Professional Documents

Culture Documents

Achieved Acquisition Savings: Management and Organizational Excellence

Uploaded by

Sunlight FoundationOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Achieved Acquisition Savings: Management and Organizational Excellence

Uploaded by

Sunlight FoundationCopyright:

Available Formats

performance and accountability report | fiscal year 2010 part 1: managements discussion and analysis

information. treasury is also enhancing its capability to monitor the use of illegal and unauthorized software in its networks and systems. this capability will help prevent software piracy and the introduction of hostile software which would put treasurys It-based business processes and information at risk of theft, compromise, or disruption.

Achieved Acquisition Savings

the Department executed its fiscal year 2010 plan to meet the oMb acquisition improvement mandate to deliver 3.5 percent in procurement savings in fiscal year 2010 and achieve a ten percent reduction in high risk contracting in fiscal year 2010. as of september 30, treasury had exceeded both goals, realizing over $241.9 million in savings versus the goal of $158.4 million, and $129.4 million in high risk contracting reduction versus the goal of $48.8 million. the Department has taken steps to achieve 3.5 percent savings in fiscal year 2011 ($158 million) and reduce the use of high risk contracting authorities. treasury will continue to actively transition to lower risk contracting strategies. treasury will achieve its targets through active management of acquisition operations and increased examination of high dollar/risk contracts.

Increased Use of Electronic Transactions

In 2010, treasury began implementing a paperless initiative to increase the use of electronic transactions with the public. the largest effort involves migrating social security, supplemental security Income, Veterans, railroad retirement, and office of Personnel Management payments to electronic transactions. Individuals will be able to receive benefits either through direct deposit or treasurys Direct express debit card. today, one million americans are receiving their benefit payments through Direct express. beginning March 1, 2011, treasury will require that new enrollees receive payments electronically. all recipients will be required to receive payments electronically by March 1, 2013. currently, 85 percent of federal benefit recipients receive their payments electronically. Moving all recipients of these benefits to electronic payments is expected to save upwards of $300 million in the first five years. currently, nearly 98 percent of all business tax dollars are paid electronically through treasurys free electronic federal tax Payment system (eftPs). Irs research has shown that businesses using eftPs are 31 times less likely to make an error. for tax collection, businesses with $2,500 or more in quarterly tax liabilities that are permitted to use paper federal tax Deposit coupons will have to make those deposits electronically beginning in 2011. this change will save an estimated $65 million in the first five years. finally, treasury will eliminate the option to purchase paper savings bonds through payroll deductions for federal employees on september 30, 2010 and for the private sector by January 1, 2011. Individuals will still be able to purchase paper savings bonds at financial institutions for themselves and as gifts. Payroll savers will be encouraged to continue their purchases through treasuryDirect, a web-based system that allows investors to buy and hold electronic treasury securities. this change is estimated to save nearly $50 million in the first five years.

Improved Transparency and Accountability

In april 2010, the Department of treasury published its first open government plan in line with the obama administrations open government Directive. an open government steering committee with representatives from each of treasurys bureaus was established to develop guidance and lead activities across the Department. In executing the plan, treasury released 84 data sets, increased stakeholder outreach efforts, and began a more focused approach to tracking reductions in the freedom of Information act (foIa) request backlog. In addition, the Department identified costs savings from open government initiatives such as tracking the impact of proactive disclosure through financialstability.gov on foIa requests to the office of financial stability (ofs). using this data, treasury developed a cost-benefit matrix to assess open government initiatives. the Department of the treasury received a leading Practices award for Participation and collaboration for achievement above and beyond the requirements of the Directive. this award recognized treasury as an agency that outlined the best and most innovative strategies for promoting open government over the next two years. treasury was only one of eight agencies to receive an award.

management and organizational excellence

33

the department of the treasury part 1: managements discussion and analysis

corrective actions (Pcas). In fiscal year 2010, treasurys offices and bureaus completed 88.4 percent of Pcas on time or early.

