Professional Documents

Culture Documents

Apollo 2010

Uploaded by

1133220 ratings0% found this document useful (0 votes)

50 views5 pagesThe Board of directors of Apollo Tyres Ltd today approved the company's unaudited financial results for the 2nd quarter and the first 6 months of the financial year 2010-11. Of particular concern is the spiraling prices of natural rubber to current all-time highs, which have sharply impacted the Indian Operations. The Board appreciated the efforts of the management and employees in maintaining the overall growth trend.

Original Description:

Original Title

apollo_2010

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Board of directors of Apollo Tyres Ltd today approved the company's unaudited financial results for the 2nd quarter and the first 6 months of the financial year 2010-11. Of particular concern is the spiraling prices of natural rubber to current all-time highs, which have sharply impacted the Indian Operations. The Board appreciated the efforts of the management and employees in maintaining the overall growth trend.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

50 views5 pagesApollo 2010

Uploaded by

113322The Board of directors of Apollo Tyres Ltd today approved the company's unaudited financial results for the 2nd quarter and the first 6 months of the financial year 2010-11. Of particular concern is the spiraling prices of natural rubber to current all-time highs, which have sharply impacted the Indian Operations. The Board appreciated the efforts of the management and employees in maintaining the overall growth trend.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

Gurgaon, Haryana, India, November 11, 2010

Apollo Tyres fights adverse conditions

Continues revenue growth story, profits impacted by rubber cost push

The Board of Directors of Apollo Tyres Ltd today approved the companys unaudited financial results for the 2nd quarter and the first 6 months of the financial year 2010-11. Of particular concern to the Board is the spiraling prices of natural rubber to current all-time highs, which have sharply impacted the Indian Operations. The Board appreciated the efforts of the management and employees in maintaining the overall growth trend, overcoming the difficulties of a lock-out in one plant in India and a general tyre industry and port strike in South Africa, alongside escalating rubber prices. Half Yearly Performance Highlights FY2010-11 (April-September) vs FY2009-10 Net sales at Rs 37.7 billion (Rs 3770 crore) from Rs 36.8 billion (Rs 3681 crore) Operating profit at Rs 3.8 billion (Rs 388 crore) from nearly Rs 5 billion (Rs 498 crore) Net profit at Rs 1.2 billion (Rs 127 crore) from Rs 2 billion (Rs 203 crore) the previous year Quarterly Performance Highlights Quarter 2 FY2010-11 (July-September) vs Quarter 2 FY2009-10 Net sales at Rs 19.5 billion (Rs 1949 crore) from Rs 20 billion (Rs 2046 crore) Operating profit at Rs 1.86 billion (Rs 186 crore) from nearly Rs 2.9 billion (Rs 290 crore) Net profit at Rs 532 million (Rs 53 cr) from Rs 1.3 billion (Rs 129 cr) in the previous year Commenting on the results, Onkar S Kanwar, Chairman, Apollo Tyres Ltd, said, Its been a very difficult 6 months managing the unprecedented rise in natural rubber prices. Unfortunately even when international natural rubber prices were significantly lower than Indian prices, we were unable to import in large quantities due to the duty policy of the government. We have had no option but to pass on price increases to our customers, though it is impossible to pass on a near 50% increase in the course of one year. Natural rubber constitutes 60% of our raw material costs, and if I look at the November to November period, natural rubber was at Rs 76/kg in November 2008, Rs 113 in November 2009 (a 14% rise) and is at Rs 192 now - an increase of nearly 70% in a single year and 150% in 2 years! This has affected all aspects of our operation. Chairman Onkar Kanwar added: I do hope the Government will look at some measure to check speculation, as well as bring down the unreal duty structure we have. With no action over so many years, despite understanding the plight of the Indian tyre industry, even an optimistic person like me is forced to consider greater investments outside India, rather than at home. (ends)

For further details contact: About Apollo Tyres Ltd Apollo Tyres Ltd is a high-performance company and the leading Indian tyre manufacturer. It is built around the core principles of creating stakeholder value through reliability in its products and dependability in its relationships. The company has three manufacturing units in India, four in Southern Africa and one in the Netherlands, with a greenfield facility currently underway in Chennai, India. Apollo's subsidiary companies are Apollo Tyres South Africa Pty Ltd (previously known as Dunlop Tyres) and Apollo Vredestein BV in the Netherlands. India, South Africa and Europe are the companys three domestic markets from where products are exported to over 70 countries. In each of the domestic markets the company operates through a vast network of branded, exclusive and multi-product outlets.

