Professional Documents

Culture Documents

7 Skills Needed by Data Center Managers

Uploaded by

Ananya ShrivastavaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 Skills Needed by Data Center Managers

Uploaded by

Ananya ShrivastavaCopyright:

Available Formats

7 Skills Needed by Data Center Managers

June 16th, 2011 : Industry Perspectives Nathan Hatch is President and CEO of C7 Data Centers, a privately held company focused on providing high-value data center solutions for colocation, disaster recovery, data backup and virtualization.

NATHAN HATCH C7 Data Centers Hiring the right data center manager is critical for customer acquisition and retention. Thorough candidate interviews with several members of your management team are indispensable. Also, making sure you have two to three positive industry references will improve your chances of getting the best candidate for this important customer-facing position. At the center of hiring, the personal skills needed by candidates can be grouped into seven areas. Here are the areas to consider when hiring a data center manger. Organization Skills Self Motivation Availability and Commitment Communication and Customer Service Skills Leadership Experience Professionalism and Maturity Work Experience

1. Organization Skills It has been said that a poorly organized person invites crisis. A well-organized data center manager will significantly reduce incidents caused by human error. 2. Self Motivation A motivated data center manager will actively seek out ways to improve his data center and staff. An unmotivated data center manager will only react to the immediate pressing needs, which could lead to preventable customer downtime. 3. Availability and Commitment A data center manager needs to be on-site, involved, and aware of all of the happenings

in the facility. Totally invested data center managers will respond to phone calls or follow up on emails, regardless what time of day or night it may be. 4. Communication and Customer Service Skills Poor communication and customer service between the data center manager and the current or potential customer can create a bad impression on an otherwise well run company. Mis-communicated information can also lead to customer downtime. 5. Leadership Experience Not only should a data center manager be comfortable managing staff, but they should also understand the importance of leading by example. A good data center manager will always feel the weight of responsibility to ensure that employees understand the data center rules and procedures. 6. Professionalism and Maturity Data center managers must exhibit confidence and act professionally with employees and customers while on the job. A successful data center manager will know his employees as well as he knows his facility. The nature of managing a multi-tenant data center requires that the data center manager take seriously the responsibility of dealing with customer concerns and any emergency that could arise. 7. Work Experience The data center manager candidate should have experience working closely with customers, responding to data center support tickets and escalating client concerns. Other valuable experience would include successfully managing and motivating security and technical personnel in a data center setting. Records show that data center managers who perform well have very good communication skills as well as the ability to be firm and reasonable in day-to-day customer and employee situations. Industry Perspectives is a content channel at Data Center Knowledge highlighting thought leadership in the data center arena. See our guidelines and submission process for information on participating. View previously published Industry Perspectives in our Knowledge Library

