Professional Documents

Culture Documents

Motion To Release 2 - Loles

Uploaded by

Helen BennettOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Motion To Release 2 - Loles

Uploaded by

Helen BennettCopyright:

Available Formats

UNITED STATES DISTRICT COURT

DISTRICT OF CONNECTICUT

UNITED STATES OF AMERICA : CASE NO.: 3:10 CR 237 (MRK)

:

v. :

:

GREGORY P. LOLES : July 25, 2011

GOVERNMENTS REPLY MEMORANDUM TO DEFENDANTS MOTION

FOR REVIEW AND MODIFICATION OF ORDER OF DETENTION

Pursuant to Title 18, United States Code, Sections 3142(e) and (f), and 3143, the

Government hereby requests that the defendant continue to be detained prior to trial. However,

the Government submits that the defendant should receive appropriate and adequate medical care

while in the custody of the Bureau of Prisons and/or the United States Marshal and his designee.

I. ELIGIBILITY OF CASE

This case is eligible for pretrial detention and pre-sentence detention because this Court

simply can not find by clear and convincing evidence that the defendant is not likely to flee or

pose a danger to the financial safety of the community if released pursuant to 18 U.S.C. 3142.

See 18 U.S.C. 3143.

The defendant in this case poses a serious risk that he will flee. The evidence gathered

by the Government in this case has established that the defendant has, in the past, had access to a

tremendous amount of money from abroad, more specifically over $14 million from an entity

located in Greece. The defendant speaks a foreign language (Greek), has conducted business

abroad and in fact a number of witnesses have indicated that he has done so. The defendant has

traveled overseas extensively, has relatives in Greece, and even has an ownership stake in an

apartment in Greece. Extraditing the defendant from Greece may prove to be difficult given the

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 1 of 18

fact that the counts to which he is expected to enter a plea of guilty include securities fraud and

money laundering.

II. REASON FOR DETENTION

The court should detain defendant because there are currently no conditions of release

which will reasonably assure the defendants appearance as required pursuant to the Bail Reform

Act and because the defendant can not establish by clear and convincing evidence that he is not

likely to flee or pose a danger to the financial safety of the community if released. See 18 U.S.C.

3143.

III. VIOLATIONS AND PENALTIES

The defendant was charged in a 32-count indictment with violations of mail fraud in

violation of 18 U.S.C. 1341; wire fraud in violation of Title 18 U.S.C. 1343; securities fraud

in violation of violation of Title 15 U.S.C. 78j(b) and 78ff and Title 17 Code of Federal

Regulations Section 240.10b-5; and money laundering, in violation of Title 18 U.S.C. 1957

and 1956(a)(1)(B). The defendant has agreed to plead guilty to four counts of the thirty-two

counts charged in the Indictment. Specifically, the defendant has agreed to plead guilty to one

count of mail fraud, one count of wire fraud, one count of securities fraud, and one count of

money laundering.

As alleged in the Indictment, the defendant, knowingly and willfully devised and

intended to devise a scheme and artifice to defraud and to obtain money and property by means

of false and fraudulent pretenses representations and promises. In the executing scheme to

defraud he used the mails, interstate wires, sold fraudulent securities, and laundering the

proceeds to conceal and disguise the source and ownership of the funds.

2

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 2 of 18

Defendant resided in Connecticut and owned and operated Apeiron Capital Management,

Inc. (Apeiron Capital). The defendant controlled bank accounts at certain financial institutions

including among others, accounts at Citibank in the names of Apeiron Capital, Knightsbridge

Holdings, Farnbacher Loles, Farnbacher Loles Motorsports, Farnbacher Loles Racing, and

Farnbacher Loles Street Performance.

Apeiron Capital was an investment adviser and broker dealer registered with the U.S.

Securities and Exchange Commission (SEC) from 1995 through 1998, at which point the

registrations were cancelled. The defendant continued to operate Apeiron as an unregistered

investment adviser and falsely represented Apeiron to be a registered investment management

firm. Apeiron was not registered as an investment company, investment adviser, broker dealer,

or in any other capacity with the SEC, with the Financial Industry Regulatory Authority

(FINRA) or its predecessor entity the National Association of Securities Dealers (NASD),

and it was not licensed by the State of Connecticut.

The defendant was the majority owner and managing member of Farnbacher Loles Motor

Sports, Farnbacher Loles Racing, Farnbacher Loles Street Performance, and various other

Farnbacher Loles businesses (collectively Farnbacher Loles). Farnbacher Loles, with its

principal place of business in Danbury, Connecticut, was engaged in the business of professional

race team operations and servicing high-performance automobiles. Farnbacher Loles managed,

operated, and competed in various automobile races and high performance motor-sports events

held throughout North America and elsewhere, and provided service and maintenance for

customers who owned high-end performance automobiles.

3

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 3 of 18

The defendant operated as an unregistered investment adviser by, among other ways,

falsely and fraudulently representing himself to be a registered investment adviser and

representing Apeiron to be a registered investment management firm.

