Professional Documents

Culture Documents

Fitch Money Market Funds Europe

Uploaded by

afonteveOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fitch Money Market Funds Europe

Uploaded by

afonteveCopyright:

Available Formats

U.S.

Money Funds and European Banks: French Exposure Down

Macro Credit Research

October 20, 2011 Continuing European Exposure Decline: As of month-end September, U.S. prime money market funds (MMFs) have reduced their total exposure to European banks by 14% on a dollar basis relative to the prior reporting period of month-end August 2011, and by 37% relative to monthend May 2011 (see the Change in Exposure to Banks table below). European bank exposure currently represents 37.7% of total holdings of $654 billion within Fitchs sample of the 10 largest prime MMFs, a decrease from 42.1% of fund assets as of month-end August. The current exposure level is the lowest in percentage terms for European banks within Fitchs historical time series, which dates back to the second half of 2006 (see Appendix). This share is down from 47.2% as of month-end July, which was based on total MMF holdings of $658 billion.

Analysts

Macro Credit Research Robert Grossman +1 212 908-0535 robert.grossman@fitchratings.com Kevin DAlbert +1 212 908-0823 kevin.dalbert@fitchratings.com Martin Hansen +1 212 908-9190 martin.hansen@fitchratings.com Fund and Asset Manager Group Viktoria Baklanova +1 212 908-9162 viktoria.baklanova@fitchratings.com

Change in Exposure to Banks (on a Dollar Basis)

(% Change in MMF Exposure) Europe France Germany U.K. Canada Nordic Australia Japan Source: Fitch Ratings, MMF public Web sites, SEC filings. Since End-May 2011 (37) (62) (40) (26) 12 0 6 41 Since End-August 2011 (14) (42) (6) (5) 3 4 4 22

Related Research

Rating Banks in a Changing World, Oct. 13, 2011 U.S. Money Funds and European Banks: Exposures and Maturities Continue to Decline, Sept. 23, 2011 European Banks and Market Turmoil: Prolonged Market Stress Negative for European Bank Credit Profiles, Sept. 20, 2011

Research Highlights

Sample based on 10 largest U.S. prime MMFs with total exposure of $654 billion as of Sept. 30, 2011 (down from $676 billion at month-end August), representing 45% of $1.47 trillion in total U.S. prime MMF assets. Geographic exposures to banks (% of total MMF assets): Europe: 37.7% (Declining) France: 6.7% (Declining) Canada: 10.7% (Increasing) Largest exposures to individual banks (% of total MMF assets): Deutsche Bank: 3.5% Westpac: 3.5% Barclays: 3.5%

Trends Vary by Country: Exposure to French banks decreased significantly from 11.2% to 6.7% of MMF assets, which on a dollar basis corresponds to a 42% decline over the past month, and a 62% decline since month-end May (see the Diverging Trends in Exposure to European Banks chart). At its peak in the second half of 2009, exposure to French banks represented 16.4% of all MMF assets. Exposure to U.K. banks decreased from 8.8% to 8.7% of MMF assets over the

Diverging Trends in Exposure to European Banks

France Europe (All) (% of Total MMF Assets Under Management) Nordic United Kingdom

60 50 40 30 20 10 0

11

11

11

11

11 8/

2H 06

1H 07

2H 07

1H 08

2H 08

1H 09

2H 09

1H 10

2H 10

2/

5/

6/

7/

Source: Fitch Ratings, MMF public Web sites, and SEC filings.

www.fitchratings.com

9/

11

U.S. Money Funds and European Banks: French Exposure Down

Fitchs sample represents 45% of the Investment Company Institutes estimate of approximately $1.47 trillion in total U.S. prime MMF assets under management. This study focuses on aggregate MMF exposure to banks certificates of deposit (CDs), commercial paper (CP), asset-backed CP (ABCP), repurchase agreements (repos), and other short-term notes and deposits. past month, a dollar-basis decline of 5%. Exposures to Nordic banks increased by 4% (on a dollar basis) since end-August and currently represent 7.2% of total MMF assets, more than France but below the U.K. level. Globally, the MMFs sampled increased their exposure to banks in several countries, including Canada, which is currently the largest single country exposure at 10.7% of total MMF assets. Since the end of August, exposures to Japanese banks increased by 22% and exposures to Australian banks increased by 4%. Shortening Maturities: In recent months, the MMFs sampled have reduced the maturity profile of their CD exposures to European banks in several countries (see the Maturity Trends chart below). As of the end of September, the proportion of MMF exposure to French bank CDs in the shortest maturity bucket (seven days or fewer) remained elevated at 27%. Additionally, there has been an

