Professional Documents

Culture Documents

Winners CFICC 2010

Uploaded by

Syed Bahauddin AlamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Winners CFICC 2010

Uploaded by

Syed Bahauddin AlamCopyright:

Available Formats

CHAMPION

3rd CFICC

Home The Competition Guideline Scope and Rules Register Contact Us

Project Name: Pro-BIZ: Software in Business Home The Competition Guideline Scope and Rules Register Contact Us

Intelligent

Predictive

Modeling

2nd CFICC

Winners and Finalists

Team: UIU-4Dimension Institution: United International University Team Members:

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Sabrina Shahin Haque, BBA, UIU Md. Aminul Islam, BBA, UIU Md. Feroj Bepari, CSE, UIU Nasir Khan, CSE, UIU Project Manager: S. M. Shabab Hossain, Lecturer, Dept. of CSE, UIU PRO-BIZ is an intelligent predictive business modeling software that brings life and add pace to business. It can help business to ensure sustainable growth through; help to find out probable migrated customers, identify the root causes of migrated customers and help business to retain them. PRO-BIZ is powered with widely used programming language JAVA. Initially, PRO-BIZ is meant to help business to take instant business decisions about customers. Primary target customers are micro finance institutions, local banks and telecommunication organizations. The business decision comes from the softwares statistical logic. For example, the business needs to figure out the most or least benefiting customers. In this case, this software can point out the lists as well as can help to take faster decision. This solution is unique because it is, Local and cost effective Highly portable (Java base) Decision implementation will be much more faster than before Highly customizable

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

24x7 hours customer support PRO-BIZ is adept at creating Decision Tree, Visual Interface, Business Report and some other handy business tools. All of these are meant to enhance business activities.

1st RUNNER UP

Project Name: DIP Micro-Banking Solution

Team: ULAB -STRIDE Institution: University of Liberal Arts Bangladesh Team Members: Racy Gomes, Electronics and Telecommunication Engineering,

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

ULAB Abdullah MD. Saad, Engineering, ULAB Electronics and Telecommunication

Mahbubur Rahman, BBA, ULAB Shaharia Arafat, BBA, ULAB Project Manager: Amitav Paul, Lecturer, CSE, ULAB DIP MICRO-BANKING is a software solution that leverages the ubiquitous mobile infrastructure, making transactions easier and giving flexibility to deposit small amount of credit to bank accounts. Dip Micro-Banking uses mobile infrastructure of the assigned telephone company and existing infrastructure of the financial institute to initiate customer deposits. With this solution, banks customer can go to the nearest mobile recharge point and make deposits to their bank accounts. The solution includes front-end module with manager, employer and mobile center module and back end server. Dip MicroBanking uses the existing infrastructure of financial institute and adds some extension. It features are: i. For Client Balance enquiry through SMS Numerous deposit booths Small amounts can be deposited ii. For Financial Institute

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Module to access Transaction Logs Enquiry against any Transaction Generate Reports and Statements Broadcast Alerts, Greetings including Advertisement iii. Server Features Authenticates user Receives client request (Registration, Deposit) Dip Micro-Banking, the transactions are secured with Transaction Management System. The Server of this solution uses Virtual Private Network (VPN) to maintain security with Telephone Company and its branches.

2nd Runner Up

Project Name: Transaction

Mobile

Cash

(MCash)

Virtual

Money

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Team: BUET- Octavian Institution: Bangladesh Technology (BUET) Team Members: Hasan Habibul Latif, Engineering (IPE), BUET Student, Industrial and Production University of Engineering and

Montasir Mamun Mithu, Student, Industrial and Production Engineering (IPE), BUET Samiul Monir, Student, Department of Computer Science and Engineering, BUET Sheikh Al Amin Sunoyon, Student, Department of Computer Science and Engineering, BUET Project Manager: Sudipa Sarkar, Assistant Professor, Industrial and Production Engineering (IPE), BUET Mobile Cash (MCash) provides stored value account which makes the user enable to transact money while they are on the move.. Any type of transaction can be done by using simple command from the mobile phone. Thus this concept is thus called virtual money transaction. This solution can be easily executed with current banking system. The legal issues of Bangladesh completely comply with this system. Main business features of this product: MCash SIM registration: Existing debit card providing &