The defendant falsely represented to numerous victim-investors, including individuals

who were his friends and were parishioners of a Church in Orange, Connecticut (the Church or

S.B.C.) that he would act as their investment adviser and invest their funds through Apeiron in

various securities including in what he described as Arbitrage Bonds. The defendant falsely

represented to victim-investors that he would invest their funds in Arbitrage Bonds which would

purportedly pay a safe and steady return. In truth and in fact, the Arbitrage Bonds did not exist.

The defendant was selected to serve on the board of the Churchs Endowment Fund, and

falsely represented that he would use his knowledge and expertise as an investment adviser to

manage the Churchs investment funds, including the Endowment Fund and the Building Fund

by investing in, among other things, the above-described Arbitrage Bonds.

The defendant falsely represented to the victim-investors, including the Churchs

Endowment Fund Board and other members of the Church, that he could achieve and was

achieving a consistent and positive return on the investment funds, including through his

investment in the Arbitrage Bonds.

The defendant solicited investments from investors he met through the Church and others

he met through his Farnbacher Loles racing business, and made false and fraudulent

representations to victim-investors including, among other things, that:

a. He had invested the Churchs Endowment Fund in Arbitrage Bonds;

b. He worked with and had relationships with brokers from major investment

firms, known to the Grand Jury, who invested funds for him;

4

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 4 of 18

c. He managed approximately $240 million that was comprised in part of

money from Greek shipping companies and his wifes family money; and

d. He was a fund manager for five or six wealthy Greek families.

The defendant took investors funds based on false and fraudulent pretenses, including

funds from the Churchs Endowment Fund and Building Fund, as well as individual victim-

investors funds that had previously been invested in IRAs, 401(k)s, and represented the

proceeds of life insurance payments.

The defendant falsely represented to certain other investors that he would invest their

money in Initial Public Offerings (IPOs) that were scheduled to occur in the near future and

into which he had the opportunity to invest.

The defendant entered into investment contracts and falsely represented to clients of

Farnbacher Loles that, in exchange for an advance of funds, he would pay them an interest rate

on their funds and provide them collateral (i.e., a secured interest) in the form of a bill of sale

with buyback option for a sport racing automoblie, when as he well knew, the promise of

collateral was fraudulent because he had made the same representations to others and the

collateral was already encumbered.

The defendant caused numerous victim-investors to invest more than $10 million with

him and Apeiron. The defendant failed to invest the money as represented, and instead diverted

investors funds for his own personal use and benefit, including to pay personal expenses such as

credit card bills, and to distribute large amounts of the funds to Farnbacher Loles.

In order to create the appearance of legitimacy, the defendant provided investors

documents including fraudulent account statements that contained false and fraudulent

5

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 5 of 18

representations, including among others, false transactions, false prices for the fictitious

securities, and false balances.

The defendant sought to lull investors into believing that their investment funds had been

invested as represented and prevented and forestalled the discovery of the true use of investors

funds by, among other ways, issuing periodic payments to the investors purportedly representing

interest on their investments or partial return of capital, when in truth and in fact, there were no

actual investments, and the defendant used portions of other victim-investors funds to make

such payments.

The defendant took victim-investor funds and transfer them to Farnbacher Loles accounts

to conceal the true source of funds, and similarly would and did transfer funds to an account he

controlled in the name of Knightsbridge Holdings to disguise the nature and source of the funds

and to make it appear that checks drawn on the Knightsbridge Holding account were actually

proceeds from the Arbitrage Bonds.

The statutory maximum penalty for each count to which the defendant has agreed to

plead guilty is twenty (20) years and a fine, pursuant to 18 U.S.C. 3571(d) of twice the gross

gain or loss, which is currently estimated as high as approximately $17 million.

1

The Government calculates defendants possible sentencing range, using the 2010

version of the United States Sentencing Guidelines, to roughly a level 30. This calculation is

only an estimate for the benefit of the Court to determine his possible risk of flight and presumes

the sentencing court would find each of the below listed specific offense characteristics and role

1

The Government currently estimates the loss to the victims to be approximately

$8.7 million.

6

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 6 of 18

in the offense enhancements to be applicable, while noting additional factors may also be

relevant.

Specifically, the defendant's base offense level under U.S.S.G. 2B1.1 is 7. The offense

level should be increased by 20 based on a loss between $7,000,000 and $20,000,000 pursuant to

U.S.S.G. 2B1.1(b)(1)(K). The offense level could further be increased by 2 levels pursuant to

U.S.S.G. 2B1.1(b)(2)(A) for 10 or more victims. The offense level could also be increased by

2 levels because the defendant represented himself to be working on behalf of a religious

organization 2B1.1(b)(8), the offense level could also be increased by 2 levels because the

defendant abused a position of public or private trust pursuant to U.S.S.G. 3B1.3. This would

place the defendant in a sentencing range of 97 - 121 months. Regardless of the eventual

Guidelines determination the defendant is facing a significant amount of time. This factor

weighs heavily in support of detention.

