Professional Documents

Culture Documents

US Interest Rates Outlook 2011 - Tug of War

Uploaded by

GeouzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Interest Rates Outlook 2011 - Tug of War

Uploaded by

GeouzCopyright:

Available Formats

INTEREST RATES RESEARCH

December 2010

U.S. INTEREST RATES: OUTLOOK 2011

TUG OF WAR

PLEASE REFER TO THE LAST PAGE FOR ANALYST CERTIFICATION(S) AND IMPORTANT DISCLOSURES

Barclays Capital | U.S. Interest Rates: Outlook 2011

FOREWORD

US rates investors might be forgiven for suffering from whiplash. 2010 has been that kind of a year full of ups and downs. It started promisingly, with the prospect of sustained economic recovery pushing rates higher. The first signs that things were not going to plan came in May, when the European sovereign crisis hit. Investors who had avoided mortgage and corporate credit issues for several years suddenly woke up to credit risks on the sovereign front. Herculean efforts by European policymakers, including a last-minute rescue package for Greece, helped calm nerves. But just as investors were starting to breathe easier, the US economy hit a soft patch. With Greece still in the rearview mirror and the effects of the stimulus starting to fade, many investors as well as policymakers started worrying openly about a double-dip recession. Central banks responded to the twin threats of fragile financial markets and softer data by re-opening the monetary spigots. Markets therefore began pricing in a new round of quantitative easing by Q3, although the Fed actually announced the program only in November. The result a massive rate rally that began in May and peaked in September, pushing yields to all-time record lows in some cases. But the tone has changed once more in the fourth quarter. Data have improved noticeably and fears of a double-dip have faded, and US policymakers seem close to passing a large tax cut/stimulus package that should boost growth. While there was a new round of sovereign headlines out of Europe in November, US bond and equity markets essentially ignored it, suggesting that they now see limited risk of contagion from peripheral Europe. And rates have sold off hard in the belly of the yield curve, bringing them close to May levels. In terms of rate moves, 2011 should be a repeat of 2010, albeit on a smaller scale. We expect another round trip, with rates rallying early in the year, only to rise in the second half and finish 2011 near current levels. But while yield levels might not ultimately move much, there should be a number of opportunities to earn profits along the way. For example, the recent sell-off has opened a window for Fed-on-hold trades across asset classes for the first time in many months, whether through being long the reds, being short gamma on short tails, or simply by buying the 2y Treasury. Similarly, other opportunities should open up in the second half of the year, as the effects of quantitative easing start to fade and attention turns to the US fiscal picture. The purpose of this publication is not only to present such trading ideas, but also to highlight the macro views that drive these recommendations. We hope that our efforts help you, our clients, in your investment decisions.

Ajay Rajadhyaksha Head of US Fixed Income and Securitized Research Barclays Capital

16 December 2010

Barclays Capital | U.S. Interest Rates: Outlook 2011

CONTENTS

OVERVIEW Tug of war 3 US rates are set to be pulled in opposite directions. An improving economy, worries about the US fiscal picture, and the boost provided by the tax cut/stimulus package all support a bearish view. But this is countered by a front end that should be pegged for several quarters, muted inflation, and heavy Fed buying. US RATES Money markets: Outlook 2011 10 Next year looks set to bring even lower rates and a flatter money market curve, as a result of the Feds renewed large-scale asset purchases (LSAP) and regulatory pressures. Politics will also likely play a role in front-end dynamics next year. Those investors hoping for some spread or extra yield may have to search elsewhere. Treasury outlook: Too fast, too furious 20 We expect yields to decline in Q1 11, led by the intermediate sector, as the recent sell-off has not been commensurate with the improvement in the growth outlook. Yield should then gradually sell off over the remainder of the year. We discuss the supply-demand dynamics in the fixed income market, relative value trades and the outlook for the STRIPS market. Inflation-linked: The debate evolves 36 We expect the 2011 trend in TIPS breakevens to be similar to that of Q4 10. However, with forward breakevens attractive only as inflation insurance, the focus is likely to shift to the short end. Liquidity and the demand base are likely to continue to grow, along with supply and increased interest in inflation derivatives. Agencies: With or without you 45 Political gridlock is likely to delay GSE reform far into the future. The Preferred Stock Purchase Agreements make agency credit effectively the same as Treasury credit, in our view. Importantly, the PSPAs do not expire after 2012, and we expect draws after that point to be well below the limit. INTEREST RATE DERIVATIVES Swap spreads: Caught in crosswinds 60 Front-end swaps are pricing in too much of a risk premium, despite our outlook for a volatile Libor. Spreads in the 5-10y sector should widen in Q1 11, before tightening in the second half. Fiscal concerns should continue to weigh on long-end spreads, which are likely to remain negative. Vol: The demand is not enough 73 Vols will likely decline in the early months of 2011, as traditional hedgers buy less than usual and investors stretch for yield in the low yield/tight spread regime. BMA swaps: Low and lower 84 BMA ratios should decline in 2011, driven by higher rates, Fed asset purchases and favorable technicals. SPECIAL TOPICS US housing finance: No silver bullet 91 We look at various housing finance alternatives and conclude that the government will play a dominant role in housing finance for many years. Any transition to the private sector should be a 15-20 year process, not the 3-5 years that many legislators are calling for. We think the focus should be as much on making mortgage loans safer as on the means of financing them.

16 December 2010 2

Barclays Capital | U.S. Interest Rates: Outlook 2011

OVERVIEW

Tug of war

Ajay Rajadhyaksha +1 212 412 7669 ajay.rajadhyaksha@barcap.com

US rates are set to be pulled in opposite directions. An improving economy, worries about the US fiscal picture, and the boost provided by the tax cut/stimulus package all support a bearish view. But this is countered by a front end that should be pegged for several quarters, muted inflation, and heavy Fed buying. We expect the bulls to win over the next few months, given the magnitude of the December sell-off. But rates should rise in H2 11, as the recovery becomes firmly entrenched. We expect nominal 10s to finish 2011 at 3.5%, close to current levels. On the inflation front, we like TIPS breakevens in general, but especially at the front end of the curve. With the exception of the front end, swap spreads across the curve should widen in H1 11, but then tighten as the effects of QE2 fade and the US fiscal picture gets more attention. Libor should also rise, but not as much as implied by the forwards after the December move. Meanwhile, volatility should resume its decline, driven by the weakness of the mortgage option, callable supply, and the GSEs being in run-off mode. The agency MBS market is poised for big shifts in 2011. For the past decade, agency MBS have had heavy government support, through the GSEs and then through the Fed and Treasury. In 2011, we expect all these entities to move into run-off mode. But banks and money managers should be able to absorb this supply and prevent market dislocations. On the agency debt front, some investors have become wary of agency credit after YE 12. We think this fear is unjustified; the Preferred Stock Purchase Agreements make agency credit effectively the same as Treasury credit, in our view, and they do not expire after 2012. We expect draws after that point to be well below the limit. The debate over US housing finance is likely to heat up as Treasury submits its plan for the GSEs in January. A transition to any other system is at least a decade-long process, in our view, not the 3-5 years that many legislators want. For the foreseeable future, the agency MBS market should not just survive, but expand. The December sell-off has given investors the best entry point into the Fed-on-hold trades in several quarters. Whether it is being outright long the whites and reds, selling gamma on short tails, or just long the 2y Treasury, trades that fade the current sell-off and the aggressive steepening in the money market curve should do well.

The macro picture: Dj vu all over again?

The macro picture at the start of 2011 is surprisingly similar to the one 12 months ago. In H2 09, equities had a big run-up, rates sold off hard in December, 3m Libor declined sharply, the central bank was a buyer of US fixed income debt, and economic optimism was picking up. Compare that with H2 10 (Figures 1 and 2), when equities have again rallied since September, 3m Libor has dropped from the highs of mid-year, the Fed is aggressively buying Treasuries, and the recovery seems to be gaining steam. Skeptics (and Yogi Berra) might be forgiven for thinking they have seen this movie before and will caution that 2011 could bring another credit crisis, or a soft patch that raises doubt about the sustainability of the recovery, or a rate rally, and so on.