The Non-Financial Skills You Need to Succeed in Finance

1. Communication Skills Financial professionals can't just be good at crunching numbers - they must be able to communicate their knowledge with strong speaking, writing and presentation skills. Beverly D. Flaxington, author of "7 Steps to Effective Business Building for Financial Advisors," says that when you are presenting to a board, an investor or a prospect, you need to know how to convey complex information in a way people can easily understand. (To learn more, read 7 Courses Finance Students Should Take.) 2. Relationship-Management Skills The people skills you need to succeed as a financial professional include understanding different personality types, listening, asking the right questions, resolving conflicts, educating others and counseling clients. Financial planner Judith Cane of Ontario-based Antara Financial Group says that success in finance is "15% technical knowledge and 85% psychology. When people come to see me it's because they have issues with money. They spend too much, they don't save anything or they save everything." What clients often need, therefore, is an unbiased advisor who can understand their needs and help them make financial decisions. Managing relationships is key whether you're dealing with subordinates, co-workers, bosses or people outside your company. When people trust you, like you and feel that you respect them, they will want to help you succeed, whether it's by speaking highly of you, promoting you or signing up to be your client. (For more on the importance of relationship-building, see Small Business: It's All About Relationships.) 3. Marketing and Sales Skills Robert L. Riedl, director of wealth management for Sumnicht Associates in Appleton, Wisconsin, says financial professionals need to be able to market their professional skills and knowledge to prospects in their niche markets. To do so, it's imperative to have a complete understanding of both your personal strengths and your firm's professional strengths. He further advises that in marketing yourself to clients, you shouldn't just communicate how much you know, but also how much you care, because "the client's most valuable assets and their biggest daily concern is not their monetary wealth, but rather their family." Clients want to know that you can help them manage their money to best provide for their family's long-term needs. (For more on marketing in financial careers read The Marketing Director's Pitch and Generational Marketing: Harvest The Whole Family Tree.) 4. Project Management Ability, Organizational Skills and Attention to Detail Any task that takes more than a few minutes is essentially a project - one that you'll need to manage effectively to be profitable. You'll need to efficiently and effectively schedule your time, manage budgets, meet deadlines and get what you need from other people in time to complete your project successfully. Both during and after any project, staying organized and paying attention to detail are also key. Corporate finance professional Myles Wolfe says, "For any analytical project, someone will usually have questions about the inputs and assumptions. If you can't deliver timely backup information, even if it is 100% accurate, people will question the accuracy of the final output." He says it's critical to have both your electronic files and hard copies organized to access information quickly. You might get asked a question months after your initial analysis by a CFO who needs the information in 30 minutes for a conference call. "Especially in the financial world, sloppiness is intolerable," he says. 5. Problem-Solving Skills You will always encounter problems in any job, and being able to solve them rather than cracking under pressure is essential. To get ahead, it can also be helpful to look beyond your own personal responsibilities. Pisik advises that by helping your coworkers solve their problems rather than simply reporting them to upper management, you'll be viewed as a team player.

"People will gravitate toward you and your career will flourish," he says. 6. Technological Savvy No matter where you work, you will need to be proficient with computer hardware and software and able to pick up new programs related to your job quickly. The more shortcuts, keys, programs and functions you know in Excel, the better off you will be in finance. You should also get familiar with marketing and communication software tools. (Swimming in a sea of numbers? Find out how to crunch them quickly! Check out Microsoft Excel Features For The Financially Literate.) 7. Tenacity and Ethics A competitive personality, passion for your work and the stamina to work long hours and go above and beyond what's expected of you and what your co-workers and competitors are doing are all crucial to success in finance. At the same time, you can't be so competitive that you make poor choices, or your career and reputation will suffer. Kevin R. Keller, CEO of the Certified Financial Planner Board of Standards, says that adhering to a set of ethical standards such as those required of certified financial planners (CFPs) is crucial to rebuilding the trust that has been broken by financial scandals. The Certified Financial Planner Board of Standards' Standards of Professional Conduct requires CFPs to provide professional services with integrity, objectivity, competence, fairness, confidentiality, professionalism and diligence. Anyone who works in finance would be wise to hold him- or herself to principles such as these. (For more food for thought on ethics in finance, read Ethical Issues For Financial Advisors and 8 Ethics Guidelines For Brokers.) Anticipation Looking ahead to what bosses or clients will need from you in the immediate or even the distant future will help you rise to the top. It's not enough to just solve the day-to-day challenges of your job; you must be able to think long term. Consider the following:

What skills can you develop and what accomplishments can you put under your belt that will get you rehired if you are laid off, land you a promotion at your current company or get your foot in the door at another company? How can you make your boss's life easier by anticipating what he or she will need from you tomorrow, next week or next month and taking care of it ahead of time? How can you develop relationships with your clients by paying close attention to their situations? For example, if you notice that the woman who has come to you for help managing an inheritance is pregnant, realizing that she could need help saving and investing for her child's college education, updating her will and possibly creating a trust can help you create a long-term business relationship with that client.

Putting It All Together: Wisdom and Interpretation Los Angeles-based writing consultant Elizabeth B. Danziger, founder of Worktalk Communications Consulting and author of "Get to the Point!", says, "Clients of financial-service professionals are looking for more than knowledge and numbers: They're looking for wisdom and interpretation." By combining your ability to analyze numbers with skills like communication, project management and relationship development, you'll emerge as a leader and position yourself to rise to the top of your field. (Experience and hard work go a long way toward securing a position in this challenging field.

