Professional Documents

Culture Documents

Untitled

Uploaded by

Vijay MahorOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

Vijay MahorCopyright:

Available Formats

Scribd Upload a Document Explore Vijay Mahor / 6

Search Documents

Download this Document for Free presence in 40 countries. Among India's first multinational companies, the opera tions of Tata Tea and its subsidiaries focus on branded product offerings in tea but with a significant presence in plantation activity in India and Sri Lanka. It is also the largest manufacturer of branded tea in India on volume basis with producing around 20% of total tea production in India. Economic Analysis of Tat a Tea Tata Tea has a market share of around 15% and it lies at second place in t he market in terms of value. HUL is the market leader with 20.2% market share wh ile Mcleod Russel lies at 8%. (Figure 3) Tata Tea also suffered in the period 20 00-03 due to slowdown in the Indian Tea Industry. Its sales went down and profit became negligent. But Tata Tea came back strongly in 2004 w hile still other companies were fighting to survive. Tata Tea realised it needs to understand the needs of the customers and brought in new varieties to fulfil their needs. It brought Agni, a n economy segment product into the market. It also realised that it needs to cut its labour costs and use the savings in raw materials cost to expand its market. It reduced its cost on compensation to empl oyees from Rs. 250 crores in 2004 to 100 crores in 2009. Since 2004, Tata Tea has seen sharp and continuous increase in sales. It saw sal es worth 1358 crores in 2008-09 and produced 84 kilo tonnes which takes out the average price of Tata Tea to be about Rs. 162/kg. (Figure 4) Tata Tea after the slump period has seen continuous rise in its profits except for last year i.e. 2 008-09. The profits last year fell from Rs. 320 crores in 2007-08 to Rs. 160 crores.This fall in profit is not due to reduction in demand but due to rise in cost of raw materials mainly. Expe nse of Tata Tea on raw materials has increased from Rs. 520 crores to around Rs. 750 crores. (Figur e 5) COMPARISON OF TATA TEA WITH HUL HUL is the market leader in the industry with 20 .2% of market share (value). It operates under its two brands, Lipton and Brooke Bond under which it has several sub-brands like Ta aza, TajMahal, Green Label, etc. Apart from producing tea from its own estates, HUL also purcha ses finished goods from third party vendors at cheap rates. The average price at which HUL sells it s products is Rs. 170/kg which is around Rs. 8 higher than that of Tata Tea which is one of the re asons why HUL has greater revenue than Tata Tea. Tata Tea and HUL are fighting with each other over the market leadership. Tata T ea attacked the brands of HUL by bringing new varieties of tea under its flagship brand, Tata Te a. It also started aggressive advertising campaign like Jaago Re. It also increased its production by 10% to increase its products in the market. The result of all this moves was increase in market share of Tata Tea by 4%. It rose from 11% in 2002 to around 15% in 2008 while market share of HUL fel

l from around 24.5% to 20.2%. (Figure 6) HUL realising that Tata Tea is slowly e ating its market share, prepared a counter strategy to handle Tata Tea. It increased its production by 25% in 2008-09 from 64 kilo tonnes to 8 0 kilo tonnes. It also brought in new varieties of tea in the market, most important of them being its economy segment product Sehatmand launched against Tata Tea Agni. It increased its advertising cam paign significantly in the same period. As a result, sales of HUL jumped by 25 %, thus outperforming Tata Tea and maintaining the gap between the two. (Figure 7) CONCLUSION Indian Tea Industry is a growth industry and its domestic demand/cons umption is increasing. India is consuming 75% of its total production in domesti c market. Although the exports are on the lower side, but they are showing signs of improvement. (Figure 8) The war between both tea giants will continue to be there with both companies making strategies to be the market leader. HUL has entered into low end segment with its new product Seha tmand thus covering whole of tea market. It has also started aggressive counter advertiseme nt. Tata Tea is planning to keep working on its Jaago Re campaign. It is targeting rur al markets where there is large scope of growth as none of the brands is a lot p enetrated in the rural market. Tata Tea is also working to control its costs and so far it has succeeded to some extent. Another move is that it is planning to integrate its coffee and bottling business with tea business to achieve economie s of scale. We have to wait and watch who wins this war for market leadership in tea industry. ANNEXURE Figure 1 Tea Production by India (Source : CMIE) Figure 2 Market Size of Indian Tea Industry: turnover value(Source : CMIE) Figure 3 Market share of different companies in Indian Tea Industry (Source: CMI E) Figure 4 Sales of Tata Tea for last 10 years (Source: CMIE) Figure 5: Profit of Tata Tea for last 5 years (Source: CMIE) Figure 6: Change in market share of Tata Tea and HUL over past 6 years (Source: CMIE) Figure 7: Comparison of sales of HUL and Tata Tea for last 10 years (Source: CMI E) Figure 8: Trends in consumption of Tea (Source: CMIE) Managerial Economics Project Report Download this Document for FreePrintMobileCollectionsReport Document Info and Rating chandanjee Share & Embed Related Documents PreviousNext p. p. p. p. p. p. p. p. p. p.

p. p. p. p. p. More from this user PreviousNext 42 p. 31 p. 6 p. Add a Comment

This document has made it onto the Rising list! 03 / 08 / 2010 Upload a Document Search Documents Follow Us!scribd.com/scribdtwitter.com/scribd facebook.com/scribd AboutPressBlogPartnersScribd 101Web StuffSupportFAQDevelopers / APIJobsTermsCopy rightPrivacy Copyright 2011 Scribd Inc.Language:English

