Professional Documents

Culture Documents

MobileTrends H1-2011

Uploaded by

Bert KokOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MobileTrends H1-2011

Uploaded by

Bert KokCopyright:

Available Formats

a mind for networks

Allot MobileTrends

Global Mobile Broadband Trafc Report

H1, 2011

Allot MobileTrends

Global Mobile Broadband Traffic Report, H1/2011

a Communications Allot mind for networks

Conclusion

The Allot MobileTrends Report highlights how global mobile data bandwidth in general, and OTT applications in particular, continue to grow at a phenomenal rate. The substantial surge in the use of applications such as video streaming, VoIP and social media, shows no sign of slowing down as subscribers increasingly seek out a more stimulating and enriching mobile experience. This shift in the status quo presents a real challenge for mobile operators and threatens their survival. They have already started to respond to this challenge by offering new service plans which monetize the network usage and better reflect the true value of these applications for both the subscriber and the operator. This is the sixth Allot MobileTrends Report to date.

Key Findings from H1, 2011

Global mobile data bandwidth usage grew by 77% in H1, 2011, indicating a CAGR of 213%. 32% of mobile operators are already offering application-aware charging models. Video streaming remains the single largest application type worldwide, accounting for 39% of global mobile data bandwidth. YouTube is responsible for 22% of total global mobile bandwidth, and remains the worlds most popular video streaming website with 52% of global video streaming traffic. VoIP and IM became the fastest growing application types with 101% growth, although they still account for only 4% of global mobile data bandwidth. Skype continues to lead the global mobile VoIP market with a slightly reduced market share of 82%, due in part to the market penetration of applications such as Viber, WhatsApp, ooVoo and more. Facebook and Twitter continue to lead the roster of social networking applications with a substantial 166% and 297% rise in global mobile data bandwidth respectively. File sharing continues to represent 29% of mobile bandwidth. A review of fixed-mobile converged data networks revealed that: Fixed data bandwidth usage grew by 25%, whilst mobile data bandwidth usage grew by 77%. File sharing is the single largest application on fixed networks, accounting for 44% of bandwidth. By contrast, file sharing is responsible for 29% of mobile data networks. Video streaming in fixed networks grew by 41% as opposed to the 93% growth it experienced in mobile networks.

2011 Allot Communications. All rights reserved.

Allot MobileTrends

Global Mobile Broadband Traffic Report, H1/2011

a mind for networks

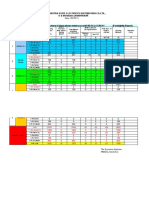

Bandwidth & Application Growth & Breakdown Global Bandwidth and Application Breakdown Application Growth

120% 100% 80% Growth Global Mean: 77% 60% 40% 20% 0% Video Streaming 5% 0% VoIP & IM Web Browsing File Sharing Other Apps File Sharing 29% Video Streaming 39% Web Browsing 25% VoIP & IM 4% Other Apps 3%

Growth in mobile data usage, H1/11

Growth in mobile data usage, H1/11

2011 Allot Communications. All rights reserved.

Mobile data usage broken down by Mobile data usage broken down by top top applications, H1/11

applications, H1/11

2011 Allot Communications. All rights reserved.

The steady growth experienced by global bandwidth since the inception of the Allot MobileTrends Report in 2009 shows no sign of abating, and has continued to rise by 77% during the first six months of 2011 (H1). This is equivalent to a CAGR of 213%. As one of the worlds most dynamic and fastest growing industries, mobile data bandwidth continues to show that it is nowhere close to reaching maturity and that the ride has only just started. Video streaming has continued to grow by an enormous 93%, and remains the single largest application by bandwidth on mobile networks, accounting for a significant 39% of global mobile bandwidth. Video is clearly still king, and the increased integration of multimedia features on mobile internet devices (MIDs) and smartphones, has made this format more accessible and more usable than ever. File sharings growth rate has slowed down slightly to 33%1 which is reflected in the minor decrease in its bandwidth share to 29%, although these typically aggressive application types (P2P and HTTP downloads) are still a major cause of congestion within mobile data networks.

