Professional Documents

Culture Documents

Manual de Opciones

Uploaded by

luikesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manual de Opciones

Uploaded by

luikesCopyright:

Available Formats

The Motley Fool Options Edge Handbook 2011

BY JE FF FISC H E R

O p t i O n s E d g E H a n d b O O k

Table of Contents

w e lCo m e ................................................................................... 3

w h y o p T i o n s ? .......................................................................... 4

B u y i n g C a l l s ........................................................................... 4

B u y i n g p u T s .................. ........................................................... 5

s e l l i n g Co v e r e d C a l l s ........................................................... 5

s e l l i n g p u T s ............................................................................ 6

8 T i p s f o r w r i T i n g ( o r s e l l i n g ) p u T s ..................................... 7

s y n T h e T i C lo n g s ..................................................................... 9

w r i T i n g s T r a d d l e s ...... ......................................................... 11

w r i T i n g s T r a n g l e s ....... ......................................................... 15

o p T i o n s g lo s s a r y ................................................................. 16

the

motley

fool

options edge handbook

page

O p t i O n s E d g E H a n d b O O k

welcome

Here is your Options Edge Handbook 2011!

Dear Fellow Investor, The market gyrations of the past few years created a unique investing landscape. One that has many investors looking beyond traditional buy and hold for the kinds of opportunities that can make you substantial amounts of money in shorter periods of time... Options Edge 2011 is a perfect primer for the moments of crisis and opportunity ahead! This handy guide (we designed it so that you can print it out and keep it) will give you the tools to make money in shorter periods of time, generate income, leverage returns, and squeeze out some of your portfolio risk. In short, this handbook could be your first step to building wealth faster and more assuredly than at any point in recent history! And its part of a bigger opportunity were extremely excited to tell you about. Youll discover all the details in a very special invitation that will be put into your hands on Monday, December 13. Keep your eyes on your inbox! Kindest regards,

Jeff Fischer Advisor, Motley Fool Options

the

motley

fool

options edge handbook

page

O p t i O n s E d g E H a n d b O O k

WHy OptiOns?

Options are ideal for generating income, protecting profits, and most importantly, earning outsized gains! They can generate returns in flat markets, cushion the blow of down markets, and be outstanding performers in decent markets. So basically, whatever your investment goals, options can be a powerful addition to your portfolio. And its important for you to know that I advocate trading options as an investor, not as a speculator. In other words, every option trade we make should be based on thorough analysis of the underlying stock and its value. That way, the option is simply a way tol everage what we know about a stock.

WHat arE OptiOns?

Stock options formally debuted on the Chicago Board Options Exchange in 1973, although option contracts (the right to buy or sell something in the future) have been around for thousands of years. Applied to stocks, an option gives the owner the right, but not the obligation, to buy or sell an underlying stock at a set price (the strike price) by a set date (the expiration date). The option contract allows you to profit if a stock moves in your favor before the contract expires. Not all stocks have options -- only those with enough interest and volume. There are only two types of options: calls and puts. A call appreciates when the underlying stock rises, so you buy a call if you are bullish on that company. A put appreciates when a stock declines. You buy a put if you believe a stock will fall or to hedge a stock that you already own. One way to remember this is: call up and put down... By the way, theres an options glossary in the back of the handbook for you to use at any point! Next, lets walk through the most common options trades: buying calls, buying puts, selling covered calls, and selling puts. sTraTegy

Buy Calls

why

When you believe a stock will rise significantly over time and you want to leverage your returns or minimize capital at risk

Buy puts

To short a position, or to hedge or protect a current long holding

sell Covered Calls (sell to open)

To earn income on shares you already own while waiting for your desired sell price

sell puts (sell to open)

To get paid while waiting for a lower share price (your desired buy price) on a stock you would be happy to buy

Buying Calls

Investors often buy call options rather than buying a stock outright to obtain leverage and potentially increase returns several-fold. Call options work as controlled leverage, enhancing your possible returns while limiting your potential losses to only what

the motley fool

options edge handbook

page

O p t i O n s E d g E H a n d b O O k

you invest (which is usually a much smaller amount than a stock purchase would be). Because each option contract represents 100 shares of stock, an investor can control -- and benefit from -- many shares of stock without putting a lot of capital at risk. When you make the right call, youll enjoy higher returns than you would have if you had used that money to buy the actual shares. Lets look at an example. Imagine that a stock that you know well has been hit hard and now trades at $27 per share. You believe the shares will rebound in the coming months or year. The market offers $30 call options on the stock that expire in 18 months for $1.50 per share. Therefore, 10 contracts, representing 1,000 shares of the stock, will cost you $1,500 plus commissions. This option contract gives you, its owner, the right to buy 1,000 shares of the stock at $30 any time before expiration. If your stock starts to rise again, your options will increase in value, too. Suppose the stock recovers all the way to $32 after a few months. Your options value would likely at least double to $3 or higher per contract. Youve made 100% in a few months. If you had simply bought the stock, youd only be up 18.5%. Of course, there is a flip side. Suppose your stock continues its decline to the abyss. Even 18 months later, its below $20, so your options expire worthless -- though hopefully you sold them at some point along the way to recoup part of your investment. The good news is: youve saved a lot of money compared to if you had bought the stock instead. I like to buy longer-term call options on well-valued stocks that I believe will pay off handsomely over the coming months or years. Its a way to take more meaningful positions in stocks I believe in -- without risking mounds of capital. This is useful if youre lacking capital or just dont feel like risking it all in a stock. As with any investment, you should only invest what you can afford to lose, since a stock can easily work against you over a set amount of time and make your call worthless. Where real opportunity can be lost is when your timing is wrong. Your options might expire before the stock rebounds, causing you to lose your option money and miss the stocks eventual rebound. Thus, we aim to buy longer-term calls in positions in which we have high confidence and that have near-term catalysts.