16 December 2010 3

Barclays Capital | U.S. Interest Rates: Outlook 2011

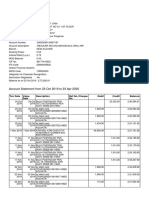

Figure 1: Similarities between H2 09

S&P500 Index 1150 1100 1050 1000 950 900 850 Jul 09 3M Libor 0.65 0.60 0.55 0.50 0.45 0.40 0.35 0.30 0.25 0.20 Aug 09 Sep 09 Oct 09 Nov 09 Dec 09 S&P 500 Index (LHS)

Source: Barclays Capital

Figure 2: and H2 10

S&P500 Index 1250 1200 1150 1100 1050 1000 Jul 10 3M Libor 0.55 0.50 0.45 0.40 0.35 0.30 0.25 Dec 10

Aug 10

Sep 10

Oct 10

Nov 10

3m Libor (RHS)

S&P 500 Index (LHS)

Source: Barclays Capital

3m Libor (RHS)

We beg to differ. The transition from the inventory/stimulus surge to a more sustainable expansion seems to be on solid ground. The jobless rate remains a disappointment, but personal income, consumption, wages and salaries are all showing steady growth, while both manufacturing and non-manufacturing ISM surveys indicate growth momentum. The extension of all the Bush-era tax cuts, as well as other parts of the agreement, should add another 0.3% to 2011 GDP. Importantly, the US is not alone. The Chinese economy seems to have overcome its own soft patch, with industrial production jumping back into double digits by October after slipping in Q2 and Q3. Germany has been a pleasant surprise; its 6% annualized growth in Q2 and Q3 has let Europe grow respectably despite sovereign debt issues. While not every major economy has pulled out of the mid-year slowdown (Japan and Brazil face a weak Q4), talk of a double-dip recession was clearly overdone. Despite the good news on European growth, euro area sovereign risks remain a major macro concern. The rescue packages for Greece and Ireland, the establishment of a stability fund, and the extension of ECB liquidity measures have all failed to calm bond markets in peripheral countries. But while another rescue package for a small country (Portugal) could be needed, we do not expect a similar situation with Spain. By our calculations, the latters debt problems are manageable, given time and the fiscal reforms it has already started (see Euro Area Bank and Sovereign Debt: Preemptive action needed, November 30, 2010). The risk is that market pressures push financing costs to unmanageable levels in the meantime. We expect European policymakers to be aware that they cannot let Spain fall prey to a crisis of confidence and to be more pro-active, if needed. Volatility will likely continue, but the European sovereign crisis should ultimately be contained. Notably, markets reached a similar conclusion in November as sovereign spreads widened unlike in the May episode, there was no flight to quality into US Treasuries or away from equities.

A round-trip on rates: First a rally, and then a sell-off

In this environment, rates should head higher in 2011, but not in the first half of the year. In fact, rates have sold off so swiftly in December that we have gone from recommending shorts to longs. There have been several theories put forward to explain the sell-off, including: Fed buying is being offset by rising inflation expectations, pushing nominal yields higher: This is patently not true. As Figure 3 shows, inflation breakevens have not really risen since early November. The bulk of the sell-off has been due to a rise in real rates.

16 December 2010 4

Barclays Capital | U.S. Interest Rates: Outlook 2011

Foreign buyers are avoiding USD assets after the QE2 announcement: It is true that there were negative comments by officials from several countries after the Fed came out with a second round of quantitative easing. But the USD has held its own against most major currencies in recent weeks. An aversion to USD assets does not seem to be behind the sell-off. The tax agreement has renewed concerns about US fiscal problems: We have been discussing the deteriorating US fiscal picture for several months (see How risk-free are US Treasuries? January 8, 2010). But for now, investors seem to be giving the US the benefit of the doubt. 5y sovereign CDS for the US has tightened in recent weeks (Figure 4). While the CDS market is a small one, it does highlight concerns about sovereign credit, as seen in fluctuations in Spanish CDS. So US fiscal problems do not seem to be the culprit, either. Rather, we think the sell-off is the result of better-than expected data (excluding a weak jobs report), which has pushed out the last of the double-dip enthusiasts from their long positions. This has been exacerbated by a lack of liquidity in December, as well as the boost provided by the proposed tax cuts, which came with an unexpected stimulus package. But the sell-off is unlikely to continue, in our view. Indeed, rates should rally over the next few months before resuming their sell-off. Fair value for rates can be broken up into an expectations component (dictated by the expected value of the funds rate averaged over the next 10 years) and a term premium. Our expectations component is at 2.2%, which, while low by historical standards, is driven by the unemployment and inflation data. The term premium cannot explain the other 128bp; 10y yields appear 50bp cheap from a fair value standpoint (for more details on our views, please see At the crossroads on page 20). Investors seem to be underestimating the power of Fed buying. The Fed plans to buy $850-900bn in Treasuries by the middle of 2011, absorbing almost all the supply in the belly of the curve. The biggest holder of US Treasuries (China) has a similar portfolio, but it took a decade to build it up, while the Fed will take just eight months. The front end seems firmly pegged for the next several quarters. The sell-off has added 80-90bp of extra net interest margin to investors in the carry trade. The steepness of the yield curve, coupled with the low risk of fed funds rate hikes for several quarters, should get carry-conscious buyers back into the market at these yield levels. Figure 3: Real rates have driven the December sell-off

10y Breakeven 10y Real Yields vs 10y Breakevens 10y Real Yield 2.3 2.2 2.1 2.0 1.9 14-Oct-10 28-Oct-10 11-Nov-10 25-Nov-10 10y Breakeven (LHS)

Source: Barclays Capital

Figure 4: US sovereign CDS has not budged recently

5y USD CDS 55 51 47 43 39 35 Aug-10 Spain vs US CDS 5y Spain CDS 400 350 300 250 200 150 Dec-10

1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 9-Dec-10

Sep-10

Oct-10

Nov-10

10y Real Yield (RHS)

5y US CDS (LHS)

Source: Barclays Capital

5y Spain CDS (RHS)

16 December 2010

Barclays Capital | U.S. Interest Rates: Outlook 2011

Core CPI has been trending lower for a few months and is now at 0.8% y/y. While we feel that core is bottoming, it is difficult for rates to rise with inflation so muted. Headlines out of Europe are set to continue. While we think the market will differentiate between the peripherals and the major countries, US yields should get some support from these headlines. All in all, while yields could rise a little higher for the rest of December in an illiquid market, we expect them to rally in the first few months of 2011. By mid-year, we expect the sell-off to resume, with 10y yields finishing 2011 at 3.5%, very close to current levels. We like TIPS on a breakeven basis across the curve, for various reasons. But we see most value in the front end, where short breakevens have under-reacted to the rise in commodity prices, even after factoring in weak consumer demand. Meanwhile, forward 1y breakevens in the 2012-13 sector have barely budged off late-summer lows, despite the tax agreements and the improvement in data. Finally, the 5y5y forward breakeven has risen nearly 90bp since late August. We still see value in longer forward breakevens, but mainly as inflation insurance. We believe the market should be pricing a higher inflation risk premium in forwards because of current monetary/fiscal policies, but also because the Fed has shown that it has an asymmetric reaction function around its inflation target of 1.75-2%. The reason for the asymmetry is that the Fed is not sure it can control deflation once it takes hold, but as Chairman Bernanke said recently, he is 100% confident that the Fed can prevent inflation from going too high. Because too much confidence can lead to excessive risk taking, we believe longer forwards still offer attractive inflation insurance.

Interest rate derivatives: Wider spreads but lower volatility

Swap spreads will, we expect, be driven by three factors in 2011: European sovereign risk issues, Fed purchases in the belly of the curve, and the deteriorating US fiscal picture. The first two should have an immediate effect, while the third should matter mainly as QE2 fades. That leaves us with wider swap spreads across the curve for the next several months as Fed buying of Treasuries sparks a rate rally. On the other hand, we think that the forwards are pricing in too sharp a rise in Libor in the coming months. We would not be surprised to see spot Libor-OIS averaging higher-than-current levels through 2011. But we do not expect forwards to be realized and recommend selling 1y LOIS spreads for the carry. The swap spread picture should change towards the end of the year. As the boost from QE2 to rates fades and as attention focuses on the US fiscal picture, swap spreads should take back some of their widening; this is a trade that we suspect will continue in 2012. Interest rate volatility is usually driven by uncertainty over Fed policy, weakness in economic data, and supply-demand dynamics including hedging needs from MBS accounts, insurance companies, etc. The first two factors should be bearish for volatility the Fed will likely be on hold for the year, and the recovery should continue. 2011 also looks to be a year of heavy volatility supply, largely through different types of callables and structured notes (for details, see The demand is not enough on page 73). Meanwhile, demand for options should stay weak, largely because the GSEs are in run-off mode and as the mortgage refinancing option has weakened in a world of tight credit standards. It is all adding up to be a gloomy year for option prices, and we recommend starting 2011 short large parts of the volatility surface.