Allot MobileTrends Report H2, 2010

2011 Allot Communications. All rights reserved.

Allot MobileTrends

Global Mobile Broadband Traffic Report, H1/2011

a Communications Allot mind for networks

Application Breakdown

40% 35% 30% 25% 20% 15% 10% 5% 0% Q2/09 Q3/09 Q4/09 Q1/10 Q2/10 Q3/10 Q4/10 Q1/11 Q2/11 Web Browsing Video Streaming File Sharing VoIP & IM

Mobile data usage trends broken down by top applications, Q2/09-Q2/11 Mobile data usage trends broken down by top applications, VoIP and IM have leapt forward to become the fastest growing application type with 101% growth2, 2011 Allot Communications. All rights reserved. although they continue to represent a mere 4% of global mobile bandwidth share. This growth can be explained by a number of factors including the introduction of front facing cameras in tablets and smartphones; the introduction of a variety of new mobile VoIP and IM applications; the ever increasing synergy between these applications and smartphones and MIDs; and by the change in operators attitude towards these types of applications.

Q2/09-Q2/11

Allot MobileTrends Report H2, 2010

2011 Allot Communications. All rights reserved.

Allot MobileTrends

Global Mobile Broadband Traffic Report, H1/2011

a mind for networks

Fixed-Mobile Convergence

Fixed Bandwidth and Application Growth

50% 40% 30% 20% 10% 0% Video Streaming 5% 0% VoIP & IM Web Browsing File Sharing Other Apps Global Mean: 25%

Application Breakdown

Other Apps VoIP & IM 2% 3% Web Browsing 12%

Growth

File Sharing 44%

Video Streaming 39%

Growth in fixed data usage, H1/11

Growth in mobile data usage, H1/11

2011 Allot Communications. All rights reserved.

Fixed data usage broken down by Fixed data usage broken down by top top applications, H1/11

applications, H1/11

2011 Allot Communications. All rights reserved.

With more and more operators looking towards Fixed Mobile Convergence (FMC) as the future, this sixth Allot MobileTrends Report takes a look at FMC networks, highlighting the differences between subscriber behavior and the two network technologies. As might be expected from a more established and mature network system, fixed data growth rates are markedly lower than mobile data growth rates. Global fixed data bandwidth rose by 25% as opposed to 77% in mobile broadband; video streaming in fixed networks grew by 41% as opposed to 93%, and VoIP and IM applications increased by 32% in fixed networks as compared to the massive 101% growth experienced in mobile networks. A review of the application breakdown in fixed data networks reveals interestingly that file sharing is the single largest application type, accounting for 44% of fixed bandwidth, although this may be set to change in the next few years as its growth rate is significantly slower at 15%.

2011 Allot Communications. All rights reserved.

Allot MobileTrends

Global Mobile Broadband Traffic Report, H1/2011

a Communications Allot mind for networks

Charging

Since the first MobileTrends report was issued in 2009, operator awareness of the key applications driving broadband consumption has grown considerably. Our findings show that operators have responded to this challenge by implementing usage and application-aware charging models and service plans. As operators gain a greater understanding of mobile data usage trends they are better able to harness this knowledge in order to Monetize over-the-top applications to reflect the true value of this traffic; Personalize their offerings according to individual subscriber needs; and Optimize the network to deliver maximum throughput at minimal cost.

