Professional Documents

Culture Documents

Liberal Is at Ion & Indian Automotive Industry

Uploaded by

sundesh85Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Liberal Is at Ion & Indian Automotive Industry

Uploaded by

sundesh85Copyright:

Available Formats

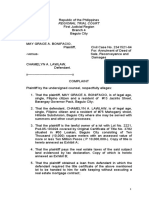

RESEARCH PAPER

Liberalization of Indian economy-Turnaround of Indian automotive industry.

Submitted bySourabh Mohan Saxena

Liberalization of Indian Economy - Turnaround of Indian Automobile industry

Liberalization - A free market economy OR Integration of the nations economies through financial flow, trade in goods and services, and corporate investments between nations. After the independence, Indian economic policy was highly influenced by the colonial experience. Before the liberalization the government attempted to close the Indian economy to the outside world. The Indian currency, the rupee, was inconvertible and high tariffs and import licensing prevented foreign goods reaching the market. India also operated a system of central planning for the economy, in which firms required licenses to invest and develop. Due to this The low annual growth rate of the economy of India before 1980, which stagnated around 3.5% from 1950s to 1980 and Per capita income averaged 1.3%. At the same time, Pakistan grew by 5%, Indonesea by 9%, Thailand by 9%South Korea by 10% and in Taiwan by 12%. Then early eighties that, the need for boosting up Indian economy was first felt. Economic progress was undoubtedly seen but, it was felt that, it was not enough to propel the engines of growth. While India was still languishing under the pains of undergrowth, the economies of China, Malaysia, Indonesia, Taiwan, and Singapore were performing very well in contrast. There had been a marked rise in their per capita incomes which were enough to provide good standards of living to their entire populations. At this juncture, the Indian Political scenario changed and in 1989, Rajiv Gandhi came to power. Actually Indian economy was in deep crisis in July 1991, when foreign currency reserves had plummeted to almost $1 billion; Inflation had roared to an annual rate of 17 percent; fiscal deficit was very high and had become unsustainable; foreign investors and NRIs had lost confidence in Indian Economy. Capital was flying out of the country and we were close to defaulting on loans.

Compare India (orange) with South Korea (yellow). Both started from about the same income level in 1950. The graph shows GDP per capita of South Asian economies and South Korea as a percentage of the American GDP per capita.

Then it felt that completeoverhauling of Indian economy and in 1990 taken four major steps for this. 1.Devaluation: To solve the balance of payment problem Indian currency were devaluated from 18% to 19%. 2. Disinvestment: To make the LPG model smooth many of the public sectors were sold to the private sector. 3. Allowing Foreign Direct Investment (FDI): FDI was allowed in a wide range of sectors such as Insurance (26%). 4. NRI Scheme: The facilities which were available to foreign investors were also given to NRI's. And then Indian economy started roaring. It created door for the FDI.Due to open the face of economy it influenced all the sectors. In which automotive was one of them. During 200010, the country attracted $178 billion as FDI.]The inordinately high investment from Mauritius is due to routing of international funds through the country given significant tax advantages; double taxation is avoided due to a tax treaty been India and Mauritius, and Mauritius is a capital gains tax heaven effectively creating a zero-taxation FDI channel.

Share of top five countries inflows in India (%) (2000-2010)-

The Indian automotive industry embarked a new journey in 1991 with delicensing of the sector. Since then almost all global majors have set up their facilities in Indian taking the level of production from 2 million in 1991. Today the automobile sector in India contributes 5% to the nations GDP, making it a prominent player in the economy. After the lifting of licensing in 1993, 17 new ventures have come up of which 16 are for manufacture of cars. STRUCTURE OF INDIAN AUTOMOBILE MARKET-

FDIs In Automotive Sector (Post liberalization) In India FDI up to 100 percent, has been permitted under automatic route to this sector, which has led to a turnover of USD 12 billion in the Indian auto industry and USD 3 billion in the auto parts industry. India enjoys a cost advantage with respect to casting and forging as manufacturing costs in India are 25 to 30 per cent lower than their western counterparts the Investment Commission has set a target of attracting foreign investment worth US$ 5 billion for the next seven years to increase India's share in the global auto components market from the existing 0.9 per cent to 2.5 per cent by 2015. FDI inflows in Automobile Industry 2008-09 was Rs.5, 212 Cr an increase of 47.25% compare to 2007-08.in Apr-May it was around 497 cr. In automobiles, the key player is Japan. During 2000-2005, Japan accounted for about 41 per cent of the total FDI in automobile, surpassing all its competitors by a big margin.