IV. LEGAL DISCUSSION AND BASIS FOR DETENTION

Under 18 U.S.C. 3143(a)(1), a court shall order that a person who has been found

guilty of an offense and who is awaiting imposition or execution of sentence . . . be detained,

unless the judge finds by clear and convincing evidence that the person is not likely to flee or

pose a danger to the community (emphasis added). In United States v. Abuhamra, 389 F.3d

309, 320 (2d Cir. 2004), the Second Circuit held that 3143 creates a presumption in favor of

detention. The court stated:

[W]e are mindful that Congress has itself weighted the procedural balance quite

decidedly in favor of the government. As already noted, 18 U.S.C. 3143(a)(1)

creates a presumption in favor of detention; it places the burden on the defendant to

defeat that presumption; and it requires the defendant to carry that burden by clear

and convincing evidence, not by a mere preponderance. Only if a defendant clears

these high procedural hurdles is he entitled to release pending sentencing.

7

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 7 of 18

389 F.3d at 320 (emphases added). The Second Circuit explained that to secure release on bail

after a guilty verdict, a defendant must rebut this presumption with clear and convincing

evidence that he is not a risk of flight or a danger to any person or the community. Id. at 319.

The Bail Reform Act of 1984 provides that a court should order a defendant detained if

no conditions or combination of conditions will reasonably assure the appearance of the person

as required. 18 U.S.C. 3142(e). Among the factors that a district court must take into account

in conducting this inquiry are: (i) the nature and circumstances of the offense charged, 18

U.S.C. 3142(g)(1); (ii) the weight of the evidence against the person, 18 U.S.C.

3142(g)(2); (iii) the history and characteristics of the person, 18 U.S.C. 3142(g)(3); and (iv)

the nature and seriousness of the danger to any person or community that would be posed by the

persons release. 18 U.S.C. 3142(g)(4). Included in the history and characteristics of a

person are, inter alia, his character, family ties, employment, financial resources, length of

residence in the community, community ties, past conduct, and record concerning appearance at

court proceedings. 18 U.S.C. 3142(g)(3)(A). See United States v. Hollender, 162 F. Supp.2d

261, 264 (S.D.N.Y. 2001) (detaining defendant on the basis of risk of flight where defendant had

been indicted of over 30 counts of fraud and faced a total of 121-151 months of imprisonment).

A. The Nature and Circumstances of the Crimes Charged

The defendant is a U.S. citizen who poses a serious risk of flight and for which there are

no conditions of release which will reasonably assure his appearance as required. Based on the

nature and circumstances of the crimes charged, the defendant should be detained.

8

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 8 of 18

1. The Defendant has had Access to a Tremendous Amount of Cash

The defendant has demonstrated the ability to acquire tremendous amounts of cash in

short periods of time from both domestic and foreign contacts. His ability to raise money

domestically is reflected in the crimes charged. However, as set forth in the attachment, the

defendant has also received deposits totaling over $14 million dollars from abroad. Specifically

from a Panamanian company that was created by a friend of the defendant who is believed to

have lived in Greece prior to his passing away and then he continued to receive wire transfers

from the individuals son. (Exhibits A & B). His foreign contact is believed to have created an

entity in the Channel Islands, which engaged in importation of certain medical devices. Cash

was sent to the defendant where it was parked to avoid detection. Loles used this money to

further the Ponzi scheme and to support his car racing business. Clearly the defendant is an

individual who can procure significant amounts of money from his foreign associates. Thus, he

potentially has access to funds he can use to support himself, thereby rendering him a significant

flight risk. See Hollender, 162 F. Supp.2d at 264. This factor alone is sufficient to detain the

defendant.

B. The Weight of the Evidence is Substantial as is the Potential Punishment

The Government asserts that the weight of the evidence against the defendant is

overwhelming as demonstrated by his anticipated guilty. The Government has collected

documents and witness statements proving that the defendant has made multiple misstatements

to numerous investors. These misstatements are repeated in the literature distributed by the

defendant. In short, the Governments case is strong and thus, the overwhelming amount of

evidence militates strongly in favor of detention. Moreover, the fact that the defendant lied to

9

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 9 of 18

his friends and colleagues in executing the fraud militates heavily in favor of detention as he may

well lie to the Court to secure an opportunity to flee.

Furthermore, the potential punishment facing the defendant is also a significant factor to

consider. As courts in this circuit have held, the severity of the punishment facing the defendant

is a relevant factor which bears upon the risk of flight. See United States v. Davidson, No. 92-

CR-35, 1992 WL 144641, at *6 (N.D.N.Y. June 18, 1992). Here the defendant faces not only a

significant statutory maximum but also under the Sentencing Guidelines, the defendant could

face a sentencing range of 97-121 months or more in prison and a fine in the millions of dollars.

This factor also weighs in support of detention.

C. Personal History and Characteristics

The defendant ties to the community are slight. He is divorced and his three grown

children live outside Connecticut. Due to the nature of his offenses, he has, for all intents and

purposes, cut all significant ties, and burned all bridges with the members of his community.

Both his religious community and his business contacts were victimized by his crimes. He

simply has no reason to stay in Connecticut or even the United States.