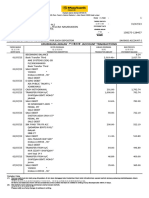

Largest MMF Exposures Financial Institutions

(As of End-September 2011)

Issuer/Counterparty Deutsche Bank Westpac Barclays Rabobank Bank of Nova Scotia Royal Bank of Canada Credit Suisse BNP Paribas Sumitomo Mitsui JP Morgan Chase National Australia Bank Bank of Tokyo Mitsubishi Svenska Handelsbanken Citibank Commonwealth Bank of Australia CD, CP, Repo, Other/Total MMF Assets Under Management (%) 3.5 3.5 3.5 3.3 3.1 3.0 3.0 2.8 2.7 2.6 2.5 2.5 2.2 2.2 2.1

CD Certificates of deposit. Repo Repurchase agreement. Note: European banks are bolded above. Source: Fitch Ratings, MMF public Web sites, SEC filings.

Maturity Trends

09/30/11 08/31/11 (% of MMFs' CD Exposure by Country) 70 60 50 40 30 20 10 0

UK UK Netherlands Netherlands Netherlands France France France UK

06/30/11

Reliance on MMF Funding: The Bank Reliance on MMF Funding table illustrates bank reliance on MMFs as a source of short-term funding. Of the top 15 MMF exposures to global banks, MMF funding accounts for at least 3% of short-term liabilities for seven institutions. This figure would be higher if it included the full universe of prime MMFs beyond the 10 largest funds, and other private and offshore money funds with similar investment profiles. The figure would also be higher if expressed as a percentage of shortterm dollar funding, a potentially more relevant metric although one that is not feasible to calculate based on current bank disclosures.

Bank Reliance on MMF Funding

(As of End-September 2011)

07 Days

860 Days

61+ Days

Source: Fitch Ratings, MMF public Web sites, SEC filings.

Issuer/Counterparty

Svenska Handelsbanken Westpac Rabobank Bank of Nova Scotia National Australia Bank Royal Bank of Canada Credit Suisse Commonwealth Bank of Australia Deutsche Bank Barclays BNP Paribas Sumitomo Mitsui Citibank JP Morgan Chase Bank of Tokyo Mitsubishi

a

CD, CP, Repo, Other/Financial Institutions Short-Term Liabilitiesa

10.6 6.3 4.5 4.2 4.0 3.6 3.2 2.8 2.1 2.0 1.6 1.3 1.3 1.2 1.1

evident shift in CD maturities out of the longest term bucket (61 days or greater), which now represent just 20% of French bank CDs down from more than half as of the end of June. Within the U.K., bank CDs experienced a proportionate decrease of about 10% from the longest-term bucket, with corresponding increases of roughly 5% in both the short-term and medium-term buckets. The maturity profile of banks in the Netherlands was stable, with slight increases in both the short-term but also in the longest-term buckets. Largest Bank Exposures. The 15 largest exposures to individual banks, as a group, comprise approximately 43% of total MMF assets (see the Largest MMF Exposures Financial Institutions table). There are three new entrants in the top 15 relative to the prior reporting period: Bank of Tokyo Mitsubishi, Citibank, and Commonwealth Bank of Australia. The six European institutions within the top 15 (down from nine institutions in the top 15 as of the end of August) account in aggregate for roughly 18% of total MMF assets.

Total deposits, money market, and short-term funding. CD Certificate of deposit. REPO Repurchase agreement. Note: European banks are bolded above. Source: Fitch Ratings, MMF public Web sites, SEC filings.