ROHIT SHARAN +91 98182 00359 rohit.sharan@apollotyres.com HARSHITA VERMA +91 97177 71576 harshita.verma@apollotyres.com

Corporate Headquarters Apollo House, 7 Institutional Area, Sector 32, Gurgaon 122001, Haryana, India. T: +91 124 2721000 F: +91 124 2383021

You might also like

- Q1fy11 Release For WebsiteDocument4 pagesQ1fy11 Release For WebsiteGanesh GPNo ratings yet

- Apollo Tyres q4 Fy11 Media Release With ResultsDocument6 pagesApollo Tyres q4 Fy11 Media Release With Resultspuneet_tambiNo ratings yet

- Adavanced Accounting-Iii Project: Made By:-Satwik Chaudhary TYA ROLL No. 3042Document20 pagesAdavanced Accounting-Iii Project: Made By:-Satwik Chaudhary TYA ROLL No. 3042Suyash KumarNo ratings yet

- Apollo Tyres ProjectDocument11 pagesApollo Tyres Projecttabish kaziNo ratings yet

- Apollo Tyres Ltd. - Project Report On Working Capital Management.Document83 pagesApollo Tyres Ltd. - Project Report On Working Capital Management.aakhir00736% (11)

- Industry Review ReportDocument7 pagesIndustry Review ReportSomil TurakhiaNo ratings yet

- Apollo Tyres LTD Project Report On Working Capital ManagementDocument83 pagesApollo Tyres LTD Project Report On Working Capital Managementprateeksri1033% (3)

- Apollo Tyre AssignmentDocument16 pagesApollo Tyre AssignmentShahjahan Alam100% (1)

- The Overall Market Value For Specialty Tires Is Expected To Grow With A CAGR of 4.2% For The Next 5 Years To Reach Nearly USD 21.5 Billion in 2020Document10 pagesThe Overall Market Value For Specialty Tires Is Expected To Grow With A CAGR of 4.2% For The Next 5 Years To Reach Nearly USD 21.5 Billion in 2020varu bhandariNo ratings yet

- Apollo Tyres Project 1Document11 pagesApollo Tyres Project 1rocky handsomeNo ratings yet

- Apollo TyresDocument9 pagesApollo Tyressanyam20007No ratings yet

- Apollo MRFDocument2 pagesApollo MRFkushal20061993No ratings yet

- Initiating Coverage:: Radialisation Demand To Push The GrowthDocument17 pagesInitiating Coverage:: Radialisation Demand To Push The GrowthrulzeeeNo ratings yet

- Apollo PaulDocument89 pagesApollo PaulTwinkle ZachariasNo ratings yet

- Business Description: Apollo TyresDocument4 pagesBusiness Description: Apollo TyresSrijit SahaNo ratings yet

- Overview of Indian Tyre IndustryDocument64 pagesOverview of Indian Tyre IndustryNitesh KumarNo ratings yet

- Falcon Tyres LTD BSE: 509527 - NSE: FALCONTYRE - ISIN: INE511B01024 Market Cap: (Rs - CR.) 82 - Face Value: (RS.) 5 Industry: TyresDocument21 pagesFalcon Tyres LTD BSE: 509527 - NSE: FALCONTYRE - ISIN: INE511B01024 Market Cap: (Rs - CR.) 82 - Face Value: (RS.) 5 Industry: TyreschethansoNo ratings yet

- Apollo Tyres Research ProjectDocument8 pagesApollo Tyres Research Projectdarshan jainNo ratings yet

- International Marketing Project Final - Apollo TyresDocument28 pagesInternational Marketing Project Final - Apollo Tyressupriya patekarNo ratings yet

- Apollo TyresDocument1 pageApollo TyresMayankDubeyNo ratings yet

- Tyre Industry AnalysisDocument21 pagesTyre Industry AnalysisAdhitya0% (1)

- Apollo-Cv-Awards 2010-WinnersDocument2 pagesApollo-Cv-Awards 2010-WinnersSachin1375No ratings yet

- Apollo TyresDocument10 pagesApollo TyresMadni MutvalliNo ratings yet

- Group 4 - Apollo TyresDocument33 pagesGroup 4 - Apollo TyresNikita KhandujaNo ratings yet

- Bridgestone Sip ReportDocument44 pagesBridgestone Sip ReportBothra SidharathNo ratings yet

- Apollo OsDocument104 pagesApollo OsGagan GoelNo ratings yet

- KRUPA Falcon Tyre ProjectDocument59 pagesKRUPA Falcon Tyre ProjectIsmail DesaiNo ratings yet

- Indian Tyre Industry: Segments For The Tyre Industry Are Two-Wheelers, Passenger Cars and Truck and Bus (T&B)Document10 pagesIndian Tyre Industry: Segments For The Tyre Industry Are Two-Wheelers, Passenger Cars and Truck and Bus (T&B)Sunaina AgrawalNo ratings yet

