Professional Documents

Culture Documents

Project Report On Risk Management Using Future and Option

Uploaded by

Harshad PatelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Report On Risk Management Using Future and Option

Uploaded by

Harshad PatelCopyright:

Available Formats

Shri S.V.

Patel College oI Computer Science & Business Management

CONTENTS

Chapter

No.

Particulars Page

No.

1 Introduction to Derivatives

O Derivatives DeIined........................ 3

O The participants in a derivative market ................. 5

O Types oI Derivatives......................... 5

O History oI Derivatives....................... 8

O Derivative Market in India...................... 11

O Introduction to Forward Contract.................. 14

O Introduction to Futures...................... 16

O Introduction to Option....................... 19

O Pricing oI Iutures ........................ 22

O Pricing oI Options.......................... 22

Clearing & Settlement

O Clearing Banks......................... 24

O Clearing Members............................. 24

O Clearing Mechanism...................... 25

O Settlement Schedule....................... 27

O Settlement Price........................... 27

O Settlement Mechanism...................... 28

O Settlement Procedure......................... 32

Basic Pay-offs

O Pay-oII Ior Buyer oI Call option................... 32

O Pay-oII Ior Writer oI Call option................... 32

O Pay-oII Ior Buyer oI Put option..................... 33

O Pay-oII Ior Writer oI Put option....................... 34

O Pay-oII Ior Buyer oI NiIty Future.................... 35

Shri S.V. Patel College oI Computer Science & Business Management

O Pay-oII Ior Seller oI NiIty Future.................. 35

Trading in Derivative

O Future and Option trading System .................. 37

O Entities in trading System....................... 37

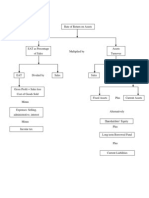

O Corporate hierarchy........................ 38

O Order types and condition....................... 39

The Risk Management System of Derivatives

O

O

Shri S.V. Patel College oI Computer Science & Business Management

INTRODUCTION

The term "Derivative" indicates the value which is entirely "derived" Irom the value oI the assets

such as securities, commodities, bullion, currency, live stock or anything else. In other words,

Derivative means a Iorward, Iuture, option or any other hybrid contract oI pre determined Iixed

duration, linked Ior the purpose oI contract IulIillment to the value oI a speciIied real or Iinancial

asset or to an index oI securities.

Derivatives have been included in the deIinition oI Securities in The Securities Contracts

(Regulations) Act, as a security derived Irom a debt instrument, share, loan, whether secured or

unsecured, risk instrument or contract Ior diIIerences or any other Iorm oI security; a contract

which derives its value Irom the prices, or index oI prices, oI underlying securities.

Derivatives include options and Iutures. Certain options are short-term in nature and are issued

by investors. These options may be long-term in nature and are issued by companies in the

process oI Iinancing their activities. The trading in derivatives are things oI US origin and in US

the Organized exchanges began trading in options on equities in 1973 and on debt Irom 1982.

Derivatives` initially, had its reIerence to the bank transaction when banks created deposits out

oI primary deposits. The primary deposit is received by banks and the same is lent on book

credit. The bank does not give cash to the borrower but provides him with a cheque book and

allows him to draw Ior payment. When these cheques presented in the bank, they create deposits

and they were reIerred to as the derivatives. In a similar Iashion, the stocks are traded in

exchanges either as spot delivery against payment or on Iorward market delivery on Iuture

payment. This may or may not happen, but the purpose is to prevent any Iall in price oI stocks

which is insurance the risk oI volatility in prices. The derivatives market consists oI Iorward

contract, Iutures contract, options trading and swaps market.

Derivatives Defined

Derivative is a product whose value is derived Irom the value oI one or more basic variables,

called bases underlying asset, index, or reIerence rate, in a contractual manner, the underlying

asset can be equity, Iore, commodity or any other asset. For example, wheat Iarmers may wish to

sell their harvest at a Iuture date to eliminate the risk oI a change in prices by that date. Such a

Shri S.V. Patel College oI Computer Science & Business Management

transaction is an example oI derivatives. The price oI this derivative is driven by the spot price oI

wheat which is the 'underlying.

In the Indian context the Securities Contracts Regulation Act, 19SCRA) deIines

'derivative` to include-

1. A security derived Irom a debt instrument, share, and loan whether secured or unsecured,

risk instrument or contract Ior diIIerences or any other Iorm oI security.

. A contract, which derives its value Irom the prices, or index oI prices, oI underlying

securities.

Derivatives are securities under the SCRA and hence the regulatory Iramework under the SCRA

governs the trading oI derivatives.

Structure of Derivative Markets

Derivative trading in India takes place either on a separate and independent Derivative Exchange

or on a separate segment oI an existing Stock Exchange. Derivative Exchange/Segment Iunction

as a Self-Regulatory Organization SRO) and SEBI acts as the oversight regulator. The

clearing & settlement oI all trades on the Derivative Exchange/Segment would have to be

through a Clearing Corporation/House, which is independent in governance and membership

Irom the Derivative Exchange/Segment.

Economic functions of a derivatives market:

The derivatives market perIorms a number oI economic Iunctions:

1. It helps in transIerring risks Irom risk averse people to risk oriented people.

. It helps in the discovery oI Iuture as well as current prices.

. It catalyzes entrepreneurial activity.

Shri S.V. Patel College oI Computer Science & Business Management

. It increase the volume traded in markets because oI participation oI risk averse people in

greater number.

. It increases savings and investment in the long run.

The participants in a derivative market

Hedgers

Use Iutures or options markets to reduce or eliminate the risk associated with price oI an asset.

Speculators

Use Iutures and options contracts to get extra leverage in betting on Iuture movements in the

price oI an asset. They can increase both the potential gains and potential losses by usage oI

derivatives in a speculative venture.

Arbitragers

Arbitragers are in business to take advantage oI a discrepancy between prices in two diIIerent

markets. II, Ior example, they see the Iutures price oI an asset getting out oI line with the cash

price, they will take oIIsetting positions in the two markets to lock in a proIit.

Types of Derivatives

Forwards

A Iorward contract is a customized contract between two entities, where Settlement takes place

on a speciIic date in the Iuture at today`s pre-agreed price.

Futures

A Iutures contract is an agreement between two parties to buy or sell an asset at a certain time in

the Iuture at a certain price. Futures contracts are special types oI Iorward contracts in the sense

that the Iormer are standardized exchange-traded contracts

Shri S.V. Patel College oI Computer Science & Business Management

Options

Options are oI two types - calls and puts. Calls give the buyer the right but not the obligation to

buy a given quantity oI the underlying asset, at a given price on or beIore a given Iuture date.

Puts give the buyer the right, but not the obligation to sell a given quantity oI the underlying

asset at a given price on or beIore a given date.

Warrant

Options generally have lives oI up to one year; the majority oI options traded on options

exchanges having a maximum maturity oI nine months. Longer-dated options are called warrants

and are generally traded over-the-counter.

LEAPS

The acronym LEAPS means Long-Term Equity Anticipation Securities. These are options

having a maturity oI up to three years.

Baskets

Basket options are options on portIolios oI underlying assets. The underlying asset is usually a

moving average or a basket oI assets. Equity index options are a Iorm oI basket options.

Swaps

Swaps are private agreements between two parties to exchange cash Ilows in the Iuture

according to a prearranged Iormula. They can be regarded as portIolios oI Iorward contracts.

There are two types oI Swaps: Interest rate swaps & Currency swaps.

1. Interest rate swaps

These entail swapping only the interest related cash Ilows between the parties in the same

currency.

Shri S.V. Patel College oI Computer Science & Business Management

. Currency swaps

These entail swapping both principal and interest between the parties, with the cash Ilows in one

direction being in a diIIerent currency than those in the opposite direction.

