Professional Documents

Culture Documents

Timing The Highs and Lows of The DAY

Uploaded by

Erkan SaglamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Timing The Highs and Lows of The DAY

Uploaded by

Erkan SaglamCopyright:

Available Formats

2nd Quarter 1996

LIFFE Equity Products Review

Timing the highs and lows of the day

Emmanuel Acar, Pierre Lequeux and Stephane Ritz, Banque Nationale de Paris Plc Emmanuel Acar, Pierre Lequeux and Stephane Ritz of Banque Nationale de Paris investigate patterns in traded prices in the FT-SE 100 Index future by examining high frequency trading data and comparing this against results from their price behaviour models. As a trader watches prices move, he is likely to be forecasting where those prices will go and seeking the optimal time to execute a trade. The optimal time to execute a trade is when the price is either at the bottom of the day, when one buys or at its top when one sells. This is especially the case for intra-day traders who take positions solely inside the trading day and have to square their positions at the close of the market. With the increasing power of computers it is natural to collect and analyse high frequency data (i.e. a detailed record of bid, ask and traded price collected throughout the trading day). At each transaction there is some probability that the quoted price is the high or low of the day. It is important for an intra-day trader to be able to detect at which time a high or low might happen. The trader is aware that not all times of the day hold equal importance. For instance, the volume traded on most futures markets follows a U shape, meaning that for liquidity reasons an extreme price occurrence say at lunch time might not be filled in the same way as an extreme price occurring on the close or open. We can devise a model to treat the time at which an extreme price occurs as a stochastic time varying process. This basically measures the probability of an event happening. We will establish the probability that a high or low falls inside a given time interval by specifically assuming that the asset returns from the FT-SE 100 Index future follow a Brownian Random Walk without drift. We assume the probability of a high or low occurring follows a random walk. This paper applies previous results from the model to quotes in the FT-SE 100 Index future and as will be seen, incidents of extreme clustering are discovered.

18.03.96 21.06.96

2nd Quarter 1996

Futures and Options

Inside

De-mystifying FT-SE charts 4 Fair value analysis Spread and returns Statistical summary Statistics on the web Fair value premium Pricing and volatility FT-SE 100 & 250 constituent lists Equity and FT-SE Index options statistics More FLEXibility LIFFE news 5 7 8 9 11 12 14 17 18 19

LIFFE Equity Products Review

Brownian Random Walk without Drift assumption We will denote the time at which the maximum price occurs as TH and the time at which the minimum price occurs as TL . The trading session is assumed to have length T. The time will be counted from open to close. Therefore, the price at t=0 is the opening price, and the price at time T is the closing price. We can therefore state:

Figure 1 Frequency distribution of extreme times: July '92 September '95 (FT-SE 100 Index future)

Frequency 35% 30% 25% 20% 15% 10% 5% 0% [0;38] [0;38[ [76;114] [76;114[

High Low N(0,1)

0 TH T , 0 TL T

Proposition If we assume that the process which drives logarithmic returns is a Brownian Random Walk without drift, the probability of a high or low occurring after a time t=r out of a trading session of length T is given by: p r,T = Prob[TH > r] = Prob[TL > r] =

[152;190] [152;190[

[228;266] [228;266[

[304;342] [304;342[

[380;418] [380;418[

38 minute time bars

2 T r with Arctg( ) 0 r T r The N(0,1) line represents the random walk. Given the number of observations on more than three years of tick data, it was convenient to select time bars of thirty-eight minutes. The bottom axis represents time in the trading day and the left axis therefore represents percentage of time in the trading day when a high or low occurred. For example, in the first time segment observed, high frequency data shows that there is roughly a 32% chance of a high occurring at that time of the day and a 33% chance of a low occurring. So the chart shows clusters of highs or lows occurring either at the open or at the close and the FT-SE 100 Index future exhibits many more extreme prices than could be expected from a random walk. You can see that at the close of the market, the observations of price extremes neither overreact no underreact to the random walk. Another statistic of interest for intraday traders is the time spent between two extremes (the range). Having hopefully initiated a position on one extreme, the investor is willing to square his position on the opposite extreme, therefore making the biggest possible gain. If a short position is initiated near the high of the day, the dealer will try to take his profit on the low of the day. If the dealer initiates a short position near the low of the day but the market moves against him, he will try to minimise his loss by dealing before or after the high of the day. In both cases, the dealer needs to know at which time the next extreme is likely to occur. The time between two extremes is defined as D= T T .