Charging Trends

Charging Trends

Mobile operators employing application-aware charging models

32%

32% of mobile operators employ application-aware charging models, including: 51% Zero-rating options, usually for social media operator-endorsed applications Partner or 89%

Mobile operators employing Mobile operators 32% employing volume application-aware charging models charging models

89%

2011 Allot Communications.

Mobile operators Mobile operators not 89% ofemploying volume mobile operators employ volume offering models, charging unlimited sometimes in conjunction with capped pricing data plans plans. Over-quota charging models

51% subscribers are usually offered one of the following: Volume top-up reserved. All rights Service plan upgrade

obile operators employing Mobile operators pplication-aware not offering unlimited data harging models

89% plans

Mobile operators employing volume charging models

51%

Mobile operators not offering unlimited 51% of mobile operators sampled do not offer unlimited or flat rate pricing plans. data plans

Many operators who have already moved away from flat-rate pricing plans are considering usage-based charging models

2011 Allot Communications. All rights reserved.

obile operators mploying volume harging models

Mobile operators not offering unlimited data plans

rved.

NOTE: The methodology for this section appears in the MobileTrends Report Methodology towards the end of the report

2011 Allot Communications. All rights reserved.

Allot MobileTrends

Global Mobile Broadband Traffic Report, H1/2011

a mind for networks

VoIP and Instant Messaging VoIP and Instant Messaging Application Breakdown

Yahoo! Messenger 2% Google Talk 1% Other VoIP 12% Windows Live 3% Other IM 12% Google Talk 12%

ICQ 4%

QQ 18% Skype 82%

Windows Live 25% Yahoo! Messenger 29%

Top VoIP applications in mobile Top VoIP applications in mobile broadband, H1/11 broadband, H1/11

2011 Allot Communications. All rights reserved.

Top IM applications in mobile Top IM applications in mobile broadband, H1/11 broadband, H1/11

Skype continues its dominance of the VoIP and IM market accounting for 82% of these application types. However, the market penetration and increased popularity of alternative VoIP and IM applications such as Viber, WhatsApp, ooVoo, Tango and KakaoTalk means that Skypes share of the bandwidth has slightly reduced since H2, 2010, despite its substantial 150% growth over the past six months. The gap between Skype and its competitors is however significant, and neither GoogleTalk, Yahoo! Messenger or Windows Live Messenger are anywhere close to presenting a real threat to Skype. The status quo in IM applications remains largely unchanged in H1, 2011. Yahoo! Messenger continues to be the most popular IM application (in terms of non-VoIP traffic), accounting for almost 29% of global instant messaging bandwidth. Windows Live runs a close second place with 25% of total IM traffic, with QQ, a Chinese language IM application not far behind with 18%. QQs audience resides mainly but not wholly in the APAC region.

2011 Allot Communications. All rights reserved.

Allot MobileTrends

Global Mobile Broadband Traffic Report, H1/2011

a Communications Allot mind for networks

Social Networking Social Networking & Video Sharing

300%

250%

200%

150%

100%

50%

0% Twitter Facebook YouTube

Growthin top social networking and & video sharing applications, H1/11 Growth in top social networking video sharing applications, H1/11

2011 Allot Communications. All rights reserved.

Facebook continued to experience significant growth with a 166% increase in mobile bandwidth, equivalent to a CAGR of 607%. This leading social networking site numbers one third of its overall active users as mobile, and these 250 million mobile users tend to be twice as active as non-mobile users3. The continuing rise in mobile users is due in part to the increasing pre-integration of Facebook within smartphones and MIDs, as well as the increased proliferation of Facebook partnerships with operators who work to deploy and promote Facebook mobile products. Twitter continued its dramatic rise in popularity with a 297% increase in mobile bandwidth during H1, 2011 representing a CAGR of 1400%. With over 200 million tweets per day4, and a new Twitter app registered every 1.5 seconds5, Twitter shows every sign that it will keep on growing as it continues to create a comprehensive micro-blogging ecosystem.