To the contrary, witnesses have indicated that he has extended family in Greece. His

step-mother owns a duel apartment building in Greece (two adjacent apartments) such that when

she dies, Loles will accept responsibility and ownership of the apartment. Furthermore, a review

of defendants travel has revealed that the defendant has had extensive foreign travel, including

the following: Malta (1990), Italy (1988, 1991), France (1987), The United Kingdom (1990,

1998, 2000, 2001, 2002, 2003, 2007), Spain (2001), The Dominican Republic (2001, 2008),

Greece (1998, 2000, 2008), Germany (2001, 2004, 2008). (Exhibit C).

10

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 10 of 18

Additionally, the circumstances of the crime occurring over an extended period of time

reflect upon the characteristics of the person. This is not a one time mistake, or a momentary

lapse of judgment. This crime was perpetrated over years and years. The defendant took money

from friends, widows, his parish priest, and the church itself. Moreover, he did not use the

money in an attempt to help others or to make ends meet. In contrast, he used the funds to

support a race car hobby in which he enjoyed racing sport racing vehicles (Porsches) and

traveling around the country and the world going to races. Victims investment funds were

diverted to cover thousands of dollars personal and business of credit card bills. In short, his

personal characteristics would militate in favor of detention.

D. Danger to the Community

Based on the significant evidence the Government has gathered in this matter, it is

obvious that the defendant has been engaged in illegal conduct for a significant length of time.

Were the defendant to be released on conditions, there is a significant likelihood that his illegal

conduct would continue; at a minimum in order for the defendant to support himself by spending

the fraudulently obtained proceeds. This illegal conduct about which the Government is

concerned, includes the continued mail fraud, wire fraud and money laundering in violation of

Title 18 U.S.C. Sections 1341, 1343, and 1956. Thus, this defendant poses a real economic

threat to the community.

The legislative history of the Bail Reform Act of 1984 makes clear that Congress

intended that the safety of any other person or the community language in Section 3142 was

expected to be given a broad construction. See S. Rep. No. 225, 98th Cong., 1st Sess. 12 (1983),

reprinted in 1984 U.S.C.C.A.N. 3182, 3195 (The reference to safety of any other person is

11

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 11 of 18

intended to cover the situation in which the safety of a particular identifiable individual, perhaps

a victim or witness, is of concern, while the language referring to the safety of the community

refers to the danger that the defendant might engage in criminal activity to the detriment of the

community. The Committee intends that the concern about safety be given a broader

construction than merely danger of harm involving physical violence.) (emphasis added). This

broad construction is equally applicable in the post conviction pre-sentencing phase as well.

Courts have appropriately construed the statute to find that protection of the community from

economic harm is a valid objective of bail conditions. See United States v. Schenberger, 498 F.

Supp. 2d 738, 742 (D.N.J. 2007) (holding that [a] danger to the community does not only

include physical harm or violent behavior and citing the Senate Committee Report language

reproduced above); United States v. Persaud, No. 05 Cr. 368, 2007 WL 1074906, at *1

(N.D.N.Y. Apr. 5, 2007) (concurring with the Magistrate Judge that economic harm qualifies as

a danger within the contemplation of the Bail Reform Act); United States v. LeClercq, No. 07-

80050-cr, 2007 WL 4365601, at *4 (S.D. Fla. Dec. 13, 2007) (finding that a large bond was

necessary to, among other things, protect the community from additional economic harm);

United States v. Gentry, 455 F. Supp. 2d 1018, 1032 (D. Ariz. 2006) (in a fraud and money

laundering case, in determining whether pretrial detention was appropriate, the court held that

danger to the community under Section 3142(g) may be assessed in terms other than the use of

force or violence ... [including] economic danger to the community).

It is well settled that the principle that economic harm may be considered as relevant in

considering possible danger to the community in the post-conviction context pursuant to 18

U.S.C. 3143. See United States v. Reynolds, 956 F.2d 192, 193 (9th Cir. 1992)

12

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 12 of 18

(post-conviction for mail fraud and witness tampering, the court held that danger may, at least

in some cases, encompass pecuniary or economic harm.); United States v. Provenzano, 605

F.2d 85, 95 (3rd Cir. 1979) (in a pre-1984 Bail Reform Act case, post-conviction, the Court

rejected an application for bail finding that danger to the community is not limited to harms

involving violence). See, e.g., United States v. Zaragoza, No. Cr-08-0083 (PJH), 2008 WL

686825, at * 3 (N.D.Cal. Mar. 11, 2008) (citing the principle regarding pecuniary or economic

harm from Reynolds in the context of a pretrial detention analysis).

Accordingly, economic danger to the community can provide a basis for detention under

the Bail Reform Act. United States v. Delker, 757 F.2d 1390, 1393 (3d Cir. 1985); see also

United States v. Reynolds, 956 F.2d 192, 193 (9th Cir. 1992); United States v. Vance, 851 F.2d

166 (6th Cir. 1988) (discussing detention in a post-conviction context). As the court noted in

United States v. Harris, The danger against which a court must safeguard encompasses much

more than the risk of physical violence. . . . Often it is economic or pecuniary interests of a

community rather than physical ones which are most susceptible to repeated danger by a released

defendant. 920 F. Supp. 132, 133 (D. Nev. 1996). Cf. United States v. Masters, 730 F. Supp.

