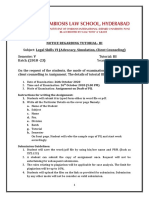

Professional Documents

Culture Documents

Constitutional Offices

Uploaded by

Mary Jane Salivio DalanonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Constitutional Offices

Uploaded by

Mary Jane Salivio DalanonCopyright:

Available Formats

Consti tuti onal Offi ces

Display #

20

1 Office of the Ombudsman

2 Bangko Sentral ng Pilipinas

3 Civil Service Commission

4 Commission on Elections

5 Commission on Audit

6 Commission on Human Rights

y Executive Offices (24)

y Constitutional Offices (6)

y Judicial Offices (3)

y Legislative Offices (3)

y Local Government Units (94)

y Government-Owned and Controlled Corporations (67)

y Government Financial Institutions (6)

y Cabinet Members (33)

y Diplomatic and Consular Missions Abroad (14)

y Diplomatic and Consular Missions in Philippines (15)

y Collegial Bodies (70)

y Other Links (3)

About Us

Click here to know more about the seal...

Click here to listen to our official hymn...

Click here to listen to Pilipinas Kong Mahal...

Mandate

THE OMBUDSMAN AND HIS DEPUTIES, as protectors of the people shall

act promptly on complaints filed in any form or manner against officers or

employees of the Government, or of any subdivision, agency or

instrumentality thereof, including government-owned or controlled

corporations, and enforce their administrative, civil and criminal liability in

every case where the evidence warrants in order to promote efficient

service by the Government to the people (Section 13, R.A. No. 6770; see

also Section 12 Article XI of the 1987 Constitution).

The Ombudsman shall give priority to complaints filed against high ranking

government officials and/or those occupying supervisory positions,

complaints involving grave offenses as well as complaints involving large

sums of money and/or properties (Sec. 15, R.A. No. 6770).

Mission

As protectors of the people, we shall endeavor, in cooperation with all sectors of the

Filipino society, to promote integrity and efficiency and high ethical standards in

public service through proactive approaches in graft prevention and public

assistance, prompt investigation of complaints and aggressive prosecution of cases

filed against erring public officials and employees.

Vision

A truly independent office run by God-fearing men and women with the highest

degree of competence, honesty and integrity and effectively serving as watchdog,

mobilizer, official critic and dispenser of justice for the people it is constitutionally

mandated to protect.

Know more about...

The Ombudsmen of the Philippines

The origins of the Tanodbayan / Office of the Ombudsman

The constitutional guarantees that insulate us from political influence and

interference

The powers, functions & duties of the Office of the Ombudsman as the Protector

of the People

The organizational structure and the functions of each unit

The key officials of the organization

MA. MERCEDITAS NAVARRO-GUTIERREZ

December 2005 to May 6, 2011

SIMEON V. MARCELO

2002 - November 30, 2005

ANIANO A. DESIERTO

1995-2002

CONRADO M. VASQUEZ

1988-1995

Overview of the BSP

The Bangko Sentral ng Pilipinas (BSP) is the central bank of the Republic of the Philippines. It was

established on 3 July 1993 pursuant to the provisions of the 1987 Philippine Constitution and the New

Central Bank Act of 1993. The BSP took over from the Central Bank of Philippines, which was established

on 3 January 1949, as the countrys central monetary authority. The BSP enjoys fiscal and

administrative autonomy from the National Government in the pursuit of its mandated responsibilities.

The BSP Seal

The new BSP logo is a perfect round shape in blue that features three

gold stars and a stylized Philippine eagle rendered in white strokes. These

main elements are framed on the left side with the text inscription

Bangko Sentral ng Pilipinas underscored by a gold line drawn in half

circle. The right side remains open, signifying freedom, openness, and

readiness of the BSP, as represented by the Philippine eagle, to soar and

fly toward its goal. Putting all these elements together is a solid blue

background to signify stability.

Principal Elements:

1. The Philippine Eagle, our national bird, is the worlds largest eagle and

is a symbol of strength, clear vision and freedom, the qualities we aspire

for as a central bank.

2. The three stars represent the three pillars of central banking: price

stability, stable banking system, and a safe and reliable payments

system. It may also be interpreted as a geographical representation of

BSPs equal concern for the impact of its policies and programs on all

Filipinos, whether they are in Luzon, Visayas or Mindanao.

Colors

1. The blue background signifies stability.

2. The stars are rendered in gold to symbolize wisdom, wealth, idealism,

and high quality.

3. The white color of the eagle and the text for BSP represents purity,

neutrality, and mental clarity.

Font or Type Face

Non-serif, bold for BANGKO SENTRAL NG PILIPINAS to suggest solidity,

strength, and stability. The use of non-serif fonts characterized by clean

lines portrays the no-nonsense professional manner of doing business at

the BSP.

Shape

Round shape to symbolize the continuing and unending quest to become

an excellent monetary authority committed to improve the quality of life

of Filipinos. This round shape is also evocative of our coins, the basic

units of our currency.

The BSP Main Complex

The BSP Main Complex in Manila houses the offices of the Governor, the

Monetary Board and the different operating departments/ offices. The

Complex has several buildings, namely: 5-Storey building, Multi-storey

building, the EDPC building and the BSP Money Museum, which

showcases the Bank's collection of currencies.

The BSP Security Plant Complex

The Security Plant Complex which is located in Quezon City houses a

banknote printing plant, a securities printing plant, a mint and a gold

refinery. The banknote printing plant and the mint take care of producing

currency notes and coins, respectively.

Products | Gallery Tour

The BSP Regional Offices and Branches

The BSP has three regional offices performing cash operations, cash

administration, loans and rediscounting, bank supervision and gold

buying operations. These regional offices are located in La Union, Cebu

City and Davao City.

There are also 18 BSP branches situated in Batac (Ilocos Norte), Tuguegarao City (Cagayan), Dagupan

City (Pangasinan), Cabanatuan City (Nueva Ecija), Angeles City (Pampanga), Lucena City (Quezon),

Naga City (Camarines Sur), Legazpi City (Albay), Dumaguete City (Negros Oriental), Bacolod City

(Negros Occidental), Iloilo City (Iloilo), Kalibo (Aklan), Tacloban City (Leyte), Cagayan de Oro City

(Misamis Oriental), Ozamiz City (Misamis Occidental), Cotabato City, General Santos City (South

Cotabato) and Zamboanga City (Zamboanga del Sur). They perform cash operations, cash

administration, and in certain areas, gold buying operations.

http://www.bsp.gov.ph/about/overview.asp - top

Creating a Central Bank for the Philippines

A group of Filipinos had conceptualized a central bank for the Philippines as early as 1933. It came up with

the rudiments of a bill for the establishment of a central bank for the country after a careful study of the

economic provisions of the Hare-Hawes Cutting bill, the Philippine independence bill approved by the US

Congress.

During the Commonwealth period (1935-1941), the discussion about a Philippine central bank that would

promote price stability and economic growth continued. The countrys monetary system then was

administered by the Department of Finance and the National Treasury. The Philippines was on the exchange

standard using the US dollarwhich was backed by 100 percent gold reserveas the standard currency.

In 1939, as required by the Tydings-McDuffie Act, the Philippine legislature passed a law establishing a

central bank. As it was a monetary law, it required the approval of the United States president. However,

President Franklin D. Roosevelt disapproved it due to strong opposition from vested interests. A second law

was passed in 1944 during the Japanese occupation, but the arrival of the American liberalization forces

aborted its implementation.

Shortly after President Manuel Roxas assumed office in 1946, he instructed then Finance Secretary Miguel

Cuaderno, Sr. to draw up a charter for a central bank. The establishment of a monetary authority became

imperative a year later as a result of the findings of the Joint Philippine-American Finance Commission

chaired by Mr. Cuaderno. The Commission, which studied Philippine financial, monetary and fiscal problems

in 1947, recommended a shift from the dollar exchange standard to a managed currency system. A central

bank was necessary to implement the proposed shift to the new system.