October 20, 2011

U.S. Money Funds and European Banks: French Exposure Down

Appendix

MMF Exposure to Bank CDs, CP, Repos, and Other By Country

(As a % of Total MMF Assets Under Management) BE FR DE 2H06 1.4 10.0 10.1 CD 0.5 6.2 3.4 CP 0.8 1.4 3.4 Repo 0.0 0.1 1.2 Other 0.1 2.4 2.0 1H07 2.1 10.4 9.8 CD 1.0 6.1 3.6 CP 0.7 1.1 2.5 Repo 0.0 0.1 1.2 Other 0.4 3.0 2.4 2H07 2.5 8.6 8.4 CD 1.2 4.8 2.1 CP 1.2 1.3 1.9 Repo 0.0 0.4 2.7 Other 0.1 2.1 1.7 1H08 2.6 10.2 7.1 CD 1.1 6.9 2.1 CP 1.0 1.2 1.1 Repo 0.0 0.2 2.9 Other 0.5 1.9 1.0 2H08 0.5 12.7 3.5 CD 0.1 7.7 0.9 CP 0.2 2.1 0.9 Repo 0.0 0.6 0.6 Other 0.2 2.4 1.1 1H09 1.0 16.2 4.9 CD 0.6 11.4 2.2 CP 0.0 2.1 1.0 Repo 0.0 0.8 1.1 Other 0.4 1.9 0.6 2H09 1.8 16.4 6.0 CD 1.0 11.7 2.7 CP 0.3 2.7 1.7 Repo 0.0 0.3 1.2 Other 0.5 1.8 0.4 1H10 1.3 12.7 7.8 CD 0.7 9.1 2.3 CP 0.3 1.7 2.3 Repo 0.0 0.3 2.0 Other 0.3 1.6 1.2 2H10 1.2 14.5 7.8 CD 0.5 10.4 2.4 CP 0.3 2.2 2.1 Repo 0.0 0.6 2.5 Other 0.3 1.4 0.9 Feb. 2011 1.0 13.3 8.2 CD 0.3 8.3 2.8 CP 0.2 2.9 2.0 Repo 0.0 0.9 2.7 Other 0.4 1.2 0.7 May 2011 0.6 15.1 6.8 CD 0.2 9.2 2.4 CP 0.1 3.8 1.4 Repo 0.0 1.2 2.5 Other 0.3 0.9 0.5 June 2011 0.7 14.4 5.5 CD 0.1 9.4 2.0 CP 0.1 3.4 1.4 Repo 0.0 1.0 1.4 Other 0.5 0.6 0.7 July 2011 0.2 14.1 4.6 CD 0.1 9.0 1.8 CP 0.1 3.0 1.1 Repo 0.0 0.9 1.1 Other 0.0 1.2 0.6 Aug. 2011 0.6 11.2 4.8 CD 0.1 5.8 1.3 CP 0.0 3.0 1.3 Repo 0.0 0.9 1.3 Other 0.5 1.6 0.9 IE 0.4 0.3 0.2 0.0 0.0 0.4 0.2 0.1 0.0 0.1 0.8 0.3 0.4 0.0 0.1 1.6 0.8 0.7 0.0 0.1 0.5 0.4 0.1 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.4 0.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 IT 2.4 0.9 0.3 0.0 1.2 1.9 0.5 0.2 0.0 1.2 1.7 0.4 0.3 0.0 1.0 3.2 1.9 0.4 0.0 0.9 2.7 2.3 0.4 0.0 0.0 3.0 2.4 0.6 0.0 0.0 3.2 2.4 0.8 0.0 0.0 1.9 1.0 0.9 0.0 0.0 1.3 0.4 0.9 0.0 0.0 1.5 0.1 1.2 0.0 0.3 0.8 0.1 0.6 0.0 0.1 0.5 0.1 0.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 NL 4.1 1.0 2.6 0.0 0.4 4.3 1.7 2.0 0.0 0.6 4.8 1.3 2.9 0.0 0.7 3.8 1.5 1.6 0.0 0.6 5.1 2.5 2.2 0.0 0.4 5.3 3.7 1.3 0.0 0.3 6.1 4.8 0.8 0.1 0.3 5.7 4.1 1.0 0.2 0.3 6.2 4.4 1.1 0.5 0.1 6.3 4.4 1.3 0.5 0.1 7.2 5.2 1.3 0.6 0.0 7.1 5.4 1.2 0.5 0.0 7.2 5.3 1.2 0.6 0.0 5.8 4.1 1.1 0.6 0.0 Nordic 2.6 0.9 1.1 0.0 0.6 2.9 0.7 1.2 0.0 1.0 3.3 1.4 1.3 0.0 0.7 3.7 0.9 1.5 0.0 1.3 3.7 1.3 1.6 0.0 0.7 4.7 2.1 1.7 0.0 0.9 5.3 3.1 1.4 0.0 0.8 5.8 2.5 1.9 0.0 1.4 5.0 3.2 1.6 0.0 0.2 5.9 2.9 1.8 0.0 1.1 6.2 3.5 1.9 0.1 0.8 5.7 2.8 1.7 0.0 1.2 6.3 3.5 1.9 0.0 0.8 6.7 3.3 2.1 0.0 1.3 PT 