Aside from betting against a position with puts, you can also buy puts to protect an important position in our portfolio, one that you dont want to sell yet for any number of reasons. When a stock being protected -- or hedged -- in this way declines for a while, the puts will increase in value, smoothing out returns. I tend to buy puts on stocks that I believe are due to decline over the coming months or even years. You may also use puts to hedge long positions that you own, or to short sectors and indexes in a small portion of your portfolio. I often buy puts rather than short something outright to limit my risk.

sElling COvErEd Calls

Now our overview moves from the act of buying options to, instead, selling them to others. Selling -- or writing -- options is what we do most, because it can be consistently lucrative and the odds are stacked in our favor. Any qualified investor can sell to open an option contract. When you do so, you dont pay the premium; instead, as the contract writer, you get paid. All cash generated from your option selling is paid immediately to you. Covered simply means that we own the underlying stock at the same time. Writing covered calls is one of the most conservative options strategies available. In fact, most retirement accounts allow you to write covered calls. Theyre generally used to generate income on stock positions while waiting for a higher share price at which to sell the stock. Heres an example of a covered call. Suppose you own 1,000 shares of a stable, blue-chip stock. Its trading at $56, but you think it is fairly valued around $60 and you would be happy to sell at that price. So you write $60 call options on the stock expiring a few months ahead, and you get paid up front to do so. If the stock does not exceed $60 by your options expiration, you keep your shares and youve made money on the call options. You could then write more calls if you wanted to for more income. If the stock is above $60 by expiration and you havent closed out your call option contract, youd sell your stock at $60 via the options. Your actual proceeds on the sale would include the option premium you were paid. So you sold your shares at the price you wanted to and received extra cash for doing so. This income really adds up as you write covered calls again and again.So, write covered calls when: You would sell a stock that you own at a higher price, and youre not worried about it declining too much in the meantime. Write calls at your desired sell price, collect the dough, and then kick back and wait. Rinse and repeat, month after month, when you can. You believe a stock you own is going to stagnate for a while,

|

page 5

Buying puts

Next up, the antithesis to call options: puts. Buy put options when you believe that the underlying stock will decline in value. Buying puts is an excellent tool for betting against highly priced or troubled stocks, or even entire sectors. With put buying, your risk is again limited to the amount that you invest in stark comparison to traditional short selling, where your potential losses are unlimited.

the

motley

fool

options edge handbook

O p t i O n s E d g E H a n d b O O k

when To wriTe Covered Calls

You would sell a stock that you own at a higher price, and youre not worried about it declining too much in the meantime. Write calls at your desired sell price, collect the dough, and then kick back and wait. Rinse and repeat, month after month, when you can. You believe a stock you own is going to stagnate for a while, but you dont want to sell it right now. Write calls to make the stagnation more profitable. You want to cushion a stock that is in decline, but that youre not ready to sell yet. Tread carefully here so you dont get sold out at too low a price.

but you dont want to sell it right now. Write calls to make the stagnation more profitable. You want to cushion a stock that is in decline, but that youre not ready to sell yet. Tread carefully here so you dont get sold out at too low a price. When you write covered calls, you must be prepared to give up your shares at the strike price. Approximately 80% to 90% of options are not exercised until expiration, but they can be exercised early, so the call writer has to be prepared to deliver the shares. That means that if the $56 stock in the example above suddenly soars to $70, youd still have to sell at $60. This is the biggest downside to covered calls -- lost potential if a stock price rises. The other risk is that a stock may fall sharply after hovering around your desired sell price for a while, forcing you to wait longer for your sell price. But in this case, at least youve earned option income. Even though covered calls are low risk, you should use them only on stocks you know well. You could even set up some covered call-only positions -- buying a stock just to write calls on it.

sElling puts

Note: to sell (or write) puts, you must have a margin account. You wont actually need to use margin -- which entails high risk -- but you must be margin-approved, have ample buying power (cash, in our margin-free strategy). Selling puts -- also referred to as selling naked puts or writing puts -- is a favorite strategy of mine to seed a portfolio. There may be plenty of stocks that Id like to buy at the start, but Id prefer to snag them at lower prices. Put options are an excellent way to potentially buy a stock at your desired, lower share price and get paid an option premium while waiting for that price, whether it arrives or not. Lets turn to an example: A top-rated stock we found on Motley Fool CAPS and researched thoroughly is trading at $39, but our analysis suggests that we shouldnt buy it above $35. The $35 put options expiring four months out are paying $3 per share. We sell to open the put contracts and get paid $3 per share to make the trade, giving us a potential net purchase price of $32 before commissions. A few things could happen here. Scenario 1: The stock could stay above our $35 strike price; the options we sold would expire. We didnt get to buy the stock at the price we wanted, but at least we made money on the options we sold. Scenario 2: The stock could fall below $35 by expiration. In this situation, our broker would automatically buy the stock for our account, giving us a start price of $32 before commissions because we still keep the option income -thats -- even lower than our $35 desired buy price! Scenario 3: The stock may tank to $29 soon after we sell the puts, but then climb back above $35 by expiration. In this case, we most likely would not have had the shares sold to us during this brief decline because about 80% of options are exercised only at expiration, not before. So we wont own the shares, and well have missed our buy price and the stocks rebound -- but we did get paid the premium, at least, and can try again.

the

motley

fool

options edge handbook

page

O p t i O n s E d g E H a n d b O O k

Scenario 4: The companys CEO flees to Bermuda and the stock is only at $16 by our options expiration. We didnt have the heart to close our losing option position, and we still have hope, so we wait and the shares are put to our account at $35 (minus our option premium) upon expiration. This is the worst-case scenario -- were down 50% to start. But we own the stock now and can hope it rebounds. Of course, assuming that we would have bought the stock outright when it hit our $35 buy price, as we had considered, we would be down even more than we would be with this strategy. You should most often sell puts when a stock you follow closely and want to own is, alas, above your desired buy price. You should sell puts on it at lower strike prices, prices that you believe are great levels at which to buy. Either you eventually get to buy the stock at your desired price via the puts, or you keep writing puts if the situation merits it, earning more income each time while you wait. You may also sell puts when a stock you already hold a partial position in is above the price where youd like to buy more. You can write puts as you wait to average in at lower prices. This is a great tool for allocation and averaging into a position. Writing puts on stocks you know well and want to own at lower prices can be an excellent tool for income and for securing lower buy prices, but you must be prepared to buy the stock should it fall below your strike price. At all times, you must maintain the cash or margin (for us its always cash and we recommend you follow that rule, too) to buy shares if they are put to you. Its important that you only write puts on stocks that you understand well and will be happy and ready to buy at the prices youre targeting. The risks of writing puts include the fact that the stock could soar away without you. In many cases, its better to just buy a great stock once youve found it. The other risk, of course, is that a stock falls sharply and youre stuck owning it. The biggest risk with selling puts, as with all options, is when investors rely on margin instead of cash. Lets review... Call opTion

The right, but not obligation, to buy a stock at a set price (the strike price); calls appreciate as the stock rises (remember: call up)

The obligation to sell a stock at the strike price; option writer must hold the stock (or seller) in the account. This is called a covered position. option buyer Believes the underlying stock will rise

The obligation to buy a stock at the strike price; must have the buying power at the ready (preferably in cash) in case the stock declines Believes the underlying stock will fall

If the stock rises, is ready to sell shares option writer at the strike price, (or seller) keeping the premium paid for writing the option

If the stock falls, is ready to buy it at the strike price, keeping the premium received for writing the option