16 December 2010

Barclays Capital | U.S. Interest Rates: Outlook 2011

Government affairs: Agency MBS and agency debt

While the agency MBS investor base should be bearish for volatility in 2011, it is also going through major changes of its own. Over the past decade, the US government has (directly or indirectly) been a big buyer of agency mortgages. Fannie Mae and Freddie Mac led the charge in the first half of the decade, and the Fed and Treasury have picked up the slack in 2008-10. By 2011, the biggest holders of agency MBS the Fed, Treasury, and the GSEs will all be in run-off mode. Despite this, we recommend an Overweight on agency MBS: Weak home sales and anemic prices should keep net new issuance at a negative $60bn. While the Fed and the GSEs could add $365bn of supply, we expect banks and money managers to be aggressive buyers of agency MBS in 2011, purchasing about $150bn each through the year. The recent rise in yields should also help MBS, as it reduces the heavy premium risk that has affected valuations. Similarly, the declining prepay sensitivity to rate moves (which should persist) is also a positive. In fact, the Fed has already gone from being long the basis to effectively being short (by allowing portfolio run-off while buying Treasuries) this year. Yet agency MBS performance has not been too shabby. Figure 5 plots the cumulative hedged performance of the major agency MBS coupons over the year. On a fully hedged basis (rates, curve and volatility) and assuming daily re-balancing of hedges, every coupon had a positive profit in 2010, and investors in higher coupons made as much as 4-5 points. While we do not expect a repeat, agency MBS should navigate the end of government sponsorship without trouble. Indeed, agency debt investors seem far more concerned about government ties. Specifically, some investors have assigned particular significance to December 31, 2012, after which the nature of the Preferred Stock Purchase Agreements (PSPAs) changes. In our view, the capital support provided by the Treasury through 2012 and beyond makes agency credit effectively the same as Treasury credit: Through YE 12, any quarterly capital shortfalls as defined by GAAP net assets will be made up by the Treasury in full within 60 days of the reporting date. Draws made after 2012 will be subject to a cumulative limit of $125bn at FNM and $149bn at FRE. This does not apply to amounts before YE 12.

Figure 5: Agency MBS had a good 2010

Figure 6: Foreclosure backlog across states

25 20 15 10 5 0

YTD performance ($)

6 5 4 3 2 1 0 -1 -2 4 4.5 10y UST 5 5.5 6 10y swap 10y curve & vol 6.5

DC

US

NY

OH

MI

CA

NJ

AZ

NV

FL

(%Fcl + %90d) / %REO

Source: Barclays Capital

% Seriously dq

Source: Barclays Capital

16 December 2010

Barclays Capital | U.S. Interest Rates: Outlook 2011

By distinguishing between FNM/FRE losses recorded before and after 2012, the Treasury has essentially made the timing, not the magnitude, of credit losses the main factor determining GSE creditworthiness. As long as losses are provisioned for before 2012, agency risk is analogous to Treasury credit risk. We believe that the GSEs have already recognized about 75% of the total credit losses they will ultimately face. We also expect the credit provisions that have yet to be taken to be recognized in full before YE 12. Worries about the 2012 deadline seem misplaced. For our views on the whole agency debt sector, please see With or without you on page 45.

Housing and housing finance

Our basic story on home prices has not changed for the past year, and we see no reason to do so now. With the foreclosure to REO pace reduced to a trickle, home prices should stabilize near current levels over the next few quarters. But this also means that the foreclosure pipeline will be an overhang in many states for several years, preventing a sustained rise in prices. For example, in New Jersey, there are nearly 15 times as many houses that could potentially be distressed sales (these loans are either 90 days delinquent or in foreclosure proceedings but not yet on the market) as the distressed houses currently on sale. This should prevent a sustained rise in home prices in several states. Most importantly, we believe the risk of another 15-20% decline in home prices is very low. For details on our home price outlook, see US Securitized Products: Outlook 2011 Hard act to follow, December 13, 2010. Even if home prices do not provide headlines in 2011, the debate over housing finance will, with the Treasurys plan for the GSEs scheduled to be revealed in January. There will likely be agreement among policymakers that the government needs at least to reduce its involvement in the mortgage market (the GSEs now provide over 90% of all mortgages). But as they wrestle with the trade-offs and choices available, they will realize that there are no easy solutions. None of the private sector alternatives private label securitization, covered bonds, or portfolio lending is a silver bullet that will easily replace the GSEs. And they all have drawbacks. But together, they can take over much of the role of financing mortgages, given time and (in some cases) the development of a regulatory framework. Any transition will likely take place over 10-20 years, not 3-5, as many policymakers have suggested. For the foreseeable future, the agency MBS market will, in our view, not just exist; it will thrive. Too much of the debate has been about ways to finance mortgages. A more important issue is simply how to make the mortgage product safer. This can be done by prescriptive means (where regulators detail what types of loans are allowed) or through rules such as risk retention guidelines (for details, please see US Housing Finance: No Silver Bullet, on page 91).

Making money: The Fed-on-hold trade

A discussion of various asset classes is useful only if it can be translated into actionable ideas. There are two overriding trading themes that drive our trade ideas for 2011. One is that Fed-on-hold trades make sense again from a valuation standpoint, after a gap of several quarters.

16 December 2010 8

Barclays Capital | U.S. Interest Rates: Outlook 2011

The other is that rates have sold off too much and that the market has completely ignored any possibility of an extension to the $600bn in QE2. On the first point, we feel that the money market curve has steepened too aggressively in recent weeks, with forwards now pricing in some hikes as early as the end of 2011. We like being long both the whites and reds, as well as selling 1y LOIS spreads. On the option front, we recommend being outright short volatility, partly because rates should be range-bound in 2011 and not rise much from current levels. Our Fed-on-hold view also leads to a recommendation to be short gamma on short tails relative to 30y tails. The second point plays into our Treasury and swap spread calls. We recommend longs across the curve, but especially in the belly, where we expect heavy buying. For the same reason, we recommend swap spread wideners in the 5-10y sector. Meanwhile, being in 10s-30s steepeners and long TIPS are ways to position for any possible extension to QE2. If an extension starts to seem more likely, longer TIPS should benefit. As always, there are a few risks. The most prominent is a spreading of the European sovereign crisis to the bigger countries. But as mentioned earlier, we believe that the fiscal picture of the peripherals is different from those of Spain and Italy. Our base case is that the bigger countries should be able to manage their way out, though there will be plenty of headlines along the way. Another risk is an increase in the $600bn that the Fed has already committed to QE2. After the recent sell-off, the market seems to be ignoring this possibility. Yet if the current unemployment rate and inflation data are an indication, the Feds own models might show that it has to do more. In particular, if the jobless rate is not coming down as quickly as the Fed wants, an expansion of the Large Scale Asset Purchases (LSAP) program is not out of the question, as we show in At the crossroads on page 20). We think that the recovery should be sustained enough that the Fed will probably stay its hand after the first $600bn. But the market remains very vulnerable to a change in opinion after the December sell-off. Other risks include a big surge in worries about the US fiscal picture that causes yields to spike, though our analysis suggests that bond markets will give the US a few more years to show progress on the fiscal front. All in all, while there are risks in both directions, our base case remains a Fed on hold, a steady rather than spectacular economic recovery, and range-bound rates in 2011. Rates markets will likely undergo a tug of war without decisively breaking in either direction, at least in 2011. This might change in 2012 as investors buy into the idea of the recovery and as central banks start worrying about whether they are too expansionary. But that, as they say, is a story for another year.