3 4 5

http://www.facebook.com/home.php#!/press/info.php?statistics http://blog.twitter.com/2011/06/200-million-tweets-per-day.html http://blog.twitter.com/2011/07/one-million-registered-twitter-apps.html

2011 Allot Communications. All rights reserved.

Allot MobileTrends

Global Mobile Broadband Traffic Report, H1/2011

a mind for networks

Video Streaming Video Streaming

YouTube 22% YouTube 52%

Other Apps 78%

Other Video Streaming 48%

YouTube as a percentage of total YouTube as a percentage of total global mobile bandwidth, H1/11 global mobile bandwidth, H1/11

2011 Allot Communications. All rights reserved.

YouTube as a percentage of total global YouTube as a percentage of total global mobile streaming, mobile video streaming, H1/11 YouTube H1/11

In H1, 2011 YouTube increased its overall global mobile bandwidth share to a substantial 22%, up from 17% in H2, 2010. Now accounting for a massive 52% of global video streaming traffic6, YouTube remains the worlds most popular video streaming website, despite the downturn in its growth rate from 190% in H2, 2010 to 152% in H1, 20117. HD video, which now accounts for 11% of all YouTube traffic, presents several complex challenges for the operator in maintaining the user experience while delivering a more bandwidth intensive technology. It also presents them with opportunities to monetize this premium service by offering subscribers new service packages and/or deploying content revenue sharing programs.

YouTube HD 11%

YouTube 89%

HD video as a percentage of total YouTube streaming, H1/11

6 7

This is a year-on-year rise of 12% Allot MobileTrends H2, 2010

2011 Allot Communications. All rights reserved.

Allot MobileTrends

Global Mobile Broadband Traffic Report, H1/2011

a Communications Allot mind for networks

App Stores Application Breakdown App Store Share

Other 3% 200% 175% Android Market 13% 150% 125% 100% 75% Apple App Store 84% 50% 25% 0% Android Market 5% Apple App Store Other

App Store Growth

App store share, H1/11 App Store Share, H1/11

2011 Allot Communications. All rights reserved.

App Store Growth, H1/11

0%

App store growth, H1/11

2011 Allot Communications. All rights reserved.

In H1, 2011, Apples App Store preserved its leadership of the app store market with downloads generating 84% of the overall app store download traffic. Although Googles Android Market experienced significant growth during these six months with 196% increase in download traffic, it still remains far behind in terms of bandwidth, accounting for a mere 13% of the download traffic.

10

2011 Allot Communications. All rights reserved.

Allot MobileTrends

Global Mobile Broadband Traffic Report, H1/2011

a mind for networks

MobileTrends Report Methodology

The MobileTrends Report is based on statistics collected from mobile networks around the world, representing more than 250 million subscribers. The detailed information was gathered using the long term reporting capabilities of Allot NetXplorer, Allots centralized management & reporting system. The length of the collection period allows for increased accuracy in the identification of usage trends and patterns, reducing the influence of any temporary events in the monitored networks. The Charging section of this report is based on a survey of more than fifty mobile networks around the world. The information gathered is publicly available on operators websites. The data collected for this report was totally subscriber-anonymous. Subscriber identifying information such as IP addresses, usernames or MSISDN were not retained in the data gathered from the mobile networks.

Glossary

App Stores

App stores refer to a service available to users of smartphones and mobile internet devices, e.g., tablets, netbooks, etc., that enables them to download a wide range of free and paid applications, specifically suited for the particular MID. App Stores include Apple App Store, Google Android Market, BlackBerry App World, Nokia Ovi Store, Palm App Catalog, Windows Marketplace for Mobile and others.

Instant Messaging (IM)

Originally, instant messaging applications delivered real-time text-based communications between two or more users over the internet. Todays IM applications offer a wider range of communication services including video conferencing, voice communications and file transfer. Instant messaging applications include Windows Live!, Yahoo! Messenger, QQ and so on.

Volume Charging

Volume charging is the ability to charge according to the volume of data consumed by different subscribers. By implementing volume charging models, operators can encourages subscribers to adopt a service plan that most suits their data usage patterns and needs.