686, 689 (W.D.N.C. 1990) (finding in a case of bail pending appeal Court believes it must also

consider the danger of a person who continues to participate in possibly fraudulent schemes. ...)

Most recently in the much publicized case of United States v. Madoff, the Second Circuit

articulated that economic danger to the community is a basis for detention under the Bail Reform

Act. United States v. Madoff, 316 Fed. Appx. 58, 59-60 (2d. Cir. 2009). In enacting the Bail

Reform Act, Congress was concerned not only with potential harm to victims or witnesses, but

with the safety of the community as a whole. United States v. Dono, 275 Fed. Appx. 35, 38

13

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 13 of 18

(2d. Cir. 2008). As the court noted in Madoff, danger may, at least in some cases, encompass

pecuniary or economic harm. Madoff, 316 Fed. Appx. at 60.

Turning to this matter, the defendant appears to have no current legitimate source of

income and no ties to the community, the Government contends that were he to be released on

conditions, he could further deplete any remaining available assets of his victim-clients and this

would be economic harm to the community. The Government further asserts that were the

defendant to be released on conditions he could easily engage in some type of fraud and he did

for nearly a decade.

V. THE DEFENDANT CAN RECEIVE ADEQUATE MEDICAL CARE IN PRISON

The defendant claims that his spinal disk problems and related pain have become

exacerbated while he has been detained at the Wyatt Detention Center, and that he has received

insufficient treatment for his condition. The Second Circuit has explained that exceptions to

prison confinement will only occur in extreme situations. Sapia v. United States, 433 F.3d 212,

219 (2d Cir. 2005). This rules out most illnesses and other physical conditions. For example,

the Second Circuit has found that in the sentencing context a heart condition by itself is not

necessarily a reason to depart downwardly under the Guidelines. United States v. Napoli, 179

F.3d 1, 18 (2d Cir. 1999). In accord with other Circuits, the Second Circuit has found that a

qualifying impairment is one that cannot be adequately cared for in the prison system. United

States v. Garcia, 45 Fed. Appx. 21, 22-3; 2002 WL 1990335, 1 (2d Cir. 2002); see also United

States v. Martinez, 207 F.3d 133, 139 (2d Cir. 2000); United States v. Persico, 164 F.3d 796, 806

(2d Cir. 1999); United States v. Altman, 48 F.3d 96, 104 (2d Cir. 1995).

14

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 14 of 18

Thus, the critical question is not whether defendant has some medical problems or

difficulties, he no doubt should receive regular appropriate medical treatment and care the

inquiry is rather, whether his medical problem can be treated in prison. See, e.g., United States

v. Sherman, 53 F.3d 782, 788 (7th Cir. 1995) (citing footnote that quotes the Department of

Justice, A Judicial Guide to the Bureau of Prisons -- There are virtually no medical problems

that the Bureau's health care delivery system cannot respond to adequately, either within its

institutions or on a contract consultant basis . . . .). Indeed, the Bureau of Prisons currently

cares for thousands of inmates with such serious medical conditions as hypertension, carotid

artery disease, arteriosclerotic heart disease, cardiac arrhythmia, and/or congestive heart failure.

United States v. Cutler, 520 F. 3d 136, 172 (2d. Cir. 2008). The Cutler court, addressing

allegations that a prisoner did not receive adequate treatment in prison for his heart condition,

noted the lack of evidence for the claim, and added that if there is evidence to support the

finding that the BOP is incapable of providing prompt response to inmates emergency medical

needs, . . . it is in the best interest of a humane society that any such evidence be disclosed. Id.

at 175.

2

The Government asserts that defendant should get appropriate medical treatment.

However, by virtue of the fact that pursuant to 18 U.S.C. 3143, the defendant must be detained,

2

A decision to detain the defendant does not necessarily end the inquiry of whether the

defendants medical condition can be addressed while he is in custody. In the event the Bureau

of Prisons concludes, after adequate investigation, that he cannot receive adequate medical

attention, or that his condition has deteriorated beyond the Bureau of Prisons expertise, the

Bureau of Prisons can remedy the situation. See, e.g., 18 U.S.C. 3582(c) (Bureau of Prisons

may move the district court to reduce the term of imprisonment for extraordinary and compelling

reasons, including needed medical care as set forth in 18 U.S.C. 3553(a)(2)(D)). Thus, a

decision to remand the defendant at this time does not prevent a release from Wyatt to the

Marshals custody for treatment in light of additional compelling medical information.

15

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 15 of 18

he does not now get the luxury of choosing a doctor, or team of doctors, to examine and treat his

back. The Government is certainly not unsympathetic to his physical ailments and the

corresponding pain he may be feeling and believes that the Bureau of Prisons, the United States

Marshal or the Marshals designee (Wyatt) should make sure that he is cared for appropriately.