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

verification system is used. Mcash SIM will just replace the debit card; Automated Software: Automated software is incorporated with that MCash SIM. That software prohibits all kind of cyber crimes. Moreover, it provides better user experience & secure interface system; Money transaction process: Customer has to put a request to transfer desired amount of money to other account. By using automated software encrypted mobile phone whole work function will be done within 30 seconds. There is no need of carrying money. The password, Pin code, IMEI no will be checked to ensure their authenticity; MCash account recharge point: Customer can recharge their account from bank. They can also withdraw money from account. All they have to do is to send a request & verify the confirmations; Loan System: Economic system will be more flexible in that way. Loan can be given or paid by this SIM; and Anti money laundering team: Every transaction record with verified bank account number will be stored & monitored. If any illegal money transactions like robbery, ransom, extortion etc. can be tracked down & eliminated. Software Specification: Software is Operating System (OS) independent; Software can be operated from Linux server which provides extra level of Security; Software can be integrated with mobile SMS which will update of data reduces human effort; The software is easy reconfigure (if needed); to install and also easy to

JAVA the most object oriented programming language is used to program this solution;

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Oracle database system is used for data storage; and Software (J2ME based) is introduced and it will be integrated in the SIM card.

Finalist

Project Name: MOBILE WALLET: A Comprehensive e-Savings Scheme Team: BUET-

Enrooters Institution: Bangladesh Technology (BUET) Team Members: Syed Bahauddin Alam, EEE, BUET University of Engineering and

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

ABM Rafi Sazzad, EEE, BUET Md. Nazmus Sakib, EEE, BUET Shakhawat Hosen Tanim, URP, BUET Project Manager: Md. Zunaid Baten, Lecturer, EEE, BUET Mobile Wallet is a solution to encourage people for savings through e-Transaction using mobile phones. Using this system people can deposit their money in a bank using simple mobile phone cash-recharge system. It works in the same way people deposit money for talk time. Using Mobile Wallet, people will be able to deposit money in their respective bank accounts from the e-Load Centers. This system does not require any additional infrastructure, as existing e-Load centre can provide this service. This system brought forth two state of the art concepts of security enhancement and user authentication. It integrates a novel concept of Digital Watermarking to safeguard the e-transactions through the business gateway. Digital Watermarking is a well established method of embedding information (e.g. text message) into other digital information (text, image or audio). To enhance the security of SMS based e-transactions, a whole new idea of hiding the SMS within an audio, image or text file using Digital Watermarking is introduced for this system. Among various biometric authentication techniques, voice can be transmitted easily using mobile communication. Again for client verification, a next generation authentication technique known as Voice Verification is also used in for this system.

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

This solution eliminates the requirement of sophisticated mobile phone. This system is built based on the current GSM/CDMA based mobile communication, so that people of all classes and income groups can easily enjoy this service. There are around 19.2 million bank account holders in Bangladesh, whereas the number of mobile phone users is well above 54.7 million. If mobile users can be encouraged in savings using their mobile phones by this e-savings scheme, then it will certainly have a profound positive impact on countrys overall economic progress.

Finalist

Project Name: Mobile LC Team: IBA- Monte Carlo

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Institution: Institute of Business Administration (IBA), Dhaka University Team Members: Saif Ahmed, BBA, Dhaka University Md. Ali Zulayed, BBA, Dhaka University Damil Alam Prakash, BBA, Dhaka University Nawsheen Sharfuddin, BBA, Dhaka University

Project Manager: Shama-e-Zaheer, Assistant Professor, BBA, Dhaka University Mobile LC is a simple IT-based solution, offered as a bank service that allows local firms to enjoy the benefits of local LC with the help of their mobile phones. This solution can immensely benefit the Small Medium Enterprises (SMEs) who regularly conduct inter-city transactions. Clients can avail the service from any place and any time. Mobile LC is a value added service for the bank. Its mechanism is not exactly like an international L/C, but suitable for local and inter-city transactions of SMEs. To avail this service both the buyer and supplier need to be the subscriber to Mobile L/C service. In the basic model, there are 3 parties: Banks clients-

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Buyer and Supplier and the Bank itself. The steps of the model are: The buyer and supplier agree upon terms of transaction before starting the process. Buyer sends an SMS to the the bank specifying the supplier ID, payment amount and number of days till payment; bank then checks database for eligibility for . If passed, bank sends a confirming SMS. The bank then sends SMS the transaction details to the supplier and the supplier confirms. Supplier then produces and delivers the goods. Buyer sends the bank an SMS confirming the receipt of product. Bank finally informs the supplier that money to be paid on the due date, and supplier releases the goods. The solution needs simple technology which includes Software to maintain and verify LCs and maintain client database, network to access and update current client accounts, SMS gateway to screen out incorrect text messages, multiple PIN codes and SMS short code to ensure the security of the system. This system can work with any types of mobile phone having text messaging capability. Based on the preliminary calculations, the project is financially feasible with a break-even point of 1.5 years and payback period of 3 years 7 months.