Federal Financial Management Improvement Act (FFMIA)

the Federal Financial Management Improvement Act (ffMIa) of 1996 mandates that agencies ... implement and maintain financial management systems that comply substantially with federal financial management systems requirements, applicable federal accounting standards, and the united states government standard general ledger at the transaction level. ffMIa also requires that remediation plans be developed for any entity that is unable to report substantial compliance with these requirements. During fiscal year 2010, the Department issued revised ffMIa guidance and procedures based on federal guidance issued by the office of Management and budget (oMb). oMb requires agencies to use a risk-based approach to assess their financial management systems compliance with ffMIa. In compliance with the revised guidance, treasurys bureaus and offices conducted a self-assessment to determine their risk level. With the exception of the Internal revenue service (Irs), all treasury bureaus and offices are in compliance with ffMIa. as required, the Irs has a remediation plan in place to correct the identified deficiencies. for each identified deficiency, the remediation plan provides specific remedies, target dates, responsible officials, and estimated resources required to correct the deficiencies. this plan is reviewed and updated quarterly. (refer to appendix D for detailed information.)

work satisfies both the bureaus diverse financial operational and reporting needs, as well as the Departments internal and external reporting requirements. the financial data warehouse is part of the overarching treasury-wide financial analysis and reporting system (fars), which also includes applications for the bureaus to report the status of their planned audit corrective actions. In addition to the existing fars applications, the Department is reviewing existing government owned and operated systems for the implementation of a Department-wide fleet management information system, which would streamline and enhance management controls and reporting and improve fleet management planning and decision making. treasurys fars applications operate at a contractor operated hosting facility. In accordance with the guidance contained in the american Institute of certified Public accountants statement of auditing standards (sas) no. 70, Service Organizations, the service providers independent auditors examined the controls for the dedicated hosting service. In the opinion of the auditors, the description of the controls presents fairly, in all material respects, the relevant aspects of the providers controls that had been placed in operation as of september 30, 2010. fourteen treasury bureaus and offices use the financial operations services and systems support from the bureau of the Public Debts administrative resource center. utilizing these services reduces the need for treasury to maintain duplicative financial management systems; enhances the quality, timeliness, and accuracy of financial management processes; and achieves a more efficient and cost-effective business model. treasury continues to work with the bureaus to evaluate plans for continuous improvement to their financial management systems structure.

Financial Management Systems Framework

the Departments overall financial management systems framework consists of a treasury-wide financial data warehouse, supported by a financial reporting tool, and separate bureau core financial systems. bureaus submit their monthly financial data to the data warehouse within three business days of the month-end. the Department then produces monthly financial statements and reports for management analysis. this frame-

50

material weaknesses, audit follow-up, and financial systems

the department of the treasury

Analysis of Performance Results

the Department exceeded targets for 73 percent of performance measures in this section. of the four measures (27 percent) that did not meet the target, the average percent of target achieved was 70 percent. treasury discontinued two measures: one in fiscal year 2010 and one in fiscal year 2009. results suggest that treasury has room for improvement in this area and that challenging targets have been set. oIgs audit completion metrics were substantially affected by material loss review work for failed banks. oIgs ability to meet this metric in fiscal year 2011 will depend largely on the number and sizes of future bank failures compared to available oIg audit resources. tIgta exceeded targets for all of its measures by at least 11 percent. tIgta should consider setting more aggressive targets for measures related to audit products delivered and recommendations implemented as both also had undesirable target trends. sIgtarPs completed audit product measure target may have been overly aggressive. although sIgtarP did not reach its goal of producing 12 audit products in fiscal year 2010, it did exhibit a 200 percent increase in completed audits (from three to nine). sIgtarP did not meet its implementation rate measure; it anticipated a higher implementation rate by ofs, but it was not fully met. ofs is working on implementing the recommendations, and planned corrective action dates extend into fiscal 2011. sIgtarP will continue to monitor the implementation of these recommendations.