Source- FDI Statistics Govt. of India Investment Post LiberalizationDue to liberalization and other resource availability at less price India has emerged as one of the favorites investment destinations for automotive manufacturers in recent times.

Volvo-Eicher Commercial Vehicles (VECV) has announced an investment of US$ 61.51 million for a new engine plant at its existing facility at Pithampur, Madhya Pradesh. With this, India will now become a global manufacturing hub for Volvo's new medium-duty engine platform, with the only other factory for the engine type being present in Japan. Tata Motors is in talks with a Canada-based company for its second generation gearless Nano. Toyoto plans to invest US$ 107 million to make engines and gearboxes for Toyota's new small car, Etios that is expected to be launched by yearend. India Yamaha Motor Limited is also planning to tap the rural market, which currently accounts for around 15 per cent of its overall sale. The company has launched a new bike YBR 110 that will target the rural markets. Mercedes Benz has met its single largest orderof 150 cars worth US$ 14.7 millionfrom the small industrial town of Aurangabad, Maharashtra. The Renault-Nissan alliance and Bajaj Auto have signed a memorandum of understanding for developing a low-cost car. According to the MoU, the

design, engineering, manufacturing and supply base expertise to create the product will be executed by Bajaj with the support of the RenaultNissan alliance. Indo-Russian commercial vehicle joint venture (JV) Kamaz Vectra Motors plans to more than double its annual capacity to 12,000 units at its Hosur plant by 2012 to capture the fast-growing market in India. Ashok Leyland and Japanese car maker Nissan Motor Co Ltd have announced the launch of three light commercial vehicles (LCVs) from 2011 through 2013. The auto makers also confirmed to be in talks to create a small car for the Indian market within the US$ 2,000 - US$ 6,000 price range. British luxury brand Jaguar Land Rover (JLR) plans to increase presence in India and will tap parent Tata Motors for assistance in areas like logistics and service support. BMW, the luxury car maker, is planning to infuse US$ 15.76 million in its Indian operations. Andreas Schaaf, President, BMW India, said that the company had invested US$ 24.77 million till September 2010 and this would be increased to US$ 40.53 million by the end of 2012. Luxury carmaker Mercedes-Benz India will set up a new facility for building of city bus bodies at its Chakan plant in Pune. The new unit will become operational by mid-2011 and will have a capacity of 700 units a year. Mercedes Benz has also re-introduced its super premium sedan Maybach in India in 2011. Mahindra & Mahindra has revealed its plans to launch 8-10 new products, including a premium sports utility vehicle, across various segments by March 2012.

PRODUCTION TREND PRE AND POST LIBERLIZATION-

In the above graph we see that till pre liberalization production of vehicles in India is growing steadily just due to isolation of economy and only presence of some players. But if we see after liberalization it sudden grows fastly.Beacuse all major players increase the production from 2million in 1991 to 14 million in 2010.

Sales Trend (Post Liberalization) --Liberalization change the taste of Indian consumer, due to increase in income level and availability of different variety of vehicles Indian automotive industry also felt huge growth in domestic sales which is shown in below chart. all the major players increase their production and got record growth in production result it increased the contribution in Indian economy. and automotive became one of key player of Indian GDP.

shows the trend of domestic sales and it shows that after the liberalization it growing smoothly and gradually.definately it surpassed at time of recession but now it recover and growing fastly.

Interpretation- Graph

EXPORT TREND (POST LIBERALIZATION)-

Export-Vehicles

2000 1500 1000 500 0

Sales

Interpretation-Theses two graph also show the rapidly growth of Export of vehicles from India after liberalization. All the above information shows that after the liberalization all with other sectors automobile sector also grown fastly due to relaxation of rules and de licensing and allows 100% FDI by automatic route. And result is that now India rank 1st in Two Wheeler, 4th biggest market in commercial vehicle,11th in passenger vehicle and 2nd in tractor manufacturing in world. and proceed on the way to hub for passenger vehicle.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Gerson Lehrman GroupDocument1 pageGerson Lehrman GroupEla ElaNo ratings yet

