Professional Documents

Culture Documents

Original For The Payer FORM 210

Uploaded by

Nilesh AadavOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Original For The Payer FORM 210

Uploaded by

Nilesh AadavCopyright:

Available Formats

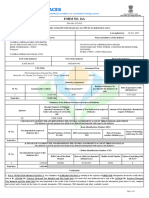

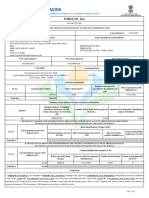

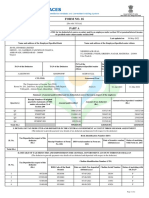

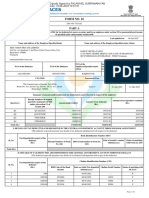

MVAT PAYMENT OTHER THAN WITH RETURN

For the Payer FORM 210 ( See rule 45 )

Original

Chalan in respect of payment made otherwise than with return by a dealer under Maharashtra Value Addd Tax Act, 2002 [ 0040 - Sales Tax - Receipts under the MVAT Act, 2002 - Tax Collection [ For Tax payment through Treasury / Bank 1) M.V.A.T.R.C. No. including a final identifier character, if any 2) C.S.T.R.C. No.

3) 4)

Period

From

To

Name and address of the person or dealer on whom behalf money is paid Name Address

Payment on account of

(a) (b) (c) (d) (e) (f) (g) (h) Sales Tax composition under section 42 Interest under section Penalty under section Composition money amount for compounding of offence Fine under section 12(2) or 14(3) Fees payable under rule 73 Amount forfeited

Amount (in figure)

Chalan of tax, penalty & composition money paid to the Treasury/ Sub- Treasury Reserve Bank of India.

Total Rs. Amount in words Crore Lac Thousand Hundred Tens Units

Date Place

Signature of Dealer or Depositor Designation For Treasury Use Only

Received Rs.

In words

Date of Entry Chalan No. Printed From Website

http://www.meraconsultant.com Treasury Accountant / Treasury Officer / Agent / Manager

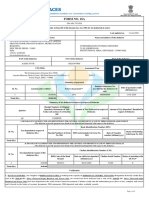

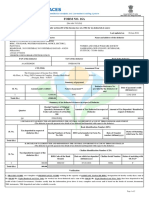

MVAT PAYMENT OTHER THAN WITH RETURN

To be sent to the Sales Tax Officer FORM 210 ( See rule 45 )

Duplicate

Chalan in respect of payment made otherwise than with return by a dealer under Maharashtra Value Addd Tax Act, 2002 [ 0040 - Sales Tax - Receipts under the MVAT Act, 2002 - Tax Collection [ For Tax payment through Treasury / Bank 1) M.V.A.T.R.C. No. including a final identifier character, if any 2) C.S.T.R.C. No.

3) 4)

Period

From

To

Name and address of the person or dealer on whom behalf money is paid Name Address

Payment on account of

(a) (b) (c) (d) (e) (f) (g) (h) Sales Tax composition under section 42 Interest under section Penalty under section Composition money amount for compounding of offence Fine under section 12(2) or 14(3) Fees payable under rule 73 Amount forfeited

Amount (in figure)

Chalan of tax, penalty & composition money paid to the Treasury/ Sub- Treasury Reserve Bank of India.

Total Rs. Amount in words Crore Lac Thousand Hundred Tens Units

Date Place

Signature of Dealer or Depositor Designation For Treasury Use Only

Received Rs.

In words

Date of Entry Chalan No. Printed From Website

http://www.meraconsultant.com Treasury Accountant / Treasury Officer / Agent / Manager

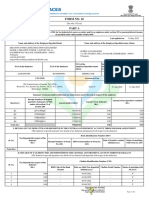

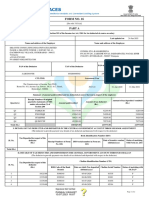

MVAT PAYMENT OTHER THAN WITH RETURN

For the Treasury FORM 210 ( See rule 45 )

Triplicate

Chalan in respect of payment made otherwise than with return by a dealer under Maharashtra Value Addd Tax Act, 2002 [ 0040 - Sales Tax - Receipts under the MVAT Act, 2002 - Tax Collection [ For Tax payment through Treasury / Bank 1) M.V.A.T.R.C. No. including a final identifier character, if any 2) C.S.T.R.C. No.

