Professional Documents

Culture Documents

Loans and Receivables - Long Term

Uploaded by

AleezaAngelaSanchezNarvadezOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loans and Receivables - Long Term

Uploaded by

AleezaAngelaSanchezNarvadezCopyright:

Available Formats

Loans and Receivables Long Term

PROBLEMS

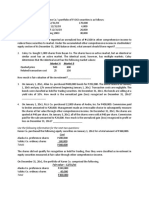

1. Smart Company has P3,000,000 note receivable from sale of plant bearing interest at 12% per annum. The note is dated June 1, 2008. The note is payable in 3 annual installments of P1,000,000 plus interest on the unpaid balance every June 1. The initial principal and interest payment was made on June 1, 2009. The interest income for 2009 is a. P300,000 b. P290,000 1. c. P210,000 d. P140,000 1. 1. How much should be recognized as gain on sale of machine? a. P10,000 c. P5,182 b. P14,818 d. P 0 How much should be recognized as interest income in 2010 related to above transaction? a. P3,166 c. P4,066 b. P2,415 d. P 0 P30 Kieso TB 11th- AMP On December 30, 2009, Chang Co. sold a machine to Door Co. in exchange for a noninterest-bearing note requiring ten annual payments of P10,000. Door made the first payment on December 30, 2009. The market interest rate for similar notes at date of issuance was 8%. Information on present value factors is as follows: Period 9 10 Present Value of 1 at 8% 0.50 0.46 Present Value of Ordinary Annuity of 1 at 8% 6.25 6.71

1.

rro Trans Company sold a tract of land to Former Co. on July 1, 2009, for P8,000,000 under an installment sale contract. Former Co. signed a 4-year 11% note for P5,600,000 on July 1, 2009, in addition to the down payment of P2,400,000. The equal annual payments of principal and interest on the note will be P1,805,000 payable on July 1, 2010, 2011, 2012,and 2013. The land had an established cash price of P8,000,000, and its cost to the company was P6,000,000. The collection of the installments on this note is reasonably assured. The current portion of the installment note receivable on December 31, 2010 is a. P1,805,000 c. P1,319,790 b. P1,400,000 d. P1,189,000 rro

1.

At the beginning of 2007, Marcos Company received a three-year non-interest-bearing P1,000,000 trade note. Marcos reported this note as a P1,000,000 trade note receivable on its 2007 year-end statement of financial position and P1,000,000 as sales revenue for 2007. What effect did this accounting for the note have on Marcos's profit for 2007, 2008, 2009, and its retained earnings at the end of 2009, respectively? a Overstate, overstate, understate, no effect b Overstate, understate, understate, no effect c Overstate, understate, understate, understate d No effect, no effect, no effect, no effect Pagudpud Company received a seven-year zerointerest-bearing note on February 22, 2009, in exchange for property it sold to Rear Company. There was no established exchange price for this property and the note has no ready market. The prevailing rate of interest for a note of this type was 7% on February 22, 2009, 7.5% on December 31, 2009, 7.7% on February 22, 2010, and 8% on December 31, 2010. What interest rate should be used to calculate the interest revenue from this transaction for the years ended December 31, 2009 and 2010, respectively? a. 0% and 0% c. 7% and 7% b. 7% and 7.7% d. 7.5% and 8%

In its December 31, 2009 statement of financial position, what amount should Chang report as note receivable? a. P45,000 c. P62,500 b. P46,000 d. P67,100 AICPA 0595 F-8 1. On December 31, 2008, Sadanga Company finished consultation services and accepted in exchange a promissory note with a face value of P300,000, a due date of December 31, 2011, and a stated rate of 5%, with interest receivable at the end of each year. The fair value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of 10%. The carrying amount of the note receivable as of December 31, 2009 is a. P300,000 c. P262,694 b. P273,963 d. P247,920 1. On December 31, 2009, Paoay Company received two P5,000,000 notes receivable from customers in exchanged for consulting services rendered. On both notes, interest is calculated on the outstanding principal balance at the annual rate of 4% and payable at maturity. The note from Pok Corporation, made under customary trade terms, is due on October 1, 2010 and the note from Wang Corporation is due on December 31, 2014. The market interest rate for similar notes on December 31, 2009 was 10%. The compound interest factors to convert future value into present value at 10% follow: present value of 1 due in nine months, 0.93, and present value of 1 due in five years, 0.62. At what amounts should these two notes receivable be reported in Paoays December 31, 2009 statement of financial position? Pok Wang a. P4,650,000 P3,100,000 b. P5,000,000 P3,720,000 c. P5,000,000 P3,100,000 d. P4,836,000 P3,720,000

1.

