%

0% Use a paid advisor Do not use a paid advisor

Beyond the scope of employer-sponsored retirement plans, other behaviors also played a role in determining Lifetime Income Scores, such as the use of a paid financial advisor. Those using the services of a paid financial advisor achieved a median score of 82%, compared with 61% for those who did not utilize such services. In fact, using an advisor boosted preparedness by an average of 5.7% across all levels of household income and investable assets. Other factors leading to higher scores included life insurance ownership with those owning either a cash-value or a term-only policy, or both, achieving higher-than-median scores and a greater propensity to save for retirement. Among those in the top quartile, retirement was significantly more than any other savings objective (e.g., childs education, major purchase), while for those in the bottom quartile paying off debt ranked nearly on par with retirement as an important savings goal.

Though investable assets are undoubtedly a factor in determining retirement preparedness, they must be assessed relative to other factors, including age, income, etc. As such, scores did not necessarily rise along with investable asset level. In fact, scores plateaued between $50,000 and $250,000 before beginning to rise again. This implies that although some households may have accrued a sizable asset base (e.g., $250,000), it is insufficient to maintain their current lifestyle in retirement. As expected, eligibility to participate in a defined benefit or cash balance plan also had a considerable impact on Lifetime Income Scores, leading to scores that were well above median. However, this advantage applies to only a small segment of the population. Over the past 35 years, the number of private-sector workers covered by defined benefit plans has decreased precipitously, from 87% of those with retirement plan access in 1975,7 to 32% in 2009.8

7 Private-Sector Retirement Plans Play Increasingly Important Role Across All Incomes, Investment Company Institute, Nov. 2010, http://www.ici.org/pressroom/news/10_news_erisa. 8 Craig Copeland Employment-Based Retirement Plan Participation: Geographic Differences and Trends, 2009, Employee Benefit Research Institute, Oct. 2010, http://www.ebri.org/pdf/briefspdf/ EBRI_IB_10-2010_No348_Participation.pdf.

Using an advisor boosted preparedness by an average of 5.7% across all levels of household income and investable assets.

J u n e 2011| Opportunity of a lifetime: using Lifetime Income Scores to assess and improve retirement preparedness

Confidence Households that are on track to being well prepared for retirement seem to know it, the survey shows, and as a result they express a greater level of confidence in their financial planning knowledge and decision-making. Among those who indicated they were very confident of being financially ready for retirement, the median score was 109%, and among those who said they were somewhat confident, the median score was 81%. Exhibit 8: The best-prepared households know it

Lifetime Income Score With SSI Without SSI

On the flip side, those who are unprepared also seem to be aware of that fact, expressing little confidence in their ability to achieve even modest retirement income goals, and correctly assuming that a much greater share of their retirement income will need to come from Social Security. In fact, households in the bottom quartile were much more likely to indicate that they expected to work in retirement, reduce their standard of living, and run out of money. Exhibit 9: The least-prepared households have a grim view of the future

Lifetime Income Score 0% < 45% Lifetime Income Score 100%+ 60%

Very or somewhat condent in

Percentage that expects to

Knowing how much is needed for health care

45%

Knowing how much is needed for retirement

30%

15%

Being nancially ready for retirement 0% 20% 40% 60% 80% 100%

0%

Those who indicated confidence in knowing how much they would need for retirement and health care also achieved higher-than-median Lifetime Income Scores, suggesting that knowledge is power. The health-care question is of particular importance for those who plan to retire prior to becoming eligible for Medicare, as the prevalence of employer-sponsored health-care coverage for retirees has declined dramatically in recent years. Among large, private-sector employers (200 or more employees), only 29% offered retiree health 9 benefits in 2009, down from 66% in 1988.

Work at least part-time in retirement

Reduce standard of living

Run out of money

Among low-scoring households, most (54%) expect to work in retirement, while one third (35%) expect to run out of money.

9 2009 Employer Health Benefits Survey, Kaiser Family Foundation and Health Research & Educational Trust (HRET), http://www.kff.org/insurance/ehbs091509nr.cfm.

Putnam Investm ents |putnam.com

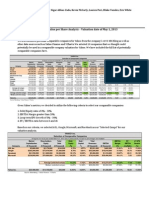

Factors for success One of the most encouraging findings was that households in the top quartile (replacing 100% or more of income) and the bottom quartile (replacing less than 45% of income) had exactly the same average income ($93,000). The difference was that one group had saved and invested, while the other had not. This implies that the most influential factors on Lifetime Income Scores and retirement preparedness relate to financial decisionmaking, and that the future can be altered by making adjustments to financial behavior. Active participation in a DC plan Results show that eligibility to participate in an employer-sponsored plan has the most impact on Lifetime Income Scores; however, many households are not optimizing this opportunity. To help ensure adequate retirement security, households should actively participate in their employer-sponsored DC plans and defer at least 10% of their income.