Immediately, the Central Bank Council, which was created by President Manuel Roxas to prepare the charter

of a proposed monetary authority, produced a draft. It was submitted to Congress in February1948. By June

of the same year, the newly-proclaimed President Elpidio Quirino, who succeeded President Roxas, affixed

his signature on Republic Act No. 265, the Central Bank Act of 1948. The establishment of the Central Bank

of the Philippines was a definite step toward national sovereignty. Over the years, changes were introduced

to make the charter more responsive to the needs of the economy. On 29 November 1972, Presidential

Decree No. 72 adopted the recommendations of the Joint IMF-CB Banking Survey Commission which made a

study of the Philippine banking system. The Commission proposed a program designed to ensure the

systems soundness and healthy growth. Its most important recommendations were related to the objectives

of the Central Bank, its policy-making structures, scope of its authority and procedures for dealing with

problem financial institutions.

Subsequent changes sought to enhance the capability of the Central Bank, in the light of a developing

economy, to enforce banking laws and regulations and to respond to emerging central banking issues. Thus,

in the 1973 Constitution, the National Assembly was mandated to establish an independent central

monetary authority. Later, PD 1801 designated the Central Bank of the Philippines as the central monetary

authority (CMA). Years later, the 1987 Constitution adopted the provisions on the CMA from the 1973

Constitution that were aimed essentially at establishing an independent monetary authority through

increased capitalization and greater private sector representation in the Monetary Board.

The administration that followed the transition government of President Corazon C. Aquino saw the turning

of another chapter in Philippine central banking. In accordance with a provision in the 1987 Constitution,

President Fidel V. Ramos signed into law Republic Act No. 7653, the New Central Bank Act, on 14 June

1993. The law provides for the establishment of an independent monetary authority to be known as the

Bangko Sentral ng Pilipinas, with the maintenance of price stability explicitly stated as its primary objective.

This objective was only implied in the old Central Bank charter. The law also gives the Bangko Sentral fiscal

and administrative autonomy which the old Central Bank did not have. On 3 July 1993, the New Central

Bank Act took effect.

Chronology of Events: Central Banking in the Philippines

The BSP Vision and Mission

Vision

The BSP aims to be a world-class monetary authority and a catalyst for a globally competitive

economy and financial system that delivers a high quality of life for all Filipinos.

Mission

BSP is committed to promote and maintain price stability and provide proactive leadership in

bringing about a strong financial system conducive to a balanced and sustainable growth of the

economy. Towards this end, it shall conduct sound monetary policy and effective supervision

over financial institutions under its jurisdiction.

The BSP Charter

The New Central Bank Act (RA 7653) - PDF file, 155 KB

Chapter I - Establishment And Organizations of the Bangko Sentral ng Pilipinas

Article I. Creation, Responsibilities and Corporate Powers of the Bangko Sentral

Article II. The Monetary Board

Article III. The Governor and Deputy Governors of the Bangko Sentral

Article IV. Operations of the Bangko Sentral

Article V. Reports and Publications

Article VI. Profits, Losses and Special Accounts

Article VII. The Auditor

Chapter II - The Bangko Sentral and the Means of Payment

Article I. The Unit of Monetary Value

Article II. Issue of Means of Payment

Chapter III - Guiding Principles of Monetary Administration by the Bangko Sentral

Article I. Domestic Monetary Stabilization

Article II. International Monetary Stabilization

Chapter IV - Instruments of Bangko Sentral Action

Article I. General Criterion

Article II. Operations in Gold and Foreign Exchange

Article III. Regulations of Foreign Exchange Operations of the Bank

Article IV. Loans to Banking and Other Financial Institutions

Article V. Open Market Operations for the Account of the Bangko Sentral

Article VI. Composition of Bangko Sentral's Portfolio

Article VII. Bank Reserves

Article VIII. Selective Regulation of Bank Operations

Article IX. Coordination of Credit Policies by Government Institutions

Chapter V - Functions as Banker and Financial Advisor of the Government

Article I. Functions as Banker of the Government

Article II. The Marketing and Stabilization of Securities for the Account of the Government

Article III. Functions as Financial Advisor of the Government

Chapter VI - Privileges and Prohibitions

Article I. Privileges

Article II. Prohibitions

Chapter VII - Transitory Provisions

Overview of Functions and Operations

Objectives

The BSPs primary objective is to maintain price stability conducive to a balanced and sustainable economic

growth. The BSP also aims to promote and preserve monetary stability and the convertibility of the national

currency.

Responsibilities

The BSP provides policy directions in the areas of money, banking and credit. It supervises operations of

banks and exercises regulatory powers over non-bank financial institutions with quasi-banking functions.

Under the New Central Bank Act, the BSP performs the following functions, all of which relate to its status as

the Republics central monetary authority.

y Liquidity Management. The BSP formulates and implements monetary policy aimed at influencing

money supply consistent with its primary objective to maintain price stability.

y Currency issue. The BSP has the exclusive power to issue the national currency. All notes and

coins issued by the BSP are fully guaranteed by the Government and are considered legal tender for

all private and public debts.

y Lender of last resort. The BSP extends discounts, loans and advances to banking institutions for

liquidity purposes.

y Financial Supervision. The BSP supervises banks and exercises regulatory powers over non-bank

institutions performing quasi-banking functions.

y Management of foreign currency reserves. The BSP seeks to maintain sufficient international

reserves to meet any foreseeable net demands for foreign currencies in order to preserve the

international stability and convertibility of the Philippine peso.

y Determination of exchange rate policy. The BSP determines the exchange rate policy of the

Philippines. Currently, the BSP adheres to a market-oriented foreign exchange rate policy such that

the role of Bangko Sentral is principally to ensure orderly conditions in the market.

y Other activities. The BSP functions as the banker, financial advisor and official depository of the

Government, its political subdivisions and instrumentalities and government-owned and -controlled

corporations.

The BSP's Organizational Structure

as of June 2009

y Executive Management Services

y Functional Sectors

o Monetary Stability Sector

o Supervision and Examination Sector

o Resource Management Sector

y Security Plant Complex

The BSP's Organizational Structure

as of June 2009

The Executive Management Services

Advocacies

The BSP is deeply involved in various projects and activities aimed towards alleviating poverty, contributing to

the global fight against money laundering, increasing transparency of monetary policy and improving the

financial literacy of the public.

y The BSP has declared microfinance as its flagship program for poverty alleviation in Year 2000 and has

since then played a key role in the development of sustainable microfinance in the country. The BSP

initiatives have focused on the policy and regulatory environment, training and capacity building as well

as on promotion and advocacy.

y In order to implement its continued commitment and support of the global fight against money

laundering, the BSP worked for the passage of the Anti-Money Laundering Act and issued a number of

measures to bring the Philippines' regulatory regime on money laundering closer to international

standards.

y The BSP has been conducting public information campaigns in line with the effort to increase public

awareness on the role of the BSP in the economy and the financial system and to further enhance the

transparency of monetary policy.

y The BSP has also taken a proactive stance in embarking on a consumer education program that aims to

improve the basic financial literacy of the public.

y The BSP undertakes various bank-related initiatives to improve the remittance environment and to

channel remittances to productive undertakings. Through these initiatives, the BSP intends to maximize

the benefits of remittances aimed at: (1) ensuring the smooth inflow of remittances, and (2) promoting

their use for development by channeling them to the financial sector so that these funds can be

mobilized for lending and other productive activities.

Governance of the Bank

The Monetary Board exercises the powers and functions of the BSP,

such as the conduct of monetary policy and supervision of the financial

system. Its chairman is the BSP Governor, with five full-time members

from the private sector and one member from the Cabinet.

The Governor is the chief executive officer of the BSP and is required to

direct and supervise the operations and internal administration of the

BSP. A deputy governor heads each of the BSP's operating sector as

follows:

y Monetary Stability Sector takes charge of the formulation and

implementation of the BSPs monetary policy, including serving

the banking needs of all banks through accepting deposits,

servicing withdrawals and extending credit through the

rediscounting facility.

y Supervision and Examination Sector enforces and monitors

compliance to banking laws to promote a sound and healthy

banking system.

y Resource Management Sector serves the human, financial and

physical resource needs of the BSP

The Civil Service Commission (CSC) is the central personnel agency of the Philippine government. One of

the three independent constitutional commissions with adjudicative responsibility in the national

government structure, it is also tasked to render final arbitration on disputes and personnel actions on

Civil Service matters.