16 December 2010

Barclays Capital | U.S. Interest Rates: Outlook 2011

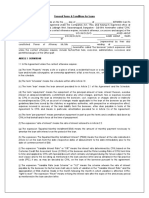

MONEY MARKETS

Outlook 2011

Joseph Abate +1 212 412 6810 joseph.abate@barcap.com

Next year looks set to bring even lower rates and a flatter money market curve, as a result of the Feds renewed large scale asset purchases (LSAP) and regulatory pressures. Politics will also likely play a role in front-end dynamics next year. Those investors hoping for some spread or extra yield may have to search elsewhere. We look for QE to pressure front-end rates lower 5-10bp and to flatten out the money market curve. Regulatory pressures are expected to prevent the supply of commercial paper from rebounding. Repo activity may decline in 2011 as window dressing ebbs and leverage remains limited. Money funds are likely to lengthen WAMs to 60 days while becoming increasingly barbelled. Foreign exposure is also expected to increase after a sharp reduction in December. Episodes of sharp risk aversion are likely to drift in and out of front-end markets throughout the year, causing rates to spike periodically. Front-end rates are expected to go through at least three phases in 2011 all headed lower. By the end of June, we see bill yields, repo and CP in the low to mid-teens. But periodic risk shocks can easily overwhelm the effect of massive liquidity in the front end.

I. QE2: Ease harder

Bank reserve balances are set to more than double

At the November FOMC meeting, the Fed announced it was re-launching its LSAP program to the tune of $600bn. Adding in MBS re-investments, the Fed is set to purchase nearly $900bn in Treasuries through the end of June 2011. At that point, the Feds balance sheet will have swollen to over $3.0trn, with a security portfolio of $2.7trn. And it will own 21% of all marketable Treasury debt. Bank reserves, which for years were below $50bn, are expected to reach $1.8trn by next June (Figure 1).

Figure 1: Bank reserves ($bn)

2000 1800 1600 1400 1200 1000 800 600 400 200 0 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11

Source: Federal Reserve, Barclays Capital

Figure 2: Fed funds and bank reserves (%, $bn)

IOER-FF (bp) 0 -5 -10 -15 -20 -25 500 600 700 800 900 1000 Reserves ($bn) 1100 1200 1300

Forecast

Source: Federal Reserve, Barclays Capital

16 December 2010

10

Barclays Capital | U.S. Interest Rates: Outlook 2011

Lowering OIS expectations

and more importantly, expectations should fall

While the Feds purchases are meant primarily to create a positive wealth effect and stimulate exports, they will likely also drag already low short-term rates lower. This will be felt through two channels: OIS expectations and GC collateral removal. Gauging the effect of each is a bit difficult and, indeed, there are some skeptics who believe that short rates are already as low as they are going to get. Instead, they argue, the Feds purchases and reserve creation will merely pile up in bank deposits at the central bank earning 25bp. After all, the direct link between the level of bank reserves and the effective fed funds rate has broken down, given the segmentation in the market (Figure 2). 1 However, we believe that the Feds very explicit commitment to bringing down term rates will be enough to pull OIS lower even if the OIS market is heavily influenced by the liquidity decisions of the GSEs. We believe the transparency of the Feds commitment with respect to the duration and scale of the LSAPs will be enough to lower overnight fed funds and OIS. It also suggests that the money market curve should get flatter in 2011. We look for the 3/6 Libor basis to narrow from 10bp, settling in to 5bp by next spring (Figure 3). For front-end investors, there is too little return to make purchasing short-term (ie, under 3m) paper attractive at current levels. As a result, they have begun aggressively pushing out the maturities of their investments. For instance, interest in 6m and 1y floating rate agency paper has been very strong in recent weeks. As demand pressures these rates lower and expectations about monetary policy stay flat in 2011, we look for the front-end curve to flatten.

We look for the money market curve to flatten

Collateral removal = lower short rates

Repo is expected to richen as the Fed buys $900bn in Treasuries

By contrast, the effect on repo markets from the entry of a large, price-insensitive buyer is easier to anticipate. We believe the removal of $900bn in Treasury collateral through midyear will drag Treasury repo rates down about 7bp as it crowds out money market funds and other private investors in the $2trn Treasury repo market. In 2009, the Fed purchased $300bn worth of Treasuries concentrated in the same sector of the Treasury curve. Over the seven-month life of the program, general collateral and other short rates fell sharply (Figure 4). The effect was exaggerated by the expiration of the SFB program and the generally anxious state of funding markets in early 2009.

Figure 3: Libor 3/6 basis (bp)

70 60 50 40 30 20 10 0 -10 Jan-09

Source: Bloomberg

Figure 4: Front-end rates, QEv.1 (%)

1.0 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 Bills 0.0 Feb-09

Source: Bloomberg

Fed buys $300bn TSYs

Fin CP GC SFB winds down

Jul-09

Jan-10

Jul-10

May-09

Aug-09

Nov-09

See, The Mechanics of a Graceful Exit: Interest on Reserves and Segmentation in the Federal Funds Market, Bech, M. and E. Klee, Federal Reserve Bank of New York working paper, December 2009

16 December 2010

11

Barclays Capital | U.S. Interest Rates: Outlook 2011

QE-driven substitution effects should drag other front-end rates lower

For most investors, Treasury repo is a close substitute for other short-term liquid investments such as bills and commercial paper. With 3m GC expected to trade around 15bp by the end of next June and traditional investors elbowed out of the market by the Fed, we expect bill and CP rates to come down. Unless credit risks rise (on a sustained basis), it is hard to see how the current 6bp spread between term repo and CP might widen. As a result, we look for a parallel move in CP rates with large AA banks likely to issue 3m unsecured paper at about 20bp. Netting out the effect of the expected SFB run-off, and given the calmer state of markets but scaling up for the 2011 operation, short rates are unlikely to fall as much as they did in 2009. In addition, to the extent that the Feds purchases are from real money accounts that are not being funded in the repo market, the effect of the Feds purchases on repo and front-end rates in general may be reduced. Nevertheless, we expect term repo and other short rates to fall 5-10bp by the end of June 2011. Puzzlingly, relatively little of this decline has been priced into the market, and bills, repo and AA financial CP seem a bit cheap at current levels. Instead, we reckon yields in the low teens seem fairer.

into the low teens

II. Supply and demand fundamentals in 2011

Front-end supply will be harder to find in 2011

We reckon it will be a bit more challenging for investors to find non-Treasury front-end supply in 2011. First, we expect regulatory pressures to encourage or even force issuers to modify their funding mix, preventing a rebound in commercial paper and repo activity. Second, politics will likely lead to the termination of the joint Treasury and Federal Reserve SFB program. And finally, we expect financial market leverage, although it is recovering, to remain under pressure. On the demand side, we expect money fund balances to face a tougher regulatory climate and more competition from banks for risk-averse depositors.

Regulatory pressures

because of regulatory pressure

Since financial markets stabilized in 2009, regulators have focused on systemic risks, in particular, how certain markets and counterparties exacerbated and spread contagion. Regulators from the Fed, SEC and the FDIC have taken a somewhat skeptical view of the repo market and the stable net asset value (NAV) money fund industry. Late in 2010, a flurry of proposals was submitted for market review. These include radical changes to money funds (insurance, liquidity banks, and floating NAVs), adjustments to the calculation of the bank deposit insurance assessment base, and the provision (at least temporarily) of unlimited deposit insurance on non-interest bearing checking accounts. In addition, banks have begun to focus on the liquidity coverage and net stable funding ratios contained in Basel III. Next year, we expect most of these provisions to take effect and begin reducing front-end supply. But the more than 2000 pages of legislation contained in Dodd-Frank have other rules that have yet to be fully fleshed out. For instance, there is an effort to limit or at least modify the bankruptcy remoteness of repo. 2 And while last years Miller-Moore provision never made it into Dodd-Frank, the law does require a study examining whether a haircut can reasonably be put on secured lenders or if there should be a temporary stay on all repo transactions in the event of a bankruptcy such that cash lenders are required to wait and seek FDIC approval before liquidating the defaulters collateral. Judging from some of the efforts now underway, it seems likely that some restriction on repo in the event of a bank bankruptcy is likely.

For a general discussion, please see Regulating the Shadow Banking System, Gorton, G. and A. Metrick, NBER, September 2010.

