Professional Documents

Culture Documents

Case Study

Uploaded by

Nupur AgarwalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study

Uploaded by

Nupur AgarwalCopyright:

Available Formats

CASE STUDY: THE COKE PEPSI RIVALRY

The cola wars had become a part of global folklore - something all of us took for granted. However, for the companies involved, it was a matter of 'fight or succumb.'Both print and electronic media served as battlefields, with the most bitter of the cola wars often seen in form of the comparative advertisements. In the early 1970s, the US soft-drinks market was on the verge of maturity, and as the major players, Coke and Pepsi offered products that 'looked the same and tasted the same,'substantial market share growth seemed unlikely. However, Coke and Pepsi kept rejuvenating the market through product modifications and pricing/promotion/distribution tactics. As the competition was intense, the companies had to frequently implement strategic changes in order to gain competitive advantage. The only way to do this, apart from introducing cosmetic product innovations, was to fight it out in the marketplace.This modus operandi was followed in the Indian markets as well with Coke and Pepsi resorting to more innovative tactics to generate consumer interest. In essence, the companies were trying to increase the whole market pie, as the market-shares war seemed to get nowhere. This was because both the companies came out with contradictory market share figures as per surveys conducted by their respective agencies - ORG (Coke) and IMRB (Pepsi). For instance, in August 2000, Pepsi claimed to have increased its market share for the first five months of calendar year 2000 to 49% from 47.3%, while Coke claimed to have increased its share in the market to 57%, in the same period, from 55%. Media reports claimed that the rivalry between Coke and Pepsi had ceased to generate sustained public interest, as it used to in the initial years of the cola brawls worldwide. They added that it was all just a lot of noise to hardsell a product that had no inherent merit. The Players Coke had entered the Indian soft drinks market way back in the 1970s. The company was the market leader till 1977, when it had to exit the country following policy changes regarding MNCs operating in India. Over the next few years, a host of local brands emerged such as Campa Cola, Thumps Up, Gold Spot and Limca etc. However, with the entry of Pepsi and Coke in the 1990s, almost the entire market went under their control. Making billions from selling carbonated/colored/sweetened water for over 100 years, Coke and Pepsi had emerged as truly global brands. Coke was born 11 years before Pepsi in 1887 and, a century later it still maintained its lead in the global cola market. Pepsi, having always been number two, kept trying harder and harder to beat Coke at its own game. In this never-ending duel, there was always a new battlefront opening up somewhere. In India the battle was more intense, as India was one of the very few areas where Pepsi was the leader in the cola segment. Coke re-entered India in 1993 and soon entered into a deal with Parle, which had a 60% market share in the soft drinks segment with its brands Limca, Thums Up and Gold Spot.

Following this, Coke turned into the absolute market leader overnight. The company also acquired Cadbury Schweppes' soft drink brands Crush, Canada Dry and Sport Cola in early 1999Coke was mainly a franchisee-driven operation with the company supplying its soft drink concentrate to its bottlers around the world. Pepsi took the more capital-intensive route of owning and running its own bottling factories alongside those of its franchisees... Is The Rivalry Healthy? In a market where the product and tastes remained virtually indistinguishable and fairly constant, brand recognition was a crucial factor for the cola companies. The quest for better brand recognition was the guiding force for Coke and Pepsi to a large extent...

Nokia's Strategy in India

"The Indian market is growing rapidly and the mobile penetration rate is still low. It's got great potential." - Song Sauk-hun, Analyst at Gartner Inc. in 2004. "We see a great potential for the continued growth of mobile telephony in India where mobile penetration is relatively low. As the leading brand in mobile communications in India, Nokia will continue to deliver products which cater to the needs and preferences of Indian consumers." - Robert Andersson, Senior Vice-president, Nokia Mobile Phones Asia Pacific, in 2003