Web Browsing

Application-aware Charging

Application-aware charging refers to the ability to differentiate and charge for types of applications. By implementing application-aware charging models, operators can offer personalized service plans that best reflect the unique value of different application types to different subscribers.

Video Streaming

Refers to communication directed through video sites including either user generated content (UGC) such as YouTube or content provided by sites such as Hulu, cnn.com and BBC iPlayer.

Refers to HTTP traffic associated with website browsing or other HTTP traffic which is not downloading or streaming. In addition, web browsing also includes apps delivering real time updates and statistics over HTTP.

Zero Rating

Voice over IP (VoIP)

File Sharing

Refers to HTTP download services, in particular from One-Click hosting sites such as RapidShare and Megaupload and P2P applications such as Bittorrent and eMule. In previous reports File Sharing was broken down into Peer-to-Peer and HTTP download.

Refers to software applications that allow users to deliver over IP networks in general and internet in particular. Internet VoIP is provided by a range of applications such as Skype, GoogleTalk and also by most popular Instant Messaging applications. This traffic also includes video calls from these applications.

Zero rating is the ability to discount the use of certain application from the service plan volume quota. By implementing zero rating charging models, operators can differentiate themselves and offer personalized service plans that best reflect their subscribers real needs.

11

2011 Allot Communications. All rights reserved.

a mind for networks

About Allot Communications

Allot Communications Ltd. (NASDAQ: ALLT) is a leading provider of intelligent IP service optimization and revenue generation solutions for mobile and fixed broadband operators and large enterprises. Allots rich portfolio of solutions leverages Dynamic Actionable Recognition Technology (DART) to transform broadband pipes into smart networks that can rapidly and efficiently deploy value added Internet services. Allots scalable, carrier-grade solutions provide the visibility, topology awareness, security, application control and subscriber management that are vital to managing Internet service delivery, enhancing user experience, containing operating costs, and maximizing revenue in broadband networks. For more information, please visit www.allot.com

www.allot.com info@allot.com

Americas: 300 TradeCenter, Suite 4680, Woburn, MA 01801 USA Tel: (781) 939-9300 Toll free: 877-255-6826 Fax: (781) 939-9393 Europe: NCI Les Centres dAffaires Village dEntreprises Green Side, 400 Avenue Roumanille, BP309, 06906 Sophia Antipolis Cedex, France Tel: 33 (0) 4-93-001160 Fax: 33 (0) 4-93-001165 Asia Pacific: 6 New Industrial Road, #08-01, Hoe Huat Industrial Building, Singapore 536199 Tel: +65-6283 8990 Fax: +65-6282 7280 Japan: 4-2-3-301 Kanda Surugadai, Chiyoda-ku, Tokyo 101-0062 Tel: 81 (3) 5297-7668 Fax: 81(3) 5297-7669 Middle East and Africa: 22 Hanagar Street, Industrial Zone B, Hod-Hasharon, 45240, Israel Tel: 972 (9) 761-9200 Fax: 972 (9) 744-3626

D261013 Rev 6

Allot Communications, 07.2011. Specifications subject to change without notice. Allot Communications and the Allot logo are registered trademarks of Allot Communications. All other brand or product names are trademarks of their respective holders.

You might also like

- Traf Cking Fraudulent Accounts: The Role of The Underground Market in Twitter Spam and AbuseDocument17 pagesTraf Cking Fraudulent Accounts: The Role of The Underground Market in Twitter Spam and AbuseBert KokNo ratings yet

- Brands On Twitter Report 2013Document14 pagesBrands On Twitter Report 2013Bert KokNo ratings yet

- More Tweets, More Votes Social Media As A Quantitative Indicator of Political BehaviorDocument11 pagesMore Tweets, More Votes Social Media As A Quantitative Indicator of Political BehaviorTomás AguerreNo ratings yet

- Taking StockDocument58 pagesTaking StockBert KokNo ratings yet

- Marketing Benchmark Report OptifyDocument40 pagesMarketing Benchmark Report OptifyBert KokNo ratings yet