8 tips fOr Writing (Or sElling) puts

Always choose a strike price at which youd be happy to buy the stock. Focus on strong businesses that youd be excited to own for the long term. Write out-of-the-money puts, meaning your strike price is below the stocks current share price. Verify that the option premium payment makes the trade worthwhile. Remember, you often wont get to buy the stock; youll just get option income. Thats why we sometimes write puts on stocks in which we already own partial positions. Put writers do not collect dividends paid by the underlying stock. Never overextend yourself by writing too many puts. Brokers allow put writing on margin, but we write puts when we have the cash to buy the stock. Vary the expiration dates among your individual option holdings so they dont all fall in the same month -- this staggers your risk. You may write in-the-money puts with strike prices above the current share price when youre especially bullish on a stock and want to capture more upside potential with its options. This strategy also increases the odds that you get to buy the stock. When you write inthe-money puts, the guidelines in our table dont apply. Put writing is a bullish, or at least neutral, strategy. When you write a put, youre saying you believe the underlying stock will eventually increase in price (hopefully after youve bought shares), or at least hold steady -- meaning youll earn income on your puts when they expire.

|

page 7

puT opTion

The right, but not obligation, to sell a stock at a set price (the strike price); puts appreciate as the stock falls (remember: put down)

option buyer

the

motley

fool

options edge handbook

O p t i O n s E d g E H a n d b O O k

when To wriTe puTs

Youre ready and willing to buy a stock at a lower price and You dont believe the stock will soar away from you in the meantime (otherwise youd just buy the stock), or You just want to make income writing puts. You dont believe a stock will drop to your buy price, but if it does, youd still be happy to buy it.

Lets use an example: Assume youre bullish on the health-care company, Kinetic Concepts (NYSE: KCI). The stock increased lately, so youre not as anxious to buy it. If the shares fell to $35 or so, however, youd be happy to buy. Rather than just sit and wait, you can write (remember, thats sell to open) the $35 strike price put options. Youll get paid while you wait, and youll potentially get that lower buy price. Before placing this trade, make sure you have the cash (or, for experienced investors, ample buying power) in your account to buy a minimum of 100 shares of Kinetic. You can then write $35 puts that expire in a few months. Lets say the puts pay you $2 per share, and you write two contracts representing 200 shares of Kinetic. Youre paid $400 (minus commissions) up front. And now you wait (cue the Jeopardy theme). If Kinetic Concepts ends this time period above $35, your options simply expire, and you keep the $400. You can then write new puts if youd like. If Kinetic dips below $35 at the options expiration, the puts you wrote will be exercised, and youre on the hook to buy 200 shares of Kinetic at a strike price of $35. Including the option premium you received, your start price is actually $33. Nice! Now you own shares at an attractive start price and can wait for appreciation. So, you write puts when: Youre ready and willing to buy a stock at a lower price and You dont believe the stock will soar away from you in the meantime (otherwise youd just buy the stock), or You just want to make income writing puts. You dont believe a stock will drop to your buy price, but if it does, youd still be happy to buy it.

WHat Can gO WrOng?

Sounds perfect, doesnt it? Youre paid to potentially buy a stock you wanted to buy anyway -- and at a price you like. Thats beautiful. But every investing strategy has some risk. In this case, assume Kinetic Concepts doesnt fall below $35 by the time your option expires, but instead jumps to $45 over the next few months. You miss out on a several dollar stock gain for only a $2 gain in the put options, and you still dont own shares. Now what do you do? It might be a tough call. Kinetic could also drop to $30 soon after you write your puts, but then climb back to $38 just as your puts hit their expiration date. Because almost all options are exercised only at expiration, you wont get the shares, and you will have missed your buy price. Of course, you keep the $2 option premium and can write new puts. Theres also the scenario that the stock drops and doesnt come back up for a long time. If Kinetic fell to $25, your options would be far underwater. In this case, you must be ready to just buy the stock at your net price of $33 and wait for a rebound. At least youre getting a much lower start price than if you had simply bought the stock outright on day one. So, Fools, whenever you write puts, be confident that you want to own the stock for the long haul.

the

motley

fool

options edge handbook

page

O p t i O n s E d g E H a n d b O O k

synthetic longs

synTheTiC longs aT a glanCe

Synthetic longs are best when youre bullish on a strong business, at least somewhat bullish on the market overall, and expect a catalyst over the next 18 months or so. ........................................... Typically, you should use the longest-dated LEAPs (Long-Term Equity Anticipation Securities) you can find so youll have the largest window of time to be proven correct; refrain from initiating short-term synthetic longs that expire in nine months or less. ........................................... You must be ready to buy the underlying stock if it falls below your put options strike price. ........................................... Remember the three possible outcomes with a synthetic long: (1) the stock increases and both your options make money; (2) the stock decreases enough that youre obligated to buy it via your put options; or (3) the stock stagnates, in which case both your options may simply expire, and youre back where you started. ........................................... A true synthetic long uses the same strike price and expiration date for both calls and puts; you can split the strikes, however, to set up a more defensive or aggressive synthetic long, depending on your preference. ........................................... Once your thesis has largely played out and youve earned money on your calls, consider taking your profit on the calls; use the underlying stocks valuation and your options approaching expiration date as guides. ........................................... Using a synthetic long option strategy on a dividend-paying stock does not entitle you to the dividend payment.

Are you confident about a stock, but reluctant to pony up the cash to buy it today? A synthetic long may be just the ticket. This option strategy works nearly the same as owning the underlying stock outright except you dont need to pay up front. Usually, youll set up a synthetic long on a stock if you foresee a strong catalyst for appreciation in the next 18 months or so. As the stock price goes up, your options gain value along with it, sometimes to a much greater degree. Earlier, you discovered that when you buy options as opposed to selling (or writing) them you aim to profit from the option itself, rather than getting the underlying equity involved (unless its to your benefit). The synthetic long allows for the best of both worlds: On the options you buy in this strategy, your upside potential is unlimited; on the options you sell, the worst-case scenario is that you end up buying the underlying stock at a price of your choosing. This makes the synthetic long an especially attractive trade for bullish investors.

Buy Calls, sEll puts

To initiate a synthetic long, you buy a call option and concurrently sell a put option on the same underlying stock or exchange-traded fund. For a true synthetic long, the calls and puts will have the same expiration date and strike price, although there are attractive variations that youll discover below. When you buy a call, you believe that the underlying stock is going to appreciate considerably over the life of your option. If it does, the call usually gains value dramatically. If the stock does not appreciate, however, your calls will move toward expiration with less and less value, finally ending with little or no value. That is always the risk of buying options. You need to be correct by the expiration date or the option wont maintain value, and you could lose your whole investment. This potential loss is much easier to stomach, though, if you use income from a put sale to buy your calls. This is exactly what you do to set up a synthetic long position. Lets see an example.

BullisH On autOdEsk? gO syntHEtiC lOng!