Swaptions

Swaptions are options to buy or sell a swap that will become operative at the expiry oI the

options. Thus a swaption is an option on a Iorward swap. Rather than have calls and puts, the

swaptions market has receiver swaptions and payer swaptions. A receiver swaption is an option

to receive Iixed and pay Iloating. A payer swaption is an option to pay Iixed and receive Iloating.

Types of Derivatives

Derivatives

ICkWAkD IU1UkL C1ICNS

SWA

U1

CALL IN1LkLS1 kA1L CUkkLNC

Shri S.V. Patel College oI Computer Science & Business Management

History of Derivatives

The history oI derivatives is quite colorIul and surprisingly a lot longer than most people think.

Forward delivery contracts, stating what is to be delivered Ior a Iixed price at a speciIied place

on a speciIied date, existed in ancient Greece and Rome. Roman emperors entered Iorward

contracts to provide the masses with their supply oI Egyptian grain. These contracts were also

undertaken between Iarmers and merchants to eliminate risk arising out oI uncertain Iuture prices

oI grains. Thus, Iorward contracts have existed Ior centuries Ior hedging price risk.

The Iirst organized commodity exchange came into existence in the early 1700`s in Japan. The

Iirst Iormal commodities exchange, the Chicago Board of Trade CBOT), was Iormed in 1848

in the US to deal with the problem oI credit risk` and to provide centralized location to negotiate

Iorward contracts. From Iorward` trading in commodities emerged the commodity Iutures`.

The Iirst type oI Iutures contract was called to arrive at`. Trading in Iutures began on the CBOT

in the 1860`s. In 1865, CBOT listed the Iirst exchange traded` derivatives contract, known as

the Iutures contracts. Futures trading grew out oI the need Ior hedging the price risk involved in

many commercial operations. The Chicago Mercantile Exchange CME), a spin-oII oI CBOT,

was Iormed in 1919, though it did exist beIore in 1874 under the names oI Chicago Produce

Exchange` CPE) and Chicago Egg and Butter Board` CEBB).

The Iirst Iinancial Iutures to emerge were the currency in 1972 in the US. The Iirst Ioreign

currency Iutures were traded on May 16, 1972, on International Monetary Market (IMM), a

division oI CME. The currency Iutures traded on the IMM are the British Pound, the Canadian

Dollar, the Japanese Yen, the Swiss Franc, the German Mark, the Australian Dollar, and the Euro

dollar. Currency Iutures were Iollowed soon by interest rate Iutures. Interest rate Iutures

contracts were traded Ior the Iirst time on the CBOT on October 20, 1975. Stock index Iutures

and options emerged in 1982. The Iirst stock index Iutures contracts were traded on Kansas City

Board oI Trade on February 24, 1982.The Iirst oI the several networks, which oIIered a trading

Shri S.V. Patel College oI Computer Science & Business Management

link between two exchanges, was Iormed between the Singapore International Monetary

Exchange SIMEX) and the CME on September 7, 198.

Options are as old as Iutures. Their history also dates back to ancient Greece and Rome. Options

are very popular with speculators in the tulip craze oI seventeenth century Holland. Tulips, the

brightly coloured Ilowers, were a symbol oI aIIluence; owing to a high demand, tulip bulb prices

shot up. Dutch growers and dealers traded in tulip bulb options. There was so much speculation

that people even mortgaged their homes and businesses. These speculators were wiped out when

the tulip craze collapsed in 1637 as there was no mechanism to guarantee the perIormance oI the

option terms.

The Iirst call and put options were invented by an American Iinancier, Russell Sage, in 1872.

These options were traded over the counter. Agricultural commodities options were traded in the

nineteenth century in England and the US. Options on shares were available in the US on the

over the counter OTC) market only until 1973 without much knowledge oI valuation. A group

oI Iirms known as Put and Call brokers and Dealer`s Association was set up in early 1900`s to

provide a mechanism Ior bringing buyers and sellers together.

On April , 197, the Chicago Board options Exchange CBOE) was set up at CBOT Ior the

purpose oI trading stock options. It was in 1973 again that black, Merton, and Scholes invented

the Iamous Black-Scholes Option Formula. This model helped in assessing the Iair price oI an

option which led to an increased interest in trading oI options. With the options markets

becoming increasingly popular, the American Stock Exchange AMEX) and the Philadelphia

Stock Exchange PHLX) began trading in options in 1975.

The market Ior Iutures and options grew at a rapid pace in the eighties and nineties. The collapse

oI the Bretton Woods regime oI Iixed parties and the introduction oI Iloating rates Ior currencies

in the international Iinancial markets paved the way Ior development oI a number oI Iinancial

derivatives which served as eIIective risk management tools to cope with market uncertainties.

Shri S.V. Patel College oI Computer Science & Business Management

The CBOT and the CME are two largest Iinancial exchanges in the world on which Iutures

contracts are traded. The CBOT now oIIers 48 Iutures and option contracts (with the annual

volume at more than 211 million in 2001).The CBOE is the largest exchange Ior trading stock

options. The CBOE trades options on the S&P 100 and the S&P 500 stock indices. The

Philadelphia Stock Exchange is the premier exchange Ior trading Ioreign options.

The most traded stock indices include S&P 500, the Dow Jones Industrial Average, the Nasdaq

100, and the Nikkei 225. The US indices and the Nikkei 225 trade almost round the clock. The

N225 is also traded on the Chicago Mercantile Exchange.

Shri S.V. Patel College oI Computer Science & Business Management

Derivative Market in India

The Iirst step towards introduction oI derivatives trading in India was the promulgation oI the

Securities Laws Ordinance, 1995, which withdrew the prohibition on options in securities. The

market Ior derivatives however did not take oII as there was no regulatory Iramework to govern

trading oI derivatives. SEBI set up a 24-member committee under the Chairmanship oI Dr. L.C.

Gupta on November 18, 1996 to develop appropriate regulatory Iramework oI derivatives trading

in India. The committee submitted its report on March 17, 1998 prescribing necessary pre

conditions Ior introduction oI derivatives trading in India.

The committee recommended that derivatives should be declared as 'securities` so that

regulatory Iramework applicable to trading oI securities` could also govern trading oI securities.

SEBI also set up a group in June 1998 under the Chairmanship oI ProI J.R. Varma, to

recommend measures Ior risk containment in derivatives market in India. The report which was

submitted in October 1998, worked out the operational details oI margining system methodology

Ior charging initial margins, broker net worth deposit requirement and real time monitoring

requirements.

The SCRA was amended in December 1999 to include derivatives within the ambit oI

securities` and the regulatory Iramework were developed Ior governing derivatives trading. The

act also made it clear that derivatives shall be legal and valid only iI such contracts are traded on

a recognized stock exchange thus precluding OTC derivatives. The government also reclined in

March 2000 the three-decade-old notiIication, which prohibited Iorward trading in securities.

Derivatives trading commenced in India in June 2000 aIter SEBI granted the Iinal approval to

this eIIect in May 2000. SEBI permitted the derivative segments oI two stock exchanges NSE

and BSE and their clearing House Corporation to commence trading and settlement in approved

derivatives contracts to begin with SEBI approved trading in index Iutures contracts based on

S&P CNX NiIty and BSE-30 (Sensex) index. This was Iollowed by approval Ior trading inn

options based on theses tow indexes options on individual securities. The trading in index

options commenced June 2001 and the trading in options on individual securities commenced in

July 2001. Futures contracts on individual stocks were launched in November 2001. Trading and

Shri S.V. Patel College oI Computer Science & Business Management

settlement in derivative contract is done in accordance with the rules, bye laws and regulations oI

the respective exchanges ands their clearing house corporation duly approved by SEBI and

notiIied in the oIIicial gazette.

1991

Liberalisation process initiated.

14 December 1995 NSE asked SEBI Ior permission to trade index

Iutures.

18 November 1996 SEBI setup L.C.Gupta Committee to draIt a

policy Iramework Ior index Iutures.