RESPONSIBILITY

Recruitment, building, maintenance and retention of a competent, professional and highly motivated

government workforce truly responsive to the needs of the government's client - the public.

SPECIFIC FUNCTIONS

leading and initiating the professionalization of the civil service;

promoting public accountability in government service;

adopting performance-based tenure in government; and

implementing the integrated rewards and incentives program for government employees.

CSC's SERVICES ARE CLASSIFIED INTO 6 STRATEGIC PRIORITIES:

1.

DEVELOPING COMPETENT AND CREDIBLE CIVIL SERVANTS

( Pagkakaroon ng Mahuhusay at Kapani-paniwalang mga Lingkod Bayan )

Competent and Credible Civil Servants Ensure High Quality Public Service

( Ang Mahuhusay at Kapani-paniwalang mga Lingkod Bayan ay Nagtitiyak ng Mahusay na Uri ng

Serbisyo Publiko )

2.

EXEMPLIFYING INTEGRITY AND EXCELLENCE IN PUBLIC SERVICE

( Pagiging Halimbawa ng Katapatan at Kahusayan sa Serbisyo Publiko )

Excellent Public Service Results in Citizen's Trust and Satisfaction

( Ang Mahusay na Serbisyo Publiko ay Nagbubunga ng Pagtitiwala at Kasiyahan ng mga

Mamamayan )

3.

CULTIVATING HARMONY, MORALE AND WELLNESS IN THE WORKPLACE

( Paglinang ng Magandang Ugnayan, Moral at Kagalingan sa Lugar ng Trabaho )

Harmony, Morale and Wellnes In The Workplace Enhance Workforce Productivity

( Ang Magandang Samahan, Moral at Kagalingan sa Lugar ng Trabaho ay Nakadaragdag sa

Pagiging Mabunga ng Lakas sa Paggawa )

4.

EFFECTIVE AND EFFICIENT PERFORMANCE OF QUASI-JUDICIAL FUNCTIONS

( Mabisa at Mahusay na Pagganap sa mga Tungkuling Mala-panghukuman )

Fair and Expeditious Disposition of Cases Affirms Citizen's Faith In The Administrative

Justice System

( Ang Makatarungan at Mabilis na Pagpapasiya sa mga Kaso ay Nagpapatibay sa Pagtitiwala ng mga

Mamamayan

sa Sistema ng Katarungang Pampangasiwaan )

5.

BUILDING PARTNERSHIPS AND STRENGTHENING LINKAGES

( Pagtatatag sa mga Pakikipagtulungan at Pagpapalakas ng mga Pakikipag-ugnayan )

Interdependence Optimizes Organizational Performance and Good Governance

( Ang Pag-asa sa isa't isa ay Higit na Nagpapalakas sa Pagganap sa Tungkulin ng isang

Organisasyon

at Mabuting Pamamahala )

6. MANAGING SUPPORT MECHANISMS

( Pamamahala sa mga Mekanismong Pananaguyod )

Leveraging Internal and External Resources Improve Quality Management of CSC

Programs

( Ang Paggamit sa mga Yamang Panloob at Panlabas ay Nakapagpapahusay sa Uri ng Pamamahala

sa mga Programa ng CSC )

These programs are carried out by the personnel complement of the Commission, which by year-end

totaled, 1,350 employees. They are distributed in the CSC's central, 15 regional, 105 field/pro

Mandate

The Civil Service Commission was conferred the status of a department by Republic Act No. 2260 as

amended and elevated to a constitutional body by the 1973 Constitution. It was reorganized under PD

No. 181 dated September 24, 1972, and again reorganized under Executive Order no. 181 dated

November 21, 1986. With the new Administrative Code of 1987 (EO 292), the Commission is

constitutionally mandated to promote morale, efficiency, integrity, responsiveness, progressiveness, and

courtesy in the Civil Service.

Mandated Functions

Under Executive Order No. 292, the Civil Service Commission shall perform the following functions:

Administer and enforce the constitutional and statutory provisions on the merit system for all levels

and ranks in the Civil Service;

Prescribe, amend and enforce rules and regulations for carrying into effect the provisions of the

Civil Service Laws and other pertinent laws;

Promulgate policies, standards and guidelines for the Civil Service and adopt plans and programs to

promote economical, efficient and effective personnel administration in the government;

Formulate policies and regulations for the administration, maintenance and implementation of

position classification and compensation and set standards for the establishment, allocation and

reallocation of pay scales, classes and positions;

Render opinion and rulings on all personnel and other Civil Service matters which shall be binding

on all head of departments, offices and agencies and which may be brought to the Supreme Court

on certiorari;

Appoint and discipline its officials and employees in accordance with law and exercise control and

supervision over the activities of the Commission;

Control, supervise and coordinate Civil Service examinations. Any entity or official in government

may be called upon by the Commission to assist in the preparation and conduct of said

examinations including security, use of buildings and facilities as well as personnel and

transportation of examination materials which shall be exempt from inspection regulations;

Prescribe all forms for Civil Service examinations, appointment, reports and such other forms as

may be required by law, rules and regulations;

Declare positions in the Civil Service as may properly be primarily confidential, highly technical or

policy determining;

Formulate, administer and evaluate programs relative to the development and retention of qualified

and competent work force in the public service;

Hear and decide administrative cases instituted by or brought before it directly or on appeal,

including contested appointments, and review decisions and action of its offices and of the agencies

attached to it. Officials and employees who fail to comply with such decisions, orders, or rulings

shall be liable for contempt of the Commission. Its decisions, orders or rulings shall be final and

executory. Such decisions, orders, or rulings may be brought to Supreme Court on certiorari by the

aggrieved party within thirty (30) days from receipt of the copy thereof;

Issues subpoena and subpoena duces tecum for the production of documents and records pertinent

to investigations and inquiries conducted by it in accordance with its authority conferred by the

Constitution and pertinent laws;

Advise the President on all matters involving personnel management in the government service and

submit to the President an annual report on the personnel programs;

Take appropriate actions on all appointments and other personnel matters in the Civil Service

including extension of service beyond retirement age;

Inspect and audit the personnel actions and programs of the departments, agencies, bureaus,

offices, local government including government-owned or controlled corporations; conduct periodic

review of the decisions and actions of offices or officials to whom authority has been delegated by

the Commission as well as the conduct of the officials and the employees in these offices and apply

appropriate sanctions whenever necessary.

Delegate authority for the performance of any functions to departments, agencies and offices where

such functions may be effectively performed;

Administer the retirement program of government officials and employees, and accredit government

services and evaluate qualification for retirement;

Keep and maintain personnel records of all officials and employees in the Civil Service; and

Perform all functions properly belonging to a central personnel agency such as other functions as

may be provided by law

CSC 2030 Agency Vision

CSC shall be Asia's leading center of excellence

for strategic Human Resource (HR) and Organizational Development

(OD)

Mission

Gawing Lingkod-Bayani ang Bawat Kawani

Strategic Initiatives

1. SPMS - HR mechanism that measures office performance and serves in setting standards for alignment of individual and

organizational objectives

2. ARTA - Massive conduct of the Report Card Survey and Conferment of the Seal of Excellence

3. ISO Certification - Certification of CSC Exams, Adjudication of cases, and Training Programs

4. Restructuring - Functional Competencies-based reengineering

5. Fiscal Autonomy - Generate financial resources through non-traditional means

6. ICT - Strengthen ICT: Computerized Exam Program, Digitization of SALN, IT-based reporting system, Call Center ng Bayan, Website

enhancement

7. Marketing - Branding for CSC through marketing its programs: Honor Awards Program, Civil Service Institute, Computerized Exams,

and the ARTA

8. HR Accreditation Program - HR Plan, Competency-based Standards, Regional Training Enhancements, and a Comprehensive

Wellness Program

Goals/Objectives

Six Strategic Priorities were identified:

