Professional Documents

Culture Documents

Aντρίκος Παπανδρέου - Unigestion

Uploaded by

Dexi ExtremCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aντρίκος Παπανδρέου - Unigestion

Uploaded by

Dexi ExtremCopyright:

Available Formats

Press Release

London 8 June, 2011

Unigestion announces closing of Secondary Opportunity Fund II

Unigestion-Ethos Environmental Sustainability Fund scheduled for first closing in June 2011

Unigestion, a leading privately owned asset manager with EUR 8.1 billion (USD 11.5 billion) of assets under management, announces the final closing of the Unigestion Secondary Opportunity Fund II at EUR 190 million, above its original target of EUR 150 million, and the first closing in June of the Unigestion Ethos Environmental Sustainability Fund. Unigestion Secondary Opportunity II, which is already well over 50% invested, takes advantage of a window of opportunity created in 2009 to acquire private equity assets below their intrinsic value. It targets small and mid-sized transactions in the EUR 3 to 20 million range, which are typically less competitive than the larger transactions. Unigestion Secondary Opportunity II invests in high quality funds run by highly regarded private equity managers well known to Unigestion through its primary investment activity. This focus allows Unigestion to price funds with insight, mitigate manager risk and accelerate the acquisition process due to the established relationships with the underlying managers. Seeing strong deal flow from banks, family offices and other sellers, the fund has already acquired 13 European and US private equity funds. Additionally, the Unigestion-Ethos Environmental Sustainability Fund will hold its first closing in June 2011. The fund will invest in 12 to 14 private equity funds that are active in the most promising environmental sustainability sub-sectors (including energy efficiency, alternative energy production, water treatment and pollution control). Companies in these fast growing industries require both, capital and hands-on ownership and will therefore benefit from private equity funding. Combining the expertise of Unigestion, Ethos (a Swiss Foundation for Sustainable Development) and a Strategic Committee* of sustainability experts, the fund will implement responsible investment processes that promote engagement with general partners and provide transparency to investors. Commenting on the final closing of the Unigestion Secondary Opportunity Fund II and the first closing of the Unigestion-Ethos Environmental Sustainability Fund, Hanspeter Bader, Managing Director of Unigestions Private Equity activities, said:

Unigestion Supervised by the Swiss Financial Market Supervisory Authority 8c avenue de Champel CP 387 CH-1211 Genve 12 Unigestion (US) Ltd Plaza 10 Harborside Financial Center Suite 203 Jersey City, NJ 07311 USA Unigestion (UK) Ltd Authorised and Regulated by the Financial Services Authority 105 Piccadilly UK-London W1J7NJ Unigestion Asset Management (France) SA Supervised by LAutorit des Marchs Financiers 12 avenue Matignon F-75008 Paris Unigestion Asia Pte Ltd 152 Beach Road Suite #23-05/06 The Gateway East Singapore 189721 Singapore

We are very pleased with the investment progress of our Secondary Opportunity Fund. Over the last 18 months, we have been able to identify and acquire, in mostly nonauctioned processes, private equity funds at an inflection point of their value development. We believe that our primary investment expertise is a great value added in accessing and executing such transactions. Global economic, social and political developments have also created excellent conditions for our Environmental Sustainability fund of funds to offer superior long-term returns to investors in one of the worlds fastest growing market segments. For media enquiries, please contact: Aviva Rajczyk Matt Rogers Unigestion JPES Partners +41 (0)22 704 42 76 +44 (0)207 002 7825

For additional information, please consult our website: www.unigestion.com

Notes to editors * The Unigestion-Ethos Strategic Committee is comprised of Andrea Papandreou (Associate Professor of the Department of Economics at the University of Athens), Serafino Iacono (Chairman of Pacific Rubiales Energy), Dominique Biedermann (Executive Director of Ethos) and Bertrand Piccard (aviator, explorer and UN Goodwill Ambassador currently working on Solar Impulse, a solar-powered aero plane project). ABOUT UNIGESTION (Data as of March 31st, 2011) Unigestion is a privately owned asset management company managing assets for institutional clients (88%) and wealthy families (12%). The company focuses exclusively on the management of highly active strategies spanning the private and public capital markets and seeks to deliver consistently superior risk-adjusted returns within the context of each clients long-term asset allocation. Unigestions investment platform offers four distinct means of generating superior risk-adjusted returns: Minimum Variance Equities (quantitative equity products), Funds of Hedge Funds, Private Equity Funds of Funds and asset allocation for wealthy families. Unigestion was created in 1971 and currently manages assets totaling EUR 8.1 billion (USD 11.5 billion). It is 76% controlled by its senior management team which ensures its independence and allows the company to concentrate on producing superior investment returns for its clients, with no conflicts of interest. Unigestion has a highly capitalised and solid structure, aligned with its clients with over EUR 150 million (USD 200 million) of shareholder equity. The company counts 149 employees and is based in Geneva with offices in London, New York, Paris, Singapore and Guernsey.