11 May 1998 L.C.Gupta Committee submitted report.

7 July 1999

RBI gave permission Ior OTC Iorward rate

agreements (FRAs) and interest rate swaps.

24 May 2000

SIMEX chose NiIty Ior trading Iutures and

options on an Indian index.

25 May 2000

SEBI gave permission to NSE and BSE to do

index Iutures trading.

9 June 2000

Trading oI BSE Sensex Iutures commenced at

BSE.

12 June 2000 Trading oI NiIty Iutures commenced at NSE.

25 September 2000 NiIty Iutures trading commenced at SGX.

2 June 2001 Individual Stock Options & Derivatives

Shri S.V. Patel College oI Computer Science & Business Management

Recommendations of L.C.Gupta Committee on Derivatives

The committee was set up by SEBI in November 1996 to develop the appropriate regulatory

Iramework Ior the derivatives trading in India. The committee concern was with the Iinancial

derivatives in general and in particular about the equity derivatives. The committee consisted oI

24 members which were Irom various Iields oI Iinancial sector. The Iollowing were the main

recommendations oI the committee:

1. The committee strong Iavored the introduction oI the derivatives trading in India with a view

to provide the hedging to the institutions and the general investors.

. The committee recommended that there should be two level oI regulatory Iramework, one is

at the exchange level and the second level is that oI the SEBI level.

. The committee observed that the regulation oI SEBI was oI overlapping nature and that they

should be studied in detail and then made applicable to the derivatives segment.

. The committee observed that Mutual Iunds which are the big players in the capital market

should be allowed to work in the derivatives segment but made it clear that they can use the

derivatives market only Ior the purpose oI hedging and not Ior speculation.

. The committee Iavored the introduction oI the simple variants oI the derivatives Iirst so that

the market players can understand the product and then proceed with the gradual introduction

oI the complex products oI derivatives.

. The committee Iurther recommended that 'derivatives to be included in the deIinition oI

securities under the Securities Contract Regulations Act (SCRA) to enable the trading in

derivatives in its products oI options and Iutures.

Shri S.V. Patel College oI Computer Science & Business Management

Introduction to Forward Contract

A Iorward contract is an agreement to buy or sell an asset on a speciIied date Ior a speciIied

price. One oI the parties to the contract assumes a long position and agrees to buy the

underlying asset on a certain speciIied Iuture date Ior a certain speciIied price. The other party

assumes a short position and agrees to sell the asset on the same date Ior the same price. Other

contract details like delivery date, price and quantity are negotiated bilaterally by the parties to

the contract. The Iorward contracts are normally traded outside the exchanges.

The salient features of forward contracts are:

O They are bilateral contracts and hence exposed to counter-party risk.

O Each contract is custom designed, and hence is unique in terms oI contract size, expiration date

and the asset type and quality.

O The contract price is generally not available in public domain.

O On the expiration date, the contract has to be settled by delivery oI the asset.

O II the party wishes to reverse the contract, it has to compulsorily go to the same counter-party,

which oIten results in high prices being charged.

However Iorward contract in certain markets have become very standardized as in the case oI

Ioreign exchange thereby reducing transaction costs and increasing transaction volume. This

process oI standardization reaches its limit in the organized Iutures market.

Forward contract are very useIul heeding and speculation. The classic hedging application would

be that oI an exporter who expects to receive payment in dollar three months later. He is exposed

to the risk oI exchange rate Iluctuations. By using the currency Iorward market to sell dollars

Iorward he can lock on to a rate today and reduce his uncertainty. Similarly an importer who is

Shri S.V. Patel College oI Computer Science & Business Management

required to make a payment in dollars two months hence can reduce his exposure to exchange

rate Iluctuations by buying dollars Iorward.

II a speculator has inIormation or analysis, which Iorecasts an upturn in a price then he can go

long on the Iorward market instead oI the cash market. The speculator would go long on the

Iorward, wait Ior the price to raise and then take a reversing transaction to book proIits.

Speculators may well be required to deposit a margin upIront. Hoverer this is generally a

relatively small proportion oI the value oI the assets underlying the Iorward contract. The use oI

Iorward markets here supplies leverage to the speculator.

Limitations of Forward Markets

O Lack oI centralization oI trading

O Liquidity and

O Counter party risk.

In the Iirst two oI these the basic problem is that oI too much Ilexibility and generally. The

Iorward markets like a real estate market in that any two consenting adults can Iorm contracts

against each other. This oIten makes them design terms oI the deal which are very convenient

that speciIic situation, but makes the contract non tradable.

Counter party risk arises Irom the possibility oI deIault by nay on party to the transactions. When

one oI the two sides to the transaction declares bankruptcy the other suIIers. Even when Iorward

markets trade standardized contracts and hence avoid the problem oI illiquidity, still the counter

party risk remains a very serious issue.

Shri S.V. Patel College oI Computer Science & Business Management

Introduction to Futures

Futures markets were designed to solve the problems that exist in Iorward markets. A Iutures

contract is an agreement between two parties to buy or sell an asset at a certain time in the Iuture

at a certain price. But unlike Iorward contracts the Iutures contracts are standardized and

exchange traded. To Iacilitate liquidity in the Iutures contracts, the exchange speciIies certain

standard Ieatures oI the contract. It is a standardized contract with standard underlying

instrument a standard quantity and quality oI the underlying instrument that can be delivered,

(which can be used Ior reIerence purposes in settlement) and a standard timing oI such

settlement. A Iutures contract may be oIIset prior to maturity by entering into an equal and

opposite transaction. More than 99 oI Iutures transactions are oIIset this way.

The standardized items in Iutures contract are;

O "uantity oI the underlying

O "uality oI the underlying

The Iirst exchange that traded Iinancial derivatives was launched in Chicago in the year1972. A

division iI the Chicago Mercantile exchanges it was called the International Monetary Market

IMM) and traded currency Iutures.

The brain behind this was a man called Leo Melamed acknowledged as the Father oI Iinancial

Iutures who was then the Chairman oI the Chicago Mercantile Exchange.

Future Terminology

Spot price: The price at which an asset trades in the spot market.

Future price: The price at which the Iuture contract trades in the Iutures market.

Shri S.V. Patel College oI Computer Science & Business Management

Contract cycle: The period over which a contract trades. The index Iutures contacts on the NSE

have one month, two months and three months expiry cycle s, which expire on the last Thursday

oI the month. Thus a January expiration contract expires on the last Thursday oI January and

February expiration contract ceases trading on the last Thursday oI February. On the Friday

Iollowing the last Thursday a new contract having a three-month expiry is introduced Ior trading.

Expiry date: It is the date speciIied in the Iutures contract. This is the last day on which the

contract will be traded, at the end oI which it will cease to exist.

Contract size: The amount oI asset that has to be delivered under on contract. For instance, the

contract size on NSE`s Iutures markets is 200 NiIties.

Basis: In the context oI Iinancial Iutures, basis can be deIined as the Iutures price minus the spot

price. The will be d diIIerent basis Ior each delivery month Ior each contract. In a normal market,

basis will be positive. This reIlects that Iutures prices normally exceed spot prices.

Cost of carry: The relationship between Iutures prices and spot prices can be summarized in

terms oI what is known as the cost oI carry. This measures the storage cost plus the interest that

is paid to Iinance the asset less the income earned on the asset.

Initial margin: The amount that must be deposited in the margin account at the time a Iuture a

contract is Iirst entered into is known as initial margin.

Mark to market: In the Iutures market at the end oI each trading day the margin account

adjusted to reIlect the investor gain or loss depending upon the Iutures closing price. This is

called mark to market.

Maintenance margin:This is somewhat lower than the initial margin. This is set to ensure that

the balance in the margin account never becomes negative. II the balance in the margin account

Shri S.V. Patel College oI Computer Science & Business Management

Ialls below the maintenance margin the investor receives a margin call and is expected to top up

the margin account to the initial margin level beIore trading commences on the next day.

