Professional Documents

Culture Documents

Eclectica Fund 2011 04

Uploaded by

fviethOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eclectica Fund 2011 04

Uploaded by

fviethCopyright:

Available Formats

The Eclectica Fund

PERFORMANCE ATTRIBUTION REPORT 29 April 2011

Discretionary Global Macro

The investment objective of the Fund is to achieve capital appreciation, whilst limiting risk of loss, by investing globally long and short mainly in quoted securities, government bonds and currencies, but also in commodities and other derivative instruments.

Monthly and Yearly Performance % ( A Shares net of fees)

Year 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 +5.2 +4.0 +2.4 +12.7 +0.7 +5.5 +1.9 +3.7 -1.1 -8.1 -1.0 +9.7 -8.2 +1.7 +18.0 +3.7 +5.2 -1.0 -4.6 +4.6 -2.5 -0.8 -2.9 -15.6 -2.1 -0.2 -0.3 +8.8 -4.9 -0.1 +3.6 +0.7 -2.7 -5.4 -0.5 +0.8 +16.2 -0.9 -4.8 -5.4 +1.8 -3.9 -0.9 +1.7 +1.9 -1.7 +3.5 +3.6 +3.7 +2.4 -1.4 +2.5 +1.8 -0.2 +0.0 -5.9 -1.0 -9.1 -1.7 +0.6 +4.2 +0.5 +4.2 -2.1 -6.4 -1.7 +0.9 +1.6 Jan Feb Mar Apr May Jun Jul Aug Sep +0.0 +7.8 +3.4 +8.5 +2.2 +1.8 -5.7 -0.1 -3.1 Oct -4.8 +1.9 +5.7 -7.0 -2.1 -1.8 +49.8 -1.9 -1.9 Nov -0.1 -3.7 +1.7 -4.8 +0.9 -3.4 +2.9 +3.0 -4.3

AUM: $240, 820, 000

Dec +0.8 +12.4 -3.0 +5.9 -0.6 +7.5 +0.4 -4.0 -2.1 Year -4.2 +49.9 +8.0 +14.2 -3.7 +1.6 +31.2 -8.0 +2.7 -1.6 Source: Daiwa. Calculation on NAV basis.

Performance Attribution

Fund Performance Since Inception Fund

250 225

Equity (Net) Carry Interest Rates CDS Currency Commodity

-1.06% -0.10%

0.10%

HFR Macro Index

1.90%

200 175 150

-0.15% 0.12%

-1.5% -1.0% -0.5% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5%

125 100 75

*HFR Macro Index in USD Assumes constituent funds performance is fully hedged. Bloomberg Ticker: HFRXM Index. Past performance is not a guide to future returns.

Asset Allocation Summary (% NAV)

Interest Rate Futures* Interest Rate Options* Long Equity* Short Equity* CDS* Commodity* Gov Bonds Corp Bonds FX Options* FX (Pegged) IRS DV01 (bps)**** Outright Swaps Swap Curve FRA/OIS Spreads EUR 2.9 GBP 3.1 USD -1.2 3.1 JPY 5.2 13.1 5.2 24.9 -9.6 4.5 5.4 2.7 0.4 1.8 48.8 AUD 0.3 NZD 0.9 -

CDS Position Breakdown Summary CDS Payout Profile

% 20 15 10 5 0 -5 Ave. Spread Notional Exposure Total CDS 195

Assumes liquidation of portfolio at 2.5yr spread levels in 1 years time

Annual Carry -1.3

CV01 (bps)* 7.2

Ave. Life 3.4yrs

* Currency, equity and commodity include listed and OTC derivatives, cash or futures on a net delta basis. Interest rate options figure represents net option premium/interest rate futures are shown on a 10yr adjusted net delta basis. CDS figure represents max loss. DV01 figure represents basis point contribution for a 1bp rise/steepening/widening of the underlying rate/curve/spread.

* CV01 figure represents basis point contribution for a 1bp rise in the weighted average credit spread of the portfolio.