to develop guidance and provide leadership on these activities across the Department. the Department released 84 data sets to date, completed a number of stakeholder outreach efforts, and began a more focused approach to tracking reduction in the freedom of Information act (foIa) request backlog. In addition, DasPtr identified cost savings from open government initiatives, developing a cost-benefit matrix and tracking the impact of proactive information disclosure on FinancialStability. gov on the number of foIa requests for ofs. the Department of the treasury received a leading Practices award for Participation and collaboration for achievement above and beyond the requirements of the Directive. this award recognized treasury as an agency that outlined the best and most innovative strategies for promoting open government over the next two years. treasury was only one of eight agencies to receive an award. the office of Disclosure services submitted the final version of the chief foIa officers report in March 2010 to meet the requirement of submission to the attorney general by March 15, 2010. the requirement supports the principles of transparency and openness in government. agencies report on the steps taken to apply the presumption of disclosure, including proactive disclosure activities, to greater utilization of technology, and steps taken to reduce backlogs and improve timeliness in responding to foIa requests. In January 2010, DasPtr launched a lean six sigma study for foIa requests processing. the objective was to analyze foIa processes within Departmental offices. the plan was to enable the Department of the treasury to promptly respond to foIa requests within statutory requirements, increase proactive disclosure of information, eliminate the foIa requests backlog, and ensure sensitive or complex foIa requests are processed properly. this will result in disclosure of information more efficiently, accurately, and rapidly to the american public to promote public trust and government accountability through increased openness and transparency. the DasPtr was designated as lead for treasurys Departmentwide the enterprise content Management (ecM) initiative during fiscal year 2010. ecM will enable the Department of treasury to create structure for managing information and complying with foIa requests. In the long term, treasury expects that the project will improve productivity, increase cost

part 2: annual performance report

Privacy, Transparency and Records

the office of the Deputy assistant secretary for Privacy, transparency, and records (DasPtr) exists to strengthen privacy and disclosure. civil liberties functions have been included to take advantage of existing privacy processes, and the records, library, and orders and directives programs are included because they are significantly interrelated with the privacy and disclosure programs. DasPtr sets the standard for the protection, access, and appropriate disclosure of treasurys information, and provides support for these activities so that program offices may concentrate on their core functions. In april 2010, the Department of the treasury published its first open government Plan, which represents the beginning of the Departments formal implementation of the open government Directive. oMb validated that the plan met every directive requirement. an open government steering committee has been convened with representatives from each of treasurys bureaus

126

strategic goal: management and organizational excellence

performance and accountability report | fiscal year 2010

the following table provides a snapshot of oIg and tIgta audit reports with significant recommendations reported in previous semiannual reports for which corrective actions had not been completed as of september 30, 2009 and september 30, 2010, respectively. oIg and tIgta define significant as any recommendation open for more than one year. there were no undecided audit recommendations during the same periods.

Audit Reports with Significant Unimplemented Recommendations

9/30/2009 OIG TIGTA OIG 9/30/2010 TIGTA

No. of Reports

26

24

iii.

finanCial m anagement s ystems frameWOrk

part 4: other accompanying information

Overview

the Department of the treasurys financial management systems structure consists of financial and mixed systems maintained by the treasury bureaus and the Department-wide financial analysis and reporting system (fars). the bureau systems process and record the detailed financial transactions and submit summary-level data to fars on a scheduled basis. fars maintains the key financial data necessary for consolidated financial reporting. In addition, the fars modules also maintain data on the status of audit-based corrective actions. under this systems structure, the bureaus are able to maintain financial management systems that meet their specific business requirements. on a monthly basis, the required financial data submitted to fars to meet Departmental analysis and reporting requirements. the Department uses fars to produce its periodic financial reports as well as the annual Performance and accountability report (Par). this structured financial systems environment enables treasury to receive an unqualified audit opinion and supports its required financial management reporting and analysis requirements. the fars structure consists of the following components:

bureau core and financial management systems that process and record detailed financial transactions treasury Information executive repository (tIer) that consolidates bureau financial data cfo Vision that produces monthly financial statements and performs financial analysis Joint audit Management enterprise system (JaMes) that tracks information on audit findings, recommendations, and planned corrective actions

bureaus submit summary-level financial data to tIer on a monthly basis, within three business days of the month-end. these data are then used by cfo Vision to generate financial statements and reports on both a Department-wide and bureau-level basis. this structure enables the Department to produce its audited annual financial statements and monthly management reports. During fiscal year 2010, treasury continued to upgrade its fars applications to take advantage of technology improvements such as information security and the technical environment. as part of the Departments enhancement effort, 14 treasury bureaus and reporting entities are cross-serviced for financial systems by the bureau of the Public Debts (bPD) administrative resource center (arc). cross-servicing enables these bureaus to have access to core financial systems without having to maintain the necessary technical and systems architectures. In an ongoing effort to streamline its financial systems environment, treasury continues to work with the bureaus to evaluate plans for continuous improvement to their financial management systems structure.