- Twitter Study Nemesis - Which Restaurants Should You Avoid Today?Document9 pagesTwitter Study Nemesis - Which Restaurants Should You Avoid Today?Bert KokNo ratings yet

- Spatio-Temporal Dynamics of Online Memes: A Study of Geo-Tagged TweetsDocument11 pagesSpatio-Temporal Dynamics of Online Memes: A Study of Geo-Tagged TweetsBert KokNo ratings yet

- Happiness and The Patterns of Life: A Study of Geolocated TweetsDocument23 pagesHappiness and The Patterns of Life: A Study of Geolocated TweetsBert KokNo ratings yet

- Can Twitter Replace Newswire For Breaking News?Document4 pagesCan Twitter Replace Newswire For Breaking News?Bert KokNo ratings yet

- Twitter Following ResearchDocument10 pagesTwitter Following ResearchHerman CouwenberghNo ratings yet

- Teens Social Media and PrivacyDocument107 pagesTeens Social Media and PrivacyBert KokNo ratings yet

- What Good Is TwitterDocument40 pagesWhat Good Is TwitterLuciana MoherdauiNo ratings yet

- Strategies For Effective Tweeting - A Statistical ReviewDocument21 pagesStrategies For Effective Tweeting - A Statistical ReviewBert KokNo ratings yet

- The Business of Social Business (Report)Document20 pagesThe Business of Social Business (Report)Bert KokNo ratings yet

- Comscore: Mobile Future in Focus Report 2013Document52 pagesComscore: Mobile Future in Focus Report 2013MobileLeadersNo ratings yet

- Adobe Digital Index ReportDocument8 pagesAdobe Digital Index ReportBert Kok100% (1)

- Twitter TV BookDocument20 pagesTwitter TV BookBert KokNo ratings yet

- Mapping The Geographical Diffusion of New Words On TwitterDocument13 pagesMapping The Geographical Diffusion of New Words On TwitterBert KokNo ratings yet

- Reuters Institute Digital ReportDocument68 pagesReuters Institute Digital ReportBert KokNo ratings yet

- Oriella Digital Journalism Study 2012 Final USDocument12 pagesOriella Digital Journalism Study 2012 Final USBert KokNo ratings yet

- Ipsosmediact Techtracker Report Q2 2012Document37 pagesIpsosmediact Techtracker Report Q2 2012Bert KokNo ratings yet

- Google Ranking Factors Uk 2012Document15 pagesGoogle Ranking Factors Uk 2012Bert KokNo ratings yet

- Effects of Recession On Mood UK PreprintDocument6 pagesEffects of Recession On Mood UK PreprintBert KokNo ratings yet

- The Pulse of News in Social Media - Forecasting PopularityDocument9 pagesThe Pulse of News in Social Media - Forecasting PopularityBert KokNo ratings yet

- Social Networks and Politics PEW ReportDocument16 pagesSocial Networks and Politics PEW ReportBert KokNo ratings yet

- Google Emea Social Report 2012Document17 pagesGoogle Emea Social Report 2012Bert KokNo ratings yet

- New York Times TwitterDocument19 pagesNew York Times TwitterBert KokNo ratings yet

- Credibility of Tweets Cscw2012Document10 pagesCredibility of Tweets Cscw2012Bert KokNo ratings yet

- Speak Up Speak Out ReportDocument8 pagesSpeak Up Speak Out ReportBert KokNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Palm Tower 3 Coverage ReportDocument61 pagesPalm Tower 3 Coverage ReportHassan DaudNo ratings yet

- Cross-Cultural Issues in Business Ethics: John Hooker Carnegie Mellon University June 2007Document28 pagesCross-Cultural Issues in Business Ethics: John Hooker Carnegie Mellon University June 2007modaloves1242100% (2)