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.5 0.5 0.0 0.0 0.0 0.3 0.2 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 ES 0.7 0.1 0.3 0.0 0.3 0.9 0.2 0.1 0.0 0.6 1.9 1.0 0.3 0.0 0.6 2.6 2.1 0.1 0.0 0.4 3.3 2.6 0.6 0.0 0.1 3.2 2.1 0.9 0.0 0.2 2.9 2.0 0.9 0.0 0.0 1.8 1.2 0.5 0.0 0.1 0.6 0.3 0.2 0.0 0.1 0.2 0.1 0.1 0.0 0.0 0.2 0.1 0.0 0.0 0.0 0.2 0.2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 CH 4.0 1.7 0.5 1.3 0.5 4.6 2.8 1.1 0.6 0.1 4.9 2.5 0.6 1.7 0.1 3.4 1.4 0.4 1.2 0.4 2.9 1.2 0.6 0.8 0.3 2.4 1.2 0.5 0.3 0.3 1.5 0.6 0.2 0.5 0.1 1.7 0.4 0.5 0.8 0.0 3.1 1.4 0.3 1.1 0.3 4.2 2.0 0.8 1.2 0.3 4.1 2.1 0.4 1.6 0.0 3.7 1.7 0.3 1.6 0.1 3.9 1.7 0.4 1.5 0.3 3.9 2.2 0.6 1.1 0.0 U.K. 12.8 5.5 3.3 1.2 2.8 13.0 5.1 3.1 1.8 3.1 13.4 6.2 4.2 1.0 2.0 11.0 5.7 2.6 0.9 1.6 10.4 5.5 2.9 1.1 0.9 10.9 6.2 2.0 1.7 1.0 11.2 6.8 1.3 2.6 0.5 9.8 5.8 1.1 2.5 0.3 9.8 4.5 1.9 2.9 0.5 8.6 3.7 1.7 3.2 0.1 10.1 5.3 1.3 3.5 0.1 10.8 5.2 1.1 4.0 0.4 10.5 4.6 1.5 3.9 0.5 8.8 3.1 1.8 3.1 0.8 Europe (All) 48.7 20.4 14.1 3.8 10.4 50.5 22.0 12.2 3.7 12.5 50.5 21.2 14.3 5.8 9.2 49.3 24.4 10.8 5.2 8.9 45.4 24.5 11.7 3.0 6.2 52.3 32.4 10.2 4.0 5.6 55.2 35.8 10.2 4.8 4.4 48.5 27.1 10.3 5.9 5.2 49.6 27.5 10.7 7.7 3.7 49.6 24.7 12.0 8.5 4.4 51.5 28.3 10.7 9.4 3.0 48.8 26.8 9.8 8.4 3.8 47.2 26.2 9.2 7.9 3.8 42.1 19.9 9.9 7.0 5.4 AU 1.6 0.1 1.1 0.0 0.4 2.1 0.4 1.2 0.0 0.5 2.0 0.3 1.0 0.0 0.7 4.0 1.0 1.6 0.0 1.4 4.2 1.9 1.1 0.0 1.2 4.0 1.8 1.3 0.0 0.9 6.2 3.0 2.2 0.0 1.0 6.1 2.3 2.3 0.0 1.5 7.2 3.5 2.6 0.0 1.0 7.0 2.9 3.2 0.0 0.9 7.7 3.5 3.2 0.0 1.0 7.8 3.2 3.3 0.0 1.2 8.1 3.5 3.5 0.0 1.1 8.8 4.0 3.6 0.0 1.2 CA 3.0 2.2 0.4 0.0 0.3 3.0 2.2 0.3 0.0 0.6 3.7 2.5 0.5 0.0 0.7 2.9 1.8 0.3 0.1 0.7 6.2 4.2 1.0 0.2 0.9 5.9 4.8 0.4 0.2 0.5 6.0 5.0 0.6 0.1 0.4 6.9 5.4 0.2 0.5 0.9 7.6 5.8 0.4 0.2 1.1 8.0 6.0 0.5 0.2 1.3 8.3 6.9 0.5 0.2 0.7 9.0 7.1 0.5 0.3 1.0 9.3 7.2 0.5 0.4 1.1 10.0 8.2 0.7 0.3 0.9 JP 2.7 2.6 0.0 0.0 0.1 2.3 2.0 0.1 0.0 0.2 1.8 1.6 0.1 0.0 0.0 1.2 1.0 0.1 0.0 0.1 0.9 0.5 0.2 0.0 0.1 3.5 3.4 0.1 0.0 0.0 4.7 4.5 0.1 0.0 0.0 4.0 3.7 0.3 0.0 0.0 5.5 5.3 0.2 0.0 0.0 4.9 4.6 0.2 0.1 0.0 4.8 4.6 0.0 0.2 0.0 5.3 4.7 0.1 0.2 0.3 4.8 4.3 0.2 0.3 0.0 6.2 5.3 0.4 0.3 0.3 U.S. 24.6 1.3 7.7 5.8 9.7 26.6 1.4 7.4 8.2 9.6 26.7 2.1 9.2 8.0 7.3 18.6 1.3 6.7 4.5 6.1 15.8 1.6 7.8 2.3 4.0 8.4 1.5 3.8 2.0 1.0 9.2 0.6 2.0 4.6 2.0 9.8 0.9 1.9 5.0 2.0 9.4 0.5 1.2 5.0 2.6 8.0 0.4 1.4 4.0 2.2 9.2 0.1 1.1 6.0 2.0 10.4 0.3 1.3 6.8 2.1 9.0 0.5 1.4 5.6 1.6 9.2 0.4 1.6 5.7 1.5