Finalist

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Finalist

Project Name: MobiCASH: Flexible & Easiest Payment Solution Team: BUET-

Apocalyptic Institution: Bangladesh Technology (BUET) Team: Mohammad Sajidur Rahman, CSE, BUET Md. Shakil Hossain,CSE, BUET Khondakar Asif Akhter, CSE, BUET Anjon Basak, CSE, BUET Project Manager: Rifat Shahriar, Associate Professor, CSE, BUET University of Engineering and

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

MobiCASH is a mobile payment platform. It offers easy money transfer service to users connecting the users with mobile operator and bank. With MobiCASH, one can use his/her mobile phone to make purchases. A simple SMS containing a PIN Code, recipients mobile number, amount to be paid and an option whether the amount will be debited from the mobile balance or bank account completes the transaction. Registration for MobiCASH is very simple - just a SMS containing a valid account number along with the bank name. Both the sender and the recipient will get a confirmation SMS after successful transaction. The amount thus will be debited from senders account & deposited into recipients registered bank account. Both the sender & recipient must be registered to enjoy this service. The secure authentication and payment validation technology underlying MobiCASH is IPCryptSIMTM Technology. IPCryptSIMTM resides on the SIM card of every type of mobile device to allow anyone to secure SMS messages. Its easeof-use interface offers a simplified method of data input to make it a simple-click operation. Each time one makes a transaction requested, encrypted information is sent to the payment server through the mobile phones wireless channel. This encrypted message is in-built with customers signature by the MobiCASH system and sent to the bank for account verification. At the bank, the message is decrypted using RSA technology. Thus the message content is kept hidden and no third party intrusion can occur for this double layer of encryption. IPCryptSIMTM follows International Standards of ANSI x509.3, PKCS#11, ISO/IEC 9798 and IEEE P1363.

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

MobiCASH can be accessed using three alternative ways; through SMS, through mobile applications (JAVA supported mobile phones required) and dedicated web platform. The advantages of MobiCACH mobile payments are: This payment solution is widely acceptable as most of the people can easily access a mobile phone; This ensures higher safety, flexibility for payment; No need to carry cash; One SMS ensures transaction; Ensure control and tracking over ones spending in real time; Customers choice of platform, either mobile platform or web platform for payment; Flourish of e-commerce as MobiCASH provides easy-touse payment gateway solution; and Finally, a careful attempt to make technology available for the outreach. banking and security, reliability and

Finalist

Project Name: BD Pay: grassroots procedures Team: NSU- New Wave

Online

payment

system for the

Institution: North South University

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Team Members: M Abdul Mukaddem Rushab, BBA, NSU Shovon Kumar Pal, ETE, NSU Nasifa Sultana, BBA, NSU Hasan Shahriar Turja, ETE, NSU Project Manager: Dr. Muhammad Abdul Awal, Professor. EECS, NSU The project is concerned with the automation of micro-finance system through mobile and Internet technology. This system can reduce operation cost of MFIs as well as give flexibility and convenience to the borrowers in paying installments and checking their loans status. This system stimulates the growth of mobile technology to solve the micro finances shortcomings, which are loan eligibility checking, repayment system and verification. Loan eligibility checking: This will work through DSS which will be done by the local branch but verified by the central branch as the system will be directed to a central database there. And the central database will have some local sub-database. And these databases are interconnected so that there is no missing of any data and this has been to make this procedure safe. The user information will be stored to database for the online verification. Repayment system: Repaying is been such a big problem in MFI. To this concern, this project offers mobile repayment system (SMS Value added service) and internet from the branch (online payment system). The