16 December 2010

12

Barclays Capital | U.S. Interest Rates: Outlook 2011

Specials activity: A small recovery in volume Since September, there has been a noticeable pickup in specials activity, with both volumes and the average depth of specialness increasing (Figures A and B). The Feds purchases will be general collateral issues; however, given the scale of the operation, as well as its repeated tapping of some sectors (particularly 5-7y), we expect market float to decline. As the float or supply of individual issues declines, volumes in the specials market should theoretically increase. Although they may recover, it is hard to see much of a widening in the expected level of specialness, given the Feds 5bp SOMA lending fee. In effect, the spread cost of borrowing a particular issue from the Fed is low enough to discourage aggressive market price action even with the 300bp fails fee. Thus, while we expect some modest increase in the volume of specials activity, the specials-general collateral spread may only trade at -10bp for much of 2011. Furthermore, with no expectation of any shift in monetary policy toward tightening until late 2012, the market short base in Treasuries should remain fairly light next year. Dealers have been running a long Treasury position since February 2010, and their need to borrow securities in repo to cover short cash positions has evaporated. When interest rates eventually rise and monetary policy shifts, the short Treasury base may return and, along with it, a pickup in volume and individual specialness.

Regulating money funds

The SEC is planning additional regulations on money funds next year

Already in 2010, the SEC has focused on money market funds, which are now subject to tighter WAM limits and stricter counterparty and liquidity guidelines that limit their ability to generate higher returns. The Presidents Working Group recommendations are even tougher arguing that even the SECs new money fund changes would not have prevented the market disruptions caused by the runs experienced by prime funds in September 2008. While we strongly disagree with some of the PWGs recommendations as being both impractical and costly, we also recognize that the SEC is not finished with its money fund regulations. As a result, while we do not see the SEC imposing shorter WAM leashes on stable value money funds than their current 60 days, we can see, for instance, a requirement that raises overnight liquid balances to, say, 20% or more of assets under management and 7-day liquid balances of perhaps 50%. Furthermore, it is possible that the sponsors of stable NAV funds may be required to put up some amount Box Figure B: Volume weighted average specials spread to GC (bp)

0 -5 -10 -15 -20 -25 -30 -35 -40

Box Figure A: Specials volume (% total GC volume)

80 70 60 50 40 30 20 10 0 Jan-06 Oct-06 Jul-07 Apr-08 Jan-09 Oct-09 Jul-10

Jan-06

Oct-06

Jul-07

Apr-08

Jan-09

Oct-09

Jul-10

Source: Barclays Capital

Source: Barclays Capital

16 December 2010

13

Barclays Capital | U.S. Interest Rates: Outlook 2011

of capital as a demonstration of their commitment to the fund. Money funds struggled earlier this year to meet the SECs initial requirements; additional regulatory burdens may not be quite as burdensome to meet in 2011. Nevertheless, they could significantly diminish the fund industrys appetite for longer-duration credit product and push it to hold more overnight repo.

and repo

and its efforts to eliminate quarter-end window dressing will reduce repo volumes

Similarly the SEC has begun to scrutinize repo market window dressing, where banks manage down their balance sheets at quarter-end to show higher capital/asset ratios. We believe quarterly average reporting, together with discussion narratives, will eliminate most of the incentive borrowers have to shrink term repo borrowings by an average of 15% in the final week of a quarter (Figure 5). To the extent that banks are comfortable reporting their current level of short-term borrowing, we expect the introduction of quarterly average reporting to reduce market volumes by about 15%. And while balance sheet renting intra-quarter will likely disappear along with peak supply, we expect one of the benefits to be longer duration trades that can now span quarter-end and significantly less volatility in rates. Quarter-end collateral rates should be little different than those at other times in the quarter.

Other related efforts

A change in the deposit insurance assessment base should also reduce supply

Other efforts, including the Basel III liquidity coverage ratio and the net stable funding requirement, are also likely to reduce front-end supply. Regulators are encouraging banks to term out their funding by issuing more longer-term unsecured debt and replacing flight-prone repo and other forms of wholesale funding with sticky retail deposits. Already, before the study period for Basel IIIs liquidity guidelines goes into effect, the FDIC has moved. Base assessment rates for deposit insurance will be adjusted higher for institutions that rely on brokered deposits. Similarly, the assessment rate will be lowered based on the amount of long-term unsecured debt the bank has outstanding. And in a break with tradition since 1935, the FDIC is severing the link between the assessment base and deposit insurance. Beginning next spring, all liabilities, including repo and commercial paper, will be subject to the FDICs assessment rate. We expect this to lower the attractiveness of both, with banks pulling back on their issuance of commercial paper and repo something the markets have already imposed on them. Since 2007, wholesale funding as a share of total large bank liabilities has fallen from 30% to 22% as deposit Figure 6: Net dealer leverage ($bn)

700 600

Figure 5: Intra quarterly repo behavior (quarter end =100)

120 115 110 105 Avg 2008-10

500 400 300

100 95 90 -5 -4 -3 -2 -1 0 1

Avg 2002-07

200 100 0

Jan-06 Oct-06

Source: Federal Reserve

Jul-07

Apr-08 Jan-09 Oct-09

Jul-10

Source: Federal Reserve

16 December 2010

14

Barclays Capital | U.S. Interest Rates: Outlook 2011

balances have risen to 64% (from 52%). The effect is expected to be more pronounced in repo, given that most recent CP issuance has come from foreign banks that are not subject to the FDICs deposit insurance rules. 3 In other developments, ratings agencies are working to remove or reduce the systemic support implicit in some banks ratings (particularly BAC, GS, MS, and C). Removal of the ratings uplift would automatically reduce the short-term debt rating since the two are tightly mapped. Assuming the long-term debt ratings of these institutions are lowered to their stand-alone levels, their short-term ratings could slip out of Tier 1 and into the much smaller and lower-rated Tier 2 market. For the most part, Tier 2 issuers are blocked from the commercial paper and repo markets, given the limitations imposed on rated money funds with respect to their trading counterparties, even in overnight GC repo.

Less leverage = less repo

Dealers have reduced their leverage and need for repo funding

Finally, after peaking in early 2008, banks and dealers have significantly reduced their leverage. Low margins or haircuts in repo markets enable investors to leverage up substantially. In the case of a (standard) 2% haircut against Treasury collateral, an investor is able to borrow up to 50x her initial investment. A number of studies have pointed out the inherent riskiness of this amount of leverage. Falling prices lead to asset price and margin spirals that amplify deleveraging. 4 Interestingly, a recently published paper notes that during the financial crisis in 2008, repo lenders were more likely to pull funding outright than to adjust margins incrementally higher. 5 With this in mind, the amount of leverage created via repo that is, the difference between the amount dealers borrow and lend against collateral has fallen from more than $600bn in 2008 to $200bn in November 2010, although it has come off its lows (Figure 6). Chastened by the flightiness of this funding and sensitive about their capital levels, we do not expect leverage to rebound much in 2011, especially given the ratings pressures on banks. As a result, a limited rebound in dealer leverage next year is expected to keep repo supply-constrained.

Political stalemate

Politics are also likely to play a role in the dynamics of front-end supply next year. The election results in November make it likely that the debt ceiling will not be expanded automatically without a public political fight. As the Treasury struggles to keep its coupon auctions regular and predictable, it will be forced to cut back on bill supply, likely specifically targeting the $200bn SFB program. In September 2009 and ahead of the previous debt ceiling showdown, the Treasury allowed the program to run off. We look for it to run down steadily beginning in February. Since there is little need to drain reserves at the moment and the Fed has other effective tools, we do not expect this $200bn in supply to come back when the debt ceiling is ultimately raised. The run-off of the SFB program would partially offset an increase in regular bill supply caused by the recent changes to the tax code, resulting in a net decline in bills of $75bn.

We look for short-term Treasury supply to increase in 2011

However, this overstates the effect of reduced front-end Treasury supply, as there is a significantly bigger amount of short-coupons maturing into the 1-year bucket than last year. By the end of 2011, the volume of Treasury coupons rolling into the money fund

A final decision on whether bank reserves will be included in the calculation of the deposit assessment base will not be released until late January. As currently written, their inclusion is expected to pull all short rates lower, by roughly the average assessment rate for top tier banks, say, 5bp. 4 See, Market Liquidity and Funding Liquidity, Brunnermeier, M. and L. Pedersen, Review of Financial Studies, 2008. 5 See, The tri-party repo market before the 2010 reforms, Copeland, A., Martin, and M. Walker, Federal Reserve Bank of New York, working paper, November 2010.