Nokia - Made in India In April 2005, Nokia India, a subsidiary of Finland-based Nokia, announced that it was setting up a manufacturing facility for mobile devices in Chennai, the state capital of Tamil Nadu in southern India. Nokia planned to invest US$ 100-150 million in the facility, where the production was expected to begin in the first half of 2006. Pekka Ala-Pietil, President and Head of Customer & Market Operations, Nokia Corporation said, "Establishing a new factory in India is an important step in the continuous development of our global manufacturing network." India was ideal for Nokia's new production facility. Each mobile handset has more than 400 parts and the average production capacity of each manufacturing unit of Nokia is around 20 million units. This level of manufacturing involves a total of 8 billion components per annum, requiring strong logistical support. Nokia's manufacturing facility needed to be located close to a major international airport or sea port for quick supply of components. India met all these requirements, and also enjoyed cheap manpower costs and proximity to the rapidly growing Asia Pacific markets. Besides, Nokia was the market leader in mobile communication devices in India. The company has been carrying out sales & marketing, customer care and research & development activities in the country. Nokia considers India to be one of its most important markets. The company's Code Division Multiple Access (CDMA) facility is located in Mumbai and provides software and technical support to CDMA consumers in India and other Asia Pacific countries. In 2004, Nokia was chosen as 'the most respected consumer durables company'by Businessworld. The magazine wrote, "This Finnish company's debut at the top of the heap says two things. One, that its strategies - including ones like developing a phone specifically for India - are respected. But, more importantly, Nokia's win is also an endorsement of the importance of the ubiquitous cell phone as a durable in today's world. After all, unlike its competitors, most of which offer a slew of durables, Nokia is mostly a cell phone company." In 2005, Nokia was recognized as the 'Brand of the Year'by the Confederation of Indian Industry, India's apex industry association. The company was chosen for this award

because of its high brand recall, well established distribution channels and being 'most preferred' by the consumers. Enamored of Nokia's success in the Indian market, Harvard University had invited Nokia India to talk on 'How Nokia cracked open the Indian market?'

The Indian Mobile Phones Industry The mobile phones industry made a slow start in India in 1995. Several private players who had entered the industry in 1995 exited in the next few years due to the unfriendly telecom policies of the Indian government, high licensing fees and absence of a proper telecom regulatory body. The growth in the subscriber base of mobile phones remained sluggish initially, reaching the 1 million milestone in 1998. In 1999, the Government of India announced a new telecom policy. This policy planned to provide telephones on demand by 2002. Among other things, the policy allowed unrestricted private entry into almost all mobile service sectors. The government allowed cellular mobile service providers to share infrastructure with other operators. It also allowed existing operators to migrate from fixed license fee to one-time entry fee with revenue sharing. This policy helped many private operators to break even faster. By 2001, the demand for mobile services was growing well. The private companies concentrated on providing basic telephone services to consumers. The number of mobile phones crossed five million by 2001 and doubled to 10 million in 2002... The Problems In spite of its strong marketing, Nokia's problems at the global level had an impact on the company's Indian venture. Globally, Nokia had been experiencing tough times with revenues falling to 29 billion euros in 2004 from 32 billion euros in 2001. The company's operating profits decreased from 5 billion euros in 2003 to 4.3 billion euros in 2004... Bouncing Back Nokia was quick to learn from its mistakes and adopted strategies to regain its lost market share. Globally, during the first quarter of 2005, the company's sales reached 7.4 billion euros, with the company selling 54 million phones during the period. In India, Nokia continued its leadership in GSM with a market share of 74% in March 2005. Nokia also surpassed Samsung in color mobiles in the GSM segment, recording a share of 55% in the same month (Refer Table VIII for share of major mobile phone brands in the GSM segment and their market shares). Nokia reorganized itself at the global level in 2004. At this point, a multimedia division was formed. The division's Indian operations concentrated on promoting the concept of high-end telephones in smaller towns while going in for higher volumes in larger cities. The marketing division of the company concentrated on making distributors in small towns sell high-end products. Though, the

distributors were skeptical to start with, by the end of 2004, the process was streamlined and the results started to show...