Suppose you have a bullish long-term stance on 3-D software leader Autodesk (Nasdaq: ADSK). You believe the business will be on the upswing again within 18 months, so youd like to set up a synthetic long position to benefit. With the shares trading around $12.50 (as of March 13), you would buy the January 2011 $12.50 call options on Autodesk for $3.80 per contract, and concurrently sell (or write) the January 2011 $12.50 put options for $3.50. Your net cash outlay is just $0.30 per share. Once you make these trades, if Autodesk begins to appreciate, both your calls and puts will start to show gains in your portfolio, in effect mirroring the stock or even outperforming it. If Autodesk appreciates to, say, $20 by sometime in 2010, your calls will gain 100% to 200%, and your puts will be well on their way to becoming a 100% cash gain, too. On the flipside, lets suppose Autodesk continues to suffer from soft sales, and shares drift lower to $10 or $11 for the next year or longer. In that case, your call options will slowly lose value, and your put options put you on the hook to buy shares at $12.50. Given that you paid a net $0.30 to set up your synthetic long, your net start price on Autodesk will

the

motley

fool

options edge handbook

page

O p t i O n s E d g E H a n d b O O k

Tip of The Trade

Target healthy businesses with attractively valued stocks, and your put writing strategy should leave you happy, whether it generates income or you end up buying the stock. Write puts on stocks youd like to own at cheaper prices, or on stocks that wont likely decline (but youd happily own if they did) to generate income. If you really want to own a stock, though, buy at least some shares outright.

be about $12.80 per share. This is the only number youll ultimately care about if your trade is underwater. Youre ready to buy Autodesk at a net $12.80, and you can then hold the shares and hope for a recovery. Your synthetic long didnt make you any money, but ideally it bought you shares of a good company.

splitting tHE strikEs

Setting up a synthetic long with identical put and call strike prices near a stocks current share price is the norm (because youre looking to approximate a stock purchase today), but it may not be the most comfortable choice for you. For more downside protection, you may consider splitting the strikes as you set up a synthetic long. In this case, you still use calls and puts that expire during the same month, but you use different strike prices. Using Autodesk as the example, lets say you decide to write the January 2011 $10 put options instead of the $12.50 puts. The $10 puts pay you $2.50 per share. With that income, you can then buy the January 2011 $15 call options (instead of the $12.50 calls from the first example) for about $2.80 per share. The net cost is the same just $0.30 per share but you have more downside protection when you split the strike this way. If Autodesk declines, you dont need to buy it until it is $10 or lower, and your net start price will be $10.30. What do you sacrifice? You now need Autodesk to appreciate by a greater degree (compared to buying the $12.50 calls) by January 2011 for your call options to appreciate meaningfully or at all.

WHEn tO ClOsE a syntHEtiC lOng

If all goes well, the underlying shares will appreciate for you well before your options near expiration, at which point based on the valuation of the stock and the amount of time left in your options you should start to consider taking your profit in your call options (unless you prefer to exercise them in order to own the stock at your calls strike price). At the same time, your put options are on the path to expire for the full cash payment. Usually, youll use synthetic longs to profit from the options themselves over the course of your investing thesis typically, around 18 months. Only rarely will you exercise the calls and turn them into a stock position if the options are successful. On the flip side, when the position works against you and you need more time for your thesis to materialize, youll be ready to buy the shares and hold them.

BOttOm linE On syntHEtiC lOngs

When youre bullish on a stock and want to invest without spending capital today, setting up a synthetic long position is a sensible alternative. The strategy can reward you with handsome profits on two options at once, with unlimited upside on the call options or it nets you shares of a stock that you should be happy to buy at a lower price.

the

motley

fool

options edge handbook

page

10

O p t i O n s E d g E H a n d b O O k

writing straddles

why wriTe a sTraddle?

You believe a stock or index is going to hold steady. ........................................... You believe a stock that was recently volatile will calm down considerably. ........................................... You believe the markets overall volatility is going to decrease.

Sometimes a stock or the market as a whole just takes a nap, and buying or even shorting isnt likely to land you a profit. But by writing (sell to open) straddles, you can generate income from a steady stock, or simply from decreasing volatility, as the market calms down or catches up on some Zs.

sEtting up tHE tradE

A straddle involves an identical number of calls and puts with the same strike price and expiration date on the same underlying stock or index. As you know, you buy the calls and puts to profit in either direction from high volatility. Inversely, writing the calls and puts is a way to profit from low or declining volatility. How? Simply by collecting option premium payments on either side of a potentially sleepy position. There are risks, however.

wriTing sTraddles: The BasiCs

Write (sell to open) an equal number of puts and calls on the same stock or index. ........................................... Use the same strike price and the same month of expiration on both options. ........................................... The strike price with a straddle is at-themoney: as close to the current underlying stock price as possible. ........................................... When you write an uncovered straddle, you dont own the underlying stock, so your risk is high (more on this in a minute). ........................................... When you write a covered straddle, you own the stock, lowering your risk. Here the straddle works like a covered call strategy but your returns are potentially goosed with additional put-writing income. ........................................... The most you can earn writing straddles is what the options pay you initially.

unCOvErEd straddlE Writing

When writing an uncovered straddle, you usually dont intend to get the underlying stock involved. Youre just looking to profit on the value erosion of the options you write, and youll plan to buy to close them (or let them expire) once youve earned your targeted profit. (Note: You need a margin account to write an uncovered straddle.) As an example, suppose a recently volatile stock just announced earnings, and you expect its volatility will now all but cease. The options still pay well, though, so youd like to capture the option premium as income. The stock is trading at $25, so you write $25 calls and $25 puts and get paid $2 for each contract thats $4 total in option premiums per straddle. This means as long as the stock ends the expiration period between $21 and $29 ($4 above or below $25), youll at least break even before commissions and in most cases, earn a profit on the trade. (call this the profit range.) For example, if the stock ends the period at $27, the puts you wrote expire (giving you the full $2 value), and the calls break even, so the trade pays you $2 per share overall. If the stock ends lower in your profit range, lets say $23, the calls expire and the puts break even, so you profit $2 per share overall here, too. However, outside your profit range, its another story. You face unlimited potential losses as the stock rises above $29 per share, and you facing growing losses (along with an obligation to buy the stock and wait for a recovery) the further it falls below $21. As the table on the next page shows, the maximum profit from an uncovered straddle occurs when the stock ends exactly at the strike price; you keep the entire $4 per share you were paid in this example. Your total profit declines as the stock moves away from the strike price in either direction which is why you want minimal volatility whenever you write straddles. Take a minute to study the table and grasp how this works. As the stock rises, the naked (or uncovered) calls you wrote increase in value, working against you. As the stock declines, the puts you wrote work against you, but youll still profit anywhere between $22 and $28, and break even at $21 or $29. Remember, you were paid $2 for each call and put, or $4 total. But since you wrote the options, your desired outcome is that their value goes to $0, or as low as possible:

the

motley

fool

options edge handbook

page

11

O p t i O n s E d g E H a n d b O O k

sToCk priCe aT expiraTion

ending Call value

ending puT value $5 and higher as the stock falls $4 $3 $2 $1 $0 $0 $0 $0 $0

your ToTal profiT per share ($1) and worsening as the stock falls Break-even $1 $2 $3 $4 $3 $2 $1 Break-even ($1) and worsening as the stock rises

number of reasons, its risky to write uncovered straddles without this added protection. However, another route is to simply own the underlying stock outright. Lets take a look.