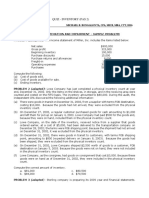

Use the following information for the next two questions. On December 31, 2009, Wolfgang Corporation sold for P50,000 an old machine having an original cost of P90,000 and a carrying amount of P40,000. The terms of the sale were as follows: 1) P10,000 down payment; and 2) P20,000 payable on December 31 each of the next two years. The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of transaction.

Page 1 of 3

Use the following information for the next two questions. 1. On January 1, 2009, Comforter Company sold equipment with a carrying amount of P800,000 to Cold Company. As payment, Cold gave Comforter Company a P1,200,000 note. The note bears an interest rate of 5% and is to be repaid in three annual installments of P400,000 (plus interest on the outstanding balance). The first payment was received on December 31, 2009. The market price of the equipment is not reliably determinable. The prevailing rate of interest for notes of this type is 10%. The interest income to be recognized in 2010 is a. P 40,000 c. P 74,708 b. P 69,587 d. P109,735 Money Bank granted a loan to a borrower on January 1, 2009. The interest rate on the loan is 10% payable annually starting December 31, 2009. The loan matures in five years on December 31, 2013. The data related to the loan are: Principal amount Direct origination cost Indirect origination cost Origination fee received from borrower 1. P4,000,000 61,520 26,400 350,000

The effective interest rate of the loan is a. P10% c. P12% b. P11% d. P13% The carrying amount December 31, 2009 is a. P4,000,000 b. P3,807,730 of the loan receivable on

1.

c. P3,756,902 d. P3,711,520

1.

On January 1, 2009, Boy Company sold a machine to Bawang Company. Bawang signed a non-interestbearing note requiring payment of P30,000 annually for seven years. The first payment was made on January 1, 2009. The prevailing rate of interest for this type of note at date of issuance was 10%. Information on present value factors is as follows: Present value of Present value of 1 ordinary annuity of 1 at 10% at 10% .56 4.36 .51 4.87

1.

On December 31, 2008, Bottle Company sold used equipment to Glass Corp. and received a noninterestbearing note requiring payment of P50,000 annually for ten years. The first payment is due December 31, 2009, and the prevailing rate of interest for this type of note at date of issuance is 12%. Present value factors are as follows: PV of 1 at 12% for 10 periods PV of ordinary annuity of 1 at 12% for 10 periods PV of annuity due of 1 at 12% for 10 periods 0.3220 5.6502 6.3282

Periods 6 7

Boy should record the sale in January 2009 at a. P107,100 c. P130,800 b. P146,100 d. P160,800

1.

1.

On July 1, 2009, Shaw Co. sold a machine costing P500,000 with accumulated depreciation of P380,000 on the date of sale. Shaw received as consideration for the sale, a P300,000 noninterest-bearing note, due July 1, 2012. There was no established exchange price for the equipment and the note had no ready market. The prevailing rate of interest for a note of this type at July 1, 2009 was 12% and 13% on December 31, 2009. In relation to this transaction, the total income to be recognized in Shaws 2009 profit or loss is (Round off present value factors to four decimal places) a. P180,000 c. P101,445 b. P119,165 d. P106,352 rro-aicpa Boy Company sold a machine to Golden Corporation on January 1, 2009, for which the cash sales price was P379,100. Golden entered into an installment sales contract with Boy, calling for annual payments of P100,000 for five years, including interest at 10%. The first payment was due on December 31, 2009. How much interest income should be recorded by Boy in 2010? a. P27,910 c. P31,701 b. P37,910 d. P50,000