You might also like

- Summary of Sunil Gupta's Driving Digital StrategyFrom EverandSummary of Sunil Gupta's Driving Digital StrategyRating: 5 out of 5 stars5/5 (1)

- Building Brand Equity: The Importance, Examples & How to Measure ItFrom EverandBuilding Brand Equity: The Importance, Examples & How to Measure ItNo ratings yet

- SDN0012CDocument16 pagesSDN0012CsanjusaysNo ratings yet

- Shahkar Zeb 9655 IbmDocument4 pagesShahkar Zeb 9655 IbmShah KhanNo ratings yet

- Pricing Strategy of NokiaDocument8 pagesPricing Strategy of NokiaSancheeta Tendulkar100% (1)

- Case 7Document3 pagesCase 7volume34No ratings yet

- Ethics and Corporate GovernanceDocument16 pagesEthics and Corporate GovernanceAbhishek GNo ratings yet

- Best Mobile Brands - Comparative StudyDocument29 pagesBest Mobile Brands - Comparative StudyShamsee SNo ratings yet

- Pricing Strategies Mobile Phone IndustryDocument22 pagesPricing Strategies Mobile Phone Industrypryprv83% (12)

- NOKIADocument15 pagesNOKIAmukesh modiNo ratings yet

- Nokia Final Report - PBMDocument16 pagesNokia Final Report - PBMRishi RajNo ratings yet

- Nokia's Strategies for Dominating the Indian Mobile MarketDocument8 pagesNokia's Strategies for Dominating the Indian Mobile Market2011ankitNo ratings yet

- Assignment of Marketing Management ON Case Study Analysis On Pricing Strategy of NOKIA'Document8 pagesAssignment of Marketing Management ON Case Study Analysis On Pricing Strategy of NOKIA'chinmayNo ratings yet

- Case Study - Nokia's Strategies in Indian Mobile Handsets Markets During 2002 To 2006Document11 pagesCase Study - Nokia's Strategies in Indian Mobile Handsets Markets During 2002 To 2006ADIL ALNUWISERNo ratings yet

- 3 Relince ProjectDocument29 pages3 Relince ProjectNick NairNo ratings yet

- Assignment No 5Document5 pagesAssignment No 5rgandotraNo ratings yet

- Marketing Strategies of LG Electronics India (PVT.) Ltd.Document95 pagesMarketing Strategies of LG Electronics India (PVT.) Ltd.Md Naushad71% (7)

- Brand Management: Brand Building Models: Levitt Model & David Aaker ModelDocument17 pagesBrand Management: Brand Building Models: Levitt Model & David Aaker ModeldhavalnmuchhalaNo ratings yet

- Marketing Strategies of LG Electronics IndiaDocument86 pagesMarketing Strategies of LG Electronics IndiaPrashant DugarNo ratings yet

- Project After Sales Services VedioconDocument57 pagesProject After Sales Services Vedioconankush_drudedude9962100% (2)

- Marketing ProjectDocument39 pagesMarketing ProjectVishal Gupta0% (1)

- Nokia Project FinalDocument83 pagesNokia Project FinalAli A. KaroutNo ratings yet

- Final Internship ReportDocument34 pagesFinal Internship ReportDanish Shamsher50% (2)

- Nokia FinalDocument13 pagesNokia FinalDeepak GhimireNo ratings yet

- A Project Report On NokiaDocument27 pagesA Project Report On NokiajonchheNo ratings yet

- NOKIA'S MARKETING MIX IN INDIADocument6 pagesNOKIA'S MARKETING MIX IN INDIAArka ChakrabortyNo ratings yet

- Executive Summary: A Project On LG IndiaDocument48 pagesExecutive Summary: A Project On LG IndiaGaurav GargNo ratings yet

- Marketing CIA 2Document19 pagesMarketing CIA 2rishav_agarwal_1No ratings yet

- LG Project ReportDocument55 pagesLG Project Report'Gitesh ⎝⏠⏝⏠⎠ Patil'No ratings yet

- Cla 1 MKTDocument8 pagesCla 1 MKTSneha MaharjanNo ratings yet

- Nokia in IndiaDocument5 pagesNokia in Indiarobinkapoor100% (2)

- EX5CHAP11Document13 pagesEX5CHAP11Huynh QuanNo ratings yet

- NokiaDocument50 pagesNokiaShreya Banerjee100% (2)

- Marketing Management Project: Submitted By: Derrick VijayanDocument37 pagesMarketing Management Project: Submitted By: Derrick VijayanStudy In Ur WayNo ratings yet

- Tutorial 1 MMLB283 Nur Hadifah Alyaa Binti Amir MT0107596 1MDocument2 pagesTutorial 1 MMLB283 Nur Hadifah Alyaa Binti Amir MT0107596 1MhadifahNo ratings yet