appendix d: material weaknesses, audit follow-up, financial systems, and recovery act risk management

339

the department of the treasury

Continued Improvement

treasurys target financial management systems structure continues to build upon the current fars foundation. treasury has enhanced fars to support new financial and performance requirements and continues to provide management with the appropriate tools needed to align the Departments goals and objectives. In fiscal year 2010, treasury established a tIer focus group to improve communication with the bureaus and to coordinate changes impacting financial management systems and financial operations. treasury enhanced the fars applications to be section 508 compliant, which assists users with disabilities in accessing reports and performing data entry. In addition, treasury upgraded the fars servers to improve performance. the Irs continued to modernize the tax administration systems, improving the speed in which the Irs processes tax returns. In fiscal year 2010, the customer account Data engine (caDe) posted more than 41.2 million tax returns and more than 35.8 million refunds. the account Management services system, which stores taxpayer information, has been enhanced to eliminate the processing of paper and reduce case cycle time from 14 days to recognizing real-time submissions; and Irs upgraded the servers which host the financial management system that accounts for $11.5 billion in Irs funding. bPD/arc continued to improve the effectiveness of providing efficient financial management systems and financial operations services to 14 treasury bureaus and offices by implementing best practices in financial management. In fiscal year 2010, bPD/arc upgraded the core financial management systems platform to increase its responsiveness in producing financial management reports and to adhere to financial reporting governance standards. bPD/arc also provides administrative services in the areas of accounting, travel, payroll, human resources, and procurement to treasury bureaus and offices and to other federal entities to support core business activities. the bureau of engraving and Printing (beP) enhanced its manufacturing system to be fully integrated into its existing financial management system to support capturing performance data into the managerial cost accounting process. beP also participated in a pilot program with the bureau of the Public Debt (bPD) for intra-governmental transactions, utilizing a secure, web-based electronic invoicing and payment information system provided by the treasurys financial Management service.

part 4: other accompanying information

Federal Financial Management Improvement Act (FFMIA) of 1996 Compliance

With the exception of the Irs, all treasury bureaus are in compliance with ffMIa. as required by ffMIa, the Irs has a remediation plan in place to correct the deficiencies. for each ffMIa recommendation, the remediation plan identifies specific remedies, target dates, responsible officials, and resource estimates required for completion. this plan is reviewed and updated quarterly. the Irs made significant progress in fiscal year 2010 toward achieving ffMIa compliance by implementing the redesign revenue accounting control system (rracs), which enabled the custodial financial management system to substantially comply with the united states standard general ledger (ussgl) chart of accounts. rracs now records all tax revenue and refunds using the ussgl format and, for the first time, records the taxes receivable and allowance for doubtful accounts. the Irs also implemented automated interfaces which enabled traceability for 98.6 percent of the over $2.3 trillion in revenue collections.

340

appendix d: material weaknesses, audit follow-up, financial systems, and recovery act risk management

You might also like

- Financial Management Plans and Reports: FY 2010 Department of State Agency Financial ReportDocument10 pagesFinancial Management Plans and Reports: FY 2010 Department of State Agency Financial ReportSunlight FoundationNo ratings yet

- Historical overview of Ethiopian Government Accounting SystemDocument20 pagesHistorical overview of Ethiopian Government Accounting Systemnegamedhane58No ratings yet

- 01522-Fy06q2-Egov UpdateDocument3 pages01522-Fy06q2-Egov UpdatelosangelesNo ratings yet

- Budget Execution Is The Process by Which The Financial Resources Made Available To An AgencyDocument4 pagesBudget Execution Is The Process by Which The Financial Resources Made Available To An Agencyruby ann rojalesNo ratings yet

- BenchmarkingDocument7 pagesBenchmarkingMelai NudosNo ratings yet

- Ethiopian Gov't AssignmentDocument7 pagesEthiopian Gov't AssignmentHasen Yib0% (1)

- Corporate Counter Fraud - Business Plan 2012 - 2013: Appendix ADocument8 pagesCorporate Counter Fraud - Business Plan 2012 - 2013: Appendix APury CastleNo ratings yet

- Tertiary Education and Other Entities: Results of The 2009 AuditsDocument6 pagesTertiary Education and Other Entities: Results of The 2009 AuditsJayson Ramirez SorianoNo ratings yet