In its December 31, 2009 balance sheet, Bottle should report the carrying amount of the note at a. P316,410 c. P282,510 b. P304,380 d. P266,410 1. Payla Company borrowed from Gold Bank under a 10year loan in the amount of P5,000,000 with interest rate of 6%. Payments are due monthly and are computed to be P55,500. Gold Bank incurs P200,000 of direct loan origination cost and P50,000 of indirect loan origination cost. In addition, Gold Bank charges Payla a 5-point nonrefundable loan origination fee. Gold Bank, the lender, has carrying amount of a. P5,200,000 c. P4,750,000 b. P5,000,000 d. P4,950,000 On December 1, 2009, Money Co. gave Home Co. a P200,000, 11% loan. Money paid proceeds of P194,000 after the deduction of a P6,000 nonrefundable loan origination fee. Principal and interest are due in 60 monthly installments of P4,310, beginning January 1, 2010. The repayments yield an effective interest rate of 11% at a present value of P200,000 and 12.4% at a present value of P194,000. What amount of income from this loan should Money report in its 2009 income statement? a. P 0 c. P2,005 b. P1,833 d. P7,833

1.

Page 2 of 3

Page 3 of 3

You might also like

- Module 13 Present ValueDocument10 pagesModule 13 Present ValueChristine Elaine LamanNo ratings yet

- Finals Answer KeyDocument11 pagesFinals Answer Keymarx marolinaNo ratings yet

- P1 Day4 RMDocument15 pagesP1 Day4 RMSharmaine Sur100% (1)

- Auditibg Problems Purchase CommitmentDocument1 pageAuditibg Problems Purchase Commitmentnivea gumayagay0% (1)

- Depreciation, Asset Costs, Capitalization SEODocument7 pagesDepreciation, Asset Costs, Capitalization SEOLara Lewis Achilles50% (2)

- Wasting AssetsDocument4 pagesWasting AssetsjomelNo ratings yet

- Budgeted Cash Flow for Earrings CompanyDocument27 pagesBudgeted Cash Flow for Earrings CompanyMavis LiuNo ratings yet

- 1 Borrowing CostDocument2 pages1 Borrowing CostNeighvestNo ratings yet

- This Study Resource Was: Cash Out Lear Flows FlowsDocument7 pagesThis Study Resource Was: Cash Out Lear Flows FlowsLayNo ratings yet

- DWC Legazpi Practical Accounting One LiabilitiesDocument14 pagesDWC Legazpi Practical Accounting One Liabilitiesyukiro rineva0% (2)

- Ose Pa1Document17 pagesOse Pa1gladys manaliliNo ratings yet

- Far 03 - InventoryDocument7 pagesFar 03 - InventoryMark Domingo MendozaNo ratings yet

- INVENTORIESDocument5 pagesINVENTORIESEdrick Devilla Dimayuga100% (2)

- ALL SubjectsDocument11 pagesALL SubjectsMJ YaconNo ratings yet

- Property, Plant and Equipement: Prior To Expense AfterDocument8 pagesProperty, Plant and Equipement: Prior To Expense AfterAvox EverdeenNo ratings yet

- LPU-CBA Departmental Quiz 4 Highlights Key Accounting ConceptsDocument3 pagesLPU-CBA Departmental Quiz 4 Highlights Key Accounting ConceptsJazzen MartinezNo ratings yet

- Accounting Test Bank - Bank ReconciliationDocument2 pagesAccounting Test Bank - Bank ReconciliationAyesha RGNo ratings yet

- Inventory LatojaDocument2 pagesInventory Latojalisa juganNo ratings yet

- A. Property, Plant and Equipment:: Current Appraised Value Seller's Original CostDocument3 pagesA. Property, Plant and Equipment:: Current Appraised Value Seller's Original CostNORLYN CINCONo ratings yet

- 3rd S.A QuestionsDocument15 pages3rd S.A QuestionsIsaiah John Domenic M. CantaneroNo ratings yet

- Practical Accounting 2 (P2)Document12 pagesPractical Accounting 2 (P2)Nico evansNo ratings yet

- Intermediate Accounting - MidtermsDocument9 pagesIntermediate Accounting - MidtermsKim Cristian MaañoNo ratings yet

- RFBT q1q2Document11 pagesRFBT q1q2Mojan VianaNo ratings yet

- Additional Problems DepnRevaluation and ImpairmentDocument2 pagesAdditional Problems DepnRevaluation and Impairmentfinn heartNo ratings yet

- Repair Cost Probabilit yDocument2 pagesRepair Cost Probabilit yNicole AguinaldoNo ratings yet

- Financial Accounting - ReceivablesDocument7 pagesFinancial Accounting - ReceivablesKim Cristian MaañoNo ratings yet