This document has been prepared for your personal use only and is for information only. All information provided here is subject to change.

Unigestion SA Supervised by the Swiss Financial Market Supervisory Authority 8c avenue de Champel CP 387 CH-1211 Genve 12 Unigestion (US) Ltd Plaza 10 Harborside Financial Center Suite 203 Jersey City, NJ 07311 USA Unigestion (UK) Ltd Authorised and Regulated by the Financial Services Authority 105 Piccadilly UK-London W1J7NJ Unigestion Asset Management (France) SA Supervised by LAutorit des Marchs Financiers 12 avenue Matignon F-75008 Paris Unigestion Asia Pte Ltd 152 Beach Road Suite #23-05/06 The Gateway East Singapore 189721 Singapore Unigestion (Guernsey) Ltd - Regulated by the Guernsey Financial Services Commission - Farnley House - La Charroterie - St. Peter Port - Guernsey, GY1 1EJ - Channel Islands

You might also like

- Europe Hedge FundsDocument126 pagesEurope Hedge Fundsheedi0No ratings yet

- Materi APK Bapak Steven Tanggara RPL ACPA 7.7.20 IAPIDocument67 pagesMateri APK Bapak Steven Tanggara RPL ACPA 7.7.20 IAPIMuhammad TaufiqNo ratings yet

- Research ProposalDocument34 pagesResearch ProposalSimon Muteke100% (1)

- A Case Study On The Financial Performance of Himalayan Bank LimitedDocument28 pagesA Case Study On The Financial Performance of Himalayan Bank LimitedSanjay Timilsina52% (21)

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ajith V0% (1)

- International Capital MarketsDocument12 pagesInternational Capital Marketschmon100% (1)

- Hedge Funds enDocument250 pagesHedge Funds enPhuong Phan100% (1)

- Business Plan Template For Online Start UpDocument7 pagesBusiness Plan Template For Online Start UpTarteil TradingNo ratings yet

- EDHEC Position Paper Risks European ETFsDocument70 pagesEDHEC Position Paper Risks European ETFsgohchuansin100% (1)

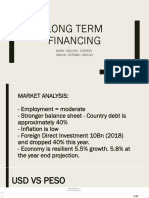

- LONG TERM FINANCING Finma FinalDocument36 pagesLONG TERM FINANCING Finma FinalJane Baylon100% (2)

- Reliance Jio Financial AnalysisDocument102 pagesReliance Jio Financial Analysisravi singh0% (1)

- European Investment Bank Group Sustainability Report 2020From EverandEuropean Investment Bank Group Sustainability Report 2020No ratings yet

- Hubert Cottogni, European Investment FundDocument14 pagesHubert Cottogni, European Investment FundPromoting EnterpriseNo ratings yet

- PR Livelihoods (VGB)Document3 pagesPR Livelihoods (VGB)LivelihoodsEuNo ratings yet

- Press ReleaseDocument3 pagesPress ReleaseFuaad DodooNo ratings yet

- European Investment Bank Group Sustainability Report 2018From EverandEuropean Investment Bank Group Sustainability Report 2018No ratings yet

- What Is The European Investment Bank?Document6 pagesWhat Is The European Investment Bank?AllinAll157No ratings yet

- CP Livelihoods (V-En)Document3 pagesCP Livelihoods (V-En)LivelihoodsEuNo ratings yet

- Euronext - Listing ESG Core Investments 20210212Document3 pagesEuronext - Listing ESG Core Investments 20210212Alex UkrNo ratings yet

- CP Uk - Smart City Final VersionDocument2 pagesCP Uk - Smart City Final VersionBelinda PHAMNo ratings yet

- Member Profile Pictet PDFDocument3 pagesMember Profile Pictet PDFownersforumNo ratings yet

- PIMCO GIS Euro Liquidity InstDocument2 pagesPIMCO GIS Euro Liquidity InstNeil WalshNo ratings yet

- Asset Management Report 2018 Voor WebDocument14 pagesAsset Management Report 2018 Voor WebOkurujaNo ratings yet

- Degremont Ra 2011 enDocument60 pagesDegremont Ra 2011 enviswanathan100% (1)

- Ef S Teodora StanDocument14 pagesEf S Teodora StanTeodora SimonNo ratings yet

- ITF - Module 2Document14 pagesITF - Module 2Anita VarmaNo ratings yet

- European Energygroups: Bernard Timothée Minier-Cottin Juliette - Master EBR - 2012/2013Document14 pagesEuropean Energygroups: Bernard Timothée Minier-Cottin Juliette - Master EBR - 2012/2013Timmy BernardNo ratings yet