- BIR 2014 priority projects focus on tax collectionDocument3 pagesBIR 2014 priority projects focus on tax collectionJianSadakoNo ratings yet

- FY 2014 Budget in BriefDocument24 pagesFY 2014 Budget in BriefhenrydpsinagaNo ratings yet

- 62983rmo 5-2012Document14 pages62983rmo 5-2012Mark Dennis JovenNo ratings yet

- Special Education AuditDocument29 pagesSpecial Education AuditCara MatthewsNo ratings yet

- Literature Review On Revenue MobilizationDocument6 pagesLiterature Review On Revenue Mobilizationafdtvztyf100% (1)

- Government Accounting in BangladeshDocument20 pagesGovernment Accounting in BangladeshMohammad Saadman100% (3)

- Federal Financial Management Leads To DevelopmentDocument86 pagesFederal Financial Management Leads To DevelopmentBulbul KarNo ratings yet

- Marmara University PhD Thesis on Accounting Information Systems in PalestineDocument11 pagesMarmara University PhD Thesis on Accounting Information Systems in PalestineMohammed AlashiNo ratings yet

- Chapter 8Document55 pagesChapter 8vijiNo ratings yet

- Nancy Kutama ProposalDocument18 pagesNancy Kutama Proposaljitha nipunikaNo ratings yet

- Strategic Action Plan 2009-2012Document36 pagesStrategic Action Plan 2009-2012LaMine N'tambi-SanogoNo ratings yet

- Exploring Financial Performance and Audit Opinions in Indonesian Central Government AgenciesDocument22 pagesExploring Financial Performance and Audit Opinions in Indonesian Central Government AgenciesfauziNo ratings yet

- Public Sector Audit Challenges of Accrual AccountingDocument44 pagesPublic Sector Audit Challenges of Accrual AccountingDaniel WilsonNo ratings yet

- Fact Sheet: South Carolina Policy CouncilDocument4 pagesFact Sheet: South Carolina Policy CouncilSteve CouncilNo ratings yet

- Integrated Financial Management SystemDocument8 pagesIntegrated Financial Management SystembagumaNo ratings yet

- Description: Tags: Sar37Document54 pagesDescription: Tags: Sar37anon-605100100% (2)

- Accounting and Information Management Division: United States General Accounting OfficeDocument60 pagesAccounting and Information Management Division: United States General Accounting Officesimphiwe8043No ratings yet

- Chart of AccountsDocument6 pagesChart of Accountssundar kaveetaNo ratings yet

- I. Issues, Challenges and Recommendations A. ARTA Disciplinary ProvisionsDocument12 pagesI. Issues, Challenges and Recommendations A. ARTA Disciplinary ProvisionsAnonymous kU8kiI05No ratings yet

- DESIGN AND IMPLEMENTATION OF A COMPUTERIZED TAX COLLECTION SYSTEMNDocument26 pagesDESIGN AND IMPLEMENTATION OF A COMPUTERIZED TAX COLLECTION SYSTEMNIbrahim Abdulrazaq YahayaNo ratings yet

- 14th-Strenthening Financial MGTDocument27 pages14th-Strenthening Financial MGTgopichand456No ratings yet

- EPA ResponseDocument12 pagesEPA ResponseSunlight FoundationNo ratings yet

- Budget Implementation and Control AssessmentDocument16 pagesBudget Implementation and Control AssessmentGelaye GebeyehuNo ratings yet

- Key Words: Compliance, Enforcement, Compliance ProgramDocument12 pagesKey Words: Compliance, Enforcement, Compliance ProgramawokedeNo ratings yet

- Government's unified accounts code structure (UACS) explainedDocument5 pagesGovernment's unified accounts code structure (UACS) explainedRuiz, CherryjaneNo ratings yet

- 01 Final IrrbamDocument200 pages01 Final IrrbamVev'z Dangpason BalawanNo ratings yet

- Financial Forecasting in The Budget Preparation ProcessDocument7 pagesFinancial Forecasting in The Budget Preparation Processnmsusarla888No ratings yet

- Government Expenditure Part 2Document6 pagesGovernment Expenditure Part 2Jeffrey RiveraNo ratings yet