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

process will be as simple as paying mobile bills. Confirmation and Verification: The borrowers can check their loans status and repayment verification through: SMS confirmation with a unique code number and verification by national ID card checking. This system is developed based on open source software. The softwares and systems which we will be using: PHP and MYSQL for building web solutions and web applications GNU PHP for digital signature and online verification Visual.net for building SMS engine Visual basic for maintaining a strong database

Finalist

Project Name: One SIM Banking Team: IBA- Titans Institution: Institute of Business Administration (IBA), Dhaka University Team Members: Kazi Noman Ahmed, IBA, DU Akif Ahmed, IBA, DU Sayeef Abdullah, IBA, DU Project Manager:

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Project Manager: Md. Iftekharul Amin, Lecturer, , IBA, DU ONE SIM Banking introduces an idea of Telecommunication based banking concept that enables the bank to serve its customers more efficiently in a faster and easier way. The core of the system is a SIM card, which will enable the customer to get various types of banking services anywhere, anytime. The concept is to provide available banking services through a SIM menu. After registration for services, the customer will be able to use his SIM menu for banking services. This way, the customer will not need to visit a bank physically or through internet to get in touch with the bank. Also in this way the bank will enter the huge market of mobile phone subscribers in Bangladesh. He will get available banking services in his fingertips, just a click away from access, accessing financial services virtually anywhere anytime. Some of services that are feasible under this project are account information, transaction details, banking product details, bill payment system, deposit from Mobile Account, branch/ATM location, stock market services, financial news, tax and other regulatory news, international and local market price, exchange rates, deadline alerts, easy donation, mobile top-up from bank account etc. Benefits of this system is endless, the most attractive of them are high growth rate for bank and making banking services

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

available to the customers. Costs for this project are extraordinarily low. These services will be able to reduce paperwork, service time and the need of physical attendance at banks. These in turn will result in greener financial activities. The plastic and electronic money use is increasing day by day. After some modification in ATM machine, plastic money can be replaced by SIM cards where we will be able to carry out transactions with our handset. Our project can be offered to the customers as an additional service and the bank even could earn revenue by providing higher level services to the customers. This service will also cut expenses in customer management department.

Finalist

Project Name: Seamless Seller Online shopping made easy Team: SUSTBihongo

Institution: Shahjalal University of Science & Technology

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

(SUST) Team Members: Mashruf Zaman Chowdhury, CSE, SUST Md. Mahbubur Rahaman, CSE, SUST Syed Modasser Hossain, CSE, SUST Zabir Haider Khan, CSE, SUST Project Manager: Abu Awal Md. Shoeb, Lecturer, , CSE, SUST Seamless Seller is a mobile based online marketplace. This projects goal is to elevate online buying and selling at the reach of hand by making it more naive, secure and acceptable. A JAVA supported mobile device with internet connection is enough for using the service. However, using SMS any mobile may enjoy most of its facilities. A customer can do all of his buying & selling tasks very easily using Seamless Seller mobile application. Besides existing money transaction procedure (direct, bank account etc.), one can pay for his purchased products and/or ship his sold product using third party courier services like (S A Paribahan, Bangladesh Postal Service etc.). Third party courier service will also hold customized Seamless Seller application. These discrete softwares will exchange payment & shipping related information among buyers & sellers via communication with the server. This service is totally mobile phone operator independent. Currently, websites and mobile services are live for selling and

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

buying goods online at www.seamlessseller.com. Sequentially, money transaction via Bank and shipping via third party courier services will be included in the system. In addition to these, integration of SMS short code for Shahjalal University of Science Technology with Seamless Seller is also at process.

Finalist

Project Name: Cash It Now (Provide a state of the art financial transaction system for banks) Team: DUDolphins

Institution: Dhaka University Team: Syed Ibrahim Saajid, IBA, DU Amit Seal Ami, IBA, DU

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Asif Imran, IIT, DU Gaushey Shahriar, IBA, DU Project Manager: Shafiul Alam Khan, Lecturer, , IBA, DU CashitNow is a server based solution that can create an interbank network among the commercial banks of Bangladesh. This network can be used to increase efficiency of all forms of interbank transactions that involve customer interaction. The primary application of this server is to clear account payee checks instantly. A customer can walk into a bank where he has an account, place an account payee check by his name and can get the money in his account within a minute. This is possible because this server will provide the teller with all the information required to clear the check. Upon the reception of the check, the teller of the receiving bank will log into the CashitNow server and manually input the account number, check number and the amount to be withdrawn. These will be cross-matched automatically with the information stored in the core banking solution server of the payee bank. If this information matches up, the server will request the CBS of the payee bank for the signature of the customer and display it to the teller at the receiving bank for verification. If everything turns out to be alright, the amount will be automatically credited to the receivers account and debited to the payees account by the server.