CD Certificates of deposit. Repo Repurchase agreement. BE Belgium. FR France. DE Germany. IE Ireland. IT Italy. NL Netherlands. PT Portugal. ES Spain. CH Switzerland. U.K. United Kingdom. AU Australia. CA Canada. JP Japan. U.S. United States. Continued on next page. Source: Fitch Ratings, MMF public Web sites, SEC filings.

October 20, 2011

U.S. Money Funds and European Banks: French Exposure Down

MMF Exposure to Bank CDs, CP, Repos, and Other By Country (Continued)

(As a % of Total MMF Assets Under Management) Sept. 2011 CD CP Repo Other BE 0.4 0.2 0.0 0.0 0.2 FR 6.7 3.3 2.0 0.7 0.7 DE 4.7 2.2 1.0 0.9 0.6 IE 0.0 0.0 0.0 0.0 0.0 IT 0.0 0.0 0.0 0.0 0.0 NL 5.5 3.6 1.0 0.6 0.2 Nordic 7.2 3.5 2.1 0.0 1.5 PT 0.0 0.0 0.0 0.0 0.0 ES 0.0 0.0 0.0 0.0 0.0 CH 4.5 2.5 0.5 1.1 0.4 U.K. 8.7 2.9 1.4 3.3 1.0 Europe (All) 37.7 18.2 8.2 6.7 4.6 AU 9.4 4.6 3.7 0.0 1.1 CA 10.7 8.4 0.7 0.5 1.1 JP 7.8 7.0 0.2 0.2 0.5 U.S. 9.6 0.7 1.5 5.3 2.1

CD Certificates of deposit. Repo Repurchase agreement. BE Belgium. FR France. DE Germany. IE Ireland. IT Italy. NL Netherlands. PT Portugal. ES Spain. CH Switzerland. U.K. United Kingdom. AU Australia. CA Canada. JP Japan. U.S. United States. Source: Fitch Ratings, MMF public Web sites, SEC filings.

Background on Fitch Study

This research study is intended to provide market participants with information on MMF exposures to European banks and does not comment specifically on Fitch-rated MMFs. At present, the report does not have any ratings implications. For the most recent observation period (i.e. Sept. 30, 2011), the MMFs in Fitchs sample represent roughly $654 billion, or 45%, of the Investment Company Institutes estimate of approximately $1.47 trillion in total U.S. prime MMF assets under management. The sample set is based on public filings from the 10 largest prime institutional and retail MMFs (as measured by assets under management) as of each observation period. Thus, in some cases the MMFs sampled differ slightly from period to period. Because this analysis is based on aggregated data for the 10 MMFs sampled, it does not capture potential differences in exposure profiles across individual funds. MMF exposure to banks encompasses the following instrument types: CDs, CP, ABCP, repos, and corporate notes. Bank exposure data for foreign branches is consolidated within the banking groups home jurisdiction. Exposures to foreign subsidiaries are generally categorized based on the country classification designated by Fitchs financial institutions group. Bank exposure data includes state-controlled financial institutions, where applicable. In order to maintain data integrity, Fitch periodically reviews raw exposure-level holdings data and, if warranted, may reclassify specific exposures (e.g., by asset type, industry sector, counterparty, or country). Reclassification and/or revisions to the dataset can result in (generally minor) changes to the historical time series of MMF exposures. The period of observation covers nine distinct semiannual periods and month-end for February 2011, May 2011, June 2011, July 2011, August 2011, and September 2011. Note that prior to 2011, financial reporting dates often varied across MMFs. Fitch therefore has applied a degree of judgment in categorizing individual MMF filings into the appropriate semiannual bucket within its historical time series.