16 December 2010

15

Barclays Capital | U.S. Interest Rates: Outlook 2011

sector will have increased more than $400bn compared with December 2010. As a result, we look for much of the current relative richness in bills to dissipate as money funds shift into Treasury coupons with shorter than 1y maturities. At the same time, some short-term investors may turn to the TLGP market. TLGP paper was short-term debt issued by banks that was guaranteed by the FDIC. As a result, it trades fairly tight to regular agencies. Depending on how individual money funds treat this debt in their portfolios, the roll-down of nearly $100bn in paper over the course of 2011 may be an attractive alternative to Treasury bills and short coupons. By the end of the year, an additional $156bn will roll down into the under 1y sector.

Money fund appetite

Demand for bills, CP and GC depends critically on the money fund industrys appetite specifically, on the size of balances in taxable funds. Regulatory pressure meant to shrink the size of the money fund industry is expected to reduce the demand for repo, CP and bills. The regulations we judge most important with respect to money fund demand include the FDICs provision of (temporary) unlimited deposit insurance and likely additional changes from the SEC regarding money fund liquidity and credit risk. At the same time, institutional interest in money funds may continue to wane, with returns in the low single digits and, perhaps, an increased willingness to do-it-yourself that is, manage cash outside money funds by direct purchases of short duration assets.

We expect $250bn to leave money funds for bank deposits

Beginning at year-end, the FDIC will provide unlimited deposit insurance to non-interestbearing checking account holders. Given that money fund rates are practically noninterest bearing already and likely to become more so next year, traditional deposits with their government insurance guarantee are likely to pull some balances out of money funds. But determining the amount of redemptions is difficult since it depends on the interest rate sensitivity of institutional investors, as well as their demand for unlimited insurance coverage. Under normal market conditions, the stable NAV is a form of quasideposit insurance. However, unlike the FDIC guarantee, the stable NAV is backstopped only by the ability of the fund sponsor to buy out assets (at above market prices) from the faltering fund. Normally, institutional investors are willing to accept this weaker form of insurance, given the higher yields available on money funds balances than on bank deposits. And during bouts of financial market volatility, the value of deposit insurance goes up. Our working assumption is that perhaps $250bn of the $1.8trn in institutional money fund balances will leave for bank deposits. Given the average composition of money funds which is heavily skewed toward repo, commercial paper and short duration Treasuries we look for a corresponding decline in the demand for all three.

III. Money funds Another difficult year

Limited supply, tougher regulations and bank competition

Money market funds are likely to experience another difficult year in 2011. Our forecasts assume that short rates will all be 5-10bp lower than late 2010 levels, amid fairly constrained supply. At the same time, tougher regulations with respect to liquidity requirements and potentially stiffer competition from banks are expected to pressure the industry in 2011. Money funds are likely to compensate for the difficult operating climate by barbelling their portfolios. Since the end of June, they have aggressively lengthened their WAMs, which have climbed from a trough of 35 days to 50 days currently. That funds have managed to accomplish this while boosting the percentage of their assets invested in the seven-day maturity bucket from 29% to 38% and keeping the proportion of commercial

16

Money fund balances are likely to get more barbelled

16 December 2010

Barclays Capital | U.S. Interest Rates: Outlook 2011

paper on their balances constant must mean that durations at the opposite end of the barbell (ie, in everything other than the week-long liquidity bucket) have lengthened considerably. Other circumstantial evidence comes from financial commercial paper issuance. CP is typically a fairly short-duration product with a WAM generally well below 1m. Federal Reserve figures indicate, however, that since nervousness about bank credit waned with the publication of the European bank stress test results this summer, the proportion of financial CP issued with a maturity greater than 81 days has increased. We expect average WAMs in money funds to continue to lengthen reaching the maximum 60 day limit before March.

with a large exposure to foreign CP

At the same time, CP holdings at money market funds have taken on a foreign flavor one that is likely to continue in 2011 after a sharp retrenchment in December 2010. On average, prime money funds hold 34% of their assets (or over $550bn) in commercial paper, just under one-third of which is asset backed. The ongoing shift in domestic bank funding has meant that the supply of domestic CP available to satisfy their demand has shrunk. In our examination of the published holdings of the top six prime funds (some 30% of the prime money fund universe), 72% of the dollar amount of their commercial paper comes from non-US issuers. Foreign exposure in the top money funds rises to over 56% once deposits are included. Interestingly, money fund exposure to Spanish and Italian banks is quite small. The largest money funds together held less than 5% of their assets in either deposits or the commercial paper of Spanish or Italian institutions at the end of October and before the latest credit flare-up. Of course, the asset allocation of these largest prime funds may not reflect the overall proportion of foreign sponsored paper across the industry. But given recent financial paper issuance, it is hard not to conclude that a substantial portion of prime money fund commercial paper holdings come from non-domestic institutions. One implication of this shift is that money funds are now more exposed to global financial events, such as the sovereign credit flare-up this month. In itself, this may not have much implication for money fund risk all prime fund holdings regardless of the locale of the issuer are Tier 1, and the paper itself is relatively short duration. Thus, under normal market conditions, the higher concentration of foreign-sponsored paper slightly boosts returns but is no less liquid than the domestic paper they would buy if it were available for sale. However, it does suggest that portfolio managers may have to get used to fielding questions such as those they were peppered with this spring and in December the next time markets get turbulent. In May and June, as LOIS spreads widened on concern about bank exposure to sovereign credit, some money fund investors began asking for details on specific regional and bank exposure. By contrast, in December, the money fund managers themselves volunteered information about their foreign bank obligations to forestall investor worries. In theory, fund redemptions could become more sensitized to international developments during these flare-ups. Indeed, it was recently noted that prime money funds sharply reduced their exposure to foreign banks in just the past few weeks. 6 However, so far in December, there has not been any increase in redemptions on the contrary, government only and prime balances have risen 1.6 and 0.8%, respectively, since the start of the month. This lengthening of WAMs is risky if redemptions pick up. However, while we suspect that the interest rate sensitivity of institutional investors may have increased, mass redemptions of the scale seen in September 2008 are unlikely. Moreover, unlike in 2008, (prime) money funds have ample liquidity their holdings of paper maturing in under a week exceeds $600bn, $200bn

increasing the importance of global financial events

See, Prime Funds Trim Foreign Bank Debt Exposure, Money Fund Report, December 10, 2010, imoney.net.

16 December 2010

17

Barclays Capital | U.S. Interest Rates: Outlook 2011

greater than the peak 7d redemption rate in September 2008. Instead, while redemptions might pick up next year as investors search for somewhat higher yields, we expect the industry to remain a behemoth, with at least $2trn in (taxable) assets under management.

IV. Rate phases

We look for rates to head lower in three phases

There are a number of reasons to expect front-end rates to decline in the coming year: QE, the likely expiration of the SFB program, and the possible inclusion of reserve balances in the calculation of the FDICs insurance assessment base. We expect these effects, together with regulatory pressures, to reduce the supply of front-end products more than the anticipated shrinkage in money fund balances. Through next year, the declines in front-end rates are likely to be lumpy in three distinct phases (Figure 7). In phase 1, the initial rounds of QE will push rates lower; these effects should be fairly steady in phases 2 and 3. Phase 2 begins in mid-to late February as the SFB program is terminated and bill supply shrinks. We look for short rates to move lower thereafter. Phase 3 will begin in late spring something after April 1 when the FDICs proposed changes to the deposit insurance assessment base take effect. This final phase is the trickiest to forecast because there is still the possibility that the FDIC will exclude reserve balances from the assessment base calculation a final decision will not be reached until early January. Nevertheless, we have a strong downward bias in our rate projections through June. Assuming the Fed is unhappy with the unemployment rate and inflation outlook, additional LSAP could continue after June with correspondingly lower front-end rates.

Figure 7: Interest rate forecast table

Phase 3 Phase 2 --------------------------------Phase 1

Current O/N GC FF Bills 3m Bills 6m AA fin CP 3m Libor 3m Libor 3/6 basis

Source: Barclays Capital

Dec-2010 0.19 0.17 0.12 0.17 0.25 0.30 0.10

Mar-2011 0.15 0.15 0.10 0.13 0.19 0.24 0.07

Jun-2011 0.13 0.13 0.09 0.12 0.15 0.20 0.05

Dec-2011 0.13 0.13 0.09 0.12 0.15 0.20 0.05

0.22 0.19 0.13 0.18 0.27 0.30 0.10

V. Risk flare-ups

Our projections assume no change in credit conditions. But as seen in the spring and again in November and December 2010, changes in credit can easily overwhelm underlying liquidity dynamics. For instance, concern over sovereign credit exposure in May pushed 3m LOIS to 30-35bp. In December, and amid rumblings of some issuers struggling to roll over their commercial paper, forward markets began pricing in significantly more credit premium. The forward LOIS spread widened from about 25bp in early October to 40bp in December through the end of 2012.