The Eclectica Fund

PERFORMANCE ATTRIBUTION REPORT What happened in April? 29 April of globalisation (aka QE2) continued to work its way through the economic system. The Asian mercantilists now have The Fed's rejection 2011 domestic price inflation to contend with and are raising rates. We expect their economies to slow in due course.

In Europe, the ECB is ignoring the perils of contractionary fiscal policy and is similarly engaged in raising rates to thwart higher QE2 induced commodity price inflation. The central bank raised rates by a quarter-point. Again, we are not optimistic on the continents prospective growth prospects. But it was a better month for the central bank that gets it. British economic data of late has been an unqualified endorsement of the Banks premise that this economic upswing will prove less vigorous for highly indebted nations and that contractionary fiscal policy should take precedent over raising interest rates. The market was compelled to rein in its hawkish rate expectations (see chart 1). How did the Fund Perform? The Fund recorded a gain of 80bps. By category, the Fund's interest rate positions were the most profitable with a gain of 214bps for the month; the Sterling swaps book contributed half of this. This was countered by a 1% loss from Japanese credit which takes this part of the book back to flat on the year. Long-short equity made 10 bps, FX cost 14bps and FRA/OIS spreads cost a further 25bps and the DVO1 exposure has been cut further from 11bps to 6bps. Accepting absurdity? I was reading something recently about the Nobel Prize winner Richard Feynman that made me think that money management was perhaps similar to physics in that you advance by accepting absurdities. The history of physics, he claimed, is one of unbelievable ideas proving to be true. "Our imagination is stretched to the utmost not, as in fiction, to imagine things which are not really there, but just to comprehend those which are ". British interest rates are a case in point. To most it is simply absurd that rates will not rise. Having adopted the Feds policy of quantitative monetary easing, inflation is now running at twice the Banks target and the core rate is at its highest since the series began in 1997. I recently presented at an investor conference during which a very prominent manager predicted that British prices would rise 11% next year; there was no dissent. And yet rate hike expectations have moderated (chart 1 again). Perhaps investors are imagining things which are not really there? The CPI data measures price changes for goods and services. But this only captures about one-third of all prices in a developed economy. The most important price is not represented. The price of labour, or wages to you and me, represents the missing two-thirds. Our obsession with CPI data is that it provides a causal explanation for the periodic bouts of general price inflation that we have observed through history (see chart 2).

Chart 1: Distribution of expectations where 3M GBP LIBOR will be on 21/09/2011

2.0% 1.8% 1.6% Expectation Weights 1.4% 1.2% 1.0% 0.8% 0.6% 0.4% 0.2% 0.0% 0.00 0.50 1.00 1.50 Expected Interest Rate 2.00 2.50 29/04/2011 31/03/2011

Source: Bloomberg

Chart 2: UK Private Sector Nominal Wage Rate YoY % Change

% 35 30 25 20 15 10 5 0 Mar-71 Mar-74 Mar-77 Mar-80 Mar-83 Mar-86 Mar-89 Mar-92 Mar-95 Mar-98 Mar-01 Mar-04 Mar-07 -5 Mar-10

But for all prices in the economy to expand at say 11% yoy Source: OECD / Bloomberg households and businesses require the necessary additional xxxxxxxx means to accommodate such an increase in their nominal outgoings. Presently, and despite QE, this is not happening. The culprit monetary is the banking system. Historically its willingness to extend credit has allowed a rise in relative prices to pass into a general bout of price inflation. But today, with higher credit standards and the private sector repaying loans faster than the banks are willing to grant new credit, the environment is deflationary. Should households maintain their consumption of those goods and services which are presently the subject of price inflation they quickly discover that they have less to spend on other outlays. In practice the pattern of consumption changes with less spent on discretionary items.