October 20, 2011

U.S. Money Funds and European Banks: French Exposure Down

ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS LINK: HTTP://FITCHRATINGS.COM/UNDERSTANDINGCREDITRATINGS. IN ADDITION, RATING DEFINITIONS AND THE TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE AGENCYS PUBLIC WEB SITE AT WWW.FITCHRATINGS.COM. PUBLISHED RATINGS, CRITERIA, AND METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. FITCHS CODE OF CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, AFFILIATE FIREWALL, COMPLIANCE, AND OTHER RELEVANT POLICIES AND PROCEDURES ARE ALSO AVAILABLE FROM THE CODE OF CONDUCT SECTION OF THIS SITE. Copyright 2011 by Fitch, Inc., Fitch Ratings Ltd. and its subsidiaries. One State Street Plaza, NY, NY 10004.Telephone: 1-800-753-4824, (212) 908-0500. Fax: (212) 480-4435. Reproduction or retransmission in whole or in part is prohibited except by permission. All rights reserved. In issuing and maintaining its ratings, Fitch relies on factual information it receives from issuers and underwriters and from other sources Fitch believes to be credible. Fitch conducts a reasonable investigation of the factual information relied upon by it in accordance with its ratings methodology, and obtains reasonable verification of that information from independent sources, to the extent such sources are available for a given security or in a given jurisdiction. The manner of Fitchs factual investigation and the scope of the third-party verification it obtains will vary depending on the nature of the rated security and its issuer, the requirements and practices in the jurisdiction in which the rated security is offered and sold and/or the issuer is located, the availability and nature of relevant public information, access to the management of the issuer and its advisers, the availability of pre-existing third-party verifications such as audit reports, agreed-upon procedures letters, appraisals, actuarial reports, engineering reports, legal opinions and other reports provided by third parties, the availability of independent and competent third-party verification sources with respect to the particular security or in the particular jurisdiction of the issuer, and a variety of other factors. Users of Fitchs ratings should understand that neither an enhanced factual investigation nor any third-party verification can ensure that all of the information Fitch relies on in connection with a rating will be accurate and complete. Ultimately, the issuer and its advisers are responsible for the accuracy of the information they provide to Fitch and to the market in offering documents and other reports. In issuing its ratings Fitch must rely on the work of experts, including independent auditors with respect to financial statements and attorneys with respect to legal and tax matters. Further, ratings are inherently forward-looking and embody assumptions and predictions about future events that by their nature cannot be verified as facts. As a result, despite any verification of current facts, ratings can be affected by future events or conditions that were not anticipated at the time a rating was issued or affirmed. The information in this report is provided as is without any representation or warranty of any kind. A Fitch rating is an opinion as to the creditworthiness of a security. This opinion is based on established criteria and methodologies that Fitch is continuously evaluating and updating. Therefore, ratings are the collective work product of Fitch and no individual, or group of individuals, is solely responsible for a rating. The rating does not address the risk of loss due to risks other than credit risk, unless such risk is specifically mentioned. Fitch is not engaged in the offer or sale of any security. All Fitch reports have shared authorship. Individuals identified in a Fitch report were involved in, but are not solely responsible for, the opinions stated therein. The individuals are named for contact purposes only. A report providing a Fitch rating is neither a prospectus nor a substitute for the information assembled, verified and presented to investors by the issuer and its agents in connection with the sale of the securities. Ratings may be changed or withdrawn at anytime for any reason in the sole discretion of Fitch. Fitch does not provide investment advice of any sort. Ratings are not a recommendation to buy, sell, or hold any security. Ratings do not comment on the adequacy of market price, the suitability of any security for a particular investor, or the tax-exempt nature or taxability of payments made in respect to any security. Fitch receives fees from issuers, insurers, guarantors, other obligors, and underwriters for rating securities. Such fees generally vary from US$1,000 to US$750,000 (or the applicable currency equivalent) per issue. In certain cases, Fitch will rate all or a number of issues issued by a particular issuer, or insured or guaranteed by a particular insurer or guarantor, for a single annual fee. Such fees are expected to vary from US$10,000 to US$1,500,000 (or the applicable currency equivalent). The assignment, publication, or dissemination of a rating by Fitch shall not constitute a consent by Fitch to use its name as an expert in connection with any registration statement filed under the United States securities laws, the Financial Services and Markets Act of 2000 of Great Britain, or the securities laws of any particular jurisdiction. Due to the relative efficiency of electronic publishing and distribution, Fitch research may be available to electronic subscribers up to three days earlier than to print subscribers.