Decomposing LOIS

Credit concerns flared up in December

LOIS can be deconstructed into credit and liquidity subcomponents. The first is the compensation front-end investors demand for taking on bank exposure even if only for 3m. As Michaud and Upper (along with others) demonstrate, LOIS is strongly correlated

16 December 2010

18

Barclays Capital | U.S. Interest Rates: Outlook 2011

with the average credit default swap of the underlying panel members, 7 which has risen from 108bp in mid-October to over 135bp in early December, is in line with its mid-May level (Figure 8). Subtracting out the risk-free rate (3m GC), we estimate the credit compensation embedded in LOIS has risen from a trough of 6bp in August to about 10bp in early December (Figure 8). Given where forward LOIS was in early December and where it got to in May and June, the market appears to be looking for some upside risk in Libor. Although we see little chance of a sustained back-up in Libor funding rates in 2011 amid QE and SFB expiration, we do expect the front end to go through periodic episodes in which credit flare-ups cause bank funding costs to move higher. In reviewing our forecasts for 2010, our biggest miss was not paying enough attention to potential credit tape bombs that caused CDS spread to widen dramatically and funding rates to react violently. Hopefully, we are not making the same mistake in this forecast round. Unfortunately, year-ahead forecasts have a way of coming back to haunt their authors.

Figure 8: 5y CDS spread of Libor panel members (bp)

210 190 170 150 130 110 90 70 Jan-10 Mar-10 May-10 Jul-10 Sep-10 Nov-10

Figure 9: 3m LOIS deconstruction (bp)

35 30 25 20 15 10 5 0 -5 -10 Jan-10 Mar-10 May-10 Jul-10 Sep-10 Nov-10 Liquidity Credit

Note: The average excludes Norinchukin, BTMU, and RBC, for which reliable data are unavailable. Source: Bloomberg

Source: Bloomberg, Barclays Capital

See, for example, What Drives Interbank Rates? Evidence from the Libor Panel, F. Michaud and C. Upper, BIS Quarterly Review, March 2008

16 December 2010

19

Barclays Capital | U.S. Interest Rates: Outlook 2011

TREASURIES

Too fast, too furious

Anshul Pradhan +1 212 412 3681 anshul.pradhan@barcap.com

We expect 2y yields to decline, as the market seems to be pricing in the Fed to offset its securities holdings with hikes in the funds rate beginning in late 2011, which we believe is unlikely; if needed, the Fed would probably drain reserves as the first step. We expect intermediate yields to decline in Q1 11, as the recent sell-off has not been commensurate with the improvement in the growth outlook, which has been partly offset by worsening of the employment and inflation picture. Yields should then gradually sell off by the end of 2011 as the recovery gains strength (Figure 1). Net supply of fixed income securities should decline in 2011 from 2010 levels led by lower Treasury issuance and higher Fed involvement. In addition, there is potential for upside surprise to the Feds asset purchase program, demand from foreign central banks and domestic banks which tilt the balance further towards excess demand and should lower term premiums in the intermediate sector. Treasury is likely to resume cutting auction sizes in the front end by the middle of 2011 as forward-looking borrowing needs decline. Investors should not rule out a rise in long intermediates and bond auction sizes later as the Treasury will likely try to prevent the process of lengthening the average maturity of its debt from stalling. We therefore expect the 10s30s Treasury curve to re-steepen. Excess demand should lower the term premium in the intermediate sector relative to the long end. At the same time, long-term inflation expectations should rise as the market reassesses the potential for further large-scale asset purchases. Little action on long-term deficits so far also supports steepening. Fed purchases of Treasuries are also likely to iron out the kinks on the Treasury curve as it continues to focus on cheap securities in its purchase operations; old 30s in the 9-10y sector and old 3s in the 1.5-2.5y sector stand out as cheap on the curve. The STRIPS market has grown rapidly in 2010 led by activity in the long end, which was helped by a steep Treasury curve, higher bond issuance and strong demand from pension funds. We expect net stripping activity to slow and recommend that investors switch from P STRIPS to C STRIPS in the 15-20y area to gain 11-13bp.

Figure 1: Near-term rally followed by a sell-off; 10y rates to end 2011 at 3.5%

Rates forecast 2s 5s 10s 30s 10s30s

Source: Barclays Capital

Spot 0.67 2.12 3.53 4.60 1.07

Q1 11 0.40 1.40 2.80 4.25 1.45

Q2 11 0.50 1.50 2.90 4.40 1.50

Q3 11 0.60 1.80 3.20 4.70 1.50

Q4 11 0.80 2.10 3.50 4.85 1.35

16 December 2010

20

Barclays Capital | U.S. Interest Rates: Outlook 2011

Front end: Interaction with Feds LSAP

We recommend going long 2y Treasuries, as the market is too early in pricing Fed hikes

2y Treasuries rallied in 2010 to a historical low of 0.33% after spending most of 2009 and early 2010 at about 1%, as economic data weakened and the Fed maintained its language of exceptionally low levels for the federal funds rate for an extended period. With 2y rates at 0.67%, we think risks are skewed towards lower rates, as the Fed may stay on hold for longer than the market is pricing in. The market seems to be pricing in the Fed offsetting its high holdings of securities with hikes in the fed funds rate starting late 2011; however, we believe this is unlikely to be the first step. Rather, we believe the Fed is more likely to drain reserves first, then hike the funds rate if conditions warrant. In Figure 2, we plot the fed funds rate against our estimate, based on a rule similar to the Taylor rule, which links the fed funds rate to the unemployment rate and core CPI inflation. As can be seen, past moves in the funds rate can largely be tracked. With the current unemployment rate at 9.8% and y/y core CPI inflation at 0.8%, the implied funds rate is -4.1%. More importantly, even by the end of 2012, using the Feds own forecast from the November FOMC minutes, the implied funds rate is still -0.9% (turns positive only by the Jul-2013) as compared with 1.47% as priced in to Eurodollar contracts (average of EDM2 and EDZ2 minus the FRA/OIS basis). If the economic outlook does not warrant Fed hikes, then why are investors expecting them? We present one plausible explanation in Figure 3. Because the Fed is engaging in large scale asset purchases (LSAP) to achieve what it would by lowering rates, we plot the true funds rate by augmenting the Feds holding of securities ($500bn is assumed to be equivalent to 50-75bp in funds rate as estimated by NY Fed). With the Feds security holdings having risen to $2.1trn from $500bn the Fed has lowered the funds rate to 1.8%, which is still well above where it would be if the Fed could cut the funds rate to negative levels. However, if the economic outlook improves as the Fed is forecasting and the Fed keeps its security holdings unchanged beyond June 2011 then by the end of 2012, the desired funds rate should be above the true funds rate; -0.9% vs. -2.4% (Figure 3). The market may be pricing in the Fed to remove this extra stimulus by hiking the funds rate instead of taking an action on its balance sheet. We believe the Fed would start by either draining reserves by

A Taylor rule estimate suggests the desired funds rate should be negative until the end of 2012

LSAPs have, to some extent, bridged the gap between the desired and effective funds rate

The market is pricing in the Fed to offset its securities holdings by hiking the funds rate, but this is unlikely to be the first step

Figure 2: Desired fed funds to remain negative for the next two years

12 10 8 6 4 2 0 -2 -4 -6 -8 Dec-87 Dec-92 Dec-97 Dec-02 Dec-07 Dec-12 Actual Fed Funds Rate, % Estimated 1.41

Figure 3: Market may be pricing in the Fed hiking to offset security holdings, but that is unlikely to be the first step

2 1 0 -1 -2 -3 -4 -5 Dec-09 Jun-10 Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Desired Fed Funds Rate, % True Fed Funds Rate with Fed Balance Sheet, % Fed Funds Rate, No action on Balance Sheet, % Market, FF contracts -2.4 -0.9 1.5

Source: Federal Reserve, Bloomberg, Barclays Capital

Source: Federal Reserve, Bloomberg, Barclays Capital

16 December 2010

21

Barclays Capital | U.S. Interest Rates: Outlook 2011

engaging in reverse repos/expanding the supplementary bill financing program (SFP)/term deposits and/or by shrinking its portfolio by letting securities roll off (about $400bn would mature/paydown in 2012) rather than hike the funds rates.