H L

This result is not new; it relates to the arcsine law for the position of the maximum price established by Feller (1951). The timing distribution of extreme prices under the random walk assumption is indicated in figure 1 by the continuous line labelled N(0,1). Contrary to intuition, the maximum price is much more likely to occur towards the very beginning or the very end of the trading day than somewhere in the middle.

Unfortunately, the exact distribution (D) under the Brownian random walk assumption without drift is extremely difficult to establish. To gain some

2nd Quarter 1996

insights on the density function of D, we have to proceed to Monte-Carlo simulations. (A Monte-Carlo Simulation is the process of drawing on random data to try to map out all the possible events that may occur). Through the Monte Carlo Simulation we can note for each sample the position of the maximum, minimum price and the distance between the maximum and minimum. For instance: High = 3, Low = 294, Distance = 291 means that for this particular simulation the maximum occurred three minutes after the opening, the low 294 minutes after the open, the time difference between the two extremes being 291 minutes. The distribution of time between extreme prices under the random walk assumption is indicated in figure 2 below by the continuous line N(0,1). Ex-ante it is not surprising that the shape of the distribution is highly skewed. Both extreme prices are not likely to happen at the same time. One would assume that if one extreme price occurs towards the opening the other will happen towards the closing. Figure 2

The chart indicates the length of the gap between two extreme prices. The bars represent observed data and the black line represents the random walk. The last time bar of 456 minutes (equivalent to around 7.5 hours) suggests that a gap of around 7.5 hours is the most frequently observed gap between extreme prices. For example, if a high was observed at 8:00am, a low would be most likely to occur 7.5 hours later at 3:30pm. The observed frequency distribution of times between extremes differs from what is being implied by the random walk profile. The random walk peak frequency involves a gap of around 266 minutes (equivalent to around 4.5 hours). This implies that if a high was observed at 8:00am, a low would be most likely to occur 4.5 hours later at 12:30pm. Therefore, when considering the time difference between two extremes, the frequency distribution substantially differs from what would be expected from a random walk without drift. The tails of the distribution are heavier than expected (i.e. they tail off more quickly than the observed distribution).

The pattern of the observed distribution may be related to previous studies which showed both large volume and volatility at the beginning of the day and less activity inside the trading day. In summary, the random walk line suggests you can get extreme prices happening in relatively quick succession, while empirical data suggests you might need to observe the full trading session to see both price extremes. Generally when one extreme occurs on the opening the other extreme can follow shortly, though is more likely to be triggered on the closing. In conclusion, new incidents of extreme clustering have been discovered for the FT-SE 100 Index future (i.e. clustering of highs or lows at certain times of the day). One further question would be: does volume cause extreme prices or is it the other way round? Both hypotheses could be defended. One may argue that volume on LIFFE is higher on the opening and on the closing of the market because of the ex-ante probability of observing extreme prices. On the other hand, it could be said that rising volume may cause increased trends in futures contracts and therefore increase the probability of observing extreme prices. Clearly, more theoretical and empirical work is needed to gain an insight on the relationship between volume and extreme prices. A fuller version of this paper is available on request from the authors. Please contact Pierre Lequeux at BNP's London office. References Feller, W (1951), An Introduction to Probability Theory and Its Applications, Wiley & Sons, Inc. s

Frequency 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% 0 38 76

Frequency distribution of times between extremes: July '92 September '95

Observed N(0,1)

114

152

190

228

266

304

342

380

418

456

Gap between extreme prices (38 minute time bars)

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Electrical Estimate Template PDFDocument1 pageElectrical Estimate Template PDFMEGAWATT CONTRACTING AND ELECTRICITY COMPANYNo ratings yet

- Installation and User's Guide For AIX Operating SystemDocument127 pagesInstallation and User's Guide For AIX Operating SystemPeter KidiavaiNo ratings yet

- Delta PresentationDocument36 pagesDelta Presentationarch_ianNo ratings yet

- Study of Risk Perception and Potfolio Management of Equity InvestorsDocument58 pagesStudy of Risk Perception and Potfolio Management of Equity InvestorsAqshay Bachhav100% (1)