I - DEVELOPING COMPETENT AND CREDIBLE CIVIL SERVANTS

( Pagkakaroon ng Mahuhusay at Kapani-paniwalang mga Lingkod Bayan )

Competent and Credible Civil Servants Ensure High Quality Public Service

( Ang Mahuhusay at Kapani-paniwalang mga Lingkod Bayan ay Nagtitiyak ng Mahusay na Uri ng Serbisyo Publiko )

Programs/Projects/Activities

A.Examination, Recruitment and Placement

1. Test Development

- Enriching Test Bank

- Development of test forms and preparation of answer keys

2. Examination administration, evaluation and SPEEDY release of results

- Administration of examinations

* CSE-PPT/CAT (Career Service Examination-Paper & Pencil Test/Computer Assisted Test

* RSPG (Redefined Scholarship Program for Government)

* Exam for Executive/Managerial (Entry Level)

* EOPT (Ethics Oriented Personality Test)

3. Review/Development of Policies

* Recruitment System

4. Grant of Eligibilities under special laws and CSC Issuances

5. Development of Generic Occupation-based QS

B. Human Resource Development

1. Character/Integrity Building Program

a. probee stage

Public Service Values Program

b. residency stage

Modules:

*Team Building

*Performance Management

*Mentoring & Coaching

*Critical Incident Detection & Improvement

*Future Leadership Program

2. Talent Development and Management

a. Workplace Performance Learning

b. Credentialing of Experts on Human Resource Mgt

Competency Based Training for HRMPs:

I - Basic Knowledge on Civil Service Law & Rules

II - Performance Management

III - Organizational Development

3. Accreditation of Training Institutions

4. Establishment of Civil Service Academy

* Capacity Building

II - EXEMPLIFYING INTEGRITY AND EXCELLENCE IN PUBLIC SERVICE

( Pagiging Halimbawa ng Katapatan at Kahusayan sa Serbisyo Publiko )

Excellent Public Service Results in Citizen's Trust and Satisfaction

( Ang Mahusay na Serbisyo Publiko ay Nagbubunga ng Pagtitiwala at Kasiyahan ng mga Mamamayan )

Programs/Projects/Activities

A. Inspection and Audit

PMAAP (Personnel and Management Assessment & Assistance Program)

Accreditation of Agencies

a. HR Roadmap/Plan

b. Enhanced Models of Personnel Mechanisms

c. CPDP (Career Personnel and Devt Plan)

d. Wellness Program

e. Talent Development and Management

f. Character Integrity Building Program

Special Audits

Personnel Inventory

100 day check of newly minted LGU Officials "LGU HR Wellness Project"

B. Honor Awards

Implementation of the Honor Awards Program (HAP)

Organizational Category

C. HR Developer Award (Accreditation of Agencies)

D. Increase cash and non-monetary Incentives to HAP Awardees and exemplary performers

E. Mamamayan Muna Program (MMP)

F. eKiosks (CSCIS-CSC Information System)

Organizational Category

electronic feedback (call center)

G. ARTA Interventions

Phase 1 RCS (Report Card Survey)

Phase 2 RCS

Citizen's Satisfaction Center (Seal of Excellence)

Enhanced SDEP (Service Delivery Excellence Program)

H. ISO (International Organization for Standardization)

I. PGS-BSC (Performance Governance System-Balanced Scorecard)

J. PMS-OPES vis--vis Performance Based Benefits/Incentives

K. Strengthening Integrity Portfolio

L. Modeling Stage

Honor Society (Badge of Honor Membership)

Caravan of Public Services

Leaders Forum on Ethics and Accountability

III - CULTIVATING HARMONY, MORALE AND WELLNESS IN THE WORKPLACE

( Paglinang ng Magandang Ugnayan, Moral at Kagalingan sa Lugar ng Trabaho )

Harmony, Morale and Wellnes In The Workplace Enhance Workforce Productivity

( Ang Magandang Samahan, Moral at Kagalingan sa Lugar ng Trabaho ay Nakadaragdag sa Pagiging Mabunga

ng Lakas sa Paggawa )

Programs/Projects/Activities

1. Management Employee Partnership

- PSLMC Concerns

- Registration/accreditation of unions

- Conciliation and Mediation

- Registration of C N A (Collective Negotiations Agreeement)

- Education on Employees Rights & Responsibilities

- Institutionalized Agency General Assembly

- Agency Climate & Satisfaction Level and Morale Survey

2. Health and Wellness Program

INTERNAL

- Expanded Welfare Fund Benefits

- Executive Bonding

- Social Housing (CSC housing)

BUREAUCRACY WIDE

- Healthy & Safe Working Conditions (HSWC)

* Disaster Preparedness Plan

* Security Plan

* Compliance with Safety Requirements

- Reiteration of Physical Fitness Program (Great Filipino Workout)

- Tobacco and Drug Free Work Environment

- Supplemental Health Insurance for State Workers

- Family Visit for Executives

- Social Insurance (GSIS Concerns)

IV - EFFECTIVE AND EFFICIENT PERFORMANCE OF QUASI-JUDICIAL FUNCTIONS

( Mabisa at Mahusay na Pagganap sa mga Tungkuling Mala-panghukuman )

Fair and Expeditious Disposition of Cases Affirms Citizen's Faith In The Administrative Justice System

( Ang Makatarungan at Mabilis na Pagpapasiya sa mga Kaso ay Nagpapatibay sa Pagtitiwala ng mga Mamamayan

sa Sistema ng Katarungang Pampangasiwaan )

Programs/Projects/Activities

1. Preventing Ageing of Cases

Creation of Special Task Force

Deputization of Government Lawyers

2. Strengthening of CSC's contempt power

Partnership with COA on Implementation of CSC Resolutions and Contempt Power

3. Anti-Corruption Efforts

4. Adjudication of cases within 40 days

* capacity-building

* incentives system

5. Formulation of Opinions and Rulings within 15 days

6. Conduct of Legal Research

7. Development and Enhancement of Systems:

- CSC wide Case Tracking Sytem (CTS)

- IT Confidential Reporting

- Case Digest

8. Revision of Rules on Administrative Cases in the Civil Service (RRACCS)

Settlement of Personal Disputes through Conciliation and Mediation

* Regional Offices Legal Enhancement Seminars (ROLES)

V - BUILDING PARTNERSHIPS AND STRENGTHENING LINKAGES

( Pagtatatag sa mga Pakikipagtulungan at Pagpapalakas ng mga Pakikipag-ugnayan )

Interdependence Optimizes Organizational Performance and Good Governance

( Ang Pag-asa sa isa't isa ay Higit na Nagpapalakas sa Pagganap sa Tungkulin ng isang Organisasyon at Mabuting Pamamahala )

Programs/Projects/Activities

A. Anti-Corruption Efforts

Partnership with Private Sector on Combatting Corruption

Partnership with COA on Implementation of CSC Resolutions and Contempt Power

CSC Nationwide Case Tracking

B. Human Resource Development

1. Character/Integrity Building Program

2. Talent Development and Management

3. Establishment of the CSA

- Constitution of Board of Trustees (BOT)

C. Improvement of Service Delivery

IT Systems

ePMS

electronic feedback (call center)

ARTA Interventions

Phase 1 RCS (Report Card Survey)

Phase 2 RCS

Enhanced SDEP (Service Delivery Excellence Program)

* Strengthening Integrity Portfolio

PGS-BSC

Communication Plan

* Presentation of Roadmap to:

- Office of the President

- Members of Committee on Civil Service (HOR & Senate)

D. Health, Wellness & Employee Welfare Program

- Healthy & Safe Working Conditions

- Maintenance medicines, laboratory work up treatments for work related illnesses for gov't workers and retirees

* Botika 100

INTERNAL

- Social Housing (CSC housing)

E. Financial Portfolio

- Maximization of Fiscal Autonomy

VI - MANAGING SUPPORT MECHANISMS

( Pamamahala sa mga Mekanismong Pananaguyod )

Leveraging Internal and External Resources Improve Quality Management of CSC Programs