3) 4)

Period

From

To

Name and address of the person or dealer on whom behalf money is paid Name Address

Payment on account of

(a) (b) (c) (d) (e) (f) (g) (h) Sales Tax composition under section 42 Interest under section Penalty under section Composition money amount for compounding of offence Fine under section 12(2) or 14(3) Fees payable under rule 73 Amount forfeited

Amount (in figure)

Chalan of tax, penalty & composition money paid to the Treasury/ Sub- Treasury Reserve Bank of India.

Total Rs. Amount in words Crore Lac Thousand Hundred Tens Units

Date Place

Signature of Dealer or Depositor Designation For Treasury Use Only

Received Rs.

In words

Date of Entry Chalan No. Printed From Website

http://www.meraconsultant.com Treasury Accountant / Treasury Officer / Agent / Manager

You might also like

- Challan 210Document3 pagesChallan 210Nitin KatreNo ratings yet

- FORM 210: For Tax Payment Through Treasury / BankDocument3 pagesFORM 210: For Tax Payment Through Treasury / BankVaibhavJoreNo ratings yet

- Challan Vat Form 210Document3 pagesChallan Vat Form 210Rakhi PatilNo ratings yet

- VAT ChallanDocument2 pagesVAT Challanrajeshutkur0% (1)

- TDS Payment ChallanDocument3 pagesTDS Payment ChallanmejarirajeshNo ratings yet

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- FORM16Document10 pagesFORM16Siva Ramakrishna100% (1)

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- TDS Form 16 & 16ADocument14 pagesTDS Form 16 & 16AVaibhav NagoriNo ratings yet

- Form Dvat 21Document3 pagesForm Dvat 21gargkgNo ratings yet

- Aaacl4159l Q2 2024-25Document3 pagesAaacl4159l Q2 2024-25vbgrandvizagNo ratings yet

- Aaacl4159l Q3 2024-25Document3 pagesAaacl4159l Q3 2024-25vbgrandvizagNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToDevasyrucNo ratings yet

- Form 16: Warora Kurnool Transmission LimitedDocument10 pagesForm 16: Warora Kurnool Transmission LimitedBHASKAR pNo ratings yet

- Acfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaDocument3 pagesAcfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaapi-564750164No ratings yet

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Prabha Maheshwari - Eorpm9411l - Q1 - Ay202324 - 16aDocument2 pagesPrabha Maheshwari - Eorpm9411l - Q1 - Ay202324 - 16aankur maheshwariNo ratings yet

- Form No. 16A (See Rule31 (L) (B) )Document4 pagesForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNo ratings yet

- Form 16Document3 pagesForm 16Bijay TiwariNo ratings yet

- 2022-23 TDSDocument6 pages2022-23 TDSMujtabaAliKhanNo ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- Kansupriya@Deloitte - Com f162022 2023Document10 pagesKansupriya@Deloitte - Com f162022 2023Supriya KandukuriNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToSOUMYA RANJAN PATRANo ratings yet

- A SimDocument4 pagesA Simsana_rautNo ratings yet

- (See Rule 31 (1) (B) )Document2 pages(See Rule 31 (1) (B) )B RNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part ANidhish AgrawalNo ratings yet

- Vaasant G - Resume Seniour LevelDocument3 pagesVaasant G - Resume Seniour LevelanikagiriNo ratings yet

- Form 16 ADocument2 pagesForm 16 Asatyampandey7986659533No ratings yet

- TDS CertificateDocument3 pagesTDS Certificatejfcgfh8fc6No ratings yet

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NDocument6 pages(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashNo ratings yet

- ShowfileDocument4 pagesShowfileMkNo ratings yet

- Form No. 16-ADocument1 pageForm No. 16-AJay100% (6)

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToPrakash PandeyNo ratings yet

- Form 16a New FormatDocument2 pagesForm 16a New FormatJayNo ratings yet

- Gjwpp7325e Q1 2024 25Document3 pagesGjwpp7325e Q1 2024 25Adarsh PandeyNo ratings yet

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuNo ratings yet

- Mvat f231Document5 pagesMvat f231pgotaphoeNo ratings yet

- Applicable For Casual or Non-Resident Taxable Person, Tax Deductor, Tax Collector, Un-Registered Person and Other Registered Taxable PersonDocument8 pagesApplicable For Casual or Non-Resident Taxable Person, Tax Deductor, Tax Collector, Un-Registered Person and Other Registered Taxable PersonVAIBHAV ARORANo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- FORM16 (Year 2020 - 21)Document11 pagesFORM16 (Year 2020 - 21)Siva RamakrishnaNo ratings yet