- GROUP WORK-Agriculture Biological Asset and Agricultural Produce13-FINALDocument5 pagesGROUP WORK-Agriculture Biological Asset and Agricultural Produce13-FINALREMBRANDT KEN LEDESMANo ratings yet

- 5.1 Seatwork Quiz Receivable FinancingDocument2 pages5.1 Seatwork Quiz Receivable FinancingSean Aaron Segucio0% (1)

- 1Document19 pages1Angelica Castillo0% (1)

- SQE - Financial Accounting and Reporting - Second Year - March 31, 2011Document11 pagesSQE - Financial Accounting and Reporting - Second Year - March 31, 2011Jerimiah MirandaNo ratings yet

- Problem 1-5 Multiple choice (IAA) classification current noncurrent liabilitiesDocument2 pagesProblem 1-5 Multiple choice (IAA) classification current noncurrent liabilitiesjayNo ratings yet

- Investment Intangible Wasting Assets 1 PDFDocument8 pagesInvestment Intangible Wasting Assets 1 PDFMeldwin C. Gutierrez50% (2)

- Quiz InvestmentsDocument2 pagesQuiz InvestmentsstillwinmsNo ratings yet

- Quiz On InvestmentDocument3 pagesQuiz On InvestmentDan Andrei BongoNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacNo ratings yet

- Quiz InventoriesDocument2 pagesQuiz InventoriesKimboy Elizalde PanaguitonNo ratings yet

- Intermediate Accounting 2.0 InvestmentsDocument6 pagesIntermediate Accounting 2.0 InvestmentsKaren Joy Jacinto ElloNo ratings yet

- DepreciationDocument6 pagesDepreciationKylie Luigi Leynes Bagon100% (2)

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- Inventory Quiz ProblemsDocument9 pagesInventory Quiz Problemspenny coronado100% (1)

- Semis Examination BDocument12 pagesSemis Examination BCHENG50% (2)

- Lecture Notes On Receivable FinancingDocument5 pagesLecture Notes On Receivable Financingjudel ArielNo ratings yet

- Armageddon Company's uncollectible accounts expenseDocument3 pagesArmageddon Company's uncollectible accounts expenseSamuel Bandibas0% (1)

- Seiler Co Purchased 6,000,000Document1 pageSeiler Co Purchased 6,000,000Zes ONo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- College of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMDocument4 pagesCollege of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMPpp BbbNo ratings yet

- Inventory and Accounts Payable AdjustmentsDocument3 pagesInventory and Accounts Payable AdjustmentsAngeline DalisayNo ratings yet

- I-Theories: Intangibles & Other AssetsDocument19 pagesI-Theories: Intangibles & Other Assetsaccounting filesNo ratings yet

- INVESTMENT PROPERTY CHAPTERDocument8 pagesINVESTMENT PROPERTY CHAPTERPacifico HernandezNo ratings yet

- Bank Reconciliation EditedDocument1 pageBank Reconciliation EditedNors PataytayNo ratings yet

- Prac 1Document9 pagesPrac 1rayNo ratings yet

- This Study Resource Was: Accounting For BondsDocument4 pagesThis Study Resource Was: Accounting For BondsSeunghyun ParkNo ratings yet

- Cel 1 Prac 1 Answer KeyDocument15 pagesCel 1 Prac 1 Answer KeyNJ MondigoNo ratings yet

- ACCTG 211 Intermediate Accounting I Practice Set 2 Bank Reconciliation ProblemsDocument1 pageACCTG 211 Intermediate Accounting I Practice Set 2 Bank Reconciliation ProblemsjazonvaleraNo ratings yet

- ReviewerDocument5 pagesReviewermaricielaNo ratings yet

- PPL Cup DifficultDocument8 pagesPPL Cup DifficultRukia Kuchiki100% (1)

- Practical Accounting 2 First Pre-Board ExaminationDocument15 pagesPractical Accounting 2 First Pre-Board ExaminationKaren Eloisse89% (9)

- Final Exam Cfas WoDocument11 pagesFinal Exam Cfas WoAndrei GoNo ratings yet

- SEO-optimized title for fitness health spa membership fees documentDocument5 pagesSEO-optimized title for fitness health spa membership fees documentDarwin LopezNo ratings yet