October 20, 2011

You might also like

- Spain S&P Downgrade Full TextDocument4 pagesSpain S&P Downgrade Full TextafonteveNo ratings yet

- Spain S&P DowngradeDocument1 pageSpain S&P DowngradeafonteveNo ratings yet

- FHFA Suit V B of A 2011Document92 pagesFHFA Suit V B of A 2011ashe350No ratings yet

- USD and Risk AversionDocument5 pagesUSD and Risk AversionafonteveNo ratings yet

- PCI AprilDocument10 pagesPCI AprilafonteveNo ratings yet

- Cme Margin Hike GoldDocument3 pagesCme Margin Hike Goldafonteve100% (1)

- ESMA 2011 266 Public Statement On Short SellingDocument2 pagesESMA 2011 266 Public Statement On Short Sellingjohn7451No ratings yet

- 2011 Q2 Tech Cuts ReportDocument4 pages2011 Q2 Tech Cuts ReportafonteveNo ratings yet

- Barclays On Debt CeilingDocument13 pagesBarclays On Debt CeilingafonteveNo ratings yet

- Budget Control Act Amendment - Debt Ceiling BillDocument74 pagesBudget Control Act Amendment - Debt Ceiling BillLegal InsurrectionNo ratings yet

- Nomura Oil OutlookDocument210 pagesNomura Oil OutlookafonteveNo ratings yet

- Emerging Markets Strategist HSBCDocument52 pagesEmerging Markets Strategist HSBCafonteveNo ratings yet

- Intel Price Target Lowered - CanaccordDocument7 pagesIntel Price Target Lowered - CanaccordafonteveNo ratings yet

- Pentagon's Diagram of Osama Bin Laden's ComponudDocument5 pagesPentagon's Diagram of Osama Bin Laden's ComponudafonteveNo ratings yet

- HSBC Precious Metals OutlookDocument64 pagesHSBC Precious Metals OutlookafonteveNo ratings yet

- Nomura What Countries Are Most Vulnerable To An Oil ShockDocument4 pagesNomura What Countries Are Most Vulnerable To An Oil ShockafonteveNo ratings yet

- AWEA First Quarter Wind Energy ReviewDocument8 pagesAWEA First Quarter Wind Energy ReviewafonteveNo ratings yet

- Silver To Drop To $34 UBSDocument3 pagesSilver To Drop To $34 UBSafonteveNo ratings yet

- JP Morgan: S&P Yearly-Low Will Be 1250Document6 pagesJP Morgan: S&P Yearly-Low Will Be 1250afonteveNo ratings yet

- 2011-q1 Emerging Markets Index Report - Embargoed Final Until 06.30 Uk, 7 April 2011 - HSBCDocument13 pages2011-q1 Emerging Markets Index Report - Embargoed Final Until 06.30 Uk, 7 April 2011 - HSBCafonteveNo ratings yet

- Nomura Effects of Treasury's Plan To Sell $142B in MBSDocument4 pagesNomura Effects of Treasury's Plan To Sell $142B in MBSafonteveNo ratings yet

- Schlumberger RBCDocument7 pagesSchlumberger RBCafonteveNo ratings yet

- Rosenberg 3 21 11Document24 pagesRosenberg 3 21 11afonteveNo ratings yet

- Nomura Oil Refinery Shut Down JapanDocument5 pagesNomura Oil Refinery Shut Down JapanafonteveNo ratings yet

- Nomura State of Electricity SupplyDocument11 pagesNomura State of Electricity SupplyafonteveNo ratings yet

- Nomura Impact of MENA Crisis On Oil CompaniesDocument22 pagesNomura Impact of MENA Crisis On Oil CompaniesafonteveNo ratings yet

- Nomura Central Banks Dump DollarDocument7 pagesNomura Central Banks Dump DollarafonteveNo ratings yet