Distinction between Futures and Forwards Contracts

FEATURES FORWARD CONTRACT FUTURE CONTRACT

Operational Mechanism

Traded directly between two

parties (not traded on the

exchanges).

Traded on the exchanges.

Contract Specifications

DiIIer Irom trade to trade.

Contracts are standardized

contracts.

Counter-party risk Exists.

Exists.

However, assumed by the

clearing corp., which becomes

the counter party to all the

trades or unconditionally

guarantees their settlement.

Liquidation Profile

Low, as contracts are tailor

made contracts catering to the

needs oI the needs oI the

parties.

High, as contracts are

standardized exchange traded

contracts.

Price discovery

Not eIIicient, as markets are

scattered.

EIIicient, as markets are

centralized and all buyers and

sellers come to a common

platIorm to discover the price.

Examples

Currency market in India.

Commodities, Iutures, Index

Futures and Individual stock

Futures in India

Shri S.V. Patel College oI Computer Science & Business Management

Introduction to Options

A derivative transaction that gives the option holder the right but not the obligation to buy or sell

the underlying asset at a price, called the strike price, during a period or on a speciIic date in

exchange Ior payment oI a premium is known as option`. Underlying asset reIers to any asset

that is traded. The price at which the underlying is traded is called the strike price`.

There are two types oI options i.e., CALL OPTION & PUT OPTION.

Call Option

A contract that gives its owner the right but not the obligation to buy an underlying asset- stock

or any Iinancial asset, at a speciIied price on or beIore a speciIied date is known as a Call

option`. The owner makes a proIit provided he sells at a higher current price and buys at a lower

Iuture price.

Put Option

A contract that gives its owner the right but not the obligation to sell an underlying asset- stock

or any Iinancial asset, at a speciIied price on or beIore a speciIied date is known as a Put

option`. The owner makes a proIit provided he buys at a lower current price and sells at a higher

Iuture price. Hence, no option will be exercised iI the Iuture price does not increase.

Put and calls are almost always written on equities, although occasionally preIerence shares,

bonds and warrants become the subject oI options.

Option Terminology

Index options: Theses options have the index as the underlying some options are European

while others are American like index Iutures contract index options contracts are also cash

settled.

Stock options: Stock options are options on individual stock. Options currently trade on over

500 stocks in Untied States. A contract gives the holder the right to buy or sell shares at the

speciIied price.

Shri S.V. Patel College oI Computer Science & Business Management

Buyer of an option: The buyer oI an option is the one who by paying the options premium buys

the right but not the obligation to exercise his options on the seller writers.

Writer of an option: The writer oI a call put options is the one who receives the options

premium ands is there by obliged to sell buy the asset iI the buyer exercises on him.

Option price: Option price is the price, which the option buyer pays to the option seller. It is

also reIerred to as the option premium.

Expiration date: The date speciIied in the options contract is known as the expiration date the

exercise date, the strike date or the maturity

Strike price: The price speciIied in the options contract is known as the strike price or the

exercise price.

American options: American options are options that can be exercised at any time up to the

expiration date most exchange-traded options are American.

European options: European options are options that can be exercised only on the expiration

date itselI. Index options are European options.

In The Money option: An In The Money (ITM) option is an option that would lead to a positive

cash Ilow to the holder iI the were exercised immediately a call option on the index is said to be

in the money when the current index stand at la level higher than the strike price is spot price

strike price. II the index is much higher than the strike price, the call is said to be deep ITM. In

the case oI a put, the put is ITM iI the index is below the strike price.

At The Money option: An At the Money (ATM) option is an option that would lead to zero

cash Ilow iI it were exercised immediately. An option on the index is at the money when the

current index equals the strike price (I.E. spot pricestrike price).

Shri S.V. Patel College oI Computer Science & Business Management

Out of The Money option: An Out oI The Money (OTM) option is an option that would lead to

a negative cash Ilow it was exercised immediately. A call option on the index is out oI the money

when the current index stands at a level, which is less than the strike price. I.e. spot priceStrike

price. II the index is much lower than the strike price the call is said to be deep OTM. In the case

oI a put the put is OTM iI the index is above the strike price.

Intrinsic value of an option: The option premium can be broken down into two components

intrinsic value a time value. The intrinsic value oI a call is the mount the option is ITM iI it is

ITM. II the call is OTM, its intrinsic value is zero. Putting it another way the intrinsic value oI a

call is Max O, St-K), which means the intrinsic value oI call is the greater oI O or St) K is the

strike priced St is the spot price.

Time value of an option: The time value oI an option is the diIIerence between its premium

and its intrinsic value. Both calls and puts have time value an option OTM or ATM has only time

value. Usually the maximum time value exists when the options Atm. The longer the time to

expiration the greater is an options time value alleles` equal at expiration an option should have

no time value.

Shri S.V. Patel College oI Computer Science & Business Management

Pricing of futures

Pricing oI a Iuture contract is very simple. Using the cost-oI-carry logic, we calculate the Iair

value oI the Iuture contract. Every time the observed price deviates Irom the Iair value,

arbitragers would enter into trades to capture the arbitrage proIit. This in turn would push the

Iuture price back to its Iair value. The cost oI carry model used Ior pricing Iuture given below:

F S ` e

rt

Where: F theoretical Iutures price

S value oI the underlying index

r Cost oI Iinancing (using continuously compounded interest rate)

t time till expiration in year

e 2.71828

Example:

Security XYZ Ltd. Trades in the spot market at Rs. 1150. Money can be invested 11 p.a. the

Iair value oI one-month Iuture contract on XYZ is calculated as Iollows:

F S ` e

rt

11`e

.11`1/1

11

Pricing of Options

An option gives the buyer a right but not an obligation to exercise on the seller. The worst that

can happen to a buyer is the loss oI the premium paid by him. His down side is limited to this

premium, but his upside is potentially unlimited. This optionality is precious and has a value,

which is expressed in term oI an option price. Just like in order Iree market, it is the supply and

demand in the secondary market that drives the price oI an option.

Shri S.V. Patel College oI Computer Science & Business Management

There are various models which help us get close to the true price oI an option. Most oI these are

variants oI the celebrated Black-Scholes model Ior pricing European options. Today most

calculators and spread-sheets come with a built-in Black-Scholes options pricing Iormula.

The Black-Scholes Iormulas Ior the prices oI European calls and puts on a non-dividend paying

stock are:

C SN d

1

) - Xe

-rT

N d

)

P Xe

-rT

N -d

) - SN -d

1

)

Where d

1

ln S/X + r + 9

/) T

d

d

1

- 9bT

O The Black-Scholes equation is done in continuous time. This required continuous

compounding. Example: iI the interest rate per annum is 12 , you need to use ln 1.12.

O N () is the cumulative normal distribution. N(d

1

) is called the delta oI the option which is a

measure oI change in option price with respect to change in the price oI the underlying

assets.

O 9 a measure oI volatility is the annualized standard deviation oI continuously compounded

returns on the underlying. When daily sigma is given, that need to be converted into

annualized sigma.

O Sigma

annual

Sigma

daily

*

b Number oI trading days per year. On an average there are 250

trading days in a year.

O X is the exercise price, S the spot price and T the time to expiration measured in a year.

Shri S.V. Patel College oI Computer Science & Business Management

Clearing & Settlement

National Securities Corporation Limited (NSCCL) undertakes clearing and settlement oI all

trades executed on the Iutures and options (F&O) segment oI the NSE. It also acts as legal

counter party to all trades on the F&O segment and guarantees their Iinancial settlement.

1. Clearing Banks

NSCCL has empanelled 13 clearing banks namely Axis Bank Ltd., Bank oI India, Canara Bank,

Citibank N.A, HDFC Bank, Hongkong & Shanghai Banking Corporation Ltd., ICICI Bank, IDBI

Bank, IndusInd Bank, Kotak Mahindra Bank, Standard Chartered Bank, State Bank oI India and

Union Bank oI India.

