Professional Documents

Culture Documents

Income Tax Calculation - Tips

Uploaded by

Vishnu CarnicOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Calculation - Tips

Uploaded by

Vishnu CarnicCopyright:

Available Formats

HCL Infosystems Ltd.

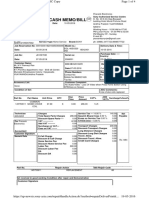

TAX COMPUTATION TIPS FOR THE YEAR 2011-2012 Particulars

A. Income Details BASIC HRA

PSS / INCENTIVE ADV & BALANCE TRANSPORT & CONVEYANCE .ALLOWANCE

PERFORMANCE ALLOWANCE 4 WHEELER ALLOWANCE EDUCATION ALLOWANCE CCA MAIF EXGRATIA / AWARD ANY OTHER ALLOWANCE Total Income : B. Perquisites SOFT-FUR VMR VMIER PETROL DRIVER SAL

CLA PERQ

CLA ADV/SEC DEP PERQ.

GUEST HOUSE PERQ CREDIT-CARD HOUSE REPAIR

LTA

ELECTRICITY & WATER CHARGES WATCH AND WARD EXPENSES MOBILE TELEPHONE MEDICAL EXPENSES PAID BY COMPANY AWARD IN KIND (Items / Free Travel/ etc) HARD FURNISHING LOAN PERQ.

Total Perquisite : C. OTHER INCOME: Income from previous employer

Loss from House Property

Other Income, if any. D. Gross income(A + B + C ) E. Less : Savings Limit u/s 80CCE LIC Pension Plan (u/s 80CCC) NSC Unit Linked Insurance

) ) )

Children Education PF & VPF PPF Infrastructure Bonds 5 yrs time deposit in post office/banks Housing Loan Principal TOTAL F. Less: Others Mediclaim (u/s 80D)

) ) ) ) ) ) )

Disablement (u/s 80DD)

Medical Treatment(u/s80DDB)

Handicapped(u/s 80U)

Higher Education Loan(u/s80E)

80G-Donations-

TOTAL G. LESS: Professional tax deducted. H. TOTAL EXEMPTED AMOUNT (E+F-G) I. Add: Short term Capital Gain TOTAL J. Total Taxable Income (D - H +I ) Gross Tax Less : Tax deducted by Prev. Employer Tax Payable

Education Cess on Tax Secondary & higher education cess on Tax Total Tax Payable ( Tax + cess ) YTD tax deducted YTD surcharge deducted YTD Education cess deducted Total tax Deducted ( Tax + Cess ) Balance tax

TAX COMPUTATION TIPS

100% taxable HRA (on submission of Rent receipts) Least of the following three is exempt from total HRA received during the year 1) Actual HRA received 2) Rent paid minus 10% of basic salary 3) 50% of basic salary for metro cities(I.e. Delhi, Mumbai., Kolkatta and Chennai) or 40% in other cities 100% taxable Rs.800/= PM is exempt, in case employee is not using the Company transport facility. For employees who are getting transport facility, amount recovered from employee is exempted. 100% taxable 100% taxable 100% taxable 100% taxable 100% taxable 100% taxable 100% taxable

100% taxable Exemption only Rs.1800/= per month subject to claim submitted by employee on monthly basis. This is applicable in case the car is owned by Employee Exemption only Rs.900/= per month subject to claim submitted by employee on monthly basis. This is applicable in case the car is owned by Employee 15%/ 10%/ 7.5% as the case may be of total income as per Point no.A or CLA availed whichever is lower. In case of self lease I.e in the name of employee or spouse, gross CLA paid during the year will be treated as Rental income by the Company. CLA Advance & Security Deposit will be treated as interest free loan for employees who are not under CLA and perquisite will be charged as per income tax rules. 15%/ 10%/ 7.5% as the case may be of total income as per Point no. A will be charged in case the Guest House. Taxable 100% taxable

In a block period of 4 years , two LTA's are non taxable to the extent of actual fare on submission of ticket & other related proofs as per LTA Circular. Block Period is 2010 -13 100% taxable 100% taxable Non taxable Amount paid by the company is exempted upto 15K only. However, reimbursement from NIC are fully exempt. Taxable 10% of Hard Furnishing availed till date is taxable. Any Loan given by company more than 20K will be subject to perquisite based on the difference between the interest rate of SBI and Company .

New joinees during the year have to provide Income Certificate from the previous employer alongwith copy of PAN Upto Rs.1.50 Lacs on submission of Bank Certificate & Declaration Form alongwith Possession proof & Ownership proof as per circular Upper limit is 30K in case the purpose of loan is for Repairs and Renovation. As per declaration

Maximum limit is Rs.1 Lac and no upper limit in any category of investment. Additional Rs. 20K for infrastructure bonds Note : Accrued Interest on NSC's is to be discontinued

Upto 15K for self& family. Additional Rs. 15K in case of dependent parents. Rs. 20K in both cases if the person is a senior citizen Upto 50K on submission of Certificate on Prescribed format from Govt Hospital subject to actual bills. Rs. 100K in cae of severe disability Upto 40K on submission of Certificate on Prescribed format from Govt Hospital subject to actual bills.