- Decline of Mughals - Marathas and Other StatesDocument73 pagesDecline of Mughals - Marathas and Other Statesankesh UPSCNo ratings yet

- Certified Data Centre Professional CDCPDocument1 pageCertified Data Centre Professional CDCPxxxxxxxxxxxxxxxxxxxxNo ratings yet

- SOL 051 Requirements For Pilot Transfer Arrangements - Rev.1 PDFDocument23 pagesSOL 051 Requirements For Pilot Transfer Arrangements - Rev.1 PDFVembu RajNo ratings yet

- The Petrosian System Against The QID - Beliavsky, Mikhalchishin - Chess Stars.2008Document170 pagesThe Petrosian System Against The QID - Beliavsky, Mikhalchishin - Chess Stars.2008Marcelo100% (2)

- Ethiopia Pulp & Paper SC: Notice NoticeDocument1 pageEthiopia Pulp & Paper SC: Notice NoticeWedi FitwiNo ratings yet

- Soriano vs. Secretary of Finance G.R. No. 184450 January 24 2017Document1 pageSoriano vs. Secretary of Finance G.R. No. 184450 January 24 2017Anonymous MikI28PkJcNo ratings yet

- 2.1.. Democracy As An IdealDocument12 pages2.1.. Democracy As An IdealMichel Monkam MboueNo ratings yet

- BloggingDocument8 pagesBloggingbethNo ratings yet

- A Collection of Poems by AKDocument16 pagesA Collection of Poems by AKAnanda KrishnanNo ratings yet

- Alexei NavalnyDocument6 pagesAlexei NavalnyMuhammad M HakimiNo ratings yet

- Test 5Document4 pagesTest 5Lam ThúyNo ratings yet

- Webinar2021 Curriculum Alena Frid OECDDocument30 pagesWebinar2021 Curriculum Alena Frid OECDreaderjalvarezNo ratings yet

- Chapter 1 Basic-Concepts-Of-EconomicsDocument30 pagesChapter 1 Basic-Concepts-Of-EconomicsNAZMULNo ratings yet

- Cir Vs PagcorDocument3 pagesCir Vs PagcorNivra Lyn Empiales100% (2)

- Chapter 06 v0Document43 pagesChapter 06 v0Diệp Diệu ĐồngNo ratings yet

- My Portfolio: Marie Antonette S. NicdaoDocument10 pagesMy Portfolio: Marie Antonette S. NicdaoLexelyn Pagara RivaNo ratings yet

- Advanced Stock Trading Course + Strategies Course CatalogDocument5 pagesAdvanced Stock Trading Course + Strategies Course Catalogmytemp_01No ratings yet

- The District Governess & Other Stories by Miss Regina SnowDocument118 pagesThe District Governess & Other Stories by Miss Regina SnowMarianne MartindaleNo ratings yet

- Ronaldo FilmDocument2 pagesRonaldo Filmapi-317647938No ratings yet

- Case 1. Is Morality Relative? The Variability of Moral CodesDocument2 pagesCase 1. Is Morality Relative? The Variability of Moral CodesalyssaNo ratings yet

- SIP Annex 5 - Planning WorksheetDocument2 pagesSIP Annex 5 - Planning WorksheetGem Lam SenNo ratings yet

- NRes1 Work Activity 1 - LEGARTEDocument4 pagesNRes1 Work Activity 1 - LEGARTEJuliana LegarteNo ratings yet

- Estimating Guideline: A) Clearing & GrubbingDocument23 pagesEstimating Guideline: A) Clearing & GrubbingFreedom Love NabalNo ratings yet

- Edu 414-1Document30 pagesEdu 414-1ibrahim talhaNo ratings yet

- Monopolistic CompetitionDocument4 pagesMonopolistic CompetitionAzharNo ratings yet

- Swepp 1Document11 pagesSwepp 1Augusta Altobar100% (2)

- People vs. DonesaDocument11 pagesPeople vs. DonesaEarlene DaleNo ratings yet

- Family Code Cases Full TextDocument69 pagesFamily Code Cases Full TextNikki AndradeNo ratings yet

- 78 Complaint Annulment of Documents PDFDocument3 pages78 Complaint Annulment of Documents PDFjd fang-asanNo ratings yet