Financial behavior or attitude by household

10%+ deferral to DC

Use of an advisor Households utilizing the services of a paid financial advisor have access to more comprehensive and customized investment management. Those using an advisor achieved a median score that was nearly 35% higher, inclusive of Social Security, and more than 100% higher, exclusive of Social Security. Confidence in decision-making Households that indicated higher confidence in their financial decisionmaking ability earned higher Lifetime Income Scores. This was true across several aspects of the financial planning process, from confidence in being able to achieve a financially secure retirement to understanding how much it would cost to maintain adequate healthcare coverage. The key to confidence is education, and by equipping households with the tools to measure and improve their own retirement preparedness, they are then empowered to achieve a more financially secure retirement.

Median Lifetime Income Score 124% 109% 84% 82%

Traits of most prepared

Very confident in being ready for retirement financially

Eligible for employer plan

Use of an advisor

No use of an advisor

61% 58% 52% 46%

Traits of least prepared

No deferral to DC

Not at all confident in being ready for retirement financially

Ineligible for employer plan

J u n e 2011| Opportunity of a lifetime: using Lifetime Income Scores to assess and improve retirement preparedness

Survey methodology 3,290 working adults, age 18 to 65 Conducted online, 12/15/10 through 1/3/11 Weighted to census parameters for all working adults The Putnam Lifetime Income ScoreSM represents an estimate of the percentage of current income that an individual might need to replace from savings in order to fund retirement expenses. For example, consider an individual, 45 years old, with an income of $100,000 per year. A Lifetime Income Score of 64% indicates that the individual is on track to be able to generate $64,000 in retirement income (in todays dollars), i.e., 64% of current income. This income estimate is based the individuals amount of current savings as well as future contributions to savings (as provided by participants in the survey) and includes investments in 401(k) plans, IRAs, taxable accounts, variable annuities, cash value of life insurance, and income from defined benefit pension plans. It also includes future wage growth from present age (e.g., 45) to the retirement age of 65 (1% greater than the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)) as well an estimate for future Social Security benefits. The Lifetime Income Score estimate is derived from the present value discounting of the future cash flows associated with an individuals retirement savings

and expenses. It incorporates the uncertainty around investment returns (consistent with historical return volatility) as well as the mortality uncertainty that creates a retirement horizon of indeterminate length. Specifically, the Lifetime Income Score procedure begins with the selection of a present value discount rate based on the individuals current retirement asset allocation (stocks, bonds, and cash). A rate is determined from historical returns such that 90% of the empirical observations of the returns associated with the asset allocation are greater than the selected discount rate. This rate is then used for all discounting of the survival probability-weighted cash flows to derive a present value of a retirement plan. Alternative spending levels in retirement are examined in conjunction with this discounting process until the present value of cash flows is exactly zero. The spending level that generates a zero retirement plan present value is the income estimate selected as the basis for the Lifetime Income Score. In other words, it is an income level that is consistent with a 90% confidence in funding retirement. It is viewed as a sustainable spending level and one that is an appropriate benchmark for retirement planning. The survey is not a prediction, and results may be higher or lower based on actual market returns.

Putnam Retail Management

Putnam Investments | One Post Office Square | Boston, MA 02109 | putnam.com

2680496/11

You might also like

- Independent Equity Research: How We Do It, and Why It Matters To InvestorsDocument12 pagesIndependent Equity Research: How We Do It, and Why It Matters To InvestorsPutnam InvestmentsNo ratings yet

- Optimizing Your LinkedIn ProfileDocument2 pagesOptimizing Your LinkedIn ProfilePutnam Investments60% (5)

- Putnam White Paper: The Outlook For U.S. and European BanksDocument12 pagesPutnam White Paper: The Outlook For U.S. and European BanksPutnam InvestmentsNo ratings yet

- Affluent Investors Use of Social MediaDocument2 pagesAffluent Investors Use of Social MediaPutnam InvestmentsNo ratings yet

- Financial Advisors' Use of Social MediaDocument2 pagesFinancial Advisors' Use of Social MediaPutnam InvestmentsNo ratings yet

- Putnam Research Fund Q&A Q3 2012Document4 pagesPutnam Research Fund Q&A Q3 2012Putnam InvestmentsNo ratings yet

- Muni Rally May Continue, But Must Navigate Policy RisksDocument3 pagesMuni Rally May Continue, But Must Navigate Policy RisksPutnam InvestmentsNo ratings yet