Only for Self upto 50K on submission of Certificate on Prescribed format from Govt. Hospital. Rs. 75K in case of severe disability Repayment of Interest only for self, spouse, children and a student of whom he is a legal guardian. No upper limit but can be availed for 8 years from the year in which the repayment started. Donation benefit will not be considered by the Company, if not deducted from the salary of the employee by the company.

On production of transaction sale and purchase proofs

In case of Women the tax will be Zero upto income of Rs.1.90Lacs Upto Rs.1.80 Lac = Nil ; Rs.1.80 Lac to Rs.5.00 Lacs = 10%; Rs.5.00 - Rs.8.00 Lacs = 20% & more than Rs. 8.00 Lacs = 30% 2% on Tax payable 1% on Tax payable

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Islami Bank Bangladesh LTD: Cumilla Chawkbazar BR, CumillaDocument1 pageIslami Bank Bangladesh LTD: Cumilla Chawkbazar BR, CumillaA.S.M. YousufNo ratings yet

- Bisb - Bank StatementDocument23 pagesBisb - Bank Statementazstartup.bhNo ratings yet

- Maceda V MacaraigDocument2 pagesMaceda V MacaraigJaz Sumalinog100% (2)

- Philippine Tax Audit ReportDocument2 pagesPhilippine Tax Audit ReportHanabishi RekkaNo ratings yet

- RHB Bank Berhad CashXcess Program TermsDocument3 pagesRHB Bank Berhad CashXcess Program TermsAmy GarrettNo ratings yet

- W-9 Tax FormDocument4 pagesW-9 Tax FormMika DjokaNo ratings yet

- Chapters 3 and 4 Income TaxationDocument24 pagesChapters 3 and 4 Income TaxationJulie Ann BarcaNo ratings yet

- Payment SystemsDocument14 pagesPayment SystemsdestinysandeepNo ratings yet

- Evershed Kroll White Consulting Ledgers Upto 19.02.24Document22 pagesEvershed Kroll White Consulting Ledgers Upto 19.02.24MILINDSWNo ratings yet

- Ronnies Resume 05-15-2017Document3 pagesRonnies Resume 05-15-2017api-363361065No ratings yet

- Activity Sheet General Mathematics Grade 11 S.Y 2021-2022 I. Answer The FollowingDocument2 pagesActivity Sheet General Mathematics Grade 11 S.Y 2021-2022 I. Answer The FollowingKurt Ruzzel BatuigasNo ratings yet

- Microtek Microtek Line Interactive UPS Legend 650 Ups Legend 650 UpsDocument1 pageMicrotek Microtek Line Interactive UPS Legend 650 Ups Legend 650 UpsAriNo ratings yet

- Indian Oil Corporation Limited: Supplier ConsigneeDocument1 pageIndian Oil Corporation Limited: Supplier ConsigneeMONTUPRONo ratings yet

- Chap 13 Statement of Cash FlowsPractice QuestionsDocument7 pagesChap 13 Statement of Cash FlowsPractice QuestionshatanoloveNo ratings yet

- Retirement Option Form: Declaration and Specimen Signature of Accont Holder (S)Document1 pageRetirement Option Form: Declaration and Specimen Signature of Accont Holder (S)Salman ArshadNo ratings yet

- Diferenc Between Tax and FeeDocument1 pageDiferenc Between Tax and FeeAyub ChowdhuryNo ratings yet

- Certificate of Donation: ABS-CBN Lingkod Kapamilya Foundation, IncDocument2 pagesCertificate of Donation: ABS-CBN Lingkod Kapamilya Foundation, IncGuile Gabriel AlogNo ratings yet

- Sony TV repair invoiceDocument4 pagesSony TV repair invoiceMahesh ReddyNo ratings yet

- Kra Pin PDF EditDocument1 pageKra Pin PDF EditFrancis KorirNo ratings yet

- CC - Riesgos, Funciones, Level (ESP-ENG)Document15 pagesCC - Riesgos, Funciones, Level (ESP-ENG)GINANo ratings yet

- Offer LetterDocument2 pagesOffer LetterRICKSON KAWINANo ratings yet

- Year-End/New Year Checklist: Item Action To Be Taken DoneDocument2 pagesYear-End/New Year Checklist: Item Action To Be Taken Donelarryching_884369919No ratings yet

- TaxDocument22 pagesTaxalphecca_adolfo25No ratings yet

- RR No. 6-2001 (Digest) PDFDocument1 pageRR No. 6-2001 (Digest) PDFFrancis GuinooNo ratings yet

- Southern Automobiles LTD.: CNG Station, Dhaka Daily Sales Statement (Shift Wise)Document1 pageSouthern Automobiles LTD.: CNG Station, Dhaka Daily Sales Statement (Shift Wise)Arpita NandiNo ratings yet

- 33 Bir (1914)Document1 page33 Bir (1914)Kimberly MayNo ratings yet

- UPVC Windows Quotation ProjectDocument3 pagesUPVC Windows Quotation ProjectsathishNo ratings yet

- Costing Misty CharmDocument1 pageCosting Misty CharmRachana PanditNo ratings yet

- Diskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Document3 pagesDiskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Hafizd FadillahNo ratings yet

- Ewaybill - Master Steel - 01112019Document1 pageEwaybill - Master Steel - 01112019AshishNo ratings yet