$20 and lower $21 $22 $23 $24 $25 (the strike price) $26 $27 $28 $29

$0 $0 $0 $0 $0 $0 $1 $2 $3 $4 $5 and higher as the stock rises

COvErEd straddlE Writing

Owning the underlying stock takes away all of the naked call option risk when writing a straddle. In fact, a covered straddlewriting strategy is basically a covered call strategy, but it generally offers more profit potential because youre also writing puts on the stock. The key difference with a straddle is that both options are at-the-money, so youre more likely to see your options exercised. As with a covered call, its important that youre ready to sell your stock if it rises. And as with writing puts, you need to be ready to buy more stock if it declines (or close the options early). The benefits of writing a covered straddle are two-fold: Your profit can be higher and your profit range wider than with a mere covered call. You have more ways to close your options profitably and still keep your stock if you like.

$30 and up

$0

Continuing the earlier example, lets assume you want to write a straddle on a steady $25 stock but in this case, you own the underlying shares. You write $25 calls and puts, getting paid $2 each, with the same expiration date. Since you own the stock, no matter how high it climbs, youre covered on that side of your trade. Lets consider some potential outcomes: You end up selling your stock via the covered calls, but you keep the $4 option premium you were paid on the puts and calls, netting a sell price of $29 (compared with just $27 if youd only done a covered call and not a straddle). The stock declines below $25. You end up buying more shares, but at a net $21 given the option premiums you were paid. Youve added to your existing stock holding. The stocks holds steady, around $24 to $26. You can buy to close both the calls and puts by expiration and capture much of the profit while keeping your existing shares. Nice! Finally, as an example of the added flexibility here: Assume the stock increases to $28 by expiration, and you decide you want to keep your shares. Since you were paid $4 per share in option income, you could close your calls for $3, still have a $1 per share profit on your straddle, and keep your stock. If you had only written covered calls and not a straddle, youd need to book a loss if you wanted to keep your stock.

To help achieve a successful uncovered straddle, you want the widest possible profit range (in other words, you want to capture generous option premiums). In this example, the range is significant $4 in either direction assuming the underlying stock isnt exceptionally volatile and your options expire in two to five months (rather than longer). But remember, the trade creates unlimited potential losses outside the profit range. One way to greatly mitigate that risk: When you write your straddle, use some of your option proceeds to simultaneously buy far out-of-the-money calls and/or puts, too with strike prices at the two ends of your profit range (for this example, you might buy $30 calls and $20 puts; or just buy calls to protect you on that side and be ready to buy the stock via your written puts if it falls). Doing so, youve hedged and covered your written straddle, and because buying these options generally costs little, youll still begin with a net credit from your option writing and keep that profit if the stock stays in a now slightly tighter range. For example, if you paid $0.80 total for the protective calls and puts, your profit range decreases by that amount on either side of the strike price. If you dont buy protective options initially, be ready to do so if the trade starts to work strongly against you. Given that a steady stock can suddenly make a big move for any

the motley fool

taking fOllOW-up aCtiOn

Writing uncovered straddles requires keeping a close tab on your

|

options edge handbook

page

12

O p t i O n s E d g E H a n d b O O k

trade. If the stock is moving sharply against you in either direction, you may want take action to limit your losses. One way to do so is to close the losing side of your straddle when the stock reaches your break-even price. In this example, if the stock rises to $29, you might close your call options for a loss and let your puts go, presumably to expiration, keeping your overall losses marginal. If the stock falls, just be ready to buy it via your puts. Uncovered straddles dont usually lend themselves to rolling forward (to a later expiration date), rolling up (to higher strike prices), or rolling down (to lower strike prices), so you cant depend on these defensive follow-up moves being available to you. As mentioned above, if you buy out-of-the money protective calls (and puts, if you like) when you set up your straddle, your potential profit on the straddle is lower, but you wont need to consider follow-up action. Writing covered straddles is much less risky and requires less upkeep, but you still want to keep a watchful eye on your strategy, since only your calls are truly covered. You need to be ready to accept more shares if the stock falls below your puts strike price. For this reason, some investors will use a lower strike price on the puts they write, providing more leeway but once you start to stagger strike prices on your calls and puts, youre not using a straddle anymore, youre using a strangle.

BOttOm linE On Writing straddlEs

Youre not likely to write uncovered straddles without using some protective options as well. Writing covered straddles, however, is a sensible way to increase option profits on a covered call strategy as long as youre also willing to buy more shares if need be. With this strategy, you have another tool to profit no matter what the market throws your way in this case, even if the market goes nowhere.

the

motley

fool

options edge handbook

page

13

O p t i O n s E d g E H a n d b O O k

strangles

mOtlEy fOOl OptiOns, our dediCaTed opTions serviCe, has Been piling up profiTs and dazzling memBers...

84% gain in 3 weeks... I closed my NVDA covered call option at a 84% gain in 3 weeks!!! I would never ever thought about using options in my years of investing if it wasnt for Jeff and Jim. Thanks guys. -- S.S. Melrose Park, IL Add to my education and wealth building.... Ive been able to add options to my toolbox. I have seen the potential options can add to your portfolio and know this service will add to my education and wealth building. -- D. Heredia, Keller, TX

You write (sell to open) a covered strangle to profit when a stock stays within a wide price range -- or, if it doesnt, to get a better buy price on new shares or a higher sell price on existing shares. Its a great strategy.

rECap: straddlE vs. stranglE

Straddle: Use puts and calls, on the same stock, with the same expiration date and strike price (one at-the-money). Strangle: Use puts and calls, on the same stock, usually with the same expiration date but with differing strike prices (both out-of-the money). A strangle is similar to a straddle: Youre using call and put options on the same underlying stock or index, typically with the same expiration date. As with a straddle, you buy a strangle to profit on high volatility. Inversely, you write a strangle to profit when a stock stays within a predetermined price range or is relatively stable. The bonus: Writing a strangle offers more flexibility than writing a straddle because you split the strikes -- set it up with a different strike price on your calls than on your puts -- and you use strike prices that are out-of-the-money, or well above or below the stocks current price, giving you more room to profit. Lets take a look. Motley Fool Options, our dedicated options service, has been piling up profits and dazzling members... 84% gain in 3 weeks... I closed my NVDA covered call option at a 84% gain in 3 weeks!!! I would never ever thought about using options in my years of investing if it wasnt for Jeff and Jim. Thanks guys. -- S.S. Melrose Park, IL Add to my education and wealth building.... Ive been able to add options to my toolbox. I have seen the potential options can add to your portfolio and know this service will add to my education and wealth building. -- D. Heredia, Keller, TX And because were committed to maximizing the profit potential and experience for our members -- Motley Fool Options is by INVITATION ONLY. And there are only a few opportunities to join each year... But rest assured, if youve received this Options Edge 2011 handbook, youve been placed on our special advance-interest list. And youll be among the first people contacted when Motley Fool Options opens to new members for 96 hours only beginning on Monday, December 13!