- Tds16a Revised As Per Notification No. 92010 Dated 18022010Document1 pageTds16a Revised As Per Notification No. 92010 Dated 18022010Sameer GanekarNo ratings yet

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- ChallanDocument2 pagesChallanrchowdhury_10No ratings yet

- TDS CertificateDocument3 pagesTDS Certificatekavita agarwalNo ratings yet

- Form16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Document6 pagesForm16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Mankamuthaka VemaratananaNo ratings yet

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Document2 pages(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarNo ratings yet

- FORM 202: Popular EnterpriseDocument4 pagesFORM 202: Popular Enterprisesam3461No ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMurthy KarumuriNo ratings yet

- QwertabacbDocument3 pagesQwertabacbNDKKMDBNo ratings yet

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- The Value Added Tax Act: Laws of KenyaDocument53 pagesThe Value Added Tax Act: Laws of KenyaEvelyn KyaniaNo ratings yet

- Satyaprakash .Document491 pagesSatyaprakash .aecNo ratings yet

- 7.6. O San Agustin V CIRDocument3 pages7.6. O San Agustin V CIRshenayeeNo ratings yet

- Taxation Management - FIN623 QuizDocument85 pagesTaxation Management - FIN623 QuizmirkazimNo ratings yet

- Problems For SSM-1-LabDocument3 pagesProblems For SSM-1-LabYUMMYNo ratings yet

- InvoiceDocument2 pagesInvoicePriyanshuNo ratings yet

- Assignment 1 For MBA 2020Document10 pagesAssignment 1 For MBA 2020Sichen UpretyNo ratings yet

- PWC 1Document20 pagesPWC 1Clyde RamosNo ratings yet

- Carrier: Delhivery: Deliver To FromDocument1 pageCarrier: Delhivery: Deliver To FromAjay SinghNo ratings yet

- RMC 78-2022Document3 pagesRMC 78-2022Ian PalmaNo ratings yet

- TAX13E910 NotesDocument38 pagesTAX13E910 NotesarulkuNo ratings yet

- Thailand Corporate Income TaxDocument31 pagesThailand Corporate Income TaxPrincessJoyGinezFlorentinNo ratings yet

- Ashiyan Price List 19-Jul-22Document1 pageAshiyan Price List 19-Jul-22love sharmaNo ratings yet

- Lurimar A. Raguini Tax Final ExamDocument45 pagesLurimar A. Raguini Tax Final Examfrance marie annNo ratings yet

- CBE Dec 22 - ADocument16 pagesCBE Dec 22 - ANguyễn Hồng NgọcNo ratings yet

- Hotel Booking DemoDocument1 pageHotel Booking Demositghana01No ratings yet

- BJZPP3740D Partb 2021-22Document3 pagesBJZPP3740D Partb 2021-22sagar lovzNo ratings yet

- HSRPDocument1 pageHSRPRakesh SinghNo ratings yet

- Explanatory Notes For The Completion of Vat Return FormDocument3 pagesExplanatory Notes For The Completion of Vat Return FormTendai ZamangweNo ratings yet

- CCIT Module 2 - TAXES, TAX LAWS and TAX ADMINISTRATIONDocument15 pagesCCIT Module 2 - TAXES, TAX LAWS and TAX ADMINISTRATIONAngelo OñedoNo ratings yet

- Court of Tax Appeals: VENUE: Second Division Courtroom, 3Document3 pagesCourt of Tax Appeals: VENUE: Second Division Courtroom, 3Aemie JordanNo ratings yet

- JD IiiDocument4 pagesJD IiiCharina BalunsoNo ratings yet

- Ola Cabs 197986805Document1 pageOla Cabs 197986805Lakshmi MuvvalaNo ratings yet

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

- Business and Transfer Taxes SylabusDocument13 pagesBusiness and Transfer Taxes SylabusagentnicNo ratings yet

- 2.03 Payment TrackerDocument1 page2.03 Payment Trackerpratik ghavateNo ratings yet

- Tax Audit PresentationDocument14 pagesTax Audit PresentationUsama FakharNo ratings yet

- Retirement PlanDocument1 pageRetirement PlanPrincess Helen Grace BeberoNo ratings yet

- In 031588Document1 pageIn 031588daltonico111No ratings yet

- Deed of Absolute Sale Condominium UnitDocument4 pagesDeed of Absolute Sale Condominium UnitAJA88% (8)