- IOSA Information BrochureDocument14 pagesIOSA Information BrochureHavva SahınNo ratings yet

- C Sharp Logical TestDocument6 pagesC Sharp Logical TestBogor0251No ratings yet

- Brochure 2017Document44 pagesBrochure 2017bibiana8593No ratings yet

- Curamik Design Rules DBC 20150901Document8 pagesCuramik Design Rules DBC 20150901Ale VuNo ratings yet

- Tendernotice 1Document42 pagesTendernotice 1Hanu MittalNo ratings yet

- Engagement Letter TrustDocument4 pagesEngagement Letter Trustxetay24207No ratings yet

- Careem STRATEGIC MANAGEMENT FINAL TERM REPORTDocument40 pagesCareem STRATEGIC MANAGEMENT FINAL TERM REPORTFahim QaiserNo ratings yet

- Question Paper: Hygiene, Health and SafetyDocument2 pagesQuestion Paper: Hygiene, Health and Safetywf4sr4rNo ratings yet

- Application of ARIMAX ModelDocument5 pagesApplication of ARIMAX ModelAgus Setiansyah Idris ShalehNo ratings yet

- PW Unit 8 PDFDocument4 pagesPW Unit 8 PDFDragana Antic50% (2)

- MBA - Updated ADNU GSDocument2 pagesMBA - Updated ADNU GSPhilip Eusebio BitaoNo ratings yet

- 3.13 Regional TransportationDocument23 pages3.13 Regional TransportationRonillo MapulaNo ratings yet

- Acevac Catalogue VCD - R3Document6 pagesAcevac Catalogue VCD - R3Santhosh KumarNo ratings yet

- Defeating An Old Adversary Cement Kiln BallsDocument5 pagesDefeating An Old Adversary Cement Kiln BallsManish KumarNo ratings yet

- Prevalence of Peptic Ulcer in Patients Attending Kampala International University Teaching Hospital in Ishaka Bushenyi Municipality, UgandaDocument10 pagesPrevalence of Peptic Ulcer in Patients Attending Kampala International University Teaching Hospital in Ishaka Bushenyi Municipality, UgandaKIU PUBLICATION AND EXTENSIONNo ratings yet

- Safety Data Sheet: Fumaric AcidDocument9 pagesSafety Data Sheet: Fumaric AcidStephen StantonNo ratings yet

- Kayako Support Suite User Manual PDFDocument517 pagesKayako Support Suite User Manual PDFallQoo SEO BaiduNo ratings yet

- Intelligent Smoke & Heat Detectors: Open, Digital Protocol Addressed by The Patented XPERT Card Electronics Free BaseDocument4 pagesIntelligent Smoke & Heat Detectors: Open, Digital Protocol Addressed by The Patented XPERT Card Electronics Free BaseBabali MedNo ratings yet

- Accounting II SyllabusDocument4 pagesAccounting II SyllabusRyan Busch100% (2)

- Project Management: Chapter-2Document26 pagesProject Management: Chapter-2Juned BhavayaNo ratings yet

- Minor Ailments Services: A Starting Point For PharmacistsDocument49 pagesMinor Ailments Services: A Starting Point For PharmacistsacvavNo ratings yet

- Pega AcademyDocument10 pagesPega AcademySasidharNo ratings yet

- In Comparison With Oracle 8i, 9i Is Have Lot Many New Features. Important IsDocument241 pagesIn Comparison With Oracle 8i, 9i Is Have Lot Many New Features. Important IsBalaji ShindeNo ratings yet

- Aluminium Extrusion Industry in IndiaDocument3 pagesAluminium Extrusion Industry in Indiakalan45No ratings yet

- Between:-Mr. Pedro Jose de Vasconcelos, of Address 14 CrombieDocument2 pagesBetween:-Mr. Pedro Jose de Vasconcelos, of Address 14 Crombiednd offiNo ratings yet

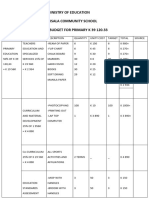

- Ministry of Education Musala SCHDocument5 pagesMinistry of Education Musala SCHlaonimosesNo ratings yet