Read more: http://www.investopedia.com/articles/financial-theory/10/important-non-financial-skillsets.asp#ixzz1UYY4Vh3l

So what are the Top 10 Qualities that make a Manager effective? 1. Integrity Integrity fosters trust, which in turn builds loyalty. A manager with loyal staff has the capability to be very effective. They have staff that they know they can rely on and, in turn, their staff are confident in their abilities to deliver knowing they have the support of their manager. 2. Empower An effective manager empowers his or her staff to perform at their best. This means creating an environment for success: setting boundaries so that people can take responsibility, creating opportunities that allow people to challenge their abilities, motivating people to find new and innovative ways, all while also ensuring support structures are in place. 3. Motivation People perform at their best when they are happy and motivated. But there is much more to motivation than salary or bonuses. A manager that understands his or her employees can set challenging yet achievable goals and rewards in a variety of ways. People can be motivated by interesting work, by being part of an effective team, by the prospect of learning new skills, or by the knowledge that their hard work will be recognised and appreciated. 4. Delegate An effective manager understands the skills and abilities of his or her staff, and knows how to delegate. Effective delegation is selecting the right person to do the work, given the constraints of skill requirements and time. Delegation is entrusting the person with the responsibility to complete the work. It includes setting clear guidelines and expectations as well as boundaries for decision-making responsibilities. 5. Adaptable The business environment is an ever-changing one. All managers must be able to quickly adjust, understanding the implications of the changes and adjusting goals and strategies accordingly. An adaptable manager sets an example to his/her employees and leads the way in demonstrating new ways of working and/or behaving. 6. Takes action

An effective manager takes action. If they see a problem they address it. This may seem obvious, but all to often there are decisions that many managers find to difficult to take, so they put it off until a later date. Or perhaps they move the problem for someone else to solve, such as the poor performing employee that gets moved around the organisation. 7. Networker Anyone can obtain the organisation chart, but what is more useful for any manager is to understand the real network within the business. Who are the key people that can make things happen? Its about understanding who affect the decisions you make today and in the future, and ensuring you have a good relationship with them. 8. Understands the Business Culture For any manager to be successful in a business they need to understand its culture. This means they understand the goals and strategic drivers, they appreciate the future vision for the business, and they know how things happen. Understanding how the wheels turn within a business helps a manager work more effectively and equally helps them contribute to the overall strategy and goals. 9. Role Model An effective manager sets an example, to all staff, of appropriate behaviour and performance standards. It may seem obvious, but it is extremely difficult to expect others to behave in a particular way, if you yourself do not set such an example. 10. Value people above all else A job well done is not about systems or processes or figures; its about people. An effective manager recognises the importance of people in business, and shows everyone respect regardless of the role that they play. An effective manager listens to people; is fair and understanding. This doesnt mean they can always keep everyone happy; because as a manager this simply isnt the case, however if a decision is reached though a fair process people understand how the outcome was reached even if they dont necessarily agree with result.

You might also like

- Kapferer Model Brand Identity Prism 1228214291948754 9Document31 pagesKapferer Model Brand Identity Prism 1228214291948754 9Ananya ShrivastavaNo ratings yet

- Kapferer Model Brand Identity Prism 1228214291948754 9Document31 pagesKapferer Model Brand Identity Prism 1228214291948754 9Ananya ShrivastavaNo ratings yet

- Banking AssignmentDocument8 pagesBanking AssignmentAnanya ShrivastavaNo ratings yet

- M Damodaran PresentationDocument10 pagesM Damodaran PresentationAnanya ShrivastavaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- EN Organizational Health Index and Organiza PDFDocument16 pagesEN Organizational Health Index and Organiza PDFbang jimmyNo ratings yet

- Emergent Curriculum Instructional Design ModelDocument11 pagesEmergent Curriculum Instructional Design Modelapi-307926958No ratings yet

- Hoff CVDocument4 pagesHoff CVapi-522428025No ratings yet

- Christmas Commercial (A2-B1) Esl Lesson PlanDocument4 pagesChristmas Commercial (A2-B1) Esl Lesson PlanAnastasia SotskayaNo ratings yet

- Organaization BehaviorDocument35 pagesOrganaization BehaviorChandra KanthNo ratings yet

- Models of PreventionDocument21 pagesModels of Preventionprecillathoppil100% (5)