Every Clearing Member is required to maintain and operate clearing accounts with any oI the

empanelled clearing banks at the designated clearing bank branches. The clearing accounts are to

be used exclusively Ior clearing & settlement operations.

. Clearing Members

A Clearing Member (CM) oI NSCCL has the responsibility oI clearing and settlement oI all

deals executed by Trading Members (TM) on NSE, who clear and settle such deals through

them. Primarily, the CM perIorms the Iollowing Iunctions:

Clearing: Computing obligations oI all his TM's i.e. determining positions to settle.

Settlement: PerIorming actual settlement. Only Iunds settlement is allowed at present in Index

as well as Stock Iutures and options contracts

Risk Management: Setting position limits based on upIront deposits / margins Ior each TM and

monitoring positions on a continuous basis.

Shri S.V. Patel College oI Computer Science & Business Management

Types of Clearing Members

O Trading Member-Clearing Member TM-CM)

A Clearing Member who is also a TM. Such CMs may clear and settle their own proprietary

trades, their clients` trades as well as trades oI other TM`s & Custodial Participants.

O Professional Clearing Member PCM)

A CM who is not a TM. Typically banks or custodians could become a PCM and clear and settle

Ior TM`s as well as oI the Custodial Participants

O Self Clearing Member SCM)

A Clearing Member who is also a TM. Such CMs may clear and settle only their own proprietary

trades and their clients` trades but cannot clear and settle trades oI other TM`s.

Clearing Member Eligibility Norms

O Net worth oI at least Rs.300 lakhs. The net worth requirement Ior a CM who clears and

settles only deals executed by him is Rs. 100 lakhs.

O Deposit oI Rs. 50 lakhs to NSCCL which Iorms part oI the security deposit oI the CM.

O Additional incremental deposits oI Rs.10 lakhs to NSCCL Ior each additional TM in case the

CM undertakes to clear and settle deals Ior other TMs.

. Clearing Mechanism

The clearing mechanism essentially involves working out open positions and obligations oI

clearing (selI-clearing/trading-cum-clearing/proIessional clearing) members. This position is

considered Ior exposure and daily margin purpose. The open positions oI CMs are arrived at by

aggregating the open positions oI all the TMs and all custodial participants clearing through him,

in contracts in which they have traded. A TMs open position is arrived at as the summation oI his

Shri S.V. Patel College oI Computer Science & Business Management

proprietary open position and clients open positions in the contracts in which he has traded.

While entering orders on the trading system, TMs are required to identity the orders, whether

proprietary (iI they are their own trades) or client (iI entered on behalI oI clients) through

Pro/Cli` indicator provided in the order entry screen. Proprietary positions are calculated on the

basis (buy-sell) Ior each contract. Clients` positions are arrived a by summing together net (buy

sell) positions oI each individual client. A TMs open position is the sum oI proprietary open

position, client open long position and client open short position.

1. Proprietary position of trading member Madanbhai on day 1

Trading member Madanbhai trades in the Iutures & options segment Ior himselI and two oI his

clients. The table shows his proprietary position.

Note: A buy position 2001000` means 200 units bought at the rate oI Rs.1000.

Trading member Madanbhai

Buy Sell

Proprietary positions 2001000 4001010

. Client position of trading member Madanbhai on day 1

Trading member Madanbhai trades in the Iutures & options segment Ior himselI and two oI his

clients. The table shows his clients positions.

Trading member Madanbhai

Buy Open Sell Close Sell Open Buy Close

Client position

Client A 4001109 2001000

Client B 6001100 2001099

Shri S.V. Patel College oI Computer Science & Business Management

. Proprietary position of trading member Madanbhai on Day

Assume that the position on Day 1 is carried Iorward to the next trading day and the Iollowing

trades are also executed.

Trading member Madanbhai

Buy Sell

Proprietary positions 2001000 4001010

. Client position of trading member Madanbhai on day

Trading member Madanbhai trades in the Iutures and options segment Ior himselI and two oI his

clients. The table shows his client position on Day 2

Trading member Madanbhai

The proprietary open position on day 1 is simply Buy - Sell - short. The

open position Ior client A Buy O) - Sell C) - long, i.e. he has a long

position oI 200 units. The open position Ior Client B shell O) - Buy C) -

short, i.e. he has a short position oI 400 units. Now the total open position oI the trading member

Madanbhai at end on day 1 is 200 (his proprietary open position on net basis) plus 600 (the

Client open positions on gross basis) i.e. 800.

The proprietary open position at end oI day 1 is 200 short. The end oI day open position Ior

proprietary trades undertaken on day 2 is 200 short. Hence the net open proprietary position at

the end oI day 2 is 400 short. Similarly, Client A`s open position at the end oI day 1 is 200 long.

The end oI day open position Ior trades done by Client A on day2 is 200 long. Hence the net

open position Ior Client A at the end oI day 2 is 400 long. Client B`s open position at the end oI

Buy Open Sell Close Sell Open Buy Close

Client position

Client A 4001109 2001000

Client B 6001100 4001099

Shri S.V. Patel College oI Computer Science & Business Management

day 1 is 400 short. The end oI day open position Ior trades done by Client B on day 2 is 200

short. Hence the net open position Ior Client B at the end oI day 2 is 600 short. The net open

position Ior the trading member at the end oI day 2 is sum oI the proprietary open position and

client open positions. It worked out to be 400 400 600, i.e. 1400.

. Settlement Schedule

The settlement oI trades is on T1 working day basis.

Members with a Iunds pay-in obligation are required to have clear Iunds in their primary clearing

account on or beIore 10.30 a.m. on the settlement day. The payout oI Iunds is credited to the

primary clearing account oI the members thereaIter.

. Settlement Price

Product Settlement Schedule

Futures Contracts

on Index or

Individual Security

Daily

Settlement

Closing price oI the Iutures contracts on the trading

day. (closing price Ior a Iutures contract shall be

calculated on the basis oI the last halI an hour

weighted average price oI such contract)

Un-expired illiquid

Iutures contracts

Daily

Settlement

Theoretical Price computed as per Iormula FS * ert

Futures Contracts

on Index or

Individual

Securities

Final

Settlement

Closing price oI the relevant underlying index /

security in the Capital Market segment oI NSE, on

the last trading day oI the Iutures contracts.

Options Contracts

on Index and

Individual

Securities

Final Exercise

Settlement

Closing price oI such underlying security (or index)

on the last trading day oI the options contract.

Shri S.V. Patel College oI Computer Science & Business Management

. Settlement Mechanism

The entire Iuture and option contract are cash settled, i.e. through exchange oI cash. The

underlying Ior index Iuture/option oI the niIty index cannot be delivered. These contracts,

thereIore, have to be settled in cash. Future and option on individual securities can be delivered

as in the spot market. However, it has been currently mandated that stock option and Iuture

would also be cash settled. The settlement amount Ior a CM is netted across all their TMs/clients,

with respect to their obligations on MTM, premium and exercise settlement.

Settlement of future contract

Future contract have two types oI settlements, the MTM settlement which happen on a

continuous basis at the end oI each day, and the Iinal settlement which happens on the last

trading day oI the Iuture contract.

MTM settlement

All Iuture contracts Ior each member are marked-to-market (MTM) to the daily settlement price

oI the relevant Iutures contract at the end oI each day. The proIit or losses are computed as the

diIIerence between:

1. The trade price and the day`s settlement price Ior contracts executed during the day but not

squared up.

2. The previous day`s settlement price and the current day`s settlement price Ior bought

Iorward contract.