However, with incarceration and detention come some realities regarding medical options and

the reality is that he can be treated by the detention centers medical staff.

In this regard, the defendant has completely failed to meet his burden of demonstrating

that his physical condition cannot be adequately addressed by the Bureau of Prisons or the

medical staff of the facility where he is currently housed. He simply cannot establish that his

medical condition is an extreme situation warranting a release from custody. Nothing

submitted at this point by the defendant establishes that he cannot receive adequate medical

treatment at the current facility.

Finally, the Government has not yet been able to determine to position of the United

States Marshals Service with regard to this matter and respectfully suggests that it may be

appropriate for the Court to consider the position of the United States Marshal for the District of

Connecticut prior to granting any modification of the defendants current detention order.

16

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 16 of 18

VI. CONCLUSION

For the reasons set out above, the Government respectfully moves this Court to keep the

defendant detained as there are no combination of conditions that could assure his appearance as

required and there is no evidence that his medical needs cannot be met by the Bureau of Prisons

or the facility at which he is currently held.

Respectfully submitted,

DEIRDRE M. DALY

ACTING UNITED STATES ATTORNEY

/s/ Michael S. McGarry

MICHAEL S. McGARRY

ASSISTANT U.S. ATTORNEY

Federal Bar No. CT 25713

157 Church Street, 23

rd

Floor

New Haven, CT 06510

Tel.: (203) 821-3700

Fax: (203) 773-5378

michael.mcgarry@usdoj.gov

17

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 17 of 18

CERTIFICATE OF SERVICE

I hereby certify that on July 25, 2011, a copy of the foregoing GOVERNMENT'S

REPLY MEMORANDUM TO DEFENDANT'S MOTION FOR REVIEW AND

MODIFICATION OF ORDER OF DETENTION was filed electronically and served by mail on

anyone unable to accept electronic filing. Notice of this filing will be sent by e-mail to all

parties by operation of the Court's electronic filing system or by mail to anyone unable to accept

electronic filing as indicated on the Notice of Electronic Filing. Parties may access this filing

through the Court's CM/ECF System.

/s/Michael S. McGarry

MICHAEL S. MCGARRY

ASSISTANT U.S. ATTORNEY

18

Case 3:10-cr-00237-MRK Document 39 Filed 07/25/11 Page 18 of 18

Exhibit A

Case 3:10-cr-00237-MRK Document 39-1 Filed 07/25/11 Page 1 of 2

I ransaction No. 11

c.:patabase Information

The current Database Is: FTNTXN

GID: F3072250006901 Adj : ,

Val cit : 13-AUG-G7 Db amt : 5OO,000.OOIUSD Status: FINAL

Ins dt : 13-Aug-2007 Cr amt : 5OO,OOO.00JUSD Pre typ : CLEAN

Rem ref: FTS070813674noo Rei ref: TXN typ :

In src : FED MOP: BOOK

In ref: IMAD 070813B1Q8153COO2949 Out ref:

DBT: F 021000018 COT: 3023

BANK OF NEW YORK APEIRON CAPITAL MANAGEMENT INC

1 WALL STREET 451 JUDDRP

FLOOR 8 EASTON CT 06612

NEW YORK, NY10015,

Transaction Information

GID: F3072250006901 Adj:

Value Date: 13-AUG-07 Debit Amount 5OO,000.00lUSD Status: FINAL

Instruction Date: 13-Aug-2007 Credit Amount: 5OO,OOO.00lUSD Processing Type: CLEAN

Remitter Reference: FTS070813J;74nOO Related Reference: Transaction Type:

In Source: ,FED ' Method of Payment: BQOK

In Re,ferenee: IMAD070813B1Q8153C002949 Out Reference:

DEBIT PARTY CREDIT PARTY

DebitAcct: 0018 Credit Acct: 3023 '

Oeblt AmOunt: 500,ooO.OOlUSQ' Credit Amount: 5OO,Ooo.000SO

Debit Value: 13:.AUG-G7

SANK' OF NEW YORK

APEIRON CAPITAL MANAGEMENT INC

1. WALL STREET ' '

451 JUDD'RD

FLO,OR8

EASTON CT 06612

NEW YORK, NY1oo15

Method of

Method of Advice: LTR

'Payment: ' NOTSP

Method of' Advice: APEIRON CAPitAf- MANA,

ORIGINATOR BENEFICIARY

N . BNF:

ORG: , 3710

MlumRY HOLDINGS SA

71 B LEVIDI STREET

ATHENS GREECE

,,,OA:

ORIGINATOR TO BENEFICIARY If\lFO

IRFBIMILSURY HOLDING S L TDACM 299608

039

BANK TO BANK

Debit: oo18 Credit: 3023

No Dbauth: N

Verify ID: RepairlD:

Bene charge: DEBIT, Bene amt: O.OOIUSD

ORIGINATING BANK PAYING BANK

0239

' Rrv A TE BANK LIMITED

LECONFIELD HOUSE, CURZON STREET

Case 3:10-cr-00237-MRK Document 39-1 Filed 07/25/11 Page 2 of 2

Exhibit B

Case 3:10-cr-00237-MRK Document 39-2 Filed 07/25/11 Page 1 of 3

Case 3:10-cr-00237-MRK Document 39-2 Filed 07/25/11 Page 2 of 3

Case 3:10-cr-00237-MRK Document 39-2 Filed 07/25/11 Page 3 of 3

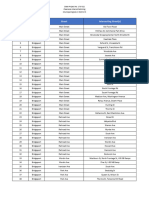

Exhibit C

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 1 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 2 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 3 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 4 of 27

.' ,. "' . .. ..

u; . ,...