- EN EN: and Participants Are Regulated or Subject To Oversight, As Appropriate To Their Circumstance'Document8 pagesEN EN: and Participants Are Regulated or Subject To Oversight, As Appropriate To Their Circumstance'Manikanta ChintalaNo ratings yet

- Travail DemandéDocument2 pagesTravail DemandéAlbert IsaacNo ratings yet

- Combined PresentationsDocument19 pagesCombined PresentationsEaP CSFNo ratings yet

- Action Plan To Make Europe The New Global Powerhouse For StartupsDocument15 pagesAction Plan To Make Europe The New Global Powerhouse For Startupsstart-up.roNo ratings yet

- Zorpas 2010Document14 pagesZorpas 2010Blue oceanNo ratings yet

- Sustainable Finance Final Report enDocument100 pagesSustainable Finance Final Report enmanopp16No ratings yet

- European Investment Bank Activity Report 2021: The innovation responseFrom EverandEuropean Investment Bank Activity Report 2021: The innovation responseNo ratings yet

- International: Financial ManagementDocument27 pagesInternational: Financial ManagementAhmed El KhateebNo ratings yet

- Randal W. Stoller To Head EurOrient Capital, The World's First Investment Bank Solely Dedicated To Mobilize Financing For Development and To Promote Socially Responsible Investing - Ron NechemiaDocument5 pagesRandal W. Stoller To Head EurOrient Capital, The World's First Investment Bank Solely Dedicated To Mobilize Financing For Development and To Promote Socially Responsible Investing - Ron NechemiaRon NechemiaNo ratings yet

- SSRN Id3672989Document40 pagesSSRN Id3672989Huong Thu100% (1)

- ESG Circular Economy 1650157042Document7 pagesESG Circular Economy 1650157042svalleystarNo ratings yet

- Innovafeed Fund Raising PDFDocument3 pagesInnovafeed Fund Raising PDFOl VirNo ratings yet

- One Planet Economics: Green Growth, Steady State, or Degrowth?Document38 pagesOne Planet Economics: Green Growth, Steady State, or Degrowth?j.k.steinbergerNo ratings yet

- 2012 FinCom Session 2Document54 pages2012 FinCom Session 2MessagedentrepriseNo ratings yet

- Sustainablefinance Commission S Action Plan For A Greener and Cleaner EconomyDocument2 pagesSustainablefinance Commission S Action Plan For A Greener and Cleaner Economytradingjournal888No ratings yet

- Paris 2012 BrochureDocument5 pagesParis 2012 BrochureesopcentreNo ratings yet

- Case Study 2Document10 pagesCase Study 2Nur QamarinaNo ratings yet

- Freshfields Legal Resp 20051123Document154 pagesFreshfields Legal Resp 20051123SamCarson100% (1)

- D.A.V.V., Indore Institute of Management Studies: International FinanceDocument10 pagesD.A.V.V., Indore Institute of Management Studies: International FinanceSNo ratings yet

- Norway Fund ProfileDocument3 pagesNorway Fund ProfilekhanfarNo ratings yet

- Hedge Fund Profile-PioneerDocument2 pagesHedge Fund Profile-Pioneerhttp://besthedgefund.blogspot.comNo ratings yet

- 2012 - Careers in Financial Markets - EfinancialDocument88 pages2012 - Careers in Financial Markets - EfinanciallcombalieNo ratings yet

- Master Thesis Mission DriftDocument126 pagesMaster Thesis Mission DriftNgale Ewah Oliver100% (1)

- IB Individual AssessmentDocument17 pagesIB Individual AssessmentShahzuan AimanNo ratings yet

- FINS3616 Chapter 1 SummaryDocument8 pagesFINS3616 Chapter 1 SummaryShruti IyengarNo ratings yet

- Gyan Ganga: Institute of Technology &sciencesDocument6 pagesGyan Ganga: Institute of Technology &sciencesMandhir NarangNo ratings yet

- Invest in Greece - General Presentation - 082012Document77 pagesInvest in Greece - General Presentation - 082012Katerina DaNo ratings yet

- 3 Pillar Structure: Excellent Science Industrial Leadership Societal ChallengesDocument2 pages3 Pillar Structure: Excellent Science Industrial Leadership Societal Challengesrock_musicNo ratings yet

- EFAMA AssetManagementReport2019Document15 pagesEFAMA AssetManagementReport2019CHUMBNo ratings yet