sEtting up tHE tradE

To write a covered strangle, sell to open puts and calls, both options out-of-the money and usually with the same expiration date. However, the number of puts you write is dependent on how many additional 100 share blocks youd like to potentially buy, and the number of calls you write will depend on how many 100 share blocks you already own and would be willing to sell at your higher price. Usually, you write both sides of your strangle at the same time, but sometimes you can increase your option payments by legging into the strategy -- setting up one side of your trade at a different time than the other; for example, writing calls on your targeted stock

the

motley

fool

options edge handbook

page

14

O p t i O n s E d g E H a n d b O O k

when its near the high of your expected range and then writing puts when its nearer the low end.

Writing a COvErEd stranglE

Writing a covered strangle (also called a short strangle) is a way to profit on a stock you own and would be willing to either buy more of or sell at the right price. Writing strangles can be superior to writing straddles because splitting the strike prices provides more flexibility and room for profit.. The options wont pay as much as a straddle, but the stock has more room to roam. For example, say you own shares of a retail stock and youre willing to buy more if the shares decline meaningfully (potentially doubling your position, well suppose); or, youre willing to sell your existing shares higher. With the retailer recently near $14, you could write the $13 puts expiring in six months for $1, and write $15 covered calls expiring at the same time for $1 as well, collecting $2 in total option premiums (or 14% of the current share price). Consider the possible outcomes: The stock ends the expiration period between $13 and $15: You keep the whole $2 per share the options paid you -- great income -- and keep your shares, and can consider your next move. The stock increases above $15 by expiration: Youre on the hook to sell your existing shares for a net $17, including the $2 the options paid you. Shares fall below $13: Youre obligated to buy new shares at a net $11, again including the $2 the options paid you. Youve now doubled your ownership, and lowered your cost basis. (It might be time to write covered calls!) Of course, in most cases you could also buy to close your options early or upon expiration, and still have a profit on the combined option trades assuming the stock hasnt moved too dramatically (in this case, as long as its between $11.10 to $16.90). As you can see, a covered strangle can give you a wide profit range, and its more powerful and flexible than a covered call strategy alone -- as long as youre ready and willing to buy more shares if it comes to that. As with any time you write puts, you need to be confident in the stock or ETF youre exposing yourself to and ready to buy it. With a covered strangle, you also must be ready to sell your existing shares if they increase in price. However, given how much the two combined options pay you, you also have more flexibility -- or possibility -- to close your options early if you wish, keep your shares, and still have a profit.

strongly believe a stock wont break above or below a certain (generally wide) price range, aiming to profit via option premiums on both ends. Were unlikely to partake in this risky strategy without buying calls to protect ourselves -- otherwise, the losses can be unlimited.

BOttOm linE On Writing stranglEs

Writing a covered strangle is a way to generate option profits on a position if you already own at least 100 shares, would be happy to add at least 100 more shares at a lower price, or sell your existing shares at a higher price. More flexible than just writing covered calls, strangle-writing can provide a wide window of profit using options on a stock that you believe will stay in a stable range.

BOttOm linE On using OptiOns

Used Foolishly, options are an excellent tool to generate steady income, protect yourself, buy a stock cheaper, or sell it dearer, leverage your returns and more. Options intimidate a lot of people initially, but once you start to use them, it soon becomes clear that youve been missing out without them. Most Fools say theyll never go back to managing a portfolio of stocks without the benefits of options again. If you have any interest in learning first-hand how to put options to work for you now, watch your inbox for our special announcement.

Writing unCOvErEd stranglEs

Some daring investors write uncovered strangles when they

the motley fool

options edge handbook

page

15

O p t i O n s E d g E H a n d b O O k

options glossary

Call option: A call option is the right to buy the underlying stock at a set price (the strike price) at or before the options expiration date. A call rises in value as a stock rises and declines in value when the stock falls. Delta: The amount that an options price will change with any change in the underlying share price. Gamma: A measure of risk in an option based on the amount that the delta will change with a $1 change in the stock (we dont concern ourselves much with delta or gamma, since were much more concerned about the underlying value of the equity were targeting, but theyre still good things to know). In the money: This term is used when an option has intrinsic value. Call options are in the money when the underlying stock is above the calls strike price. Put options are in the money when the underlying stock is below the options strike price (a stock is at $22 and the put option has a strike price of $30, allowing the holder to sell the stock at $30). Intrinsic value: This is the value of an option if it were to expire immediately. Its an options value in direct proportion to the underlying stocks current price. If a call option gives the owner the right to buy a stock at $10, and the stock is trading at $12, the options intrinsic value is the difference: $2. The option may actually be priced at $3, with $1 of time value (see below) because it doesnt expire for a few months, and much could change by then. LEAPS (Long-Term Equity Anticipation Securities): These are simply stock options that, when first offered, expire at least two years in the future. We like LEAPS because they give you a relatively long time for an investment thesis to play out. Option contract: Each option contract represents 100 shares of the underlying stock. A contract is quoted at the price for just one share, so you need to multiply it by 100 to get the full value. So, if you buy two option contracts for $1.50 each, it actually represents 200 (2 x 100) shares of stock, and would cost you $300 ($1.50 x 200). Out of the money: This is the opposite condition as in the money. Here, an option has no intrinsic value, only time value. This occurs when, for example, a stock is trading at $8 and a call option has a strike price of $10. Premium: Not unlike an insurance premium, the value paid for an option contract is called the premium. The more volatile a stock is, generally the higher the premium on its options. Also, all else equal, the longer until an option expires, the higher the premium it commands, accounting for more unknowns. Put option: A put option is the right to sell a stock at a set price at or before the options expiration date. A puts value increases as a stock falls. Strike price, expiration, and exercise: Every option has a strike price and expiration date (which is always the third Friday of a month, after the market closes). The strike price is the value at which the underlying stock can be bought or sold. When an option is converted into a stock transaction, the option has been exercised. Time-value premium: This is the price of an option above its intrinsic value. Its the value placed on an option purely to account for unknowns and expected volatility between now and expiration. Time value declines as expiration draws closer. Writing a contract: Selling a new option contract (opening a position) is usually called writing a contract; the brokerage command to do so is usually sell to open, just as when you short a stock. The new option seller is called the option writer; to close the position, the trade command is called buy to close.