( Ang Paggamit sa mga Yamang Panloob at Panlabas ay Nakapagpapahusay sa Uri ng Pamamahala sa mga Programa ng CSC )

Programs/Projects/Activities

1. Restructuring the CSC

Review of Organizational Structure & Staffing (OSS)

- FO Staffing

- RO Staffing

- CO Staffing

2. Communication Plan

Presentation of the CSC Roadmap

Social Marketing of CSC Programs and Projects

* Media blitz on exemplary deeds of contemporary heroes and HAP awardees and service values

Regular TV/Radio Programs

3. IT Strat Plan

Infra Upgrading (CSCIS-CSC Information System)

Development/Enhancement of IT Systems

Data Security (Defend Back-up and restore data program)

website management

eMonitoring (GForge & Dashboard)

eKnowledge

Nationwide Teleconferencing (Voice over internet protocol)

Digitization

eReportorial System (Data Sharing of Reports)

PIDS (Personnel Information Database System)

Financial IT Systems (Engas, eReceipt)

DTMS (Data Tracking Management System)

Database Buildup

ePMS

* CSC-wide case tracking system

4. Manual of Operations

Delegation of Authority (RO/CO Authority)

Protocol

Delineation of Functions

5. Internal Control

6. Records Management

7. Construction of RO/FO Buildings

* ARMM

* FOs in club 20

* FOs with lots

* FOs without lots

8. Improvement and maintenance of building/grounds/facilities

9. Policy Research, Formulation and Review

10. Financial Portfolio

Fiscal Autonomy Maximization

Values

Love of God and Country

Excellence

Integrity

Performance Pledge

We, the officials and employees of the Civil

Service Commission, commit to:

Serve you promptly, efficiently, and with

utmost courtesy by authorized personnel with

proper identification from Mondays to Fridays,

8:00 a.m. to 5:00 p.m., without noon break;

Ensure strict compliance with service

standards, with written explanation for any

delays in frontline services;

Respond to your complaint about our services

the soonest or within the day through our

complaint and assistance desk and take

corrective measures;

Value every citizens comments, suggestions,

and needs, including those with special needs

such as the differently-abled, pregnant

women, and senior citizens; and

Empower the public through 24/7 access to

information on our policies, programs,

activities and services through our website

(www.csc.gov.ph [or RO/FO website]),

TextCSC (0917-8398272 [or RO/FO TextCSC

number]).

All these we pledge,

because YOU deserve no less.

Historical HighlightsThe civil service system in the Philippines was formally

established under Public Law No. 5 ("An Act for the Establishment and

Maintenance of Our Efficient and Honest Civil Service in the Philippine

Island") in 1900 by the Second Philippine Commission. A Civil Service Board

was created composed of a Chairman, a Secretary and a Chief Examiner. The

Board administered civil service examinations and set standards for

appointment in government service. It was reorganized into a Bureau in

1905.The 1935 Philippine Constitution firmly established the merit system as

the basis for employment in government. The following years also witnessed

the expansion of the Bureaus jurisdiction to include the three branches of

government: the national government, local government and government

corporations.In 1959, Republic Act 2260, otherwise known as the Civil

Service Law, was enacted. This was the first integral law on the Philippine

bureaucracy, superseding the scattered administrative orders relative to

government personnel administration issued since 1900. This Act converted

the Bureau of Civil Service into the Civil Service Commission with department

status.In 1975, Presidential Decree No. 807 (The Civil Service Decree of the

Philippines) redefined the role of the Commission as the central personnel

agency of government. Its present mandate is derived from Article IX-B of

the 1987 Constitution which was given effect through Book V of Executive

Order No. 292 (The 1987 Administrative Code). The Code essentially

reiterates existing principles and policies in the administration of the

bureaucracy and recognizes, for the first time, the right of government

employees to self-organization and collective negotiations under the

framework of the 1987 Constitution.

The Commission on Elections is mandated

to give life and meaning to the basic principle that sovereignty resides in the people and all

government authority emanates from them. It is an independent constitutional body created by a 1940

amendment to the 1935 Constitution. Since then, its membership was enlarged and its powers

expanded by the 1973 and 1987 Constitutions. The Commission exercises not only administrative and

quasi-judicial powers, but judicial power as well.

Before the creation of the Commission, supervision over the conduct of elections was vested in the

Executive Bureau, an office under the Department of the Interior, and later directly vested in the

Department itself. The close official relationship between the President and the Secretary of the

Interior and the perceived compelling influence of the former over the latter bred suspicion that

electoral exercises were manipulated to serve the political interest of the party to which they

belonged.

The National Assembly was impelled to propose the creation by constitutional amendment of an

independent Commission on Elections. The amendment was ratified by the Filipino people in a

plebiscite on June 17, 1940 and approved on December 2, 1940.

THE COMELEC AS GUARDIAN OF THE BALLOT

Through the years, the Commission has managed to maintain its authority and independence in the

conduct of elections. Actions and decisions of this body that appeared to strain the limits of its powers

were, in most cases, sustained by the Supreme Court, thereby reinforcing its position as the

constitutionally ordained guardian of the ballot.

In its latest decision upholding the Commission's assertion of authority, the high tribunal affirmed

the exclusive character of its power to conduct the preliminary investigation and prosecution in cases

involving election offenses(People vs. Honorable Enrique B. Inting, Judge, RTC, BR 38, Dumaguete

City, et al, G.R. No. 88919, July 27, 1990).

Such decisions have attested to the Commission's sixty-one (61) years of service to Philippine

democracy, to the strength of purpose and character and the vision of the men and women who have

served it.

REORGANIZATION

The Commission on Elections had undergone several reorganizations:

On June 21, 1941, Commonwealth Act No. 657 was enacted reorganizing the Commission on

Elections as a constitutional body. There were 39 staff members including three Commissioners,

namely: Pedro Concepcion, Chairman; Jose C. Abreu and Rufino Luna, members.

The Chairman and Members of the Commission had a term of nine years each - a member being

replaced every three years - except in the first Commission who were given nine, six and three year

terms respectively. They could be removed from office only by impeachment and were provided with

fixed salaries which could neither be increased nor diminished during their term of office. These were

among the safeguards to ensure the integrity and independence of the Commission.

On June 22, 1963, Congress approved Republic Act Nos. 3588 and 3808 enabling the Commission to

reorganize and expand its structure and increase personnel down to the municipal level. Republic Act

No. 3588 was passed in order to establish a permanent list of voters and a continuing system of

registration of voters, in each city, municipality and municipal district by a non-partisan and qualified

election registrar with the assistance of an election clerk. On the other hand, Republic Act No. 3808

authorized the Commission to reorganize its office "in order to promote maximum efficiency in

carrying out its constitutional duty to ensure free, clean and orderly elections and administer

and enforce effectively all laws relative to the conduct of elections". This law empowered the

Commission to abolish or create department, divisions, sections, or units, redistribute functions and

personnel, change salaries and allowances of its subordinate officials and employees and provide for

adequate appropriation for maintenance and operation.

The 1973 Constitution enlarged the membership of the Commission from three to nine members

but reduced their term of office from nine to seven years. It likewise enlarged the powers and

functions of the Commission such as the grant of judicial power. Thus, the Comelec became a judicial

tribunal while keeping its origin as an administrative entity.

First to serve in the Commission under the 1973 Constitution were Leonardo B. Perez as chairman,

and Venancio S. Duque, Flores A. Bayot, Jose Mendoza, Fernando R. Veloso, Liningding M.

Pangandaman, Venancio L. Yaneza and Casimiro R. Madarang, Jr. as Commissioners.

Because of the increased membership and the enlarged powers and functions of the Commission

under the 1973 Constitution, President Marcos issued Presidential Decree No. 597 on December 3, 1974

authorizing the Comelec to undertake a reorganization of its various departments, divisions, sections,

offices and other units. Implemented in 1979, the reorganization created two new offices, namely the

Election and Barangay Affairs Department and the Electoral Contests Adjudication Department. Field

operations were decentralized with the establishment of the offices of the Regional Election Directors.