- PPL Cup AverageDocument7 pagesPPL Cup AverageRukia KuchikiNo ratings yet

- UAE Restructuring OverviewDocument6 pagesUAE Restructuring OverviewSadnanNo ratings yet

- TestDocument47 pagesTestsamcool87No ratings yet

- Audit of RecivableDocument5 pagesAudit of RecivableayanegadNo ratings yet

- Facts:: Leung Yee V Strong Machinery (G.R. NO. L-11658, February 15, 1918)Document33 pagesFacts:: Leung Yee V Strong Machinery (G.R. NO. L-11658, February 15, 1918)Ayana LockeNo ratings yet

- FHA Loans GuideDocument5 pagesFHA Loans GuideHollanderFinancialNo ratings yet

- Capital Structure and Financial Performance Evidence From Listed Firms in The Oil and Gas Sector in NigeriaDocument8 pagesCapital Structure and Financial Performance Evidence From Listed Firms in The Oil and Gas Sector in NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparing Financial Performance of Beximco and Square TextilesDocument28 pagesComparing Financial Performance of Beximco and Square TextilesDhiraj Chandro RayNo ratings yet

- Jurnal 1Document8 pagesJurnal 1Ibnu AwallaNo ratings yet

- Alliance Housing Loan Term Loan Terms ConditionsDocument12 pagesAlliance Housing Loan Term Loan Terms ConditionsRazali ZlyNo ratings yet

- Credit Samplex For Finals SerranoDocument1 pageCredit Samplex For Finals SerranoShanelle NapolesNo ratings yet

- Notes Receivable and Loan ReceivableDocument21 pagesNotes Receivable and Loan ReceivableLady BelleNo ratings yet

- Corporate Money Puts MFs Back On The Growth Path (May'13)Document1 pageCorporate Money Puts MFs Back On The Growth Path (May'13)Darshan JoshiNo ratings yet

- Sinking Funds PDFDocument8 pagesSinking Funds PDFCirilo Gazzingan IIINo ratings yet

- Chapter 13 Currency and Interest Rate SwapsDocument24 pagesChapter 13 Currency and Interest Rate SwapsaS hausjNo ratings yet

- Business vs Personal LoansDocument6 pagesBusiness vs Personal Loansraymond galagNo ratings yet

- Exam Working CapitalDocument4 pagesExam Working CapitalBereket K.ChubetaNo ratings yet

- TAX DEDUCTIONS AND ALLOWANCES FOR PHILIPPINE TAXPAYERSDocument23 pagesTAX DEDUCTIONS AND ALLOWANCES FOR PHILIPPINE TAXPAYERSMich SalvatorēNo ratings yet

- Spouses Albos vs. EmbisanDocument9 pagesSpouses Albos vs. EmbisanAaliyahNo ratings yet

- Existing Cross-Border Insolvency Framework in India and Need for UNCITRAL Model LawDocument4 pagesExisting Cross-Border Insolvency Framework in India and Need for UNCITRAL Model Lawlatika singhNo ratings yet

- RWJ Chapter 16Document11 pagesRWJ Chapter 16Sohini Mo BanerjeeNo ratings yet

- BAC102 Business Law Midterm Activity 1Document6 pagesBAC102 Business Law Midterm Activity 1Jing ChowNo ratings yet

- HARTALEGADocument7 pagesHARTALEGATeo Zhen TingNo ratings yet

- Successful Entrepreneurs: This Photo by Unknown Author Is Licensed Under CC BY-NC-NDDocument6 pagesSuccessful Entrepreneurs: This Photo by Unknown Author Is Licensed Under CC BY-NC-NDMichael Jorge BernalesNo ratings yet

- Document 1Document1 pageDocument 1Ghasem KhanNo ratings yet

- Sub 123Document10 pagesSub 123SenateBriberyInquiryNo ratings yet

- KCO-Rate-Card 2021Document13 pagesKCO-Rate-Card 2021Aqib SheikhNo ratings yet

- Loan Agreement BinwagDocument6 pagesLoan Agreement BinwagAnn DonatoNo ratings yet

- A Study On Working Capital ManagementDocument71 pagesA Study On Working Capital Managementnandhini_k_s50% (2)

- Akuntansi ObligasiDocument3 pagesAkuntansi Obligasimuhammad fadillahNo ratings yet

- ConvertibleDocument14 pagesConvertibleAkansha JadhavNo ratings yet