- Falcon Tyres LimitedDocument52 pagesFalcon Tyres Limitedrnaganirmita0% (1)

- Tyre 1,3,16,32Document82 pagesTyre 1,3,16,32srp188No ratings yet

- Post Graduate Programme Post Graduate Programme in Management: 2010 - 2012Document22 pagesPost Graduate Programme Post Graduate Programme in Management: 2010 - 2012Ashiq AbdullahNo ratings yet

- Apollo Annual Report PDFDocument188 pagesApollo Annual Report PDFhamza omarNo ratings yet

- Bajaj AutoDocument14 pagesBajaj Autonehasoningras0% (1)

- General Overview: Name DesignationDocument5 pagesGeneral Overview: Name DesignationSaksham KalraNo ratings yet

- Apollo Tyres LTD Is The Leading Tyre Manufacturing Company in IndiaDocument5 pagesApollo Tyres LTD Is The Leading Tyre Manufacturing Company in IndiaroiNo ratings yet

- Apollo Tyres - WikipediaDocument5 pagesApollo Tyres - WikipediaKhushbu MalviyNo ratings yet

- Tyre Industry AnalysisDocument5 pagesTyre Industry AnalysisVaibhav Shah100% (1)

- APOLLO TYREs 26032012100430Document2 pagesAPOLLO TYREs 26032012100430After Burn FirebrowlNo ratings yet

- BAIBF 09012 ManuDocument5 pagesBAIBF 09012 ManuManu VargheseNo ratings yet

- Chapter 1 SGDocument38 pagesChapter 1 SGKruthika KruthiNo ratings yet

- About Organisation Apollo Tyres LTDDocument1 pageAbout Organisation Apollo Tyres LTDVineeth KunnathNo ratings yet

- Apollo TyreDocument11 pagesApollo TyreNishith ShahNo ratings yet

- CEAT Limited: Navigation SearchDocument5 pagesCEAT Limited: Navigation SearchImran MohammedNo ratings yet

- Apollo Tyres (Darshankumar - Kabre - 73)Document41 pagesApollo Tyres (Darshankumar - Kabre - 73)Rohit VisaveNo ratings yet

- Directors Report Year End: Mar '11Document18 pagesDirectors Report Year End: Mar '11Jatin SunejaNo ratings yet

- Final Apollo PRJCTDocument29 pagesFinal Apollo PRJCTHema DubeyNo ratings yet

- Apollo TyresDocument2 pagesApollo TyresmechhandbookNo ratings yet

- By Ankush Roy (13068) Dipankar Patir (13074) Evangeline K. Jyrwa (13076) Saurabh Agarwal (13102) Soupa Soundararajan (13109) Gaurav Arora (13118)Document224 pagesBy Ankush Roy (13068) Dipankar Patir (13074) Evangeline K. Jyrwa (13076) Saurabh Agarwal (13102) Soupa Soundararajan (13109) Gaurav Arora (13118)Anirban BanerjeeNo ratings yet

- Apollo Tyres - PPT (Final)Document21 pagesApollo Tyres - PPT (Final)akli12100% (3)

- Castrol IndiaDocument8 pagesCastrol IndiaRohit Chawla100% (1)

- Indo Rama Synthetics (India) Ltd. Q1 EBIDTA at Rs 58.10 Crore Net Sales at Rs 705.27 CroreDocument2 pagesIndo Rama Synthetics (India) Ltd. Q1 EBIDTA at Rs 58.10 Crore Net Sales at Rs 705.27 CroreSachinNo ratings yet

- Apollo TyresDocument10 pagesApollo TyresMayank ChawlaNo ratings yet

- Global Tires Meeting 2012 - 13Document44 pagesGlobal Tires Meeting 2012 - 13kevinrajkumarNo ratings yet

- JK Tyre Report (By Siddhant Malhotra)Document65 pagesJK Tyre Report (By Siddhant Malhotra)Dev Parashar100% (1)

- Apollo Tyres LTDDocument14 pagesApollo Tyres LTDjopi60No ratings yet

- Apollo Tyres LTDDocument27 pagesApollo Tyres LTDamal roiNo ratings yet

- Good Bearing Ahead For The IndustryDocument7 pagesGood Bearing Ahead For The IndustryAbhishek MaakarNo ratings yet

- Nonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryFrom EverandNonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Pneumatic Tires & All Solid Tires World Summary: Market Sector Values & Financials by CountryFrom EverandPneumatic Tires & All Solid Tires World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Ralf Bohle GMBH Otto-Hahn-Strasse 1 D-51580 Reichshof Fon 02265/1090 Fax 02265/7022Document28 pagesRalf Bohle GMBH Otto-Hahn-Strasse 1 D-51580 Reichshof Fon 02265/1090 Fax 02265/7022krmktsNo ratings yet