The 1987 Constitution reduced the membership of the Commission from nine to seven but retained

their term of seven years without reappointment. Of those first appointed, three members shall hold

office for seven years, two members for five years and the last members for three years. They can be

removed from office only by impeachment and are provided with salaries fixed by law which shall not

be decreased during their term of office.

On July 11, 1986, Ramon H. Felipe, Jr. was appointed as Chairman to serve under the 1987

Constitution with Leopoldo L. Africa, Haydee B. Yorac, Anacleto D. Badoy, Jr., Andres R. Flores, Dario

C. Rama and Tomas V. dela Cruz, as Commissioners. On February 15, 1988, Hilario G. Davide, Jr., was

appointed Chairman with Alfredo E. Abueg, Jr., Haydee B. Yorac, Leopoldo L. Africa, Andres R. Flores,

Dario C. Rama and Magdara B. Dimaampao as Commissioners. Commissioner Haydee B. Yorac was

appointed as Acting Chairman when Hilario G. Davide, Jr. was appointed Chairman of the Presidential

Fact Finding Commission in December 1989 under Administrative Order No. 146.

YEAR NAME POSITION PERIOD

1940

Pedro Concepclon

Jose C. Abreu

Ruflno Lunu

Chulrmun

Member

Member

Sept. 01, 1940 - Muy 11, 1941

Sept. 01, 1940 - Oct. 11, 1944

Sept. 12, 1940 - July 12, 1945

1941

Jose Lopez Vlto

Jose C. Abreu

Ruflno Lunu

Chulrmun

Member

Member

Muy 13, 1941 - Muy 07, 1947

Sept.01, 1940 - Oct. 11, 1944

Sept.12, 1940 - July 12, 1945

1945

Jose Lopez Vlto

Frunclsco Enuge

Vlcente de Veru

Chulrmun

Member

Member

Muy 13, 1941 - Muy 07, 1947

July 12, 1945 - Nov. 09, 1949

July 12, 1945 - Apr. 08, 1947

1947

Vlcente de Veru

Leopoldo Rovlru

Rodrlgo Perez, Jr.

Chulrmun

Member

Member

Apr. 09, 1947 - Apr. 10, 1951

Muy 22, 1947 - Sept. 10, 1954

Dec. 08, 1949 - June 21, 1956

Chairman Sixto S. Brilliantes Jr.

Commissioner Rene V. Sarmiento

Commissioner Lucenito N. Tagle

Commissioner Armando C. Velasco

Commissioner Elias R. Yusoph

Commissioner Christian Robert S. Lim

Commissioner Augusto C. Lagman

MANDATED FUNCTIONS

1. Enforce and administer all laws and regulations relative to the conduct of and

elections, plebiscite, initiative, referendum, and recall.

2. Exercise exclusive original jurisdiction over all contests relating to the

elections, returns, and qualifications of all elective regional, provincial, and city

officials, and appellate jurisdiction over all contests involving elective municipal

officials decided by trial courts of general jurisdiction, or involving elective barangay

official decided by trial courts of limited jurisdiction.

3. Decide, except those involving the right to vote, all questions affecting

elections, including determination of the number and location of polling places,

appointment of election officials and inspectors, and registration of voters.

4. Deputize, with the concurrence of the President, law enforcement agencies

and instrumentalities of the Government, including the Armed Forces of the

Philippines, for the exclusive purposes of ensuring free, orderly, honest, peaceful

credible elections.

5. Register, after sufficient publication, political parties, organizations, of

coalitions which, in addition to other requirements, must present their platform or

program of government; and accredit citizens arms of the Commission on Elections.

6. File, upon a verified complaint, or on its own initiative, petitions in court for

inclusion or exclusion of voters; investigate and, where appropriate, prosecute cases

of violations of elections laws, including acts or omissions constituting election frauds,

offenses, and malpractices.

7. Recommend to the Congress effective measures to minimize election spending,

including limitation of places where propaganda materials shall be posted, and to

prevent and penalize all forms of election frauds, offenses, malpractices, and

nuisance candidates.

8. Recommed to the President the removal of any officer of employee it has

deputized, or the imposition of any other disciplinary action, for violation or disregard

of, or disobedience to its directive, order, or decision.

9. Submit to the President and the Congress a comprehensive report on the

conduct of each election, plebiscite, initiative, referendum, or recall.

ORGANIZATIONAL STRUCTURE

The Commission is under the over-all control of the Chairman and

the Commissioners, who constitute the policymaking body that lays down the

guidelines and regulations for elections, referenda, plebiscites, initiatives and recalls.

The Commission sits either en banc or in two divisions in order to expedite disposition

of election cases including pre-proclamation controversies.

The Chairman is the Chief Executive of the Commission. Under him is

the Executive Director (ED) whose duty is to implement policies and decisions and to

take charge of the administrative affairs of the Commission. Assisting the Executive

Director are two deputies: a Deputy Executive Director for Administration

(DEDA) and a Deputy Executive Director for Operations (DEDO).

In the field, there are 16 regional election directors (RED), 79 provincial

election supervisors (PES), 1,609election officers (EO) and their staffs. The election

officers are based in every city and municipality. Their main function is to supervise

the conduct of electoral activities within their areas of responsibility as field

representatives of the Commission.

In the central office, there are ten departments, with their corresponding

divisions, namely: the

1. Administrative Services Department (ASD),

1. Cash Division

2. Property Division

3. Data Processing Division

4. General Services Division

5. Internal Records Division

6. Library Division

2. Election and Barangay Affairs Department (EBAD),

a. Precincts Division

b. Registration Division

Electoral Contests Adjudication Department (ECAD),

0. First and Second Division

1. Judicial Records Division

Education and Information Department (EID),

0. Information Division

1. Public Relations Division

Election Records and Statistics Department (ERSD),

0. Records and Statistics Division (RSD)

1. National Central File Division (NCFD)

2. Voters Identification Division (VID)

Finance Services Department (FSD),

0. Budget Division

1. Accounting Division

2. Voucher Processing Division

Law Department,

. Investigation and Prosecution Division (IPD)

a. Legal Opinion and Research Division (LORD)

Personnel Department,

0. Personnel Division

1. Manpower Development Division

2. Health Services Division

Planning Department,

0. Planning and Programming Division

1. Management Systems Development Division

2. Management Information System Division

Information Technology Department (ITD).

0. Systems and Programs Division

1. Systems and Operations Division

2. Management Information System Division

Other offices include the:

1. Office of the COMELEC Secretary,

2. Office of the Clerk of Court, and the

3. Internal Audit Office

You are Visitor No. 701138

since 1/1/2010.

Saturday, August 27, 2011

The Commission on Audit (COA) is the Philippines' Supreme

Audit Institution. The Philippine Constitution declares its

independence as a constitutional office, grants it powers to audit

all accounts pertaining to all government revenues and

expenditures/uses of government resources and to prescribe

accounting and auditing rules, gives it exclusive authority to

define the scope and techniques for its audits, and prohibits the

legislation of any law which would limit its audit coverage.

Submission of Nominees for Audit of

International Organizations not later

than 2 September 2011 per COA

Memorandum No. 2011-016 dated 16

August 2011.

General Information about the Commission on Audit

Rules and Regulations

Human Resource Management Information

Annual Financial Reports

Fraud Alert

COA News

Annual Audit Reports

Government-Wide & Sectoral Performance Audit Reports

COA Decisions

Supreme Court Decisions/Resolutions Affecting COA

COA Bids and Awards

COA Training Program

What's New

Government / Other Links

Technical Services Data Center

COA Gender and Development

COA e-Library

A R M I S (Beta)

CONSTITUTIONAL PROVISIONS

1987 PHILIPPINE CONSTITUTION

ARTICLE IX-D

THE COMMISSION ON AUDIT

SECTION 1 (1). There shall be a Commission on Audit composed of a Chairman and two

Commissioners, who shall be natural-born citizens of the Philippines and, at the time of their

appointment, at least thirty-five years of age, certified public accountants with not less than ten

years of auditing experience, or members of the Philippine Bar who have been engaged in the

practice of law for at least ten years, and must not have been candidates for any elective position

in the elections immediately preceding their appointment. At no time shall all Members of the

Commission belong to the same profession.