.. _.._ ....c...... '.' .........\.D .. ..... '.... . ... .. .................. .

; ..(. .

i -7'''''',

I".

.

. ,

,

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 5 of 27

Visas

omttR

..

18 JlJN t990

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 6 of 27

~ ABPOI\IIYIRNAa

I, BNQN

, 2 ',MAR 1 9 ~ O ,

.' 110402 ... .

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 7 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 8 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 9 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 10 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 11 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 12 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 13 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 14 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 15 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 16 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 17 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 18 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 19 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 20 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 21 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 22 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 23 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 24 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 25 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 26 of 27

Case 3:10-cr-00237-MRK Document 39-3 Filed 07/25/11 Page 27 of 27

You might also like

- West Hartford Proposed budget 2024-2025Document472 pagesWest Hartford Proposed budget 2024-2025Helen BennettNo ratings yet

- Finn Dixon Herling Report On CSPDocument16 pagesFinn Dixon Herling Report On CSPRich KirbyNo ratings yet

- PURA 2023 Annual ReportDocument129 pagesPURA 2023 Annual ReportHelen BennettNo ratings yet

- Hunting, Fishing, And Trapping Fees 2024-R-0042Document4 pagesHunting, Fishing, And Trapping Fees 2024-R-0042Helen BennettNo ratings yet

- 20240325143451Document2 pages20240325143451Helen BennettNo ratings yet

- South WindsorDocument24 pagesSouth WindsorHelen BennettNo ratings yet

- Pura Decision 230132re01-022124Document12 pagesPura Decision 230132re01-022124Helen BennettNo ratings yet

- Commission Policy 205 RecruitmentHiringAdvancement Jan 9 2024Document4 pagesCommission Policy 205 RecruitmentHiringAdvancement Jan 9 2024Helen BennettNo ratings yet

- Analysis of Impacts of Hospital Consolidation in Ct 032624Document41 pagesAnalysis of Impacts of Hospital Consolidation in Ct 032624Helen BennettNo ratings yet

- 2024 Budget 12.5.23Document1 page2024 Budget 12.5.23Helen BennettNo ratings yet

- 75 Center Street Summary Suspension SignedDocument3 pages75 Center Street Summary Suspension SignedHelen BennettNo ratings yet

- National Weather Service 01122024 - Am - PublicDocument17 pagesNational Weather Service 01122024 - Am - PublicHelen BennettNo ratings yet

- District 3 0173 0522 Project Locations FINALDocument17 pagesDistrict 3 0173 0522 Project Locations FINALHelen BennettNo ratings yet

- Be Jar Whistleblower DocumentsDocument292 pagesBe Jar Whistleblower DocumentsHelen BennettNo ratings yet

- Hartford CT Muni 110723Document2 pagesHartford CT Muni 110723Helen BennettNo ratings yet

- District 3 0173 0522 Project Locations FINALDocument17 pagesDistrict 3 0173 0522 Project Locations FINALHelen BennettNo ratings yet

- CT State of Thebirds 2023Document13 pagesCT State of Thebirds 2023Helen Bennett100% (1)

- District 1 0171 0474 Project Locations FINALDocument7 pagesDistrict 1 0171 0474 Project Locations FINALHelen BennettNo ratings yet

- Crime in Connecticut Annual Report 2022Document109 pagesCrime in Connecticut Annual Report 2022Helen BennettNo ratings yet

- District 4 0174 0453 Project Locations FINALDocument6 pagesDistrict 4 0174 0453 Project Locations FINALHelen BennettNo ratings yet

- District 1 0171 0474 Project Locations FINALDocument7 pagesDistrict 1 0171 0474 Project Locations FINALHelen BennettNo ratings yet

- Voices For Children Report 2023 FinalDocument29 pagesVoices For Children Report 2023 FinalHelen BennettNo ratings yet

- PEZZOLO Melissa Sentencing MemoDocument12 pagesPEZZOLO Melissa Sentencing MemoHelen BennettNo ratings yet

- Final West Haven Tier IV Report To GovernorDocument75 pagesFinal West Haven Tier IV Report To GovernorHelen BennettNo ratings yet

- University of Connecticut Audit: 20230815 - FY2019,2020,2021Document50 pagesUniversity of Connecticut Audit: 20230815 - FY2019,2020,2021Helen BennettNo ratings yet