the

motley

fool

options edge handbook

page

16

You might also like

- Options Trading Crash CourseDocument80 pagesOptions Trading Crash CourseJustin Thiede86% (7)

- Blueprint For Options Success - Strategic TraderDocument17 pagesBlueprint For Options Success - Strategic TraderRosNo ratings yet

- How To Win 97% of Your Options Trades Ebook PDFDocument24 pagesHow To Win 97% of Your Options Trades Ebook PDFAdam Perez100% (6)

- Marketing Management AssignmentDocument6 pagesMarketing Management AssignmentNishaNo ratings yet

- NERA The Impact of Online Video DistributionDocument56 pagesNERA The Impact of Online Video DistributionAnonymous LhBzHYIHgsNo ratings yet

- The Motley Fool "Options Edge" HandbookDocument11 pagesThe Motley Fool "Options Edge" Handbookapi-25895447100% (4)

- The Strategic Options Trader: A Complete Guide to Getting Started and Making Money with Stock OptionsFrom EverandThe Strategic Options Trader: A Complete Guide to Getting Started and Making Money with Stock OptionsNo ratings yet

- Louise Bedford Trading InsightsDocument80 pagesLouise Bedford Trading Insightsartendu100% (3)

- What Are OptionsDocument14 pagesWhat Are OptionsSonal KothariNo ratings yet

- Option StrategiesDocument25 pagesOption Strategiesaditya_singh3036844No ratings yet

- 30 Days To Options TradingDocument77 pages30 Days To Options TradingJam Amir100% (10)

- Options Trading Basics The Ins and Outs of Options Trading For Beginners 1368Document3 pagesOptions Trading Basics The Ins and Outs of Options Trading For Beginners 1368IvanaBurićNo ratings yet

- Option Trading for Beginners: The Ultimate Guide on How to Trade Options, Options Trading Strategies and Binary Options Trading.From EverandOption Trading for Beginners: The Ultimate Guide on How to Trade Options, Options Trading Strategies and Binary Options Trading.Rating: 3 out of 5 stars3/5 (1)

- Option Profit AcceleratorDocument51 pagesOption Profit AcceleratorAllan Sorowon100% (4)

- HowToWin FYST EbookDocument12 pagesHowToWin FYST Ebookmehdi810No ratings yet

- Options Aa ReportDocument10 pagesOptions Aa ReportDavid GarciaNo ratings yet

- Value InvestingDocument24 pagesValue InvestingjucazarNo ratings yet

- The Advanced Options Trading Guide: The Best Complete Guide for Earning Income with Options Trading, Learn Secret Investment Strategies for Investing in Stocks, Futures, ETF, Options, and Binaries.From EverandThe Advanced Options Trading Guide: The Best Complete Guide for Earning Income with Options Trading, Learn Secret Investment Strategies for Investing in Stocks, Futures, ETF, Options, and Binaries.Rating: 3 out of 5 stars3/5 (17)

- How To Trade Options: Swing Trading Debit Spreads (Exclusive Guide): How To Trade Stock Options, #2From EverandHow To Trade Options: Swing Trading Debit Spreads (Exclusive Guide): How To Trade Stock Options, #2No ratings yet

- How To Trade Options: Swing Trading Credit Spreads (Exclusive Guide): How To Trade Stock OptionsFrom EverandHow To Trade Options: Swing Trading Credit Spreads (Exclusive Guide): How To Trade Stock OptionsNo ratings yet

- Options 101 The Ultimate Beginners Guide To OptionsDocument47 pagesOptions 101 The Ultimate Beginners Guide To OptionsChicobiNo ratings yet

- Selling Cash-Secured Puts for Passive Income: Financial Freedom, #173From EverandSelling Cash-Secured Puts for Passive Income: Financial Freedom, #173No ratings yet

- Trading Options Developing A PlanDocument32 pagesTrading Options Developing A Planjohnsm2010No ratings yet

- Dipi DataDocument10 pagesDipi DataJigisha PatelNo ratings yet

- The Options Ultima - Volume 1Document49 pagesThe Options Ultima - Volume 1spixb473t100% (1)

- Xtrades Onboarding Guide - Options TradersDocument15 pagesXtrades Onboarding Guide - Options TradersJrGomes100% (1)

- Let's Get Started: Wendy KirklandDocument6 pagesLet's Get Started: Wendy Kirklandjimilon100% (1)

- An Introduction To OptionsDocument22 pagesAn Introduction To OptionsbrijeeshNo ratings yet

- The Market Calls: A Primer on the Strategy of Writing Covered CallsFrom EverandThe Market Calls: A Primer on the Strategy of Writing Covered CallsNo ratings yet

- Options Trading For Beginners: A Complete Step-By-Step Trading Guide To Profit In Options TradingFrom EverandOptions Trading For Beginners: A Complete Step-By-Step Trading Guide To Profit In Options TradingNo ratings yet

- Options Wheel Strategy: How to Generate an Income Stream Using Cash Secured Puts and Covered CallsFrom EverandOptions Wheel Strategy: How to Generate an Income Stream Using Cash Secured Puts and Covered CallsNo ratings yet

- Option Trading GuideDocument17 pagesOption Trading GuideMariusD100% (1)

- Options Trading For BeginnersDocument146 pagesOptions Trading For BeginnersMohaideen Subaire100% (6)

- Options BasicsDocument13 pagesOptions BasicsNeha KapurNo ratings yet

- Guide To Expert Options Trading: Advanced Strategies That Will Put You in The Money FastDocument16 pagesGuide To Expert Options Trading: Advanced Strategies That Will Put You in The Money Fastemma0% (1)

- Optiontradingbook PDFDocument18 pagesOptiontradingbook PDFdonhankietNo ratings yet

- How To Trade Options: Swing Trading Iron Condors (Exclusive Guide): How To Trade Stock Options, #3From EverandHow To Trade Options: Swing Trading Iron Condors (Exclusive Guide): How To Trade Stock Options, #3No ratings yet

- Options Trading: How to Make Money in Less Than 7 DaysFrom EverandOptions Trading: How to Make Money in Less Than 7 DaysRating: 2.5 out of 5 stars2.5/5 (3)

- Stock: Buying and Selling Tracking Stock TricksDocument13 pagesStock: Buying and Selling Tracking Stock TricksnnikshaNo ratings yet

- Value Investing: Amy FontinelleDocument31 pagesValue Investing: Amy FontinelleAnup PillaiNo ratings yet

- The Advanced Forex and Options Trading Guide: Learn The Vital Basics & Secret Strategies For Day Trading in The Forex & Options Market! Make Your Online Income Today by Becoming a Top Trader!From EverandThe Advanced Forex and Options Trading Guide: Learn The Vital Basics & Secret Strategies For Day Trading in The Forex & Options Market! Make Your Online Income Today by Becoming a Top Trader!Rating: 5 out of 5 stars5/5 (7)