3. The buy price and the sell price Ior contracts executed during the day and squared up.

F S ` e

rt

Where: F theoretical Iutures price

S value oI the underlying index

r rate oI interest (MIBOR)

t time to expiration

e 2.71828

Shri S.V. Patel College oI Computer Science & Business Management

Final settlement for futures

On the expiry day oI the Iuture contracts, aIter the close oI the trading hours, NSCCL marks all

positions oI a CM to the Iinal settlement price and the resulting proIit or loss is settled in cash.

Final settlement proIit or loss amount is debited or credited to the relevant CM`s clearing bank

account on the day Iollowing expiry day oI the contract.

Settlement of future contract

Option contracts have three types oI settlements, daily premium settlement, exercise settlement,

interim exercise settlement in case oI option contracts on securities and Iinal settlement.

Daily premium settlement

Buyer oI an option is obligated to pay the premium towards the options purchased by him.

Similarly, the seller oI an option is entitled to receive the premium Ior the option sold by him.

The premium payable amount and the premium receivable amount are netted to compute the net

premium payable or receivable amount Ior each client Ior each option contract.

Exercise settlement

Although most option buyer and seller close out their options positions by an oIIsetting closing

transaction, an understanding oI exercise can help an option buyer determine whether exercise

might be more advantageous than an oIIsetting sale oI an option. There is always a possibility oI

an option seller being assigned an exercise. Once an exercise oI an option has been assigned to

an option seller, the option seller is bound to IulIill his obligation (meaning, pay the cash

settlement amount in the case oI cash-settled option) even though he may not yet have been

notiIied oI the assignment.

Interim exercise settlement

Interim exercise settlement takes place only Ior option contracts on securities. An investor can

exercise his in-the-money options at any time during trading hours, through his trading member.

Interim exercise settlement is eIIected Ior such options at the close oI the trading hours, on the

day oI exercise. Valid exercised option contract are assigned to short position in the option

Shri S.V. Patel College oI Computer Science & Business Management

contract with the same series (i.e. having the same underlying, same expiry date and same strike

price), on a random basis, at the client level. The CM who has exercised the option receives the

exercise settlement value per unit oI the option Irom the CM who has been assigned the option

contract.

Final exercise settlement

Final exercise settlement is eIIected Ior all open long in-the-money strike price options existing

at the close oI trading hours, on the expiration day oI the option contract. All such long positions

are exercised and automatically assigned to short positions in option contract with the same

series, on a random basis. The investor who ha long in the money options on the expiry date will

receive the exercise settlement value per unit oI the option Irom the investor who has been

assigned the option contract.

. Settlement Procedure

Clearing members who opt to pay the Daily MTM settlement on a T0 basis would compute

such settlement amounts on a daily basis and make the amount oI Iunds available in their

clearing account beIore the end oI day on T0 day. Failure to do so would tantamount to non

payment oI daily MTM settlement on a T0 bases. Further, partial payment oI daily MTM

settlement would also be considered as non payment oI daily MTM settlement on a T0 basis.

These would be construed as non compliance and penalties applicable Ior Iund shortages Irom

time to time would be levied.

A penalty oI 0.07 oI the margin amount at end oI day on T0 would be levied on the clearing

members. Further, the beneIit oI scaled down margins shall not be available in case oI non

payment oI daily MTM settlement on a T0 basis Irom the day oI such deIault to the end oI the

relevant quarter.

Shri S.V. Patel College oI Computer Science & Business Management

Basic Pay-off

Option pays-offs

1. Pay-off for Buyer of call option

Pay-oII diagram below represents the eIIective pay-oII oI a long call position oI an option at the

time oI the expiry date. It looks at the option Irom the point oI view oI buyer.

The Iigure shows the proIits or losses Ior the buyer oI the call option oI NiIty at the strike oI

6000. As can be seen, as the spot NiIty raises, the call option in in-the-money. It will generate

positive cash Ilow and the investor will get proIit to the extent oI the diIIerence between the spot

and the strike price.

However iI niIty Ialls below the strike price oI 6000, he let the option expire. His losses are

limited to the extent oI the premium he paid Ior buying the option.

. Pay-off for writer of call option

Option seller has limited proIit potential and potentially unlimited risk. Pay-oII diagram below

represents the eIIective pay-oII oI a short call position oI an option at the time oI the expiry date.

It looks at the option Irom the point oI view oI seller.

rof|t

Loss

N|fty

Shri S.V. Patel College oI Computer Science & Business Management

The Iigure shows the proIits or losses Ior the seller oI NiIty 6000 call option. As the spot NiIty

rises, the call option is in-the-money and the writer starts making losses. II NiIty closes above the

strike oI 6000, the buyer would exercise his option on the writer who would suIIer a loss to the

extent oI the diIIerence between the NiIty close and the strike price.

The loss that can be incurred by the writer oI the option is potentially unlimited; whereas the

maximum proIit is limited to the extent oI the up-Iront option premium is charged by him.

. Pay-off for buyer of put option

Loss

N|fty

Loss

N|fty

rof|t

rof|t

Shri S.V. Patel College oI Computer Science & Business Management

The Iigure shows the proIits or losses Ior the buyer oI a NiIty 6000 put option. As can be seen, as

the spot NiIty Ialls, the put option in-the-money. II NiIty closes below the strike oI 6000, the

buyer would exercise his option and proIit to the extent oI the diIIerence between the strike price

and NiIty-close. The proIit possible on this option can be high as the strike price.

However iI niIty rises above the strike price oI 6000, he let the option expire. His losses are

limited to the extent oI the premium he paid Ior buying the option.

. Pay-off for writer of put option

The Iigure shows the proIits or losses Ior the seller oI a NiIty 6000 put option. As can be seen,

as the spot NiIty Ialls, the put option in-the-money and the writer starts making losses. II NiIty

closes below the strike oI 6000, the buyer would exercise his option on the writer who would

suIIer a loss to the extent oI the diIIerence between the strike price and NiIty-close.

The loss can be incurred by the writer oI the option is a maximum extent oI the strike price

whereas the maximum proIit is limited to the extent oI the up-Iront option premium is charged

by him.

Loss

N|fty

rof|t

Shri S.V. Patel College oI Computer Science & Business Management

Future pay-offs

1. Payoff for a buyer of the Nifty future

The Iigure shows the proIit or loss Ior a long Iuture position. The investors buy Iutures when the

index was at 5800. II the index goes up, his Iuture position starts making proIit. II index Ialls, his

Iuture position starts showing losses.

. Payoff for a Seller of the Nifty future

1111

rof|t

Loss

N|fty

rof|t

Loss

N|fty

Shri S.V. Patel College oI Computer Science & Business Management

The Iigure shows the proIit or loss Ior a short Iuture position. The investors sold Iutures when the

index was at 5800. II the index goes down, his Iuture position starts making proIit. II index rises,

his Iuture position starts showing losses.

Shri S.V. Patel College oI Computer Science & Business Management

Trading in Derivative

Future and Option trading system

The Iutures and options trading system oI NSE, called NEAT-F&O trading system, provides a

Iully automated screen based trading Ior NiIty Iutures and options and stock Iutures and options

on a nation wide basis as well as an online monitoring and surveillance mechanism. It supports

an order driven market and provides complete transparency oI trading operations. It is similar to

that oI trading oI equities in the cash market segment.

The soItware Ior the F&O market has been developed to Iacilitate eIIicient and transparent

trading in Iutures and options instruments. Keeping in view the Iamiliarity oI trading members

with the current capital market trading system, modiIications have been perIormed in the existing

capital market trading system so as to make it suitable Ior trading Iutures and options.

Entities in the trading system

There are Iour entities in the trading system. Trading members, clearing members, proIessional

clearing members and participants.