- Royal University of Bhutan Gedu College of Business Studies Gedu: ChukhaDocument4 pagesRoyal University of Bhutan Gedu College of Business Studies Gedu: ChukhaRajesh MongerNo ratings yet

- Institutional Graduate Outcomes and Program Graduate OutcomeDocument14 pagesInstitutional Graduate Outcomes and Program Graduate OutcomeRoNnie RonNieNo ratings yet

- Sevastia Moundros ResumeDocument1 pageSevastia Moundros Resumeapi-658863187No ratings yet

- Experimental Project On Action ResearchDocument3 pagesExperimental Project On Action Researchddum292No ratings yet

- Personality DevelopmentDocument6 pagesPersonality DevelopmentAnusha Verghese100% (1)

- CBR ICT IN ENGLISH LEARNING - Kel 5 DIK EDocument5 pagesCBR ICT IN ENGLISH LEARNING - Kel 5 DIK EZuan Sandria Baltazar SerangNo ratings yet

- Self-Esteem and Branded Apparel: An Evaluation of One's Behavioral StateDocument8 pagesSelf-Esteem and Branded Apparel: An Evaluation of One's Behavioral StateGABRIELLE SOPHIA BAUTISTANo ratings yet

- Module I Nature and Scope of Research MethodologyDocument6 pagesModule I Nature and Scope of Research MethodologyKhushbu Saxena100% (1)

- Sankanan NHS CGP Implementation Report Sy 2020-2021Document5 pagesSankanan NHS CGP Implementation Report Sy 2020-2021Iris Joy Lee GeniseNo ratings yet

- Playwriting Pedagogy and The Myth of IntrinsicDocument17 pagesPlaywriting Pedagogy and The Myth of IntrinsicCaetano BarsoteliNo ratings yet

- Leila Ponsford 2016-2017Document3 pagesLeila Ponsford 2016-2017api-267808262No ratings yet

- Teaching ModelsDocument38 pagesTeaching ModelsRomelynn SubioNo ratings yet

- Master English Through Listening, Speaking, Reading and WritingDocument3 pagesMaster English Through Listening, Speaking, Reading and WritingRusmanizah UstatiNo ratings yet

- Contribution - 2019 - She Ji The Journal of Design Economics and InnovationDocument1 pageContribution - 2019 - She Ji The Journal of Design Economics and InnovationnitakuriNo ratings yet

- Tips For Being A Super-Organised Student - ExercisesDocument3 pagesTips For Being A Super-Organised Student - Exerciseshasan ibrahimNo ratings yet

- Full TextDocument21 pagesFull TextKartini AmbomaiNo ratings yet

- Review of Related LiteratureDocument6 pagesReview of Related LiteratureMimik MikNo ratings yet

- Strategy for Decreasing Problem Behavior Using ExtinctionDocument3 pagesStrategy for Decreasing Problem Behavior Using Extinctioniulia9gavrisNo ratings yet

- Resume Grace Sugg WeeblyDocument2 pagesResume Grace Sugg Weeblyapi-287948480No ratings yet

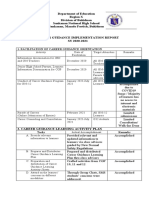

- Department of Education: Republic of The Philippines Deped Complex, Meralco Avenue, Pasig City, PhilippinesDocument1 pageDepartment of Education: Republic of The Philippines Deped Complex, Meralco Avenue, Pasig City, PhilippinesSam PadabocNo ratings yet

- en Improving Students Writing Skill Using ADocument15 pagesen Improving Students Writing Skill Using AfatinfiqahNo ratings yet

- (Dieter Mans, Gerhard Preyer (Eds.) ) Proto Sociolo (BookFi) PDFDocument208 pages(Dieter Mans, Gerhard Preyer (Eds.) ) Proto Sociolo (BookFi) PDFSaleem SadaatNo ratings yet

- Multimedia Lesson PlanDocument4 pagesMultimedia Lesson PlannidhiNo ratings yet

- Examine The Customers' Attitude To Mobile Banking Based On Extended Theory of Planned Behaviour (A Case Study in EN Bank)Document11 pagesExamine The Customers' Attitude To Mobile Banking Based On Extended Theory of Planned Behaviour (A Case Study in EN Bank)xaxif8265No ratings yet