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

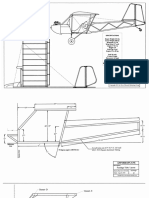

- Plans PDFDocument49 pagesPlans PDFEstevam Gomes de Azevedo85% (34)

- GROSS Mystery of UFOs A PreludeDocument309 pagesGROSS Mystery of UFOs A PreludeTommaso MonteleoneNo ratings yet

- 3200AMMe - Part 4Document207 pages3200AMMe - Part 4Tanja Kesic100% (1)

- Napoleonic WargamingDocument13 pagesNapoleonic WargamingandyNo ratings yet

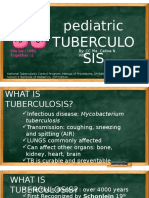

- Tuberculosis PowerpointDocument69 pagesTuberculosis PowerpointCeline Villo100% (1)

- Training Report On Self Contained Breathing ApparatusDocument4 pagesTraining Report On Self Contained Breathing ApparatusHiren MahetaNo ratings yet

- H107en 201906 r4 Elcor Elcorplus 20200903 Red1Document228 pagesH107en 201906 r4 Elcor Elcorplus 20200903 Red1mokbelNo ratings yet

- Automobile Industry in Indi1Document4 pagesAutomobile Industry in Indi1Vijay MahorNo ratings yet

- NokiaDocument10 pagesNokiaVijay MahorNo ratings yet

- MarketingDocument21 pagesMarketingVijay MahorNo ratings yet

- Managerial EconomicsDocument271 pagesManagerial EconomicsRaghu Sabbithi67% (3)

- Valor Corporativo de La RSDocument9 pagesValor Corporativo de La RSALBERTO GUAJARDO MENESESNo ratings yet

- American BreakfastDocument4 pagesAmerican BreakfastHamilton Valenzuela ChipongianNo ratings yet

- Shandong Baoshida Cable Co, LTD.: Technical ParameterDocument3 pagesShandong Baoshida Cable Co, LTD.: Technical ParameterkmiqdNo ratings yet

- Drilling & GroutingDocument18 pagesDrilling & GroutingSantosh Laxman PatilNo ratings yet

- Hydraulic Fan Speed - Test and AdjustDocument12 pagesHydraulic Fan Speed - Test and Adjustsyed ahmedNo ratings yet

- Esteem 1999 2000 1.3L 1.6LDocument45 pagesEsteem 1999 2000 1.3L 1.6LArnold Hernández CarvajalNo ratings yet

- Data Bulletin Group Motor Installations:: Understanding National Electrical Code (NEC) 430.53 RequirementsDocument8 pagesData Bulletin Group Motor Installations:: Understanding National Electrical Code (NEC) 430.53 RequirementsshoaibNo ratings yet

- Nasopharyngeal Angiofibroma - PPTX Essam SrourDocument10 pagesNasopharyngeal Angiofibroma - PPTX Essam SrourSimina ÎntunericNo ratings yet

- A Year On A FarmDocument368 pagesA Year On A FarmvehapkolaNo ratings yet

- Niir Integrated Organic Farming Handbook PDFDocument13 pagesNiir Integrated Organic Farming Handbook PDFNatalieNo ratings yet

- MarbiehistoryDocument6 pagesMarbiehistoryMarbie DalanginNo ratings yet

- Curing Obesity, WorldwideDocument6 pagesCuring Obesity, WorldwideHernán SanabriaNo ratings yet

- Electrowetting - Wikipedia, The Free EncyclopediaDocument5 pagesElectrowetting - Wikipedia, The Free EncyclopediaDwane AlmeidaNo ratings yet

- AoS Soulbound - Pregens - Skyrigger Malgra DainssonDocument2 pagesAoS Soulbound - Pregens - Skyrigger Malgra DainssonAdrien DeschampsNo ratings yet

- The Light Fantastic by Sarah CombsDocument34 pagesThe Light Fantastic by Sarah CombsCandlewick PressNo ratings yet

- Significance of GodboleDocument5 pagesSignificance of GodbolehickeyvNo ratings yet

- NAT-REVIEWER-IN-PHYSICAL EDUCATIONDocument4 pagesNAT-REVIEWER-IN-PHYSICAL EDUCATIONMira Rochenie CuranNo ratings yet

- Seminar On Solar Mobile Charger: Submitted To: Submitted byDocument16 pagesSeminar On Solar Mobile Charger: Submitted To: Submitted byAkhila GottemukkulaNo ratings yet

- Dusta ManaDocument16 pagesDusta ManamahaphalaNo ratings yet

- Logic NotesDocument19 pagesLogic NotesCielo PulmaNo ratings yet

- Board Replacement CasesDocument41 pagesBoard Replacement CasesNadeeshNo ratings yet

- Updated Factory Profile of Aleya Apparels LTDDocument25 pagesUpdated Factory Profile of Aleya Apparels LTDJahangir Hosen0% (1)

- Digging Deeper: Can Hot Air Provide Sustainable Source of Electricity?Document2 pagesDigging Deeper: Can Hot Air Provide Sustainable Source of Electricity?Рустам ХаджаевNo ratings yet

- 123 09-Printable Menu VORDocument2 pages123 09-Printable Menu VORArmstrong TowerNo ratings yet