- Putnam Gifting Opportunities in 2012Document4 pagesPutnam Gifting Opportunities in 2012Putnam InvestmentsNo ratings yet

- Asset ProtectionDocument4 pagesAsset ProtectionPutnam InvestmentsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Question Bank (Repaired)Document7 pagesQuestion Bank (Repaired)jayeshNo ratings yet

- Principles of Corporate Finance 10 Ed PDFDocument57 pagesPrinciples of Corporate Finance 10 Ed PDFOlivia BaluNo ratings yet

- AP 5902 Liability Supporting NotesDocument6 pagesAP 5902 Liability Supporting NotesMeojh Imissu100% (1)

- Yahoo! Inc. Valuation ProjectDocument8 pagesYahoo! Inc. Valuation ProjectNigar_AbbasNo ratings yet

- Prowessiq Data Dictionary Ind ASDocument2,757 pagesProwessiq Data Dictionary Ind ASIrene ImamNo ratings yet

- Financial Management of Sick UnitsDocument12 pagesFinancial Management of Sick UnitsTeena PoonachaNo ratings yet

- Transaction Codes (T-Codes) in SAP FI - CODocument8 pagesTransaction Codes (T-Codes) in SAP FI - COvivekan_kumarNo ratings yet

- Instant Download Ebook PDF Financial Management Principles and Applications 13th Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial Management Principles and Applications 13th Edition PDF Scribdcheryl.morgan37898% (43)

- Outsourcing - Some Definitions 1/2: - Outsourcing - Outsourcing - Offshoring - MultisourcingDocument20 pagesOutsourcing - Some Definitions 1/2: - Outsourcing - Outsourcing - Offshoring - MultisourcingjuanNo ratings yet

- Eeco 111716Document20 pagesEeco 111716Rom HoboiiNo ratings yet

- Topic 3 - Money - Time Relationships and EquivalenceDocument50 pagesTopic 3 - Money - Time Relationships and EquivalenceMc John PobleteNo ratings yet

- Notes To Consolidated Financial Statements: Department of EducationDocument65 pagesNotes To Consolidated Financial Statements: Department of EducationEmosNo ratings yet

- Philippine Christian University: Dasmarinas CampusDocument14 pagesPhilippine Christian University: Dasmarinas CampusRobin Escoses MallariNo ratings yet

- 1 Planning Ore Extraction Sequences in Open Pit MinesDocument86 pages1 Planning Ore Extraction Sequences in Open Pit Minesronald100% (2)

- Investment Decisions: Capital BudgetingDocument29 pagesInvestment Decisions: Capital BudgetingAditya ChavanNo ratings yet

- Practice Questions Final Exam-Financial ManagementDocument8 pagesPractice Questions Final Exam-Financial ManagementNilotpal Chakma100% (8)

- W.T. Wendel Financial Literacy Notes: What Is The 'Dow Theory'Document19 pagesW.T. Wendel Financial Literacy Notes: What Is The 'Dow Theory'DyenNo ratings yet

- Concepts of Value and ReturnDocument38 pagesConcepts of Value and ReturnVaishnav KumarNo ratings yet

- Bond Valuation PDF With ExamplesDocument17 pagesBond Valuation PDF With ExamplesAmar RaoNo ratings yet

- AAAAAAAAAAAAAADocument8 pagesAAAAAAAAAAAAAAEl - loolNo ratings yet

- Interim Financial ReportingDocument9 pagesInterim Financial ReportingNelly GomezNo ratings yet

- Current Liabilities Management SOLUTIONSDocument9 pagesCurrent Liabilities Management SOLUTIONSJack Herer100% (1)

- IPPTChap 002Document32 pagesIPPTChap 002ufuk uyanNo ratings yet

- Financial ManagementDocument25 pagesFinancial Managementsammie helsonNo ratings yet

- Total Cash Receipt From Issuance of BondsDocument11 pagesTotal Cash Receipt From Issuance of Bondskrisha milloNo ratings yet

- Modern Auditing Chapter 16Document13 pagesModern Auditing Chapter 16Charis SubiantoNo ratings yet

- (2015 S2) FINS1613 TutorialSlides Week09 RiskandReturn CostofCapitalDocument68 pages(2015 S2) FINS1613 TutorialSlides Week09 RiskandReturn CostofCapitalSmartunblurrNo ratings yet

- M1 C2 Case Study WorkbookDocument30 pagesM1 C2 Case Study WorkbookHasan Md ErshadNo ratings yet

- Midsem Exams Fin Accting WeekendDocument4 pagesMidsem Exams Fin Accting WeekendMichael LastNo ratings yet

- Unit 2 FMDocument11 pagesUnit 2 FMpurvang selaniNo ratings yet