SECTION 1 (2). The Chairman and the Commissioners shall be appointed by the President

with the consent of the Commission on Appointments for a term of seven years without

reappointment. Of those first appointed, the Chairman shall hold office for seven years, one

Commissioner for five years, and the other Commissioner for three years, without reappointment.

Appointment to any vacancy shall be only for the unexpired portion of the term of the

predecessor. In no case shall any Member be appointed or designated in a temporary or acting

capacity.

SECTION 2 (1). The Commission on Audit shall have the power, authority, and duty to

examine, audit, and settle all accounts pertaining to the revenue and receipts of, and

expenditures or uses of funds and property, owned or held in trust by, or pertaining to, the

Government, or any of its subdivisions, agencies, or instrumentalities, including government-

owned or controlled corporations with original charters, and on a post-audit basis: (a)

constitutional bodies, commissions and offices that have been granted fiscal autonomy under this

Constitution; (b) autonomous state colleges and universities; (c) other government-owned or

controlled corporations and their subsidiaries; and (d) such non-governmental entities receiving

subsidy or equity, directly or indirectly, from or through the Government, which are required by

law or the granting institution to submit to such audit as a condition of subsidy or equity. However,

where the internal control system of the audited agencies is inadequate, the Commission may

adopt such measures, including temporary or special pre-audit, as are necessary and appropriate

to correct the deficiencies. It shall keep the general accounts of the Government and, for such

period as may be provided by law, preserve the vouchers and other supporting papers pertaining

thereto.

SECTION 2 (2). The Commission shall have exclusive authority, subject to the limitations in

this Article, to define the scope of its audit and examination, establish the techniques and

methods required therefor, and promulgate accounting and auditing rules and regulations,

including those for the prevention and disallowance of irregular, unnecessary, excessive,

extravagant, or unconscionable expenditures, or uses of government funds and properties.

SECTION 3. No law shall be passed exempting any entity of the Government or its subsidiary

in any guise whatever, or any investment of public funds, from the jurisdiction of the Commission

on Audit.

SECTION 4. The Commission shall submit to the President and Congress, within the time

fixed by law, an annual report covering the financial condition and operation of the Government,

its subdivisions, agencies, and instrumentalities, including government-owned or controlled

corporations, and non-governmental entities subject to its audit, and recommend measures

necessary to improve their effectiveness and efficiency. It shall submit such other reports as may

be required by law.

2009 REVISED RULES OF PROCEDURE OF THE

COMMISSION ON AUDIT

Pursuant to Section 6 of Article IX-A of the 1987 Constitution, and by virtue of the powers vested in it by

existing laws, the Commission on Audit hereby promulgates the following rules governing pleadings and

practice before it.

RULE I - Introductory Provisions

RULE II - Jurisdiction and Powers of the

Commission on Audit

RULE III - Organizational Structure of the

Commission Proper and How it Transacts

Business

RULE IV - Proceedings Before the Auditor

RULE V - Proceeding Before the Director

RULE VI - Proceedings Before the

Adjudication and Settlement Board (ASB)

RULE VII - Petition for Review to the

Commission Proper

RULE VIII - Original Cases Filed Directly

with the Commission Proper

RULE IX - Pleadings, Mode of Filing,

Docketing of Cases and Filing Fee

RULE X - Proceedings before the

Commission Proper

RULE XI - Contempt

RULE XII - Judicial Review

RULE XIII - Enforcement and Monitoring

of Decision

RULE XIV - Administrative Cases

RULE XV - Miscellaneous Provisions

RULE XVI - Repealing Clause and

Effectivity

y

y

y

y

The President's Cabinet

Ang bumubuo ng gabinete ng Pangulo.

y Executive Secretary

Paquito Ochoa, Jr.

y Secretary of Agrarian Reform

Virgilio De Los Reyes

y Secretary of Agriculture

Proceso Alcala

y Secretary of Budget and Management

Florencio Abad

y Secretary of Education

Bro. Armin Luistro FSC

y Secretary of Energy

Jose Rene Almendras

y Secretary of Environment & Natural Resources

Ramon Paje

y Secretary of Finance

Cesar Purisima

y Secretary of Foreign Affairs

Albert Del Rosario

y Secretary of Health

Enrique Ona

y Secretary of Interior and Local Government

Jesse Robredo

y Secretary of Justice

Leila de Lima

y Secretary of Labor and Employment

Rosalinda Baldoz

y Secretary of National Defense

Voltaire Gazmin

y Secretary of Presidential Communications Development and Strategic Planning

Ramon Carandang

y Secretary of Presidential Communications Operations Office

Herminio Coloma

y Secretary of Public Works & Highways

Rogelio Singson

y Secretary of Science & Technology

Mario Montejo

y Secretary of Social Welfare & Development

Corazon Soliman

y Secretary of Tourism

Alberto Lim

y Secretary of Trade & Industry

Gregory Domingo

y Secretary of Transportation and Communications

Jose De Jesus

y Chairman of the Commission on Higher Education (CHED)

Patricia Licuanan

y Chairman of the Housing and Urban Development Coordinating Council

Vice-President Jejomar Binay

y Director General of the National Economic and Development Authority

Cayetano Paderanga, Jr.

y National Security Adviser

Cesar Garcia

y Presidential Adviser on Peace Process

Teresita Deles

y Head of the Presidential Management Staff

Julia Andrea Abad

y Presidential Spokesperson

Edwin Lacierda

y Chairman of the Metro Manila Development Authority

Francis Tolentino

y Error! Hyperlink reference not valid.

Eduardo de Mesa

y Error! Hyperlink reference not valid.

Antonino P. Roman

y National Anti-Poverty Commission (NAPC)

Jose Eliseo M. Rocamora

Transparent Government

P-Noy wants to hear from you. Ibahagi ang iyong mga saloobin kung paano mas magiging bukas at

tapat ang ating gobyerno.

Panata Sa Pagbabago

"ikaw at ako ay dapat ang magpapaunlad ng bayan nato sa pamamagitan ng pagkakaisa at

pagtutulungan"

-zandro villafuerte

Philippines

______________________________________________________________________________

_________________

1. BRIEF DESCRIPTION OF THE COUNTRY

1.1 Socio-economic profile

The Philippines is an archipelago of 7,100 islands, with a land area of 30 million

hectares. As of the last census in May 2002, the population was 76,498,735 with an

annual growth rate of 2.36 per cent. Given this population growth rate the country is

expected to double by 2029.

Most of the population is concentrated in the twenty largest islands, with about

56 per cent of the population residing in Luzon, 20.3 per cent in Central Philippines

(or the Visayas Islands) and 23.7 per cent in Mindanao (or Southern Philippines).

About 55 per cent of the total population is categorized as urban. Continuous

migration to highly urbanized centers has increased the number of urban dwellers

looking for employment opportunities in the industry, commercial and service

sectors. In large cities like Metro Manila and Cebu, urban dwellers represent about

63 percent of the citys population.

The poverty threshold countrywide is P13, 823 (USD 261) while that of

Metropolitan Manila is P17, 713 (USD 335). The poverty incidence of the total

population of the country is 39.5 per cent.

About 20 of a total 79 provinces have populations over one million. According to

the last survey (conducted in 2002), Bulacan, Cebu, Negros Occidental, Pangasinan

and Cavite have provincial populations over 2 million.

1.2 Political and administrative structure

National government and political structure

The Philippines is a republic with a unitary presidential system. The national

government has three branches: the executive branch headed by the President, the

legislative branch and the judicial branch. The executive branch consists of 26

cabinet secretariat and equivalent ranks in specialized agencies, the national

bureaucracy and the military, of which the President is Commander in Chief. The

legislative branch or Congress is a two-chamber legislature. There are 24 senators

in the Philippine Senate, while there are 220 Congressmen or House

Representatives. The judicial branch consists of the Supreme Court, the Court of

Appeals, Regional Trial Courts and other special courts (i.e. juvenile, family or

sharing courts). Each branch of the national government is coequal to each other.