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

This network can be used to clear all other negotiable instruments, like pay orders, bank drafts, cash checks etc. Depositing money through this system is even easier as there is no hassle of verifying any information for that. So this network can be used to distribute foreign remittance throughout the country following the same principle. The connection used for this network is basic internet connection. A Virtual Private Network will be used within the existing connection to ensure security. All the data passing through the network will also be encrypted for greater security. The transaction history will be stored in the server for a certain period of time to ensure retrieval if required. This entire system will be watched over and governed by Bangladesh bank. The governing model of Central Depository Bangladesh Ltd. can also be followed for this purpose. The issue of information sharing within banks is a critical but practical one as a similar situation can be seen in the case of ATM card transaction. Online check clearing is also a practical solution as many banks already follow this system for intra bank transactions.

Finalist

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

Project Name: Cell Control; Daily Credit Limited Cell-phone Service Package Team: IBAAbacus

Institution: Institute of Business Administration (IBA), Dhaka University Team Members: Hossain Mohammad Sarram, IBA, DU Tousif Jamal, IBA, DU Mahfuzul Islam, IBA, DU Adnanul Haque Ahmed, IBA, DU Project Manager: Md. Mushtaque Ahmed, Assistant Professor, IBA, DU The Cell Control is a solution to reduce misuse of mobile phone by kids as well as company employees using provided mobile phones. Using the Cell Control package, parents as well as

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

employers can control the mobile phone usage and thus can save money. The solution is very processes will be: simply designed. The step by step

The guardian buys a connection for the child which is the junior connection and configures his or her own mobile phone as the master connection along with his or her spouses connection; The package is activated which allows the child to use a fixed amount of daily credit upon exhaustion of which the outgoing of the connection is halted; The child can then only call the master connections from his or her cell phone for a limited amount of time everyday; The bill for the junior connection, which includes the aggregate of the daily amounts as well as a premium, is paid by the guardians at the beginning of the month; The remaining amount of credit everyday is to be divided in two parts with 80% being added to the next days balance, and 20% taken by the operator; The call rates between the junior connections using cellcontrol will be lower than calling other connections. This benefits all the parties, the guardians and the children, as well as the operators in the following ways, The burden is reduced on the pockets of the guardians; The operator is identified as a socially responsible and caring company. As the number of new subscribers increase, the operators revenue will also increase;

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

The children get to learn more about budgeting and how to manage their personal finances.

De sign by Md. Masum Billah

open in browser PRO version

Are you a developer? Try out the HTML to PDF API

pdfcrowd.com

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Mobile Phone CloningDocument38 pagesMobile Phone CloningDevansh KumarNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Format of Family Must KnowDocument71 pagesFormat of Family Must Knowchopperjoe1957No ratings yet

- Internship Report at MCB Bank LimitedDocument116 pagesInternship Report at MCB Bank Limitedshahzadwaheed0% (1)

- Simple Bank AgreementDocument30 pagesSimple Bank AgreementNora RadovanNo ratings yet

- Rotary Excellence Award 2011-Syed Bahauddin AlamDocument5 pagesRotary Excellence Award 2011-Syed Bahauddin AlamSyed Bahauddin AlamNo ratings yet

- CFICC CertificateDocument1 pageCFICC CertificateSyed Bahauddin AlamNo ratings yet

- Rotary Award Invitation CardDocument1 pageRotary Award Invitation CardSyed Bahauddin AlamNo ratings yet

- B.sc. Thesis ParticipationDocument1 pageB.sc. Thesis ParticipationSyed Bahauddin AlamNo ratings yet

- Invitation Card - Gala Event 3rd CFICCDocument1 pageInvitation Card - Gala Event 3rd CFICCSyed Bahauddin AlamNo ratings yet

- CFICC 2010 Presentation Final RoundDocument29 pagesCFICC 2010 Presentation Final RoundSyed Bahauddin AlamNo ratings yet