The Eclectica Fund

PERFORMANCE which has blunted REPORT So a condition of stasis prevailsATTRIBUTION the overall impact of QE and is unlikely to result in the elevated general inflation that many macro investors fear; as the chart below illustrates it is likely that there are just too many losses still to be recognised by the banking system. 29 April 2011 reported cumulative loss rates of just 6.2% on risk assets versus the 8.5% written off following the non-crisis British banks have recession of 1989-93. One has to think that it is the presence of such unrecognised losses residing on the British banking ledger that is likely to stymie the present infatuation with mass inflation

Stock Insight: Olam Trees Don't Grow to the Sky This month's IPO of Glencore may attract some unwelcome scrutiny to the opaque world of Asian commodity trading and supply chain . management. Trading of grains and oilseeds is relatively transparent and carried out by agribusinesses such as ADM, Bunge is and Cargill. But we are short a company which is engaged in sourcing, transporting and trading lesser-known commodities like shea nuts, cashews, sesame seeds and spices. These are often produced exclusively in obscure parts of Africa or South East Asia, and have no futures market. We have no problem with this. Indeed the combination of sourcing difficulties and information asymmetry can and does lead to very nice profit margins for businesses with the physical network to exploit such inefficiencies. As a rule of thumb, the more obscure the product, the higher the margins, with grains attracting EBIT margins of 1-3% and nuts and spices up to 10%. The Singapore listed Olam has historically grown fast, with 2009 revenues up fivefold since 2002, an impressive achievement recognised by the stock trading on 20x consensus earnings forecasts.

Loss Rates as a % of Risky Assets

0.0% 5.0% 10.0% 15.0% 20.0%

UK Big 4: Current Crisis (To Date)

6.0%

UK 1989-1993 (Non-Crisis Recession)

8.5%

US: Current Crisis (To Date)

8.8%

10% "Typical" Single Country Crisis

10.0%

Synchronous (Nordic) Crisis

15.0%

Japan

20.2%

Source: Companies Data, Arbuthnot

But is this due recognition of a job well done or a temporary leave of absence from Mr Market's renowned laws of reasoning? Is Olam fully valued or overpriced? We think the latter. The trouble with life is that it is often so difficult to stay popular. Back in 2007, Olam vowed to pull out all the stops in its quest for enduring investor satisfaction. If its eps growth they want ,its eps growth they're going to get. However this necessitated a change in strategy whereby they would invest more in capital intensive upstream production and downstream processing rather than the asset-light supply chain business. Rarely is this strategy called by its true name: the acceptance of lower marginal rates of return. This shift was no doubt in part driven by the fact that you can only grow so big trading shea nuts. In practice, it made them far more comparable to someone like Glencore, who have a presence throughout the value chain. But putting the trading business on a P/E of about 15x (in-line with Singapore-listed metals trader Noble) and the rest in-line with mining groups like Rio Tinto (on a P/E of 7x), values Glencore at 11x earnings which is a pretty sizeable discount to Olams 20x. Furthermore, close analysis of the Olam annual report reveals a notable change in the quality of earnings since the new strategy in 2007/08, with large percentages of stated profits coming from items such as revaluation of their own convertible debt, negative goodwill from acquisitions and non-cash "biological" gains. The latter is my favourite and derives apparently quite legitimately from the accounting treatment of all those little acorns the group planted in its Asian almond and palm oil plantations several years back. As the trees grow they are reckoned to be more valuable to the bean counters; its a jack and the beanstalk business! The sell side analysts (with 14 buy recommendations, 3 holds and 2 sells) adjust for some of these but not all, taking historical profit numbers (in Singapore dollars) for 2009 and 2010 down from the reported $252m and $372m to $182m and $272m respectively. However, our analysis suggests that more realistic figures are $100m and $170m, the latter putting the stock on 40x historic earnings as opposed to the 25x used by the sell-side. This means that the forward P/E is probably at least 25x, not 20x, and looking stretched relative to peers. Maybe we should just stop there; job done. Alas some $95m out of last years $170m came from export incentives and subsidies, which may be part of doing business in Africa but certainly should not be valued by the stock market on anything like 20x P/E (never mind 40x). Just don't call these items a "bung" from the Nigerian government whose respectability is of course beyond reproach.