- Final 9Document38 pagesFinal 9Tishina SeewoosahaNo ratings yet

- Green Recovery - ENDocument7 pagesGreen Recovery - ENthornockjoe84No ratings yet

- Finance in Africa: for green, smart and inclusive private sector developmentFrom EverandFinance in Africa: for green, smart and inclusive private sector developmentNo ratings yet

- EIB Activity in Africa, the Caribbean, the Pacific and the Overseas Countries and Territories: Annual Report 2018From EverandEIB Activity in Africa, the Caribbean, the Pacific and the Overseas Countries and Territories: Annual Report 2018No ratings yet

- Anderton SICAV Launches New High Income Investment Fund. Gamma Capital Markets Acts As Investment Manager.Document5 pagesAnderton SICAV Launches New High Income Investment Fund. Gamma Capital Markets Acts As Investment Manager.PR.comNo ratings yet

- Ibm Unit 1Document12 pagesIbm Unit 1Aarya YadavNo ratings yet

- Horizon 2020inbriefDocument40 pagesHorizon 2020inbrieftjnevado1No ratings yet

- Ufer EITI Globally and Implementation at Country-Level Current Status, Emerging Results and LessonsDocument23 pagesUfer EITI Globally and Implementation at Country-Level Current Status, Emerging Results and LessonsInternational Consortium on Governmental Financial ManagementNo ratings yet

- Societe Generale Shares Voting Rights As of 31 10 2023Document2 pagesSociete Generale Shares Voting Rights As of 31 10 2023cbrnspm-20180717cdcntNo ratings yet

- Chapter-1 Industry Profile "A Study On Comparative Analysis of Financial Statements of BMTC, BengaluruDocument18 pagesChapter-1 Industry Profile "A Study On Comparative Analysis of Financial Statements of BMTC, Bengaluruadarsha jainNo ratings yet

- Common-Size Financial StatementsDocument16 pagesCommon-Size Financial StatementsApril IsidroNo ratings yet

- Chapter 7 Advacc 1 DayagDocument31 pagesChapter 7 Advacc 1 Dayagchangevela83% (6)

- Chapter 2 - FADocument23 pagesChapter 2 - FANouh Al-SayyedNo ratings yet

- BMWDocument14 pagesBMWkiranNo ratings yet

- "Navodaya Vidyalaya Samiti" PRE-BOARD Exam 2020-21 Class: Xii Subject: Accountancy (055) TIME: 3 Hours Max Marks: 80Document12 pages"Navodaya Vidyalaya Samiti" PRE-BOARD Exam 2020-21 Class: Xii Subject: Accountancy (055) TIME: 3 Hours Max Marks: 80hardikNo ratings yet

- Trading On EquityDocument12 pagesTrading On Equitychoraipakhi100% (6)

- 105 Top Most Important Questions CA Inter Advanced Accounting ForDocument125 pages105 Top Most Important Questions CA Inter Advanced Accounting ForUday tomarNo ratings yet

- Securities and Exchange CommissionDocument185 pagesSecurities and Exchange CommissionWilliam BlairNo ratings yet

- Shares & DebenturesDocument7 pagesShares & DebenturesKARISHMA RAJNo ratings yet

- Solution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian EditionDocument38 pagesSolution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian Editionwarpingmustacqgmael100% (13)

- Analysis & Findings - GPDocument79 pagesAnalysis & Findings - GPFarhat987No ratings yet

- ACCT 2200 - Chapter 10Document29 pagesACCT 2200 - Chapter 10afsdasdf3qf4341f4asDNo ratings yet

- Balance Sheet of Dabur India LTDDocument15 pagesBalance Sheet of Dabur India LTDAshish JainNo ratings yet

- BATADocument33 pagesBATACHANDAN CHANDUNo ratings yet

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDocument17 pagesUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNo ratings yet

- Mutual Funds at KarvyDocument77 pagesMutual Funds at KarvyNaveen KumarNo ratings yet

- Cooperative Chart of AccountsDocument37 pagesCooperative Chart of AccountsGianena MarieNo ratings yet

- Exam PreparationDocument75 pagesExam Preparationسموذلي نعومة كالحريرNo ratings yet

- Ssbi Dallmill Prject WorkDocument30 pagesSsbi Dallmill Prject WorkPratik TiwariNo ratings yet

- Australian Dairy Industry: A Review of TheDocument51 pagesAustralian Dairy Industry: A Review of Thevivek_pandeyNo ratings yet

- YPF Repsol CaseDocument30 pagesYPF Repsol CaseVijoyShankarRoyNo ratings yet

- 2012 0419 Urc Annual Report 2011 FinalDocument146 pages2012 0419 Urc Annual Report 2011 FinalMelan YapNo ratings yet