- TM 5-2330-305-14 Topographic Support System Trailer (Adcor)Document160 pagesTM 5-2330-305-14 Topographic Support System Trailer (Adcor)AdvocateNo ratings yet

- Michelin X Multi DDocument2 pagesMichelin X Multi DSilambu SelvanNo ratings yet

- Tune Up XV 750Document3 pagesTune Up XV 750Jose RamirezNo ratings yet

- Apd 2006 07Document63 pagesApd 2006 07Soumen DasNo ratings yet

- NDR030AEDocument14 pagesNDR030AEernesto ordoñez100% (1)

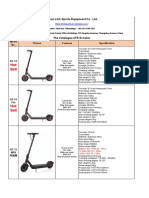

- Linksports - EscooterDocument11 pagesLinksports - EscooterdersNo ratings yet

- Pulsar - NS125 - REV 00 MAR 2021Document52 pagesPulsar - NS125 - REV 00 MAR 2021baidu1980No ratings yet

- Scrap Directory EGLE-MMD-PART-169-SCRAP-TIRE-2020-MARKET-STUDY-DIRECTORY - 707970 - 7Document51 pagesScrap Directory EGLE-MMD-PART-169-SCRAP-TIRE-2020-MARKET-STUDY-DIRECTORY - 707970 - 7girish_patkiNo ratings yet

- AT2403 Vehicle Maintenance: Layout of An Automobile Repair, Service and Maintenance ShopDocument58 pagesAT2403 Vehicle Maintenance: Layout of An Automobile Repair, Service and Maintenance ShopERKATHIRNo ratings yet

- As 1973-1993 Pneumatic Tyres - Passenger Car Light Truck and Truck Bus - Retreading and Repair ProcessesDocument8 pagesAs 1973-1993 Pneumatic Tyres - Passenger Car Light Truck and Truck Bus - Retreading and Repair ProcessesSAI Global - APACNo ratings yet

- Simulation and Structural Analysis of Modules During Land TransportationDocument6 pagesSimulation and Structural Analysis of Modules During Land TransportationRay Lee100% (1)

- F2663 PDFDocument9 pagesF2663 PDFAhmad Zubair RasulyNo ratings yet

- Camion Lieber NTB T236 EnGB-USDocument24 pagesCamion Lieber NTB T236 EnGB-USBillie Joe ArmstrongNo ratings yet

- RS125 Workshop ManualDocument290 pagesRS125 Workshop ManualJuan José Cázares RamírezNo ratings yet

- 19 Tyre Inflation Safety Cage PDFDocument5 pages19 Tyre Inflation Safety Cage PDFRemira IdNo ratings yet

- Technical Manual Operator'S Manual FOR 2-1/2-TON, 6x6, M44A2 Series Trucks (Multifuel)Document396 pagesTechnical Manual Operator'S Manual FOR 2-1/2-TON, 6x6, M44A2 Series Trucks (Multifuel)GeorgeStefos100% (1)

- Peralatan PertambanganDocument11 pagesPeralatan PertambanganPrismark Dhonald MirzhaNo ratings yet

- Yıldırım, Özturan - 2021 - Impact Resistance of Concrete Produced With Plain and Reinforced Cold-Bonded Fly Ash Aggregates-AnnotatedDocument16 pagesYıldırım, Özturan - 2021 - Impact Resistance of Concrete Produced With Plain and Reinforced Cold-Bonded Fly Ash Aggregates-AnnotatedEstefania Loyola FernandezNo ratings yet

- FarosDocument31 pagesFarosAnonymous 0omT4xhXNo ratings yet

- Liu GongDocument5 pagesLiu GongUbaldo Enrique Caraballo Estrada100% (1)

- 797F Mining TruckDocument28 pages797F Mining TruckMall FoksiNo ratings yet

- 01 Coalescer Elements CombinedDocument14 pages01 Coalescer Elements Combinedeino6622No ratings yet

- Omm Wa800-3 Pen00683-00 ItpDocument365 pagesOmm Wa800-3 Pen00683-00 ItpMulyadi TarchaniNo ratings yet

- Vehicle Wheels: Presented byDocument16 pagesVehicle Wheels: Presented byFelipe ArceNo ratings yet

- Maxxis 2019 Bike TXT Low PDFDocument76 pagesMaxxis 2019 Bike TXT Low PDFHilas AraujoNo ratings yet

- Fatal Risk Control ProtocolDocument40 pagesFatal Risk Control Protocolsarge18100% (1)

- SAE - Design of A Suspension For A CarDocument74 pagesSAE - Design of A Suspension For A CarEnrique Balam100% (3)

- Aprilia V990 Engine Workshop Manual USADocument204 pagesAprilia V990 Engine Workshop Manual USAfocus_q100% (1)