- Citi Bank AwardDocument1 pageCiti Bank AwardSyed Bahauddin AlamNo ratings yet

- B.sc. Thesis AwardDocument1 pageB.sc. Thesis AwardSyed Bahauddin AlamNo ratings yet

- Cficc 2010 2ND RoundDocument16 pagesCficc 2010 2ND RoundSyed Bahauddin AlamNo ratings yet

- CFICC 2010 1ST ROUND PresentationDocument25 pagesCFICC 2010 1ST ROUND PresentationSyed Bahauddin AlamNo ratings yet

- Syed Bahauddin Alam at IEEE Signal Processing 2010Document8 pagesSyed Bahauddin Alam at IEEE Signal Processing 2010Syed Bahauddin AlamNo ratings yet

- Indian Overseas Bank: Application For Iob Visa Credit CardDocument2 pagesIndian Overseas Bank: Application For Iob Visa Credit CardmagicpalNo ratings yet

- 3G USB Dongle User ManualDocument19 pages3G USB Dongle User ManualAnthony KhurramNo ratings yet

- Test Cases For ATM: Verifying The MessageDocument2 pagesTest Cases For ATM: Verifying The MessageAbdul WaheedNo ratings yet

- ATM Simulation Using Fingerprint VerificationDocument35 pagesATM Simulation Using Fingerprint VerificationShashank Verma50% (2)

- Gearcif-Number-Sbiamp#what Is CIF Number in SBIDocument1 pageGearcif-Number-Sbiamp#what Is CIF Number in SBIAswin DasNo ratings yet

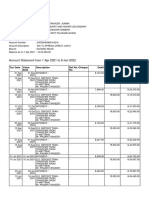

- Account Statement From 1 Apr 2021 To 28 Feb 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2021 To 28 Feb 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAPPLE MARINENo ratings yet

- Software Requirements Specification February 01, 2011Document18 pagesSoftware Requirements Specification February 01, 2011Mahesh GowdaNo ratings yet

- BOC AC Opening FormDocument4 pagesBOC AC Opening FormbocbpocityexNo ratings yet

- Account Statement From 5 Apr 2023 To 5 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 5 Apr 2023 To 5 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAman guptaNo ratings yet

- RadiusManager User Manual 4.1Document83 pagesRadiusManager User Manual 4.1tutakhaluNo ratings yet

- Assignment MCA OOPSDocument1 pageAssignment MCA OOPSAHMAD HUSSAINNo ratings yet

- PRO3000 2-Door Intelligent Controller Architect and EngineeringDocument6 pagesPRO3000 2-Door Intelligent Controller Architect and EngineeringMartin KwanNo ratings yet

- Dvi-300 S User's Guide (Doc0499) r01-001Document14 pagesDvi-300 S User's Guide (Doc0499) r01-001trungdungtb73No ratings yet

- JAIIB Module C study guide for banking technology and operationsDocument32 pagesJAIIB Module C study guide for banking technology and operationsChandan Kumar RoyNo ratings yet

- Account Statement From 1 Apr 2021 To 8 Jan 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2021 To 8 Jan 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceTanveer PinjariNo ratings yet

- INTERNET BANKING USER GUIDE & FAQSDocument18 pagesINTERNET BANKING USER GUIDE & FAQSZobi HossainNo ratings yet

- Blue TrackingDocument5 pagesBlue Trackingpatrick_lloydNo ratings yet

- Alarma Homeguard MS8000Document58 pagesAlarma Homeguard MS8000Aurelian BriaNo ratings yet

- E-Statement 25-07-2021Document1 pageE-Statement 25-07-2021swathiNo ratings yet

- Huawei F685-ENG PDFDocument13 pagesHuawei F685-ENG PDFBernard MarreauNo ratings yet

- Commission Structure: S.No. Particulars CSP ShareDocument4 pagesCommission Structure: S.No. Particulars CSP ShareKunal ShivhareNo ratings yet

- Lab 2Document6 pagesLab 2NestorNo ratings yet

- (User Manual) Bip-6000 - enDocument76 pages(User Manual) Bip-6000 - enGA16DETNo ratings yet

- 7010 w14 Ms 13Document13 pages7010 w14 Ms 13DBNo ratings yet

- Atm Management SystemDocument40 pagesAtm Management SystemDada KhalandarNo ratings yet

- pkcs-15v1 2Document85 pagespkcs-15v1 2Pedro LopesNo ratings yet