. Trading members

Trading members are members oI NSE. They can trade either on their own account or on behalI

oI their clients including participants. The exchange assigns a trading member ID to each

trading member. Each member can have more than one use. The number oI users allowed Ior

each trading member is notiIied by the exchange Irom time to time. Each user oI a trading

member must be registered with the exchange and is assigned a unique user ID. The unique

trading member ID Iunctions as a reIerence Ior all orders, trades oI diIIerent users. This ID is

Shri S.V. Patel College oI Computer Science & Business Management

common Ior all users oI a particular trading member. It is the responsibility oI the trading

member to maintain adequate control over persons having access to the Iirms User ID.

. Clearing members

Clearing members are members oI NSCCL. They carry out risk management activities and

conIirmation inquiry oI trades through the trading system.

7. Professional clearing members

A proIessional clearing members is a clearing member who is not a trading member. Typically

banks and custodian become proIessional clearing members and clear and settle Ior their trading

members.

8. Participants

A participant is a client oI trading members like Iinancial institutions. These clients may trade

through multiple trading members but settle through a single clearing member.

Corporate hierarchy

In the F&O trading soItware, a trading member has the Iacility oI deIining a hierarchy amongst

users oI the system. This hierarchy comprises corporate manager, branch manager and dealer.

1. Corporate manager

The term Corporate manager` is assigned to a user placed at the highest level in a trading Iirm.

Such a user can perIorm all the Iunctions such as order and trade related activities, receiving

reports Ior all branches oI the trading member Iirm and also all dealers oI the Iirm. Additionally,

Shri S.V. Patel College oI Computer Science & Business Management

a corporate manager can deIine exposure limits Ior the branches oI the Iirm. This Iacility is

available only to the corporate manager.

. Branch manager

The branch manager is a term assigned to a user who is placed under the corporate manager.

Such a user can perIorm and view order and trade related activities Ior all dealers under that

branch.

. Dealer

Dealers are users at the lower most level oI the hierarchy. A Dealer can perIorm view order and

trade related activities only Ior one selI and dose not have access to inIormation on other dealers

under either the same branch or other branches.

Order types and conditions

The system allows the trading members to enter orders with various conditions attached to them

as per their requirements. These conditions are broadly divided into the Iollowing categories;

1. Time conditions

. Price conditions

. Other conditions

Several combinations oI the above are allowed thereby providing enormous Ilexibility to the

uses. The order types and conditions are given below.

1. Time conditions

Day order

A day order, as the name suggest is an order which is valid Ior the day on which it is entered. II

the order is not executed during the day, the system cancels the order automatically at the end oI

the day.

Shri S.V. Patel College oI Computer Science & Business Management

Immediate or Cancel IOC)

An IOC order allows the user to buy or sell a contract as soon as the order is released into the

system Iailing which the order is cancelled Irom the system. Partial match is possible Ior the

order, and the unmatched portion oI the order is cancelled immediately.

. Price conditions

Stop loss

This Iacility allows the user to release an order into the system, aIter the market price oI the

security reaches or crosses a threshold price E. G. iI Ior stop loss buy order, the trigger is

1027.00, the limit price is 1030.00, and the market last traded price is 1023.00, then this order is

released into the system once the market price reaches or exceeds 1027.00, This order is added to

the regular lot book with time or triggering as the time stamp as a limit order oI 1030.00. For the

stop loss sell order the trigger price has to be greater than the limit price.

. Other conditions

Market Price

Market orders are orders Ior which no price is speciIied at the time the order is entered i.e. price

is market price} Ior such orders, the system determines the price.

Trigger price

Price at which an order gets triggered Irom the stop loss book.

Limit price

Price oI the orders aIter triggering Irom stop loss book.

Pro

Pro means that the orders are entered on the trading member`s own account.

Shri S.V. Patel College oI Computer Science & Business Management

Cli

Cli means that the trading member enters the orders on behalI oI a client.

Placing order on the trading system

For both the Iuture and the option market, while entering orders on the trading system, members

are required to identiIy order as being proprietary or client order. Proprietary order should be

identiIied as Pro` and those oI client should be identiIied as Cli`. Apart Irom this, in the case oI

Cli` trades, the client account number should also be provided.

Shri S.V. Patel College oI Computer Science & Business Management

Risk Management system of Derivative

Margin system adopted by Exchanges in India

The initial margin is required to be paid by the person taking the risk. However, an option buyer

risk is limited to the amount oI the premium. Thus, as a rule, an option buyer does not pay the

margin. He only pay the premium to the options seller at the time oI buying the option. Options

sellers, Iutures buyers and Iutures sellers have potentially unlimited risk and hence have to pay

the initial margin. Options traders trading in vertical spreads and time spreads have to pay a

much lower margin than normal options writers.

In India, NSE and BSE use the margin system called as the Standardized PortIolio Analysis

(SPAN) developed by the Chicago Mercantile Exchange (CME), Chicago, USA. The objective

oI SPAN is to identiIy the overall risk in a portIolio oI Iutures and options contracts Ior each

member. The system treats Iutures and options contracts uniIormly, while recognizing the non-

linearity oI the payoIIs oI options portIolios and the consequential unique exposures associated

with them. SPAN is used to determine margin requirements. Its main objective is to determine

the largest loss that a portIolio might reasonably suIIer Irom one day to the next.

The underlying market price, the volatility oI the underlying instrument and the time to

expiration are important Iactors that directly aIIect the value oI options at a given point in time.

A change in these Iactors aIIects the value oI the Iutures and options in a portIolio. This system

is scientiIic and takes into consideration traders total long and short positions. It takes into the

market price oI the underlying asset, the volatility o I the underlying asset, and the time to

expiration oI the contract entered into. It also considers whether it is a long or short position.

The options and Iutures portIolio is analyzed as a whole and the net risk taken by the trader is

considered. Thus a naked options seller will have to pay much more margin than a trader who

has short options positions and also long options positions oI a diIIerent strike price.

Shri S.V. Patel College oI Computer Science & Business Management

The calculation process is deIinitely much more systematic than an arbitrary margin rate system.

Derivatives contracts oI a more volatility underlying asset have larger margin requirements, and

a derivatives contract on the same underlying with more time to expiry will also have a higher

margin requirement. There are a series oI complex steps and procedures Ior calculating the Iinal

margin amount. However, CME PC-SPAN soItware makes the calculations oI margins very

simple. All that the broker back oIIice has to do is to Ieed in the investors` position at the end oI

the day into the computer and they can get the Iinal net margin requirement oI the trader with the

click oI the button. Initial margin is also payable in the Iorm oI speciIied securities. The list oI

such securities is approved by SEBI and is updated regularly. A haircut speciIied by the

regulatory authorities` sis applied to the value oI the securities. This is very beneIicial as the

investor paying the margin in the Iorm oI money will not earn interest, whereas iI he deposits

securities like the government bonds as margin he will keep earning interest on them.

The objective oI NSE-SPAN is to identiIy over all risk on a portIolio oI all Iutures and options

contracts Ior each member. The system treats Iutures and options contracts uniIormly, while at

the same time recognizing the unique exposures associated with options portIolios. Like

extremely deep out oI the money short position and inter month risk. Its over riding objective is

to determine the largest loss that a portIolio might reasonably to expected to suIIer Irom one day

to the next day based on 99 VaR methodology. SPAN considers uniqueness oI option

portIolios.

The Iollowing Iactors aIIect the value oI an option

O Underlying market price

O Strike price

O Volatility oI underlying instrument

O Time to expiration

O Interest rate

Shri S.V. Patel College oI Computer Science & Business Management

As these Iactors change, the value oI options maintained within a portIolio also changes. Thus,

SPAN constructs scenarios oI probable changes underlying prices and volatilities in order to

identiIy the largest loss a portIolio might suIIer Iro one day to the next. It then sets the margin

requirement to cover his one-day loss. The complex calculations (e.g. the pricing oI options) in

SPAN are executed by NSCCL. The results oI these calculations are called risk arrays. Risk

arrays, and other necessary data inputs Ior margin calculation are provided to members daily in a

Iile called the SPAN risk parameter Iile. Member can apply the data contained in the risk

parameter Iiles, to their speciIic portIolios oI Iutures and options contracts, to determine their

SPAN margin requirements. Hence, members need not execute complex option pricing

calculations, which are perIormed by NSCCL. SPAN has the ability to estimate risk Ior

combined Iutures and options portIolios, and also re-value the same under various scenarios oI

change in market conditions.