The Eclectica Fund

PERFORMANCE ATTRIBUTION REPORT 29 April 2011

Fed QE

High sovereign debt restricts fiscal stimulus US rejects globalisation

Long Interest Rate Receivers

Zero lower bound restricts monetary policy

US rejects China gaming FX

US and Germany slow

US seeks to create domestic price inflation overseas

EM growth slows Debtor countries raise rates despite high unemployment a la 1931 Creditor countries tighten monetary policy

US seeks to revalue China et al FX real v nominal prices

Long Equities & Commodities

We Are Here

Fund Information Fund Details Investment Manager Administrator Fund Managers Structure Inception Date Share Classes Minimum Investment Dividends Stock Exchange Listing

Fees, Costs & Redemption Structure Eclectica Asset Management LLP Dealing A Shares Daiwa Europe Fund Managers Ireland Ltd Dealing B & C Shares Hugh Hendry & Espen Baardsen Dealing Notice Cayman Islands OEIC within a Master Feeder structure Dealing Line 30 September 2002 Dealing Fax //$ 100,000 or equivalent in /$100,000 Accumulated Irish Dealing Email AMC A Shares AMC B & C Shares Performance Fee Exit Fee

1st & 15th of each month 1st of each month 7 days before dealing day (+353) 1 603 9921 (+353) 1 647 5830

daiwaSHSdealing@daiwagas.com 1% 2% 20% 1% exit fee on redemptions within 12 months

Service Providers Custodian/Prime Broker Custodian Auditors

Eclectica Asset Management: Investor Relations 1) Morgan Stanley and Co Int Plc Telephone 2) Credit Suisse Securities (Europe) Ltd Email Daiwa Securities Trust & Banking (Europe Plc) Deloitte & Touche

+44 (0)20 7792 6400 info@eclectica-am.com

This document is being issued by Eclectica Asset Management LLP ("EAM"), which is authorised and regulated by the Financial Services Authority. The information contained in this document relates to the promotion of shares in one or more unrecognised collective investment schemes managed by EAM (the "Funds"). The promotion of the Funds and the distribution of this document in the United Kingdom is restricted by law. This document is being issued by EAM to and/or is directed at persons who are both (a) professional clients or eligible counterparties for the purposes of the Financial Services Authority's Conduct of Business Sourcebook ("COBS") and (b) of a kind to whom the Funds may lawfully be promoted by a person authorised under the Act (an "authorised person") by virtue of Section 238(5) of the Financial Services and Markets Act 2000 (the "Act") Chapter 4.12 of COBS. No recipient of this document may distribute it to any other person. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of, and no liability is accepted for, the information or opinions contained in this document by any of EAM, any of the funds managed by EAM or their respective directors. This does not exclude or restrict any duty or liability that EAM has to its customers under the UK regulatory system. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase, any securities mentioned herein nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for securities are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus which may be different from the information and opinions contained in this document. The value of all investments and the income derived therefrom can decrease as well as increase. This may be partly due to exchange rate fluctuations in investments that have an exposure to currencies other than the base currency of the relevant fund. Historic performance is not a guide to future performance. All charts are sourced from Eclectica Asset Management LLP. Side letters: Some hedge fund investors with significant interests in the fund receive periodic updates on the portfolio holdings. 2005-11 Eclectica Asset Management LLP; Registration No. OC312442; registered office at 6 Salem Road, London, W2 4BU.6

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Text That Girl Cheat Sheet NewDocument25 pagesText That Girl Cheat Sheet NewfhgfghgfhNo ratings yet

- Cost Volume Profit AnalysisDocument7 pagesCost Volume Profit AnalysisMatinChris KisomboNo ratings yet

- Civpro RevDocument102 pagesCivpro RevJocelyn Baliwag-Alicmas Banganan BayubayNo ratings yet

- Mind Mapping BIOTEKDocument1 pageMind Mapping BIOTEKAdrian Muhammad RonalNo ratings yet

- Sop Urilyzer 100Document4 pagesSop Urilyzer 100misriyantiNo ratings yet

- NGOs in Satkhira PresentationDocument17 pagesNGOs in Satkhira PresentationRubayet KhundokerNo ratings yet