- Rosenberg - What Would Happen Without QE3?Document7 pagesRosenberg - What Would Happen Without QE3?afonteveNo ratings yet

- Feb11 Job Cuts ReportDocument9 pagesFeb11 Job Cuts ReportafonteveNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Credit Rating Agencies PDFDocument17 pagesCredit Rating Agencies PDFAkash SinghNo ratings yet

- RATIO ANALYSIS MCQsDocument9 pagesRATIO ANALYSIS MCQsAS GamingNo ratings yet

- I. Comparative Income Statement:: Malaluan, Joselito S. 17-56760 BA-506 1. Comparative Financial StatementsDocument9 pagesI. Comparative Income Statement:: Malaluan, Joselito S. 17-56760 BA-506 1. Comparative Financial StatementsJo MalaluanNo ratings yet

- Demetrious Dabadee 08-15-2023-3Document1 pageDemetrious Dabadee 08-15-2023-3Irfan khanNo ratings yet

- WWW Yourarticlelibrary ComDocument5 pagesWWW Yourarticlelibrary ComDhruv JoshiNo ratings yet

- Understanding LiabilitiesDocument2 pagesUnderstanding LiabilitiesXienaNo ratings yet

- NFP Report 8 Mar 2019Document4 pagesNFP Report 8 Mar 2019Dian LanNo ratings yet

- Activity Chapter 4: Ans. 2,320 SolutionDocument2 pagesActivity Chapter 4: Ans. 2,320 SolutionRandelle James Fiesta0% (1)

- 2 Acknowledgement, Abstract, ContentDocument5 pages2 Acknowledgement, Abstract, ContentHema MaliniNo ratings yet

- QUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestDocument3 pagesQUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestLalaine Jhen Dela CruzNo ratings yet

- Simulates Midterm Exam. IntAcc1 PDFDocument11 pagesSimulates Midterm Exam. IntAcc1 PDFA NuelaNo ratings yet

- Reviewing The Ambit of Control' Apropos To The Objective of Mandatory Bids': An Analysis Under The Takeover RegulationsDocument32 pagesReviewing The Ambit of Control' Apropos To The Objective of Mandatory Bids': An Analysis Under The Takeover Regulationsyarramsetty geethanjaliNo ratings yet

- Pertinent Laws in Urban DesignDocument31 pagesPertinent Laws in Urban DesignAnamarie C. CamasinNo ratings yet

- Chapter 2Document4 pagesChapter 2HuyNguyễnQuangHuỳnhNo ratings yet

- Salary Advances and Staff LoansDocument3 pagesSalary Advances and Staff LoansomarelzainNo ratings yet

- Republic Planters Bank Vs CADocument2 pagesRepublic Planters Bank Vs CAMohammad Yusof Mauna MacalandapNo ratings yet

- M2U SA 128457 Jul 2023Document5 pagesM2U SA 128457 Jul 2023syafiqah.mohdali38No ratings yet

- Idt For May and Nov 13Document149 pagesIdt For May and Nov 13Rakesh SinghNo ratings yet

- 2016 April ResumeDocument2 pages2016 April Resumeapi-308709576No ratings yet

- A Project Report On Kotak InsuranceDocument82 pagesA Project Report On Kotak Insurancevarun_bawa251915No ratings yet

- Account - STMT 2Document5 pagesAccount - STMT 2Be HappyNo ratings yet

- Synthesis Essay Final DraftDocument5 pagesSynthesis Essay Final Draftapi-575352411No ratings yet

- Employee Stock Option PlanDocument7 pagesEmployee Stock Option Plankrupalee100% (1)

- Ap Workbook PDFDocument44 pagesAp Workbook PDFLovely Jay AbanganNo ratings yet

- Pairs Trading Cointegration ApproachDocument82 pagesPairs Trading Cointegration Approachalexa_sherpyNo ratings yet

- INTERNAL CONTROL - Test BankDocument5 pagesINTERNAL CONTROL - Test BankwendyNo ratings yet

- Working Capital ManagementDocument14 pagesWorking Capital ManagementJoshua Naragdag ColladoNo ratings yet

- Guide To Retail Math Key Formulas PDFDocument1 pageGuide To Retail Math Key Formulas PDFYusuf KandemirNo ratings yet

- IE 343 Final Exam ReviewDocument16 pagesIE 343 Final Exam Reviewterriberri22No ratings yet

- We Like Project 2019Document59 pagesWe Like Project 2019Yash TrivediNo ratings yet