- Pifra Business Finance ProjectDocument17 pagesPifra Business Finance ProjectWaqas AhmedNo ratings yet

- Description: Tags: Mgmtchall2004condDocument5 pagesDescription: Tags: Mgmtchall2004condanon-36602No ratings yet

- Banner Budget ManualDocument31 pagesBanner Budget ManualMadjid MansouriNo ratings yet

- Journal PristineDocument9 pagesJournal Pristinepristine hollysaNo ratings yet

- (IMF Working Papers) Introducing Financial Management Information Systems in Developing CountriesDocument25 pages(IMF Working Papers) Introducing Financial Management Information Systems in Developing Countriesstratmen.sinisa8966No ratings yet

- Philippine: Ublic Inancial AnagementDocument2 pagesPhilippine: Ublic Inancial AnagementJetmark MarcosNo ratings yet

- Introduction to FGE Accounting and Financial ManagementDocument61 pagesIntroduction to FGE Accounting and Financial ManagementGirma100% (4)

- An Evaluation of The Effectiveness of Public Financial Management System Being Used by Government Departments in Zimbabwe.Document8 pagesAn Evaluation of The Effectiveness of Public Financial Management System Being Used by Government Departments in Zimbabwe.Alexander DeckerNo ratings yet

- PUBLIC FINANCE Midterm 01 3Document4 pagesPUBLIC FINANCE Midterm 01 3ocampojohnoliver1901182No ratings yet

- Fy11 Oig JustificationDocument47 pagesFy11 Oig JustificationCristina ZotoiuNo ratings yet

- Unified Account Code SystemDocument5 pagesUnified Account Code SystemHanz paul IguironNo ratings yet

- Request For Tender - FTA AI Digital Use Case v4.1FDocument18 pagesRequest For Tender - FTA AI Digital Use Case v4.1Fshamalsaleem999No ratings yet

- System To Assist The Goss To Track Aid-Funded Projects and Donor Funds, inDocument4 pagesSystem To Assist The Goss To Track Aid-Funded Projects and Donor Funds, inmad4anNo ratings yet

- Other Financial Management ToolsDocument4 pagesOther Financial Management ToolsPrudentNo ratings yet

- Annual Performance PlanDocument84 pagesAnnual Performance PlanIRSNo ratings yet

- Psa522 Group 6 - Liyana 2017525427Document32 pagesPsa522 Group 6 - Liyana 2017525427Liyana IzyanNo ratings yet

- J2014 Muhammed - Government Expenditure Management and Control in EthiopiaDocument10 pagesJ2014 Muhammed - Government Expenditure Management and Control in EthiopiabudimahNo ratings yet

- Federal Grants Improvements Needed in Oversight and Accountability ProcessesDocument26 pagesFederal Grants Improvements Needed in Oversight and Accountability ProcessesJeffrey DunetzNo ratings yet

- Audit Plan 2021Document12 pagesAudit Plan 2021GARUIS MELINo ratings yet

- Fge Group Assignment No.1&2Document6 pagesFge Group Assignment No.1&2Emebet TesemaNo ratings yet

- Comptroller Report On MWBE and DASNYDocument22 pagesComptroller Report On MWBE and DASNYMatthew HamiltonNo ratings yet

- Tool Kit for Tax Administration Management Information SystemFrom EverandTool Kit for Tax Administration Management Information SystemRating: 1 out of 5 stars1/5 (1)

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Birthday CelebrationDocument3 pagesBirthday CelebrationSunlight FoundationNo ratings yet

- Luncheon For Republican Governors AssociationDocument2 pagesLuncheon For Republican Governors AssociationSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Information SessionDocument2 pagesInformation SessionSunlight FoundationNo ratings yet

- LuncheonDocument4 pagesLuncheonSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

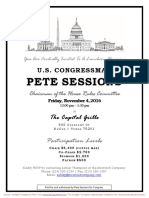

- Private Screening of Jason Bourne For Pete SessionsDocument2 pagesPrivate Screening of Jason Bourne For Pete SessionsSunlight FoundationNo ratings yet

- FundraiserDocument1 pageFundraiserSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