- AlarmsReference ME-B 1212 PDFDocument130 pagesAlarmsReference ME-B 1212 PDFNAGENDRA KUMAR DNo ratings yet

- Flow Chart Fixed Column BasesDocument4 pagesFlow Chart Fixed Column BasesstycnikNo ratings yet

- 3530 Nellikuppam Clarifier SpecDocument62 pages3530 Nellikuppam Clarifier Specgopalakrishnannrm1202100% (1)

- SB Pac 1402002 CeDocument11 pagesSB Pac 1402002 CesergeyNo ratings yet

- Vanos E36Document68 pagesVanos E36Jorge SepulvedaNo ratings yet

- Cleaning Krisbow 2013 (Low Res) 2Document12 pagesCleaning Krisbow 2013 (Low Res) 2Andres Agung PerdanaNo ratings yet

- Experiment 1 Phy 360Document14 pagesExperiment 1 Phy 360Mohd Khairul0% (2)

- Physics 05-01 Fluids and DensityDocument2 pagesPhysics 05-01 Fluids and DensityRocelin E. MolabolaNo ratings yet

- Class B BiosolidsDocument9 pagesClass B BiosolidsGissmoNo ratings yet

- Model A360 CatalogDocument12 pagesModel A360 CatalogThomas StempienNo ratings yet

- Misuse of Ai in ArtDocument2 pagesMisuse of Ai in ArtjNo ratings yet

- Call of Duty MG08/15 LMG Weapon WikiDocument1 pageCall of Duty MG08/15 LMG Weapon WikiSelin HNo ratings yet

- Maharashtra State Electricity Distribution Co - LTD., O & M Division, NANDURBARDocument3 pagesMaharashtra State Electricity Distribution Co - LTD., O & M Division, NANDURBARPuru BornareNo ratings yet

- ASME B31.3 2020 CambiosDocument10 pagesASME B31.3 2020 CambiosJosé Juan Jiménez AlejandroNo ratings yet

- Action Stories Lesson 2Document2 pagesAction Stories Lesson 2api-296427690No ratings yet

- DA 65we EnglishDocument2 pagesDA 65we EnglishAlvin NguyenNo ratings yet

- S4L1D-D41 Wdg.311 - Technical Data Sheet - StamfordDocument10 pagesS4L1D-D41 Wdg.311 - Technical Data Sheet - Stamfordscribbles_buddyNo ratings yet

- High-Temp, Non-Stick Ceramic Cookware CoatingDocument3 pagesHigh-Temp, Non-Stick Ceramic Cookware CoatingTomescu MarianNo ratings yet

- Spokane County Sheriff's Internal Communication PlanDocument11 pagesSpokane County Sheriff's Internal Communication Planjmcgrath208100% (1)

- IECDocument52 pagesIECM.r. Munish100% (2)

- Sni+03 6868 2002Document3 pagesSni+03 6868 2002abanghasanNo ratings yet

- Third Party Inspection Report: Industry & Facilities Division Page 1 of 9Document9 pagesThird Party Inspection Report: Industry & Facilities Division Page 1 of 9mustafa nasihNo ratings yet

- PLSQL 4 2 Practice RodrigoDocument6 pagesPLSQL 4 2 Practice RodrigoRodrigoRojasHuerta100% (1)

- Avinash Excat Full ProjectDocument87 pagesAvinash Excat Full ProjectNaguSwamyNo ratings yet

- 32961part Genie Z-45-22Document138 pages32961part Genie Z-45-22johanaNo ratings yet

- Plan for Inspection and Testing of LV Power CablesDocument1 pagePlan for Inspection and Testing of LV Power CablesRami KsidaNo ratings yet

- Fire Safety Equipment SpecificationDocument12 pagesFire Safety Equipment SpecificationRIMEL ASMANo ratings yet

- 66 67wvh8m8dall BLL-2936104Document50 pages66 67wvh8m8dall BLL-2936104ManunoghiNo ratings yet