- Market Analysis of Bingo ChipsDocument39 pagesMarket Analysis of Bingo ChipsShardul DeshpandeNo ratings yet

- 1) The Rise, Dominance and Fall of Kingfisher About KingfisherDocument24 pages1) The Rise, Dominance and Fall of Kingfisher About KingfisherDhiviNo ratings yet

- GM02 Economic and Social Environment of Business: Assignment No.IDocument4 pagesGM02 Economic and Social Environment of Business: Assignment No.IMahfooz AlamNo ratings yet

- Marketing Strategy of NokiaDocument12 pagesMarketing Strategy of Nokia1254312543100% (3)

- Project Report On Sony DdepakDocument69 pagesProject Report On Sony Ddepaktechcaresystem33% (3)

- Literature Review On Nokia's Marketing Strategy in India"Document24 pagesLiterature Review On Nokia's Marketing Strategy in India"Tanishq KambojNo ratings yet

- Literature Review On Nokia's Marketing Strategy in India"Document24 pagesLiterature Review On Nokia's Marketing Strategy in India"Tanishq KambojNo ratings yet

- Final BodyDocument18 pagesFinal BodyKazi Faisal KabirNo ratings yet

- Wrong Targeting Renders Strategy IneffectiveDocument5 pagesWrong Targeting Renders Strategy IneffectiveEmelia D' SilvaNo ratings yet

- Marketing ProjectDocument33 pagesMarketing ProjectpranalipendurkarNo ratings yet

- The Rise and Fall of Iconic BrandsDocument28 pagesThe Rise and Fall of Iconic BrandsApoorvi Mishra roll no 11No ratings yet

- PR PresentationDocument23 pagesPR Presentationprathm_patelNo ratings yet

- Umila, Annel Neth B. BSBM 2om-1Document3 pagesUmila, Annel Neth B. BSBM 2om-1Annel UmilaNo ratings yet

- Case of LGDocument21 pagesCase of LGSarthak KabiNo ratings yet

- Chapter 12 CSDocument4 pagesChapter 12 CSKashaf FatimaNo ratings yet

- LG Marketing ProjectDocument67 pagesLG Marketing ProjectGaurav ChauhanNo ratings yet

- Nokia Case StudyDocument14 pagesNokia Case StudyPawan100% (1)

- LG Marketing ProjectDocument64 pagesLG Marketing Projectsimply_cooolNo ratings yet

- Title: Consumer Behaviour Towards LG Television inDocument22 pagesTitle: Consumer Behaviour Towards LG Television inkunikithNo ratings yet

- Climbing Up The Ladder: The Disruptive Way!Document3 pagesClimbing Up The Ladder: The Disruptive Way!sonu1aNo ratings yet

- Marketing Management Case StudiesDocument15 pagesMarketing Management Case StudiesReynavi Olivares0% (1)

- Indian Consumer Durables MarketDocument54 pagesIndian Consumer Durables MarketNiks Dujaniya75% (12)

- Micromax Mobile Sourabh ShrivastavaDocument37 pagesMicromax Mobile Sourabh ShrivastavaNitinAgnihotriNo ratings yet

- Marketing Management Project: Submitted byDocument41 pagesMarketing Management Project: Submitted byrpotnisNo ratings yet

- BB A L1 Acc. IntroDocument67 pagesBB A L1 Acc. IntroNupur AgarwalNo ratings yet

- GK Alerts SMS - Join OnlineGK for Free QuizzesDocument14 pagesGK Alerts SMS - Join OnlineGK for Free QuizzesNupur AgarwalNo ratings yet

- AMITY Business School: Cost Accounting Nupur AgarwalDocument41 pagesAMITY Business School: Cost Accounting Nupur AgarwalNupur AgarwalNo ratings yet

- Acc EquationDocument26 pagesAcc EquationNupur AgarwalNo ratings yet

- RuralDocument1 pageRuralNupur AgarwalNo ratings yet

- AMITY Business School: Cost Accounting Nupur AgarwalDocument41 pagesAMITY Business School: Cost Accounting Nupur AgarwalNupur AgarwalNo ratings yet

- CH 1 InvestmntDocument13 pagesCH 1 InvestmntNupur AgarwalNo ratings yet

- Fundamental Analysis - IntroDocument25 pagesFundamental Analysis - IntroANUPAM UPPALNo ratings yet