- Video 6 - Long Call - Puts Strategies - UsefulDocument6 pagesVideo 6 - Long Call - Puts Strategies - UsefulIsIs Drone100% (1)

- Credit Spreads:Beginners Guide to Low Risk, Secure, Easy to Manage, Consistent Profit for Long Term WealthFrom EverandCredit Spreads:Beginners Guide to Low Risk, Secure, Easy to Manage, Consistent Profit for Long Term WealthNo ratings yet

- Financial Engineering & Risk Management: Unit - VDocument16 pagesFinancial Engineering & Risk Management: Unit - VPrakash ChoudharyNo ratings yet

- Trading Long Strangles for Passive Income: A Great Passive Options Trading Strategy: Financial Freedom, #204From EverandTrading Long Strangles for Passive Income: A Great Passive Options Trading Strategy: Financial Freedom, #204No ratings yet

- When To Sell (Special Report)Document5 pagesWhen To Sell (Special Report)Vishal Safal Niveshak KhandelwalNo ratings yet

- Muslim Investor: The Stock Market Made SimpleFrom EverandMuslim Investor: The Stock Market Made SimpleRating: 5 out of 5 stars5/5 (1)

- The Act of Committing Money or Capital To An Endeavor With The Expectation of Obtaining An Additional Income or ProfitDocument7 pagesThe Act of Committing Money or Capital To An Endeavor With The Expectation of Obtaining An Additional Income or Profitreddyreshma44_414448No ratings yet

- What Are The Different Types of Stocks Available in The Market?Document5 pagesWhat Are The Different Types of Stocks Available in The Market?rachit2383No ratings yet

- White Paper 001Document13 pagesWhite Paper 001asifibrarNo ratings yet

- Generate Monthly Cash Flow by Selling OptionsDocument23 pagesGenerate Monthly Cash Flow by Selling OptionsCHAIMA CHICHA100% (2)

- OPTIONS TRADING CRASH COURSE: Mastering Strategies for Financial Success (2023 Guide for Beginners)From EverandOPTIONS TRADING CRASH COURSE: Mastering Strategies for Financial Success (2023 Guide for Beginners)No ratings yet

- Options Trading: How to Start Investing Consciously with this Ultimate and Practical Guide. Learn How to Become a Smart Investor by Using Technical Analysis Before Purchasing Options (2022)From EverandOptions Trading: How to Start Investing Consciously with this Ultimate and Practical Guide. Learn How to Become a Smart Investor by Using Technical Analysis Before Purchasing Options (2022)No ratings yet

- Covered Calls: Making your Investments WorkFrom EverandCovered Calls: Making your Investments WorkRating: 3.5 out of 5 stars3.5/5 (2)

- OPTIONS TRADING: Mastering the Art of Options Trading for Financial Success (2023 Guide for Beginners)From EverandOPTIONS TRADING: Mastering the Art of Options Trading for Financial Success (2023 Guide for Beginners)No ratings yet

- Stocks E Book PDFDocument38 pagesStocks E Book PDFdexter0% (1)

- BNFN 4309 - Topic 2 (Activity # 3) - AKDocument18 pagesBNFN 4309 - Topic 2 (Activity # 3) - AKabeerNo ratings yet

- The Harshad Mehta ScamDocument31 pagesThe Harshad Mehta ScamShraddha SakharkarNo ratings yet

- Module BS1: The Business FrameworkDocument27 pagesModule BS1: The Business FrameworkMs. Yvonne CampbellNo ratings yet

- 16 DecDocument38 pages16 Decmahmoudfahmytotti1No ratings yet

- Money and Banking Cpa1Document19 pagesMoney and Banking Cpa1kirwanicholasNo ratings yet

- Manual Operated Grader For Round Vegetables.1Document58 pagesManual Operated Grader For Round Vegetables.1Leena BisenNo ratings yet

- Fleming, Jasmine, MKT 6953-003Document25 pagesFleming, Jasmine, MKT 6953-003Spencer KariukiNo ratings yet

- Brand LoyaltyDocument18 pagesBrand Loyaltymithuncea0% (1)

- Flores - Week 1 - BUSI-612 - D01 - Spring2023Document11 pagesFlores - Week 1 - BUSI-612 - D01 - Spring2023Charlene de GuzmanNo ratings yet

- Pullback Trading StrategyDocument10 pagesPullback Trading Strategysantosh pandey0% (1)

- Competitive Profile MatrixDocument4 pagesCompetitive Profile MatrixDikshit KothariNo ratings yet

- Security Characteristic LineDocument2 pagesSecurity Characteristic LineayyazmNo ratings yet

- Small Country and Large CountryDocument3 pagesSmall Country and Large Countryhims08No ratings yet

- RE, EE PROJECT - Docx (Pas Jamal)Document27 pagesRE, EE PROJECT - Docx (Pas Jamal)Sabrina Abdurahman100% (2)

- Korean Shine Muscat: No. Shop Unit Price Retail Unit of CalculationDocument4 pagesKorean Shine Muscat: No. Shop Unit Price Retail Unit of CalculationThao NguyenNo ratings yet

- Marketing Debate: Does Marketing Create or Satisfy Needs?Document3 pagesMarketing Debate: Does Marketing Create or Satisfy Needs?Shafayet JamilNo ratings yet

- SCM Group 3 Sec EDocument30 pagesSCM Group 3 Sec EpankajsyalNo ratings yet

- Mec-008 EngDocument35 pagesMec-008 EngnitikanehiNo ratings yet

- Chapter 3 Depreciation - Declining and Double Declining MethodPart34Document12 pagesChapter 3 Depreciation - Declining and Double Declining MethodPart34Tor GineNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasdnesudhudhNo ratings yet

- CH - 05 Feasibility & Business PlanningDocument55 pagesCH - 05 Feasibility & Business PlanningPablo Ragay Jr100% (1)

- Student Slides 1 To A PageDocument173 pagesStudent Slides 1 To A PagejNo ratings yet

- 03chapters6 9Document94 pages03chapters6 9Anonymous BwLfvuNo ratings yet

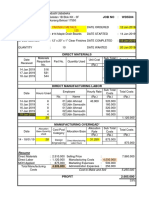

- COST SHEET Atau JOB COSTDocument1 pageCOST SHEET Atau JOB COSTWiraswasta MandiriNo ratings yet

- Cme Micro e Mini Futures Fact CardDocument2 pagesCme Micro e Mini Futures Fact CardJohn KaraNo ratings yet

- Work Sheet PDFDocument8 pagesWork Sheet PDFdhruv soniNo ratings yet

- The Lean CRMDocument8 pagesThe Lean CRMSidak KatyalNo ratings yet

- Project Management - Shipyard ManagementDocument2 pagesProject Management - Shipyard ManagementMuhammed Saied El-KabbanyNo ratings yet