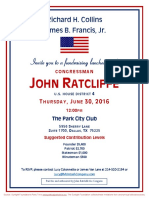

- Reception For John RatcliffeDocument1 pageReception For John RatcliffeSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- The Sound Collector - The Prepared Piano of John CageDocument12 pagesThe Sound Collector - The Prepared Piano of John CageLuigie VazquezNo ratings yet

- Lecture 1 Family PlanningDocument84 pagesLecture 1 Family PlanningAlfie Adam Ramillano100% (4)

- MSDS FluorouracilDocument3 pagesMSDS FluorouracilRita NascimentoNo ratings yet

- SEO Design ExamplesDocument10 pagesSEO Design ExamplesAnonymous YDwBCtsNo ratings yet

- Impact of Bap and Iaa in Various Media Concentrations and Growth Analysis of Eucalyptus CamaldulensisDocument5 pagesImpact of Bap and Iaa in Various Media Concentrations and Growth Analysis of Eucalyptus CamaldulensisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 14 15 XII Chem Organic ChaptDocument2 pages14 15 XII Chem Organic ChaptsubiNo ratings yet

- Device Interface Device Type (Router, Switch, Host) IP Address Subnet Mask Default GatewayDocument2 pagesDevice Interface Device Type (Router, Switch, Host) IP Address Subnet Mask Default GatewayRohit Chouhan0% (1)

- Tender Notice and Invitation To TenderDocument1 pageTender Notice and Invitation To TenderWina George MuyundaNo ratings yet

- Transformer Oil Testing MethodsDocument10 pagesTransformer Oil Testing MethodsDEE TOTLVJANo ratings yet

- Cinema 4D ShortcutsDocument8 pagesCinema 4D ShortcutsAnonymous 0lRguGNo ratings yet

- Digital Communication Quantization OverviewDocument5 pagesDigital Communication Quantization OverviewNiharika KorukondaNo ratings yet

- Introduction To OpmDocument30 pagesIntroduction To OpmNaeem Ul HassanNo ratings yet

- Oblicon SampleDocument1 pageOblicon SamplelazylawatudentNo ratings yet

- Variable Speed Pump Efficiency Calculation For Fluid Flow Systems With and Without Static HeadDocument10 pagesVariable Speed Pump Efficiency Calculation For Fluid Flow Systems With and Without Static HeadVũ Tuệ MinhNo ratings yet

- PharmacologyAnesthesiology RevalidaDocument166 pagesPharmacologyAnesthesiology RevalidaKENT DANIEL SEGUBIENSE100% (1)

- Optimization of The Spray-Drying Process For Developing Guava Powder Using Response Surface MethodologyDocument7 pagesOptimization of The Spray-Drying Process For Developing Guava Powder Using Response Surface MethodologyDr-Paras PorwalNo ratings yet

- Budget ControlDocument7 pagesBudget ControlArnel CopinaNo ratings yet

- TransistorDocument1 pageTransistorXhaNo ratings yet

- WWW - Istructe.pdf FIP UKDocument4 pagesWWW - Istructe.pdf FIP UKBunkun15No ratings yet

- A General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFDocument37 pagesA General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFDiego JesusNo ratings yet

- Feasibility StudyDocument47 pagesFeasibility StudyCyril Fragata100% (1)

- Condy LatorDocument11 pagesCondy LatorrekabiNo ratings yet

- The Singular Mind of Terry Tao - The New York TimesDocument13 pagesThe Singular Mind of Terry Tao - The New York TimesX FlaneurNo ratings yet

- Determination of Vitamin C in FoodsDocument11 pagesDetermination of Vitamin C in FoodsDalal Shab JakhodiyaNo ratings yet

- May, 2013Document10 pagesMay, 2013Jakob Maier100% (1)

- Programming Language Foundations PDFDocument338 pagesProgramming Language Foundations PDFTOURE100% (2)

- Bandung Colonial City Revisited Diversity in Housing NeighborhoodDocument6 pagesBandung Colonial City Revisited Diversity in Housing NeighborhoodJimmy IllustratorNo ratings yet

- Tatoo Java Themes PDFDocument5 pagesTatoo Java Themes PDFMk DirNo ratings yet

- Irctc Tour May 2023Document6 pagesIrctc Tour May 2023Mysa ChakrapaniNo ratings yet

- Hawk Technology Systems v. NCLDocument6 pagesHawk Technology Systems v. NCLPriorSmartNo ratings yet