- Advanced Excel Training ManualDocument6 pagesAdvanced Excel Training ManualAnkush RedhuNo ratings yet

- Final Answers Chap 002Document174 pagesFinal Answers Chap 002valderramadavid67% (6)

- What Is EBSD ? Why Use EBSD ? Why Measure Microstructure ? What Does EBSD Do That Cannot Already Be Done ?Document5 pagesWhat Is EBSD ? Why Use EBSD ? Why Measure Microstructure ? What Does EBSD Do That Cannot Already Be Done ?Zahir Rayhan JhonNo ratings yet

- Bid Evaluation Report Sample TemplateDocument2 pagesBid Evaluation Report Sample Templatemarie100% (8)

- Guide To Networking Essentials Fifth Edition: Making Networks WorkDocument33 pagesGuide To Networking Essentials Fifth Edition: Making Networks WorkKhamis SeifNo ratings yet

- 70-30-00-918-802-A - Consumable Materials Index For The Engine (Pratt & Whitney)Document124 pages70-30-00-918-802-A - Consumable Materials Index For The Engine (Pratt & Whitney)victorNo ratings yet

- Top Ten Helicopter Checkride TipsDocument35 pagesTop Ten Helicopter Checkride TipsAbhiraj Singh SandhuNo ratings yet

- Indian Consumer - Goldman Sachs ReportDocument22 pagesIndian Consumer - Goldman Sachs Reporthvsboua100% (1)

- Collection of Solid WasteDocument38 pagesCollection of Solid WasteMuhammad UsmanNo ratings yet

- DMP 2021 TPJ SRDocument275 pagesDMP 2021 TPJ SRishu sNo ratings yet

- Hood Design Using NX Cad: HOOD: The Hood Is The Cover of The Engine in The Vehicles With An Engine at Its FrontDocument3 pagesHood Design Using NX Cad: HOOD: The Hood Is The Cover of The Engine in The Vehicles With An Engine at Its FrontHari TejNo ratings yet

- Hospital Management System DatabaseDocument18 pagesHospital Management System DatabasesamdhathriNo ratings yet

- History of Phosphoric Acid Technology (Evolution and Future Perspectives)Document7 pagesHistory of Phosphoric Acid Technology (Evolution and Future Perspectives)Fajar Zona67% (3)

- French Revolution EssayDocument2 pagesFrench Revolution Essayapi-346293409No ratings yet

- GGSB MibDocument4 pagesGGSB MibShrey BudhirajaNo ratings yet

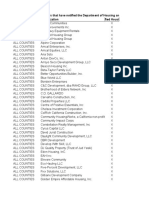

- Ab 1486 Developer Interest ListDocument84 pagesAb 1486 Developer Interest ListPrajwal DSNo ratings yet

- Guide On Multiple RegressionDocument29 pagesGuide On Multiple RegressionLucyl MendozaNo ratings yet

- Far160 Pyq Feb2023Document8 pagesFar160 Pyq Feb2023nazzyusoffNo ratings yet

- A88438-23 Critical Procedure 11-01 - Pipeline Cut Outs - A5X9W9Document7 pagesA88438-23 Critical Procedure 11-01 - Pipeline Cut Outs - A5X9W9mahmoudNo ratings yet

- PT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaDocument16 pagesPT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaihsanlaidiNo ratings yet

- PraxiarDocument8 pagesPraxiara_roy003No ratings yet

- Mobile Fire Extinguishers. Characteristics, Performance and Test MethodsDocument28 pagesMobile Fire Extinguishers. Characteristics, Performance and Test MethodsSawita LertsupochavanichNo ratings yet

- Germany's Three-Pillar Banking SystemDocument7 pagesGermany's Three-Pillar Banking Systemmladen_nbNo ratings yet

- An Analytical Study On Impact of Credit Rating Agencies in India 'S DevelopmentDocument14 pagesAn Analytical Study On Impact of Credit Rating Agencies in India 'S DevelopmentRamneet kaur (Rizzy)No ratings yet