- EthicsDocument15 pagesEthicsNupur AgarwalNo ratings yet

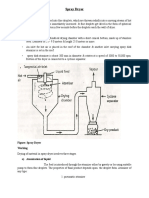

- Dryers in Word FileDocument5 pagesDryers in Word FileHaroon RahimNo ratings yet

- Business Plan1Document38 pagesBusiness Plan1Gwendolyn PansoyNo ratings yet

- Complimentary JournalDocument58 pagesComplimentary JournalMcKey ZoeNo ratings yet

- Acid content in fruitsDocument2 pagesAcid content in fruitsbone fire100% (1)

- Monthly Business ReviewDocument36 pagesMonthly Business Reviewmdipu5_948971128No ratings yet

- RA For Installation & Dismantling of Loading Platform A69Document15 pagesRA For Installation & Dismantling of Loading Platform A69Sajid ShahNo ratings yet

- How To Oven and Sun Dry Meat and ProduceDocument12 pagesHow To Oven and Sun Dry Meat and ProduceLes BennettNo ratings yet

- Litz Wire Termination GuideDocument5 pagesLitz Wire Termination GuideBenjamin DoverNo ratings yet

- TelanganaDocument16 pagesTelanganaRamu Palvai0% (1)

- Connection Between Academic and Professional IntegrityDocument3 pagesConnection Between Academic and Professional IntegrityJoshua NyabindaNo ratings yet

- The Seven Kings of Revelation 17Document9 pagesThe Seven Kings of Revelation 17rojelio100% (1)

- Cat TSDDocument55 pagesCat TSDvarsha sharmaNo ratings yet

- The German eID-Card by Jens BenderDocument42 pagesThe German eID-Card by Jens BenderPoomjit SirawongprasertNo ratings yet

- Youre The Inspiration CRDDocument3 pagesYoure The Inspiration CRDjonjammyNo ratings yet

- MMADDocument2 pagesMMADHariharan SNo ratings yet

- Preparatory Lights and Perfections: Joseph Smith's Training with the Urim and ThummimDocument9 pagesPreparatory Lights and Perfections: Joseph Smith's Training with the Urim and ThummimslightlyguiltyNo ratings yet

- Complete Approval List by FSSAIDocument16 pagesComplete Approval List by FSSAIAnkush Pandey100% (1)

- Security Testing MatDocument9 pagesSecurity Testing MatLias JassiNo ratings yet

- Management and Breeding of Game BirdsDocument18 pagesManagement and Breeding of Game BirdsAgustinNachoAnzóateguiNo ratings yet

- Seminar 6 Precision AttachmentsDocument30 pagesSeminar 6 Precision AttachmentsAmit Sadhwani67% (3)

- OTGNNDocument13 pagesOTGNNAnh Vuong TuanNo ratings yet

- PHILHIS Executive Summary - EditedDocument7 pagesPHILHIS Executive Summary - EditedMaxy Bariacto100% (1)

- Effect of Dust On The Performance of Wind Turbines PDFDocument12 pagesEffect of Dust On The Performance of Wind Turbines PDFJallal ArramachNo ratings yet

- Temptations in MinistryDocument115 pagesTemptations in MinistryJoseph Koech100% (1)

- Chapter 7 - The Political SelfDocument6 pagesChapter 7 - The Political SelfJohn Rey A. TubieronNo ratings yet

- Gujarat Technological University: Emester ViDocument4 pagesGujarat Technological University: Emester ViPradeep SutharNo ratings yet

- Canopen-Lift Shaft Installation: W+W W+WDocument20 pagesCanopen-Lift Shaft Installation: W+W W+WFERNSNo ratings yet

- Psalms Magick of The Old Testament PDFDocument129 pagesPsalms Magick of The Old Testament PDFirrrs100% (1)

- Pmls 1 Final Exam Reviewer: Clinical Chemistry ContDocument14 pagesPmls 1 Final Exam Reviewer: Clinical Chemistry ContPlant in a PotNo ratings yet

- Process of Producting High Carbon Ferro ChromeDocument5 pagesProcess of Producting High Carbon Ferro ChromeSantosh Kumar MahtoNo ratings yet