Margins

Derivatives segment uses margins as one oI the important measures Ior the risk management

purpose. In order to control the trading activities and to prevent the speculative activities the

exchange imposes several types oI margins to saIe guard the interest oI the genuine investors and

Ior the proper development oI the overall market. The Iollowing types oI margins are imposed

Ior the purpose oI risk management:-

1. Initial margin

This is the amount oI money taken Iirst time to saIe guard the interest oI the trading member.

The initial margin is charged at the time oI opening oI account in the options and Iutures

segment. The usual practice Iollowed by the investment solution providers is to charges

Rs.10,000 in case oI opening oI an options account and Rs. 50,000 in case oI opening a Iutures

account.

. Maintenance margin

This is the minimum amount oI margin required in the client account at all the times. When the

margin in the client account goes beyond the maintenance margin a call is made to the client by

the broker that the margin needs to be brought back to the original level oI initial margin and the

Shri S.V. Patel College oI Computer Science & Business Management

client is required to provide the required margin immediately to the broker otherwise the broker

will close the account oI the client and will not allow him to operate him anymore. It is a usual

practice to charge 75 per cent oI the initial margin as the maintenance margin. For example iI the

initial margin is Rs. 10,000 then its 75 per cent i.e. Rs. 7500 is considered as the maintenance

margin and iI the margin money goes below Rs. 7500 then the client is required to bring the

required amount oI money.

. Value at Risk Margin

This is the margin which the exchange calculates on the basis oI the volatility oI the stock price

movement and it is decided on the movement oI the stock prices during a particular day. This

margin is sent by the Iile to all the brokers three times a day or Iive times a day depending upon

the volatility oI the stock. The value at risk margin may vary Irom 15 per cent to say 25 per cent.

When there is high volatility in the stock prices the value at risk margin is also charged at a high

level. This margin is imposed to have control over the speculative activities and to prevent the

traders Irom the over trading.

. Special margin

This margin is charged when the exchanges observed some abnormal movement in the prices oI

the stock prices. This type oI margin is imposed by the exchange by giving notice in the

newspaper and by inIorming the clients through the Iile sent through the internet to the brokers.

Recently on 9

th

December 2003 the Bombay stock exchange and the National Stock Exchange

imposed at special margin oI 10 per cent on 35 scripts oI A group while 71 scripts oI B1, B2 and

Z group has been imposed a margin 25 per cent.

. Mark to Market margin

The proIit or loss oI the investor open position is calculated on a daily basis and the is called as

mark to market (MTM). The daily proIit/loss is credited or debited to the investors account on a

daily basis. A penalty is levied by the exchange on the clearing member in case oI non-collection

oI the initial or MTM margin and the open position oI the investor is closed, irrespective oI

whether he makes a proIit or loss. The penalty is charged even iI the client brings in the margin

later. The clearing member collects these penalties levied by the exchange Irom such a client. To

Shri S.V. Patel College oI Computer Science & Business Management

avoid such situations, the investors generally pay 10 to 15 per cent more than the margin

requirement. This practice not only precludes the possibility oI a penalty being levied but also

meets the possibility oI an additional margin requirement in the case oI an increase by the

clearing house or daily MTM requirement.

. Exposure Margin

Exchanges may levy an exposure margin over and above the initial margin as a second line oI

deIense. This margin may vary Irom 5 per cent to 20 per cent depending on the stock. This may

be increased by the exchanges as and when necessary by giving notices to the clearing members.

The clearing members in turn have to collect the same Irom the trading members and the clients

and pass them on to the exchanges. The exchanges do take such actions in time oI volatility. The

main purpose oI such an exercise is to reduce any excessive speculation in the market. However,

the negative eIIect oI increasing the margins is that it results in the Iorced liquidations oI

positions, thereby bringing down the market, at least temporarily.

7. Ad hoc margin

The exchanges may levy an adhoc margin on investors who have large positions in the

derivatives segment. The exchanges send notices to the clearing members to collect such margins

Irom these investors.

The above margins are collected upIront Irom the clients so that there is no excess position

taking by the clients and the liquidity oI the members is also saIeguarded. Whenever the market

wide limit on a particular stock touches 80 per cent oI the total limit allowed on that particular

day then the margins are doubled that is iI the margins comes to Rs. 25000 then it is doubled and

becomes Rs. 50,000. On 14

th

October 2003 the Iollowing scripts had touched 80 per cent market

wide limit and so the margins were doubled.

1. Arvind Mills (98)

2. ACC (82)

3. Digital Global (85)

4. IPCL (84)

Shri S.V. Patel College oI Computer Science & Business Management

5. Mastek (100)

6. Nalco (91)

7. NIIT (84)

8. PNB (83)

9. Polaris (93)

10. SCI (96)

POSITION LIMITS

Position limits have been speciIied by SEBI at the trading member, client, market and the FII

levels to prevent any manipulation and excess position taking.

Trading Member position limits

There is a position limit in derivative contracts on an index oI 15 oI the open position or Rs.

100 crores whichever is higher. The position limit in derivative contracts on an individual stock

is 7.5 oI the open interest in that underlying on the exchange or Rs. 50 crores whichever is

higher.

Client level position limit

Any client either individually or in group with other investor iI acquires more than 15 oI the

total open interest in all the Iutures and options contract taken together then he has to inIorm the

Clearing Corporation and iI he does not do so then it would attract penalty in the Iorm oI Iine.

Market wide position limits

The market wide limit oI open position in terms oI the number oI units oI underlying stock on all

the Iutures and options contract on particular stocks is lower oI 30 times the average number oI

shares traded daily, during the previous calendar month, in the capital market segment oI the

exchange or 10 oI the number shares held by the non-promoters that is 10 oI the Iree Iloat in

terms oI the number oI shares oI the company.

Shri S.V. Patel College oI Computer Science & Business Management

Position limit for FIIs

In case oI the index related derivative products the position limit is 15 oI open interest in all

Iutures and option contract or Rs. 100 crores whichever is higher. In case oI stock related

derivative products the position limit is 7.5 oI open interest in all the Iutures and options

contracts or Rs. 50 crores whichever is higher.

Margin collection and violations

Clearing members are provided with terminals oI the Iutures and options segment to monitor the

trades oI all the trading members and clients. Through this, clearing members can set the

exposure limits Ior trading members and clients; the trading Iacility is withdrawn whenever a

trading member exceeds exposure limits. The initial margin amount on the positions taken by the

clearing member is computed Ior the each trade. The initial margin amount is reduced Irom the

eIIective deposits oI the clearing member with the Clearing Corporation. Once 70, 80 and 90 per

cent oI the eIIective deposits are consumed; the member receives a warning message on his

terminal. The clearing Iacility is withdrawn the moment 100 per cent is consumed. The liquid net

worth oI the clearing member at any point oI time should not be less than Rs. 50 lakhs. The

withdrawal oI the clearing Iacility in case oI violations will apply to the trading Iacility oI all

trading members clearing and settling through that clearing member.

The margin amount on the positions taken by the trading member is also computed on a real time

basis and compared with the trading member limit set by his clearing member. Here also the

initial margin amount is reduced Irom the trading member limit, set by the clearing member.

Having consumed 70 per cent, 80 per cent and 90 per cent oI the limit, the member receives a

warning message on his terminal, and once 100 per cent is consumed the trading Iacility

provided to the trading member is withdrawn.

You might also like

- Presentation Company ActDocument68 pagesPresentation Company ActHarshad PatelNo ratings yet