- Hurley Employment Agreement - Final ExecutionDocument22 pagesHurley Employment Agreement - Final ExecutionHelen BennettNo ratings yet

- 2023lco07279 R00 AmdbDocument8 pages2023lco07279 R00 AmdbHelen BennettNo ratings yet

- PEZZOLO Melissa Govt Sentencing MemoDocument15 pagesPEZZOLO Melissa Govt Sentencing MemoHelen BennettNo ratings yet

- No Poach RulingDocument19 pagesNo Poach RulingHelen BennettNo ratings yet

- 04212023final Report MasterDocument25 pages04212023final Report MasterHelen BennettNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- August 30, 2014Document18 pagesAugust 30, 2014The Delphos HeraldNo ratings yet

- Jonah Mallari y Samar v. People of The PhilippinesDocument2 pagesJonah Mallari y Samar v. People of The PhilippinesMichelle MasalonNo ratings yet

- Notes ObliConDocument4 pagesNotes ObliConSherily CuaNo ratings yet

- CRIMINAL JUSTICE SYSTEM DEFINEDDocument127 pagesCRIMINAL JUSTICE SYSTEM DEFINEDHarrison sajorNo ratings yet

- Japan AirlinesDocument46 pagesJapan AirlinesRafael Kieran MondayNo ratings yet

- United States v. Cox, 1st Cir. (2017)Document29 pagesUnited States v. Cox, 1st Cir. (2017)Scribd Government DocsNo ratings yet

- Macks v. Mosley Et Al (INMATE 2) - Document No. 3Document3 pagesMacks v. Mosley Et Al (INMATE 2) - Document No. 3Justia.comNo ratings yet

- PALS Civil ProcedureDocument150 pagesPALS Civil ProcedureLou Corina Lacambra100% (2)

- Affidavit on Bombing Incident at Happy Shopping CenterDocument4 pagesAffidavit on Bombing Incident at Happy Shopping CenterBfp-ncr MandaluyongNo ratings yet

- Lawyers and The CourtDocument4 pagesLawyers and The CourtMa. Paulina Carina RafananNo ratings yet

- Ient v. Tullett Prebon, G.R. No. 189158, 11 January 2017Document20 pagesIent v. Tullett Prebon, G.R. No. 189158, 11 January 2017AldrinmarkquintanaNo ratings yet

- Compiled Oblicon DigestsDocument196 pagesCompiled Oblicon Digestscmv mendozaNo ratings yet

- Due Process Upheld in Mass Grave Murder CaseDocument4 pagesDue Process Upheld in Mass Grave Murder Caseevgciik100% (1)

- IRACDocument1 pageIRACMercury2012No ratings yet

- Criminalisation of The JudiciaryDocument21 pagesCriminalisation of The Judiciarymanikandan_vathanNo ratings yet

- Heirs of Ureta Vs UretaDocument24 pagesHeirs of Ureta Vs UretaColBenjaminAsiddaoNo ratings yet

- Attorney Stanford Solomon Accused of Violations and FRAUDDocument105 pagesAttorney Stanford Solomon Accused of Violations and FRAUDFraud RangerNo ratings yet

- Supreme Court upholds fraud defense in property sale disputeDocument5 pagesSupreme Court upholds fraud defense in property sale disputelala reyesNo ratings yet

- Bermudez Vs Castillo - DigestDocument1 pageBermudez Vs Castillo - Digestcmv mendoza100% (1)

- Us V Henthorn, Appellant's Brief, 10th CirDocument36 pagesUs V Henthorn, Appellant's Brief, 10th CirBen MillerNo ratings yet

- CRPC - Introduction Week 1Document10 pagesCRPC - Introduction Week 1Amit Singh khincheeNo ratings yet

- Melissa Anderson-Seeber Judicial Nomination ApplicationDocument63 pagesMelissa Anderson-Seeber Judicial Nomination ApplicationShane Vander Hart100% (1)

- United States v. Edwin Galvez-Berganza, 4th Cir. (2014)Document4 pagesUnited States v. Edwin Galvez-Berganza, 4th Cir. (2014)Scribd Government DocsNo ratings yet

- Hitler Post Card From World War I FoundDocument2 pagesHitler Post Card From World War I FoundDalibor PancicNo ratings yet

- Organ donation ruling highlights consent issuesDocument14 pagesOrgan donation ruling highlights consent issueschristian villamanteNo ratings yet

- Final Exam Set 2Document3 pagesFinal Exam Set 2Lara Delle100% (1)

- Robert Lambert MBE "Rebuilding Trust"Document2 pagesRobert Lambert MBE "Rebuilding Trust"BristleKRSNo ratings yet

- Notice of Libel HUFFINGTON - July 11, 2018Document7 pagesNotice of Libel HUFFINGTON - July 11, 2018Diana DavisonNo ratings yet

- DILG Presentation ADACDocument30 pagesDILG Presentation ADACLouie C. Manarpiis86% (7)

- StatCon Assignment 2Document165 pagesStatCon Assignment 2Charmaine Key AureaNo ratings yet