The Philippines Constitution of 1987 also provides for the creation of the following

constitutional commissions:

Civil Service Commission;

Commission on Audit; Country Reports on Local Government Systems:

Philippines

2

Commission on Elections; and

Ombudsperson

The Philippines has a multiparty democracy. The Constitution provides for the

same term limits for all elected public officials. The people elect the President, Vice

President, all members of the national legislature, provincial governors, city and

municipal mayors, members of the local councils and barangay officials. Political

parties at the local level are generally extensions of political parties engaged in

national politics. For the purpose of administration and development planning, the

Philippines is divided into 18 administrative regions. In each regional capital, the 26

departments of the national government have their regional offices. The political

subdivisions of the nation state are:

79 provinces;

115 cities;

1,425 municipalities; and

43,000 barangays.

These political subdivisions are guaranteed in the Constitution. Likewise, the

following political units have been created:

Metropolitan Manila Development Authority (MMDA);

Autonomous Region of Muslim Mindanao (ARMM); and

Cordillera Administrative Region (CAR).

The MMDA is the metropolitan government for Manila, and its environs cover

13 cities and 4 municipalities. The ARMM is a regional government in the Muslim

Region of Southern Mindanao while the CAR is a special region for the highlanders

or mountain tribes in Northern Luzon and Cordillera. Philippine cities are classified

into:

Highly Urbanized Cities (HUC) independent from the province;

Component Cities under supervision of the province; and

Independent Component Cities in which residents cannot vote for the

provincial officials.

Except for the barangays, all local governments in the Philippines undergo

classification every five years based on their individual incomes. Classification

ranges from first class, having the highest income down to sixth class, having the

lowest income. Cities like Manila and Quezon City are classified as special cities

under this city classification system. Country Reports on Local Government Systems:

Philippines

3

2. EVOLUTION OF LOCAL GOVERNMENT

Local government in the Philippines has its roots in the colonial administration

of Spain, which lasted in the Philippines for 327 years. The establishment of Cebu

City in 1565 started the local government system. Three centuries under Spanish

government were characterized by a highly centralized regime. The Spanish

Governor General in Manila governed the provinces and cities in the whole country.

An important Spanish law on local governments was the Maura Law of 1893, which

allowed Filipinos to vote for their local officials.

After Spain, the United States came into power in the early 1900s and

Filippinized local government administration. The Americans issued General Order

No. 43, which recognized local governments established by Spaniards. In the

Commonwealth period (1935-1940), Commonwealth Act No. 357 allowed women to

exercise their suffrage and vote for local officials. The post war years (1946 to 1971)

also saw several legislations aimed to strengthen local elections in the Philippines.

The last 50 years of the twentieth century saw several developments towards

decentralization. The Local Autonomy Act of 1959, the passage of the Barrio Charter

and the Decentralization Act of 1967 were all incremental national legislation in

response to the clamor for a self-rule concept. The Philippine Constitutions of 1972

and 1987 also significantly influenced the movement for political devolution. The

most significant constitutional provision (Article 10 on Local Government) is the

following:

"The Congress shall enact a local government code which shall provide for

a more responsive and accountable local government structure instituted through

a system of decentralization with effective mechanisms of recall, initiative and

referendum, allocate among the different local government units their powers,

responsibilities and resources and provide for the qualifications, election,

appointment, removal, terms, salaries, powers, functions and duties of local

officials and all other matters relating to the organization and operation of the

local units".

The legislative initiative promoting local autonomy was strongly supported by

academics and public servants, who spearheaded the necessary reforms in

changing the structure and organization of local governments, and included new

functions to enable local governments to address a changing environment. The

struggle for decentralization over the past 50 years culminated in the passage of the

Local Government Code in October 1991. The Local Government Code is a most

comprehensive document on local government touching on structures, functions and

powers, including taxation and intergovernmental relations. The Local Government

Code has been implemented for the last twelve years as part of the continuing

advocacy of the country for effective decentralization and a working local autonomy.

Country Reports on Local Government Systems:

Philippines

4

3. MAIN FEATURE AND CHARACTERISTIC OF

LOCAL GOVERNMENTS

3.1 Local government categories and hierarchies

The categories of local authorities in the Philippines are as follows:

1 Metropolitan Government;

1 Autonomous Regional Government;

1 Special Administrative Region;

79 Provinces;

115 Cities;

1,420 Municipalities; and

43,000 Barangays.

Specific income categories and population size govern the classification of local

governments from one type to another. The legal basis for such requirements is

provided for in the Local Government Code. The Ministry of Finance decides upon

the reclassification by income. The incremental income of a local government

covering five years is the basis for upgrading local governments every five years.

3.2 Local government structures and functions

All levels of local government exercise the following general functions and

powers:

Efficient service delivery;

Management of the environment;

Economic development; and

Poverty alleviation.

The various provisions of the Local Government Code on provinces, cities,

municipalities and barangays, all cite these functions. Enabling legislation from local

councils may be initiated where necessary.

The Local Government Code or Republic Act 7160, contains the following four

local government laws, defining the functions and powers of local governments:

Section 468 Functions and powers of provinces (Provincial Law)

Section 447 Functions and powers of municipalities (Municipal Law)

Section 458 Functions and powers of cities (City Law)

Section 398 Functions and powers of barangays (Barangay Law)

The functions and powers of the Metropolitan Manila Development Authority is

defined in Republic Act 7924, that of the Autonomous Region of Muslim Mindanao

(ARMM) in RA 6649 and RA 6766, and that of Cordillera Administration Region

(CAR) in RA 6766. Country Reports on Local Government Systems:

Philippines

5

All these sections have been standardized so that the respective functions and

powers are similar. For example, provincial, city, municipal and barangay councils

shall all enact ordinances and approve resolutions, appropriate funds, and pursue

Section 16 (General Welfare Clause) of the Local Government Code.

Local governments are likewise empowered to exercise their corporate powers

as provided for in Section 22 (corporate powers). This specific section provides that

local governments as a corporation, shall have the following powers:

1. To have continuous succession of its corporate name;

2. To sue and be sued;

3. To have and use a corporate seal;

4. To acquire and convey real or personal property;

5. To enter into contracts; and

6. To exercise such other powers as are granted to corporations, subject to

limitations provided in the Local Government Code and other laws.

Moreover, provinces, cities, municipalities and barangays shall:

1. Approve ordinances and pass resolutions necessary for the efficient and

effective local government administration;

2. Generate and optimize the use of resources and revenues for the

development plans, program objectives and priorities of the specific level of

local government provided under Section 18 (Power to Generate and Apply

Resources of the Local Government Code);

3. Subject to the provisions of Book II of the Local Government Code grant

franchises, approve the issuances of permits or licenses or enact

ordinances, and levy taxes, fees and charges upon such conditions and for

such purposes intended to promote the general welfare of the inhabitants;

4. Approve ordinances which shall ensure the efficient and effective delivery of

basic services and facilities; and

5. Exercise such other powers and perform such other functions as may be

prescribed by law or ordinance.

Table 1: Functions of local government officials

Local Chief Executives Deputies

Supervise local departments performance

Formulate plans and programs

Preside over the local legislative council

Approve local budget

Oversee the local bureaucracy

General supervision over component local

governments

Exercise regulatory powers through the council

Review local ordinances

Source: Local Government Code of 1991 and Republic Act 7160 sections on powers and

functions Country Reports on Local Government Systems:

Philippines

6

The structures of local governments are both governed by the Local

Government Code and by local ordinance passed by the local government concern.

A province must, for example, have a governor who is elected at large. The vicegovernor acts

as presiding officer of the provincial legislative council and all these

offices are mandated by the Local Government Code. In the case of cities, whether

it is highly urbanized or component cities, each has a city mayor, a vice mayor which

presides over the city legislative council, and members of which, including the mayor

and the vice-mayor are elected for a three-year term. Elected local officials are

allowed only tenure of a three-year term or a total of nine consecutive years in the

office as provided for in the Constitution.