Long 2y Treasuries or other variants such as receiving 1y1y OIS should perform well

Hence, while 2y rates at 0.67% are still quite low in a historical context, they are still high with respect to the current environment. We recommend going long 2y Treasuries. Investors should also consider receiving 1y1y OIS or swaps, the latter because we believe that the 1y1y Libor-OIS basis at 35bp is too high (please see the Swaps outlook).

10y rates: Near-term rally, followed by a sell-off

10y rates staged an impressive rally during the middle of 2010 as the economic outlook worsened and sovereign crises engulfed some euro area countries

10y rates remained in a tight range of 3.6% to 3.8% in the first quarter of 2010, before selloff to 4.0% as the first Fed purchase program came to an end but then rallied off sharply over the coming months because of the sovereign crisis in Europe as well as the weakening of growth outlook in the US; real GDP growth slowed down from the originally reported 5.6% in Q309 to 1.7% in Q210. Equally worrying was the disinflation trend; y/y core CPI inflation fell to 0.9% by mid-2010 from 1.8% at the beginning of 2010; breakevens and real yields contributed equally to the rally in nominal yields. Fedspeak then switched from exiting the stimulus to a need for more action, which culminated in the Fed announcing a new LSAP of $600bn in Treasuries in addition to reinvesting paydowns from its agency portfolio. As one would expect, this resulted in a sharp decline in real yields and a rise in breakevens; the latter blunting the effect on nominal yields to some extent, which fell to slightly below 2.4%. With fiscal policy becoming supportive of growth on the margin after the latest announcement, the market not only seems to have revised its growth outlook higher (our economists have revised their 2011 growth forecast higher by 0.3%, to 3.1%), but also has reduced the odds of the Fed expanding the LSAP, as evidenced by the sharp pickup in real yields to above preSeptember FOMC levels; 10y real yields are now trading at 1.17% versus 0.96%. At current levels, we believe 10y rates are 50bp too high, even before accounting for supplydemand dynamics tilting towards excess demand. In Figures 4 and 5, we breakdown 10y nominal rates into expectations and term premium; the former is derived from the expected evolution of fed funds rate over the next 10 years and the latter is the difference between Figure 5: 10y term premium 50bp too high at current levels, even before accounting for the excess demand

2.5 2.0 1.5 1.0 0.5 0.0 1.28 0.75

Change in the Feds stance towards more stimulus lowered real rates further and resulted in higher breakevens; the price action in real yields has been reversed

10y rates are 45bp too high given the current economic outlook

Figure 4: 10y rate expectations have declined to just 2.25%, given high unemployment rate and low inflation rate

9 8 7 6 5 4 3 2 1 0 Dec-90 Dec-95 10y rates, % Dec-00 Dec-05 Dec-10 3.53 2.25

-0.5 -1.0 -1.5 -2.0 -2.5 Dec-90 Dec-95 Dec-00 Dec-05 Dec-10

10y expectations, %

10y Term Premium, %

Source: Federal Reserve, Bloomberg, Barclays Capital

Estimate, %

Source: Federal Reserve, Bloomberg, Barclays Capital

16 December 2010

22

Barclays Capital | U.S. Interest Rates: Outlook 2011

the actual rate and the expectations component. Figure 4 shows that the bullish trend over the past two decades is largely captured by declining expectations; the trend was driven by declining inflation. Even in 2010, the swings in 10y rates can largely be attributed to expectations. Current 10y expectations are at just 2.25%; while this seems low in a historical context, they are justified given the high unemployment and low core CPI inflation rate. 10y rates are 128bp above expectations, and as Figure 5 shows, this term premium is roughly 50bp higher than what can be explained by our model, which uses the 2y term premium/monetary policy stance and structural budget deficits as explanatory variables.

We expect intermediate yields to decline over the Q1 11; 10y rates should decline to 2.8% before inching higher to 3.5% by the end of 2011

As the data continue to improve, we believe that the expectations component will rise through 2011; however, the fair value of our term premium is biased lower in the near-term because of the supply-demand dynamics. With the Fed buying Treasuries through the first half of 2011, and given the potential for up-scaling of the program, overall net supply of fixed income securities that investors need to absorb should be lower in 2011 versus 2010. In addition, we believe there is the potential for upside risks to the demand side of the equation from foreign central banks and domestic banks. We therefore expect 10y rates to decline over the next few months to 2.8%, led by real rates, before rising to 3.5% by the end of 2011. We discuss the supply-demand dynamics in detail below.

Fixed income supply landscape: Less to go around

Net fixed income supply that investors need to absorb should decline in 2011

Figure 6 tabulates net supply across fixed income sectors (Treasury, munis, agencies, corporate debt and other securitized debt) for the past few years and our expectations for 2011. We exclude Fed/Treasury purchases from 2009, 2010, and 2011 numbers. For 2011, we assume that the Fed buys the announced $600bn Treasuries by June-2011 and continues to reinvest pay-downs in its agency portfolio into Treasuries through December 2011. Net term fixed income supply to the market should decline to $1.15trn from $1.77trn in 2010. Including short-term/floating rate supply, overall fixed income supply should be $0.96trn in 2011 versus $1.58trn in 2010, or ~$600bn lower. The biggest contributor to the swing is net Treasury coupon supply, which should decline by $825bn because of lower net issuance (-$365bn) and higher Fed involvement (+$460bn). Supply of agency debt/MBS should increase, led mainly by the pay-downs in the portfolios of the Fed, Treasury, and GSEs. The recent rise in yields has reduced our expectations of pay-downs in the Feds agency

due largely to a decline in Treasury supply and higher Fed involvement

Figure 6: 2011 fixed income supply ~$600bn lower versus 2010 due to higher Fed involvement and lower Treasury supply

FI supply, net, $bn Treasury, ex-bills Municipal Debt Agency Debt-ex discount notes Agency MBS Fixed Rate IG/HY Corporate Non-Agency MBS+CMBS+ABS Total Net Term Supply, $bn T-bills/Agency Discos/Floating Rate Corporate Grand Total, $bn Memo-Fed/Treasury Net purchases 2006 191 135 85 315 178 798 1,702 296 1,998 0 2007 101 156 -60 538 309 441 1,485 658 2,142 0 2008 332 1 -44 507 454 -270 980 1,025 2,005 0 2009-ex Fed/Tsy 1,256 31 -174 -860 928 -306 875 -714 161 1,760 2010E-ex Fed/Tsy 1,363 93 -197 -19 787 -255 1,773 -188 1,585 77 2011E-ex Fed/Tsy 540* 0 -40 305** 570 -230 1,145 -185 960 465***

Note: *Net Treasury coupon supply is expected to be $1.24trn, of which the Fed is scheduled to buy $480bn through the new program and $225bn through paydowns. **Net agency MBS supply of $305bn assumes GSEs are net sellers of $170bn. ***The Fed is assumed to purchase $705bn in Treasury, partly offset by $240bn pay-downs in the Fed/Treasury portfolio of agency securities. Source: Treasury, Federal Reserve, EMBS, Barclays Capital

16 December 2010

23

Barclays Capital | U.S. Interest Rates: Outlook 2011

MBS portfolio, which result in lower Feds Treasury purchases but at the same time lower the supply of agency MBS that investors need to absorb. Corporate supply has declined from 2009 to 2010, and we expect it to do so further given high redemptions and record cash on balance sheet, the latter should gradually normalize. Other securitized net issuance should remain negative.

Lower net supply should put downward pressure on the term premium in the intermediate sector

Lower net fixed income supply should put downward pressure on intermediate real yields in the near term but the story does not end there. We see the potential pickup in demand at the intermediate sector from key investors: the Federal Reserve, foreign central banks and domestic banks. Before going into the demand side, we look at Treasury supply in detail below (for details on the supply outlook of spread products, please see respective outlooks).

Treasury supply outlook: Terming out to continue

Treasury has been gradually terming out debt; we expect a continuation